What is a problem debt department?

Sberbank, like many other banks, issues consumer loans to the population and provides mortgages for the purchase of housing. In this regard, the organization formed a department for working with problem debts.

Attention! Loan payments must be made at the time specified in the agreement and in the minimum amount.

There are unscrupulous borrowers who do not consider it necessary to pay their debts on time. Because of this, the total amount of the loan increases due to fines, penalties and interest. If the borrower cannot make the loan payment on time, but is sure that he will be able to do it later, it is better to call the bank and negotiate with the loan manager about a deferment.

To prevent bank losses, a special department is created in the organization, whose activities are aimed at debt collection. Thus, Sberbank is trying to protect itself and reduce financial risks. As you know, Sberbank received a state license, which is why service employees never resort to illegal methods of debt collection.

On the contrary, they often help people who find themselves in difficult life situations, so there is no need to be afraid of the specialists in the problem debt department.

There are often several ways to solve a problem. Sometimes clients are given a deferment for a certain period. In other cases, bank employees restructure the loan or completely change the payment schedule.

Is it possible to fly around Russia if you have loan debts?

Reasons to start working with debtors

The debtor relations department begins its work on the third day of failure to make the next payment. Bank employees will contact the borrower and ask when he plans to pay the funds. If the client has an unforeseen situation, the service worker can provide a short delay. But to do this, you need to go to a bank branch and write an application.

The reason for opening a case on overdue debt is the payer’s refusal to make payments for 90 consecutive days.

That is, during the first three months, bank employees do not send requests or send information about the defaulter to the credit history database. During this time, the bank waits for active actions from the client.

If an unforeseen situation occurs that prevents you from fulfilling your loan obligations on time, it is better to go to a branch of the credit institution and, together with the overdue debt collection service, find a fair, rational solution.

It is necessary to pay attention to the fact that the department for working with debtors differs from the collection service. Their methods are softer and aimed at jointly solving the problem with the borrower. Often bank employees help their clients not to ruin their credit history.

How long does it take for bailiffs to write off debts?

Departments for working with overdue debts of Sberbank exist in every region of Russia. They are located in large banking divisions. In addition, the work of each employee is streamlined. Some talk to clients over the phone, others meet with them in person, and still others deal with debt restructuring and deferment.

Service operation algorithm

Once the defaulter’s case is transferred to the overdue debt department, the client faces big problems. After all, first of all, a citizen’s credit history immediately turns out to be spoiled. Every day, service workers will make calls and ask when he plans to pay the debt. It should be noted that the actions of department employees cannot be illegal. All methods of debt collection are strictly regulated, since these people do not work for the collection service but for Sberbank.

Important! The first thing employees of the overdue debt department do is call the debtor, as well as his guarantors or relatives, whose numbers were indicated as contacts. But it is not often that service workers exert psychological pressure on debtors. However, their conversations do not go beyond what is permitted. They can justify their actions by the fact that in the future the client will not be able to get a loan from any Russian bank.

At the first stage, bank employees may well make concessions. They will help with granting deferment, debt restructuring or changing payment schedules, extending the loan term.

When the bank's security service starts working, the client should expect service employees to arrive home. At the same time, they inform about their visit in advance and talk with the debtor exclusively about the possibilities of repaying the loan.

According to the plan, the work of the department lasts no more than a year. But in fact, bank employees sell the client’s debt to collectors after eight or nine months. It is with the conclusion of an agreement with the collection agency that the work of the department for collecting overdue debts stops.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Methods and process of work

The work of the Sberbank service for the return of borrowed funds is as follows:

- Lists of problem payers are sent to the debt collection department.

- The contract has been in effect for a month.

- Bank employees print out the personal data and photo of the debtor.

- Responsible persons call the client to find out the reasons for late payments and recommend repaying the resulting debt. At the same time, the payer receives an SMS with a reminder of the amount of the debt and the timing of its repayment.

- If there are no results, the debtor is sent postal notifications about the growth of the debt and the possible consequences of non-payment.

- The mobile team goes to the debtor’s actual residence address.

- Bank representatives establish contact with the borrower or his relatives.

- Employees of the debt collection department negotiate with the debtor to repay loan obligations.

