Legislative regulation

The main document regulating labor relations is the current Labor Code of the Russian Federation (LC RF) of 2001 (current version dated October 11, 2018). This document contains 3 articles that cover the issues of extracurricular activities, as well as the provision of time off for this:

- Art. 91;

- Art. 113;

- Art. 153.

Art. 91 establishes the definition and duration of working hours . This is the period during which a person fulfills his work obligations. In addition, periods provided for by current regulations may be included here.

The optimal length of the working week is considered to be a week lasting no more than 40 hours . According to the above norm, if the week is an ordinary five-day week, then it is optimal to work no more than 8 hours a day.

Also, Article 91 provides that special bodies are responsible for calculating working time standards (Article 216 of the Labor Code). A takes into account the time worked according to Art. 91 Labor Code employer.

Art. 113 indicates the illegality of organizing work on weekends and holidays (the generally accepted day off is Sunday, and holidays in the Russian Federation are considered 1.01 - 7.01, 23.02, 03.08, 1.05, 9.05, 12.06, 4.11). Within the meaning of this article, the manager is not authorized to oblige people to work on these days.

This is only possible if the employer receives written consent.

The law provides for a number of special circumstances in which a call to an enterprise is possible without obtaining consent:

- if the enterprise is threatened by an accident due to workers’ absence;

- if, without the emergency exit of employees, an accident occurs or damage to the property of the enterprise itself, the municipality, or the state;

- if there is a state of war or a state of emergency, as well as if a natural disaster or catastrophe occurs.

Cinematographers, journalists and representatives of other creative professions can be called to work on weekends legally .

This also includes professional athletes and coaches. This circumstance must be provided for in their employment contract or other local document.

Art. 153 indicates exactly how out-of-hour work is paid . Thus, such exit must be paid twice (at least), and specific amounts are established by an employment or collective agreement in each organization.

In addition to the Labor Code, you should also be guided by the Letter of the Federal Assembly on Labor and Employment of 2008, which addresses the question of how many hours of time off are given if the employee went out during non-working hours, but for a partial day (Letter No. 5917-TZ). FS (Rostrud) gives the following answer: time off will include a whole day, regardless of whether a full or partial day is worked outside of school hours.

Rostrud justifies this by the lack of precise regulation of this issue in the current legislation: in Part 3 of Art. 153 of the Labor Code states that if a person goes to work on a day off/holiday, he can, if he wishes, get a day off ( its duration is not specified ).

Situation. The employee was required to work on 3 days off

The employee works a 5-day, 40-hour work week. In June 2021, he worked 23 days (20 days according to the production calendar), since this month, with his consent, he was involved in work for 3 days off for 7 hours each. The employee is paid on a time basis, the salary is calculated from the tariff salary. The monthly tariff salary, taking into account the increase for work under a contract, is 700 rubles. Bonuses, allowances and additional payments are not provided for by the organization's remuneration system.

How to calculate an employee's salary for working on weekends in June?

All employees are provided with days off (weekly continuous rest). With a 5-day working week, they provide 2 days off every calendar week (parts one and two of Article 136 of the Labor Code of the Republic of Belarus; hereinafter referred to as the Labor Code). Work on weekends is permitted at the suggestion of the employer and only with the consent of the employee or at the initiative of the employee with the consent of the employer, except for the cases provided for in Art. 143 Labor Code (part one of Article 142 Labor Code).

For each hour of work on weekends in addition to the wages accrued for the specified time, additional payment is made to employees:

1) with piecework wages - not lower than piecework rates;

2) with time-based wages - not lower than hourly tariff rates (salaries) (Article 69 of the Labor Code).

Important! Additional payment is made for hours actually worked on weekends.

The procedure for determining hourly tariff rates (salaries) for calculating additional payment for work on a day off for employees of commercial organizations is within the competence of the employer. Possible options for calculating the hourly tariff rate:

– or based on the monthly tariff salary and the monthly standard working time;

– or based on the monthly tariff salary and the average monthly standard of working time, taking into account the calculated standard of working time established annually.

The chosen procedure is fixed in the LRP.

For work on weekends, instead of additional payment, with the consent of the employee, another unpaid day of rest may be provided (parts one and three of Article 69 of the Labor Code).

Thus, for working on a day off, the employee is paid additionally or given an additional day of rest. If additional payment for work on a weekend is not made, then, despite this, wages for time worked on weekends are mandatory.

Important! If, instead of additional payment, the employee is given another day of rest (time off), then it does not matter how much time the employee worked on the day off: a full 8-hour working day or only a couple of hours. That is, for working on a day off, an employee is given a day of rest, regardless of the number of hours he worked on that day off.

