Free legal consultation by phone:

8

The performance of government services is far from ideal, which causes frequent confusion among citizens. The state fee is paid at the time of filing the application, this is a general rule. The body to which the appeal is made satisfies it only after examining the documents. If you refuse, the question of a refund arises, but this applies to large amounts. Refunds of small state fees are not popular as they take up additional time.

The Tax Code does not establish restrictions on the refund of the amount of duty paid, but receipts must be kept. Otherwise, proving a mistake in case of an incorrectly paid contribution to the treasury will become more difficult and expensive, since you will need to contact the bank. A duplicate payment receipt will be issued, but there will be a fee and will take up to three days. Only after this can the money be returned to the tax office or the authority in whose favor the payment was made. General procedure and documents for the return of paid state duty through the tax office and government authority:

- Statement;

- A photocopy of the second to fifth page of the Russian Federation passport (foreign passport for non-residents of the Russian Federation, read the article on how to restore the passport of a citizen of the Russian Federation:);

- Photocopy of the receipt;

- Certificate of non-use of the paid duty;

- Account details.

The duty refund period is equal to the limitation period: according to the law of the Russian Federation, no more than three years.

When does the right of return arise?

Issues regarding payment of state duties are regulated by the Tax Code of the Russian Federation. Article 333.40 of the regulatory act provides for cases when funds received by federal and municipal departments must be returned to the payer upon his request. These rules are relevant for any method of paying state fees, including payments through the State Services website.

The amount paid may be refunded in full or in part. Each situation is considered individually. There are several typical cases when a client wants to return a transferred payment. The table shows the likely results of consideration of the appeal in accordance with the law.

| Situation | Possibility of return |

| The citizen paid the state fee, but did not apply for the service. | The law provides for the return of funds at the request of the payer. |

| The money was transferred in an amount exceeding the statutory fee. | Refunds are allowed for the difference in payment. |

| The authorized body refused the service. | Reasons for refusal will be considered for refund. If an employee of a government organization is to blame for failure to perform a service, the state duty is transferred to the payer. If it is established that the client is at fault, a refund may be refused. |

| The court returned or does not accept the statement of claim (complaint) | The state fee is refunded or taken into account when re-filing the claim. |

| The legal proceedings on the claim have been terminated. | Refunds are provided with some exceptions. |

| The notary refused to perform notarial acts. | The funds are returned to the client. |

| A foreign passport or a refugee passport has not been issued | The law obliges to transfer the duty back to the payer. |

Separately, we should consider the situation when the applicant makes mistakes in the details. The Tax Code does not provide for a reverse payment in this case.

Useful Civil legislation considers erroneous payment as unjust enrichment, obliging the purchaser of property to return valuables to the real owner (Article 1102 of the Civil Code of the Russian Federation).

Exceptions

The Tax Code of the Russian Federation, along with the possibility of returning money transferred to the treasury, establishes a ban on such an operation in a number of cases when the client paid the state fee through “State Services”, but did not use the service. Before demanding an amount from a state or municipal agency, you need to check whether the payment is subject to restrictions.

The civil registry office will not reimburse expenses if the state duty was transferred for the following purposes:

- marriage registration;

- dissolution of family relationships;

- name change;

- correction of records.

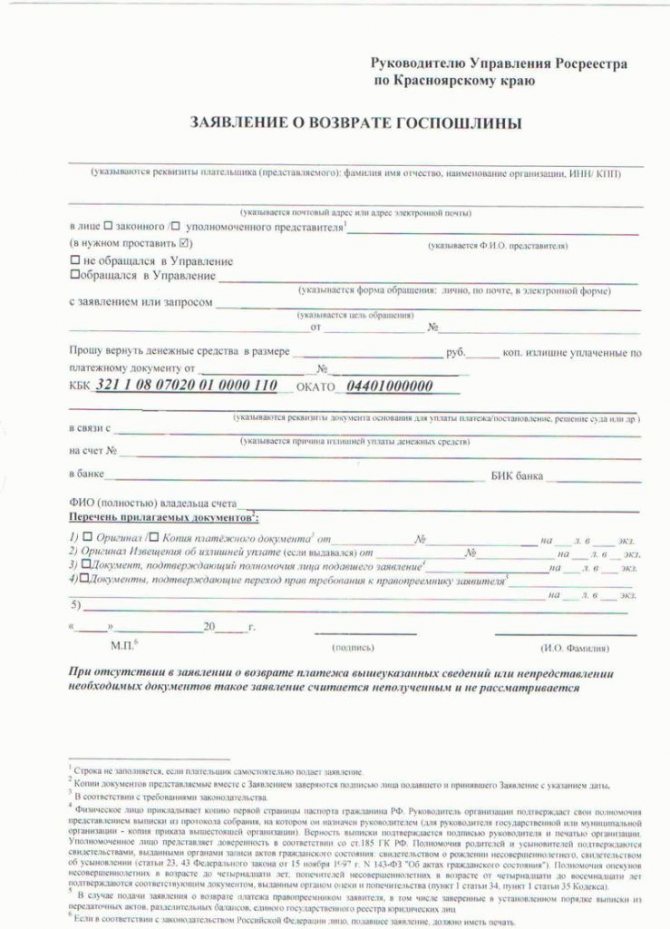

Rosreestr will return half the money for registering a real estate transaction if the operation is terminated at the request of one of the parties. If the procedure is refused for other reasons, funds will not be refunded.

Is it possible to return money for paid state duty at the registry office?

The marriage registration fee cannot be refunded if the couple managed to pay it but changed their mind. The same rules apply to the amount paid for changing the name and other data. However, there is an exception for spouses with children. Since their divorce is formalized through the court, and not through the registry office, then, accordingly, payment will occur according to the rules for filing a lawsuit.

There is no fee for a birth certificate, but a paternity certificate also requires a non-refundable fee.

Step-by-step instruction

In order to return the payment, you must contact the state or municipal authority where the funds were transferred. Regardless of the government structure, the general procedure is the same. Having learned, for example, how to return the state fee for a foreign passport through “State Services” at the UVM, the next time the user will not have problems when contacting Rosreestr or the tax office.

