Meaning of the terms gross and net

First, let's define what the words gross and net mean by themselves:

- gross - large, extensive, large, unrefined.

- net is the antonym of the word “gross”, something cleared of unnecessary things.

That is, “gross” and “no” are antonyms: unrefined and refined. In the context of the topic of our article, we are talking about unrefined salary (gross salary) and cleared salary (net salary). What can wages be cleared of? We are talking about taxes and various deductions.

In what situations can you meet the gross salary? Why do you need to know and be able to calculate gross and non-gross salaries? We will answer these questions and tell you in which cases it is important to know what the difference is between no and gross wages.

Salary Net: what is it?

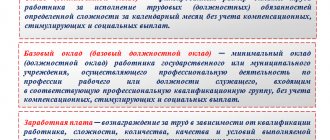

The next concept, net salary (translated as “net salary”) means “salary without tax.” That is, this is a “take-home” payment, from which all deductions and taxes established by law and local regulations of the organization were taken away.

More often we hear the concepts of “clean” and “dirty” salary in relation to earnings, respectively, the first of them will be net or netto. It is this that is the final settlement with the employee at the end of the working period.

Salary gross - unrefined

You can often hear about gross salary, that it is a “dirty” salary.

Gross salary is salary before deduction of all taxes and deductions. In this case, we are talking about white wages, reflected in all tax returns and calculations that the employer submits to the regulatory authority.

Sometimes an employee who gets a job does not realize that he is transferring taxes to the budget from his salary. He does not do this himself - according to the rules of the Tax Code, this is done for him by his employer, a tax agent, if we speak in terms of tax legislation. The employer cannot shift this responsibility to the employee; he himself is obliged to withhold tax from the salary and transfer it to the tax office. Let us repeat that here we mean conscientious employers paying white wages. We will list cases where the employee pays the salary tax themselves below in the article.

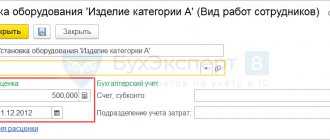

The employment contract must specify the salary amount. And there they indicate the gross salary. Therefore, when applying for employment, one must take into account the fact that the employee will receive less than the amount specified in the employment contract. This is not a mistake or a reason to argue with the employer. Sometimes they verbally set the salary amount “in hand”. Then the employer indicates in the employment contract an amount greater than what was agreed upon, since calculating the gross salary if you know the net salary (the one that was agreed upon in words) will not be difficult.

Gross salary - what does it mean?

Most often, citizens hear the above foreign terms for the first time during an interview with a potential employer. For example, when discussing remuneration, an employer may use the word “gross,” which is translated from English as “full.” Quite often, job candidates do not specify the meaning of this word for fear of appearing ignorant. And then, having agreed to the conditions proposed by the boss, they are disappointed when they receive as a reward for their work an amount less than what was agreed upon at the interview. To avoid such situations, you need to know gross salary - what it means.

Let's answer the question gross salary - what is it? When looking for a job, applicants pay great attention to such a thing as the amount of wages. Employers know this. Therefore, in order to attract the largest number of candidates for a vacancy, they often indicate a larger salary in advertisements. This is the so-called gross salary, which is the amount without deduction of income tax. In Russia it is often called “dirty”. The employer can indicate it in the contract when hiring the employee, but in fact pay him less money at the end of the month. That is, the boss bets that the person in need of work is unfamiliar with this concept.

Therefore, in order to avoid getting into trouble, the amount of remuneration for work should be discussed at the interview.

Salary net - cleared

It is already clear what the difference is between gross and net wages.

Let us express the ratio of gross and net wages with the formula:

You can also hear that the net salary is called “salary in hand”, that is, this is the amount that the employee will actually receive.

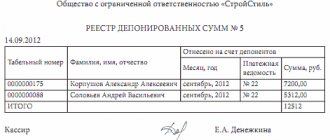

Let's give a simple example. The employment contract states the salary amount is 30,000 rubles. This is the gross salary. And at the end of the month, the employee will receive a net salary - the amount specified in the contract minus personal income tax, which the employer is obliged to withhold. 30,000 – 13% (3,900) = 26,100 rub.

In addition to tax, the employer has the right or obligation to make certain other deductions, if any. For example, this could be alimony that is withheld based on writs of execution. Another option is to deduct damages caused to the employer from wages if the employee is found guilty.

Check out a selection of our articles on child support withholding:

- “Calculation of alimony from wages and the procedure for their deduction”;

- “Do they withhold alimony from vacation pay or not?”;

- “Accounts for calculating and deducting alimony from wages”.

Here we note that it is impossible to withhold more than 20% (50% and 70% in some cases) from wages, according to Art. 138 Labor Code of the Russian Federation.

How to work with writs of execution and not receive a fine from regulatory authorities? Sign up for a free trial access to ConsultantPlus and receive an algorithm of actions for working with writs of execution, compiled by experts of the K+ system.

The employer, in addition to personal income tax, makes contributions for pension, medical and social insurance for the employee. How do contributions affect net salary? No way. Contributions are transferred to the employer's funds account.

Let's return to our example. For an employee's salary of 30,000 rubles. Contributions in the amount of 30.2% were assessed (in general). 30,000 × 30.2% = 9,060 rub. The employee will still receive 26,100 rubles. But the employer will transfer to the budget: 3,900 (personal income tax) + 9,060 (contributions) = 12,960 rubles.

