Sick for three days without sick leave

For example, in some companies a certificate of incapacity is required from the very first day of illness, while in other - more loyal companies - employees are allowed to go on unpaid, unofficial leave for health reasons for a period of 3 to 5 days.

But in accordance with Art. 20 (The right of citizens to medical and social assistance) of the Fundamentals of the Legislation of the Russian Federation on the protection of the health of citizens “Working citizens in the event of illness have the right to three days of unpaid leave during the year, which is granted upon the personal application of the citizen without presenting a medical document certifying the fact of the disease.” In accordance with this article, you have the right to receive unpaid leave.

What does the law say?

How long can you be sick without sick leave according to the law? According to the established legislation on the protection of public health, in case of illness, a person has the right to 3 days of unpaid leave throughout the year. In this case, time off must be granted at the request of the employee himself, without presenting a medical document.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

However, this part of the legislation is constantly subject to change. Today, it is impossible to officially fall ill without the appropriate medical confirmation in government institutions.

In Europe the situation is much simpler. For example, in Germany, an employee has the right not to go to work for health reasons, even without a certificate; it is enough to simply warn his boss. Moreover, during the entire period of illness (up to one and a half months), the person’s salary is paid in full.

How many days does the employer pay for sick leave?

To ensure that an accountant does not make a mistake in calculating and paying sick leave benefits, you need to know how many days of sick leave are paid per year. And this period depends on whether the sick leave was due to the employee’s own illness or to care for a child/relative.

Here it is important to understand that sick leave for child care must be paid, even if such sick leave was not taken by one of the child’s parents, but by another family member, for example, a grandmother. Those. What matters is not the fact of the parent-child relationship, but only the age of the sick family member for whose care a sick leave is issued.

Is sick leave paid during vacation at your own expense?

Clause 22 of the Procedure for issuing certificates of incapacity for work states that the certificate must be issued from the day of the planned return to work. However, the employee does not always know about this, and the doctor often forgets to ask. If the leave at his own expense has ended and the sick leave has not been closed, then the employee has the right to benefits for those days when he was supposed to go to work.

Employee Yakovlev S.A. went on leave at his own expense for 3 days - from June 18 to 20 - due to the birth of a child, but fell ill on the third day and, according to the sick leave issued, was ill for 7 days - from June 20 to 26. On June 27, he went to work and brought a certificate of incapacity for work to the accounting department.

Method 1: no payment

An employee who feels unwell can take a day, two, three at his own expense.

Such time off must be agreed upon with the employer so that it is not considered absenteeism. Usually, an application is written for this, and the manager puts his visa on it. Attention! Recommendation from ConsultantPlus When taking leave without pay, we recommend following the following procedure. 1. Receive a vacation application from the employee (Part 1 of Article 128 of the Labor Code of the Russian Federation). Make sure that it indicates:... For the entire design algorithm, see K+. Trial access to the system is provided free of charge.

You can view a sample application for leave at your own expense here.

But this can only be done in the case of a planned day off. For example, if an employee has scheduled a visit to the doctor and knows exactly the date when he will not be able to attend work.

What if the illness began suddenly? In this case, the option with a pre-written statement will not work. But it's not scary. You can ask your employer for sick leave in other ways: by SMS, email, messenger, etc. The main thing is that the correspondence makes it clear that absence from work has been agreed upon and authorized by the administration.

The employee will receive the salary for the corresponding month minus unpaid days.

Labor Code of the Russian Federation, an employee has the right to take a day without sick leave

While on a permanent job, you can only submit a letter of resignation - notify the employer two weeks in advance (Article 80 of the Labor Code of the Russian Federation). But even if two weeks pass, they still won’t formalize your dismissal (they won’t issue an order, they won’t give you a work book, they won’t make the final payment) until you submit a closed sick leave certificate. And the point here is not only, and not even so much, in payment, but in the very procedure for registering dismissal. An employee can only be fired (regardless of the reason) while he is ACTUALLY at work. Any absence (illness, vacation, performance of government duties, even absence for an unknown reason) deprives the employer of the right to formalize dismissal “in absentia” - part three of Art. 84.1. Labor Code of the Russian Federation.

