Citizens of Russia, upon reaching a certain age, have the right to stop working and count on material support for their needs in the form of a pension. However, it is known that cash payments to pensioners in our country remain quite low.

The average pension in the country is, according to statistical authorities, 14,100 rubles, but it should be borne in mind that the calculation method used is not perfect, so the vast majority of the population can count on a significantly smaller amount.

In this regard, many able-bodied people, including relatively young people, are beginning to think about how they can increase the amount of their security in old age. One of these methods is the formation of a funded pension, the calculation details of which are given in the article below.

Principles for the formation of the specified part of savings

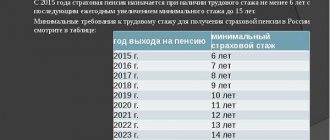

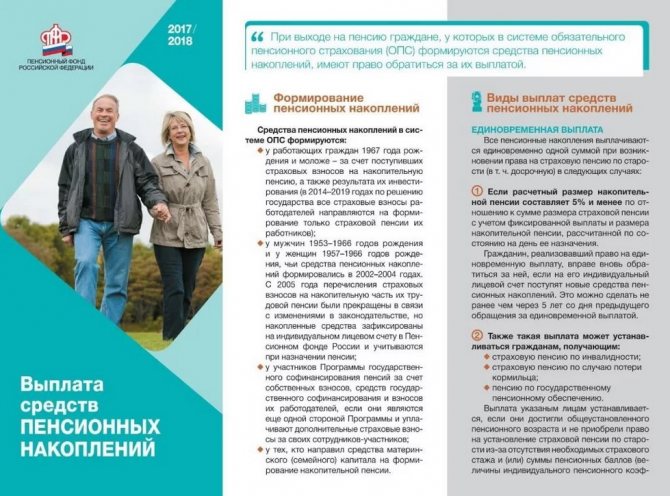

According to the provisions of Law No. 424-FZ, this part of the pension is established for women born in 1957-1966. and men born in 1953-1966, if they received pension contributions in 2002-04, as well as citizens born in 1967. and younger ages.

How many people have chosen a funded pension?

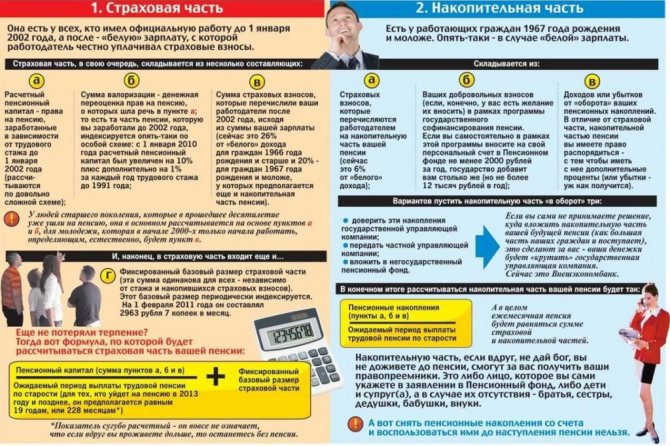

The part specified in Federal Law No. 424-FZ is formed from:

- personally transferred funds of citizens;

- redirection of part of maternity capital;

- insurance premiums paid for the employee;

- transfers under the pension co-financing program.

Important! Regardless of the fact that the type of savings proposed by Federal Law No. 424-FZ includes its own version of contributions, it can only be established for citizens receiving a basic pension.

To exercise their legal rights, until the end of 2015, citizens were asked to confirm the redirection of part of their contributions allocated to the basic pension to the establishment of its funded part by submitting a special application to the Pension Fund.

