What to do if collectors call? – This question does not lose its relevance. Despite the fact that on January 1, 2021, Law No. 230-FZ of 07/03/2016 (hereinafter referred to as the Law) came into force, regulating their activities, the methods of working to collect debts have changed little.

Often they are not humane and are characterized by the use of insults, threats, and physical force. What do collectors have the right to, and how to give a worthy response to their unscrupulous representatives - this article will help you figure it out.

Powers of collectors under the new law

The new Law, called the Law on Collectors, defines a set of general rules governing debt collection actions. It outlines possible methods and prohibitions regarding contacts with debtors. In parallel with the law, Article 14.57 was introduced into the Code of Administrative Offences, regulating liability for violation of the rights of borrowers who have committed “delays”.

Rights

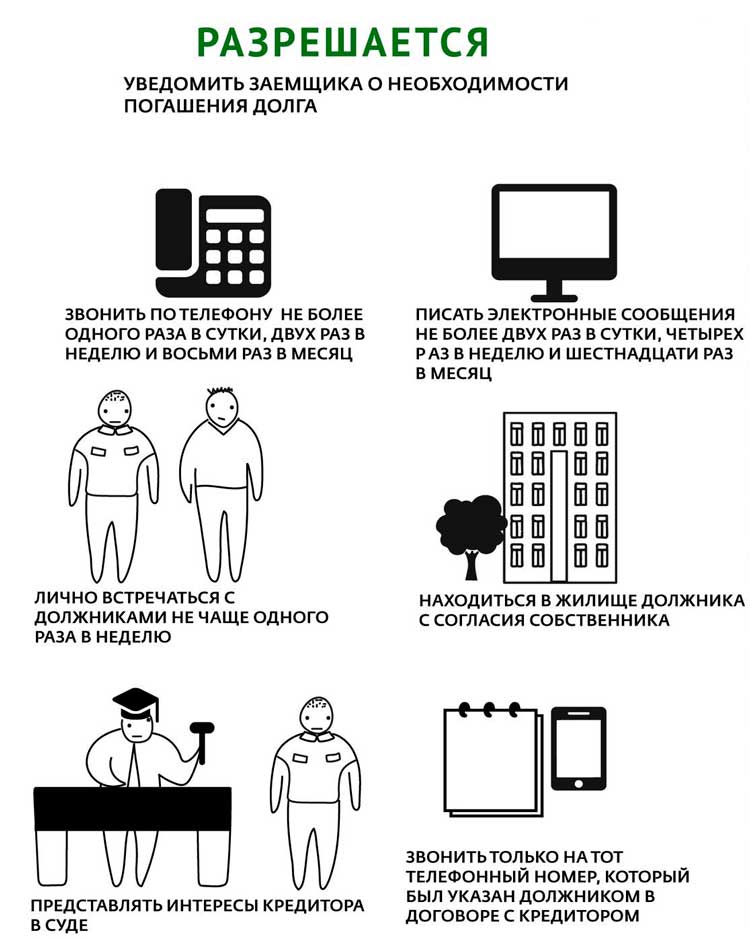

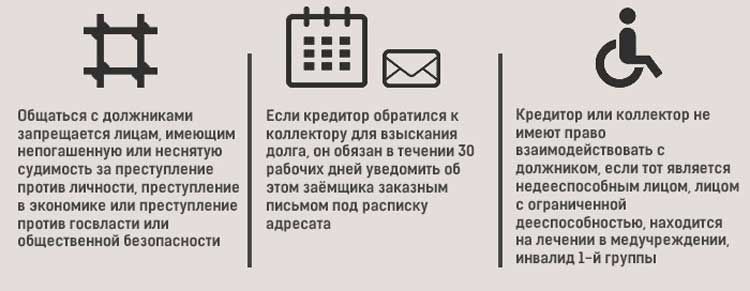

What rights do debt collectors have? Only companies included in the State Register can engage in debt collection activities. It is administered by bailiffs. It is freely available on the Internet. When a financial institution that is a creditor turns to collectors, it must inform the borrower about this within 30 working days (Article 9 of the Law). Do debt collectors have the right to write and call the debtor?

As follows from Art. 4, the rights of debt agencies include:

- the opportunity to meet with borrowers;

- talk on the phone;

- send telegrams;

- write SMS;

- send messages by email;

- send letters via Russian Post to the place of residence and location of the debtor.