Note! Even when transferring money through the State Services portal, documents must be submitted to the branches in person or by mail. There is no state duty refund service on the e-government website.

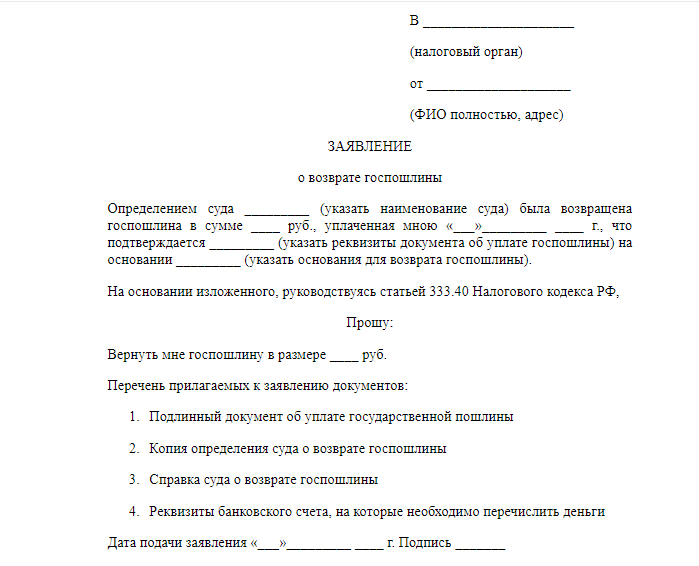

Step 1. Writing an application

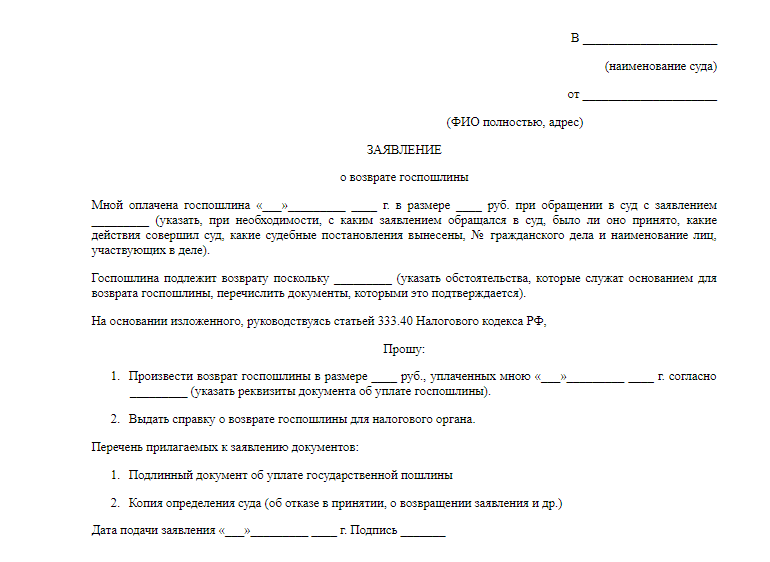

The main document for starting the process of returning the fiscal fee is the payer’s application. The appeal is written in any form in compliance with the basic rules of office work.

The header of the application states:

- body or official to whom the documents are sent;

- Full name of the applicant;

- passport, contact details, residential address of the author of the letter.

Then the name of the application is written - “Application”, “Application for refund of state duty”, etc.

The main part of the document must state the request for a refund and the basis for satisfying it. If there are several reasons, they should all be displayed in the body of the letter. The transfer data is indicated - date, number of the payment document or transaction. You should also write down your bank details for a refund.

The document is certified by the signature of the applicant indicating the date of drawing up the application. It is better to prepare 2 copies of the application. One is transferred to a government agency, the second remains with the client.

Step 2. Collection of supporting documents

A package of papers confirming the transfer of state duty must be submitted to the government organization responsible for providing the service. According to Art. 333.4 of the Tax Code of the Russian Federation, in case of a full refund, the original payment document is provided, in case of a partial refund, a copy is provided.

If money is transferred through the State Services portal, the proof document will be a receipt that can be printed in the user’s Personal Account. To receive a payment check you need to complete the following steps.

Log in to the site. Go to the notifications feed in your profile. To do this, click on your last name in the upper right part of the main page and click on the “All notifications” link in the form that opens.

On the notification feed page you need to find the translation for which the receipt is printed. To avoid viewing all messages, you can go to the “Payment” section or use the search bar in the general list.

After finding the payment, double-click on the transaction.

On the payment page, you can print a receipt or send it by email.

The finished payment document contains all the necessary information to search for payment in the database.

Step 3. Submitting the application to the government agency

Applications for refund of state fees are considered by the department responsible for the service. You need to contact the territorial body of the state organization at your place of residence or the municipal department. Payments for legal proceedings are returned to the tax inspectorates. A payment receipt is attached to the application.

When submitting the package in person, an acceptance mark is placed on the applicant’s copy. If documents are sent by mail, you must make an inventory of the attachment and send it by valuable mail. An application with a stamp and an inventory confirm the fact that a package of papers has been submitted to a government agency in the event of unforeseen situations.

Statement

A refund for a foreign passport is issued only after the citizen writes an application, where the filling must meet all the requirements of office work:

- A cap. It is important to indicate in it the name of the body or its head, the full name of the applicant, passport details, address of residence and contact information for communication.

- Titles of official papers. In this case, “Application for refund of state duty.”

- The basis. The essence of the appeal is briefly but clearly stated here. Indicate the reason, as well as all payment details and refund account details.

- Conclusion. This is a personal signature and date of drawing up the application.

Next, you will need to prepare a package of documents that will confirm your right to return the money. If the original receipt is attached, the amount will be full. Otherwise, the money will be partially returned.

When everything is ready, you can contact the government service at your place of residence. The employee will accept the documents and mark the transfer “from hand to hand”. If the package was sent by mail, an inventory is compiled and sent by registered mail. This is necessary in case of unforeseen incidents or disputes. All court costs are reimbursed by the tax service.

