Samples of complaints against debt collectors to the Prosecutor's Office and Roskomnadzor

ATTENTION! Look at the completed sample complaint to Roskomnadzor against debt collectors:

You can DOWNLOAD samples of complaints against debt collectors to the Prosecutor's Office and Roskomnadzor using the links below:

- Complaint to Roskomnadzor against collectors

- Complaint to the Prosecutor's Office against debt collectors

Document submission procedure

The deadline for filing a complaint with Roskomnadzor is 1 year from the date the parties sign the loan agreement.

The supervisory authority has an online system for receiving visitors. So, having found the desired electronic page, you can file a complaint by filling out the fields and information about yourself. To specify the problem, you must select the field with the text “protection of the rights of personal data subjects.”

Important! Scanned images or photographs confirming the disclosure of information must be attached to the electronic complaint.

Next, the system will require a verification code, after which the complaint can be sent for review. There are other ways to send a package of documents to Roskomnadzor, for example, by fax or through a mailbox (submission through a personal visit).

The current fax number and branch addresses can be found on the Internet by first calling the reception or office.

Watch the video. Complaint against debt collectors:

Appeal to the Prosecutor's Office

To terminate the actions of collection agencies, the first thing you need to do is submit to the credit institution or other creditor to whom you owe a debt an application to revoke permission to use your personal data.

Such a statement indicates the debtor's right to protection. After receiving this request, the bank must withdraw the debt case from the collection agency.

If the collection agency continues its activities, you should file a complaint with the prosecutor's office. If debt collectors have threatened you or your loved ones with death or violence, then this fact must be indicated in the appeal. The prosecutor's office has broad powers to punish violators of borrowers' rights.

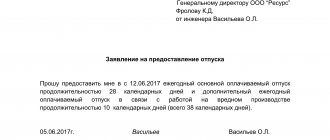

Elements of the complaint:

- in the upper right corner the full name of the authority and its address are indicated,

- Full name of the applicant,

- title of the document “Application”,

- terms of the loan agreement,

- at what point did calls from collectors start coming in?

- which collectors performed the actions,

- legal assessment of work methods,

- references to legislation,

- please compare the actions of debt collectors with the law,

- list of applications,

- applicant's signature and date.

It is necessary to clearly state the actions of collectors and their sequence. When describing, highlight facts of violations of the law, referring to regulations. A complaint to the prosecutor's office must contain a demanding part and a request to notify the applicant about the results of the consideration.

What to do if debt collectors sue the debtor?

Can collectors come to the debtor’s home without a court decision, if there are no places, read here.

What rights are granted to collectors in 2021, read the link: https://novocom.org/vozmeshhenie-vreda/kakie-prava-est-u-kollektorov-v-2019-godu-vozmozhnosti-i-zaprety.html

Important! All documents that can serve as evidence are attached to the application in the form of attachments. Based on the results of the inspection, if violations of the law are detected, the prosecutor's office will go to court.

Having received a response from the prosecutor's office, the debtor can continue to protect his rights in court if he is not satisfied with the decision of the supervisory authority.

How to write a complaint?

If a fact of unlawful action by debt collectors is revealed, none of the listed institutions can leave the appeal without consideration. The complaint is drawn up in free form, since there is no approved form.

The claim must be made in writing and contain the following:

- the name of the institution where the injured party applies;

- information about the applicant (full name, address, contact telephone number);

- the name of the document, in our case – Complaint;

- information about the collection organization;

- a detailed description of the current situation;

- demands put forward by the applicant, for example, to inspect the institution and hold it accountable;

- the listed documentary evidence (they must be attached to the application);

- date of completion and personal signature of the applicant.

The complaint is drawn up taking into account the violations identified, as well as the body to which the debtor applies. You can even complain about calling relatives if personal information was obtained illegally.

Roskomnadzor guards personal information

The Law “On the Protection of Personal Data” prohibits the transfer of information about a person to third parties without his consent. Collectors who make calls to neighbors and colleagues and inform them about your debt, its volume and other data are directly violating the law.

Credit organizations, even after revocation of personal data, often refer debtors’ cases to collectors.

You know! If, after withdrawing your data, you continue to be harassed by calls from collectors, you have the right to contact Roskomnadzor.

The reason for the appeal will be a violation by the credit institution of the procedure for using and storing personal data of its clients and an encroachment on the privacy of personal life.

