The topic of vacation pay worries every employer. Read about all the nuances of this difficult topic in our material today from Eleonora Dzgoeva, chief accountant of a large trading organization and author of a blog on Instagram, where she talks about the calculation of benefit payments, taxation, tax deductions and much more, in an accessible way for non-professionals.

Over my many years of practice as a payroll accountant, and later as a chief accountant, I became convinced that few employees understand how their vacation pay is calculated. They have questions, which they often ask with a negative intonation. And the dissatisfaction is primarily due to the fact that vacation pay is less than the usual salary. And the first thought that comes to mind is: “I’ve been shortchanged.”

Today, most often, wages and vacation pay are calculated in special programs designed for this purpose. Everything is automated, the calculation algorithm is tied to the current legislation. But despite this, you need to know the calculation rules. It’s a good idea to double-check whether the calculation is correct. A machine can also make mistakes, especially if a person made a mistake earlier when entering some data into it.

Average daily earnings in 2021

The general procedure for calculating average earnings is regulated by Article 139 of the Labor Code.

More detailed rules that must be followed when calculating vacation pay were approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

For vacation pay, average daily earnings are calculated for the 12 calendar months preceding the month the vacation starts.

For each fully worked month, 29.3 days are taken into account. This is the average monthly number of days ((365 days - 14 holidays per year) / 12 months).

Compensation for unused vacation is calculated in the same manner.

Use the online calculator to calculate vacation pay

Determination of the working year

The working year for which labor leave is granted is a period of time equal in length to a calendar year, but calculated for each employee from the date of hiring.

The order of its determination is as follows:

| Start date of the first working year: | First day of work with the employer |

| Start date of the second (and subsequent) years: | Date following the end date of the previous business year |

| End date of the working year | As a general rule: from the date of admission or the beginning of the current working year, we count 12 months. However, there should be no periods of absence from work that are not included in the working year. |

If the sum of the periods included in the working year is less than 12 full calendar months, the employee’s working year is shifted by the missing time. A shift in the working year does not entail a change in the duration of the leave due to the employee in accordance with the terms of the employment contract.

For more detailed examples of calculating the working year, as well as practical situations when the working year is shifted, read the article:

We shift the working year when granting vacation

How to calculate average daily earnings

To calculate average daily earnings, you need:

First, determine the billing period.

Secondly, the amount of payments that the employee received in the pay period.

The calculation period for vacation pay is 12 months preceding the month in which the employee goes on vacation.

You need to take the calendar month into account:

January: 1st to 30th of the month inclusive.

February: from the 1st to the 28th of the month inclusive.

March: from the 1st to the 31st of the month inclusive.

… and so on.

EXAMPLE 1. HOW TO DETERMINE THE BILLING PERIOD

An employee of the organization goes on vacation from July 10, 2021. The billing period includes: - July-December 2021 - January-June 2019

SDZ for sick leave

Step 1: Determine the billing period

The billing period is two calendar years before the employee’s sick leave.

Nikolai fell ill on June 17, 2021. The billing period is from January 1, 2019 to December 31, 2021.

If during the billing period the employee was on parental leave or maternity leave, one or both years can be replaced by others - before the leave. But only if the replacement increases the benefit amount. To do this, the employee writes an application to replace one or two years of the pay period with the years before the vacation.

Step 2: calculate the employee’s earnings for the pay period

Take into account all payments to the employee from which contributions for disability were transferred: for example, salary, bonuses, vacation pay.

Do not take into account sick leave, financial assistance up to 4,000 rubles, daily allowance up to 700 rubles and other payments from Article 422 of the Tax Code.

If an employee has been working for you for less than two calendar years, look at his income in the salary certificate from the previous company.

Income must be taken into account within limits. The maximum amount of income per year is limited by the amount from which contributions are calculated. Minimum - the minimum wage multiplied by the number of months in the billing period. If your income for the year does not fit into these limits, take the minimum or maximum amount.

Maximum income:

- for 2021 - 718 thousand rubles

- for 2021 - 755 thousand rubles

- for 2021 - 815 thousand rubles

- for 2021 - 865 thousand rubles

- for 2021 - 912 thousand rubles

The minimum income is calculated using the formula 24 x minimum wage:

- from January 1, 2021 to June 30, 2021 - 148,896 rubles

- from July 1, 2021 to June 30, 2021 - 180 thousand rubles

- from July 1, 2021 to December 31, 2021—RUB 187,200

- from January 1, 2021 to April 30, 2021 - 227,736 rubles

- from May 1, 2021 to December 31, 2021 - 267,912 rubles

- from January 1, 2021 - 270,720 rubles

- from January 1, 2021 — 291,120 rubles

If your income for the year does not fit into these limits, take the minimum or maximum amount.

