Every year, both for ordinary employees and for accountants of enterprises and organizations, a busy time comes - some go on vacation, others, in connection with this, have an additional burden: calculating vacation pay. To ensure that accounting staff do not have difficulties when calculating vacation funds, there are specially developed algorithms by which they are supposed to be calculated. The same algorithms help to understand the method of calculating vacation pay to ordinary employees of enterprises and organizations without special education. We will talk about how to calculate vacation pay in different cases in this material.

Calculate the number of earned vacation days using the vacation days calculator.

How often can you take vacation?

First, let's look at how many times a year employees have the right to go on vacation. The Labor Code of the Russian Federation states that the average vacation should be 28 days according to the calendar.

At the same time, the Labor Code states that these four weeks can be divided into two or three parts, at the discretion of the employee or the management of the enterprise. It is important that one of these parts - the main one - lasts at least two weeks.

This is quite justified: not every company can afford to release valuable employees for 28 days in a row, especially in cases where this in any way affects production processes.

How is vacation paid under the labor code?

Hi all! The next topic of my article is how the vacation period is paid according to the labor code. The question is quite popular, because there are many bosses who want to “save” on their employees. Every second person, or even every first one, tries not to overpay, and very often, the stumbling block becomes the payment for vacation.

I personally encountered a situation where I was simply denied vacation pay. The company's management justified their actions by the fact that they are a commercial organization and are not obliged to pay vacation pay. As a result, the labor inspectorate did not agree with them at all, and I received my money in full.

Today, when applying for a new job, I always ask the question regarding whether the company pays vacation pay or not. If the answer is negative, there is no talk of any further cooperation. So, let's discuss the issue of vacation compensation payments in 2021 in more detail.

Rules for issuing vacation pay

The law clearly and unambiguously states that vacation pay must be issued in full to the employee no later than three days (according to the working calendar) before the next vacation. In cases of violations, the management of the enterprise may face administrative liability. But in some situations, for example on holidays, certain questions arise. Let's take a closer look at them.

- If an employee’s vacation begins immediately after the New Year holidays, then in this case vacation pay must be given to him in December, on the last working day, regardless of whether it is the 29th, 30th or 31st day of the month.

Nuance: The accountant should be aware that the general January holidays cannot be included in the vacation period established by the internal schedule of the enterprise; accordingly, vacation pay for holiday days does not need to be accrued.

Let's give an example

Employee Potemkin A.A. I decided to take a vacation from December 15, 2015 for twenty-eight days. The accounting department of the enterprise where he works must accrue vacation pay for exactly 28 days, but excluding holiday weekends.

- From the point of view of benefits, it is most interesting for an employee to take vacation in the month when, according to the calendar, the number of working days is greatest. Let's consider this statement in a specific situation;

Let's give an example

Kosulin I.T. at his own request he goes on legal leave from 01/12/2015-01/25/2015, for a total of fourteen days. Since January has a total of 15 working days, his average salary per day will be equal to 2333.33 rubles (that is, 35 thousand rubles divided by 15 days). We know that Kosulin I.T. starts work on January 26th. Thus, before the end of the month he only needs to work five days, which means his salary will be 11,666.67 rubles (2333.33 times 5 days). From further simple calculations it is clear that the difference in salary is 9627.60 rubles.

Another simple example

Salary of employee Kuznetsov K.K. is 35 thousand rubles. According to the vacation schedule developed and approved by his employer, Kuznetsov K.K. must go on vacation from December 18-31, 2015, for only two calendar weeks. There are 23 working days in December, and his average daily salary is 1521.74 rubles. (35 thousand rubles divided by 23 days). Thus, Kuznetsov K.K. The accounting department must calculate wages for days worked before vacation in the following amount: 21,304.36 rubles (i.e. 1,521.74 rubles multiplied by 14 days)

23.06.2021If the last working day is a holiday according to the calendar

The end of the employment contract may coincide with the weekend. Then, the employee’s dismissal is formalized on the first working day after the weekend. On the first working day, any other dismissal at the initiative of the employer must be formalized.