The use of telephone numbers and other contact information of the debtor by debt collectors is punishable. An application to Roskomnadzor can be submitted online on the website or during a personal visit to the department.

The complaint states:

- information about the applicant,

- contact details of the debtor,

- subject of the appeal – personal data,

- presentation of the problem situation.

A complete list of what the appeal must contain is on the website of the supervisory agency.

How to get rid of debt collectors once and for all?

Within 30 calendar days, Roskomnadzor employees consider the application. Based on the results of the review, the complainant will receive a response to the email specified in the appeal. If the agency establishes violations of citizens' rights in the actions of collection agencies, it may impose an administrative fine and order the violations to be eliminated.

If Roskomnadzor refuses to satisfy the complaint, the applicant has the right to appeal to the courts to protect his rights.

Before going to court, debtors make attempts to reach an agreement with creditors. But they are rarely successful, since collectors receive a monetary reward for “extorting” the amount of debt from the debtor. To do this, they can take a variety of measures: from threats to physical violence.

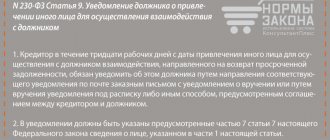

Normative base

The official term “collectors” does not exist in Russian legislation. But there is another concept - “legal entities that repay overdue debts.” In order to protect citizens and to control the activities of these offices, the law of July 3, 2016 No. 230-FZ was adopted. But even the introduction of this act sometimes does not stop debt collectors; some of them still act in violation of the law.

We list the regulations on the basis of which collectors must carry out their activities:

- Civil Code of the Russian Federation (the document determines the procedure for transferring existing debt from the creditor to the new claimant);

- Law on the Protection of Consumer Rights No. 2300-1 (the act regulates relations between the parties, so debtors can demand protection of their rights if they are violated);

- Law “On Enforcement Proceedings” No. 229-FZ (the document defines the procedure for debt collection, including measures and deadlines);

- GD dated December 19, 2016 No. 1402 (establishes the rules for maintaining a unified register of legal entities engaged in debt collection);

- Law “On the protection of the rights and legitimate interests of individuals when carrying out activities to repay overdue debts...” No. 230-FZ.

It is necessary to clearly understand whether the rights of a citizen have really been violated. After all, if employees of debt offices act in accordance with the law, then there are no reasons for appeal.

Who are collectors

Credit organizations and private borrowers may transfer cases of collecting funds from debtors to special persons or organizations. This happens when the creditor cannot independently obtain money from the debtor in payment of the debt.

Who carries out debt collection at a professional level, and what means and methods are used?

At the state level, the Federal Bailiff Service is responsible for debt collection, but creditors cannot contact them directly. A court decision is required to initiate enforcement proceedings. Therefore, banks turn to private organizations. These entities are called collectors or collection agencies.

There are regulations governing the activities of these organizations. Collectors cannot seize the debtor's property and accounts, but they can complicate the borrower's life.

Of course, debts must be repaid. But even if the bank’s claims are justified, and the collectors act with its permission, this does not give them any right to violate the law and use illegal collection methods.

Watch the video. Advice from a lawyer on how to complain about debt collectors:

What actions of debt collectors are considered illegal?

The concept of illegality stems from the rule that guides lawyers when interpreting the legality of a particular offense: it is permissible to do everything that is not prohibited by law. Following this rule, it is not difficult to establish which actions of collectors are lawful, and which a borrower whose rights have been infringed can safely complain to regulatory authorities. This can be determined by clause 1 of Art. 4 of Law No. 230-FZ, which lists the rights of collectors. There are few of them:

- make calls;

- meet with the debtor in person;

- send SMS or voice notifications;

- send postal correspondence.

What a collector cannot do according to the law

Collectors do not have the right to:

- disclosure of information about debt without the consent of the debtor (in writing),

- making calls, visits at night from 22:00 to 8:00 on weekdays and from 20:00 to 8:00 on weekends,

- writing emails more than 2 times a day and more than 16 times in 7 days,

- scheduling personal meetings, visits more than once a calendar month. Making calls more than once a day,

- contacting the debtor without providing your contact information and information about the debt,

- communication with persons under 18 years of age or deprived of legal capacity,

- committing acts of violence,

- insult to the personality and dignity of the debtor,

- damage to property,

- restriction of free will and movement.

Below we will study the issue of personal data protection in more detail. This is the area of activity of Roskomnadzor.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Debtor is temporarily unavailable: Where and how to complain about debt collectors

Dmitry Alexandrovich, how do you feel about the term “collector” itself?

