Responsibilities of Borrowers

If a bank client does not repay payments on time, the loan becomes overdue.

To avoid debt, credit institutions use some measures against the offender:

- accrue penalties (interest) or charge a fixed amount,

- repay the overdue debt by selling the property left as collateral.

Criminal liability measures with the following sanctions are also possible: arrest, forced labor, etc.

Before taking enforcement action, financial institutions may use certain measures:

- warn the client about the consequences of non-payment in a telephone conversation or written message,

- transfer information to the Credit History Bureau, where the borrower will be placed on the “black list”,

- sell debt to collectors.

As a rule, credit institutions immediately respond to delays, but the method of solving the problem is chosen on an individual basis.

Please note! If the funds are not transferred to the account on the next day after the payment date (fixed in the schedule), the bank contacts the borrower and finds out the reason for the non-payment. The main task is to understand what motivates the debtor - direct intent or unforeseen circumstances.

Why does a bank sell debts?

A bank by its nature is a financial company. It derives income from investing the funds received from investors, other clients and founders in various instruments, as well as from providing loans.

By providing a loan with a rate of 12-15% or higher, a financial institution makes good money. However, this only happens if the client repays the debt on time.

It is unprofitable for the bank to have debt on its balance sheet that is already overdue for a couple of months for several reasons:

- the need to allocate a reserve. When a client defaults, the risk of non-repayment of the debt increases significantly, which has a negative impact on the bank’s fulfillment of its own obligations to the Central Bank. Depending on the duration of the delay and the type of loan, the amount of the reserve may be equal to 100% of the debt amount. The bank has no right to provide this money as a loan to other clients or invest in any instrument. They must be used only for their intended purpose,

- negative impact on the company's reputation. The existence of many “bad” debts on the balance sheet demonstrates to investors and clients that there are clearly problems in the bank’s activities. He probably has the wrong approach to assessing borrowers or working with debtors incorrectly,

- expenses for the return of funds. Communication, actions of employees of the collection department, etc. are expensive for a credit institution. If you use debt collectors under an agency agreement, you will have to spend no less.

It is clear that the bank has the right, within the framework of current legislation, to file a claim and go to court to collect the debt.

But he will do this only as a last resort due to the following circumstances:

- extra expenses. You will need to pay a fee, a lawyer, travel expenses,

- unpredictability of the court verdict. Often, credit institutions are faced with cases when the judicial authority takes the side of the debtor and simply writes off the fine or penalty. Instead of income, the bank, even with a successful outcome of the case, often at best returns only the amount initially provided,

- long-term recovery mechanism even if there is a court decision. Bailiffs are in no hurry to return the debt to the bank, confiscating the debtor’s property, especially if at least some payments are made. In addition, the debtor may not have any property or income.

Do debt collectors have the right to describe property?

Given all the problems and difficulties, credit institutions often prefer to sell the debt to professional collectors or any third parties who are ready to buy it. This allows the bank to release reserves and also return at least some money.

Some financial institutions practice selling overdue debt even to representatives of “difficult” borrowers. Essentially, a credit institution needs to draw up an assignment agreement in order to be able to release reserves.

Does an MFO have the right to go to court?

If we talk specifically about appealing to judicial authorities, then a microfinance organization is indeed endowed with such a right. This opportunity is available to all Russian microfinance organizations that operate within the legal framework, are licensed by the Central Bank of Russia and are included in the register of organizations that engage in microfinance activities.

Regardless of where you apply - to the MCC or the IFC, both of them can, if the borrower refuses to voluntarily repay the debt, go to court to forcefully collect the debt. This right of theirs is enshrined in Russian legislation, so you should not treat such words as empty threats, everything is quite real.

How quickly do you go to court? Everything is purely individual; the law does not clearly state from what period of time a claim can be filed against a debtor. Some wait a month, some wait three months, some may even try for six months to get the money back on their own, and only then do the company’s lawyers prepare a lawsuit.

By the way, now this process is happening a little faster due to the fact that the legislation has limited the maximum interest that can be charged on the debt. And as soon as this level is reached, the MFO understands that they could not increase the amount of debt even more, this income is the maximum, and they sue the borrower.