When a collector calls a person who has not repaid a loan, he must state his first and last name and the organization he represents (Article 7).

When he pays a visit, he is obliged, before entering the home, to present a special permit. During a visit, only persuasion through verbal influence is allowed. It is allowed to disclose the debt amount and find out the reasons for its non-repayment. You can report the amount of fines and penalties and the time for closing loan obligations.

What can collectors do with the debtor under the new rules? – According to the new Law, collectors have the right to demand compensation for costs incurred in the process of returning funds. However, only the court can determine the amount of such expenses.

The collection agency is obliged to video record conversations and record messages (Articles 7, 17).

Restrictions

What are collectors not allowed to do while working? Collection agencies must take into account the prohibitions specified in the Law:

Do debt collectors sue?

Creditors have 3 years to initiate proceedings to enforce debt collection. This applies to:

- banks;

- microfinance organizations and credit cooperatives;

- collection agencies;

Why exactly 3 years? This period is established according to the provisions of Art. 196 of the Civil Code of the Russian Federation is the limitation period for debts. If the creditor does not have time to declare an overdue loan, and does so later than the established deadline, the debtor has the right to file an objection, citing the expired deadlines. The court is obliged to return the application to the creditor and close the case.

But the debt case will not be closed automatically. The borrower must himself declare that the statute of limitations on the case has expired.

Having received a debt for the assignment of the right of claim, collectors try to squeeze everything possible out of the person. Collectors rush to court only after they receive a court order, which the debtor can appeal.

How a court order works:

- after 10 days the order is transferred from the court to the FSSP;

- enforcement proceedings are opened, which are conducted by a certain bailiff;

- The bailiff has a fairly high workload and is often in no hurry to carry out collections.

But even if the bailiff takes the debtor seriously, he is still obliged to act strictly within the framework of No. 229-FZ. His powers include:

- Ban on traveling abroad. People who cannot pay off a loan usually do not have money to travel abroad, so for many this restriction is purely formal. But if there is a strong desire to visit Turkish resorts, the debtors go to Belarus, and from Minsk they calmly leave for a date to the sea.

- Collection from income - withdrawal of 50% of wages. The method will not work if the debtor is not employed or works unofficially. Therefore, many debtors try to work according to gray schemes - to receive a minimum amount of income under 2-NDFL, and the rest is in an envelope that the bailiff cannot get to.

- Arrest, inventory and seizure of property.

Used as a last resort. Considering that collection agencies are not children whose mothers demand alimony from their unlucky father, bailiffs very rarely apply this measure in relation to credit debts. But even if the creditor turns out to be particularly zealous, in practice it is difficult to recover some property - most debtors have nothing. And what is there cannot be taken away according to the provisions of Art. 446 Code of Civil Procedure of the Russian Federation: a single apartment, furniture, appliances, food.

Taking into account the above realities, collectors go to court when other methods of influencing the debtor have been exhausted. Before this, creditors try to repay the overdue loan on their own. But if there is nothing to take from the debtor, the collector (like any other creditor) can return the writ of execution to the bailiff many times - for example, if the debtor receives an inheritance or gets an official job. That is, the debtor can get on the debtor’s nerves for a very long time using purely legal methods.

Requirements for collection agencies

The law established the requirements for a legal entity engaged in debt collection.

It should:

- Register as a business entity.

- Have net assets in an amount not less than 10 million rubles.

- Not under liquidation or bankruptcy proceedings.

The law establishes:

- The procedure for carrying out control measures at the state level over the activities of collectors.

- Reasons for ordering unannounced inspections.

- Regulations for making decisions on exclusion from Rosreestr.

What robots do collectors use?

Automated systems for calling debtors began to be widely used in 2021. Most often, robots are used when making the first call to a person, since the scenarios for such conversations are the most universal, says RBC’s interlocutor at a large collection agency. Conversation scripts, or scripts, that are used for automated calling depend on the time the collector contacts the debtor and the duration of the delay. Collector robots are conventionally divided into four types.

- Static autoinformers. They make a call and send a voice message about the debt.

- Basic robots. Systems that are capable of recognizing the simplest phrases of the interlocutor-debtor (“yes”, “no”, “I don’t know”) for voicing information according to a script.

- One-way systems. Robots that are able to recognize the debtor’s phrases and generate answers to questions.