We recommend reading: Sale of an apartment received by inheritance

Hiring persons with refugee status or who have received temporary asylum on the territory of the Russian Federation. Each employee has the right to 3 sick days per year without providing sick leave, but with prior notification to management.

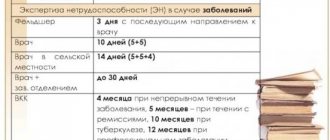

How long can you legally remain on sick leave continuously?

If you have a long-term sick leave, you need to renew it every fifteen days. After two weeks, the patient must attend meetings of the commission that records his condition and level of recovery at the moment. We looked at how long you can be on sick leave. Will it be paid?

If there are no other options, the sick leave is extended for ten months (when the case is very severe, then for one year), a special document is drawn up, which describes the diagnosis and treatment methods. Most often, the patient is offered treatment in a day hospital. During the year, he must visit the doctor every month and talk about all the changes. How long can you stay on sick leave in special cases?

How many days can you legally be on sick leave?

But if you think that you can stay in long-term treatment for all 10 months at once, then you are mistaken. Since sick leave for care and recovery will have to be confirmed every 15 calendar days by a special medical commission. At which the patient will be examined and his tests will be studied, as well as the dynamics of the course of the disease will be monitored.

• If a person has had tuberculosis and is in the recovery period; • If an employee is seriously injured and requires a recovery period for additional treatment; • If the employee has undergone surgery that requires extensive postoperative recovery.

How many sick days are paid per year? Procedure for paying sick leave

Many people wonder how much sick leave they can afford. Adults are required to remain on treatment for no more than 30 days per year. The same time is needed to care for an adult relative. If it is a work or domestic injury, occupational disease, there are no restrictions on the time of treatment.

If compensation is due, then who pays for sick leave? According to the law, for 3 days of incapacity for work, funds are collected from the employer. And then who pays for sick leave? This is carried out by the FSS (Social Insurance Fund).

The nuances of paying sick leave during downtime

Sick leave during working hours is paid in the usual manner. But downtime is not exactly working time in the usual sense. It all depends on how exactly the employee’s wages were maintained on these days (or hours), because it is this that affects the amount of payments under the certificate of incapacity for work.

Version of the Law

In Art. 2 of the Federal Law of December 29, 2006 No. 255-FZ “On the provision of benefits for temporary disability, pregnancy and childbirth to citizens subject to compulsory social insurance” states that benefits must be paid to officially registered employees in all cases specified in the legislation. Further in Art. 7 directly states the rule of payments during downtime : they are retained in the same amount as wages are accrued at this time, but no more than a person would be accrued simply as payment for downtime. In other words:

- if hospital payments are less than the amount for downtime, they will be paid in full;

- if payments on the slip exceed the payment for downtime, then only the funds intended for payment for downtime should be accrued.

Thus, first of all, it is necessary to determine how exactly the downtime situation is paid for at a given enterprise and whether it is paid at all.

How do you pay for downtime?

Labor Code of the Russian Federation in Art. 157 clearly stipulates the specifics of payment for downtime from several hours to a longer period, depending on the guilty party. So, how much will employees who are forced to temporarily stop working be paid:

- through the fault of the employer - at least 75% of their average earnings;

- due to the fault of the employee - they will not pay anything;

- downtime does not depend on the parties - at least 2/3 of the tariff rate or salary calculated based on downtime.

The employee’s average daily earnings are calculated in the usual manner (according to Article 139 of the Labor Code of the Russian Federation), then multiplied by the number of days of inactivity, and then 2/3 of this amount is taken.

If work was interrupted only for a few hours, then payment is calculated based on the calculated average hourly earnings.

NOTE! A part-time worker who is “idle” at an additional place of work will receive the due payments, even if he continues to work regularly at his main job.