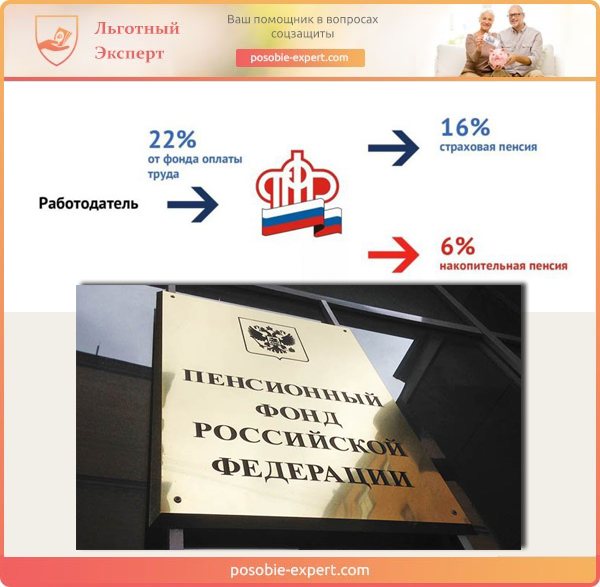

When a person exercises this right, 6% of his contributions from the 22% deducted for the employee begin to be deposited in a specialized account, further invested in the credit market through the Pension Fund or Non-State Pension Fund.

Reference! If a citizen does not take advantage of the opportunity provided, the specified 6% from 2021 will also continue to be invested by the Pension Fund, and after his retirement will be paid to him in the total amount.

Indexation of the funded part by the state as a percentage

It is also important to note that the funded part is not indexed by the state, and income from it is not guaranteed in any way. If her investments turn out to be successful, this will provide a good increase in her pension, but if they are unprofitable, the state will only pay insurance premiums for her.

Reference! In 2014, the state applied a moratorium freezing this part of payments, as a result of which the entire volume of insurance contributions was redirected exclusively to the main part of the pension.

The moratorium was applied due to the deterioration of overall economic indicators, and it is currently planned to extend it until 2020.

Definition of insurance and funded pension

How to calculate the funded part of a pension

Persons who formed this type of pension provision can apply for payment of funds if they have the corresponding right. It occurs when they reach the age established in the country for retirement.

Reference! If a citizen has the right to early assignment of a pension, then the funded one will be assigned to him along with the insurance one.

The law provides for three forms of payment of the funded portion:

Indefinite

It is made in equal payments throughout the pensioner’s life or until the funds in the pension account are exhausted. In this case, to calculate the specific amount that will be paid to an elderly person, a parameter such as the “survival period”, calculated in calendar months, is used. It should be understood as the life expectancy of a pensioner after the assignment of funds to him.

This parameter depends on many factors and is subject to annual change. In 2021, the survival period is 252 months.

Urgent

In this case, funds are paid within 10 years after the pension is assigned. As soon as the specified period expires, transfers will be stopped in full.

One-time

In this case, the pensioner is paid the entire amount accumulated by him. However, this is possible only if certain conditions are met that do not depend on the will of the person himself.

Formula and example

In practice, most often citizens receive unlimited transfers, which are calculated taking into account the survival period.

They are calculated using the following formula:

NP = PN/T

Where:

NP – the amount of pension payments made monthly.

PN – the amount accumulated by the citizen.

T – survival period.

For clarity, an example should be given.

Citizen Petrov will retire in 2021. There is an amount of 300 thousand rubles in his pension account.

Respectively:

300000/252 = 1190,47.

Thus, the amount of Petrov’s accumulated pension will be 1190 rubles, 47 kopecks.

If a term payment is expected, for example, 10 years (120 months), then the calculation procedure is the same:

300000/120 = 2500.

Accordingly, the amount of security will be 2,500 rubles. The period of urgent payment can be any, but not less than 10 years.

How to find out the location of your pension

To find out the location of your pension funds, you can:

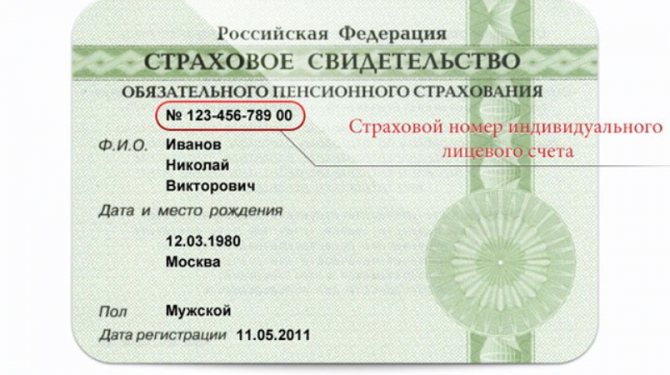

- go to the PFR unit at your place of residence, filling out an application to provide information about the management company. You will also need to provide a passport and SNILS. Employees of the department using the SNILS number can provide the required data within 10 working days, either in a personal meeting or with notification via mail;

