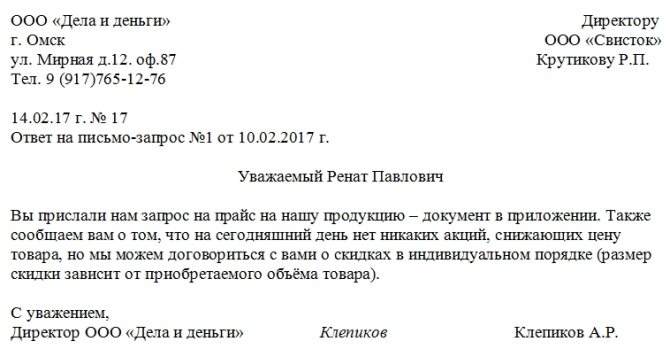

Samples of response letters

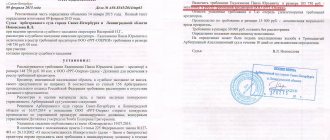

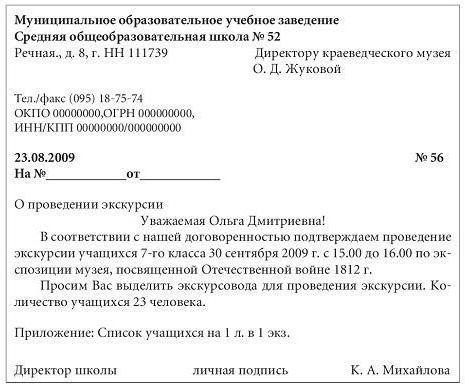

ATTENTION! View the completed response to a request for information:

You can DOWNLOAD sample response letters to requests for information using the links below:

- Response to a request for information

- Positive response to request for information

- Negative response to request for information

When is it required?

Conventionally, we can identify several of the most common situations when there is a need to compose a response letter:

- To government authorities (for example, when a request is received from the tax office for the provision of financial statements of an enterprise, separate information about the activities of a business entity, etc.).

- To suppliers (for example, if the supplier has requested in writing an updated list of materials for which the order is being placed).

- To buyers (for example, when a request is received about the possibility of delivering goods on a certain date).

- To the judicial authorities (for example, a request by the court for specific evidentiary documents).

- To a banking institution (for example, if the bank requested a certificate of business reputation from another bank serving the organization).

- To an individual (for example, in response to a request for information about the opportunity to get a certain position in a given organization), etc.

How to draw up a document correctly

The response to a request for certain data is composed as follows:

- Letter header. Located in the upper right corner (sometimes in the upper left). Here are the full details of the company sending the response to the request: full name, INN, KPP, OKPO, legal address, location, contact phone number, email,

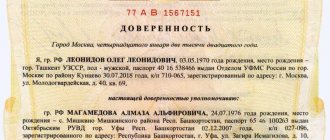

- In the opposite upper corner the details of the person who sent the request are indicated. If this is a legal entity, then the above details and a contact person acting on the basis of the charter or power of attorney are also specified.

- In the journal of outgoing correspondence, you need to make a note about who and when the response was sent. The subject of the letter is indicated at the discretion of the person entering the data into the journal,

- Next, in the middle, we write a message. For example, “Dear Sergei Petrovich.”

The composition of the main part of the document will depend on the type of decision made:

- If the answer is positive about the provision of information upon request - the number or details of the letter that was received from the applicant, the essence of the request and the information itself, in connection with the need to obtain which the request was made,

- In case of refusal, a brief essence of the appeal is also indicated, and then the very fact of the negative decision and the reasons for the refusal.

How to respond to citizens' appeals?

If documents or extracts from them were requested, then the response letter may contain attachments on several sheets (containing such documents). At the end there is a date and signature of the general director of the company with a transcript and seal.

The response to the request is compiled and sent only by the employee (representative) of the company to whose name the request was written.

Exceptions are the following cases:

- Employee illness

- Vacation,

- Dismissal,

- Business trip,

- Absence of an employee from work for another reason.

In such a situation, the answer is made by the one who replaces him. When responding to a letter of inquiry, it is recommended to use the “mirroring” technique, i.e. use the same stylistic devices, figures of speech, metaphors, terminology, etc. in the text.

Deadline for responding to a written complaint under the consumer protection law.

Read how to write a response to the Prosecutor's Office's request to eliminate violations here.

How to write a response to a request to provide documents to the tax office, read the link: https://novocom.org/dokumenty/otvety-na-obrashheniya/obrazec-otveta-na-trebovanie-o-predostavlenii-dokumentov-v-nalogovuyu.html

Compliance with this condition is permissible only if the request is drawn up correctly. It is inappropriate to respond to a received letter with the same errors and omissions. In addition, it is incorrect to point out to the person contacting you his mistakes. This is a rule of bad manners.

Try to correctly express your thoughts in writing. It should be as short as possible, but succinct. A business style of presenting the essence is required. Try to address the applicant as politely and discreetly as possible. Avoid unnecessary phrases that have no meaning and are not related to the essence of the message.

Attention! The response to a request should under no circumstances contain rudeness or false information.