Step 3: Calculate your average daily earnings

Average daily earnings = Payments for the billing period / 730

Calculation of vacation pay in 2021

After you have determined the billing period, you need to calculate the amount of payments for this time.

The calculation includes all payments for days worked, including bonuses, additional payments, allowances, incentives, etc.

The payments that are taken into account are listed in Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

These include, in particular, wages in monetary and non-monetary form, bonuses and additional payments (for class, qualification category, length of service, combination of professions, etc.), compensation payments related to working hours and working conditions.

The following are not included in the calculation of average earnings: financial assistance, dividends, loans and other payments that are not related to wages.

EXAMPLE 2. CALCULATION OF AVERAGE EARNINGS INCLUDING ALL PAYMENTS

The employee goes on vacation from July 5, 2021. The calculation period is 12 months preceding the vacation. We take into account the periods: - July-December 2021 and - January-June 2021. Monthly the employee's salary is 20,000 rubles. In addition to the salary, the employee receives bonuses for fulfilling and exceeding the sales plan in accordance with the Regulations on bonuses. In March, the employee exceeded the sales plan and received a bonus in the amount of 8,000 rubles. In April, the employee again exceeded the sales plan, but this times in a smaller amount and received a bonus of 5,000 rubles. In May, the employee did not fulfill the plan, but received financial assistance in the amount of 4,000 rubles in connection with the birth of a child. Let's calculate the average employee's earnings: 1) We calculate wages for 12 months: 12 months × 20,000 rub. = 240,000 rubles. 2) We include in the calculation two bonuses paid in March and April 2019. 240,000 rubles. + 8,000 rub. + 5,000 rub. = 253,000 rubles. 3) We do not include financial assistance in the calculation.

Formula for calculating average earnings

The average daily earnings of an employee for vacation pay are determined by the formula:

| The amount of accrued wages for the billing period (including bonuses, allowances, remuneration, coefficients) | : | 12 months | : | 29.3 calendar days | = | Average daily earnings |

Formula for calculating vacation pay

The amount of vacation pay is calculated as follows:

| Average daily earnings | × | Number of vacation days | = | Vacation pay amount |

EXAMPLE 3. CALCULATION OF HOLIDAY PAY FOR 2021

An employee goes on vacation from August 7, 2021 for 14 calendar days. The employee’s monthly salary is: 20,000 rubles. In April, the employee received a bonus in the amount of 5,000 rubles. The calculation period is 12 months preceding the vacation: August-December 2021 and January-July 2021. The average daily earnings is: (20,000 rubles × 12 months + 5,000 rubles. ): 12 months : 29.3 calendar days = 696.81 rubles. The amount of vacation pay will be: 696.81 rubles. × 14 days of vacation = 7,755.34 rubles.

SDZ for vacation

Step 1: Determine the billing period

If an employee has been working for you for more than a year, the calculation period is 12 calendar months before the vacation.

Dasha’s vacation begins on August 14, 2021, which means the billing period is from August 1, 2021 to July 31, 2021.

If an employee has been working for you for less than a year - from the date of hire until the last day of the month before the vacation.

Andrey joined the company on February 1, and on September 3 he goes on vacation. The billing period is from February 1 to August 31.

If an employee takes leave immediately after maternity leave, 12 calendar months before the start of maternity leave.

Masha was on maternity leave and maternity leave from May 11, 2021 to July 25, 2021. And from July 26, she took a regular vacation. The billing period is from May 1, 2021 to April 30, 2018.

Step 2: calculate your earnings for the pay period

Take into account the salary with all allowances and coefficients, and bonuses according to the rules from paragraph 15 of the Government Decree.

Do not take into account vacation pay, travel allowance, sick leave and other payments that are calculated based on average earnings, financial assistance, and compensation for food expenses.

Step 3: count the number of days worked during the pay period

To do this, determine how many days worked in each month of the period:

- If the employee worked for a full month, the number of days is 29.3.

- If on some days of the month the employee did not work. Number of days = Number of days worked / Number of calendar days in a month x 29.3.

Worked hours are considered to be weekdays, weekends and holidays, when the employee is not on vacation, business trip or on sick leave. For calculations, we take calendar days, not actual days worked. For example, for an employee with a 5/2 schedule, to calculate a week we take 7 calendar days, and not 5 actually worked days

Add up the days worked in each month, and you get the number of days worked for the billing period.

