There is no special legislation imposing the obligation to timely report to bailiffs. Nevertheless, it is worth following the Memo for managers and accountants of organizations or enterprises, dedicated to the issues of deduction and transfer of funds from the salary of a debtor-employee under writs of execution.

There is no requirement to submit a report to the FSSP, but it describes the process of interaction between bailiffs and accounting departments within the framework of special inspections. In particular, after the enterprise receives a writ of execution for the collection of alimony, the accountant immediately sends a return notification of receipt of the papers to the employee of the FSSP department.

The document states:

- mark (incoming number and date);

- telephone number of the organization (enterprise);

- accountant's signature;

- seal of the company that received the executive document.

Part 2 of Article 12, as well as paragraphs 3 and 16 of Part 1 of Article 64 of the Federal Law of July 21, 1997 No. 118-FZ “On Bailiffs,” are devoted to the issue of providing a report.

In accordance with the rules, the bailiff has the right to inspect employers for:

- collections under enforcement documents in relation to employed debtors;

- conducting financial activities for the sale of these securities.

If the bailiff demands to submit a report for the quarter, month or year, as part of the above-mentioned audit, the accountant has no right to refuse this. If such a situation arises, it is necessary to correctly draw up a report on the withholding of alimony.

How to properly submit a report on alimony withholding to the bailiff service?

Not all citizens like to interact with the bailiff service. Especially when it comes to accountants who do not have a lot of time to travel to the FSSP services. It is not necessary to submit the report in person; it is enough to send the document by mail - registered mail.

There is also an additional method of referral - submission through a representative by proxy (for example, through a regular courier of an enterprise).

The authorizing document must necessarily contain the right to represent interests in the bailiff service.

When reporting, the bailiff who received the original documents must give the representative a receipt containing the following information:

- date of receipt of the package;

- position of the specialist who accepted the papers;

- list of documents accepted as a report.

The receipt is endorsed by an official. The most popular way to send a report is by registered mail, because this saves time, effort and money for the organization’s employees.

Registration and submission

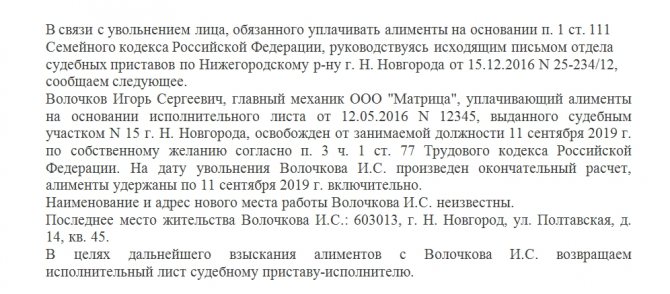

The Family Code provides that a letter to the bailiffs upon dismissal of the alimony worker must be sent almost immediately: no more than 3 days from the date of dismissal.

The personnel officer (clerk, accountant or other person who is responsible for sending such documents) needs to act quickly.

Immediately after dismissal, a letter is drawn up, certified by signatures and seal. After this, it must be recorded in the journal of outgoing correspondence and sent to the addressee - the recipient of alimony and to a specific branch of the bailiff service.

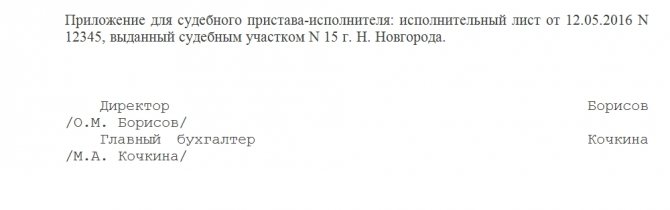

Appendix to the writ of execution for withholding alimony payments

To correctly send the writ of execution, you must attach a covering letter.

There is no specific form for the document, but the structure of the letter should include:

- hat (name of the FSSP department, information about the alimony provider and the claimant);

- a request to initiate enforcement proceedings against a specific person;

- document details;

- applicant's signature.