23.06.2021Transferring and splitting VAT deductions must be done with caution

Disagreements with the tax office regarding VAT deductions are perhaps the most common. To minimize them, you need to remember important rules that relate to the transfer and splitting of deductions.

23.06.2021Small Business Legal Mistakes

Legal problems are among the TOP 16 reasons why startups fail, according to the analytical company CB Insights. At the same time, in Russia, many beginning entrepreneurs often make similar, from a legal point of view, mistakes. We tell you how to minimize such risks.

23.06.2021Transportation costs can still be confirmed by the old waybill

From January 1, 2021, a new form of consignment note will be used. But many organizations were unable to quickly switch to using this form due to the need to refine the software for its design. Therefore, they are forced to issue invoices using the old form, which was valid until December 31, 2020 inclusive. Can these organizations justify their costs for transporting goods using a consignment note issued in the old form?

23.06.2021Tax debts or employee salaries: which will be written off first from a blocked account?

Failure to submit the declaration on time can lead to unpleasant consequences. Organizations can block a current account. But no one can cancel the payment of wages or the transfer of taxes on time. The Ministry of Finance explained in a letter dated 04/06/2021 No. 03-07-09/25250 how to pay salaries to employees from an account on which operations have been suspended.

23.06.2021How to calculate 60% of employees for mandatory vaccination?

As of June 15, 2021, many firms are puzzled by the mandatory accountable vaccination of 60% of their workforce. How to correctly calculate this amount?

23.06.2021Who should shorten their working hours in hot weather and when?

Rospotrebnadzor informs that the hot weather that has established itself in most of the country leads to a deterioration in working conditions for workers in open areas, in industrial and public premises without air conditioning. Therefore, employers are advised to reduce working hours.

23.06.2021An individual entrepreneur has closed his business: what unemployment benefits is he entitled to?

An individual entrepreneur has ceased his activities and wants to register with employment centers. Is he entitled to benefits and in what amount?

23.06.2021Business asks for clarification on vaccinations: top 30

Mandatory vaccination has already been announced in 12 regions, the list is expanding every day - just as questions are piling up among entrepreneurs who were suddenly made partially responsible for the successes of the vaccination campaign in Russia. The Moscow Council of Entrepreneurs sent a letter to the capital's chief sanitary doctor, Elena Andreeva, with a request to answer 30 questions formulated by the business community regarding mandatory vaccination.

22.06.2021Correct the UPD: from July 1, 2021, a new form for VAT deductions is needed

From July 1, 2021, you need to use a new invoice form. Line 5a will appear in the invoice for the details of the shipping documents on the basis of which it was compiled. This change will also affect those who use UPD with status “1”. How, the Federal Tax Service spoke about this in a letter dated June 17, 2021 No. ЗГ-3-3/ [email protected]

22.06.2021Did the Federal Tax Service manage to put Google in its place or Where does a Russian blogger pay personal income tax?

The information that Russian bloggers recently received from Google LLC really excited them. After all, from July 2021, the company is going to tax income from advertising in videos posted on the Internet, “according to American laws,” in the amount of 30%. How did the Federal Tax Service react to this?

22.06.2021How can the chief accountant delegate his powers during vacation?

Chief accountant is an important position in the company. He is responsible for signing payments, requirements of the Federal Tax Service, reporting, signing acts, calculating vacations and sick leave, etc. Who has the right to sign all documents during the chief accountant’s vacation? How to transfer all powers?

22.06.2021Reclassification of work contracts into labor contracts: is it legal?

The FSS conducted an inspection and accrued additional contributions to the organization, reclassifying civil contracts into employment contracts. The judges considered that the fund had no grounds for this.

22.06.2021Inheritance tax

Inheritance... According to Article 217 of the Tax Code of the Russian Federation, inheritance received in cash and in kind is not subject to tax. However, in reality, not everything and not always in life is ideally divided into “black” and “white”. And some shades and metamorphoses of “hereditary” situations can slightly discourage even the servants of Themis.

21.06.2021Who is subject to mandatory audit and on what basis?

At the end of last year, changes were made to Part 1 of Article 5 of the Federal Law “On Auditing Activities”. As you know, it establishes cases of mandatory audit of financial statements of organizations. Starting with the 2021 financial statements audit, a number of mandatory audit cases have been removed from this law. But they have not been cancelled. They just need to be looked for in other federal laws.