Sberbank’s methods for returning borrowed funds do not include actions that entail damage to the client’s property, as well as the use of physical and psychological violence against him. Threats towards the payer are also excluded.

Refund procedure

To repay a loan, the overdue debt service needs to take four planned steps:

- Communication between a department operator and a client by phone. In this case, you can easily agree on a deferred payment or an increase in the loan term.

- Communication with security officers in person. At this stage, it becomes more difficult to reach an agreement with bank employees, but it is still possible. Sometimes defaulters are granted debt restructuring.

- The work of a collection agency. In this case, it is no longer possible to reach an agreement. The activities of employees of such a service are entirely aimed at receiving money, and not at helping the client. Sometimes you have to pay more than you owed on the loan.

- Court. After the release of a new law on the work of collectors, employees of such a service are trying to peacefully negotiate with defaulters. To do this, a package of documents is collected and submitted to the court. Next, it is this body that makes a decision on the need to repay the debt.

If the agreement specifies the possibility of transferring the debt to third parties, then any other organization can collect the debt. And it is no longer known what methods of influence they use.

Watch the video. How to communicate with the bank collection department regarding non-payment of a loan:

Connection of collectors

If the debt management service fails to convince the debtor to repay the loan, the agreement is transferred to a third party - a collection agency. Please note that if the contract does not contain a clause “transfer of the contract to third parties,” then bank employees do not have the right to sell debts.

Often, agency employees are engaged in real “knocking out” money. They are aimed at making a profit. Sometimes their methods go beyond Russian legislation. In this regard, Federal Law N230 was adopted in 2021, which regulates the actions of collectors.

But it should be noted that large credit organizations always adhere to the law. That is why Sberbank cooperates with collection services that do not violate the norms of current legislation and have proven themselves in the market.

When collecting a debt, it is encouraged to make calls to the debtor himself, his relatives, as well as guarantors. If there is no way to contact the defaulter, then a letter is sent to him at the place of registration. Sometimes service workers come directly to the client’s home or workplace.

Experienced collectors are familiar with current Russian legislation. That is why they know how to put so much pressure on the client to force him to repay the debt and not exceed his authority. Sometimes service workers make direct threats.

But, as practice shows, law enforcement agencies are powerless in such cases. After all, it is almost impossible to prove the correctness of the debtor’s words.

You can DOWNLOAD samples of complaints against debt collectors using the links below:

- Complaint to Roskomnadzor against collectors

- Complaint to the Prosecutor's Office against debt collectors

- Complaint to the Police against debt collectors

- Complaint to the FSSP against collectors

What is the Sberbank field collection group?

Many people are interested in what it is - a mobile debt collection group, and whether its activities have legal grounds.

The legislation of the Russian Federation does not provide for measures for debt collection through intimidation, psychological or physical pressure on the borrower.

The Sberbank field collection group operates within the established framework. Its representatives are security officers of the financial institution. The conversation with the borrower is conducted correctly. Therefore, the Sberbank client has no reason to fear the consequences of this meeting.

However, this method of influencing the debtor is not provided for by law. The issue of repayment of loan funds can only be resolved in court. Therefore, the borrower has the right not to contact bank representatives who present him with demands for debt repayment.

Possible actions of the mobile group include telephone calls to the debtor or direct contact with him. As practice shows, if attempts to reach an agreement with the client do not lead to results, the bank turns to the collection service for help, and then to the court. The consequences for the debtor will depend in the latter case on the decision of the judicial authority.

Work process

- Mobile groups receive to work a register of debtors that have already been worked out by employees of office teams, but are suitable for the conditions described above.

- The contract has been in effect for one month.

- The first thing that employees of mobile groups do, before going to the debtor, is to print out personal data, his photograph, comments from the employees of the delinquency and collection department, and a pre-trial claim (what this is, see here).

- Then they travel to the registration address, sometimes at the actual address.

- Establish contacts with the client, relatives, acquaintances, colleagues.

- Negotiating the closing of a loan agreement by the client.

If the debt is closed, then the agreement is sent to the archive, if not, then the office team members return to work, who, using the established telephone numbers (if any), call the client and his immediate circle.

Resolution of the issue in court

lawsuit in court for free in word format

Currently, collection services do not resort to illegal methods of debt collection.