How to write a response to a request

The form of submission and execution of the response to the letter of request can play a decisive role in the relationship between organizations. That is why its compilation should be treated very carefully, adhering to certain rules.

First of all, before composing a response letter, you should inform the sender in any convenient way that you have received the request. Next, if you have all the necessary information, you can begin to answer. The sooner a response message is written, the better, but if the requested information is not available at the moment, it is better to wait with the letter.

The structure of the answer is quite standard from the point of view of office work.

- At the top of the message (right or left) you need to write the name of the sending company (indicating the address and telephone number), as well as the specific employee on whose behalf the response is being written.

- Next, enter information about the recipient in the same way.

- After this, the answer itself is written. It must fully correspond to the essence of the request and, if the requester in his letter asked several questions at once, divided into separate points, the answer must be written in exactly the same format. If any additional information is attached to the response, this must be reflected in the body of the letter, noting it separately.

- Likewise, if circumstances so require, the response can include references to some laws, regulations and legal acts.

What types of response letters exist and what are their features?

In practice, there are several types of responses to requests for information.

They are divided into two groups:

- A positive response with the provision of the requested data - the applicant is informed about the decision made and is provided with the information that he requested,

- Negative answer - the applicant is presented with a reasoned refusal with a detailed indication of the reasons for the decision.

The difference between these two categories of answers is their content. For example, with a positive decision, not only a complete answer to the question asked is given, but also all the information on the essence of the requested information is included as much as possible. As a result, having received such a response, the applicant should be completely satisfied with it without unnecessary additional questions.

The main feature, as well as the difference between these types of response letter to a request for information, lies in its content. So, when composing a positive letter, it is necessary to give the most complete and comprehensive answer to the question posed.

Ultimately, the applicant organization should have no questions regarding the substance of the information provided. When forming a negative response to a request, on the contrary, the emphasis is placed on the motivating part of it, since the requested information will not be provided for one reason or another.

If there is such a possibility, then in a negative decision, indicate to the applicant the addresses where he should contact to obtain the requested data.

Watch the video. In what form should documents be submitted upon request by the tax authorities?

Response to requests for documents, Part 2

Continuing the section on responding to requests for documents, we will review a number of requirements of the tax inspectorate.

Tax inspectors require documents that have expired

So. You have received a request to provide documents (information) outside the framework of tax audits for periods for which the storage period has already expired. Is this legal? How should you respond to this requirement?

Article 93.1 of the Tax Code of the Russian Federation does not contain restrictions on the number of tax periods that can be covered by such an audit. However, outside the framework of a tax audit, the inspectorate can only require those documents or information that relate to a specific transaction. Inspectors do not have the right to demand documents that are not directly related to a specific transaction. At the same time, you have the right not to submit documents whose storage period has already expired.

All primary accounting documentation and reporting must be stored for certain periods; the average storage period for documents is at least 5 years. The storage periods for accounting documents are regulated by the Law “On Accounting”.

Conclusion: It is at your discretion to provide these documents or unsubscribe to the corresponding request.

Tax inspectors require documents regarding the counterparty, the documents are lost

The safety of documentation in the organization’s archive is one of the requirements that must be strictly observed. In case of loss of documents, only those documents that contain relevant information for the organization can be restored. Plus documents whose storage period has not yet expired.

You must request copies of lost (damaged) primary accounting documents from your counterparties. In case of loss of documents, we recommend that you read the article - algorithm of actions in case of damage (loss) of documents

As a rule, the loss of tax and accounting documentation entails penalties provided for by the Tax Code of the Russian Federation. Sanctions can be imposed both on the organization as a whole and on the employee, through whose established fault the damage or loss of documents occurred. In case of failure to provide documents, your organization will be fined at least 200 rubles for each document not provided.

The taxpayer is summoned to an inspectorate where he is not registered

Previously, we described a new extraterritorial principle of work of tax authorities or a new mechanism for controlling taxpayers.

The Federal Tax Service is a unified system of tax authorities that monitors their calculation and payment. It can exercise its powers through any of its inspectorates. Your Federal Tax Service is only a matter of your territorial affiliation, but this does not mean that the tax service should interact with you strictly through this inspectorate.

In other words, calling a taxpayer to the tax office, where he is not registered with the tax authorities, is completely legal. In addition, Article 90 of the Tax Code of the Russian Federation gives the tax inspectorate the right to summon anyone to the tax office for questioning. Any person who knows any circumstances relevant to the implementation of tax control can be interrogated.

Tax inspectors require documents for all suppliers of the organization using a continuous method

This is the so-called struggle of the tax inspectorate with complex tax gaps. Tax inspectors are faced with the task of identifying the beneficiary and proving to the latter that they have misrepresented the facts of economic life. To do this, they need to request documents along the entire chain - from the “break” to the beneficiary.

All these actions are conditioned by the entry into force of Article 54.1 of the Tax Code of the Russian Federation in 2021.

This innovation has changed the emphasis from due diligence and the reality of business transactions to the reality of execution of the transaction by a specific counterparty. Any transaction must have an economic purpose and the reduction of value added tax should not be the only purpose of the transaction. Today, the request for documents along the entire chain of counterparties is done in order to prove that your specific counterparty, for one reason or another, could not supply goods, perform work or services. And you have to prove the opposite.

