— How does the future pension depend on the length of service?

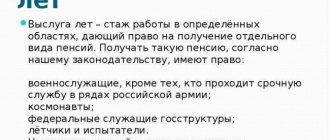

— When assigning a pension, insurance and total length of service are taken into account.

The total length of service is determined until January 1, 2002. Insurance experience is the duration of periods of work and (or) other activities for which insurance premiums were accrued and paid to the Pension Fund. At the same time, there are so-called non-insurance periods that are counted in the insurance period: the period of caring for a child until the age of one and a half years, the time of caring for a disabled child, a disabled person of group I or a person who has reached the age of 80, the period of military service and some other. They also earn pension points. Work periods are confirmed based on individual (personalized) accounting information. If the accounting information contains incomplete information about periods of work, or there is no information about individual periods, the length of service can be confirmed with documents. The longer the period during which insurance contributions to the Pension Fund were paid, and the higher the salary, the greater the amount of contributions reflected in the individual personal account of the insured person in the Pension Fund of Russia and the higher the insurance pension will be.

You can familiarize yourself with your pension rights, find out everything about your length of service, earnings, and the amount of insurance contributions without leaving your home, through the citizen’s Personal Account on the website of the Russian Pension Fund. Your rights are based on the data that the Pension Fund received from employers. If you think that any information has not been taken into account or has not been taken into account in full, contact your employer to clarify the data and submit it to the Pension Fund in advance.

What types of pensions are there and according to what regulatory laws are they calculated?

Many people cannot understand under what regulations a pension can be calculated. In Russia there are several legislative acts in force that regulate the issue of pension payment.

Today, the provisions of the Law “On Insurance Pensions” dated December 28, 2013 N 400-FZ are taken into account.

According to the law of 2013, pensions are calculated from the beginning of 2015. At the same time, when calculating for previous periods, the reference is to the law of 2001, which is no longer in force.

Excerpt from Article 1 of Federal Law No. 400

Currently, the concept of an insurance pension is increasingly used. If we talk about labor pensions, this concept has been used before. You can understand that now the insurance period is used, and the work experience is already somewhere in the past. Law number 400 allows you to take into account all the rules that were in force at the time of forming the length of service.

Therefore, the calculation usually uses data from several laws. An example is the situation: a woman studied at a technical school from 1972 to 1974, and after that she worked until 1979. From 1980 to 1982 she was on maternity leave, and after 2000 she worked. According to the rules of the Soviet Union, the period of training and maternity leave is counted as length of service, and work since 1992 will be taken into account according to Russian laws.

Note ! The main type of pension in our country is old-age insurance. At the same time, the calculation procedure also applies to insurance pensions for the loss of a breadwinner, as well as for disability. Only some coefficients will differ there.

The main type of pension in Russia is insurance

It may be noted that labor pensions, which were calculated before 2001, are paid as before. Other types of pensions, such as military, state and social, are calculated according to completely different rules. For example, social pensions can be determined by fixed amounts, and military pensions - as a certain percentage of monetary incentives. Therefore, it is necessary to consider all the rules by which pension payments are calculated for citizens who are now retiring.

There are also social and military pensions, which are calculated according to different rules.

— Is it important at what age you retired?

- Yes, definitely.

For each year of later application for an insurance pension after the right to it arises (including early), the fixed payment and the insurance pension increase by certain coefficients. These premium factors have different meanings for the fixed benefit and the insurance pension. For example, if you apply for an old-age insurance pension five years after the right to it arises, the total pension amount may be approximately 40% more.

Retirement age

The right to register and receive an old-age pension arises upon reaching retirement age.

As a general rule, women who have reached the age of 55 and men who have reached the age of 60 are entitled to receive a pension. For certain categories of citizens, the retirement age limit may be different, for example, for teachers, civil servants and military personnel, people working in the Far North and other categories.

Discussions about a possible increase in the retirement age have been going on for quite some time, however, according to top government officials, such changes in legislation in the field of social security are not yet expected.

— Does anything depend on the pension option?

— If a citizen forms a funded pension, then he is accrued fewer pension points annually compared to if only an insurance pension was formed.