If after the work of the agents the debtor still does not decide to pay, he is sent a notice of intention to file a lawsuit.

If the client does not respond to the letter within ten days, preparations for the trial begin.

Documents are collected, an application is drawn up, and then the package is submitted to the territorial division of the court at the place of registration of the borrower.

The agency will notify the defaulter in writing of the fact that a claim has been filed in court. Often the court sides with the collectors.

However, the fact that the case is dealt with with the involvement of the judiciary has its advantages:

- the court will fix the final amount, it will no longer change upward,

- Based on current legislation, the defaulter is exempt from paying fines and penalties on the loan.

After making a decision, the court sends copies to both the plaintiff and the defendant. After the verdict comes into force, the defaulter is given five days to voluntarily fulfill his obligations under the contract. If the defendant does not want to contribute funds, the case is transferred to the bailiffs.

Do I need to pay debt collectors for an overdue loan?

What to do if the bailiffs seized the card?

If the bank has seized funds from your account or collected a certain amount, pay attention to the following reasons:

- Ignoring and delaying traffic police fines;

- Non-payment of taxes to the Federal Tax Service;

- Unpaid bills for housing and communal services;

- Ignoring payment of alimony (information can be found on the FSSP website);

- Administrative fines and judicial penalties;

- Availability of overdue payments on loans and borrowings.

If the search will be carried out in branches of Sberbank of Russia in another city or region of the Russian Federation, then the accepted fee for the search is also transferred there, and a notary request and a statement from the heir about the search are sent, on which a note is made on the date and number of the payment order drawn up for the transfer accepted fee.

If the notary authority does not have information about the location of the deposit account of a deceased investor, it can be searched based on a request from a notary, which the heir, along with an application, can submit to any branch or structural unit of Sberbank of Russia. After this is carried out

Having received information about the write-off of money, the debtor must visit the bailiff service (FSSP of the Russian Federation) at the place of residence. In case of unwillingness to provide the necessary documents from the case materials or in the absence of data on the withdrawal of money from the card, the injured person has the right to write a statement addressed to the senior bailiff with a demand to understand the current situation.

If the control information matches, the controller informs the depositor by telephone of the information he is interested in, which is included in the certificate for the next period. If the depositor cannot provide control information or wants to change its content, he must contact the bank’s structural unit at the place where the application was submitted and fill out an application to change the control information.

If the investor wishes to cancel the application, he writes this down on the previously drawn up application and signs it. The controller for the deposits indicated by the depositor in this application cancels the previously marked notes on the provision of certificates for these accounts and makes a corresponding entry on the application with his signature.

The depositor's statements (if any) are subject to removal from the folder in which they were stored and placement in the folder in which the second copies of certificates with the depositors' notes on their receipt are stored. After drawing up the annual report during the first quarter, the second copies of certificates with notes from depositors on their receipt, issued in the past year, as well as statements along with a statement (if any), in which all specified accounts were closed in the past year, are transferred to the archives of the Sberbank branch Russia.

If the court, preliminary investigation body, or foreign consular office does not have information about the location of deposit accounts, they will not be searched. If the notary authority does not have information about the location of the deposit account of a deceased investor, it can be searched on the basis of a request from a notary, which the heir can submit with an application to any branch or structural unit of Sberbank of Russia.

After this, a search for the deposit is carried out. If the search is carried out in branches of Sberbank of Russia in another city or region of the Russian Federation, then the accepted fee for the search is also transferred there, and a notary’s request and a statement from the heir about the search are sent, on which a note is made on the date and number of the payment order drawn up on transfer of accepted payment.

One fine day you may find that the card is blocked, the money has been completely debited from the account, and the balance is in the red or at zero. Can bailiffs seize an account? The answer is yes. The fact is that they have access to many of the debtor’s bank accounts and at any time have the right to arrest and write off funds. Therefore, no one is immune from such an accident.

- compensation for the loss of a breadwinner;

- subsidies for a disabled child;

- state subsidies to victims of man-made disasters;

- income that the debtor receives as compensation for moral damage;

- maternal capital;

- government payments received by employees of government agencies upon injury in the performance of professional duties;

- humanitarian aid received by Russians affected by terrorist attacks and disasters;

- loan accounts and credit.