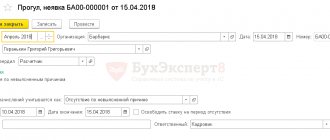

What happens after? The court, as a rule, satisfies the claim and enforcement proceedings begin, for which the bailiff is responsible. He can:

- Seize your accounts;

- Collect funds from your bank accounts;

- Send a letter to your employer asking that 50% be deducted from your salary until the debt is repaid;

- Come home, seize property;

- Restrict your travel abroad or your right to drive.

How do collectors work?

Despite the fact that collectors buy the right to claim for an insignificant percentage of the debt amount, they will collect the entire amount with interest, often demanding additional interest and penalties on top. Whether you should pay all of this depends on the individual case.

First, you need to try to come to an agreement with the collectors - many such companies agree to return even part of the debt, after which they refuse the demands.

Another option is to repay the loan in installments over several months or years. The essence of the work of collectors under the law is to indicate to the debtor the requirement to repay the debt, list options, and explain rights and obligations.

What rights are granted to collectors in 2019?

In practical terms, this comes down to constant calls and even personal visits in order to force the debtor to pay. The payment will come at a high price.

Some collectors do not hesitate to use illegal methods:

- The employee does not introduce himself during a telephone conversation and does not present documents during a personal visit. If this happens, you shouldn't even continue the conversation,

- the collector makes offensive attacks against the debtor, uses rudeness,

- phone calls occur at night,

- the company discloses personal information about the debt, while this information is a bank secret,

- threats of violence and other forceful methods. In response to these steps, you should immediately contact law enforcement.

If you decide to return the debt to collectors, you should not give them cash. The debt must be paid only by non-cash payments using a bank transfer.

You can DOWNLOAD samples of complaints against debt collectors using the links below:

- Complaint to Roskomnadzor against collectors

- Complaint to the Prosecutor's Office against debt collectors

- Complaint to the Police against debt collectors

Collection agencies: rights and responsibilities

As soon as Federal Law No. 230 came into light, collectors immediately had to curb their appetites. They can no longer abuse their power, exert psychological pressure or use physical force.

What collectors can do now:

- Interact with the borrower;

- Notify him about the current amount of the debt, interest and repayment terms;

- Explain the consequences of failure to fulfill your obligations;

- Offer payment in installments;

- Agree on a convenient debt repayment schedule;

- Go to court to collect the debt.

That is, all the activities of collection agency employees now boil down to communicating with the borrower and helping him repay the debt. If he is not going to do this, then the agency goes to court.

The law regulates which methods of communication are legal:

- Through telephone calls;

- Through personal meetings;

- Text and voice messages in instant messengers;

- Messages by email;

- Via postal mail.

At the same time, collectors can no longer constantly call day and night; there are clear restrictions that must be observed:

- You cannot call more than once a day, and 8 times a month;

- You cannot write SMS or leave voice messages more than 2 times a day and 16 times a month;

- You cannot meet with the debtor more than 4 times a month;

- You can't call at night;

- You cannot call from numbers that cannot be identified and give false information to the debtor.

In addition, collectors are prohibited from making threats, committing actions dangerous to his health and life, intimidating, etc. They also cannot demand debt from bankrupt people, incompetent people under 18 years of age, disabled people of group 1, as well as those who are undergoing treatment in a hospital.

Legality of claims

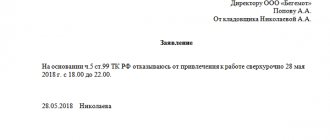

If the credit institution has sold the debt, the borrower must be given a registered letter containing the following information:

- the fact of a change in creditor, details of the debt assignment agreement,

- calculating the amount of debt along with fines and penalties,

- new details for debt payment.

If the collector's demands are made only verbally, you should not pay. Most likely, they do not have legal grounds to return the debt, and it may happen that the borrower is still listed as a debtor to the credit institution.

If the debtor is shown all the documents, the question of repayment of the debt depends on financial capabilities.

Watch the video. What to do if the bank sold your debt to collectors:

Small debt

Sometimes a situation occurs that there is a small debt, and the borrower simply forgot about it. It often happens that he forgot about the interest charged for the transfer, as a result of which the underpaid amount accumulates.

Some credit institutions in such situations will not report the debt for a certain period of time, since the delay benefits them - by delaying for a certain time, they wait for penalties to arise.

Remember! There may be a thousand or two thousand rubles unpaid, but fines begin to work - and now the debt has already increased several times.

The bank does not want to get involved with such insignificant debts, so it gives unrepaid small loans to collectors under an agency agreement for a set fee, having already received some profit from the debtor. And the collectors, in turn, begin to demand repayment of the debt.

The calculation in this case is simple - it is easier to return this insignificant amount than to waste time and nerves. Is it worth paying back the debt to collectors in such a situation? It all depends on the specific situation.

When do collection agencies appear?

You should not think that as soon as you are 1-2 days late on your payment, collectors will immediately start calling you, far from it. The bank or microfinance company initially tries to remind themselves, to inform the debtor about the debt and the consequences that await him if he does not make the payment in the near future.

This continues for several months - calls, SMS, letters to the registration address, and they will be daily. The bank waits longer - 3-4 months, the MFO no more than 1-1.5 months, after which they decide: to go to court or to a collection agency.

The decision depends on exactly how much you owe and what information the lender has about you. If you are officially employed, you provided information about your income and work experience, then the creditor will definitely go to court, because then the bailiffs will seize your accounts and carry out forced collection.

But if you were given a quick loan or a loan without certificates or collateral, the lender does not have information about your solvency, or it is quite low, then he may recognize the debt as uncollectible. And then, under an assignment agreement, he will sell it to the agency for a small percentage in order to get at least some money. But the collectors will strive to get as much as possible from you, because this amount will be their profit. We will describe below what they can do to get a refund.

If the debt is large

If the debt is large, each day overdue will bring large fines. As a rule, by the time the collector arrives, the debt is already significantly greater than the original amount.

What to do if debt collectors come home?

That is, if the client borrowed, for example, one hundred thousand, and under the terms of the agreement is obliged to pay back one hundred and twenty thousand, now he already owes two hundred thousand, or even three hundred thousand. In such a situation, it is better to wait for a court decision than to pay huge sums to collectors that they dream of receiving.

There is nothing to lose in such a situation, the credit history is already damaged anyway, and even if you manage to pay everything off, it will not be returned, so there is no need to succumb to the actions of debt collectors.

Over time, when the debtor stops making payments on the loan, the statute of limitations begins, and after its completion, it will no longer be possible to collect money from the debtor on the loan.

It is clear that it is naive to believe that this period will be missed, however, collectors will have to go to court before the expiration, after which the case will already be in court, and, as a rule, the total amount of the loan that has to be paid will become significantly lower than what the collectors demanded.

What can collectors do in relation to the debtor?

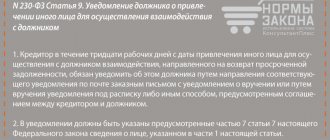

Federal Law No. 230 FZ clearly states the rights and responsibilities of collection agency employees.

Let us recall that the body that licenses, regulates and maintains the legality of the work of collection agencies is not the Central Bank (as is the case with banks and microfinance organizations), but the Federal Bailiff Service (FSSP).

Collectors have the right to call the debtor strictly from 8 to 22 on weekdays and from 9 to 20 on weekends. You can make 1 call per day and only 2 calls per week. They are allowed to visit the debtor in person once a week.

You have no right to be harassed by more than one collection agency for the same debt at the same time (but after a month, it may already be a different agency). Phone calls cannot be made from hidden numbers. When calling, the operator must clearly state his details - first name, last name and patronymic and the company he represents.

All conversations between the collector and the debtor, by law, must be recorded. This is also a rule of law. As a result, the recording of the conversation is also material for the court and the FSSP if the debtor decides to complain about rudeness, rudeness or threats from people calling him who introduce themselves as employees of collection companies.

Collection agencies can work:

- under agency agreements with the lender;

- buying the debt from the creditor.

In the first case, a credit institution or microfinance organization involves collectors in collection, that is, the debt itself remains with the creditor. In the second, a bank or microfinance organization sells them an overdue loan or loan, and this debt becomes the property of the collector.

Sometimes a debtor has a question about how collectors gained access to his personal data. The answer is simple - this data is contained in loan agreements, and absolutely all banks and microfinance organizations in these agreements require the borrower’s consent to transfer data to third parties. By signing the agreement, you agree to the transfer of your data to collectors - in the event that you are late and fall into “bad” debts.

If unacceptable and illegal measures are applied to an individual, the person can appeal them and count on the following:

- the collection agency will be fined;

- the agency may lose its license and be excluded from the register maintained by the FSSP.

Collectors have no right to threaten, intimidate or be rude to you.

Collection employees have the right to remind you of the debt, its amount, politely demand to repay the debt, provide details for its repayment and offer options: installment plan, restructuring, writing off part.

Collectors do not have the right:

- apply physical force to debtors, even grab them by the hand;

- use psychological violence, such as blackmail, threats, boorish tone;

- spoil or damage the debtor’s property, for example, draw the words “debtor” on his door;

- carry out forced seizure of someone else's property;

- deceive and mislead a person;

- take measures that may harm human health and life.

What debt collectors have the right to do:

- Make attempts to talk with the debtor, find out his intentions regarding the debt, ask about the person’s solvency, and identify financial difficulties.

- Inform about the amount of debt and methods of payment. For these purposes, calls and messages sent by phone to the debtor, visits to the home or place of work can be used.

- Communicate with the person with respect and in a business-like manner. No one can threaten you or use other methods of shock collection; this is illegal. During the communication process, debt collectors are required to follow a certain “ritual”: introduce themselves and name the company for which the employee works, and, if the debtor inquires, provide its registration information.

- Offer options for debt repayment.

In particular, if a person refers to a lack of money, then the agency can provide restructuring or installment plans, write-off of interest and penalties. Often, collectors hold promotions in which a person can pay part of the debt (for example, half), and the rest will be written off. Collectors buy out debts for approximately 5% or even less than the amount of the overdue loan. They can afford to write off penalties and accrued interest, and even part of the debt, without losing the money invested in the purchase of an overdue loan, and even receive income. - Go to court.

Collection agencies have the right to appeal to the courts. In particular, they can apply for a court order and initiate enforcement proceedings for forced collection. They can also begin full legal recovery by filing a lawsuit. The submission of documents to the courts by most large collection agencies has long been automated and streamlined.

If the statute of limitations has expired

applications for the application of the statute of limitations free in word format

Many people want to know whether they should repay the debt to collectors if the statute of limitations has expired? In this case, the clear answer is no.

Please note! The statute of limitations for loan obligations is three years. After this time, credit institutions (and collectors) do not have the right to demand funds back.

In addition, this period of time is not affected by the date of the agreement between the bank and the collectors. Even if the debt was sold only yesterday, but it has already been going on for five years, the debtor may not pay it.

It is worth noting that previously (now less often) collectors purchased various debts, including overdue ones, from credit institutions. It was possible to force debtors to repay the debt through threats. But today this is difficult to achieve.

It must be said that the statute of limitations can be extended by the court. But in this case, the collectors will have to go there, prove their own position and convince the court that they are right. This doesn't happen often. Therefore, most likely it will not be possible to force the debtor.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

How to avoid paying money to collectors

If the collectors’ demand is legitimate, then it is better to return the debt. In such a situation, this will be the best solution.

However, if you need to avoid such a fate, you can try:

- change place of residence,

- change your phone number and social media page,

- stop contact with relatives and friends,

- wait until the statute of limitations expires (three years),

- find inaccuracies in the agreement and build a defensive line of behavior around this.

However, it should be remembered that all these actions may affect the fate of the debtor. If the creditor can confirm that the debtor “disappeared” on purpose, then he may be accused of fraud. And then he could face imprisonment, so he needs to think it over.

Watch the video. How to avoid paying debt to debt collectors: