A pre-trial claim under a loan agreement or otherwise is now the first stage in a dispute with the debtor. Legislators introduced the institution of mandatory pre-trial procedure in the Arbitration Procedure Code of the Russian Federation, concerning the settlement of many civil disputes.

ATTENTION : our lawyer in disputes between the borrower and the lender will not only advise you, but will also take the task of drawing up a pre-trial claim; the proposal can be found at the link Drawing up a claim with us.

How to write a pre-trial claim to a borrower under a loan agreement?

In the content of a citizen’s claim, all demands must be clearly justified and structured. It is also necessary to indicate the circumstances on which these requirements for the judiciary are based. In the text of the complaint, it is recommended to indicate the cost and focus on violations of legal norms and requirements.

In addition to directly drawing up and sending the demand to the debtor, the pre-trial settlement claim must comply with the following rules:

- Judges always proceed from the fact that all claims (their content and scope) must fully comply with the requirements of the statement of claim subsequently submitted for consideration by the court. According to the new provision, a statement of claim may be withdrawn due to the discovery of discrepancies between the requirements specified in the claim and in the filed claim. This information is recorded in the fifth paragraph of the first part of Article 129 of the Arbitration Procedure Code of the Russian Federation.

- Another important aspect concerns the fact that a claim can be filed with the arbitration court only after the period allotted for resolving the conflict without judicial intervention has passed. It is known that it is equal to thirty calendar days from the date of sending the claim document. Other deadlines may be established in accordance with Russian legislation. If the time intended for resolving conflict situations before the trial has not yet expired, the application or claim may be rejected by the judges already at the stage of accepting the claim for proceedings.

USEFUL: watch a video on how to write a pre-trial claim and consult with a lawyer through the comments to the video on your issue

General requirements

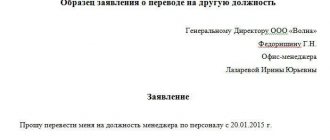

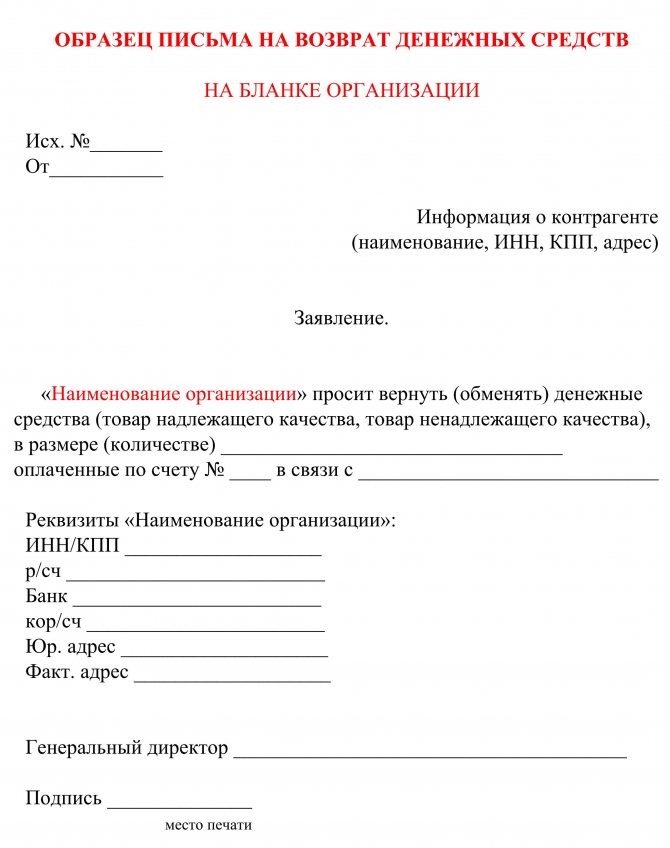

The document is an application (request) for the return of the transferred money. There is no unified form, so we draw up a free application. Be sure to include the following information:

- details of your organization: the application can be made on company letterhead;

- bank details for refund;

- name of the counterparty's manager, his position and full name;

- subject of the appeal (subject of the claim): indicate on the basis of which document (agreement, invoice agreement, universal transfer document) the letter is drawn up;

- subject of appeal: describe exactly how and as a result of which the money was transferred to the supplier’s bank account. Indicate the basis on which you need to return the money, your requirements for terms, include fines and penalties, if any, in the document that forms the basis of the obligation. Justify your position with the law or terms of the contract, on the basis of which the supplier is obliged to return the funds.