21.06.2021Unclaimed dividends: accounting features during company reorganization

The organization decided to pay dividends. But within 3 years after the expiration of the established period for payment of part of the profit, the participant did not apply to the LLC for them. After this, the organization changed its LLC form to JSC. What is the procedure for accounting for unclaimed dividends when transforming a company?

21.06.2021If natural loss rates are not established

You cannot independently develop norms for natural decline. Losses from natural loss can be taken into account when calculating income tax only according to standards approved by an official document.

21.06.2021Preferential insurance premium rates: who has them?

Reduced insurance premium rates have been established for a number of areas of activity and organizations. The conditions for their use are prescribed in the Tax Code of the Russian Federation. The application of benefits is strictly controlled; if the company deviates from the criteria, it loses the right to the benefit from the beginning of the calendar year.

21.06.2021In what calculations does an accountant use the key rate?

On June 11, 2021, the Central Bank increased the key rate, and now it is 5.5% per annum. You know that the size of the key rate is also needed in the work of an accountant. And in what cases? Let's remember together.

21.06.2021Whose VAT returns will not be accepted after July 1

A number of companies may have problems filing their VAT returns.

From July 1, 2021, a new paragraph 5.3 of Article 174 of the Tax Code of the Russian Federation, which was included in the code by Federal Law No. 374-FZ of November 23, 2020, will come into effect. Before filing your tax return, it makes sense to check the control ratios so that the tax authorities do not reject it. 1 Next page >>

How to calculate the average daily salary for calculating vacation pay

When calculating vacation pay, an accounting employee should be aware that, in accordance with the amendment made to Article 139 of the Labor Code of the Russian Federation on April 2, 2014, a coefficient of 29.3 has been determined, which must be used when calculating vacation pay.

For example, if during working hours an employee did not take time off, was not on sick leave, or had other absences from work for any reason, then the average daily earnings are equal to the amount of payments for the estimated time, divided by 29.3 multiplied by 12.

In situations where during the billing period an employee, for some reason, did not come to work every day, his average daily earnings will be equal to the amount of payments for the billing period divided by the number of days in the billing period.

Legislative regulation

According to the Labor Code, Article 115, the employer must pay at least 28 days per year. No matter what disputes this may cause, calendar days are paid and provided to the employee .

If the vacation falls on non-working holidays, then they are not included in its duration and are paid , which is regulated by Article 120 of the same Labor Code.

More information about holidays that fall on holidays can be found in this article.

Let's look at an example of how to calculate vacation:

- Manager Karpov decided to rest and wrote an application for leave from April 10 to April 17. During these 7 days there are 2 days off - Saturday and Sunday. Karpov is paid for all 7 days in a row and all of them are included in vacation.

- If Karpov writes an application for vacation for the period from May 7 to May 14, then only 7 days will be counted towards the vacation, since May 9 is a holiday .

The time that a vacationing employee spent on sick leave is not included in the calculation of vacation if he submits a sick leave certificate to the payroll department. The period of incapacity spent on vacation extends the duration of rest by the number of days of illness .

Watch a video about the nuances of granting leave:

Vacation pay in different cases: we count it correctly

What can we say, calculating vacation pay is not always simple. It happens that at the estimated time an employee goes on sick leave or takes time off. What to do in this state of affairs, how to calculate vacation pay?

Attention! To calculate vacation pay in accordance with the law, there is a special formula. Vacation pay is calculated by multiplying the average daily earnings by the number of vacation days.

Let's look at an example

Employee Masloedov P.P. vacation starts from 1.06. 2015 Moreover, his average annual salary is 20 thousand rubles. In order to calculate the amount of his vacation pay, you need 20 thousand rubles. divide by coefficient 29.3 and multiply by 30 days. As a result of these calculations, we will come to the amount of 20,477.82 - this will be the amount of P.P. Masloedov’s vacation pay.

