During maternity leave and subsequently to care for a child when he reaches the age of one and a half years, his mother is entitled to financial assistance in the form of social benefits. The monthly child benefit in 2021 can be ranked based on the fact whether the woman worked before pregnancy or not and whether funds were deposited into her Russian bank account. So, after the birth of a baby, his mother receives two types of monthly child benefits:

- Child care allowance;

- Child benefit.

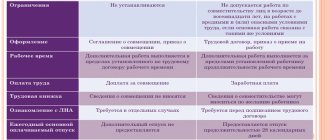

Depending on whether the mother worked before pregnancy or not, the body paying the benefit and its amount differ.

Choose a mortgage for large families

Monthly child benefit in 2021 - table

The amount of the monthly child benefit depends on the age of the child and additional conditions, such as the size of the family, whether the child’s father is serving in the military, etc.

Amounts of monthly benefit payments

| Monthly benefits | Set payment amount, rub. | |

| from January 1, 2021 | from February 1, 2021 | |

| Child care allowance up to 1.5 years old | 40% of the average monthly earnings (for the calculation of which in 2021, income for the previous two full years is taken), but not less than the minimum established by law (which is paid, including to unemployed citizens, through Social Security): | |

| 6,751.54 - for the first, second, third and subsequent | 7,082.85 - for the first, second, third and subsequent | |

| Monthly payment at the birth of the first or second child up to 1.5 years from 2021 | Regional cost of living per child for the 2nd quarter of 2020 (depending on the region) | |

| Allowance for the child of a conscript serving | 12 219,17 | 12 817,91 |

| Monthly payment up to 3 years for each child living in the Chernobyl zone | 3,485.21 - from birth to 1.5 years; for a child aged 1.5 to 3 years, the benefit has been canceled | 3,652.44 – from 0 to 1.5 years for a child aged 1.5 to 3 years, the benefit has been canceled |

| Mother doing military service under contract One of the parents, serving in the internal affairs bodies, the State Fire Service, institutions and bodies of the penal system, customs authorities | For the first child, second, third - 40 percent of average earnings, but not less than 6,751.54 rubles. and no more than 13,503.10 rubles. | For the first, second and subsequent children - 40 percent of average earnings, but not less than 7,082.85 rubles and not more than 14,165.70 rubles. |

Who will receive child care benefits and what will be its amount?

The following have the right to benefit for child care up to 1.5 years:

- relatives of the child who are subject to compulsory social insurance;

- mothers are contract military personnel;

- mothers fired during pregnancy or maternity leave; they and other relatives who were fired during parental leave;

- mothers, fathers, guardians who are full-time students;

- relatives who are not subject to compulsory social insurance, for example in the event of the death of a mother or father, deprivation of their parental rights, etc.

The benefit is paid from the funds of the Social Insurance Fund. Employed citizens receive it from their employer, others - from social security authorities.

For employed citizens, child care benefits are calculated by the employer. Its size will be 40% of average earnings. At the same time, the law establishes the minimum and maximum amounts of benefits: for employees it cannot be less than 6,752 rubles. and from January 1, 2021 more than 27,984.66 rubles.

The maximum benefit is 27,984.66 rubles. can receive:

- mothers or fathers, other relatives, guardians caring for the child and subject to compulsory social insurance in case of temporary disability and in connection with maternity;

- mothers or fathers, other relatives, guardians who are on parental leave, from among the civilian personnel of military formations of the Russian Federation located on the territories of foreign states in cases provided for by international treaties of the Russian Federation.

The following categories of citizens will also receive a benefit in the amount of 40% of average earnings:

- mothers doing military service under contract;

- mothers or fathers serving as private and commanding officers of internal affairs bodies, national guard troops, the State Fire Service, employees of institutions and bodies of the penal system, enforcement agencies, customs authorities and on maternity leave;

- mothers or fathers, other relatives, guardians dismissed during the period of parental leave;

- mothers dismissed during maternity leave due to the liquidation of organizations, termination of powers as notaries and the status of a lawyer, termination of activities by individuals as individual entrepreneurs and other individuals whose professional activities are subject to state registration or licensing, including those dismissed from organizations or military units located outside the Russian Federation, dismissed from such units due to the expiration of their employment contract, and mothers dismissed during the period of parental leave, maternity leave in connection with the transfer of their husband from these units to the Russian Federation.

From June 1, 2021, the amount of their benefit should not be less than 6,752 rubles. and more than 13,504 rubles.

For a minimum benefit of 6,752 rubles. can count:

- mothers or fathers, guardians caring for a child and not subject to compulsory social insurance in case of temporary disability and in connection with maternity;

- other relatives caring for the child and not subject to compulsory social insurance in case of temporary disability and in connection with maternity, if the mother or father has died, been declared dead, deprived of parental rights or limited in them, recognized as missing, incompetent or partially capable, according to due to health reasons, they cannot raise and support a child, are serving a sentence of imprisonment, are in custody, are evading raising children or protecting their rights and interests, have refused to take their child from an educational, medical organization, social service organization or other similar organization;

- full-time students in professional educational organizations, educational organizations of higher education and additional professional education, scientific organizations.