Article number 333.40 of the Tax Code of the Russian Federation provides for the opportunity to fill out an application for a refund of the state duty for a foreign passport if the citizen ultimately refuses to receive the document. There are many nuances regarding how to return money already paid to the state.

Depending on the situation, a government agency is selected to which the return application is subsequently sent. In this case, the document must be drawn up according to a specific plan.

Deadlines

After receiving the application, the government organization has 10 days to consider it. After this period, the answer can be obtained from the office or from the responsible person. Refusal to pay is permitted only on grounds provided by law. The decision can be appealed to a higher authority or court.

Important! If the department decides to return the state fee, the money must be transferred to the applicant’s account within 30 days from the date of receipt of the application.

When submitting papers in person, the moment of registration of the application is the date indicated on the application stamp. When sending by post, the day of receipt of papers can be tracked on the Russian Post website using the letter number (indicated on the receipt).

This government agency may have its own application forms

A response to the satisfaction of the request or its rejection must be given within 10 days. If the answer is positive, the money is returned within a month. If you receive a refusal, you can appeal to a higher authority or go to court.

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

When preparing documents, you are almost always required to pay tax. But, if the payment was made incorrectly or the citizen changed his mind for one reason or another about receiving the document, in this case, returning the state fee for the international passport through State Services seems to be the simplest option.

Features of the procedure for some departments

Although the general scheme of actions is the same, there are some nuances in individual government agencies, knowledge of which will be useful to users.

traffic police

The State Traffic Safety Inspectorate is a separate structure of the Ministry of Internal Affairs of the Russian Federation. It carries out the functions of registering vehicles, issuing driver’s licenses, and maintaining road safety. Almost every citizen who owns a vehicle is faced with the need to obtain the services of the State Traffic Inspectorate. At the same time, an increasing number of clients are faced with the question of how to return the state duty paid through the State Services of the State Traffic Safety Inspectorate, since payments through the website are 30% lower.

To get a refund, you need to contact the territorial traffic police department. The inspection transfers money if the service is not received:

- for vehicle registration;

- deregistration of a vehicle;

- obtaining a duplicate of PTS or STS;

- changing data in documents;

- obtaining national and international driving licenses;

- replacement of a driver's license.

The transfer will be made if the driver did not apply for a government service or paid more. If you apply for the service through the government portal, your refund may be denied.

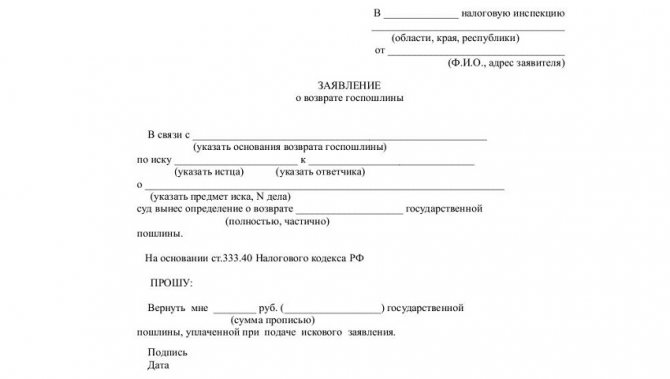

Court

Fees for consideration of a claim can be very high, as they depend on its value. In this regard, the issue of refunding the state duty is particularly acute for the plaintiffs. To receive a refund, you need to contact the tax service in whose territory the court is located. You can get your money back:

- upon refusal to accept a statement of claim (complaint);

- reducing the cost of the claim;

- termination of legal proceedings in the case;

- concluding a settlement agreement in arbitration court.

Reference Information. The fee paid for court proceedings is not refunded if the defendant voluntarily satisfied the plaintiff’s demands after the case was accepted for proceedings in arbitration or the Supreme Court. Upon concluding a settlement agreement, the plaintiff may receive 50% of the fiscal fee if the case was heard in arbitration court. In a court of general jurisdiction, such a procedure does not provide for the reimbursement of state fees.

UVM

Territorial divisions on migration issues of the Ministry of Internal Affairs of the Russian Federation function after the transfer of functions from the FMS to the police. If denied, contact your local service office;

- in obtaining a civil passport;

- issuance of a foreign passport;

- obtaining a visa, residence permit, work permit for foreign citizens, etc.

The department also transfers money if the amount paid is greater than the state duty established by law.

Get your money back for state fees in court

The judicial system provides a number of features when reimbursing money. As compensation for a failed trial, you can receive from half to the full cost of the state fee. The full cost is refunded if:

- The trial did not take place due to the defendant’s refusal, but on the condition that he did not receive compensation from the defendant in the form of a settlement agreement;

- The trial did not take place due to the death of the defendant.

Half the cost of the state fee to the court is paid if:

- A documented agreement has been reached between the plaintiff and the defendant;

- The defendant paid off all the plaintiff’s claims voluntarily before the court’s decision.

Partial cost is provided for overpaid funds. Compensation is received through the tax office.

Still have questions?

Consult a lawyer (free of charge, 24 hours a day, seven days a week):

8 Federal

8 Moscow and region

8 St. Petersburg and region

Attention! Lawyers do not make appointments, do not check the readiness of documents, do not advise on the addresses and operating hours of the MFC, and do not provide technical support on the State Services portal!

It is very easy to transfer money to the budget through State Services. The service will offer to process a payment after registering a service request. If the client does not pay the fee immediately, reminders will be sent via personal messages, email and phone. It is much more difficult to get back funds transferred by mistake. There is no information on this issue on the e-government website. We will tell you how to return the state duty paid using “State Services” in our material.

Consult a lawyer (free of charge, 24 hours a day, seven days a week):

Attention! Lawyers do not make appointments, do not check the readiness of documents, do not advise on the addresses and operating hours of the MFC, and do not provide technical support on the State Services portal!