One more example

In this example, consider the case when, during the time that is taken as the basis for calculating vacation pay, the employee went on sick leave . So, Starshov M.M. I was going on vacation for two weeks from March 1-14, 2015. In this case, we will take the period from March 1, 2014 as the billing period. until 02/28/2015. Without further ado, let’s take the figure of 20 thousand rubles as his average salary. However, there is a nuance: Starshov M.M. from September 1-8, 2014, he was on sick leave, as a result of which he was paid sick leave in the amount of three thousand rubles. Thus, his salary for September 2014 was only 13 thousand rubles. In this situation, without racking our brains too much, we’ll calculate it like this: 20 thousand rubles. multiply by 11 + 13 thousand rubles. = 233 thousand rubles. Let's calculate the days when Starshov M.M. was at his workplace. To do this, simply multiply 29.4 by 11 + 29.4 divided by 30 (since there are 30 days in September) and multiply by (30 - = 344.96 days. It turns out that they worked 344.96 days in a year. Thus Thus, based on all the above calculations, it is clear that M.M. Starshov’s average daily earnings will be equal to 233 thousand rubles divided by 344.96 = 675.44 rubles, that is, his vacation pay for two weeks will be: 675.44 multiplied by 14 = 9456.16 rub.

So, Starshov M.M. I was going on vacation for two weeks from March 1-14, 2015. In this case, we will take the period from March 1, 2014 as the billing period. until 02/28/2015. Without further ado, let’s take the figure of 20 thousand rubles as his average salary. However, there is a nuance: Starshov M.M. from September 1-8, 2014, he was on sick leave, as a result of which he was paid sick leave in the amount of three thousand rubles. Thus, his salary for September 2014 was only 13 thousand rubles. In this situation, without racking our brains too much, we’ll calculate it like this: 20 thousand rubles. multiply by 11 + 13 thousand rubles. = 233 thousand rubles. Let's calculate the days when Starshov M.M. was at his workplace. To do this, simply multiply 29.4 by 11 + 29.4 divided by 30 (since there are 30 days in September) and multiply by (30 - = 344.96 days. It turns out that they worked 344.96 days in a year. Thus Thus, based on all the above calculations, it is clear that M.M. Starshov’s average daily earnings will be equal to 233 thousand rubles divided by 344.96 = 675.44 rubles, that is, his vacation pay for two weeks will be: 675.44 multiplied by 14 = 9456.16 rub.

What to do if the money was not paid within the established time frame?

It happens that meeting deadlines is extremely difficult. For example, an employee is on sick leave or on a business trip. The issue can be resolved very simply.

To do this, it is enough to submit an application to postpone the vacation period to a later time. Such an action is provided for by the labor code and will not be considered a violation.

This is interesting: What is Plato on the roads

If the application was not received and the employee went on vacation as scheduled, then there can be no talk of postponing the period, and all responsibility for non-payment of compensation falls on the employer.

It is important to say here that filing an application is not an obligation, but only a right of the employee. If this could not be done earlier, then the money must be transferred as quickly as possible.

How to calculate vacation pay if an employee has only worked for six months

Cases where an employee has worked in a new place for only six months or a little more and is already getting ready to go on vacation happen all the time.

The right to vacation 6 months after starting work is guaranteed by Russian law.

How to calculate vacation pay in this situation?

Let's look at an example

Employee Orlov D.D. took a vacation from November 13-26, 2014. He has been on the company’s staff since April 13, 2014. His salary for partial April amounted to 20 thousand rubles. In the remaining months, in which he did not take sick leave or time off, his full salary was equal to 30 thousand rubles. Now we count vacation pay. For the billing period we take the period from 04/13/2014 to 10/31/2014. Next, we calculate the total earnings using the formula: 20 thousand rubles plus 30 thousand rubles multiplied by 6 months = 200 thousand rubles. Don’t forget about the coefficient and calculate the number of days actually worked: (18/30) multiplied by 29.3 + 6 months, multiplied by 29.3 = 193.4 days. It is easy to calculate that the average daily earnings of Orlov D.D. amounted to: 1034.1 rub. (200 thousand rubles divided by 193.4). Thus, Orlova D.D.’s vacation pay will be equal to 1034.1 multiplied by 14 days. As a result, we will receive vacation pay equal to 14,477.4 rubles.