- child support;

- maternal capital;

- maternity benefit, monthly child care benefit, one-time benefit for women registered in the early stages of pregnancy

- pensions and death benefits;

- payments to a carer for a disabled person;

- compensation for damage caused to health;

- compensation for travel or benefits for medicines for a certain category of citizens;

- funds from the employer at the birth of a child, death of relatives, marriage;

- intended for a person who was injured during service or, if he died, then for his relatives, benefits for victims of disasters, one-time financial assistance in case of natural disasters, terrorist attacks, the death of a family member, humanitarian assistance;

- funeral benefit.

- First of all, the account owner’s access to the allocated money is blocked and the user is prohibited from performing expenditure transactions using them.

- They send the bailiffs all the information about the details, as well as the person’s current accounts, including how much money is stored on it, but the source of the money is not indicated.

- At the same time, bailiffs cannot seize a credit account, but almost no one adheres to this rule.

We suggest you read: Will and its execution

The basis for imposing sanctions in this case is the failure to fulfill debt obligations under the loan agreement. Since this document implies a detailed consideration of the procedure for repaying the loan, indicating the payment date and penalties for late payment, the establishment of a violation is carried out based on it.

It is worth noting that the return of funds can occur through the judicial system not only on the initiative of Sberbank, to which the borrower owes a loan. The institution can carry out these operations, including in connection with a criminal procedural or administrative offense on the part of the client and at the insistence of law enforcement and other authorities who have applied to the court.

Other reasons for sanctions (other than failure to fulfill loan obligations):

- presence of unpaid car fines;

- accumulation of child support debt;

- tax evasion;

- debt for utilities, etc.

Nevertheless, Russian law protects the rights of both parties to the conflict. Leaving a person without a livelihood by writing off his earnings as a loan is prohibited. Salaries and pensions held in this status through Sberbank accounts can be written off to a maximum of 70%. It is also completely prohibited to write off certain categories of income, such as child benefits and alimony payments.

Repayment of overdue loan funds is carried out on the basis of the Federal Law dated 07 with registration number 229 or Art. 115 Code of Criminal Procedure. It is explained here that authorization in the form of a refund can be carried out by banks exclusively with the participation of state executive bodies, including the court or law enforcement system.

Collection activities involve targeted work solely to collect money received as a loan from Sberbank or another institution. It makes sense for banking organizations to contact collectors if there is a serious delay without identifying prospects for further repayment of the loan (the defaulter is hiding and does not declare a desire to restructure the loan).

At the moment, such activities are extremely poorly regulated. But large financial institutions, such as Sberbank, prefer to act through the justice system. Contacting collectors is rather the prerogative of microfinance organizations and small non-banking organizations.

In the area of MFO activities, Russian legislation has been actively working since the beginning of 2021, indirectly influencing their interaction with collectors (limiting the rights to transfer overdue loans). As for well-known banking organizations with a universal or basic license, they prefer to first file a claim in court.

Hearing

The consequence of filing a statement of claim is the opening of legal proceedings. At the same time, there are some procedural differences between summary proceedings and standard proceedings. The first does not imply holding meetings with the participation of the parties. The court makes a decision independently after analyzing the documents provided. A specific hearing of a case with an argument between the parties takes place in standard legal proceedings.

The result of the trial is the issuance of one of two versions of acts:

- simplified court order for seizure or collection with further execution of a writ of execution;

- a court decision obtained through a full legal process.

Options for court decisions:

- arrest of accounts;

- collection of funds.

Each alternative has its own specifics. Blocking accounts implies a ban on the use of funds on them by both the borrower and the plaintiff (the bank). It is impossible to withdraw funds at branch cash desks, ATMs using a card, or by transfer through mobile online services. It is also unrealistic to make cashless payments in a store.

Freezing accounts is a precursor to the collection of money (or its actual withdrawal) from accounts. However, this is not necessary. The funds available in the account to repay the loan are written off in the amount determined by the court. In fact, the amount in the account may be insufficient or exceed the required amount for repayment.

Both seizure and collection can be carried out in full or in part, depending on the amount of debt on the loan. Thus, blocking an account if there is a larger amount than Sberbank needs is carried out partially. In this case, the client can use the remaining funds freely.