Payment options

You can pay the fee for an identification document of a citizen of the Russian Federation abroad in cash or by bank transfer. Sberbank accepts both forms of payment without restrictions. A huge network of branches with cash desks, street ATMs and terminals allows you to pay for services provided by the state almost anywhere in Russia. Sberbank Online provides even more opportunities. It does not work with “real” money, only with electronic ones, and without any problems.

Let's take a closer look at each payment method.

At the bank's cash desk

You shouldn’t burden yourself with searching for the details for paying the state duty at the Sberbank cash desk. The employees know them, but if you have a ready-made receipt, the process will go faster. You can pay in cash or by card. At the same time, it is not necessary to stand in a live queue if you first receive an electronic ticket. To do this, you need to sign up for the queue online on the bank’s website.

The cashier needs to present your passport and indicate your desire to receive one or another type of document. He will fill out a receipt and indicate the required amount to pay for the public service. All you have to do is pay and pick up the check. There are no fees for banking transactions.

Via terminal and ATM

All Russians are well aware of how to work with Sberbank devices. Unfortunately, the ATM does not allow you to pay the fee in cash, but is inferior to the terminal only in this regard. Otherwise, their operating algorithms are identical.

Most terminals are accessible 24 hours a day. However, it is better to use those located closer to the bank branch so that you can ask the employees for help if necessary. Payment here can be made in cash or by card.

Instructions for paying the state fee for a foreign passport through the Sberbank terminal:

- Select the “Payments and Transfers” section. If you intend to pay by card, insert the plastic into the slot and enter the PIN code.

- Go to the “Taxes and Fines” tab and then select the “State Duties and Fees” item.

- Enter the name of your Department of Internal Affairs of the Ministry of Internal Affairs. Details are not needed here either, since they are available in the bank’s database and are filled in automatically.

- Select a service (obtaining a foreign passport).

- Specify the document type (biometric/standard).

- Enter your passport details (full name).

- Deposit the amount into the receiver (cash) or pay by card.

- Confirm payment.

- Receive a check.

When paying in cash, keep in mind that the device does not give out change. When paying by card, you must have a phone with you, which will receive an SMS with a confirmation code.

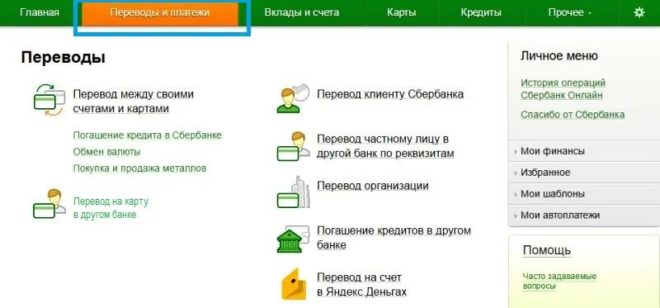

Payment procedure via Sberbank Online

To use the service, you need to become a full client of the bank. To do this, you first need to apply for a card. In addition, you will need a computer or any other device with Internet access. Full access to all the functionality of Internet banking is provided by the presence of a personal account, which requires registration. How to access your personal account is a topic for a separate discussion. We are only interested in the issue of payment. And it is done as follows:

- You should log in to your account using your password and login using the link.

- Open the payments and transfers section.

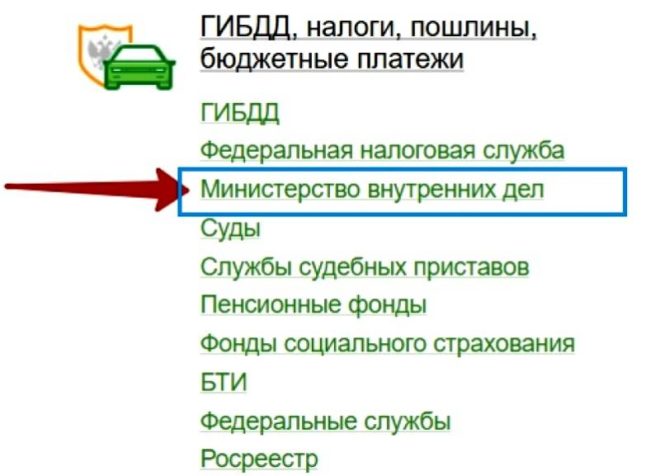

- Log in to “Staff Police, taxes, fines, budget payments” and click on the link of the main recipient - the Ministry of Internal Affairs.

Which country would you rather live in? ⚡ Take the test in 2 minutes

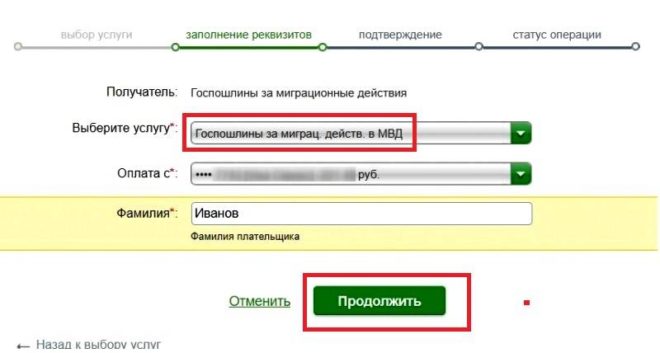

- Select the service and the organization that provides it (GUVM MIA) in your region and fill out the template that opens.

- Click the “Continue” button.

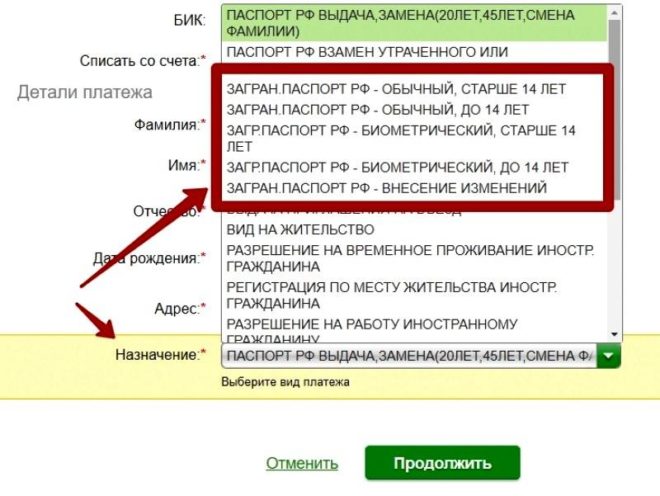

- Select document type.