When can you take a vacation?

After 6 months of continuous work with a particular employer, the employee receives the right to paid leave. An employee can request leave from the employer before this period. In this case, vacation is not calculated in proportion to the time worked, but is provided in full, and the employer pays for all days of vacation .

An employer does not have the right to impose a vacation of 14 calendar days on an employee. If the employee subsequently quits before a year has elapsed from the start of employment, the portion paid for the excess leave granted is withheld .

In subsequent years of work, vacation is provided in accordance with the vacation schedule , which is drawn up taking into account the wishes of the employee. Study leaves do not have any impact on the main leave.

In conclusion, it can be noted that an employee can demand that the employer provide him with full leave - no matter how long it may be. The employer cannot refuse to satisfy his legal requirements.

Division of vacation is allowed only by mutual agreement of the parties.

How to calculate vacation pay when working part-time

Employees working part-time also have the right to a full vacation of 28 days, this is guaranteed to them by Art. 93 Labor Code of the Russian Federation. This schedule does not provide for deviations from the standard calculation of vacation pay: in the same way, the average daily earnings for the last 12 months are taken into account.

Specific example

Employee Oleynikov, who worked on a salary of 20,000 rubles, is going on vacation from September 15, 2021 for the entire period of 28 days. From August 15, 2021, he switched to a part-time working schedule - a shortened working week with a salary of 15,000 rubles. Let's calculate his vacation pay.

The billing period will be the 12 months preceding the vacation: September 2021 – August 2021 inclusive.

The amount of vacation pay will be as follows. Earnings for the previous year: 20,000 x 11 + 15,000 = 235,000 rubles. Average monthly earnings: 235,000 / 12 = 19,583.3 rubles. Average daily, respectively: 19,583.3 / 29.3 = 668.4 rubles. Let's multiply by the 28 days of vacation due: Oleinikov is entitled to 18,714.44 rubles. vacation pay.

How the Labor Code regulates vacation pay

Every organization must have a schedule in accordance with which employees will be provided with regular annual paid leave and accrual of vacation pay according to the Labor Code of the Russian Federation in 2021. Many employees are interested in the question of when they will go on vacation, how much vacation pay will be accrued and during what time payment is made vacation. The procedure for calculations and accruals for days of well-deserved rest is regulated by the labor code.

In order to go on vacation in 2021, an employee must write an application addressed to the management of his organization. It indicates how many days of leave are granted. When is vacation pay paid? What is the procedure for calculating this amount? Does the length of rest depend on length of service? Is there a dependence of the amount of vacation pay on interest for length of service, as is the case with sick leave? What period is taken as the calculation period to determine the average salary? What to do if it’s time to go on vacation under the Labor Code of the Russian Federation, but the employer does not sign the application? What to do if the vacation has already passed, and payments for it have not been received?

This is interesting: How to get a subsidy to open a small business

If you are in doubt about the correctness of granting you the next annual paid leave and in the procedure for calculating and accruing its payment, please contact our consultants via the feedback form.

Together with experienced, qualified lawyers, it will be much easier and faster to understand the problem. Moreover, all consultations are free.

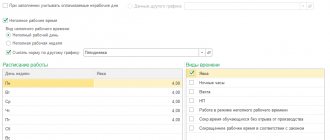

How to calculate vacation pay when summing up working hours

If an employee works in this mode, the average daily earnings cannot serve as a calculation indicator for calculating vacation pay. To do this, you need to use the criterion of average hourly earnings: the amount of money earned during the accounting period adopted by the company, divided by the number of hours actually worked during this time. The rest of the calculation procedure does not differ from the usual one.

What does this look like in an example?

The organization works according to a schedule of summarized working hours, a 40-hour week is typical. The accounting period is taken to be a month. Employee Sokolovsky, who works on a monthly salary of 40,000 rubles, was going on vacation in March 2021 for 14 days. Over the previous 12 months - from April 2021 to February 2021 - Sokolovsky worked 1,972 hours. For this year they earned: 40,000 x 12 = 480,000 rubles. Average hourly earnings will be: 480,000 / 1972 = 243.4 rubles. at one o'clock. Let's calculate how many hours of vacation need to be paid: 40 hours / 5 days (work week) x 14 days of vacation = 112 hours. Vacation pay will be: 112 x 243.4 = 27,260.8 rubles.