Pension Fund employees can provide information about the location of your pension funds using your SNILS number

- Also, the specified information can be requested from financial and credit organizations that have entered into a special agreement with the Pension Fund: Sberbank, VTB 24, Gazprombank, Bank of Moscow, UralSib, without being a client of the listed institutions. It is only necessary to capture the documents listed in paragraph 1;

- Another way to obtain the required data is to approach an accountant at your place of work. The employee responsible for the monthly pension contributions of the company's employees can provide the required data;

- finally, the easiest way is to obtain information via the Internet, for example through the “Unified Government Services Portal”, located at: https://www.gosuslugi.ru/. To provide information on the portal, you need to register on it and receive the status of the entry “Confirmed”.

You can obtain information about your pension via the Internet on the government services portal

To acquire this status you can:

- Issue an activation code at gosuslugi.ru, it will be sent by mail to the selected address within 1-3 weeks with notification.

- Find a Rostelecom customer service point in your region and arrange to receive an activation code there; you just need to take with you the documents specified in paragraph 1 and your Taxpayer Identification Number.

- Use an electronic signature obtained from a special certification center.

- Apply an electronic universal card (discontinued 01/01/17).

After acquiring the required status, in the “Category”, click “Notice of account status in the Pension Fund” and click “Get service”.

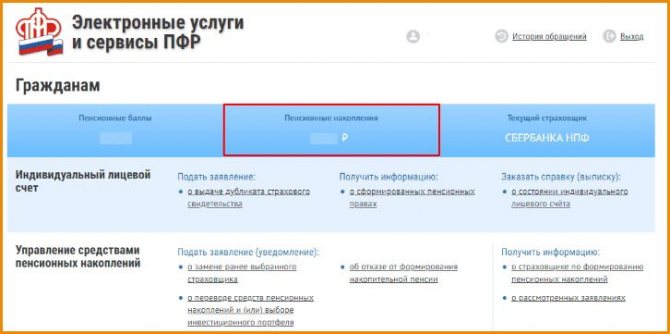

The “Notice of Personal Account” will be loaded, where the name of the insurer will be presented.

In addition to the specified portal, it is also possible to access the PFR website: https://www.pfrf.ru/, where in the “Personal Account” you can obtain a personal account statement by clicking the “Request” button.

On the Pension Fund website you can obtain a statement of your pension personal account.

A message indicating acceptance of the request will be displayed, and after some time the statement will appear in the “Request History” section.

Important! To collect this data, under no circumstances should you use online services other than those listed, incl. transfer your personal information to them or send SMS to short numbers.

From the data obtained from the presented services you can also find out:

- name of personal insurer;

- selected pension option;

- the amount of service taken into account for calculating the pension;

- the number of points calculated for calculating the pension;

- the volume of accumulated funds and the results of their investment.

Pension savings formula

How to calculate the amount for pensioners?

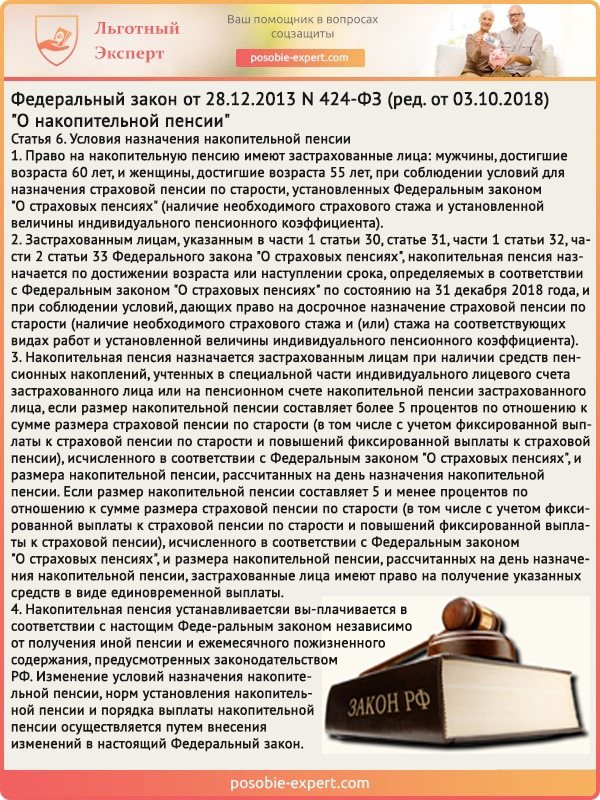

First, let's figure out who this type of support is provided for (read more about who is entitled to such a payment here):

- For citizens who have been assigned a payment for the loss of a breadwinner, state pension provision or disability, but there are no reasons for establishing an old-age insurance pension.