In regions and localities where regional coefficients are applied to wages, the amount of benefits is determined taking into account these coefficients.

An annual indexation of the benefit is provided - the next one should be in February 2021. But the benefit, calculated as a percentage of average earnings, is not indexed. It is subject to recalculation only if its size is less than the minimum. In such a situation, from the date of the next indexation, the employee must be paid a benefit in the amount of the indexed minimum. Benefits that exceed the new minimum are paid in the same amount.

Benefit for working mother

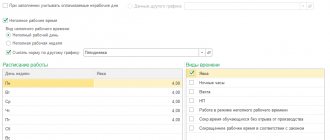

Officially employed women are paid a monthly allowance for a child up to 1.5 years of age by the employer, and its amount directly depends on her salary at the time of going on maternity leave. The amount of the benefit is equal to 40% of the salary, but cannot exceed 100% of the salary received or the average earnings in the region. The amount of the monthly child care benefit is calculated per child; if twins are born, the amount increases by 2 times, i.e. equal to 80% of earnings.

If you continue your parental leave for up to 3 years, you cannot count on a monthly child care allowance.

MIR debit card from UniCredit Bank

Apply now

Child benefit until the child reaches adulthood is paid provided that he or she studies in any educational institution until the age of 18.

Single-parent families receiving survivor pensions may also be deprived of child benefits if the total family income is above the subsistence level.

Monthly allowance for child care up to 1.5 years.

The following have the right to receive a monthly child care allowance:

- Mothers or fathers, other relatives, guardians actually caring for the child, dismissed during the period of maternity leave, mothers dismissed during maternity leave due to the liquidation of organizations, termination of activities by individuals as individual entrepreneurs, termination of powers by notaries engaged in private practice and termination of the status of a lawyer, as well as in connection with the termination of activities by other individuals whose professional activities in accordance with federal laws are subject to state registration and licensing, including those dismissed from an organization or military units located outside outside Russia, dismissed due to the expiration of their employment contract in military units, as well as mothers dismissed during the period of parental leave, maternity leave in connection with the transfer of their husband from such military units to the Russian Federation;

- Mothers dismissed during pregnancy due to the liquidation of organizations, termination of activities by individuals as individual entrepreneurs, termination of powers by notaries engaged in private practice, and termination of the status of a lawyer, as well as in connection with the termination of activities by other individuals whose professional activities are in in accordance with federal laws, is subject to state registration and (or) licensing, including those dismissed from organizations or military units located outside the Russian Federation, dismissed due to the expiration of their employment contract in military units located outside the Russian Federation, or in connection with the transfer of the husband from such units to the Russian Federation;

- Mothers or fathers, guardians who actually care for the child and are not subject to compulsory social insurance in case of temporary disability and in connection with maternity (including full-time students on a paid or free basis in professional educational organizations, educational organizations of additional professional education and scientific organizations - further full-time students in educational organizations);

- Other relatives who actually care for the child and are not subject to compulsory social insurance in case of temporary disability and in connection with maternity, if the mother and (or) father died, were declared dead, were deprived of parental rights, limited in parental rights, recognized missing, incapacitated (limitedly capable), for health reasons cannot personally raise and support a child, are serving a sentence in institutions executing a prison sentence, are in places of detention of suspects and accused of committing crimes, are evading raising children or from protecting their rights and interests or refused to take their child from educational institutions, medical organizations, social welfare institutions and other similar institutions.

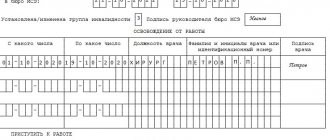

This measure is issued at the place of residence (stay, actual residence).

The benefit is assigned if the application is made no later than six months from the date the child reaches the age of one and a half years.

For the appointment of the above benefits, the applicant can apply:

- to the regional state government institution - a center for social support of the population at the place of residence;

— to one of the multifunctional centers for the provision of state and municipal services” at the place of registration or actual residence (if your actual place of residence does not coincide with the registration at the place of residence in the region);

— via postal service on paper;

- in electronic form using public information and telecommunication networks, including the Internet, including the Portal and the Unified Portal.

If postal services are used, copies of documents certified in the prescribed manner are sent, original documents are not sent.

To assign a monthly child care allowance, you must provide:

1. Parents’ passports);

2. Birth certificate of the child (children);

3. A document confirming cohabitation with the child;

4. Parents’ work records (statement of absence);

5. Certificate from the father’s place of work stating that he does not use leave to care for a child under 1.5 years old (full name and date of birth of the child) and does not receive this benefit;

6. Statement of consent to the processing of personal data

The amount of the monthly child care benefit is from February 1, 2021.

| Type of benefit | Benefit amount with regional coefficient 1,2 | Benefit amount with regional coefficient 1,3 |

| Monthly allowance for caring for the first child | 3678,82 | 3985,38 |

| Monthly allowance for caring for the second and subsequent children | 7357,64 | 7970,78 |