When submitting a report to the bailiffs, it is necessary to attach receipts, checks and receipts confirming the fact of timely payment of alimony.

If the deduction of funds is made through the accounting department, you should attach documents indicating that a certain amount per child is deducted from the employee’s income. At his discretion, the bailiff may additionally request a salary certificate.

The accountant is not recommended to refuse this request to the FSSP employee, since this paper serves as confirmation of the debtor’s good faith as a payer of alimony.

If the reporting documentation is immediately provided to the bailiff, holding the organization or the payer himself (when he is an individual entrepreneur) to any liability is excluded. Otherwise, sanctions may be imposed for failure to fulfill duties as part of the audit.

Dear readers, the information in the article may be out of date, please take advantage of a free consultation by calling: Moscow, St. Petersburg or using the feedback form below.

Covering letter for the writ of execution for bailiffs

A sample letter to bailiffs regarding a writ of execution can be found below. In Russia, proceedings for forced debt collection through writs of execution often take a long time. In order for the matter to proceed as quickly as possible, the plaintiff must indicate in his application as much information as possible about the debtor.

Deadlines for applying to the bailiff service Historical background The judicial reform of 1864, which was of great importance for the development of legal proceedings in Russia, radically changed the mechanism for executing court decisions, the core of which were bailiffs. During the judicial reform, Laws (Judicial Statutes) were developed and adopted, which were based on the organization of the courts of the French Republic. Judicial statutes regulated issues related to the legal status of bailiffs.

Important of Law No. 229-FZ);

- deductions of one queue within the maximum amount are distributed among all claimants of this queue in proportion to the amounts due to them (clause 3 of Article 111 of Law No. 229-FZ).

Amounts withheld under enforcement documents must be transferred to the claimant within three days from the date of each payment of income to the employee (clause 3 of Article 98 of Law No. 229-FZ). The payment details of the collector must be indicated in the writ of execution. If the writ of execution contains only the postal address of the claimant, then the withheld amounts will have to be transferred by postal order.

In this case, the costs of transferring deductions to the claimant (bank commission, postage) must be borne by the employee. An example of calculating deductions according to executive documents. Salary of an employee of Alfa LLC, A.P. Petrova. is 60,000 rubles. A classic example is alimony, when one of the former spouses is obliged to transfer part of their official earnings to the other. Thus, the accounting department is obliged to regularly deduct money from wages and transfer money to collectors on the basis of the following documents (Part 1, Article 12 of Law No. 229-FZ of October 2, 2007):

- writ of execution;

- court order;

- a notarized agreement on the payment of alimony.

The basis for deductions can only be the original document or its duplicate: deductions cannot be made based on a copy. If an employer receives an improper copy, they can either return it to the sender and request the original, or take no action at all.

Any of the listed documents is transferred to the organization either by post from the bailiffs, or by the employee himself. Attention: This means that employers who pay their employees at the minimum wage must raise their wages from May 1. Duties of bailiffs regarding alimony

The most important duty of all bailiffs is the execution of court orders, decisions, and determinations. This provision is enshrined in federal legislation and various regulatory documents of departmental significance. Among other duties, bailiffs are charged with the obligation to collect alimony and other debts.

The basis for opening an enforcement case is the bailiff receiving a writ of execution for the collection of alimony from the court. As part of the case, the FSSP specialist must ensure:

- carrying out organizational and control measures to implement the requirements of the writ of execution;

- forced retention of debts;

- organization of search activities in relation to the defaulter;

- the use of legal methods of influence on the defaulter: arrest and confiscation of property, suspension of a driver’s license, a ban on traveling outside the country, etc.;

- control measures regarding the spending of alimony payments.

Can bailiffs force the accounting department to provide a report on deductions from debtors?