Since the employee is paid on a time-based basis and is calculated based on the tariff salary, we will give the calculation of the additional payment using conditional examples.

Example 1

The hourly tariff rate for calculating the additional payment is determined based on the monthly working hours of the month in which the employee was involved in work on weekends

Additional payment for work on a day off will be made at the hourly rate. Let us conventionally assume that in an organization the hourly tariff rate is determined based on the monthly tariff salary and the monthly standard working time of the month in which the employee was involved in work on weekends.

The estimated working time in June 2021 is 160 hours (40 hours × 4).

For work on one day off, an employee should be accrued:

– salary – 30.63 rubles. (700 rubles / 160 hours × 7 hours);

– additional payment for work on this day off – 30.63 rubles. (700 rubles / 160 hours × 7 hours).

Thus, the payment for work on one day off was 61.26 rubles. (30.63 rubles × 2), for 3 days off – 183.78 rubles. (RUB 61.26 × 3 days).

Example 2

The hourly tariff rate for calculating the additional payment is determined based on the monthly tariff salary and the average monthly standard of working time, taking into account the calculated standard of working time established annually

The legislation establishes an estimated standard of working time for 2021 with a full standard of its duration for a 5-day working week with days off on Saturday and Sunday - no more than 2,008 hours.

Thus, the average monthly estimated working time in 2019 is 167.33 hours (2,008 hours / 12 months).

The estimated working time according to the production calendar in June 2021 is 160 hours.

For work on one day off, an employee should be accrued:

– salary – 30.63 rubles. (700 rubles / 160 hours × 7 hours);

– additional payment for working on a day off – 29.28 rubles. (700 rubles / 167.33 hours × 7 hours).

The total wage for work on one day off is 59.91 rubles. (30.63 + 29.28), and for 3 weekends – 179.73 rubles. (RUB 59.91 × 3 days).

If an employee was paid extra for work on 3 days off in June, then he will not be given any further time off for work on these days off.

If time off is still provided, for example, in July, then in June the employee should only be paid a salary for 3 days of work on a day off. In July, 3 days of leave provided should not be paid. Let's look at a hypothetical example.

Example 3

For work in June on 3 days off, the employee was paid a salary, and instead of additional payment, he was given 3 days of rest (time off) in July

Let's calculate what salary the employee will have for June and July.

In June it was necessary to accrue:

– 700 rub. – official salary;

– 105 rub. (700 rubles / 20 days × 3 days) – salary for work on weekends.

Total 805.00 rub.

In July, according to the production calendar, there are 22 working days, but the employee will work only 19 days. Since he was given 3 days off, these days are not paid. The salary for 19 working days will be 604.55 rubles. (RUB 700 / 22 days × 19 days).

Based on the above, in July the employee should be accrued 604.55 rubles.

Employee benefit

The nuances of payment for extracurricular work activities are discussed in Art. 153 TK:

- a day off or holiday on which an employee is called to work is paid at least twice as much;

- if a person wants to take time off as a day off, then the worked day off is paid as a regular worker, and the time off is not paid at all.

Therefore, it is often more profitable for the employee himself to receive double payment. However, there are times when a person may need an extra day to resolve personal issues, then it makes sense to take a day off.

For an employer, the option of providing an extra day off to an employee is preferable to additional payment costs.

Moreover, if the employee takes time off in the same month when the off-hours absence occurred, then the amount of payment for the month will not change, but if in the next month, then the employee will receive less for that month (the amount of payment for one working day).

What is time off?

The concept of time off does not exist in labor legislation. But the employer is obliged to provide a day of rest to an employee who was hired to work on days when all workers rest. Time off cannot be considered as a vacation day; it is compensation to the citizen for the inconvenience and personal time spent. It can be issued in the following cases:

- attraction to work on weekends or holidays;

- being on a business trip if the days fell on weekends and holidays;

- doing work overtime;

- blood donation.

In exchange for time off, the employee has the right to receive compensation in the form of double pay for the hours worked.

Correct design

A manager who wants to call an employee on a day off or holiday must notify him of this in writing, while warning him in writing that he has the right to refuse to go out . If the employee agrees to leave, he also agrees in writing.

In this article you can learn in detail about how to correctly call an employee on his day off.

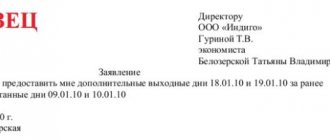

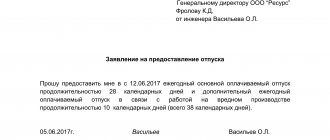

Since time off for going on a non-working day is provided at the request of the employee, the latter must write a corresponding statement to the employer about this. The application is written in the usual form for such documents and must contain the following information:

- to whom (director, manager, etc.), full name;

- from whom (from a specialist, expert, etc.), full name;

- name of the document (“application for time off”);

- a request for time off on a specified day in exchange for a worked day off or holiday;

- applicant's signature and date.