- For citizens whose funded part of their pension is no more than 5% of their total financial security in old age.

- For those who are heirs or assigns of a deceased account holder.

- For people born in 1967 and younger.

- For participants in the state co-financing program for the formation of pension savings. Entry into the Program ended on December 31, 2014. If, during the period from October 1, 2008 to December 31, 2014, a citizen submitted an application to join the Program and made the first contribution before January 31, 2015, then he is a participant in the Program.

- For citizens in whose favor in the period from 2002 to 2004. insurance premiums were paid inclusive. Since 2005, these deductions have been discontinued due to changes in legislation.

The size of the one-time payment is established by specialists of the Russian Pension Fund. From the fund, funds are allocated to the subject, and not separately to each person, for this reason the determination of the size of payments is closely monitored. The amount of payments directly depends on the savings of a particular pensioner (the higher it is, the higher the amount of the one-time payment). The minimum payment amount is 5 thousand rubles.

Step-by-step calculation plan:

- Use the following formula:

NP = PNT. Where:- NP - the amount of monthly payments of funded pension.

- PN - pension savings accounted for in a special part of the personal account of the insured citizen.

- T is the expected payment period. In 2021, the expected period is 246 months.

- Using the formula, you can find out the amount of your monthly funded pension. This figure is added to the monthly insurance pension. Then the percentage of the funded part of the total amount is calculated. If the percentage is less than 5%, then a one-time payment will be available to the citizen. If it is above 5%, then it is not possible to receive a one-time payment.

You can also get all the information at the Pension Fund branch at your place of residence (take your passport and SNILS with you). You can use the State Services Portal or the online calculator of a non-state pension fund (for example, Sberbank NPF). You will need to enter information about age, length of service, and average salary.

The lump sum payment will be provided again to citizens who have already received it only after five years.

How to obtain the specified type of savings and their calculation

If a person has taken advantage of the right granted to him by law, he can receive savings by submitting an application to the Pension Fund at his place of residence, providing the required documents.

Reference! In 2021, the main news is related to the non-indexation of pensions if the pensioner continues to work, and the impossibility of claiming a funded payment in this situation.

Upon retirement, a citizen receives the right to receive savings under Federal Law No. 424-FZ in one of 3 options.

Formation of savings and types of pension payments

One time

With this method of receiving accumulated funds, they will be transferred to the person once in the aggregate amount.

The specified option for transferring funds is established:

- recipients of a survivor's pension, disabled people or state pension recipients. provision;

- having a sufficient number of retirement years, but not having the required length of service and points;

- upon the death of a citizen who has the specified account, his heirs, if they claim these funds.

Reference! Part 1 of Article 6 of Federal Law No. 424-FZ also states that if these funds represent an amount of less than 5% of the basic pension, they are also paid in a lump sum.

A lump sum payment of accumulated funds can be transferred only once

Example of calculating a lump sum payment

Below is a calculation of whether a pensioner can request payment of the specified savings in a lump sum.

For example, the amount of a person’s calculated pension is 7,200 rubles, and a specialized account has 172,000 rubles.

Calculation of NP: NP=SPN/T, where:

- NP – monthly savings payments;

- SPN – amount of pension savings;

- T – expected period of payment of NP, per month. (Part 1, Article 17 of Federal Law No. 424-FZ; 246 months in 2021).

You can calculate:

- Payments to NP: 172000/246=699.19 rubles.

- Payment of basic pension + NP: 7200 + 699.19 = 7899.19 rubles.

- NP coefficient to the basic pension (insurance + savings): 717 rubles / 7917 rubles = 0.09 * 100% = 9%.

Because 9% is more than 5%, a person will not be able to request funds from a special account with a one-time payment, and they will be paid gradually.