At the same time, the maximum number of pension points that can be earned in a year also varies. For those who form only an insurance pension, in 2021 this is 10 pension points, and for those who form both insurance and funded pensions - 6.25 pension points. So, the future pension depends on the following four factors: the size of the official (white) salary, length of service, retirement age and the pension option that each citizen chooses for himself.

What is the minimum age pension?

Having reached a certain age, every person must remember that he has a minimum pension amount. But what is he like?

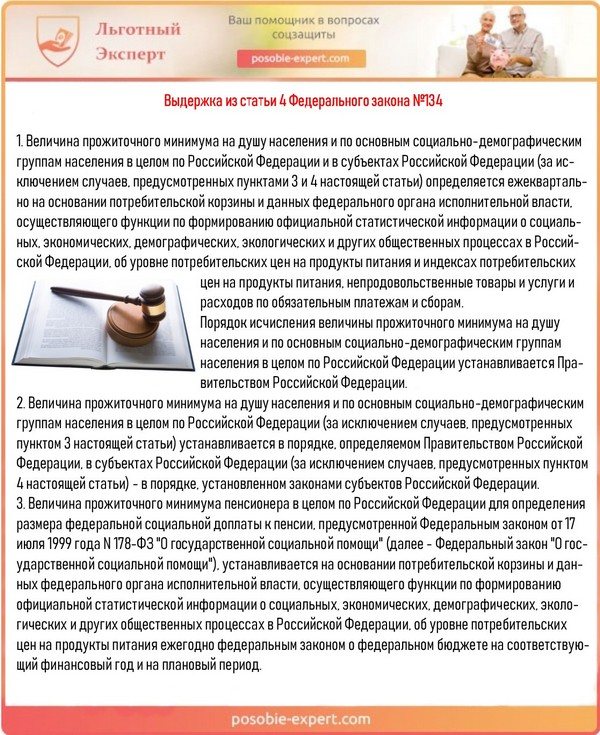

In the legislation of our country today there is no concept of a minimum pension. The size depends on several factors. The minimum amount should not be lower than the subsistence level for pensioners. It is installed in each region separately. If the payment underestimates this amount, then additional social benefits are established for the pensioner. And then the pension will be “adjusted” to the cost of living.

Excerpt from Article 4 of Federal Law No. 134

Social supplement is established only when there is an application from a pensioner. If a person continues to work, then such payment does not exist. The minimum pension amount is increased only under certain circumstances:

- citizen is over 80 years old;

- there are several dependent relatives;

- indexation of insurance pension;

- pensioner goes to work.

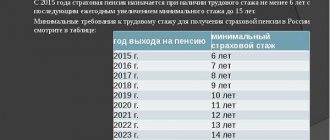

Note ! To receive the minimum pension, you must have more than 15 years of work experience. But this is not the case for everyone. In this case, we will talk about the payment of a social pension.

At least 15 years of work experience is required to receive an insurance pension

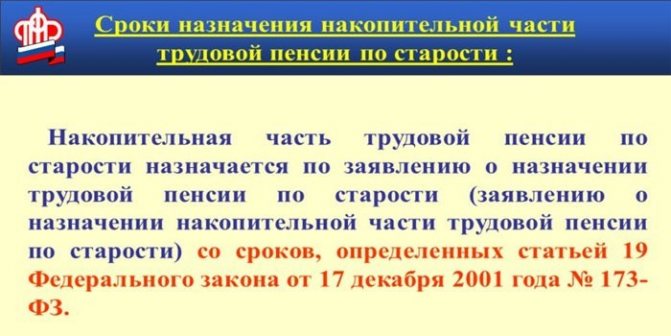

Cumulative part of old-age pension

According to the law, every person can form a funded pension (CP). For this purpose, deductions are made from wages to state and non-state pension funds. The size of the expected monthly payments directly depends on the amount of savings. In addition, citizens who have accumulated savings in the compulsory pension insurance system have the right to apply for payment of a funded pension:

- those born in 1967 and later;

- for men born 1953-1966 and women born 1957-1966, for whom the employer made contributions in 2002-2004;

- participants in the state co-financing program;

- women who sent maternity capital or part of it to form a funded pension.