Dmitry Shelomentsev: We must understand that the concept of “collector” does not exist in Russian legislation. In my opinion, it misleads people: they understand by it too wide a circle of people. Federal Law No. 230-FZ “On the protection of the rights and legitimate interests of individuals when carrying out activities to repay overdue debts and on amendments to the Federal Law “On microfinance activities and microfinance organizations” (hereinafter referred to as the Law) regulates the work of creditors and legal entities carrying out collection of overdue debts as the main activity and included in the state register. They can be called professional collectors. For example, so-called direct interaction with the debtor is provided (these are personal meetings, telephone conversations); creditors and professional collectors have the right to carry it out. In addition, they can send text and voice messages to debtors. Other persons and organizations that are not creditors or not included in the register do not have such rights.

How actively do people complain?

Dmitry Shelomentsev: Over the 5 months of 2021, our department accepted 322 applications for consideration, of which 116 were for legal entities from the register, 123 for microfinance organizations, 41 for credit organizations, the rest were for other persons whom the applicants cannot identify. Most often, people complain about exceeding the permissible possible number of telephone calls and messages from creditors or collectors.

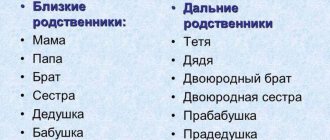

There are also requests from so-called third parties. These are colleagues, relatives, friends, neighbors of debtors. According to the law, it is possible to interact with them if the debtor has expressed his consent to this in writing and if a third party has not expressed disagreement.

That is, in order not to be bothered by calls about a certain acquaintance who owes money to someone, it is enough to “express disagreement”? How?

Dmitry Shelomentsev: This is not regulated by law, but if you asked not to call again and hung up, that’s enough. It is not necessary to make a written statement for this.

How do you deal with complaints about excessive calls?

Dmitry Shelomentsev: Professional debt collectors are required to keep audio recordings of all telephone conversations, and there is a procedure for conducting these negotiations: the interlocutor must introduce himself, give his first and last name, and warn that the conversation is being recorded. So if we don't have enough information when reviewing an application, we can request those records. An important point: they must be stored by the organization for three years on special equipment - this is one of the mandatory conditions for including professional debt collectors in the state register.

You mentioned that most often Sverdlovsk residents complain about microfinance organizations with non-local registration. It turns out that they are massively taking out microloans in other regions?

Dmitry Shelomentsev: No. An MFO can be registered in Moscow, and its branch (for example, in a pavilion, conditionally, standing on the station square) in Yekaterinburg. Some collectors have call centers registered in other regions and operating throughout the country. By the way, often people don’t even know that their debt can be transferred to another organization.

Does this matter to the consumer?

Dmitry Shelomentsev: Only to know to whom he has obligations. Often the debtor writes a complaint against the microfinance organization that issued the loan, but the right of claim has long been assigned to another organization. Our task is to figure it out, find out who is interacting with the applicant, and whether there are any violations in this process. We record them in the form of a protocol and go to court, which decides whether an administrative penalty is necessary. “Our” article is 14.57 of the Code of Administrative Offenses of the Russian Federation (“Violation of the requirements of the law on the protection of the rights of individuals when collecting overdue debts from them”), according to which only officials of the FSSP of Russia are authorized to draw up protocols. A total of 34 such protocols were drawn up.

There are, as you said, 322 requests, but ten times fewer protocols?

Dmitry Shelomentsev: Yes, often people do not complain so much as ask for clarification on whether creditors have the right to certain actions. It happens that a citizen does not provide information for feedback or does not contact us.

Why?

Dmitry Shelomentsev: We must actively work with applicants before contacting legal entities and obtain the necessary information from them. Evidence may be audio recordings or call details from a mobile operator. For example, a citizen contacts us with a complaint about frequent calls from a professional debt collector, but does not provide details of the calls. During the review, we conduct an inspection and request from the legal entity a recording of negotiations in order to establish whether or not there was a violation. Detailing will significantly speed up this process.

What is the threat to the violator?

Dmitry Shelomentsev: An administrative fine, disqualification of an official or suspension of the activities of a legal entity. Part 4 of Article 14.57 of the Code of Administrative Offenses of the Russian Federation provides for punishment - an administrative fine of 50 to 500 thousand rubles for citizens. For officials - a fine from 100 thousand to a million or disqualification for a period of 6 months to a year. For legal entities - a fine of 200 thousand to 2 million rubles. Its size is determined in court.