Vacation days

Standardly, as already mentioned, a working person is entitled to a vacation of 28 calendar days. But sometimes, due to the nature of the job, additional days of vacation are required.

An employee can take vacation not for the entire 28 days, but in parts. However, once his vacation must be at least 14 days. For example, in a year you can go on vacation for 14 days and two more times for 7. Some employees take not 7 days, but 5 (from Monday to Friday) and thus win 4 more vacation days. But this approach is not encouraged by all employers, although they cannot refuse by law.

If an employee falls ill during vacation, the vacation can be extended. This is possible if the employee opened sick leave and expressed a desire to extend it. You can extend it for those days that coincide with sick leave and vacation pay.

Please note that sick leave to care for a sick child does not give the right to extend or postpone leave.

How to calculate vacation pay when going on vacation immediately after leaving maternity leave

Employees who are mothers have this right if they have enough work experience that gives them the right to paid leave. Child care is not included in this length of service, but maternity leave counts.

A situation arises in which the employee had partially no earnings in the previous 12-month period. In this case, the Ministry of Labor of the Russian Federation, in its letter No. 14-1/B-972 dated November 25, 2015, explains the need to replace the billing period: the countdown will begin one month before the employee goes on maternity leave.

Let's calculate using an example

Employee Kolmanovskaya, who worked at a salary of 30,000 rubles, gave birth to a child in 2014. She went on maternity leave in May 2014, it ended in September 2014, after which she took leave to care for a child up to 3 years old. In July 2017, when the maternity leave ended, Kolmanovskaya took another annual leave of 28 days. Since the billing period turned out to be incomeless, we will count vacation pay for the year preceding the maternity leave: from May 2013 to the end of April 2014. The amount of vacation pay will depend on the average daily earnings: 30,000 x 12 / 29.3 / 12 = 1023.9 rubles. Multiply by the number of days on vacation: 1023.9 x 28 = 28,668.9 rubles. This is how much vacation pay Kolmanovskaya is supposed to pay.

Vacation period in days

Every year, every employed person can apply and receive 28 days of rest. This norm is fixed by the Labor Code of the Russian Federation and applies to any employee. A longer period is provided for certain groups. It all depends on the position and the specifics of employment.

To regulate the priority, the enterprise draws up a special schedule, which is considered mandatory for both the employer and employees. All persons who will be sent on vacation in the future must sign this form.

After familiarizing yourself with the workers’ report, it is required that the manager certify the document with a personal signature and affix the organization’s seal. If the enterprise has such a schedule, then in the future there will be no need to issue an order according to which the citizen will go on vacation. It will be enough just to wait for a specific date.

How to calculate vacation pay for seasonal workers

Employees who have signed fixed-term employment contracts for short periods, that is, planning to work for less than 2 months, can count on paid leave at the rate of 2 days of leave per month of work. For such categories of workers, vacation pay is also calculated on the basis of average daily earnings, but this indicator will have to be calculated a little differently: the entire salary must be divided by the number of calendar days that were worked, based on a working week of 6 days.

Calculation example

A fixed-term employment contract was signed with employee Pelevanov for seasonal work for 2 summer months for a payment of 90,000 rubles. per season. During this time, he is entitled to 4 days of leave (2 days per month). If you subtract Sundays. Pelevanov worked 26 days in July, and 27 days in August, that is, 53 days in total. Pelevanov's average daily earnings will be: 90,000 / 53 = 1,698.11 rubles. For 4 days of vacation he will be credited with 1698.11 x 4 = 6,792.45 rubles.

From the above examples it is clear that in different situations, vacation pay is accrued differently. The final amount of vacation funds that the employee will receive depends on whether the employee took time off, was on sick leave, or worked the reporting period in full. A competent accountant must have a perfect understanding of all the intricacies of calculating and paying vacation pay to employees of an enterprise and take into account all the nuances when making calculations.

The procedure for applying for vacation pay

To receive compensation, the employee will need to submit an application in a standard form to his superiors. If the company has a vacation schedule, then there is no need to do this; it is enough to be guided by the date the period begins.

Before the designated day arrives, the accountant performs benefit calculations and within the specified time frame the money is transferred to the employee. If a citizen resigns, payment for unused days is made on the day the employment relationship is terminated.

As a result, it is worth noting that you can receive compensation for a standard vacation by contacting the company’s accounting department. If you have a schedule, you just need to sign for the funds received and go on vacation.

How to correct errors when calculating vacation pay

In a situation where an accounting error was discovered when performing transactions when calculating vacation pay, it is urgent to understand what its consequences are. Whether there was an overstatement or understatement of vacation payments. This is necessary in order to determine the order of further actions.

- If vacation pay was improperly underestimated, it is necessary to carry out a procedure for additionally accruing the missing amount to the employee.

- In a situation where vacation payments have been overstated, it is impossible to withhold funds overpaid to the employee, due to the fact that an accounting error was made in violation of the procedure for applying the norms of the current legislation of the Russian Federation. The procedure for withholding overpaid vacation pay will be possible only if the employee writes a corresponding statement expressing his agreement with the procedure.

After receiving the employee’s consent, the procedure for withholding the overpaid amount can be carried out in full. This will be considered as retention at the initiative of the employee, so there are no restrictions in this case. If the employee’s consent is not obtained voluntarily, the company will have to go to court.

Calculation of the billing period

From the moment an employee begins to perform direct duties, seniority begins to accrue. This indicator directly affects payments for temporary disability and the date of retirement. In addition, it gives the right to take paid vacation. The period from the first working day to the end of the calendar year is defined as settlement. In situations where a specialist goes on vacation, for example, after six months, the calculation period is calculated from the first day at the enterprise until the start of the official vacation.

So, if a specialist was hired on May 12, 2011, and plans to go on vacation on December 25, 2011, the billing period will be 7 months and 13 days. Vacation payments for six months and any other period are also calculated.

It is worth noting that only hours worked are included in the estimated period. They are entitled to full earnings and deductions established by the state are made.

Calculation for an incomplete year worked

Calculations for partial years are made differently. Full months are counted as 29.3 days, and the number of days in incomplete months is calculated using the formula:

29.3 / total duration of the month * number of days worked

After this, the days of the settlement period are summed up and can be calculated using the standard formula.

Calculation example

Sample calculation:

- duration of work – from 01.01.19 to 20.07.19;

- duration of rest – 28 days;

- total earnings - 500,000 rubles.

Algorithm:

- Period: six months and 20 days. Duration: (6 * 29.3) + (29.3 / 31 * 20) = 194.7 days.

- Average income per day: 500,000 / 194.7 = 2,568 rubles.

- Charge amount: 2,567 * 28 = 71,904 rubles.

- 71,904 * 0.87 = 62,556 rubles. Payment amount after deduction of personal income tax.

All bonuses in the billing period are included in the calculation of vacation pay.

Erroneous actions of the accountant will be such as, for example, including in the calculation of vacation bonus payments to an employee, which:

- They were not provided for by the provisions of local regulations in force at the enterprise.

- They were accrued and paid to the employee not for work, but, for example, in honor of a professional holiday or as a reward for an anniversary.

- They are annual paid for the year that does not precede the calculation of vacation pay.

- The amounts of all monthly, quarterly, semi-annual and other bonuses accrued in the billing period.

IMPORTANT! Based on the information contained in paragraph 15 of Resolution No. 922, it is permissible to include in the calculation no more than four quarterly bonuses accrued and paid to an employee for the same indicator. A similar situation occurs with monthly and semi-annual bonus payments.

Summarizing all of the above, we can conclude that when performing an operation to calculate the amount of an employee’s average earnings, when calculating vacation pay, you should include exclusively:

- bonus payments provided for by local regulations in force at the enterprise

- bonus payments accrued and paid to an employee for work activities

- not exceeding 12 monthly, four quarterly, two semi-annual bonus payments, accrued during the billing period, for the same indicator

- daily bonus payment accrued and paid to the employee for the previous calendar year event