Step 4: Calculate your average daily earnings using the formula

SDZ = Earnings for the billing period / Days worked for the billing period

Submit reports without accounting knowledge

Elba is suitable for individual entrepreneurs and LLCs with employees. The service will prepare all the necessary reporting, calculate salaries, taxes and contributions, and generate payments.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

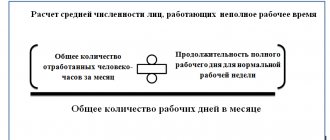

Calculation of vacation pay if the company has a part-time working day

Nowadays, enterprises have a common practice of shortened working hours for many categories of workers. Instead of an 8-hour working day, a 6, 7, 4, etc. day can be established. hourly working days.

For employees who work with reduced working hours, vacation pay is calculated in the same way as for all employees.

You need to take the amount of payments for the 12 months preceding the vacation, add all allowances, bonuses and rewards, divide the total amount by 12 and divide by 29.3 rubles.

Vacation registration

To be granted leave, the employee writes an application addressed to the director or the person replacing him. The application may be endorsed by the employee's supervisor.

You can study a sample vacation application here >>>

Usually, vacations are issued by order of the manager. You can find the order form in the “Documents” section at this link .

How to calculate vacation pay if an employee was sick, studied or was on vacation at his own expense

In practice, you rarely encounter textbook situations when you only need to know your salary to calculate vacation pay.

For vacation pay, the calculation period is 12 months preceding the vacation. At this time, the employee could take sick leave, go on study leave, or take a few days at his own expense.

In these cases, the time the employee was away from work must be subtracted from the billing period. And from the total amount of payments you need to subtract payments for the time of absence.

In Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages” you can see the list of payments that are excluded. These are periods when an employee:

- was on annual main, additional or study leave;

- received sick leave benefits;

- received maternity benefits;

- was on vacation at his own expense;

- received additional paid days off or days off to care for disabled children and people with disabilities since childhood;

- did not work due to downtime due to the fault of the employer;

- received time off, etc.

How to calculate vacation pay if wages have changed

If your organization’s salary changes within the billing period, after the billing period, but before the employee’s vacation, or during the vacation, the amount of vacation pay will have to be recalculated.

This rule is established by clause 16 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922 “On the peculiarities of the procedure for calculating the average salary.”

Formula for calculating the vacation pay adjustment factor for salary increases

| Salary accrued for the month in which the increase occurred | : | Salary for each month of the billing period | = | Increase factor |

EXAMPLE 5. CALCULATION OF THE SALARY INCREASE RATIO

The employee’s salary in September and October 2021 was 20,000 rubles. From November 2021, the employee’s salary was increased to 24,000 rubles. - by 4,000 rubles. The salary increase coefficient is equal to: 24,000 rubles. : 20,000 rub. = 1.2.

If the salary was increased within the billing period, then the employee’s salary that he had before the increase must be multiplied by the increase factor.

EXAMPLE 6. CALCULATION OF HOLIDAY PAY WITH INCREASE RACTOR

From August 21, 2021, an employee goes on vacation for 28 calendar days. The employee’s salary was 20,000 rubles before February 1. From February 1 - 22,000 rubles. Let's calculate vacation pay for an employee: 1) Calculate the increase factor: 22,000 rubles. : 20,000 rub. = 1.1.2) We determine the months that will be included in the billing period:— August-December 2021;— January-July 2021.3) We calculate the amount of payments that we must take into account when paying for vacation:— we take into account the amount of wages before they are increased for 6 months (August 2021 - February 2021) with a coefficient of 1.1 and the amount of wages after an increase without a coefficient (February - July 2017) (RUB 20,000 × 6 months × 1.1) + (22,000 rubles × 6 months) = 264,000 rubles. 4) We calculate the average daily earnings: 264,000 rubles. : 29.3 calendar days days : 12 months = 750, 85 rubles. 5) We calculate the amount of vacation pay: 750, 85 rubles. × 28 days of vacation = 21,023.8 rubles.

It is also necessary to adjust the average earnings if the salary increase occurred outside the billing period, but before the moment when the employee went on vacation.

EXAMPLE 7. ADJUSTMENT OF HOLIDAY PAY IF SALARY IS INCREASED AFTER THE CALCULATION PERIOD BUT BEFORE THE START OF HOLIDAY

The employee goes on vacation from August 21, 2021 for 14 calendar days. Until August 1, his salary was 18,000 rubles. From August 1, the organization increased salaries, and the employee’s salary was: 21,600 rubles. Let’s calculate vacation pay: 1) Let’s calculate the increase factor: 21,600 rubles. : 18,000 rub. = 1.2.2) We determine the billing period. It will include: August-December 2021 and January-July 2021. The employee was not sick during the billing period, did not take vacation at his own expense - he worked the full period.3) Average earnings for calculating vacation pay will be: (RUB 18,000 × 12 months): 12 months. : 29.3 calendar days days = 614.33 rubles. 4) We calculate the amount of vacation pay for 14 calendar days: 614.33 rubles. × 14 calendars days = 8,600 rubles. 5) Let’s adjust the amount of vacation pay taking into account the coefficient. The salary was increased after the pay period, but before the start of the vacation. 8,600 rub. × 1.2 = 20,320 rub.