Insurance part of pension

The individual or insurance part of the pension is calculated for each applicant separately according to the formula:

SC = IPKS × SPB × PC, where

- SP – estimated amount of the insurance part;

- IPKS is the number of PB earned by a citizen, plus non-working periods.

- TsPB – price 1 PB. The size is determined annually by Government decree;

- PC – adjustment factor for each full year of delayed retirement.

Number of pension points

The concept of PB was introduced in 2015 due to the pension reform. From this moment, all deductions from the salary of the future pensioner are transferred to points and stored in a personal account. When calculating the security, they are summed up and multiplied by the cost of one point.

Additionally, PB accrued for the so-called “non-working periods” is taken into account. This is the time when a citizen did not work due to his social status (serving in the army, caring for a child under 1.5 years of age or a disabled person).

- Pickled carrots: recipes

- Muscovite social card: how to get it and what it gives

- Which calcium is better absorbed in the human body?

The number of PB directly depends on the amount of insurance contributions. For this reason, the larger the “white salary”, the more points a future retiree can accumulate over his life. The number of pension points is calculated using special formulas for the periods:

- until 2002;

- from 2002 to 2014 (inclusive);

- since 2015

Starting from January 2015, all deductions are automatically transferred to the PB, but the law determines the maximum amount of points for one calendar year:

| Period | Number of PB |

| 2018 | 8,70 |

| 2019 | 9,13 |

| 2020 | 9,57 |

| 2021 | 10 |

The amount of the IPC and the size of the pension

The size of the insurance part is affected not only by the size of the IPC, but also by the cost of one PB. The figure is revised annually from February 1 and indexed to the inflation rate. The amount is approved by government decree and is the same for all categories of security recipients. In 2021, the cost of PB is 81.49 rubles.

Converting work experience before 2002 into pension points

All insurance premiums transferred before 2002 are transferred to the PB using a complex formula. To determine the following are calculated:

- experience coefficient;

- average monthly wage ratio.

Having determined these values, the estimated pension amount is calculated. The valorization procedure is applied to the result obtained. If there is no work experience before 1990, 10% is added, for each year worked an additional one percent is accrued. Afterwards, the final result is divided by 64.10 - the value of the PB established on January 1, 2015.

- Thermokeratin - what is it, description of the procedure for hair treatment and restoration, cost in salons

- Sanatorium for pensioners - what free and discounted vouchers are offered by social protection authorities

- What are the dangers of high blood sugar after 50 years?

What affects the size of the pension and how to calculate future old-age benefits

In Russia today the retirement age is 60 years for women and 65 for men. Pension, its calculation, size and factors on which it depends are extremely exciting topics. The editors of TIA asked questions and addressed them to the regional Pension Fund. For example, is it possible to find out the size of your future pension? What documents does a pensioner need to confirm his work experience? What are insurance and funded pensions? Explanations were provided by Vyacheslav Voevodin, manager of the PFR Branch for the Tver Region.

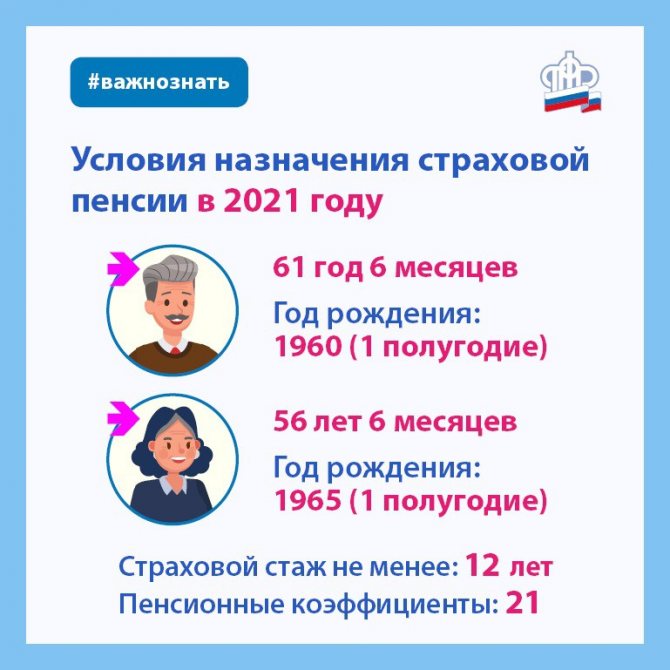

Retirement age

Raising the retirement age in our country is not a one-time process, but a gradual one. From 2021, it will be increased gradually, by 1 year annually. From 2028, the old-age insurance pension will be awarded to men at 65 years of age and to women at 60.