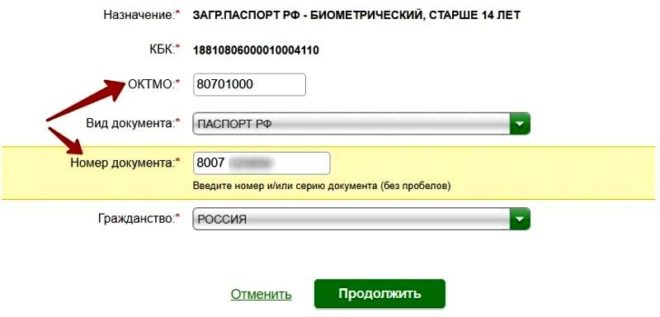

- Enter OKTMO, civil passport number.

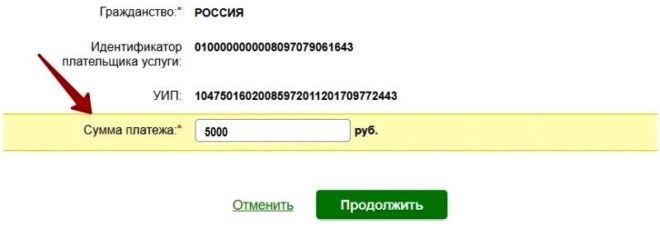

- Check and, if necessary, indicate the amount to be paid.

- Make payment. The payment is confirmed by a code from a message sent to the mobile phone number attached to the card.

- After verification, the system will assign the transaction status as completed, and the receipt can be printed through your personal account.

Basic information about state duty

State duty is payment by a citizen for services provided by employees of various government bodies.

Traffic police services for which you will have to replenish the treasury:

- issuance of Russian or international driving licenses;

- issuing a temporary permit allowing you to drive a car, as well as certificates of permission to drive a tractor;

- vehicle registration, registration of PTS (including replacement of a document or issuance of a duplicate).

Payment procedure and terms

Despite the fact that the service is provided by a specific department of the traffic police, the amounts of money are not credited to the bank account of the institution, but are sent in full to the state treasury.

Important! Payment for services is made only by bank method. When contacting the state traffic police, a receipt confirming payment is presented.

Payment period

In most cases, the fee is paid before applying to government services, so that by the time the application is submitted, you will have a bank receipt for payment.

Payment of the state fee after receiving the service is made only with the appropriate court decision. This usually happens when a controversial issue is being considered in court and does not apply to services provided by the traffic police.

Benefit when paying fees through the State Services portal

The amount that must be paid for obtaining various documents or solving other problems with the participation of government agencies is determined by current legislation.

Officials responding to a citizen’s request cannot independently change (reduce or increase) the established amount.

The benefit is provided only if the state fee is paid through the State Services portal. In this case, the usual cost of the service is reduced by 30%.

Procedure for returning funds

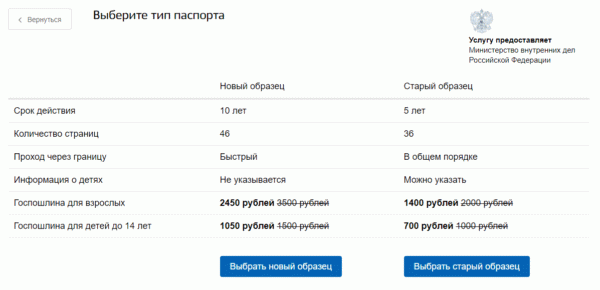

The cost of a foreign document in 2021 is in the price range from 700 to 3,500 rubles, depending on its type and age category of the applicant. Biometrics are more expensive, a regular old-style document is cheaper. The applicant who makes the payment on the website will have to pay the least.

State duty for the service of obtaining a foreign passport

By the way. Despite the fact that the law establishes a three-year period for applying for a refund, and if necessary, it can still be extended by court, citizens most often apply within the first few months after discovering an error.

If the request was made on time and the request was completed correctly, the money will be returned to the payer within a few weeks.

- First, if you paid and you do not have a bank payment receipt in your hands, you need to log into your personal account on the above-mentioned site.

- There, among the completed payment transactions, you need to find the one you need and print a receipt on the printer.

- Then, with a written application and a check, you should contact the migration service employees.

Questions about paying fees through State Services

Refund of state duty paid to the traffic police

Despite the fact that the state duty accompanies certain procedures in the interests of a particular person and at his personal request, sometimes there is a need to return money already paid. This is possible, the legislation provides such an opportunity.

Types of return (full, partial)

There are 2 types of refunds:

- full: the amount spent is returned in full if the service was not received;

- partial: overpayment exceeding the required amount is returned.

Important! You can apply for a refund within 3 years after the date indicated in the receipt for transferring money to the state treasury.

Reasons for returning the state duty paid to the traffic police

You can apply for a refund in the following cases:

- crediting an excess amount to the treasury;

- change in circumstances and non-receipt of service (for example, refusal to sell a car);

- double payment for services;

- errors made in the recipient's details.

Return duty deadlines

Applications for a refund of funds are considered by authorized bodies. If the results of the review are positive, the amount is returned to the person who made the payment. The deadline for consideration and return of money is 1 month.

Refund of fees paid to the court

Litigation is quite unpredictable. When paying the state fee for a trial, you can never guess how the case will turn out. For example, it may end before it even begins, or the amount of the fee may change during the consideration of the claim.

Form for filling out an application for a refund of state duty for a statement of claim in court

Sample application for refund of state duty paid in court

Refund of the state duty will be required in cases provided for by the Code of Civil Procedure of the Russian Federation and the Arbitration Procedure Code of the Russian Federation:

- if the defendant fulfills the requirement voluntarily immediately after sending the documents to the court;

- if the applicant does not comply with the rules of jurisdiction of judicial institutions;

- if the amount of claims changes during the consideration of the case.

