Who pays sick leave in 2021 and when?

From 01/01/2021, temporary disability benefits throughout the country are paid according to the rules of the “pilot” project. So, in case of illness or injury:

- the employer issues benefits for the first 3 days of illness;

- The employee receives the rest from the Social Insurance Fund.

In cases of sick leave:

- caring for a sick family member;

- for quarantine of an employee, his child under 7 years old attending kindergarten, or an incapacitated family member of the employee;

- for prosthetics for medical reasons in a hospital;

- when providing follow-up treatment to an employee in a sanatorium-resort organization on the territory of the Russian Federation immediately after providing him with medical care in a hospital,

benefits The FSS pays benefits in full starting from the first day.

See our memo for accountants on the new procedure for paying benefits from 2021.

The benefit is accrued no later than 10 calendar days from the date of receipt of sick leave from the employee. The employer issues the money on the next day after the settlement date established for the payment of wages. Social insurance pays funds within 10 calendar days from the date of receipt of documents (information) or a register of information from the employer.

For example, if an employee submitted sick leave on January 15, and the salary payment deadlines are on the 5th and 20th of each month, then the benefit must be paid no later than February 5.

Important! Recommendations from ConsultantPlus To pay an employee benefits due to illness or domestic injury, obtain from him the following documents (information): certificate of incapacity for work... See the full list of documents in K+, having received a free trial access.

How to calculate the insurance period?

When calculating length of service according to the calendar, the following are considered separately:

- full calendar years (from January 1 to December 31);

- full calendar months (from the 1st to the last day) not included in the full calendar years;

- remaining days not included in full months.

Read in the berator “Practical Encyclopedia of an Accountant”

Experience when calculating temporary disability benefits

Example.

How to determine the insurance period for calculating sick leave An employee of Romashka LLC, Ivanov, fell ill on April 20, 2021. From this date he has a sick leave certificate. Ivanov has been working for the company since February 2, 2021. Before that, he worked at Alpha LLC. Let's calculate the employee's insurance length on the date preceding the date of onset of illness - April 20, 2021. The employee worked at Alpha LLC for 1 year 5 months 12 days. Ivanov worked at Romashka LLC for 4 years 2 months 16 days - from 02/02/207 to 04/19/2021. We add up the years, months, days and get: 5 years 7 months 28 days. To determine the amount of temporary disability benefits, Ivanov’s insurance period should be taken as 5 years and 7 months, since 29 days are less than the required 30.

How was sick leave paid until 2021?

Until 2021, payment of temporary disability benefits within the statutory sick leave payment period was carried out by:

1. The employer - upon subsequent reimbursement of expenses from the Social Insurance Fund (starting from the 4th day of illness, in case of a work injury - for all days).

This scenario was implemented in the most general case. It was assumed that at the time of payment of sick leave, the employee was an active full-time employee of the employer.

Read about filling out an application for reimbursement of expenses that exceeded the amount of accrued OSS contributions here.

2. FSS as a subject of legal relations regulated by the provisions of the Law “On Compulsory Insurance” dated December 29, 2006 No. 255-FZ.

The Social Insurance Fund was obliged to make payments for sick leave (starting from the 4th day of illness, in case of a work injury - for all days), if (clause 4 of Article 13 of Law No. 255-FZ):

- the employer from whom the employee has the right to receive benefits was liquidated at the time of registration of sick leave;

- the employer cannot pay sick leave due to insufficient funds in the account, based on the priority of fulfilling other financial requirements;

- the employer is in bankruptcy, and there is no way to recover sick pay from its existing assets.

3. FSS as a subject of legal relations regulated by Decree of the Government of Russia dated April 21, 2011 No. 294.

Here we are talking about a “pilot project”, within the framework of which the calculation and payment of benefits is carried out only by the Social Insurance Fund (from the 4th day of illness, except for sick leave for an industrial injury).

Let’s consider how long it took for employers and the Social Insurance Fund to pay for sick leave under each of the above scenarios.

How can an employee start using ELN?

The employee must find out from the employer (usually from HR or accounting) whether he has the technical ability to accept and process electronic personal information.

Most likely, if the employer has such an opportunity enabled, then he conducts an information campaign for his employees (for example, a mailing to a corporate email), informing them that they can apply for sick leave electronically.

If, however, the employee did not clarify this point in advance and took electronic sick leave, but the employer cannot accept it, then there is still a way out of this situation. The medical institution has the right to replace the issued ETN with a paper one. In this case, a note about termination is made in the ENL.

Next, the employee must contact the medical organization, express his desire to issue a certificate of incapacity for work electronically and give written consent to its execution. The medical institution receives an ELN number in the special Social Insurance Unified Insurance System.

Then the medical institution issues an ELN and communicates its number to the employee. ELN is issued according to the same rules as a paper sheet: after an examination and appropriate diagnosis by a doctor and upon presentation by the patient of an identification document (passport). You also need to be prepared to tell the health worker your SNILS number.

After the sick leave is closed, the employee must communicate the sick leave number to the employer in any way. This can be either the presentation of a coupon with its number, or simple communication by phone or on the Internet (Skype, corporate mail, instant messengers, etc.) - there are no rules or restrictions here.

How long did employers have to pay for sick leave in 2021?

The obligation to pay sick leave for Russian employers arose from the moment an employee who is on or has returned from sick leave presents a certificate of incapacity for work, which is issued by a medical institution. Within 10 calendar days after receiving such a certificate, the employer was obliged to accrue temporary disability benefits to the employee.

On the nearest (relative to the date of accrual of benefits) salary transfer day, the employer is obliged to pay the corresponding benefit. As a rule, this payment is made simultaneously with the salary and in the same way (cash or by transfer to a card).