Features of payment depending on the start of sick leave

So, we found out that the sick employee will receive disability payments, calculated on the basis of payment for downtime, that is, in the vast majority of cases, based on 2/3 of regular earnings. Let us now consider situations where downtime and sick leave do not completely coincide in time.

- The downtime began, and the employee fell ill only later. The employee will be paid only for downtime if work is stopped due to the fault of the employer or regardless of the fault of the parties, or for sick leave if it is less than the amount due for downtime. If the employee is at fault for downtime, no funds will be paid to him.

- The downtime is over, but the employee still has not recovered. If the sheet is opened during downtime and closed after the enterprise has resumed work, the employee will receive sick pay for those days that fall during normal work hours. The amount is calculated in the usual way, with the first three days of sick leave after the end of the downtime paid, as usual, by the employer, and the rest - at the expense of the Social Insurance Fund.

- The employee went on sick leave, and then downtime began. Disability payments are accrued as usual for the entire duration of the illness. For the days preceding the downtime, the calculation is based on the full amount of the salary, and for the period of illness coinciding with the downtime, based on 2/3 of it.

IMPORTANT INFORMATION! The above calculation rules apply to all certificates of incapacity for work, except for that issued for pregnancy and childbirth - the downtime situation does not apply to it.

Calculation example. Employee of LLC "Constance" Lyubimov A.A. I was sick for 5 calendar days, two of which were on the weekend. All these days the LLC was idle due to the fault of the employer. Working hours are a regular five-day week. The average daily earnings of Lyubimov A.A., calculated according to the general rules, is 1000 rubles. What amount will A.A receive? Lyubimov?

The work was idle for 3 working days. For them, Lyubimov should pay 2/3 of his usual earnings, that is, 1000 x 3 x 2/3 = 2000 rubles.

Let’s imagine that due to length of service, sick leave benefits for A.A. Lyubimov. on normal working days it would be 500 rubles. in a day. Thus, if the LLC had not been idle, he would have received 500 rubles on the certificate of incapacity for work. x 5 days = 2,500 rub. Since this amount exceeds the downtime payment, Lyubimov A.A. They will pay only 2000 rubles.

Three days without sick leave according to the law

How many days can you be sick without sick leave according to the law? In addition, any unpaid leave is controlled by the administration. Until 2005, according to Article No. 20 of the Fundamentals of Legislation of the Russian Federation, workers had the right to receive unpaid leave for three days a year. Such leave was granted to the employee upon submission of a personal application, but without a medical document that would confirm the fact of illness. Thus, the law still accommodated working citizens.

As for payments on sick leave from the Social Insurance Fund and the employer, they are made for the entire period of illness of the employee before the onset of disability, and it does not matter how long he is sick and how many times he opens sick leave in accordance with Article 6 of the Federal Law “On the Fundamentals of Protecting the Health of Citizens in the Russian Federation " .

What are the consequences of sick leave without a BL?

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

Article 81 of the Labor Code of the Russian Federation defines the grounds for dismissing an employee at the initiative of the employer. Among them is this: absenteeism. What is this? This is the absence of an employee from the workplace:

- throughout the day or shift;

- absence of a person from work for more than 4 hours in a row during a working day (shift).

It is important that the person does not have valid reasons not to attend his place of work.

Illness is, of course, a valid reason. But the fact of the presence of the disease must be documented - a certificate of incapacity for work. Otherwise, the employer has every right to believe that the employee is misleading him, wanting to avoid punishment for absenteeism.

By the way, you don’t always get fired for absenteeism. The employer has the right to limit himself to another disciplinary measure. For example, reprimand and deprive of bonuses.

This is important to know: Is sick leave opened retroactively?

Thus, a person who is sick and cannot (does not want) to go to work is obliged to contact a medical institution that has the appropriate license to issue a certificate of incapacity for work.

How are the first three days of sick leave paid in 2021?