The accounting department receives resolutions of bailiffs, where one of the paragraphs of each resolution states the following requirement:

“to oblige the person making the deductions to provide the bailiff once a quarter, before the 20th day of the month following the reporting period, with information about the withholding and transfer to PJSC “S” of the debtor’s funds (full name) in favor of the claimant ( Full name or name of the organization of the claimant) indicating the amounts of accrued wages, other payments from which the debt is withheld, the amount of transferred funds and the dates of their transfer with the attachment of payment documents confirming the transfer. The information should be sent in writing (followed by the name of the bailiff department and address).”

Question:

Are the demands of bailiffs justified?

Answer:

In accordance with Art. 6, Art. 9 of the Federal Law of 02.10.2007 No. 229-FZ “On Enforcement Proceedings” (hereinafter referred to as the Law on Enforcement Proceedings), the debtor’s employer is obliged to withhold funds from the debtors’ wages to pay off the debt under judicial acts and acts of other authorized bodies, including by decisions of bailiffs - executors.

Resolutions of the bailiff in accordance with clause 7, part 1, art. 12 of the Law on Enforcement Proceedings are independent enforcement documents that are executed in the manner prescribed by this law (from the Determination of the Supreme Arbitration Court of the Russian Federation dated March 15, 2010 No. VAS-2352/10 in case No. A63-15938/2008-C6-39).

In paragraph 1 of Art. 64 of the Law on Enforcement Proceedings provides for a list of enforcement actions that the bailiff has the right to perform, including: requesting the necessary information from individuals, organizations and bodies, receiving explanations, information, certificates from them (subparagraph 2); carry out an inspection, including an inspection of financial documents, regarding the execution of executive documents (subclause 3); request the necessary information from the parties to enforcement proceedings (subclause 11); perform other actions necessary for the timely, complete and correct execution of executive documents (subclause 17). A similar rule is contained in paragraph 2 of Art. 12 of the Federal Law of July 21, 1997 No. 118-FZ “On Bailiffs”, according to which the bailiff has the right to receive the necessary information when performing enforcement actions , including personal data, explanations and certificates, as well as to give citizens and organizations involved in enforcement proceedings, instructions on the implementation of specific enforcement actions .

Thus, the list of actions of bailiffs is not closed, therefore bailiffs can use a variety of measures that do not contradict the principles of enforcement proceedings to fulfill the requirements of the writ of execution. This, in our opinion, means that, despite the fact that the legislation does not directly establish the right of the bailiff to demand from organizations paying wages, pensions, scholarships or other periodic payments to the debtor to provide information about the deductions made, but such a requirement does not contradict the above-mentioned norms of the laws on enforcement proceedings and on bailiffs.

In addition, in paragraph 8 of Appendix No. 108 “Resolution on foreclosure of wages and other income of the debtor ” to the order of the Federal Bailiff Service dated July 11, 2012 No. 318 “On approval of sample forms of procedural documents used by officials of the Federal Service bailiffs in the process of enforcement proceedings”, the organization’s obligation to provide a report is expressly provided for:

| “To oblige the person making the deduction to submit to the bailiff once a quarter before the 20th day of the month following the reporting period, information about the deduction and transfer of _______________________ (name of organization) debtor's funds ________________________________________ (full name of debtor) in favor of the claimant ________________________________________________ (full name (name) of the claimant) indicating the amounts of accrued wages, other payments from which the debt is withheld, the amount of transferred funds and the dates of their transfer, with the attachment of payment documents confirming the transfer.” |

Some regional FSSP of Russia (for example, in the Ivanovo and Tomsk regions) have developed a “Memo for managers and accountants of organizations (enterprises) on the issues of withholding and transferring funds under executive documents of various categories,” in which the requirement to provide a report is also directly stated:

“ The employer is obliged to provide monthly information to the bailiff about the deductions made and the transfer of funds to the recoverer in the manner specified in the resolution on foreclosure of wages.”