In 2021, women will receive the right to receive an old-age insurance pension upon reaching the age of 58 years, and men - 63 years. In this case, it is necessary to have 12 years of experience and 21 individual pension coefficients.

How is the pension calculated? What coefficients are used, how many and for what can you get them?

The basis of a future pension is the insurance premiums that the employer pays monthly for its employee. In 2021, the rate at which employers pay insurance premiums is 22% of the employee’s annual wage fund. At the same time, the maximum annual earnings from which insurance premiums are paid are determined annually by federal law. In 2021 - 1,021,000 rubles, and in 2021 - 1,129,000 rubles. For amounts exceeding this amount of annual earnings, the employer pays contributions at a rate of 10%, says Vyacheslav Voevodin, manager of the Pension Fund Branch for the Tver Region. — Part of the insurance premium rate is 6% — a solidarity rate. It is used to generate nationwide funds necessary for fixed payments to pensioners. The rest of the insurance premium rate—16%—is an individual rate. Funds received under this tariff are reflected in the citizen’s individual personal account opened with the Pension Fund of Russia. The number of this account - SNILS - is indicated on the certificate of compulsory pension insurance.

Taxes received by the Federal Tax Service, unlike insurance premiums, do not have an address basis and are not personalized when received by the budget. Insurance contributions for compulsory pension insurance are returned to citizens in the form of pensions, since they are taken into account in the individual personal accounts of citizens. The amount of future pension payments depends on the amount of insurance premiums accumulated on the individual personal account, which were paid by the policyholder during the period of the citizen’s work. The more your employer paid for you, the larger your pension will be.

Every year, those funds that were allocated to the insurance pension are automatically recalculated into pension coefficients. The formula is simple - the higher the salary, the greater the coefficients. When a citizen retires, all coefficients are summed up.

There may be several employers - then insurance premiums are also summed up.

When a citizen retires, all accumulated coefficients are multiplied by the value of the pension coefficient in the year the pension was assigned. At the same time, the cost of the pension coefficient is indexed annually by the state. For example, in 2021 the cost of the coefficient was 93 rubles, and in 2021 - 98 rubles 86 kopecks.

Does the pension period include periods of study, military service, and maternity leave?

— The periods of work during which insurance contributions to the Pension Fund are paid for a citizen are called insurance periods. Along with them, there are non-insurance periods when a citizen does not work, and contributions to compulsory pension insurance are not deducted for him. However, his pension rights to the insurance pension are being formed. Like insurance periods, non-insurance periods are counted towards the length of service and for them the state calculates pension coefficients,” explains Vyacheslav Voevodin.

Non-insurance periods include military service, the care of one parent for each child until he reaches the age of one and a half years, and some other periods. Periods of study are not considered non-insurance periods.

Is there somewhere I can find out what kind of pension I can expect?

The pension amount is calculated based on the sum of pension coefficients. Anyone can find out what contributions your employer made and how many pension coefficients have already been accumulated in the “Personal Account of a Citizen” on the Pension Fund website. His pension rights are recorded on an individual personal account in the compulsory pension insurance system.

— If you think that some information has not been taken into account or has not been taken into account completely, you can contact your employer to clarify it, and then submit the information to the Pension Fund. You can gain access to your personal account by registering in the Unified Identification and Authentication System.

Let me remind you that residents of the Tver region can confirm their account in the Unified Identification and Autonomy (USIA) in the territorial bodies of the Pension Fund of the Tver region, which are located in every district of the region.

From 2022, the Russian Pension Fund will proactively inform citizens over 45 years of age about the status of their “pension” account and accumulated experience, as well as the expected amount of the old-age insurance pension. This information will be sent to the citizen’s personal account on the government services portal.