Tax inspectors require a breakdown of the organization’s existing assets in order to settle the debt

A request for a breakdown of the organization’s existing assets (real estate, vehicles, breakdown of inventories, receivables and finished products) as of a certain date is legal.

Previously, identification of existing assets of organizations was used only during tax audits. Carried out to apply interim measures and debt collection measures. Today, the practice of applying interim measures in the form of a pledge (seizure) of property, a ban on the alienation (pledge) of property to ensure the fulfillment of the obligation to pay taxes (fees, contributions) continues to gain momentum.

Continued (part 3)

@garant_ooo

How to format a response letter correctly

The response form could be:

- In handwritten form. Relevant when a letter requesting certain information is also handwritten,

- In printed form. This form saves time and makes the letter understandable (the reader does not have to understand the intricacies and features of your handwriting)

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

The response letter is drawn up either on a white, blank A4 sheet, or on the organization’s letterhead. The latter option looks more solid and is processed faster (no time is wasted on entering company details).

At the end of the response letter to the request there must be a signature of the responsible person or director. The requirement to have a seal for such letters no longer applies in 2021.

How to file a petition to obtain documents?

The letter is marked with the date of signing and is assigned a serial number by which it can be identified in the journal of outgoing correspondence in the event of loss or a controversial situation.

Such logs contain all information about outgoing correspondence. Entering letters into them is a mandatory rule for any organization. This is necessary so that in the event of a dispute, all information about the correspondence can be quickly retrieved.

The rules for document flow are practically the same for all companies. In most cases, the response to a request is generated in a single copy, but there are cases when an organization plays it safe and keeps a copy of the sent response.

Another important rule is to send a letter with notification of receipt. After the correspondence is issued to the applicant, you will receive a notification that will indicate who, when and on what grounds received your letter.

In what cases is it necessary?

It becomes necessary to compose answers when contacting an enterprise from the outside:

- Government body (when requesting information about the activities of the institution, financial statements or data of a specific employee).

- Counterparty in a civil contract (for example, as a result of sending a protocol of disagreements to a supply agreement, an offer to deliver goods earlier than the deadline established by the contract).

- Court (due to the demand for evidence in a specific case, the invitation of witnesses).

- Credit institution (about the presence of outstanding monetary obligations, an increase in interest on a bank deposit).

- Citizen (about available vacancies in the organization, about the possibility of internship).

Should I expect a response to such a letter?

According to the rules of business ethics, all letters within the framework of official correspondence between the parties require a response. But there are also exceptions. For example, you don’t need to wait for a response if you received a request and you have already written your response to it.

Often a written response to a question is the starting point at the beginning of a business relationship between the parties. For example, you were asked for information about the services provided. The answer from your company completely satisfied the future partner and a cooperation contract was concluded.

Watch the video. How to upload documents for submission to the tax office:

Respond in a timely manner and in the correct form.

Politeness and attentiveness do not exclude formalities. It is necessary to respond to requests from owners with reason and within the established time frame.

If the request was sent to you by email, you must respond to it within ten business days of receipt. The response letter must contain (clauses 18, 19 of RF PP No. 731):

- request text;

- information upon request;

- contact details: Full name and the position of an employee of a management organization or entrepreneur, a member of the board or chairman of the board of an HOA or housing cooperative.

Also, within ten days after receipt, you must have time to respond to the request that you received in writing. The content of the answer will be identical. Its owner can (clause 21 of RF PP N 731):

- send by mail,

- hand out in person to the address of the MA,

- send an email if the owner wrote it in the request.

Previously, it was thought that it would take longer to respond to a written request from the owner - twenty working days were allotted for a response. However, it was not allowed to be sent by email. For HOAs and housing cooperatives, the rules were even stricter. The answer could only be conveyed to the owner personally at the address of the actual location of their management bodies.

Who pays if the owner’s property is damaged?

193430

Correspondence with individuals

Some enterprises, due to the nature of their activities, have direct contact with individuals. This could be an organization operating in the service sector or a company producing consumer goods. Such an enterprise may receive information of a very different nature from citizens, both positive and negative. Nevertheless, it requires an appropriate response and a mandatory response. In such cases, you cannot limit yourself to a personal conversation or a telephone call. The citizen must be given full explanations on all issues of interest to him. This should be a detailed response to the letter.

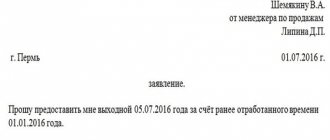

A sample of such a document must meet certain requirements:

- For any business correspondence, it is better to use official letterhead.

- It is necessary to take into account the peculiarities of drawing up such documents. The main thing is that they must be written in accordance with the well-known rule of parallelism, that is, contain the same vocabulary and language expressions that were used by the initiating author. This will allow you to achieve maximum mutual understanding.

- Be sure to make a link to the request letter, indicate its number and date.

- It is better to start the text with the phrase: “In response to your letter, the number...”, “In response to your request...” or “We are informing you...”.

Next comes a presentation of the facts and a final decision.