According to clause 4. Art. 14 of the Law on Enforcement Proceedings, the decision of the bailiff or other official of the bailiff service is subject to execution within the period specified in the decision , and can be appealed in the order of subordination to a higher official of the bailiff service or challenged in court. That is, if an organization believes that the bailiff’s demand to provide a report violates its rights, it has the right to apply to the arbitration court to declare it illegal. Unfortunately, we were unable to find a single judicial act that would analyze the legality of the bailiff’s demand under consideration.

We think that in this case, when filing such an application, the prospect of a court decision in favor of the organization is extremely small, since the requested report is necessary for the bailiff to monitor the fulfillment of the requirements of the executive documents, and it is up to the court to argue what the violation of the rights and legitimate interests of the organization is. which the report is requested is almost impossible.

In turn, violation of the legislation on enforcement proceedings is an administrative offense provided for in Article 17.14. Code of the Russian Federation on Administrative Offenses, in accordance with paragraph 1 of which:

“violation by the debtor of the legislation on enforcement proceedings, expressed in failure to comply with the legal requirements of the bailiff, provision of false information about his rights to property, failure to report dismissal from work, a new place of work, study, place of receipt of a pension, other income or place of residence, with the exception of the violation provided for in Article 17.17 of this Code - entails the imposition of an administrative fine on citizens in the amount of one thousand to two thousand five hundred rubles; for officials - from ten thousand to twenty thousand rubles; for legal entities - from thirty thousand to one hundred thousand rubles.”

Failure by the debtor to comply with the requirements contained in the writ of execution within the period established by the bailiff after the issuance of a decision to collect the enforcement fee shall entail the imposition of an administrative fine on officials - from ten thousand to twenty thousand rubles; for legal entities - from thirty thousand to fifty thousand rubles (Article 17.15 of the Code of the Russian Federation on Administrative Offences).

Thus, in our opinion, the bailiff’s requirement to provide a report on the deductions made should be fulfilled within the time frame and in the manner prescribed in the relevant resolution.

Bailiffs' rights

To protect the interests of minor children who are entitled to receive financial support, alimony bailiffs have the following powers:

- oblige the parties involved in the case to appear at the FSSP office;

- accept information, documentation, explanations and other necessary information from participants in accordance with the requirements of the law;

- request the necessary information from representatives of local and federal authorities, from legal entities that are the debtor’s employers;

- visit the place of work and residence of the defaulter to inform about the property owned by him;

- draw up an inventory and seize property, the value of which compensates for the funds lost by the other party and the costs of proceedings under the writ of execution;

- seize the debtor's bank accounts so that the debt can be withdrawn from them;

- if necessary, involve the Department of Internal Affairs - in the event of the disappearance of the defaulter, the bailiff will issue a request to search for him;

- initiate criminal proceedings against a willful defaulter on the basis of Art. 175, 315 of the Criminal Code of the Russian Federation.

The bailiff has the right to request from the employer a report on the withholding of alimony payments. If there is no response to the request, then penalties in the amount of up to 100 thousand rubles will be imposed on the legal entity, and up to 20 thousand rubles on the manager. In order to avoid fines, you can draw up a report to the bailiffs on the withholding of alimony for the quarter, a sample of which is presented below.