- The employee’s total income base for the last 2 calendar years is taken, for which insurance premiums are calculated;

- The received amount is divided into 730 (seven hundred and thirty) days;

- The calculated value is the average daily earnings;

- Next, the percentage of payment is determined based on the length of the employee’s insurance period:

- Insurance experience of 8 or more years – 100%;

- From 5 to 8 years – 80%;

- From 3 to 5 years – 60%;

- Less than 6 months

(RUB 1,824.68 × 80% × 3 days), and the fund’s share – RUB 5,838.98. (10,218.21 – 4379.23). Terms and procedure for payment of sick leave benefits in 2018 As a rule, temporary disability benefits must be accrued and paid for the entire period of illness: from the first day of illness or injury until the recovery of the employee (his family member) or until disability is established (Part 1 Article 6 of Law No. 255-FZ). The benefit must be assigned within 10 calendar days after the employee has submitted a correctly completed sick leave certificate.

We recommend reading: Birth of a child in 1 year of marriage Penza

If instead of a sick leave certificate

If an employee did not just rest at home, but still went to a medical facility, he will be given a certificate (since sick leave for one day is not issued). This certificate will confirm that the reason for his absence from work was valid, that is, it will remove the grounds for considering this day as absenteeism. But at the same time, the presence of a certificate does not give the employee the right to receive temporary disability benefits for that day. Whether it will be paid or not will depend on the employer’s policy (see options 1 and 2, which we discussed above).

By the way, if you have a doctor’s certificate, the employee should not be punished or fired for absenteeism, even if he did not agree with you about his absence from work. If he goes to court, the judges will most likely cancel the penalty, and in case of dismissal, they can reinstate him at work (see, for example, the appeal ruling of the Moscow City Court dated January 22, 2019 in case No. 33-1842/2019).

You will find a selection of judicial practice on the legality of dismissal for absenteeism in the presence of confirmation of a visit to a doctor in ConsultantPlus. Trial online access to the legal system is available for free.

For more details, see: “The employee brought a certificate instead of a sick leave certificate.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Time off and sick leave

Margarita Bagirova writes: For now, it seems to me that you can be sick without sick leave for up to 5 days a year, but no more than two/three days in a row. Time off can be no more than 3 days per year, subject to agreement with the immediate supervisor.

Andrey Bakharev writes: Everything you ask about looks like an attempt to simply increase your paid leave. This, in principle, can be achieved from the employer, but the employer is not obliged to make such gifts to employees - neither in the form of increasing vacation time, nor in the form of sick days not confirmed by sick leave or the so-called. "time off"

Method 2: with payment

This option is possible if the company accepts paid time off for employees. This possibility is prescribed in the LNA (for example, in the provision on the social package). It defines:

- how many days a year can you be sick without sick leave;

- procedure for notifying/coordinating absence from work with the employer;

- amount of payment (this can be either the full average daily earnings or some percentage of it).

An application for such leave can be formulated as follows:

“Due to poor health and in accordance with the provisions on the social package, I ask you to give me a paid day off on August 12, 2021.”

The employee can send such a statement by email. It is better if it is not just in the body of the email, but in the form of a scan or photo of the document with the employee’s signature. He can present the original upon returning to work.

For what period is sick leave issued?

The doctor has the right to independently decide to extend the validity period of the certificate of incapacity for work up to 14 days. Dentists are given the right to extend it up to 10 days. At the end of this period, the patient is sent to a medical commission if there is a need for further treatment.

The period during which the sheet must be submitted is established in Federal Law No. 255. The employee is given 6 months for this time, but usually citizens submit the document immediately upon going to work. If for some reason the sheet was submitted later, but before the expiration of 6 months, then the employer does not have the right not to accept and not pay for days of forced disability. The deadline specified in the law for submitting a document on incapacity for work applies to all types of sick leave, including caring for a sick child, caring for a sick relative, etc.

How many sick days are paid according to the law?

According to Part 1 of Article 255 of the 6th Federal Law of December 29, 2006, in case of absence from work due to illness, the employee will be compensated for absolutely all days during the year. However, there are some exceptions. For example, sick leave payments to disabled people are made for no more than 4 consecutive months, or for 5 months in a calendar year.

In the case under consideration, the number of paid sick days does not exceed 30 calendar days per year (6th subclause of the 5th part of the 6th article of Federal Law No. 255).

