The acceptance certificate for completed work is drawn up after the contractor has fulfilled its obligations. The act is not an independent document, but serves as an annex to the work under the contract. It is part of the procedure for accepting the results of work and serves as the basis for final settlements under the contract agreement between the customer and the contractor.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

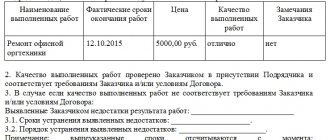

Sample filling

.

.

The form of the certificate of work performed is not prescribed by law, so an organization can develop its own form to fill out and use.

In order to correctly (and in as much detail as possible) draw up the act, you must indicate the following points:

- The serial number of this document for its registration in the accounting department.

- Date of document creation.

- Number of the contract according to which the work completion certificate is drawn up.

- Deadlines for completing the agreed work.

- Volumes of work performed.

- Total cost of work (including mandatory VAT).

- The invoice number that is provided to the customer to pay for the work (service) performed.

- Full name of the customer and contractor, according to the constituent documents.

- Stamp of the seal of both interested organizations.

- Signatures of the contractor and the customer, or persons authorized to sign.

.

.

Changes in contractual terms

During the implementation process or as a result of the customer filing a claim at a number of stages, the cost may change relative to the previously signed copy of the document.

For this purpose, an adjustment report for the work performed is drawn up indicating:

- number and date of the document to which the adjustment is being made;

- changes in the pricing policy upward or downward with reference to circumstances, including a defect identified by the customer after signing the main act and accepted by the contractor;

- new total cost according to the changes made.

The date of signing by the customer is the basis for recording and adjusting the VAT amounts relative to what was previously accepted and reflected in the accounting registers by both parties to the transaction.

Why is the act needed?

A certificate of completed work is required when it is necessary to confirm the fact that the work has been completed by the contractor - in this case, the certificate acts as a report from the contractor to the customer.

An act of acceptance and transfer without a preliminary contract or any agreement may be considered void by the tax authorities, which will entail the impossibility of taking these expenses into account in reducing the tax base.

If the contractor does not fulfill his duties, fails to meet the deadlines for the work, there is a defect or improper performance of the work, then the customer has every right not to sign the certificate of completion and not to accept the work until the deficiencies are completely eliminated or to refuse payment to the contractor altogether. In this case, the contractor is obliged to eliminate all shortcomings and draw up a new act of completion, taking into account the new circumstances.

When an act is required

For the most part, acts are not mandatory. There are only a few cases when an acceptance certificate is required:

- When transferring the building to the buyer - clause 1 of Article 556 of the Civil Code.

- When transferring the enterprise to the buyer - clause 1 of Article 563 of the Civil Code.

- When accepting work under a construction contract - clause 4 of Article 753 of the Civil Code.

- When transferring real estate for rent.

In the field of capital construction, the unified form KS-2 is used as a certificate of completion of work. This form is filled out based on the Work Progress Log.

The act is signed by the contractor and the customer. Then, on the basis of the act, a certificate of the cost of work and the costs incurred is prepared in the KS-3 form. Based on the certificate, the customer pays for the contractor’s services.

Why is this act needed?

The work acceptance certificate is a kind of guarantee against the occurrence of legal disputes and disagreements. If such proceedings nevertheless arise, the act becomes an evidentiary document. The court may regard the absence of an act as a disregard for the legally established procedure for the delivery and acceptance of work, which in turn may lead to the imposition of penalties by regulatory agencies.

A table is drawn up from the list of completed works. The document also states that the work was completed properly and the customer has no complaints against the contractor.

In cases where the customer is dissatisfied with the quality of the work performed, this should also be reflected in the report with a detailed listing of the identified deficiencies, as well as an indication of the time frame for their elimination.

Act as an accounting document

| Tax | Is the act required? |

| All tax regimes | In any case, it is better for the contractor to sign the act so that there are no claims later. |

| USN Income | An unsigned act will not affect the tax in any way. |

| USN Income-Expenses | The act is needed to confirm expenses. |

| Personal income tax | The act is needed to confirm expenses. |

| Income tax | The act is needed to confirm expenses. |

| Unified agricultural tax | The act is needed to confirm expenses. |

| VAT | Without a certificate of completion of work, it is risky to deduct VAT. |

| UTII | An unsigned act will not affect the tax in any way. |

| PSN | An unsigned act will not affect the tax in any way. |

In fact, a document of acceptance and transfer is not a very obligatory document; it is very often requested by the accounting department of an organization, and for good reason. The absence of an act complicates the procedure for confirming costs and profits received.

The company's costs for performing work can be included in the cost of production and these expenses can be included in the organization's expenses when calculating income tax. Therefore, such expenses must be documented - the act of completion of work will be such a basis. According to the Federal Tax Service, only an act of acceptance of work can reliably confirm the fact that costs have been incurred.

And also, in the absence of a certificate of completion of work, the organization will not be able to receive accrued and paid VAT.

Also, the acceptance certificate will serve as an accounting document, which will help in a conversation with the tax authorities if they decide that the company is trying to evade paying taxes.

Explanation of work (services) performed in acts

However, even if the act does not contain details of the work performed (services provided), then any other documents can be adequate confirmation of the fact of their provision. For example, in relation to company management services, such evidence may include:

Negative court decisions for companies are usually due to the fact that the actual circumstances identified by the tax authorities do not confirm the fact that work was performed (services were provided). The presence of transcripts will not help here.