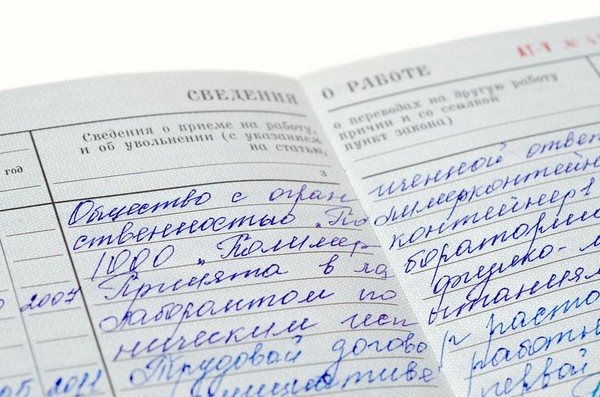

What documents does a pensioner need to confirm his length of service?

A pensioner does not need to confirm his work experience. All length of service is already taken into account when assigning a pension.

How to confirm work experience that is not reflected in the work book, and if the company or firm ceased to exist and the documents were not submitted to the archive?

In this case, the future pensioner needs to find witnesses, two or more people. They must confirm the fact that the citizen is employed at a particular enterprise that has closed or been liquidated. Witnesses will also help if a person for some reason has lost his work record, but it is impossible to prove the accumulated experience in any other way.

— When calculating the insurance period, periods of work on the territory of Russia before registering a citizen as an insured person in the compulsory pension insurance system can be established on the basis of the testimony of two or more witnesses.

If work documents are lost due to a natural disaster (earthquake, flood, hurricane, fire and similar reasons) and it is impossible to restore them, then testimony from such people is needed.

In some cases, it is possible to establish length of service based on the testimony of two or more witnesses in case of loss of documents and for other reasons (due to careless storage, intentional destruction and similar reasons, but not through the fault of the employee).

Is it possible to calculate your future pension? And what types of pensions are there in the Tver region

You can calculate the conditional size of the future insurance pension using the pension calculator, which is posted on the Pension Fund website.

— Pension provision for Russians, including residents of the Tver region, is carried out in accordance with federal laws dated December 28, 2013 No. 400-FZ “On insurance pensions” and dated December 15, 2001 No. 166-FZ “On state pension provision in the Russian Federation” . There are three types of insurance pensions: old age, disability and survivors.

If a citizen for any reason is not entitled to an insurance pension, such citizens have the right to a social pension. This is a state pension and is paid from the state budget.

What is the minimum/maximum pension in our region?

Pensions with maximum amounts include insurance pensions for participants in the Great Patriotic War; they amount to about 40 thousand rubles.

The minimum pension, taking into account the federal social supplement, in 2021 in the Tver region is 9,875 rubles.

The average old-age insurance pension for non-working pensioners in the Upper Volga region is 17,160 rubles, for disability – 9,637 rubles, and for the loss of a breadwinner – 10,488 rubles.

What is a funded pension?

This is a monthly lifetime payment of pension savings formed from insurance payments from employers and income from their investment.

Pension savings in the compulsory pension insurance system are formed for working citizens born in 1967 and younger, for men born in 1953-1966 and women born in 1957-1966, participants in the State Pension Co-financing Program and citizens who have allocated funds from maternity (family) capital to form funded pension.

These citizens have the right to choose the method of their formation, as well as the insurer, which can be either the Pension Fund of Russia (PFR) or a non-state pension fund (NPF).

On freezing the funded part of the pension. Where is it stored and will it be returned to citizens?

— This is not a “freezing of pensions” or a “withdrawal of pension savings.” From 2014 until the end of 2023, by decision of the state, there is a moratorium on the formation of pension savings. This means that 6% of insurance premiums that could have gone to a funded pension, starting in 2014, are used to finance the insurance pension. Thus, all insurance premiums paid by the employer for a citizen are included in the formation of the pension in full,” says Vyacheslav Voevodin, manager of the Pension Fund Branch for the Tver Region. — The moratorium does not affect the possibility of transferring pension savings to management companies or from one pension fund to another at the request of a citizen. But you need to remember that changing your insurer more than once every five years is unprofitable, since this step reduces the accumulated investment income. All savings already formed are assigned to citizens and will be paid after they are assigned a pension.

