Methods for canceling a money transfer

Instant transfers of payments to a card have become familiar to every person. Millions of transfer transactions take place around the world every day. It is enough to fill out a few fields in the mobile application on your smartphone, and the money will already be transferred to the account of another person or organization. In this case, technical errors often occur, both on the part of cardholders and the bank. Let's consider how you can return the transferred money.

On average, it takes from a couple of minutes to several hours to complete cash transactions. If an error is noticed when transferring from a card via mobile or online banking, the user can immediately cancel the completed action, where the mark “for execution” is indicated.

If there is no application or the money transfer has already been sent, then the first thing to do is contact the bank that services the plastic card holder. To cancel an erroneously made payment, you will need to submit an application. If you don’t have time to come to the bank’s office, then you should write to the online chat of the technical support service or call the operator on the hotline, the telephone number of which is indicated on the back of the card. These options will help you save time and quickly resolve the issue. The most reliable way is to write an application to the bank branch, where you indicate your account information, the reason for canceling the transfer, prove that an error was made, and attach a copy of the check, if available. If incorrect details were specified during the transfer, the money will be automatically returned to the owner.

It is possible to personally contact the recipient who received the transfer by mistake. Returning the money is solely his own decision. You can contact him and convince him to return the money received. If the person does not ignore the request, the issue will be resolved. Otherwise, all you have to do is file a lawsuit.

Deadlines for returning erroneous transfers to the card

Russian legislation does not provide for a specific time frame within which the money must be returned. This directly depends on the bank.

- If the payment has not yet been credited, the amount can be returned within 5 working days.

- If the money has already been transferred to an individual or legal entity and a lawsuit has been filed, then it is possible to receive a refund within 7 days from the moment the defendant receives a letter about the erroneous payment.

If the process of returning funds is delayed, you can demand compensation in the form of interest for each day of delay. The statement of claim will need to be filed with the courts.

How to return funds to your current account for goods and services

Network business has been booming lately. More and more people are ordering goods on social networks and paying for purchases by non-cash payment. Buyers request a refund in several cases:

- Poor quality products;

- The product does not correspond to the description;

- Failure to meet delivery deadlines;

- The buyer made a purchase, but changed his mind about using the purchased product and wants to return it.

If the buyer's claims are justified, he demands a refund of the payment made. If the seller of a product or service refuses to return the money, you can contact the consumer protection inspectorate.

Is it possible to return money sent to the scammer?

Recovering funds that were sent by mistake is easier than in the case of illegal actions on the account. The bank is not obliged to compensate people for material losses if they voluntarily disclosed their bank card number and transaction codes to third parties. According to the Central Bank, in 2021, only 15% of the total amount of funds that were illegally written off from the accounts of affected citizens was returned.

If you made a transfer to scammers yourself, you can return it using the scheme described below:

- Call the bank or visit its office. Write an application for the return of the transferred funds and attach evidence of fraud. If the funds have not yet been sent, they will be returned to the account and the card will be blocked. The re-issue of a new payment instrument will need to wait for two weeks

- File a report with law enforcement if the money has already been deposited into an online wallet, third-party account, or another bank.

To confirm the fact of illegal withdrawal and transfer of funds, it is necessary to provide correspondence, sent SMS messages, and available data on fraudulent activities. Any person should not lose vigilance and be attentive when filling out the form for transferring funds to another account. You should not follow the instructions of unknown persons who are trying to obtain bank card details. Check and monitor its balance in order to see an error and lack of money in time. And do not fall for fraudulent tricks and deception schemes.

Refund to credit card when returning goods

In the modern world, non-cash payments are becoming increasingly popular. They are used to pay for both large and small purchases. However, many people have a question about whether it is possible to return money through non-cash payments if such a need arises. It is worth keeping in mind that the law provides for such a possibility, and the procedure here is not much different from paying in cash. The main condition is to provide the credit card from which the funds were debited. This article will discuss all the rules of such an operation, possible nuances in the procedure, and also provide information on how long you will have to wait for the transfer.