For information on the specifics of withholding personal income tax from sick leave payments, read the article “Is sick leave (sick leave) subject to personal income tax?”

How long does it take for an employer to pay disability benefits if an employee takes sick leave on the day of dismissal? The answer to this question is considered step by step by ConsultantPlus experts. Get trial access to the system and study the material for free.

What length of service is taken into account when calculating benefits in 2021 and how to calculate it

It is very important to correctly calculate the length of service to calculate disability benefits, since an error even on one day will give the Social Insurance Fund inspectors reason to recalculate the entire amount of sick leave.

For sick leave, the SS is taken into account, including all non-insurance periods. SS calculation is carried out in calendar order. All partial work periods are converted to full months and years in the following order: 30 days are counted as a full month, and 12 months are converted to a full year.

How to calculate the insurance period in partial months, we described here.

What periods of work (other activities) are included in the insurance period when assigning benefits for temporary disability, pregnancy and childbirth is described in detail in ConsultantPlus. Get a free trial and get started with expert guidance.

Moreover, if a person worked in different organizations at the same time, then one of the periods of the employee’s choice is taken into account. This choice must be supported by a statement from the employee.

NOTE! When calculating length of service for sick leave, all insurance periods are taken into account, regardless of work interruptions.

Let's consider the algorithm for calculating the CC using an example.

Example:

Efimova A. Yu. On 02/20/2021 she submitted to the accounting department of Versailles LLC a sick leave certificate for 14 days of incapacity for work (from 02/06/2020 to 02/19/20XX). The period of work in this company is 1 year 8 months. and 5 days.

The work book contains the following entries:

07/17/2018 to 03/31/2019 - Garant LLC;

01/15/2017 to 07/16/2018 - Azimuth LLC.

Let's calculate the total SS.

The insurance experience at Azimut LLC was 1 year 6 months. (from 01/15/2017 to 01/15/2018 - 1 year and from 01/16/2018 to 07/16/2018 - 6 months).

At Garant LLC, the insurance period was 8 months 15 days (from 07/17/2017 to 03/17/2018 - 8 months and from 03/18/2018 to 03/31/2018 - 14 days).

The 2 months when A.Yu. Efimova was unemployed are not included in the insurance period (period from 04/01/2019 to 05/31/2019).

Now we add up the obtained indicators: 1 year 6 months. + 8 months 14 days + 1 year 8 months. 5 days = 2 years 22 months. 19 days.

22 months convert to full years, that is, it is 1 year 10 months.

2 years 19 days + 1 year 10 months. = 3 years 10 months 19 days.

19 days are less than 30 and are not counted as a full month, so the SS is not included in the calculation.

Thus, the SS is equal to 3 years 10 months.

Deadlines for payment (payment) of sick leave from the Social Insurance Fund until 2021

If the employer was located in a constituent entity of the Russian Federation in which the FSS pilot project was not operating, then in cases provided for by law, the fund paid the employee sick leave funds within 10 calendar days from the date of receipt directly from him or through the MFC of the necessary documents:

- statements (according to Appendix No. 1 to the regulations, approved by order of the Ministry of Labor and Social Protection of Russia dated May 6, 2014 No. 290n);

- sick leave;

- certificates of earnings (according to Appendix No. 1 to the order of the Ministry of Labor of the Russian Federation dated April 30, 2013 No. 182n);

- documents certifying insurance experience (according to the rules approved by order of the Ministry of Health and Social Development of the Russian Federation dated February 6, 2007 No. 91):

- other documents listed in clause 13 of the regulations approved by order No. 290n.

If the employing company was located in the region in which the Social Insurance Fund pilot project is being implemented, then sick leave payment - the timing of benefit payment - consisted of the following periods:

1. The period during which the employer is obliged to transfer to the local Social Insurance Fund the necessary data about an employee who went on sick leave is 5 calendar days.

2. The period of verification of documents by the Social Insurance Fund and payment of sick leave is 10 calendar days.

Thus, the total period for paying sick leave in 2021 in the regions of the FSS pilot project may have a longer duration (up to 15 calendar days).

Results

Starting from 2021, sick leave is paid according to new rules: the employer calculates and issues benefits for the first 3 days of illness, the second part of the amount is paid to the Social Insurance Fund employee. To accrue benefits, the employer is given 10 calendar days from the date of receipt of sick leave from the employee. Money is issued along with the next salary. The Social Insurance Fund pays benefits within 10 calendar days after receiving the relevant documents from the employer.

Sources:

- Federal Law of December 29, 2006 No. 255-FZ

- Decree of the Government of the Russian Federation of April 21, 2011 No. 294

- Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n

- Order of the Ministry of Health and Social Development of Russia dated February 6, 2007 No. 91

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

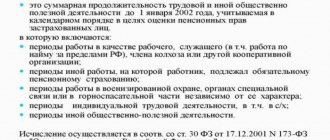

Experience when calculating temporary disability benefits

The insurance period is the total length of time for payment of insurance premiums from the employee’s income (Article 3 of the Federal Law of July 16, 1999 No. 165-FZ).

The insurance period is calculated in calendar order. This means that calendar days of work under an employment contract, as well as official or other activities during which the employee was subject to compulsory social insurance are summed up.

The insurance period includes the time when a person was listed as an employee of the organization, even if he was sick or on vacation, including maternity leave and leave to care for a child under three years of age and leave at his own expense.

The periods of work under the employment contract are confirmed:

- work book;

- or information about work activity generated by the employer in accordance with Article 66.1 of the Labor Code.