Of all four parts of this article, this is the largest fine. Why? Specifically, so that no one who is not authorized by law interacts with citizens.

Did we use it?

Dmitry Shelomentsev: There was one fact in 2021, the materials are now in court.

There are many stories circulating in the media and on the Internet: debt collectors painted the entrance, scared the wife or mother-in-law, and threatened with violence. What are the stories based on, if everything seems to be regulated in our country, everyone knows their responsibilities?

Dmitry Shelomentsev: Let's go from the other side: in principle, all this cannot be done! Such actions are assessed by law enforcement agencies, and another type of criminal liability is provided for it. This is a very important point: the law we are talking about regulates issues related to the collection of overdue debts. If a citizen sees that his rights are being violated by committing a crime or offense, he must contact the police.

How would you describe a typical collection agency manager? And then, you know, there are certain stereotypes about strong guys with soldering irons in their hands...

Dmitry Shelomentsev: Ordinary people: literate, educated men and women, entrepreneurs running their own businesses. Some people's main activity is selling food, while theirs is collecting overdue debts, that's all. It is no coincidence that I avoid the word “collector”; it is now discredited in our country.

Key Question

In your opinion, what is the main trend in the area of accounts payable collection?

Dmitry Shelomentsev: In 2021, 144.5 thousand consumer loans were issued in the Sverdlovsk region, and we received 332 requests. Roughly speaking, almost every 500th borrower contacts us. Moreover, the very fact of the appeal does not confirm the violation; this is a very large number that speaks of two things: good and not so good. It is good that legislation is being improved in Russia, there is a lot of coordinated work by many government agencies aimed at preventing and suppressing violations of the rights of our citizens: us, and the Central Bank, and the prosecutor’s office, and the police, and Roskomnadzor. On the other hand, people do not always know their rights and do not know how to protect them. Many people think like this: I really have a debt, so they call me all day long. But there is a law that regulates everything. Yes, you have an obligation to repay the debt, but you also have rights: you cannot be disturbed more often than allowed. You need to know this and be able to defend yourself with the help of those institutions created by the state.

Contact

The general register of persons who can collect overdue debts is posted on the official website of the FSSP of Russia in the “Services” section: https://fssprus.ru/gosreestr_jurlic.

On a note

Collectors are allowed to meet with the debtor no more than once a week (from 8.00 to 22.00 on weekdays and from 9.00 to 20.00 on weekends and holidays). You can call no more than once a day, twice a week and eight times a month (at the same time), send SMS up to twice a day. There are no restrictions on the number of postal items.

No earlier than 4 months after the delay occurs, the debtor has the right to refuse to interact with the creditor or collector. You must send them a written statement about this. In addition, the debtor has the right to declare that he will communicate only through a lawyer.

How to complain about debt collectors in the Sverdlovsk region:

— come in person to the address: Ekaterinburg, st. Proletarskaya, 7;

— send a letter by mail to the same address;

- through the electronic reception on the website fssprus.ru. Indicate your postal address, email, phone number. It is advisable to attach audio recordings of conversations, details of calls from a mobile operator or screenshots of SMS messages to your application.

Grounds for application

The response to threats and insults from debt collectors must follow immediately. You can seek help from a number of authorities, but for this there must be compelling reasons and evidence.

The basis for the complaint is illegal actions on the part of the collectors:

- physical and psychological violence or the threat of its implementation against the debtor or his relatives,

- insult and humiliation of the debtor's dignity. Distribution of materials discrediting his honor.

- causing physical damage to the borrower’s property or taking this property without the person’s consent,

- transfer of personal information about the debtor, data on his debt,

- accrual of interest and penalties on the principal amount not regulated by the loan agreement,

- violation of the debtor’s personal space by calls at night,

- communication on debt collection issues with persons under 18 years of age or deprived of legal capacity,

If the activities of collectors are clearly unlawful, and there are suspicions that they are acting without the sanction of a credit institution, it makes sense to contact the bank.

If collectors cannot provide documentary evidence that they are acting in accordance with an agreement with the creditor bank, this may serve as confirmation of their illegal activities and violation of Russian legislation.

How to pay a loan if the bank’s license has been revoked?

How to avoid taking matters to debt collectors

The second thing you should definitely remember is your loan obligations. In general, the loan does not need to be repaid in full at once.

