Labor disputes are one of the most common categories of disputes arising between an employer and an employee.

Most citizens throughout their lives enter into labor relations by getting hired jobs. But few people know their legal rights provided for by the Labor Code of the Russian Federation. Some citizens are superficially aware of their rights, but are afraid to declare them for fear of dismissal and loss of permanent income. As a result, an employee whose interests are violated by the actions of the employer’s representative most often remains silent. Timely and adequate protection of workers' rights is not always carried out, which in the vast majority of cases is due precisely to ignorance of the laws.

A common problem is optimizing employer expenses by changing salaries, which is achieved by changing the staffing table, job titles, etc. Does the employer have the right to take such actions?

Salary reduction at the initiative of the employer

In a difficult economic situation, when organizations have to take measures to increase operational efficiency, including those related to reducing costs (including costs for employees), the question of how to legally reduce an employee’s salary becomes particularly relevant. Current labor legislation primarily protects the interests of employees, who rarely agree to a salary reduction.

However, even in difficult situations, the employer has the opportunity to reduce wage costs and reduce the employee’s salary. There are few options, each of them represents a special process that should be properly documented.

What the law says

The norms of the Labor Code of the Russian Federation, as well as the provisions of the collective agreement, determine the procedure, amount and timing of payment of wages to an employee of the organization. An article of the Labor Code of the Russian Federation establishes that a reduction in wages is possible only by agreement of the parties to labor relations.

Article 72 of the Labor Code of the Russian Federation “Changing the terms of an employment contract determined by the parties”

Normative base

When considering the issue of legal regulation of the procedure for reducing wages, you should pay attention to the following norms:

- Labor Code of the Russian Federation;

- an employment or collective agreement signed by an employee of an organization or enterprise.

Attention!

It is recommended that you familiarize yourself with Federal Law No. “On the minimum wage” dated June 19, 2000. This normative act makes it possible to determine whether there is a violation of the rights of an employee in the event of a reduction in wages.

Federal Law of June 19, 2000 N 82-FZ “On the minimum wage”

Is it legal?

Employees whose salaries have been cut by their employer are primarily interested in the legality of such actions. It should be noted that in most cases, the employer adheres to the norms of current legislation and carries out the procedure in accordance with regulatory legal acts. Moreover, wages can be reduced for one or all employees of the organization.

Normative base

To answer the question whether the employer can reduce the salary, one must keep in mind that the amount of the salary is necessarily fixed in the employment contract. Labor Code of the Russian Federation in Art. 57 directly provides for the mandatory indication of the conditions for remuneration of the employee in this document. And here is Art. 135 of the Labor Code of the Russian Federation specifies that the salary is set by the employer in accordance with its current remuneration system. In this case, the fixed component (salary, rate) is reflected in the staffing table of the institution. The variable part of income (incentive payments in the form of bonuses, etc.) is regulated by local acts of the employer, that is, the provision on bonuses, for example.

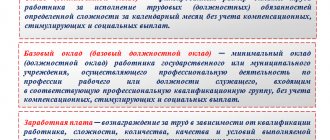

Salary composition

Remuneration for the work of an employee consists of a fixed and variable part.

The constant part is the one that appears in the internal documents of the enterprise under the term “wages”. This is the component of the salary that is regulated by all legislative documents, and the amount of which the employer does not have the right to arbitrarily encroach on. It depends on those elements that were included in the company’s local acts at the stage of documentation generation. Most often, this is a salary in accordance with the staffing table, from which income tax and possible social payments (for example, alimony) will also be withheld, plus special payments that depend on various factors:

- additional payments for degree, title, qualification;

- coefficient characterizing the region of the country;

- bonus for length of service;

- compensation for late payments;

- sick leave and vacation pay.

Is it legal to reduce an employee’s salary if his position remains unchanged ?

The variable part is the one that the employer can vary depending on the conditions specified in the documents, for example, the results of the employee’s work. This part includes, first of all, bonuses based on performance, which can be:

- monthly;

- quarterly;

- at the end of the year;

- 13 salary, etc.

This part may also include “health” financial resources if the employer allocates such for its employees.

All provisions relating to the conditions for payment of the variable part of the salary. They must be recorded in the internal documents of the organization; unfounded deviations from them are illegal.

NOTE! If a bonus or salary, according to the internal documents of the organization, is included in the main part of the remuneration for labor, then management has no right to reduce or not pay it.