Sample application for leave:

The application must be submitted in the month in which the holiday is expected. The document is submitted to the HR department, after which an order is prepared to invite the employee to work on days off and provide him with time off. Based on this order, a time sheet is drawn up and wages are calculated.

However, some categories of workers cannot be involved in extracurricular work:

- students during their studies;

- pregnant women;

- minors.

Special conditions in this case apply to disabled people and people with children under 3 years of age: they cannot be involved in extracurricular work if they have the appropriate medical certificate.

Second approach

Single pay for work on days off means that an employee receiving a salary is paid a single daily rate on top of it for work on days off. The salary in the month when a day of rest is used is not reduced. It does not matter whether he takes a day of rest in the current month or in subsequent ones.

Such clarifications were given in paragraph 5 of the Rostrud Recommendations on compliance with labor legislation governing the procedure for providing employees with non-working holidays approved by Protocol No. 1 of 06/02/2014, in the Rostrud Letter of 02/18/2013 No. PG/992-6-1.

The Ministry of Labor also expressed the opinion that the salary is not reduced if the employee takes time off for working on a day off (Letter of the Ministry of Labor of Russia dated October 26, 2018 N 14-2/OOG-8551). That is, the time off itself will reduce the standard hours for the employee in the month it is provided, but will not reduce the salary. An employee will receive a full salary when using time off, as well as a single additional payment to the salary for working on a day off.

In turn, we believe that it is the employer who has the right to choose which approach to use. Any of them does not contradict the law. The first approach looks more profitable for the employer if it is necessary to save the wage fund budget, but it may have to be further justified in the event of a GIT audit. The second option seems more expensive, but eliminates inspection risks. Plus, Rostrud also recommends it. But, of course, it’s up to you to choose.

Is the refusal legal?

the employer has no right to refuse time off for a worked day off or holiday In accordance with Art. 153 of the Labor Code, time off is provided at the request of the employee.

To exercise his right to time off, the employee needs to write an application to the employer. If the manager refuses time off, you can file a complaint with both the prosecutor’s office and the labor inspectorate, since failure to provide time off in this case is illegal .

Payment or time off?

The Labor Code of the Russian Federation, namely Article 153, indicates that an employee can choose to receive compensation for going to work after hours or taking time off.

With the exception of situations where an employment agreement is concluded for a period of less than 60 days (only monetary incentives are provided for going to work on a day off).

Current legislation establishes the employer's obligation to double pay for hours worked by subordinates on holidays.

If an employee expresses a desire to take time off for a worked holiday, the company management is obliged to provide it.

In this case, payment for the day worked is made in a single amount; time off is not paid. You are only allowed to take time off for the number of hours previously worked.

If a holiday falls on the date of departure or arrival from a business trip, the employee is given time off without payment of compensation.

Time off can also be obtained for working overtime or donating blood as a donor.

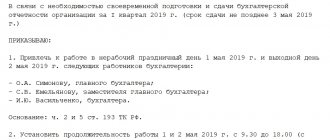

How to arrange time off for work on weekends and holidays according to the Labor Code of the Russian Federation

Time off can only be granted on the basis of a personal application from the employee. In this case, the application must contain a request for a day of rest indicating a specific date and the date of the weekend or holiday on which the employee was brought to work. A reference to Part 4 of Art. 153 Labor Code of the Russian Federation.

An example entry is:

“In connection with working on a non-working holiday, 03/08/2019, I ask you to provide me with a day of rest on 03/16/2019 in accordance with Part 4 of Art. 153 Labor Code of the Russian Federation.”

If the employer agrees to give the employee leave on a specified date, then an order is issued by the organization, and he uses this day at his own discretion. Familiarization with the employee's order is mandatory.

When providing a day of rest, it does not matter how many hours the employee worked on a weekend or holiday, time off is given for a full work shift (letter of the Federal Service for Labor and Employment dated October 31, 2008 N 5917-TZ).

The employer does not have the right to limit the period for providing a day of rest by a temporary framework, but it is permissible to provide for the procedure in the collective agreement. Also, the order to hire may indicate the date when the employer will release the employee to rest. If he agrees, he signs the document, and then there is no need to write an additional statement or issue another order.

Days off must be reflected on the time sheet. This is done as follows:

- in the standard form T-12 or T-13 it is coded 28 or NV;

- when independently developing a time sheet within your organization, indicate the code corresponding to these days of rest.

The Labor Code does not contain strict requirements for drawing up timesheets.

How to write an application for leave at your own expense for 1 day?