Usually the agreement is structured in such a way that you, as the borrower, only need to pay a certain obligatory amount every month. This was done not to make your life easier, but to make money.

The fact is that the longer you repay the loan, the more profitable it is for the bank. Every month you pay interest on the loan, and a lot of it, so

The first tip is that you can avoid problems with debt collectors simply by making the obligatory loan payment on time. If you do not know the amount of the mandatory payment, then contact the bank and they will definitely help you.

The second is the process of communication with the bank. If you correctly explain to the bank employee that you will soon pay off the debt, then the matter most likely will not reach the collectors.

You don’t have to worry about how to write a statement about the actions of debt collectors to the police. Usually, the case is not immediately transferred to collectors and they simply call you to remind you about the debt.

A bank representative will call you during business hours and politely ask when you are going to repay the debt. It is best to answer that you will deposit the required amount soon and actually do so.

The case is usually transferred to collectors when a call from the bank did not bring any benefit - you did not promise to repay the debt or promised earlier, but no payments were received.

Related article: Administrative claim for inaction of a bailiff: sample 2021

We write applications to the prosecutor's office: we protect ourselves from debt collectors

Procedure

What to do if unscrupulous collectors torture you with calls:

- clarify on whose behalf the collector is acting: a credit organization or a collection agency. Call the hotline and state your complaint and dissatisfaction with the actions,

- write a complaint to Roskomnadzor and the Central Bank of the Russian Federation,

- If debt collectors threaten and insult you, you must file a complaint with law enforcement agencies.

What to do if debt collectors call you about someone else's loan?

How to properly complain about debt collectors

Collection companies, when returning problem debts, often forget about the civil rights of borrowers. Some actions of “black” collectors are criminal in nature. Bank clients have every right to appeal the following illegal actions of debt collectors to law enforcement agencies:

- Insulting a borrower is an administrative offense.

- A unilateral increase in the amount of debt is the inclusion of the so-called “counter”. The offense is classified as extortion.

- Use of physical force. Actions fall under Articles 111, 112, 115 of the Criminal Code of the Russian Federation (depending on the severity). A forensic medical report is required for confirmation.

- Psychological pressure, intimidation of the debtor and his relatives.

- Damage to property or removal of valuables are classified as theft or robbery.

- Kidnapping, blackmail, deprivation/restriction of freedom.

Responsibility for violations

For violation of laws, collectors can be punished and held accountable in accordance with current legislation:

- an administrative penalty in the amount of up to 50 thousand rubles may be imposed on an employee of a collection agency, and on the agency itself in the amount of up to 100 thousand rubles,

- If debt collection is carried out by an individual or legal entity that is not registered in the state register, penalties can amount to up to 2 million rubles for an organization, and up to 1 million rubles for an individual.

Victims of the illegal activities of debt collectors do not always turn to government agencies to protect their rights. Although unscrupulous collectors may be held accountable for their actions that violate the law, up to and including imprisonment.

To correctly submit an application to the relevant government authorities, the debtor can enlist the support of an experienced lawyer or lawyer, as well as contact human rights organizations.

Watch the video. What to do if debt collectors call?

Debtor's appeal to the police

Expert opinion

Korolev Stanislav Vitalievich

Lawyer with 10 years of experience. Specialization: family law. More than 3 years of experience in defense in court.

A complaint about illegal actions of debt collectors can be submitted to any territorial police department. However, lawyers advise passing it on:

- or at the place of residence of the victim;

- or at the place where the illegal act was committed by representatives of the collection agency;

- or at the location of the claimant.

As already noted, the police (formerly the police) should be disturbed if the borrower sees signs of a crime or offense in the collector’s actions. In this case, it must contain a detailed description of the incident:

- what happened;

- where and when;

- which collection agency violated the rights of a citizen;

- with whom of his representatives did he contact, under what circumstances, etc.

Any sample police statement, in addition to the descriptive part, contains a number of mandatory details:

- addressee of the complaint: full name and position (head of the police department, district police officer, duty investigator, etc.);

- police unit number and area;

- from whom the application was received: full name and place of residence of the debtor who suffered from the actions of debt collectors, contact details;

- after describing the unlawful behavior of the collectors, it is necessary to indicate which articles of the Criminal Code and the Code of Administrative Offenses were violated by them;

- a requirement to suppress the illegal acts of collectors and to initiate criminal proceedings against these persons;

- list of attached documentary evidence;

- date of filing the complaint and signature of the debtor.