How to remove an arrest

FSSP actions

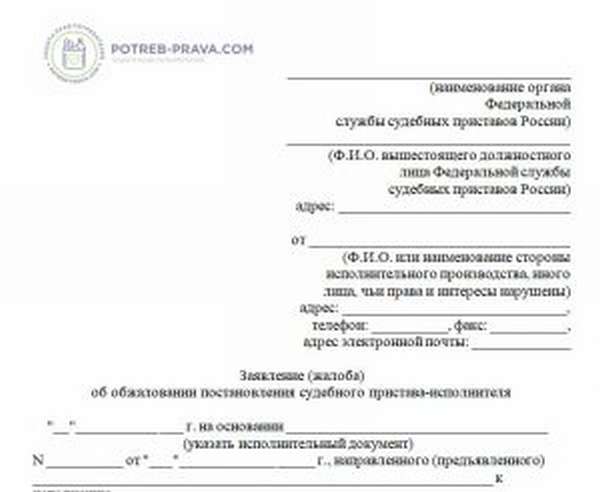

appealing a bailiff's decision free of charge in word format

Employees of the Federal Bailiff Service act exclusively within the framework of Russian legislation. After all, an authority is one of the state structures. First of all, FSSP employees find out if the debtor has any property, as well as funds in bank accounts.

If it turns out that the debtor is officially employed, then a decision is made to partially recover the amount of debt from his income.

A letter is sent to the client's employer - a requirement on the basis of which the accounting department is obliged to deduct 50% of total income monthly to pay off the debt.

If there is no official workplace, then service workers will seize bank accounts or write off funds from them.

Remember! If the defaulter has neither income nor bank accounts, then the bailiffs resort to extreme methods. They confiscate the debtor's property.

How to remove the action of arrest or foreclosure

If you disagree with the decision of the FSSP, the account holder can challenge the decision or its individual points, for example, in the case of receiving social benefits. Let's figure out what is needed to challenge the FSSP's decision:

- photocopy of passport;

- SNILS and TIN;

- a well-written application;

- certificates confirming the purpose of funds.

It is recommended to seek the help of a lawyer, which will increase the chances of the complaint being satisfied. The help of a professional will be useful in drafting counter legal proceedings.

After the situation is resolved or the debt is repaid, the arrest or collection ceases to apply within 1-3 days. If the blocking is not lifted during this time, then it is necessary to check with the FSSP and the creditor for the availability of all the necessary documentation. In most cases, this is the reason for delays in revoking the writ of execution.

How can a debtor avoid getting into such a situation?

If a client learns that he has a debt, but does not understand where it came from, he needs to immediately contact an employee of the bank’s territorial division. An employee of a credit institution will prepare detailed information about the formation of debt and the movement of funds.

The statement contains information about the accrual of fines, penalties, as well as the dates and amounts of monthly payments. If it turns out that the client actually owes the bank, the debt must be repaid urgently. Otherwise, its size will only grow.

Often the reason for the formation of debt is late payment. Sometimes clients don't even know about it. In fact, they transfer funds on the appointed day. But due to the delay in the turnover of funds, a delay appears.

To avoid this situation, borrowers are advised to create a loan calendar and make monthly payments no later than three days before the due date.

How to find out if a Sberbank card has been seized?

Sberbank has developed several channels for clients to obtain information about the seizure of cards and accounts. Usually he just uses SMS messaging. If the card is seized, the bank sends the client a message about this fact. After the arrest is lifted, the person also receives an SMS. But if a citizen changes his number, he will not receive the message.

The arrest is always reflected in the Sberbank Online system. If any actions have been taken with the card by order of the bailiff, it will be marked with the phrase “Foreclosure or seizure is in effect.” Next, you can click on the “Executive Documents” tab, where you can find out what type of enforcement document was applied, the reason for the production, information about the authority that imposed the arrest, and the name of the bailiff or other recoverer. Having this data, further proceedings can be conducted.

If a citizen has changed his number and does not use online banking, he will learn about the arrest when he cannot withdraw money from the card at an ATM or pay in a store.

It’s better to monitor the situation; you can always find up-to-date information about your debts on the State Services portal and the FSSP website. If they exist, the Sber card will be seized very soon.