Refund to card if purchased with cash

Each transaction for the purchase of goods is recorded by a control cash register tape. Therefore, replacing the cash form of payment with a non-cash one goes against tax legislation and is interpreted as “misuse of funds,” which entails a penalty of 50,000 rubles per store. In addition, the agreement between the acquiring bank and the store describes in detail the procedure for making a reverse money transfer and prohibits the replacement of payment methods.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation

We will answer your question in 5 minutes!

Step-by-step instruction

To return money to your card for an unsuitable product, when contacting the store you will have to perform the following operations :

give receipts and goods to the store employee (in this case, the appropriate act or invoice will be drawn up);- make a written statement.

After review, the store can immediately carry out the return procedure on the spot . In this case, the seller’s actions will be as follows:

- establishing or clarifying the date of purchase of the goods (the application must be made no later than 14 days after purchase);

- searching for confirmation that the product must be accepted back (and not replaced, for example, or classified as a product that cannot be exchanged or returned);

- inspect the goods - they must be returned unchanged;

- preparation of documentation for the return of money - signing a check, drawing up a report (the buyer receives one copy);

- an order to return the payment is sent to the bank;

- deadlines are assigned.

The buyer must carefully provide the details for a refund of the amount paid.

What documents will be required?

To apply for a refund to your card, you must have only the following documents and papers with you when applying:

- passport;

- check - a cash receipt from a machine and/or a check for debiting money from a card account;

- payment bank card.

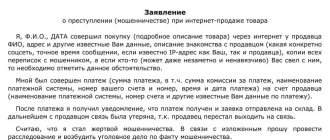

How to write an application?

- Personal data - full name, contact phone number.

- Name of the store, initials of the owner.

- The essence of the complaint is when the product was purchased and was not satisfied with it. For example, a product of poor quality, non-functional, or not satisfied with the parameters.

- A request for the return of the amount of money paid, with the obligatory clarification of the form of payment made - by bank card (indicate its details).

- applications for a refund for goods purchased using a card

- applications for a refund for goods purchased using a card

You can also clarify that you can return the money to this card or specify other details for the transaction.

Transfer deadlines

Now let’s talk about how quickly, that is, after how many days, funds are returned to the card. The Law “On the Protection of Consumer Rights” regulates the period for returning money paid within 3 working days after filing a claim and returning the goods to the seller.

The actual side of this operation depends on the procedure for agreeing on the financial side in the agreement between the store and the credit (banking) organization.

How are accounting and tax documents prepared?

The differences in the preparation of accounting and tax documents when returning money for goods to a bank card from a cash refund are as follows:

| Salesman | Buyer | |

| Documents for cash return |

|

|

| Documents for returning money to the card |

|

|

When returning money via non-cash payment to the store, there is less paperwork to complete - most operations are computerized and work automatically.

If the buyer is not satisfied with the purchase, then he can return it and get the money back for its purchase (if it is not included in the list of non-exchangeable goods and non-returnable products). For non-cash payments, the amount is returned to the buyer’s card. It is important to preserve the receipt and presentation of the product.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Will it be possible to find a fraudster by card number?

Usually, affected users, at least on my blog, along with the question of whether it is possible to return the money transferred to the fraudster’s card, also clarify how to identify the fraudster by the card number and punish him.

Of course, you can understand them, emotions and all that, but for example, simply approaching a bank employee, telling them the card number of a person suspected of fraud and finding out the necessary information will not work if your brother-in-law is not an FSB captain or at least not the head of the regional Ministry of Internal Affairs.

Even if we assume that the bank employee met halfway and told the cardholder’s last name, what to do with this information, there are more than one hundred people in the country who have the same last name.

And it will not be possible to calculate the address, again, without the database of the Ministry of Internal Affairs or the FSB officer’s brother-in-law, so the motivation of people who ask whether it is possible to identify a fraudster by the card number that you will go home to him is not completely clear...

And if he doesn’t suspect and he is used in the dark, as described above in the article, when money is credited to the account and they are asked to return it, but with other details or cards issued to persons without a specific place of residence or those who are sitting in the zone.

In general, I think that it is better not to ask this question but to make efforts to return it if you are caught in a scam involving transferring money to a card or other fraud, and you can punish the attacker, as an option, by blocking the card.