Salary

Remuneration is a financial system that regulates monetary relations between employer and employee. According to established legislation, payments must be made on time and in the prescribed amount.

Article 129 of the Labor Code of the Russian Federation contains basic information about the rules for making payments. Tariffs and wages are regulated by various legal acts and agreements. In controversial situations, federal legislation is recognized as dominant and decisions are made in accordance with it. For example, instructions for calculating the tariff rate are contained in Art. 143 Labor Code of the Russian Federation.

Payment of wages to the pieceworker for the first half of the month

The Ministry of Labor, in letter No. 14-1/B-725 dated August 10, 2017, explained its position: an employee has the right to expect to receive part of his salary for the month in proportion to his output.

When determining the salary for the first half of the month, not only the employee’s salary (tariff rate) is taken into account, but also all bonuses that are not motivation for the results calculated at the end of the period. We are talking about additional payments at night, bonuses for length of service and combination of professions, regular bonuses for skill, etc.

The same additional payments that can be calculated only after summing up the results of the month are determined during the final calculation and are included in the salary issued at the end of the month. These are bonuses for efficiency (exceeding monthly plans), additional payments for overtime hours, etc.

Error . Very often, the salary for the first half of the month is called an advance and is paid in a fixed amount, without making individual calculations. This is a direct violation of labor laws and, upon inspection, can be regarded as discrimination against employees, which is punishable by serious fines and sanctions.

Piece wages

Piecework remuneration is one of the types of wages, which involves the dependence of the amount of money on the quantity or volume of work delivered.

The volume of work delivered may be calculated in terms of the number of units produced, the number of tasks completed, or some other measurement. This takes into account the quality of work, the complexity of the task, working conditions and the required level of qualifications.

Advantages of piecework payment

From the employer's side:

- The employee's interest in performing the maximum amount of work.

- The employee is also responsible for fluctuations in output.

- There is no need to control the work process, since payment is made after the fact and before that it is possible to assess the volume of work and its quality.

- It is believed that if an employee is ready for piecework payment, he knows how to work productively.

From the employee's side:

- Has the opportunity to independently control your earnings and increase it by increasing the volume of work.

- Work on a piecework basis is available even to novice specialists and workers without a reputation.

Disadvantages of piecework wages

From the employer's side:

- Possible reduction in product quality to increase production volumes.

- Often the costs of product quality control are equal to the total costs of control in other production areas.

- Often, workers are in a hurry and violate safety regulations or rules for handling equipment, which leads to injuries and breakdowns.

- Workers don't care much about production costs.

- Psychological factor - the employee does not feel like he belongs to the company’s team and does not work for a common result, but only for his own enrichment.

- Some types of work are quite difficult to measure in all respects; accordingly, difficulties arise in determining the volume of work performed.

- High staff turnover, which stems from a psychological factor, rarely employees are focused on the prospect of long-term cooperation.

- The need to introduce any compensating payments to smooth out possible fluctuations in earnings.

From the employee's side:

- Earnings are unstable, this fact frightens many workers who do not like risks.

- The employer is not always able to take into account all the factors that influence the result, but often do not depend on the employee.

- The rate of wages may be lowered as output increases, so that the amount of work is not directly proportional to the amount of earnings.

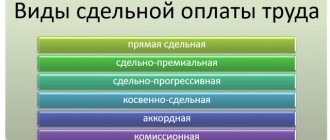

Types of piecework payment

Payment at piece rates is divided into:

- Direct piecework. It provides a direct relationship between the volumes completed and the amount of earnings.

The prices (rate) are fixed, depending mostly on the specifics of the work, its conditions and the qualifications of the employee. It is worth noting that when using this type of payment, the employee is least interested in the company’s production growth and improving overall performance indicators. So this type of payment is more suitable for hiring temporary workers. - Piece-bonus . In essence, this is the same as direct piece payment, however, it implies the presence of incentive payments for work above the plan or for the high quality of the product produced.

- Indirect piecework. It helps calculate wages for maintenance personnel involved in maintaining equipment or working places. It is quite difficult to determine the volume and quality of work performed. To calculate wages, you need to divide the rate by the production rate of workers using the equipment being serviced. Bonuses under such a system are usually awarded for trouble-free operation of equipment.

- Chord . Such a system is designed to complete work with a limited time frame. Then the worker knows the price for the entire volume and knows in what period of time he needs to complete the work. If the task takes a long time to complete, an advance is paid. It is a common practice to pay bonuses for completing work ahead of schedule. It is used mainly in those areas where it is difficult to standardize labor in any other way: during repairs, construction.

- Piece-progressive . Such a system involves paying for production norms at standard prices, and after exceeding the plan, prices increase. Typically, increased prices do not exceed standard prices by more than 100%. Typically, a progressive piece-rate system is introduced for a certain period of time in those areas of production where maximum performance is required. This payment method is quite expensive for the employer.

How is piecework wages calculated?

When making calculations, a system of fixed prices per unit of production or fulfillment of an agreed volume is usually used. This approach allows you to take into account the maximum number of factors and set a stable price for labor.

Prices directly depend on temporary production standards, tariffs and type of work. To calculate the final price, divide the hourly rate (or daily or standardized) by the production rate for the same period of time. Payments can occur either individually or to a group of workers.

With a direct piece-rate wage system, calculate wages using the formula: Wages = Piece rate per unit of product (type of work) x Number of manufactured products (work performed)

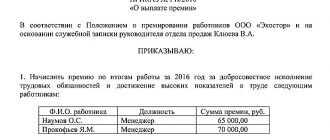

How are salaries set taking into account the bonus system?