Calculator for calculating the amount of payments of the funded part of the pension

The calculator for calculating payments of the funded part of the pension will help you.

Go to calculations

Urgently

With this method of receiving funds, they are paid within the period chosen by the person on a monthly basis, and the specified period cannot be less than 10 years.

Urgent payments are issued to a pensioner once a month for 10 years or more

Calculation example

Urgent payment (SPV) is paid from the amount of SPV divided by the number of months T: SPV = SPV/T.

Indefinitely

With this payment method, funds are paid monthly, throughout the person’s life, or until the account is depleted.

Calculation example

Calculation of unlimited payments: NP=SPN/T. With a salary of 30 thousand rubles. 6% contributions amount to 1800 rubles. In this case, on the account, for example, for 20 years, there will be: SPN = 1800 * 12 months * 20 years = 432,000 rubles.

Reference! The T period in this case is a gradually growing statistical value; for 2021 it was 246 months, or 20.5 years.

Let’s also assume that the investment profit from the accumulated funds was 216,000.

If a person has chosen unlimited payments, the amount of the NP will be: NP=SPN/T=648,000 rubles/246 months=2634 rubles.

The open-ended type of pension savings is paid monthly, throughout the person’s entire life, or until the account is exhausted

Calculator for calculating perpetual funded pension payments

Go to calculations

What it is?

First of all, the funded pension, from which the lump sum payment is made, is a monthly benefit from pension savings. It is formed through deductions of insurance premiums from employers and/or income from their investment; the accumulation program began its formation after 2014 and can be implemented in two forms:

- accumulative;

- insurance.

The first is provided to persons born in 1967 and younger, but it is mandatory when choosing this particular type of pension funds. It was possible to connect to the program until the end of 2015.

One-time funds from funded portions are a one-time payment of all pension funds from the individual account of a person with insurance. The following categories of citizens are entitled to receive lump sum funds:

- Those who have an insurance pension for a disability group or the loss of a breadwinner, as well as those on state pension provision.

For example, men over 60 years old and women over 55 years old. Attention ! Receipt is not affected by the number of pension points and the lack of required insurance experience. - If you have the right to old-age insurance (early term is also taken into account), the accumulated amount is about 5 percent or less in relation to the old-age insurance part. But, a fixed payment to the insurance and the amount of the accumulated part is also taken into account, and its size begins to be calculated from the date of appointment.

Only those who were not previously subscribed to the program for the funded part will not receive sums of money.

You can receive a lump sum payment once every five years.

Read more about what a lump sum payment from the funded part of a pension is and who is entitled to it here.

The most common question regarding this type of pension

Question from Victor: 2 months have passed since my father passed away. He had savings in a funded pension. Is it possible for his heirs to receive this money?

Answer: Law No. 424 states that upon the death of a person who had a funded pension, they can be inherited. This rule does not affect maternity capital.

To inherit them, it is necessary to establish whether there is a statement from the father determining the order of persons who can inherit the savings upon his death.

If there is no specified application, the savings are inherited by all heirs of the owner for up to 6 months after his death, upon submission of a claim for inheritance of funds.

Federal Law “On Funded Pension” N 424-F3. Article 6

My pension and money

If a person is used to living in abundance, the average pension will not provide him with the level of comfort to which he is accustomed. Insurance payments today have a salary ceiling of 59,000 rubles.

This implies that it does not matter whether the employee earns the specified salary or a higher salary, pension contributions in both cases will be the same.

Because The moratorium on the type of pension specified in Federal Law No. 424-FZ has been extended until 2020; the presented scheme of cash investments still exists in fact only in theory.

Even taking into account the fact that PFs invest incoming money in investment portfolios, inflation may partially absorb them.

Today there are about 2.5 workers per pensioner, and, according to Rosstat, by the 2040s. there will be 1.5 of them. This implies that the financial cushion for pensioners will gradually decrease.

Insurance payments today have a salary ceiling of 59,000 rubles.

In the emerging realities, there is a need to think about your own future well-being. Purchase real estate, save funds for deposits, invest in securities and foreign currency savings.

These measures will make it possible to contribute a certain amount towards pension at retirement age and get a real opportunity, albeit not a rich one, but a fairly “well-fed” old age.