Attach copies of supporting documents: payment slips, bank statements about debits from the account. In the inventory, indicate not only the quantity, but also the number of pages in each of them. In the attachment to the letter, be sure to add a reconciliation act for mutual settlements. Confirm the application with the signatures of: the responsible executive, the financial director (chief accountant) and the head of the organization.

>Sample letter for refund from supplier

Sample claim to the debtor under a loan agreement

Full name of the debtor under the contract

debtor's address

Full name of the creditor under the loan agreement

address, telephone

Claim

under a loan agreement between individuals

On January 24, 2003, you borrowed 25,000 rubles from B., according to the receipt, and undertook to return the money “within one month.” To date, these funds have not been returned.

We believe that at the moment of transfer of money, relations arose between B. and you arising from the loan agreement, in accordance with Art. 807 of the Civil Code of the Russian Federation: “under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return the same amount of money (loan amount) to the lender.”

According to Art. 808 of the Civil Code of the Russian Federation: “in confirmation of the loan agreement and its terms, a receipt from the borrower or another document certifying the transfer by the lender of a certain amount of money or a certain number of things may be presented.”

According to Art. 810 of the Civil Code of the Russian Federation, you were obliged to repay the loan amount on time and in the manner specified in the receipt (“the borrower is obliged to return to the lender the received loan amount on time and in the manner provided for in the loan agreement”), namely until February 24, 1003. To date, you have not fulfilled this obligation.

In addition to the principal amount, you are required to pay interest for the use of someone else's money. Since, in accordance with Art. 811 of the Civil Code of the Russian Federation: “unless otherwise provided by law or the loan agreement, in cases where the borrower does not repay the loan amount on time, interest is payable on this amount in the amount provided for in paragraph 1 of Article 395 of the Civil Code of the Russian Federation.”

USEFUL : more about disputes challenging a loan between a borrower and a lender on our website at the link

Therefore, in addition to the principal amount, you are obliged to pay interest for the use of other people’s funds at the rate of the uniform discount rate of the Central Bank of the Russian Federation of 13% in accordance with the Central Bank Directive of November 28, 2008 N 2135-U of the overdue amount for each day of delay. Since the defendant’s obligations have not been fulfilled, the amount for the use of other people’s funds in the specified amount of interest is subject to accrual for the period from February 24, 2003 to the present, which amounts to 20,148 rubles.

Thus, despite the fact that the price of a claim when going to court is determined on the day the claim is filed, We can demand to collect interest from you in accordance with Art. 395 of the Code of Civil Procedure of the Russian Federation on the day of execution of the court decision, according to the following formula:

A x 13% x d

360

- where A is the amount of debt

- 13% per annum – refinancing rate of the Bank of Russia from December 2, 2008 (directive of the Central Bank of the Russian Federation No. 2135-U dated November 28, 2008)

- d – number of days of using someone else’s money

- 360 is the number of days in a year according to the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 14 of 10/08/1998 and the Plenum of the Supreme Court No. 13.

The number of days in a year and month is taken to be 360 and 30 days, respectively, according to the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 14 and the Plenum of the Supreme Court No. 13 dated 08.10.1998.

Consequently, the longer the period of non-payment, the greater the amount of the penalty that you are required to pay due to improper fulfillment of your obligations to repay the debt.

We invite you to voluntarily return the loan amount, pay interest for the use of other people's funds; if you do not return the specified funds within 10 days from the date of receipt of this claim, we will be forced to go to court with demands for their recovery.