Refund of the state fee when the statement of claim is returned by the court is made when the judge has no grounds for accepting the dispute. According to Art. 135 of the Code of Civil Procedure of the Russian Federation, the court may return documents on the following grounds:

- the applicant has not completed all the steps necessary to resolve the dispute;

- the plaintiff incorrectly determined the procedure for considering the claim (for example, he filed a statement of claim instead of an application for a court order) or did not sign it;

- the applicant does not have the right to appeal (due to age or mental condition);

- the person filing the claim requests the return of the claim before its consideration;

- the dispute must be considered by another court or is already being considered by this judicial institution.

The demand sent to the arbitration court is returned by the court back to the applicant with the opportunity to return the paid state fee, if in accordance with Art. 129 of the Arbitration Procedure Code of the Russian Federation, it will be left without consideration. This occurs when the applicant:

- files a claim in the wrong court;

- draws up a claim without the signature of an authorized person;

- fails to appear at a meeting twice and does not ask for its adjournment;

- ignores pre-trial dispute resolution;

- sends the application to the judicial institution again.

The state fee is subject to return even when a claim is submitted to a judicial institution that cannot be considered in the manner chosen by the applicant, or the court has no grounds for considering it.

Example: When an individual entrepreneur brings a dispute to a counterparty in a court of general jurisdiction, the court will refuse to accept the claim.

The judge will also refuse to accept the application in the following cases:

- appeals from an unauthorized subject;

- resolution of the same dispute earlier;

- presence of a decision of another court on the same case.

Regardless of the basis for the return of the fee from the court, this process is regulated by the Tax Code of the Russian Federation.

traffic police

The need to return payments may arise when applying for any government service. Thus, a refund of the fee paid to the traffic police may be necessary if the parties refuse to register a transaction for the sale of a car, or if they do not want to apply for a driving license.

Rosreestr

To return the state duty paid to Rosreestr, it is sufficient for one of the parties to refuse to register the transfer of rights to real estate. Sometimes vigilant citizens pay all mandatory payments to the state registry authorities in advance so as not to delay the registration process. But in the process of collecting documents, it turns out that they do not have sufficient rights to register the property, so they have to return the savings transferred to the budget.

Sample of filling out an application to return the paid duty to the tax office

Sample application to the tax office for a refund of state duty

When importing or exporting goods across the border, state duty must be paid to the account of the customs authorities. If you refuse to transport goods, payments made to customs are also subject to return.

If the mandatory fee is not paid or returned, the government agency will refuse to provide the service. Therefore, duty refunds should only be made if there are compelling reasons.

How to return funds when contacting the traffic police in person

Refund of the paid amount in full or in part is made only upon personal application to the traffic police.

How to make an application for a refund of state duty

An application requesting a partial or full refund must include:

- name of the body - the addressee of the document;

- personal data of the applicant (last name, first name, patronymic, address, contact details);

- in connection with which there was a need to return the amount;

Reference! As the basis for the application, it is advisable to refer to the Tax Code of the Russian Federation, which in Art. 333.40 provides citizens with this opportunity.

- reliable and as complete information as possible about the payment made (branch of the bank that accepted the payment, details of the receipt or transfer, exact amount);

- exact details for returning funds.

Important! Regional traffic police authorities can develop and introduce a form or application form. Information about this can be obtained upon application or on the organization’s website.

Where to apply for a refund of state duty

A written request for a refund of the state duty is submitted to the territorial office of the road safety inspectorate. After checking the application and ensuring that it is correctly formatted, the application is accepted for consideration, and the applicant is given a notification of acceptance.

Important! The application can be sent by registered mail. In this case, a notice will be sent to the applicant if he has enclosed a self-addressed envelope in the letter.

What documents will be needed to return the state duty?

The information contained in the application requires confirmation. To do this, attach the following documents to the application:

- original payment document (check or receipt);

- copy of the passport;

- copy of TIN.

How to apply for a refund of state duty

First, you need to find out the address of the local branch of the Main Department of Migration Affairs of the Ministry of Internal Affairs, as well as the name of the head of this unit. It is for him that the corresponding application is drawn up.

FULL NAME. the manager should be indicated in the dative case in the upper right corner of the sheet, immediately after the address of the institution. Further after the word “From” follow the full name. applicant, registration address and telephone number.

In the central part of the sheet you should write the word “Statement” and start its main part with a red line.

This is what an application for a refund of state duty for a foreign passport looks like

It is necessary to submit a request for a refund of the erroneously paid state duty for the production of a foreign passport. It is mandatory to indicate the amount of the transferred amount (2,000 rubles for an old-style document or 3,500 for a new form of passport) and the date of payment.

This is followed by the details of the bank account where the state fee for the international passport will be refunded, a list of attached documents, the date of the application for refund and the signature of the applicant. The completed document with the papers attached to it is submitted directly to the GUVM treasury or sent in the form of a registered letter by mail.

How to apply for a refund of state duty through the traffic police website

To apply to the traffic police, it is not necessary to bring the application in person or visit the post office to send a registered letter. Another option is to contact the inspectorate via the Internet using the traffic police website.

To enter the State Traffic Inspectorate website, you can use the State Services portal.

Sequence of actions when accessing the Internet:

- We enter the site through the State Services portal or through any search engine.

- On the main page of the site we find the tab for requests - “Receiving requests” and open it.

- In the window that opens, we present the text of the application.

- We make scanned copies of documents (payment slips, passport, TIN) and attach them to the application.

- After checking the correctness of all the information provided, we confirm the submission of the application.

Why they may refuse to return the state duty paid to the traffic police

Consideration of an application does not always end with a positive decision. Refusal occurs in the following cases:

- detection of errors in the application (incorrect personal information, amount, etc.);

- the refund application is submitted by the wrong person who paid the fee;

- There is no document confirming payment of the fee.

If rejected, you must correct the errors in the application and apply for a refund again.