If wages increase during a vacation, which is very rare in practice, you only need to adjust that part of the average earnings that falls on the period from the moment the salary was increased until the end of the vacation.

EXAMPLE 8. ADJUSTMENT OF HOLIDAY PAY IF SALARY IS INCREASED DURING HOLIDAY

An employee goes on vacation from March 27, 2021 for 14 calendar days - until April 9. The employee's salary is 28,000 rubles. The billing period includes: March - December 2021 and January -February 2017. The employee was not sick in the last 12 months before the vacation. Worked throughout the entire billing period. On April 3, the company increased wages. The employee’s salary was 30,000 rubles. Let’s calculate the employee’s vacation pay: 1) We calculate the average earnings: (28,000 rubles × 12 months): 12 months. : 29.3 calendar days = 955.63 rubles. 2) We calculate vacation pay according to the general rule: 955.63 rubles. × 14 calendars days = RUB 13,378.82 3) During the vacation, wages were increased. Therefore, we will calculate the salary increase coefficient: 30,000 rubles: 28,000 rubles. = 1.07 Remember that wages are increased during vacation. This means that we need to adjust the part that falls on the period from April 3 to April 9, 2021 (7 calendar days). 4) Let’s calculate the amount of vacation pay for 7 calendar days that falls in the period before the salary increase. Average earnings before going on vacation was: 955.63 rubles. The amount of vacation pay for 7 calendar days (before the salary increase) was: 955.63 rubles. × 7 calendar days = 6,689.41 rubles. 5) Let's calculate the amount of vacation pay for the period during which the salary increase occurs - 7 calendar days. To do this, multiply the earnings by the increase factor. 955.63 rubles. × 7 calendar days × 1.07 = 7,157.67 rubles. 6) Calculate the total amount of vacation pay. To do this, you need to add two figures: the amount of vacation pay before and after the promotion. RUB 6,689.41 + RUB 7,157.67 = RUB 13,847.08 7) Let’s determine the amount that needs to be paid to the employee. Since vacation pay was paid to the employee before the vacation, we need to calculate the difference that is obtained when recalculating vacation pay for 7 calendar days after the salary increase with the coefficient. The difference must be paid to the employee. It is: 13,847.08 – 13,378.82 rubles. = 468.26 rub.

Calculation of vacation pay for summarized accounting of working hours

If the enterprise operates continuously, summarized working time recording is usually established for employees. Then, for each employee, the number of hours worked per month, quarter, half year and year is taken into account.

When accounting for working time in aggregate, vacation pay and compensation for unused vacation are calculated in accordance with Article 139 of the Labor Code of the Russian Federation.

First, determine the average hourly earnings, and then calculate the average earnings to calculate vacation pay.

Formula for calculating average hourly earnings with summarized accounting of working hours

| The amount of accrued payments for hours worked in the billing period, taking into account bonuses, allowances, and incentives | : | Number of hours actually worked in this period | = | Average hourly earnings |

Formula for calculating average earnings with summarized accounting of working hours

| Average hourly earnings | × | For the number of hours according to the schedule in the billing period | = | Average earnings |

SDZ for a business trip

Step 1: Determine the billing period

The billing period is 12 months before the business trip.

Lyudmila went on a business trip on June 15, 2021, the billing period is from June 1, 2021 to May 31, 2021.

If the employee has worked for less than a year, take the period from the date of hire to the last day of the month before the vacation to calculate.

Maxim joined the company on January 15, and on July 8 he was sent on a business trip. This means that the billing period is from January 15 to June 31.

Step 2: calculate your earnings for the pay period

Take into account the salary with all allowances and coefficients, bonuses - according to the rules from paragraph 15 of the Government Decree.

Do not take into account sick leave and benefits, vacation pay, payments based on average earnings and other accruals from paragraph 5 of the Government Decree.

Step 3: count the number of days actually worked during the billing period

Look at the number of working days on the timesheet. Add up the actual days worked in each month, and you will get the number of days worked for the billing period.

Step 4: Calculate your average daily earnings using the formula

SDZ = Earnings for the billing period / days worked for the billing period