- Intelligent assistants. Robots capable of storing named entities. These are systems that can not only perceive the debtor's responses, but also store them to create scripts for subsequent conversations. Such a robot collector, for example, can remember why a person refuses to pay a debt and use this information during the next call.

Communication with the collector

What documents should a collector who comes on a visit provide?

- passport or other identification document;

- power of attorney to carry out actions;

- confirmation of the company's entry into the register (copy).

It would be a good idea to call the creditor bank and clarify information about the organization that it has attracted.

What can collectors do when they come to your home? The most that a collector can do when visiting a debtor is to have a conversation and convince the borrower to pay off the debts and, together with him, find a legal way to do this. He has no right to use coercive measures. This is the prerogative of the bailiffs. Only they can confiscate things or money, arrest them, evict them from their home (Article 68 of the Law No. 229-FZ of October 2, 2007).

Collectors need to pay for an overdue loan only if two conditions are met:

- When notification is presented that the bank has transferred the debt to debt collectors.

- When a request for repayment of overdue debt is received indicating:

- debt amounts;

- accrued interest;

- penalties;

- commission payments;

- current account for sending funds;

- maturity date.

What to do if debt collectors call or come home?

There is a lot of advice on this matter on the Internet. Some people advise resisting and fighting debt collectors - cursing and arguing with them for hours on the phone or in person. But this is wrong, since all this will spoil your nerves and take up your time.

There is also such a tactic as completely ignoring collectors. After all, the debtor does not have a legal obligation to listen to the debt collector’s demands for repayment of the debt, and there is no liability for refusing to communicate with the debt collector. Therefore, many find a way out of this problem by simply changing the phone number and closing the front door when uninvited guests visit. But such tactics have their problems. Not all debtors have the opportunity to constantly change their SIM card, including due to work-related calls. In addition, it won’t be possible to hide in an apartment around the clock, and sooner or later you will have to leave the apartment, stumble upon a collector in the entrance and ruin your nerves, and sometimes your health.

There is a legal way to get rid of telephone and personal communication with debt collectors. 230 Federal law allows debtors to submit to collectors an application for refusal to cooperate in collecting overdue debts.

After filing such an application, collectors will not be able to call or visit the debtor, but will only be able to write letters to him by mail or file a lawsuit against him. This is what many debtors are trying to achieve, since after the debt has been fixed in court, they will only need to communicate with the bailiff. And making a promise with a bailiff is always easier. And the bailiff himself usually doesn’t really need such communication with the debtor. Debt is not his money.

Where to look for protection?

Unfortunately, no law begins to work immediately. The same picture can be observed today regarding the implementation of the law on collectors. Both in the media and on the Internet, people often talk about being tortured by debt collectors. They have by no means stopped their illegal actions and continue to call debtors and their acquaintances day and night, on weekends and holidays, intimidate them, threaten them with legal action and criminal punishment. They also send threatening SMS messages, guard debtors at the entrance and post information containing offensive statements or write curse words on the walls that are difficult to erase.

How to protect yourself, what to do first when debt collectors call and threaten? – You should complain to the police, namely to the duty station of the district office at your place of residence. Having arrived at the scene, the police must record facts of violations of the law and bring unscrupulous collectors to justice by initiating a criminal case. To get the greatest effect from the work of law enforcement agencies, you need to take the initiative yourself and accumulate an evidence base. To do this, you need to make video and audio recordings, record phone calls, save threatening SMS messages, photograph inscriptions discrediting honor and dignity, collect letters and telegrams.

It is advisable to send the application to the bailiff service. It needs to describe the problem and demand that the claimant be held accountable. A complaint to the bailiffs serves as the basis for ordering an extraordinary inspection (Article 18 of the Law). The appeal is studied by bailiffs within a period not exceeding 30 days.

Based on the results of the inspection (Article 19), one of the decision options is made:

- Indication of the need to eliminate the violation.

- Resolution on the exclusion of an organization from the FSSP register.

Usually the first option can complete the first check. When the instructions are ignored and a gross violation is repeated once, and damage to health, life or property is caused, the second option follows. In such a situation, this agency will no longer be able to engage in such activities. However, it has the right to file a complaint with the arbitration court within 3 months from the date of the decision. While the court is considering the application, the bailiffs' order will remain in force.