If the application is refused due to the fact that more than 3 years have passed since the transfer of the state duty, the funds will not be returned.

Very often, vehicle owners have a situation where they need to return money paid to the traffic police. How to return the state fee paid through State Services? Let's figure it out.

Registration of a car, or obtaining a driver's license - these operations must be paid by law in a certain amount to the state budget. But if you don’t need them and don’t use them, then how can you get your funds back?

For what reason can they refuse to issue a passport?

The most common reasons for refusal are: incorrect completion of the application and inappropriate format of the collected package of documents; mechanical errors while filling out documents. In this case, you just need to correct all errors and resubmit the documents.

Now let’s go through the points when you may be denied a passport for a long period of time:

- Called up for military service (ban period until the end of the service period);

- Are under investigation;

- Failure to fulfill the obligations that were imposed on you by the court (failure to pay alimony, failure to pay fines, etc.) – After paying all obligations or under an agreement between the connecting parties, the law is required to issue you a foreign passport;

- Providing false data;

- As for children under 18 years of age, one and the main reason for refusal is that one of the parents did not give permission to leave the Russian Federation.

In such cases, employees of the Federal Migration Service will issue you a notice, which indicates: for what period and for what reason the refusal was presented to you. You can also find out about this by phone.

Situations in which a refund is possible

Refund of paid state duty or other payments is possible only in the following situations:

- if there is an overpayment for various services;

- the payment details were entered incorrectly;

- repeated payment for the same violations;

- transfer of funds from the payer’s account and re-depositing them through online resources.

Most people make payments through the State Services portal. It's fast, convenient and also very safe. But sometimes force majeure situations occur, and at such moments it is necessary to know and understand how to return the state traffic police duty paid through State Services. Everyone may need this.

The site itself is a link in sending funds, but despite this, the traffic police will deal with this problem. Therefore, you need to go there in person. To receive a duty refund, you need to write an application (an example is on the State Services website) and collect the following list of documents:

- original payment receipt;

- a copy of the first page of the passport and registration;

- a copy of the individual taxpayer number (TIN).

A refund application can be completed electronically on a computer or written by hand. It needs to indicate information about the traffic police department, the initials of the person writing the application, place of residence, a description of the specific state duty for which the refund will be made, the date, and of course, the signature. The question of how to return the state duty through State Services has been sorted out. Now let's talk about timing.

Who to write to

The general procedure for working with state duty amounts tells us that you need to write a refund application to the place where you applied for the service. Such an application must be accompanied by an original document documenting the fact that you paid the fee. The original is required if you are claiming a full refund. For a partial refund, a copy of the payment slip is sufficient.

Have you paid too much and are you sure that you are entitled to a refund of the state duty? Which tax office to contact depends on which region the authority that provided you with the service belongs to. This means that you will not be able to submit an application in your city if you contacted a notary in a neighboring region.

Exceptions

As with any other rule, there are exceptions. These include:

- courts of general jurisdiction;

- Constitutional Court of the Russian Federation;

- world, arbitration court.

Whichever of these authorities you apply for a refund of the amount of overpaid state duty, the application will have to be submitted to the fiscal authority at the location of the court. At the same time, in addition to a copy/original of the payment, you need to stock up on a ruling, decision or certificate from the court to confirm the grounds for the return of funds. Let us note once again that the application must be written to the tax authority where the court submits its reports, and not to the place where you yourself report.

When can the state duty be refunded?

The state fee (duty) can be reimbursed in full or in part in the following situations:

- when it is paid in an amount slightly larger than necessary (Chapter 25.3 of the Tax Code of the Russian Federation);

- when the complaint, application/appeal was returned to the submitter or left without consideration;

- in case of refusal to carry out a notarial act.

There is another option when the state duty is not returned to the payer, but can be counted when re-filing a claim or performing another legal action. To offset the amount, you must attach a receipt for payment.

Refund of the state duty from the tax office is also carried out in the case when the legal proceedings on the claim were terminated, or the appeal (claim) was left without consideration. If the parties conclude a voluntary settlement agreement before the arbitration decision, the amount of the fee may be partially refunded in the amount of 50%. If the parties came to an agreement already during the execution of the judicial act, the fee is not refundable. Half of the amount can also be returned in the case when a citizen voluntarily refuses to register his right to real estate.

Refund of state duty from the tax office can also be carried out in the following cases:

- The person who paid the state fee refused to perform a legal action until the moment it was started. For example, to travel abroad you needed a passport. You paid the fee, but the trip was cancelled, and you changed your mind about getting a passport.

- The person who paid the fee was refused to issue documents to refugees.

- A refusal was received to obtain a passport for exit/entry from/to the territory of Russia.

Period of consideration and receipt of funds

Having collected and provided all the necessary materials, all that remains is to wait for a response from the traffic police.

According to the legislation of the Russian Federation, consideration of these precedents is 10 working days from the date of filing the application.

It is during this period that service employees check all submitted documents and the fact of payment. If there is a discrepancy on some points, employees may have questions, and then the process of returning the state duty paid through State Services earlier may be delayed. But in practice, such cases are resolved in one day.

If the verification of the fact of overpayment is successful, the citizen will be able to receive his finances within one month from the date of receipt of all necessary documents in fact.

There are cases of unsuccessful checks, and then a refusal occurs. The reasons for such decisions can most often be:

- lack of payment receipt or other evidence;

- absence of a complete package of documents or the submitted documents were filled out incorrectly;

- The service itself does not provide for a refund.

With these actions you can return the state duty through State Services. The main thing is to collect all the necessary documents and write the application correctly.

Refund of state duty through State Services: step-by-step algorithm

You can pay the state fee through the State Services website in just a couple of minutes. The service will offer to make a payment upon completion of registration of the service request. If the state fee is not paid on time, the client will receive constant reminders to the specified phone number, email address, as well as to the personal account account. It will be more difficult to return funds transferred using erroneous details. It is important to know how to return the state fee paid on the State Services portal.