Agreement of the parties

Drawing up an agreement gives the employer the opportunity to reduce the amount of income of the employee. The steps are as follows:

- oral conversation with the employee;

- reaching an agreement on a salary reduction;

- signing an additional agreement to the employment contract to change the amount.

Regardless of which component of the salary is to be reduced (fixed in the form of a rate, salary or variable in the form of allowances), the document stipulates the final amount based on the results of the agreement reached.

Employer initiative

A common reason for salary reductions is the reorganization of an institution. Income also decreases in the event of organizational or technical changes in the enterprise.

To legally reduce your salary, the employer must meet a number of requirements.

Step 1. Notify employees in writing about the upcoming salary reduction at least 2 months in advance.

Option of step 1. Draw up a notice (in 2 copies) about the changes, indicating their reasons and nature in free form, hand one copy to the employee against signature (if he refuses to sign, issue a report), leave the second copy with the employer.

There is no set notification template, so a custom format is possible, including:

- name of the institution;

- location address;

- details of the manager;

- information about the need to reduce the employee’s income;

- detailed information about the employees who will be affected by the reduction, indicating their full name. and positions;

- reasons for the decline;

- director's signature and seal.

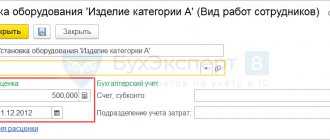

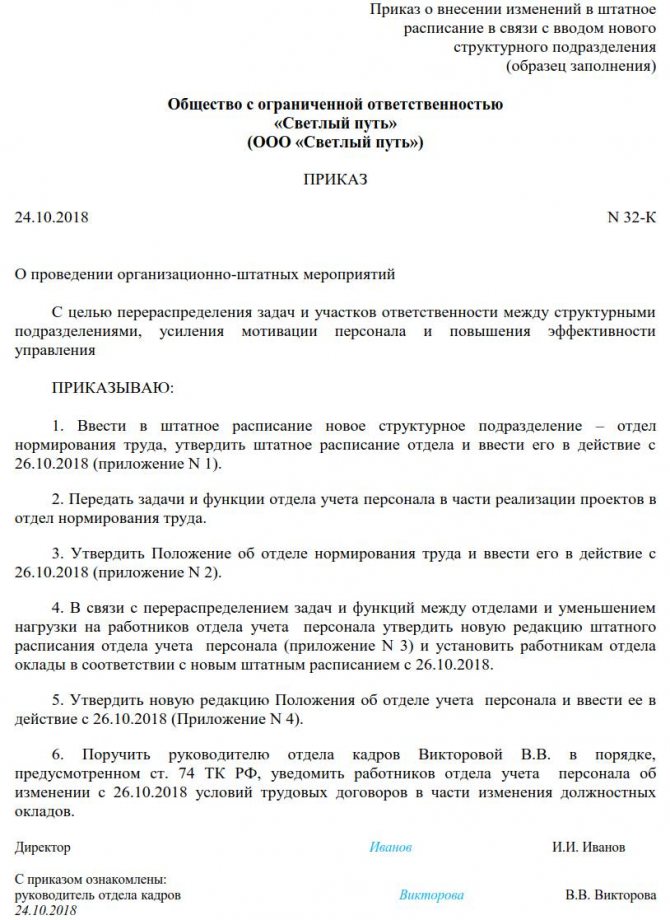

Step 2. Issue an order to amend the employment agreement indicating the reasons and familiarize with the order to amend in writing.

There is no established sample, it can be prepared in the form including:

- full and abbreviated details of the organization;

- number, date of the document;

- administrative part indicating the reasons that forced management to reduce wages, detailed information about the employee;

- signature of the manager with transcript.

Step 3. Obtain written confirmation (signature) of the employee of familiarization with the notice and expression of the employee’s decision.

Step 3 options:

- directly in the notice or order;

- in a separate document (for example, a log of notifications).