A few years ago, people switched to non-state pension funds. How to find out the profitability of a non-state pension fund?

— The choice of a pension provision option is associated with the choice of an insurer - an organization to which a citizen entrusts the management of his pension savings and which, upon the occurrence of a right or an insured event, will pay out pension savings. A citizen can find out the profitability of the selected non-state pension fund on its website.

As the Pension Fund explained, in 2021, citizens who have not completed 5 years from the date of first accrual of insurance contributions have the right to choose a pension option. As well as citizens under the age of 23 for whom the five-year period has expired from the year of the first calculation of insurance contributions for compulsory pension insurance.

If a non-state pension fund goes bankrupt, will the state help its pensioners?

— Starting from the date of revocation of the license of your current insurer - NPF, the Pension Fund of the Russian Federation will become your new insurer in the compulsory pension insurance system.

In this case, the amount of pension savings guaranteed to be transferred to the Pension Fund is equal to the face value, that is, the amount of contributions that your employers paid for you, excluding investment income. Funds that were paid under the Co-financing Program and generated from maternal (family) capital will also be taken into account.

If the proceeds from the sale by the Deposit Insurance Agency (DIA) of NPF assets exceed the size of the guaranteed face value, then the excess funds will also go to the Pension Fund for the restoration of lost investment income by the insured person.

You can find out about the revocation of licenses from non-state pension funds on the website of the Deposit Insurance Agency. On the Bank of Russia website you can find a list of non-state pension funds with valid licenses that operate in both compulsory and voluntary pension insurance.

The list of non-state pension funds that are included in the system of guaranteeing the safety of pension savings is also posted on the sites mentioned above. Here you can also find out about the progress of the liquidation of non-state pension funds whose licenses were revoked by the Central Bank.

Quite often, people are faced with the fact that the Pension Fund incorrectly calculates pensions, usually not in favor of citizens. And if this happens, where should you go to resolve the conflict?

Repeatedly, TIA readers sent letters to the editor with disturbing questions and complaints. People said that they encountered injustice in calculating pensions; often, length of service was not taken into account. What can we hide, relatives of the editorial office also found themselves in such situations. The question was ripe, and we asked it to Vyacheslav Voevodin, manager of the PFR Branch for the Tver Region.

— I don’t agree that this happens, as you say, quite often. But there are situations when a pensioner believes that he was awarded too small a pension.

If a pensioner has questions about the calculation of a pension, he has the right to contact the Pension Fund Branch in the Tver Region - for a personal meeting or in writing, which is the basis for checking the correctness of the calculation in accordance with the documents of the pension file.

Based on the results of the review, a written response will be prepared for the citizen, and, if necessary, assistance will be provided in requesting additional documents.

It should be noted that in accordance with the current pension legislation, the assignment, recalculation and payment of pensions is carried out by the territorial bodies of the Pension Fund of the Russian Federation on the basis of available documents on length of service, wages and other documents submitted by the applicant. If missing documents are provided, the pension will be recalculated upward from the first day of the month following the month in which the documents and application for recalculation of the pension were accepted.

If a citizen does not agree with the answer received, he has the right to appeal to the judicial authorities, but in our country such cases are rare.

Let me note that you cannot trust all sorts of organizations that groundlessly promise pensioners an increase in their pension. Such “entrepreneurs” lure pensioners, but then it turns out that they still have to pay for the promised free consultation, the size of the pension remains the same, and the “consultants” disappear. Issues of establishing and recalculating pensions are dealt with only by specialists from the Pension Fund of the Russian Federation. If you have questions about establishing or calculating the amount of your pension, it is better to contact the Pension Fund directly.

Is there a universal and convenient instruction for working citizens on how to calculate their pension from the very beginning of their working career?

— The amount of insurance contributions paid by the employer for the employee to the Pension Fund directly determines the citizen’s future pension. Paying insurance premiums on an underestimated amount of wages or failing to pay contributions altogether leads to a reduction in the amount of the pension. Thus, everything that is paid unofficially in person will not be taken into account when assigning a pension. Not only the size of the “white” salary is important, but also the period during which the citizen receives it.

You can obtain information about the generated pension rights (the number of pension points, insurance experience, amounts of insurance contributions), as I already said, through the electronic service “Personal Account of a Citizen” on the website of the Pension Fund of the Russian Federation.

To understand how much you have already earned for your pension, whether your employer paid contributions correctly, and whether your entire length of service has been taken into account to date, the extract “Information on the status of the individual personal account of the insured person” will help.

This is a document from which you can find out about the number of pension points and the duration of the insurance period recorded on the personal account, obtain detailed information about the periods of work, places of work, the amount of insurance contributions accrued by employers and the level of wages.

There are several ways to obtain this information. On the Unified Portal of State and Municipal Services, you must first, of course, register on it. Through the “Personal Account of the Insured Person” on the official website of the Pension Fund of the Russian Federation in the “Electronic Services” section.

— To gain access to the “Personal Account of the Insured Person” on the PFR website, a citizen must register on the website www.gosuslugi.ru or in the Unified Identification and Authentication System (USIA).

The third way is a personal reception. A citizen needs to contact the territorial department of the Pension Fund of the Russian Federation at the place of residence or work and write an application. You need to take your passport and SNILS with you. Such information will be provided within 10 days from the date of application.

You can also obtain a statement through one of the banks with which the Pension Fund has entered into an agreement on informing insured persons. For example, through Sberbank.

A credit institution can issue an “Extract on the status of an individual personal account in the Pension Fund of the Russian Federation” in several ways. Again, during a personal visit - on paper. This can be done by the operator or self-service terminals (ATMs).

Or, which is much more convenient, receive a document, for example, through Sberbank Online without leaving your home or office. The required “paper” arrives at the specified personal email on the day of application.

When does accrual begin?

They begin to pay the pension after its assignment, which is carried out from the date of application to the Pension Fund. The money is issued at the pensioner’s place of residence after submitting an application. It is sent by mail, in the form of an electronic document or using a multifunctional center.

The day of circulation is considered the date indicated on the postmark if sent by mail.

Retired military personnel are paid not by the pension fund, but by the department in which they served.

In some cases, pensions are granted ahead of schedule. This applies to categories of citizens who have the necessary experience in performing certain jobs. To receive money in this case you need:

- Reach the designated age.

- Have experience or social background. This could be disability after a war injury, the birth of children, etc.

- Have insurance experience.

To process payments, you need to visit the Pension Fund with all the necessary documents.

What to consider?

The law on calculating insurance pensions applies specifically to those people who receive payments depending on their age. If we talk about disability or survivor pensions, then additional coefficients are used. The total amount will be much less. To make the calculations simpler, increasing coefficients for those people who decide not to retire early are not taken into account here.

If there is a deferment for a year, the payment will increase by 5.6%. If a person left 2 years later, then by 12%, and if 3 years later, then by 19%. Over 10 years, the figure reaches 111%.

Disability and survivor pensions are calculated differently

Note ! The cost of a point for a year with a deferment will increase by 7%, for 2 years - by 15%, and if for 3 - then by 24%. Over 10 years, the figure reaches 132%.

Those people who are planning to retire in the coming years can use some tips.

- Collect all certificates from any place of work up to 2002. At that time, there was still an accounting system in place for each person separately. You need to collect certificates in order to confirm your fact of work. We must not forget about the documents that will indicate a change in the name of the enterprise or organization.

- When there were periods of study that could be included in the experience, then you need to collect all the supporting documents. These may be educational documents or entries in the work book. In addition, there is also a certain list of additional documents.

It is recommended to prepare all documents for timely and correct registration of pension

- If you receive a salary certificate for 5 years before 2002, then you need to select those periods where the income mark was the highest.

- Before carrying out the procedure, it is better to contact the Pension Fund. This can be done 9 months before retirement. This may require an additional list of documents, the collection of which may take some time.

- An application for a pension can be submitted one month before retirement age.

If we consider all the current provisions, then the main thing should be noted: you must be officially employed at any time, and also pay insurance contributions to the Pension Fund. Without such contributions, there will be no pension points, which means that you will not be able to receive an insurance pension in any way.