Reasons for return

Free legal consultation

The Tax Code of the Russian Federation regulates the procedure for calculating mandatory payments, including state duties. Article 333.40 of the regulation specifies cases in which recipients of funds are required to return money upon the applicant's request. This procedure applies to all methods of paying state fees, including using the State Services website.

The previously transferred amount is subject to partial or full refund. It all depends on the specific case. Let us highlight the main situations when the payer has the right to return the transferred money:

- the service was not received, but the state duty has already been paid;

- money for the state fee was transferred in a larger amount;

- a refusal was received from the authorized body to provide the service;

- The court, for certain reasons, returned or did not accept the submitted statement of claim.

Important! Particular attention should be paid to situations where the applicant provided incorrect details. The Tax Code of the Russian Federation does not provide for a refund in this case.

The Tax Code of the Russian Federation, along with the possibility of returning money transferred to the state budget, introduces a ban on these actions in some situations. Before requesting a refund from a federal agency, you need to check whether the payment is a restrictive one.

In order to return the money, the applicant must contact the department or authorities itself where the funds were transferred. Regardless of which government agency the payment was transferred to, the procedure for returning it will be the same.

Knowing the procedure for reimbursement of funds for issuing a foreign passport on the State Services portal at the UVM, the payer will not have any difficulties in the future when contacting any federal department.

Stage 1. Writing an application

The most important document required for a state duty refund is the payer’s application. This document is written arbitrarily, but following certain rules. In the header of the appeal you should indicate:

- name of the body or official to whom the payer sends the appeal;

- Full name of the citizen, his passport details, telephone number;

- applicant's residential address.

Next, indicate the name of the document - “Application”, “Application for refund of state duty” and others. The main part of the appeal should set out the request for the return of funds, as well as the basis for this. If there are many reasons, they should be indicated in full in the main part of the appeal.

Information about the transfer of funds is recorded - date, number of the payment document or transaction. At the same time, you need to indicate the details of the bank to whose account the money will be transferred. At the end of the document, the applicant must sign and date the letter.

Important! It is recommended to make 2 application forms - for a government agency and for yourself.

Stage 2. Collection of documents confirming the fact of return

A list of supporting documents for payment of the fee must be submitted to the organization responsible for the service. Based on Art. 333.4 of the Tax Code of the Russian Federation, a full refund requires the provision of a payment document in the original. If a partial refund is required, the applicant may provide a copy of the document. If the funds were transferred on the State Services website, the transfer receipt will become a mandatory document. You can print it out by logging into your personal account on the website.

To receive a payment check, you must complete the following steps:

- Go through authorization on a single portal. Go to the notifications section in your profile. Click on the last name located at the top of the main page and follow the “All notifications” link in the form that appears.

- In the feed of available notifications, you should find the translation for which the receipt is printed. In order to select a specific message from the list, it is recommended to go to the “Payment” section or use the search bar on the main page.

- When the payment is found, double-click on the payment transaction.

- In the payment window, you can print out the receipt or send it to the required email address.

- The finished payment document contains all the required information, with which you can find the desired translation in the general database.

Stage 3. Submission of the letter to the government agency

An application for a refund of payment prepared by the borrower is subject to consideration by the department responsible for providing the service. For these purposes, a citizen can contact the territorial body of the department located at the place of residence.

The municipal department is engaged in similar work. Reimbursement of costs for legal proceedings is borne by tax inspectorates. A receipt of payment must be attached to the application.

After receiving the documents, the payer’s copy must be marked with acceptance. When sending documents by mail, it is imperative to make an inventory and put it in an envelope, and then send a letter with the declared value. An application with a stamp and an inventory in hand is confirmation of the transfer of documents to a government agency in the event of unforeseen cases.

Reasons for return

All payments to government agencies are regulated by the Tax Code of the Russian Federation. It contains legislative norms regarding both payment and return of such funds. Article 333.28 specifies the amount of state duty, and Art. 333.40 procedure for returning paid services. There are only a few of them:

1. When an erroneous overpayment occurs.

According to the Tax Code of the Russian Federation, it will be considered an overpaid amount. This happens when a foreign passport is issued for a child under 14 years of age.

The fee varies and is significantly less. 2.

Full refund if the service cannot be provided to the person. Many people make a mistake and pay on their own behalf, but on the receipt it is necessary to fill in the details of the child for whom the passport will be issued.

Due to such a discrepancy, that is, a discrepancy between the questionnaire and payment data, it will be considered that the money has not been received. 3.

Articles on the topic (click to view)

- Economic Crime Lawyer

- What to do next after you have bought a plot of land?

- Official rating of companies providing bankruptcy support for legal entities

- The bank has demanded full repayment of the loan, what should you do in such a situation?

- ROIS - Customs Register of Intellectual Property Objects

- Electronic trading platforms for bankruptcy

- The theory of consumer behavior suggests that the consumer strives

A refusal to issue a document was received. This happens when a citizen has given false information or has a ban on traveling abroad.

4. If a person paid, but did not submit the required documents to the migration service, and as a result could not receive a passport.

As the law states, a refund is possible within three years from the date of such payment.

Thus, according to paragraph 6 of Article 333.40 of the Tax Code of the Russian Federation, a citizen has the right to offset such an amount against another duty for similar services. For example, if a person initially thought about applying for an old-style international passport, and then, before submitting a package of documents, decided to get a new one.

In this case, he can pay the difference rather than pay the entire amount again in a single payment.

The same should be done if for some reason a person was unable to immediately submit documents for a foreign passport to the migration service, but he still has a receipt for payment, and another three years have not passed. Then he can at any time contact his department of the Main Department of the Ministry of Internal Affairs of the Ministry of Internal Affairs with the same receipt, if the state tax has not increased.

If an additional payment occurs, you must write an additional application addressed to the head of the department, briefly stating the circumstances and attaching the original of one or two receipts. For example, the text itself might look like this:

To the head of the department for migration issues of the Ministry of Internal Affairs of the Russian Federation for the Losinoostrovsky district of Moscow, V.P. Roshchin. Nazarov Vyacheslav Vadimovich Registered (specify address) contact phone number: