Home / Collectors / Let’s decide once and for all: can collectors call on weekends and holidays?

In times of crisis and unstable financial situation, people do not always manage to make loan payments on time, and if the bank is unable to solve the problem with the payment of money, they transfer the debtor’s case to a collection agency. Agency employees begin calling the debtor, his relatives and work colleagues.

Often these calls bring some inconvenience. Can debt collectors call on weekends and holidays? What laws govern their activities? What to do if debt collectors do not follow the law and call at unauthorized times? Let's look at these questions in more detail.

General provisions (calls from specialists)

The legislative framework has several regulations and resolutions that regulate the activities of credit institutions and debt collectors (how a collection agency specialist should behave, whether collectors can call on weekends, what ways to seek debt repayment), these are :

- Federal Law No. 149, which regulates control of the dissemination of data in electronic form;

- Federal Law No. 152, which protects the personal data of the debtor;

- Article 857 of the Civil Code and Article 26 of the Federal Law regulate control over the actions of banks and collectors;

- Supreme Court Resolution No. 17, which states that banks do not have the right to disclose information on loans to third parties unless they have a special license;

- Letter No. 01/8179-12-32, dated July 23, 2012. from Rospotrebnadzor, which states that loan collection specialists can take from the bank all the data that is specified in the loan agreement;

- The main document, which specifies all the rights, obligations and prohibitions for collection agencies, was Federal Law No. 230 of July 3, 2016;

Do you have a question about the illegality of calls from collectors?

Ask an experienced credit lawyer as part of FREE consultation!

Hotline in Moscow: 8 (495) 131-95-79

Ask a Question

Actions that collection agency specialists can take include::

- Calls and voice messages to the defaulter;

- Writing telegrams and emails;

- Personal meetings;

- Sending paper letters with requests to pay a debt or proposals for payment methods.

While these activities are permitted, they are regulated in terms of timing and mode of interaction. That is, the law clearly states what is not allowed to be said in letters or in a personal meeting, whether collectors have the right to call on weekends, and also at what time these calls should be made.

The laws also stipulate how a specialist collector should behave and what qualities he should have :

- Collectors must be conscientious and not go beyond what is reasonable (6 Article 230-FZ);

- If the case is transferred to another specialist, the debtor must be warned about this within 30 days;

- Collectors must answer questions of interest to the defaulter by telephone, in person or by letter;

- Calls from collectors on weekends should only be made during permitted hours.

If the actions of debt collectors are contrary to the law and infringe on your rights, you must immediately contact law enforcement agencies!

Can they visit the debtor’s relatives?

If the defaulter lives in the same living space with relatives, agency employees can come to them.

When communicating with loved ones, the lender should not disclose confidential information about the borrower:

- amount of debt;

- period of delay;

- other credit information.

Visitors can ask relatives about the client’s whereabouts and ask for a contact phone number.

Creditors have the right to interact with the relatives of the defaulter if their number is indicated in the loan agreement and the family members themselves have not given a written ban on communication.

They will also be able to contact the debtor’s relatives regarding loan repayment if they act as co-borrowers on an unpaid loan.

Can they call on weekends?

Calls from collectors can bring a lot of inconvenience to the defaulter: collectors call on weekends, calls come in the middle of the working day or at night, all this can ruin not only your mood, but also undermine your health.

Therefore, in order to protect your rights and maintain your health, you need to clearly know whether they call on weekends, what time they can make calls and when restrictions are placed on these actions :

- On weekdays, problem debt specialists can call from 8 a.m. to 10 p.m.;

- On weekends and holidays, calls from collectors should be limited to the hours from 9 a.m. to 8 p.m.

If you are interested in the issue related to the time of calls, we suggest reading an article devoted to this issue - until how long can collectors call.

Preparing for the visit of collectors

If you do not repay the loan, communication with creditors is inevitable. You should not shy away from interaction; better study your rights, as well as the law on collection companies No. 230-FZ.

Debt collection specialists believe that people are incompetent in many legal matters, and can violate the legal rights of a citizen, act rudely and be persistent.

Remember that you don’t have to let anyone else into your home. If a meeting with creditors is unavoidable, arrange it in a public place, on neutral territory. This will ensure your own safety, because... when there are many witnesses around, creditors will not dare to use physical force or threats.

What to do if they call on holidays

Often, collectors rely on the fact that the debtor is not very familiar with the law regarding their activities, does not know whether collectors have the right to call on weekends, and is not shy about the methods by which they plan to achieve payment of the loan, while breaking the law. If you encounter just such a case, you need to follow some rules :

- Warn the collector that calls will be recorded.

- Find out the name of the caller and information about the organization.

- Do not immediately agree to the terms for repaying the debt, as they may turn out to be extremely unfavorable for you.

- Warn that if their organization fails to comply with the law, you will be forced to file a complaint with the appropriate authorities

If debt collection agencies continue to violate your rights and call at inappropriate times, feel free to write a complaint to the prosecutor’s office about extortion and the Central Bank about violation of the law.

Do you intend to study this issue thoroughly? We invite you to read an article that provides competent answers to related questions - where to complain about debt collectors.

What happens if you don't communicate?

Refusal to communicate is possible after 4 months have passed since the delay, which was the reason for the connection of collectors for an out-of-court settlement of the dispute over the repayment of the loan. Before this period, if the debtor does not belong to the category of borrowers listed in Part 1 of Art. 7 of Law No. 230-FZ, he cannot, on his own initiative, refuse calls or other methods of notification from the agency, he cannot. This does not mean that for a third of the year the debtor is obliged to listen to claims or have direct conversations with a representative of the collection company.

The law does not regulate the duration of interaction. An incoming call is recorded automatically by the telecom operator. Therefore, if the conversation consists of 2 words: “Hello!” "Goodbye!" It will be considered completed, although it will take less than 5 seconds, and will count towards the call limit available to the collector. Thus, the debtor does not need to change the phone number or disconnect it. It is enough to answer the collector’s call with one phrase and the “interaction” will be formally considered completed.

Articles:

What time do debt collectors have the right to call?

What to do if debt collectors call you at work - do they have the right to do so?

Case resolution practice

Taking legal action against collection agencies is not uncommon.

Judicial practice regarding calls at unspecified times is ambiguous and has several options for resolving the case. In March 2021, citizen S.N. Titova appealed to the Leninsky District Court of Orenburg. with a statement of claim against Active Collection LLC demanding compensation for moral damage caused by the fact that collectors call on weekends at times not established by law (at night).

Citizen Titova S.N. she herself represented her interests in court, during the trial she was unable to prove that the calls were made at night (she did not provide the court with a printout of calls from the telephone company), which is why the court decided to dismiss the claim.

The time of calls should be taken into account at the location of the debtor. If the collector is located in a different time zone, this does not relieve him of the obligation to take into account the time of the defaulter .

In July 2021, the Khabarovsk court considered the claim of citizen M.V. Ryzhkov. to the collection agency Avanta LLC for the recovery of moral and material damages. According to the case materials, agency employees called the plaintiff at night, which caused problems with the plaintiff’s health.

Ryzhkov M.V. a doctor's report from the medical center on his state of health was provided, as well as details of calls from the cellular company. Having considered the circumstances of the case, having studied all the evidence presented, the court decided to satisfy citizen Ryzhkov’s claim in full.

Is a lawsuit with collectors or a bank inevitable? Don't despair, but start taking concrete actions. We suggest the following article is required reading - how to sue debt collectors.

Legislation on the activities of collectors

The negative opinion formed in society about collection agencies originates from times when their activities were regulated rather weakly or not regulated at all. As a result, numerous unscrupulous services often took harsh and even aggressive measures towards borrowers, which created a negative image. But as of January 1, 2017, Federal Law No. 230-FZ provides for how the work of agencies is regulated. The new rules established restrictions on the time and number of calls and other methods of communication with the client, and also determined how the collector must communicate with the borrower. Today, every conscientious, law-abiding agency strictly complies with the requirements of the Federal Law and aims not to scare, but to help.

Useful video

Legal advice:

Dear readers! To solve your problem right now, get a free consultation

— contact the lawyer on duty in the online chat on the right or call: +7 (499) 938 6124 — Moscow and region.

+7 (812) 425 6761 — St. Petersburg and region. 8 (800) 350 8362 - Other regions of the Russian Federation You will not need to waste your time and nerves - an experienced lawyer will solve all your problems! Or describe the situation in the form below:

Other ways to get rid of calls

Article 8 of the Federal Law provides for how to stop contact persons from calling collectors. The debtor has the right to refuse any interaction (except postal) with the creditor by issuing a notice. If collectors are bothering you with calls, then you can use this right.

The document is sent through a notary office, by mail (registered mail) or delivered in person against a receipt to the collector.

The notification form is available on the FSSP website.

In addition to refusing to interact, you can notify the representative attorney. After receiving the application, the collection organization is obliged to communicate with a lawyer.

Can debt collectors collect debts?

Collectors can collect debts under an overdue monetary obligation only by a court decision. Collection agencies do not have the right to independently write off funds from accounts in order to pay off an existing debt.

If the court makes a decision on the forced collection of an overdue debt, a sum of money (equal to the amount of the obligation) may be written off from the debtor’s accounts.

If the debtor does not have enough funds to repay the debt, then the law provides for the withholding of part of the wages in favor of the creditor. The amount of such write-off cannot exceed 50% of the salary itself. However, there are categories of citizens with a “preferential” amount of wage deduction (for example, if there is a dependent in the family whom he provides, the amount of write-off should not exceed 30% of the salary).

Legal aspects of conversations with collectors

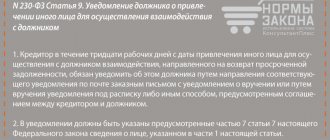

The rights of collectors are enshrined in Federal Law No. 230, which was adopted in 2016. It was he who imposed a ban on force on the part of the collection agency, illegal confiscation and sale of the debtor’s property. Article 7 of this law established a certain period of time when the collection agency is allowed to contact the debtor.

Who are collectors prohibited from contacting?

- with persons who have been officially declared bankrupt;

- with patients in difficult situations in hospitals;

- with disabled people belonging to group 1;

- with women carrying a fetus and mothers who have children under one and a half years of age;

- with a minor.

When and how many calls can collectors make per day according to the law?

The law established the exact time period when the collector can make calls to the borrower or send him letters - from 8:00 to 22:00. They are not allowed to call more than:

- 1 time per day;

- 2 times a week;

- 8 times a month.

The maximum allowed number of messages is:

- 2 times a day;

- 4 times a week;

- 16 times a month.

At the beginning of the dialogue, the collector must introduce himself and say which company he represents. Record all conversations with debt collectors so that if your rights are violated, you can prove it.