Downtime – is this working time?

Downtime is issued when an enterprise or its division temporarily suspends its activities. The reasons for downtime may depend on both the employer and the employee, and can be:

- economic - work stops to save resources;

- technological – problems with individual production processes;

- technical – equipment breakdown, accident, etc.;

- organizational – human factor, supply shortages, etc.

Sometimes downtime is caused by circumstances beyond the control of the parties to the employment contract, for example, a natural disaster, untimely delivery of materials or spare parts by the contractor, etc.

IMPORTANT! The Labor Code of the Russian Federation lists possible reasons for downtime in Part 3 of Art. 72.2, however, their list is incomplete and it is not closed. With regard to payment, the main thing is to determine whether it is the fault of the employee or the employer. The employee’s guilt must be proven to the employer, as well as one’s own innocence.

Downtime is the unofficial release of an employee from work, which occurs in cases specified by law, for example, when performing civil duties (Article 170 of the Labor Code of the Russian Federation). When released from work, provided for by this article of the Labor Code of the Russian Federation, sick leave benefits are not assigned, and it does not matter whether wages are retained, they are accrued only partially or are not preserved (clause 1, clause 1, article 9 of the Federal Law of December 29, 2006 No. 255-FZ “On providing benefits for temporary disability, pregnancy and childbirth to citizens subject to compulsory social insurance”).

Is sick leave subject to contributions to the Pension Fund, insurance premiums, and personal income tax?

If the statute of limitations does not exceed six months from the onset of the illness, the employee has the right to demand payment. The management of the organization must calculate the full amount of compensation within 10 days and ensure its payment on the appropriate salary date.

However, personal income tax must be withheld from the entire amount of sick leave benefits. Payment due to temporary disability to an employee is made with a deduction of 13%. These requirements do not apply to maternity benefits, which are exempt from withholding all kinds of contributions and deductions (clause 1 of Article 217 of the Tax Code of the Russian Federation). Read more about what taxes are taken from sick leave in 2021 in the article https://otdelkadrov.online/7207-raschet-vzimanie-ndfl-s-bolnichnogo-lista-v-year-godu.

Description of the certificate of incapacity for work

A certificate of incapacity for work is a legal document that is issued to a person after he or she seeks medical help. On the one hand, it confirms that a person could not come to work for a certain period of time for medical reasons, and on the second, it gives the employee the right to receive payments (benefits). In our country, only a doctor has the right to issue sick leave. And only in remote rural areas can a paramedic also draw up this document.

This is important to know: When is sick leave issued for pregnancy and childbirth?

The procedure for issuing sick leave is regulated by the order of the Ministry of Health of 2011. It additionally describes how to correctly fill out a certificate of incapacity for work in various situations.

According to current legislation, you can receive sick leave in the following situations:

- the occurrence of an acute disease or exacerbation of a chronic disease (for example, bronchial asthma, coronary heart disease or chronic pyelonephritis); traumatic injury (fall with a fracture, damage to internal organs, traffic accident); occurrence of industrial or household poisoning in an employee; the need for treatment in a sanatorium (during the rehabilitation period after a stroke or myocardial infarction); establishment of sanitary quarantine in conditions of an outbreak of an infectious disease, after man-made disasters and pollution of the environment with toxic substances; the need for constant care for a sick family member (regardless of his age); carrying out planned surgical interventions; pregnancy, childbirth and the early postpartum period in women; carrying out the procedure of in vitro fertilization; limb prosthetics in a specialized clinic or sanatorium; carrying out diagnostic manipulations, instrumental diagnostic methods.

The sick leave certificate consists of two structural parts. The first is filled out by the attending physician during a patient consultation on an outpatient basis or during discharge from a hospital or sanatorium. Then the paper version of the document is given to the patient, and he must take it to the accounting department of the employing company. Already there, the employee fills out the second part of the document, which indicates the length of service, the average salary for the last two years and other information. After this, the necessary information is transferred to the Social Insurance Fund, which must make payments to the person.