Subject to consent

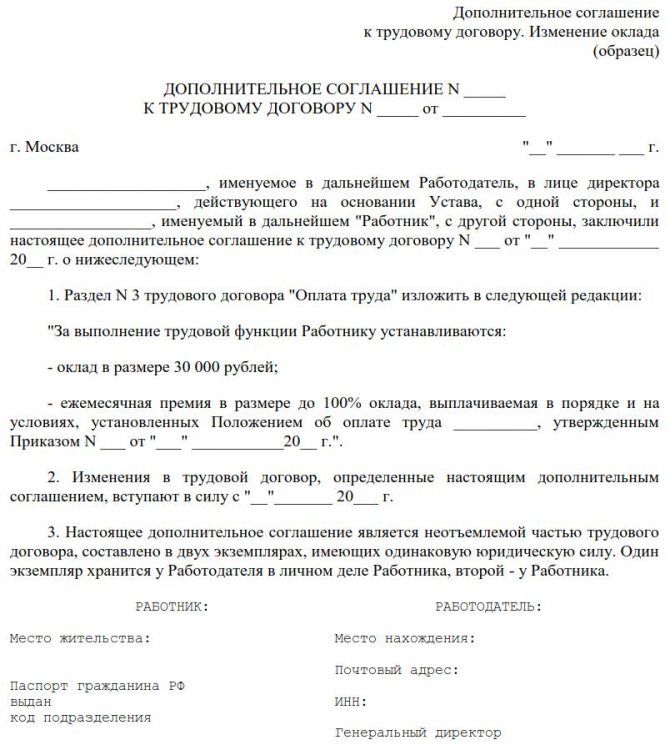

If the employee agrees, he must sign an additional agreement (in 2 copies) to the employment contract, establishing updated conditions.

The document includes:

- information about the place and date of signing;

- information about the employee and employer indicating the full name. and positions;

- number and date of execution of the employment contract.

Both copies must contain the signature of the manager, the seal of the organization, and the signature of the employee.

Based on the additional agreement, the employer needs to issue an order to change working conditions (the document is signed by the head of the institution, the employee gets acquainted with it in writing). There is no unified form.

In the absence of consent to work under new conditions

Option 1. If the employee does not agree with the employer’s decision to reduce his salary, but is not against the transfer, the employer:

- signs an additional agreement to the labor agreement on transferring the employee to a position from the proposed list;

- issues a transfer order;

- enters information into the personal T-2 card.

Option 2. If an employee refuses to change working conditions and transfer, the employer must perform a number of actions:

- obtain the employee’s refusal (in writing) to work under the new conditions;

- register a document;

- offer another position in the same area and corresponding qualifications;

- get rejected;

- draw up and register a notice of termination of the employment agreement;

- issue and register an administrative document on dismissal in form T-8 with reference to clause 7, part 1, art. 77 of the Labor Code of the Russian Federation (indicating full name, last day of work) and signed by the manager. The employee is familiarized with the order to terminate the employment agreement against his signature. If it is not possible to bring the contents of the paper to the attention of the employee or he refuses to sign the order, an appropriate entry must be made in it;

- familiarize the employee with it in writing;

- draw up and issue a work book;

- make due payments (final payment, compensation for vacation that was not used, severance pay - two-week average earnings (part 3 of article 178 of the Labor Code of the Russian Federation)).

Notification

Order to amend the staffing table

Additional agreement

Record reduction in wages

On average, for March-May 2021, the total volume of the wage fund (payroll) in real terms decreased by 4% compared to the same period last year. If in March wages still showed a slight increase - by 1.7% in annual terms, then in April they decreased by 6%, and in May they continued to fall - by 7.6%. Experts noted that the volume of payroll began to recover after the opening of the economy in June.

The assessment of the reduction in payroll by SberData is comparable to the calculation of analysts of the auditing and consulting network FinExpertiza, according to which the size of the total salary fund for March-May 2021 decreased by 4.7% compared to the same period last year. Based on statistics on personal income tax (NDFL) collections, analysts found that due to the pandemic, the payroll in the spring decreased for the first time at least since 2001.

The reduction in the salary fund is associated with direct cuts in salaries or bonuses, layoffs, transfer of some employees to part-time work, and sending on unpaid leave, experts explained. “Unskilled workers and people with low wages were the first to suffer. Therefore, in addition to a general reduction in the well-being of the population, we may also encounter an increase in inequality,” said Elena Trubnikova, president of FinExpertiza.

A traditional feature of the Russian labor market is that it adapts to the crisis not so much by increasing unemployment, but by reducing working hours and wages while formally maintaining employment. The closure and contraction of the most affected industries by the pandemic crisis “has created a ‘overhang’ of unemployment, as well as people formally employed but on unpaid leave, idle time or underemployment,” the government indicated in the draft national plan for restoring the economy and incomes of Russians. About 15 million jobs were under strict restrictions during the self-isolation period, of which about 4.5% (680 thousand people) were laid off, the Ministry of Economic Development estimated.