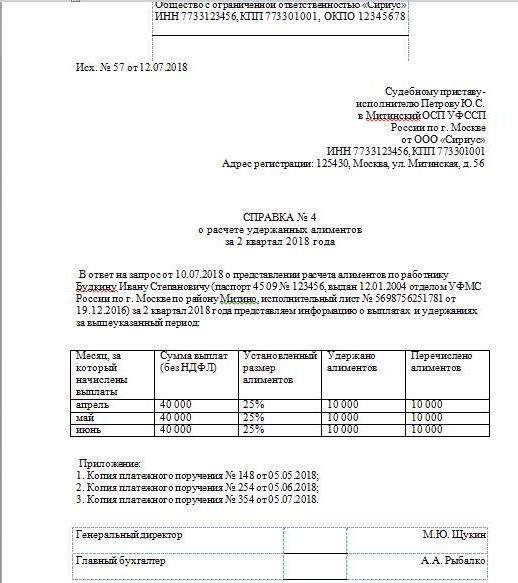

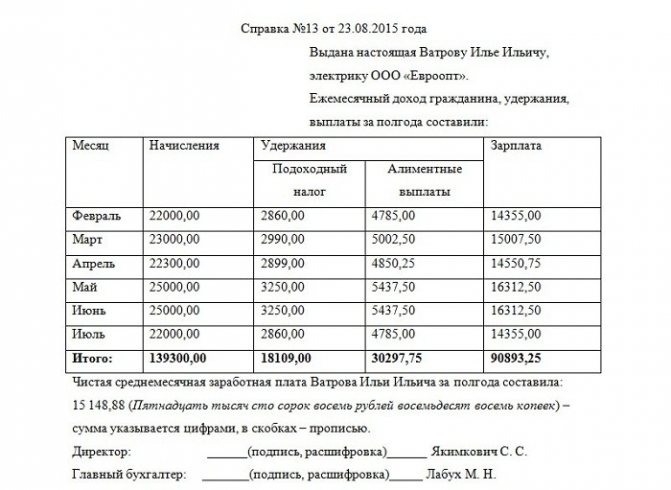

Note! The report to the bailiffs on the withholding of alimony must necessarily contain information about accrued wages, the amount of payments and the amount withheld. Below is a sample quarterly payroll deduction report.

Certificate of deduction from salary

Receipt procedure

A certificate of withholding under a writ of execution is issued by the employer or another institution that makes periodic payments to the debtor. To obtain it, you must contact the accounting department at your place of work with a written application for the issuance of the required certificate. The application must contain:

- a request to issue a certificate;

- the period of time for which deductions must be entered.

The document preparation period does not exceed three working days. There are often situations when data on the amount of deductions from the debtor and the bailiff differ, in which case the bailiff can independently request a certificate from the place of work.

In addition, the right to receive information about the amount of the amount withheld from the debtor is vested in:

- judiciary;

- tax service divisions;

- collector.

The employer has no right to refuse to issue a certificate, and if the official’s request is ignored, administrative liability may be imposed.

When to contact the bailiff service and where are they located?

The alimony recipient has the right to appeal to the FSSP from the moment of receipt of the writ of execution in court until the child reaches 18 years of age. Until the age of 21, a citizen is given the opportunity to collect debt on alimony payments for the previous 3 years.

That is, the law does not limit the time for the alimony recipient to submit the writ of execution to the FSSP. After receiving the court document, the bailiff will initiate legal proceedings. Within its framework, a specialist from a government department will determine the enforcement fee, the amount of indexation and penalties for withdrawn alimony payments.