What is net in salary

There is another term - net or net salary, which is the exact opposite of “blurred” earnings. If the employer says that the salary is net, this means the amount of salary that the employee will receive in hand after the employer has withheld all taxes and other fees. In posted vacancies, this concept is also characterized by a special salary or salary in hand, which means that this is the amount you will manage every month. Otherwise called net earnings or net earnings.

There is a special formula that helps determine the net salary, what is it? To determine the amount of net earnings, it is necessary to subtract from the gross indicator the amount of tax deductions that are established by the current fiscal legislation.

Equality of gross salary and net salary for different workers

Let's consider an interesting situation. Can the same gross salary guarantee the same net salary for different workers? No, he can not. Even if two employees are given the same gross salary level, this does not mean that their salary will also be the same. The thing is that personal income tax, which is deducted from the salary gross and the salary is not received, can be calculated differently, depending on the circumstances of the taxpayer. For personal income tax, tax legislation provides for tax deductions that reduce the tax base. But not all individuals have the right to them. We are talking about deductions for children, social and property deductions. Employers can provide these deductions upon written application from the employee.

Here is a comparative analysis of the gross salary and the net salary with and without deductions.

We wrote about how to get the standard child tax credit in the article “Child Tax Credit in 2021.”

Read about the new rules for obtaining a personal income tax deduction in the article “Deduction of personal income tax in a simplified manner .

Let's calculate gross and net wages

Knowing the size of the gross salary, it will be very easy to calculate the amount you can expect to receive - to do this, you just need to subtract 13% of the income tax from the specified amount of payment. If you need to do this “in your head”, then just remember the banal mathematics: you need to calculate how much 1% of the amount is, multiply it by the required number of percentages and subtract the resulting amount from the total amount. So, for example, an employer promises you a salary of 20,000 rubles. Dividing 20 thousand by 100 - we get 200 rubles - this is 1% of the salary. Income tax is 13%, which means 200 needs to be multiplied by 13 - it turns out 2,600 rubles. Now we subtract the amount of income tax from the gross salary: 20,000 - 2600 = 17,400 - this is the amount actually received monthly.

If you need to find out how much income tax you pay per month, and your salary is indicated by net, then to calculate it you will need to divide the indicated salary by a constant value of 0.87, and then find the difference in the resulting amounts. For example: divide 17,400 by 0.87 and get 20,000 rubles; subtract 17,400 from 20 thousand rubles and get 2,600 rubles of income tax paid per month.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Why might you need a gross salary and a non-gross salary?

As we have already said, the gross salary is written in the employment contract. And by and large it is believed that a person receives exactly this amount, this is his income. And the tax is its expense. But in addition to taxes, a person has a lot of expenses - paying for housing, food, clothing, other taxes, and so on. We do not subtract them when talking about the amount of our income, but say the amount received in hand. This is not entirely fair; it is still more logical to consider the gross salary as income. By the way, the state considers this exactly when allocating various benefits and subsidies. If the purpose of the benefit depends on the amount of income, then the income is the gross salary, not the net salary.

Net salary is needed primarily by the employee himself - the citizen who calculates his actual income and expenses.

Gross salary: what is it?

The concept of gross salary (translated as “gross salary”) means wages without deduction of personal income tax, which in our usual vocabulary sounds like “dirty”. This is earnings before taxes are withheld.

Most often, it is the gross salary that is indicated in vacancies, so the job seeker must understand that he will ultimately receive the amount minus tax. Its size is constant (for residents of the Russian Federation) and amounts to 13%. Calculating the final value “on hand” is not difficult.

You need to know the nuances associated with gross wages:

- gross includes all payments related to the concept of salary: salary, bonus payments, allowances and additional payments;

- if in the area where the organization is located, an increasing regional coefficient is established, it is additionally accrued and becomes an element of the gross salary;

- the final monthly payment for labor will be issued to the employee minus personal income tax and other deductions established by the organization (for example, union dues).

The term “brutto” is also applicable to this type of salary, which, along with “gross”, is often used in world and Russian practice.

When does an employee receive gross salary in hand?

Let us immediately make a reservation that such a question is not entirely correct. But misinterpretation of terms can be found, so we will operate with them, but with explanations of what is wrong.

Often employers do not enter into employment contracts with their employees, but civil contracts. Sometimes such a move is just an evasion of taxes and compliance with labor laws. However, sometimes this is completely justified by the circumstances.

In this case, they also say that the employee receives wages. This is not true. Salaries can only be received within the framework of labor legislation, that is, if there is an employment contract. If the work is performed not under an employment contract, but under a civil law contract, then we are talking about remuneration under the contract.

If an employee (by the way, in this case he cannot be called an employee, he is a performer under a contract) is hired under the GPA and is an individual entrepreneur or self-employed, then he receives payments under the contract in full, that is, a gross salary, and then pays taxes on one's own.

If, according to the GPA, just an individual without a special status works, then under the contract he also receives payments minus personal income tax, that is, a net salary. Even according to the GPA with an individual, the employer (it is correct to call him the customer) must withhold personal income tax from payments under the agreement.