What is it needed for?

Construction production is a very complex technological process , part of the processes is, as they say, “always visible” - for example, installing reinforcement, laying floors, this can also apply to painting walls and ceilings, tiling floors, wallpapering walls, and so on.

But in order to begin the next stage, it is necessary to do a number of previous works, for example, before laying tiles on the floor, it is necessary to install a floor screed, before pasting or painting the walls with wallpaper, these walls must be plastered, puttied, and only then the walls must be wallpapered or the walls painted, these subsequent operations will completely “hide” previous actions.

And to confirm and verify previous types of work, the implementation of which will be impossible to verify after the completion of the following processes in construction technology, an inspection report for hidden work is drawn up.

Clause 6.13 of SP 48.13330.2011 “Construction Organization” obliges all participants in construction production to draw up an act, that is, the execution of an act is not the wish of the customer or contractor, but a requirement of regulatory documentation governing the construction industry.

Commission inspection report

Upon completion of construction or repair work, a selection committee gathers to inspect the facility: identify violations in accordance with GOST, the presence of errors that need to be corrected. The document is necessary to confirm the fact of the inspection carried out for the purpose of safe use of the facility in the future.

It is important to take into account that the document reflects not only the fact of the event, but also violations, if they are present and subject to immediate correction. The start and end dates of the event must be recorded.

Important points

Since the acceptance certificate for completed work is an annex to the contract between the customer and the contractor, and, accordingly, a bilateral document, it must be drawn up in two copies. For the customer of the service, the act and agreement will be the basis for making payment for the completed transaction, and for the contractor - the basis for the receipt of funds. One copy of the signed act is given to the customer, and the second copy remains with the contractor. When drawing up acts in form KS-2 and KS-3, any number of copies can be used (it all depends on the number of organizations performing the contract)

Payment is made immediately after signing, since in this case the work is considered completed and the services rendered.

If the customer is not satisfied with the quality, he can refuse to sign until the contractor eliminates all the shortcomings. By the way, you can use the form for the certificate of work performed).

Of no small importance is the wording “The work was completed in full, on time and with proper quality. The customer has no complaints regarding the volume, quality and timing of the provision of services.” It confirms that the customer has no complaints about quality, which eliminates any controversial issues in the future.

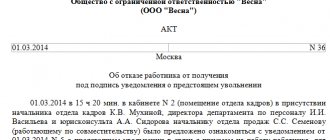

Acceptance certificate

Drawed up when transferring the subject of the contract to the customer. This can be not only a construction project, but also funds, rent of premises, transfer of special equipment for use. The main purpose of the document is to record the transfer of movable/immovable property for use or further possession, depending on the specifics.

It also provides information about the current state of the subject of the contract so that disputes do not arise in the future. The document displays the following information:

- Full title of the document without abbreviation.

- The date when the deed was formed and the place of signing.

- If the goods are transferred for use, then a complete list and the final amount.

- Legal information about each party and bank details for transferring funds.

- On what basis is the transfer of goods and other objects specified in the contract carried out?

- Visas and stamps of each enterprise.

Explanation for the work completion certificate sample

However, even if the act does not contain details of the work performed (services provided), then any other documents can be adequate confirmation of the fact of their provision. For example, in relation to company management services, such evidence may include:

The work performed in KS-2 is indicated based on the contract value, including both the direct cost of construction and installation processes, which are provided for in the estimate, and other costs that are not included in the unit prices. These may be tariffs, an increase in the cost of materials, the cost of operating machinery, equipment, mechanisms, the cost of wages of personnel who carry out construction, the cost of winter increases in prices, changes in the conditions of construction organization, the traveling nature of work, allowances for being in difficult conditions (for example , in the regions of the Far North) and so on.

This is interesting: State duty for a registration certificate through government services in Rostov

In what cases is a work completion report drawn up?

Often a firm will not make full use of services for which it has already paid an agreed upon fixed price. By drawing up a report or providing a breakdown of the services provided in the act, the contractor will only draw the attention of the tax authorities to the fact that payment was made for services that were not actually used by the customer.

All this information should be sufficient for tax inspectors. According to established judicial practice, the tax inspectorate has no right to impose additional requirements on acts of services rendered (work performed). Judges in most cases consider this illegal.

Document - Certificate of completed work template

IIN/BIN Customer LIMITED LIABILITY PARTNERSHIP “NORTH”, Semey, st. Kudaiberdy 43 111111111111 full name, address, information about communication means Contractor LIMITED LIABILITY PARTNERSHIP “Training and Practice Center”, Semey, st. Goethe 82 22222222222 full name, address, information about means of communication Agreement (contract) Without agreement Document number Date of preparation

Sequential number Name of work (services) (in terms of their subtypes in accordance with the technical specification, task, schedule of work (services), if any) Date of completion of work (provision of services) Information about the report on scientific research, marketing, consulting and others services (date, number, number of pages) (if any) Unit of measurement Work performed (services provided) quantity price per unit cost 1 2 3 4 5 6 7 8 1 Driller training 05/28/2021 pcs 1 25,000.00 25,000.00 2 Driver training roller 05/28/2021 pcs 1 45,000.00 45,000.00 Total 2 x 70,000.00

This is interesting: How many days are you on sick leave after an ischemic stroke?