Labor law provisions permitted for independent development are enshrined by the employer in internal regulatory documents (Article 135 of the Labor Code of the Russian Federation). To establish a remuneration system and bonus rules, the employer can create:

- a single document containing a description of the remuneration system and bonus rules (remuneration regulations or collective agreement);

- separate documents (provisions), devoting one of them to the characteristics of the remuneration system, and the other to the bonus rules;

- the corresponding clauses are directly in the text of the employment agreement with the employee, if individual bonus conditions are provided for this employee or the employer (who has such a right under Article 309.2 of the Labor Code of the Russian Federation) does not adopt internal labor regulations.

If the text of the employment agreement does not contain a detailed description of the rules for remuneration for labor functions performed by the employee (including the procedure for bonuses), then it must make a reference to the corresponding internal regulatory document developed by the employer.

Establishing bonus rules requires determining:

- list of types of bonuses accrued;

- frequency of their payment;

- the circle of those persons who may qualify for a bonus of one type or another;

- indicators, the fulfillment of which makes the calculation of incentive payments mandatory for the employer;

- procedures for assessing the right of each employee to receive bonuses;

- a system that allows you to evaluate the amount of remuneration for each type of bonus and determine the amount due to a specific employee;

- a list of grounds on which an employee can be deprived of bonuses or the amount of remuneration due to him can be reduced;

- the procedure for establishing the amount of reduction in the amount of bonuses;

- a procedure that gives the employee the opportunity to challenge the results of the distribution of bonuses, including deprivation of his bonus or reduction in the amount of remuneration.

Read more about the procedure for establishing bonus rules in the material “The procedure for paying bonuses under the Labor Code of the Russian Federation.”

ConsultantPlus experts explained in detail how to calculate an employee’s earnings under a piecework-bonus labor system. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Piece work and time work: what is the difference?

In fact, piecework and time-based payment are polar approaches to remuneration and, accordingly, to its evaluation. Time-based pay assumes that the employee spends his time in the most efficient way. The employer hopes that the result of the employee’s work will be more valuable than the time purchased.

When using piecework payment, time spent is not recorded. Often, the employer does not know how many hours it took to produce the product and has difficulty determining its cost. The employee bears all responsibility for the effective use of time, and bears the costs associated with irrational time management. Often, workers themselves set piece rates for their work.

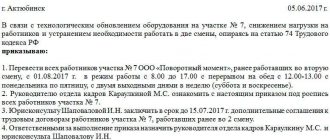

Revision of piece rates due to replacement of equipment

According to Art. 162 of the Labor Code of the Russian Federation, when labor standards change, employees must be notified no later than 2 months in advance. The company performs mechanical processing of a certain part. Workers are paid piecework.

The processing time for a unit of manufactured products may, in connection with customer requirements, either decrease or increase. The customer partially changes the design of the part, as a result, the control program on the CNC machine and the time standard change.

In this case, the product code and drawing number do not change, but there are changes in the drawing made manually with the signature of the designer. No more than two weeks pass between the moment of making changes to the order and the start of production work taking into account the changes made.

In this case, there is no time to familiarize yourself with the new norm (two months).

Types of remuneration

At the moment, the legislation provides for several types of remuneration:

- Main. It consists of:

- payment for a specified period of time, payment for a specified amount of labor, subject to the calculation of payments according to the piecework system, as well as time-based or progressive payment;

- overtime payments for work longer than the established period, for night work, for any work performed in excess of the norm specified in the contract;

- payments for production downtime that occurred due to reasons beyond the employee’s control;

- bonus payments, as well as incentives and incentives.

- Additional. It consists of :

- payment for time not worked for reasons beyond the employee’s control in cases where such a possibility is provided for in the contract and legislation;

- vacation deductions;

- payments to employees on maternity leave and nursing mothers;

- teen benefits;

- severance pay.

In addition to species, classification by form is also used. These include:

Time-based payment is based on the amount of time the employee spent at work. Usually the contract specifies the number of working hours.

Time payment may include:

- hourly pay;

- tariffs (daily or hourly);

- a certain norm established by agreement and helping to make a different measurement of time worked.

Time payment consists of:

- simple - assumes that the employee is paid for a certain amount of time that he spent on the work process, regardless of how many and what kind of labor products were produced;

- bonus – assumes that in addition to payments based on time worked, bonuses are provided for high quality work.

Piecework payment is divided into several subtypes. Read more about each type of payment below.

Chord payroll system

The peculiarity is that the price is set not for individual works or units of manufactured products, but for the performance of a certain set of works. This form of remuneration is used when work is performed in teams. The chord task states:

- volume and list of work to be performed by the team;

- the cost of this scope of work;

- deadlines;

- a method of distributing payments among team members, for example, based on working hours.

This method is used for construction, installation and repair work. Bonuses may also be provided for achieving certain performance indicators.

Legal norms

Guarantees for timely and complete transfer of payments are established by Article 130 of the Labor Code of the Russian Federation.

According to the law, the state provides guarantees for:

- minimum wage level;

- control of the level of salaries of employees of budgetary institutions;

- regulation of the amount of tax deductions for wages;

- introducing restrictions on wages in kind;

- regulation of federal legislation in accordance with the interests of workers;

- exercising state control over the fulfillment of labor remuneration obligations;

- holding unscrupulous employers accountable;

- establishing rules regarding the timing and order of payments;

- control over the implementation of legislation.