In addition to the loan amount itself, interest, on the day of their actual payment, we can recover from you all legal costs incurred in the case, incl. paid state duty (Article 98 of the Code of Civil Procedure of the Russian Federation) and the costs of paying for the services of a representative within reasonable limits (Article 100 of the Code of Civil Procedure of the Russian Federation), however, when making a reasoned decision to change the amount of amounts collected to reimburse the relevant expenses, the court does not have the right to reduce it arbitrarily therefore, if the case goes to court, you will have to pay a much larger amount than was provided to you by L.V. Brezgin.

We hope for a peaceful resolution of this conflict, without going to court. It is possible that during the negotiations we will also be able to find some other acceptable solution to the problem.

Date, signature

General information

Indeed, as practice shows, cases of non-provision of already paid services are quite frequent. But before making claims, you need to figure out who is to blame for what happened? After all, situations can be different.

For example, the service may not have been provided due to the client’s illness, dishonesty of the supplier, or other circumstances. The content of the agreement that the parties entered into is also important. Thus, often no refund is provided for hotel services not provided if the client did not warn in time about the circumstances that prevented him from using them.

Regulatory regulation

The main regulatory act regulating the relationship between the contractor and the customer is Law No. 2300-1. Information about the form of a consumer contract and the features of legal structures relevant to the field of consumer rights protection are set out in parts 1 and 2 of civil legislation.

The Civil Procedure Code of the Russian Federation provides for judicial protection of the rights of service customers. Information on the procedure for returning funds, compensation for moral damages and other issues related to the protection of consumer rights can be found in law enforcement practice.

Document preparation

The law does not contain a form or sample for filing a complaint about violation of an agreement. However, the form must comply with the Office Work Instructions. Since a claim for a refund of funds under a service agreement is an evidence base in court if the issue cannot be resolved amicably.

A standard claim for the recovery of funds under a contract consists of three parts.

Introductory

The details of both counterparties are recorded. This information can easily be specified in the signed agreement. This is the name, location of the legal entity or full name and address of the citizen.

Name – “Claim under Agreement No. . ."

Main

The circumstances of signing the agreement are described in detail:

- Under what number and when was the contract executed?

- What services have the counterparties agreed to provide (the essence of the agreement);

- Information about counterparties, their names;

- Terms of the agreement that are not fulfilled by one of the parties.

Next, it is necessary to confirm with facts the non-fulfillment or poor-quality fulfillment of the terms of the agreement.

All clauses of the agreement and articles of law that provide for the fulfillment of the violated condition should be indicated.

Other examples

An advance payment when buying an apartment is a way to “stake out” territory. If the deal falls through, the advance must be returned. In this case, a document on the return of the advance payment is drawn up.

A correct sample receipt for the return of an advance payment for an apartment includes:

- indication of the city, date of completion;

- Full name, passport details of the parties;

- mandatory reference to the terminated contract;

- a note that the transfer of money occurs due to the cancellation of the agreement;

- advance amount (indicating the amount in words);

- dated signatures of the parties.