Where to complain about debt collectors for calls

Before you start complaining about the actions of debt collectors, you need to find out whether the agreement remained with the credit organization, and the collection was transferred to another organization, or the loan was transferred to this company under an assignment of claim agreement.

If the contract remains with the bank, and the organization from which the calls are coming is authorized by it to repay the debt, then you can and should complain first of all to the bank itself and the Central Bank of the Russian Federation. Probably, after this, the collectors will stop pestering the debtor.

You can complain about the actions of a company that bought an overdue debt from a bank to Roskomnadzor and the association of collection agencies, provided that the collector is a member of this association. Most problems are solved this way.

Complaints can be sent through the online reception desks of supervisory organizations or by letter with acknowledgment of receipt. Such an appeal must be accompanied by a copy of the recording of telephone calls, a printout from the telecom operator company indicating the time of conversation and other evidence of pressure exerted.

If debt collectors torment you with calls, call at odd hours (at night), constantly threaten life and health, spread false information about the debtor, damage his property or the property of relatives and neighbors, you must submit an application to law enforcement agencies.

Adviсe

What to do when debt collectors call you at work? As mentioned above, collectors do not have the right to transfer information to third parties without the consent of the debtor, and in principle they do not have the right to call for work. Therefore, you need to contact:

- To Rospotrebnadzor, indicating that confidential data was being distributed illegally, as well as the full name of the caller, his position and the telephone numbers from which the calls were made.

- To the Central Bank, reporting a credit organization that turned to unscrupulous collectors to collect debts.

- To the prosecutor's office, pointing out a violation of the rights of the borrower and citizen of the Russian Federation.

How to block collector numbers? To do this, you can use the Anticollector phone application and download it for free on the Internet. It is not very difficult to use, working on the “black list” principle. The numbers of collectors are entered into the phone's memory; when calling from them, the signal is blocked. As a result, the borrower becomes inaccessible to the creditor. According to lawyers, this method should be used when solving debt problems as a last resort - only when a debt collector calls, going beyond what is permitted.

Dealing with debt collectors is not an easy task. And, if they behave illegally, you need to contact the above authorities. If the creditor behaves within the legal framework, it is necessary to seek a compromise and strive to repay the obligations in a way acceptable to both parties.

Rights of collectors when collecting debts

A collection company is an organization that specializes in debt collection. They either act as intermediaries to collect the debt in favor of the bank, or purchase the debt from a financial institution.

Essentially, debt collectors are those who seek payment of a debt, in favor of themselves or a third party, but do so on a professional level.

Any actions taken by such organizations must be strictly within the framework of current legislation. First of all, it is worth considering Federal Law No. 230-FZ of July 3, 2016, which in Chapter 2 lists the general rules for collection.

Thus, debt collectors have the right to act as follows when collecting debt:

- organize personal meetings with the consent of the debtor;

- carry out telephone conversations;

- send various messages, for example, SMS or email;

- use postage.

Collection agencies also have the right to sell the debt (if they acquired it under an assignment agreement), as well as file a claim in court to collect the debt. Essentially, they have the same rights as the creditor with whom the agreement was originally concluded.

Link to document: Federal Law No. 230-FZ of July 3, 2016 “On the protection of the rights and legitimate interests of individuals when carrying out activities to repay overdue debts...”

How to get rid of debt collectors forever

To completely get rid of claims, you need to close the debts themselves. The only effective and legal way to get rid of debts is personal bankruptcy. Bankruptcy of an individual will allow you to write off debts on loans, microloans, debts to individuals, debts in housing and communal services and even traffic police fines.

With the support of an experienced credit lawyer, you will be able to get rid of all overdue and problematic debts within 8-12 months.

Our services

Sale of property - bankruptcy "turnkey" - from 7,900 ₽/month.

Legal support for bankruptcy - from 88,000 ₽

Preparation for the extrajudicial bankruptcy procedure - 15,000 ₽

Consultation on bankruptcy of individuals - 0 ₽

It is also important to consider that from the moment you file for bankruptcy, debt collectors lose the right to bother you about debts.

all enforcement proceedings are also suspended, and penalty interest for delays ceases to be accrued.

You can learn more about the bankruptcy procedure for individuals or get professional help in combating the arbitrariness of collection agencies by contacting the credit lawyers of our company. Our specialists will develop an optimal bankruptcy strategy for you, help you create an image of a respectable borrower, and represent your interests in court and when communicating with creditors.