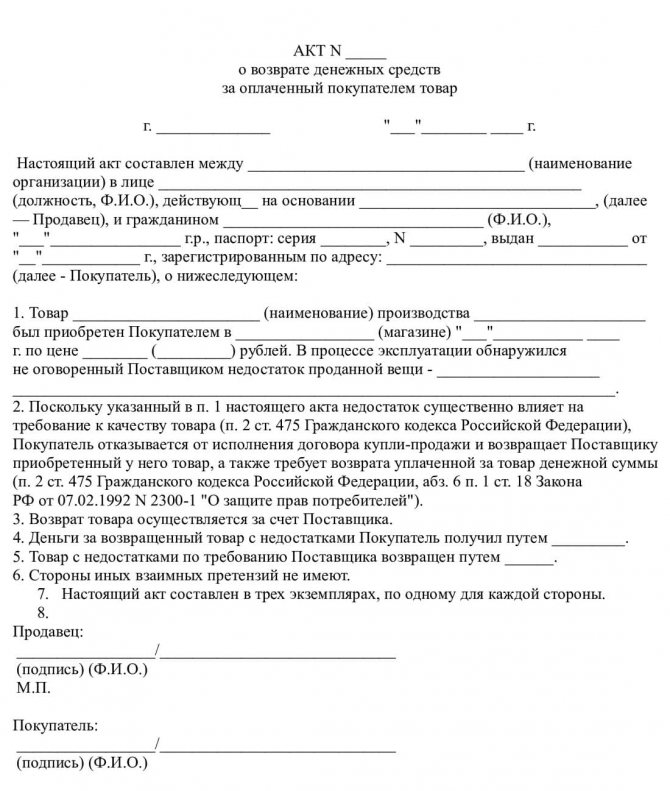

Another situation: you bought a product, it turned out to be of poor quality, and you demanded that the seller return the money for it (this right is guaranteed to you by the Consumer Rights Protection Law). In this case, the procedure for “reverse exchange” of money for goods is formalized approximately in the following act:

act (obligation to return money for goods)

A sample of such an act is written in free form. Indicate:

- city, date of filling;

- Full name, passport details;

- indicate the product, state that the exchange has been made and there are no complaints;

- if the goods were taken with a deposit, it is stated that the deposit was returned.

- signatures of the parties with date

Don't rely on words. Document transactions. Then the law will be on your side.

What if the damage is not compensated?

Let us say right away that the agreement will receive legal force only if it is certified by a notary.

If the parties decide to limit themselves to a simple written form (that is, without notarizing the agreement), then the injured party has no guarantees of payments. This means that the victim will have to file a lawsuit.

In this case, the agreement will be a serious help in motivating the claim, since in the text of the agreement the guilty person not only admits the fact of causing damage, but also agrees with its amount.

If the agreement is certified by a notary, then if the debtor fails to fulfill his obligations, the claimant can take the agreement to the magistrate's court and, on its basis, ask for the issuance of a court order in an indisputable manner.

What to do in case of refusal

If the seller refuses to accept the document, you can turn to the Court or Rospotrebnadzor for help. Moreover, contacting the RPN is a simpler and more acceptable option for the buyer when compared with the judicial records management authorities. You can submit your application in person, via mail or through a special website. RPN has exactly 30 days to respond. During these 30 days, the RPN will have to formulate a written response to the request, and this response will be the official position.

As for appealing to judicial authorities, this option is a more effective measure to protect one’s own rights as a consumer, but this option is also one of the most time-consuming. But the whole point is that the client or buyer will have to write a statement of claim with proof of the fact that they tried to resolve the case at the pre-trial stage. If there is no evidence that they tried to resolve the case before the trial, the buyer or client will not be able to go to court to have the case heard.

In the claim, the applicant party will have to justify the reason why it was necessary to file a complaint with the judicial authorities. It is best to attach various documents to the application, including the fact of marriage, an expert assessment (independent), as well as other documents and evidence.

Factors that allow you to conclude an agreement

- flood damage assessment report (if you don’t have one, call or leave your contact details). The assessment report is evidence in court and describes in detail all the circumstances and damage that occurred. It is your insurance against non-payment.

- act of the management company, which indicates the reason for the flood

- an adequate neighbor who decided to do without trial

All you have to do is enter into an agreement on voluntary compensation for damage from flooding; believe me, this agreement will insure you against a huge number of risks. An agreement on compensation for damage caused to an apartment, it is also called an agreement on compensation for damage from the bay , which fixes the timing and volume of payments, as well as the justification for these payments (act, report).

When discussing the timing of payments, we recommend that you go to a meeting with the culprit and agree on an installment plan, as indicated below in our sample.

Current account in Sberbank: check accounts in Sberbank + find out account data, request, information

Finding out information about a Sberbank account is not as easy as it might seem at first glance.

Especially if you want to know about the bank account holder. This is personal data, and this information should not fall into the wrong hands (and even more so to unauthorized persons). However, not everything is as simple as it may seem at first. Today we will talk about bank accounts and understand their structure using the example of Sberbank. However, the general theory will be relevant for almost any bank. Except for the part where specific methods and instructions will be given. Let's begin. Show in full