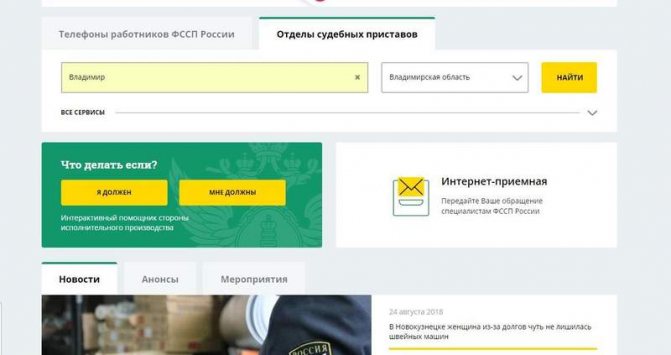

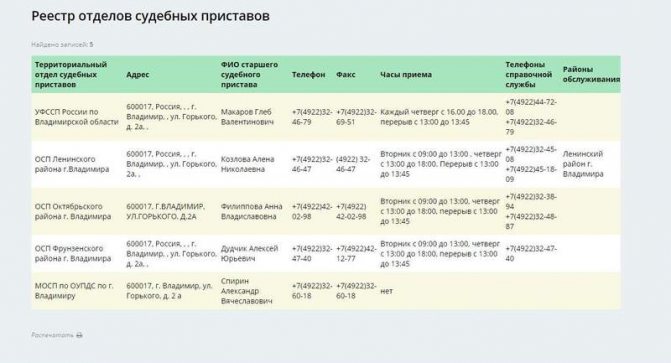

FSSP branches are located in all districts and urban districts of the country. On the page of the official website of the state structure you can find out the address of the nearest unit. To do this, you will need to select the “Bailiff Departments” tab on the title page, enter the name of the city (locality) in the search bar, select your region, region, district from the drop-down list and click “Find”.

After processing the request, a page will be loaded with detailed information about all branches in the city with addresses and contact information.

Finding the required FSSP branch

What is needed to open enforcement proceedings

To open enforcement proceedings, the recipient of payments for the maintenance of minors will need to submit the following documentation to the bailiff:

- personal passport of a citizen of the Russian Federation;

- document confirming the birth of the child;

- Bank account details for crediting funds withdrawn from the debtor:

- writ of execution from the court: court order, decision, written agreement on the payment of alimony with notarization, or writ of execution.

If desired, you can make copies of documents.

Sample letter to bailiffs regarding a writ of execution

Good afternoon The restriction and arrest are lifted in court. If the debtor was not at the court hearing and was not notified by the FSSP about the enforcement proceedings, and this often happens, then he can successfully appeal the decision. The trial will be forced to go through again, but for some time the seizure of the vehicle will be lifted. Executors do not have the right to detain a vehicle if it is used by a disabled person or the debtor’s main income depends on it. But this norm applies when the cost of the car does not exceed 100 minimum wages. You can drive a car with arrest warrants. To do this, you only need an MTPL policy issued in the name of the old owner. You must enter it as a driver authorized to drive. According to the general rule enshrined in Art. 46 of the Federal Law “On Enforcement Proceedings”, collection under enforcement documents is applied primarily to the debtor’s funds in rubles and foreign currency and other valuables, including those located in banks and other credit organizations. If the debtor does not have sufficient funds to satisfy the claims of the claimant, the foreclosure is applied to other property belonging to the debtor (including the debtor’s share in property that is in common ownership), with the exception of property that, in accordance with federal law, cannot be subject to foreclosure has been made. Thus, when executing executive documents against citizens, the penalty cannot be applied to the property specified in the law

.

According to Art.

446 of the Code of Civil Procedure of the Russian Federation, recovery under executive documents cannot be applied to property owned by a citizen , in particular,

to residential premises (parts thereof), if for the debtor and members of his family living together in this premises of the debtor, it is the only one suitable for permanent residence in the premises

, with the exception of the property specified in this paragraph, if it is the subject of a mortgage and foreclosure may be taken against it in accordance with the legislation on mortgages (as amended by the Federal Law of December 29, 2004 N 194-FZ). Read carefully with a court decision in enforcement proceedings.

Take photographs of all documents in production. If you do not agree with the production materials. File a complaint with the chief bailiff of your area against the bailiff who is handling your case. Print on two sheets of paper, one for the institution, the other for you with a mark (date, signature of the person who accepted the application) stamp of acceptance. If you do not receive a response within 30 days, complain to the FSSP Office in your region. If you do not receive a response, contact the court at your place of registration with a statement to challenge the actions of the bailiff. The MIP legal team will draw up all complaints and statements for you using the MIP promotional code 9. Consultations are free. Document preparation services are paid. Representation of interests in court is also paid. For the cost of services, please call +7 (499) 938-82-06 Moscow, Staropimenovsky Lane 18 Attention! Promo code discounts are no longer valid

What to do if the bailiffs have lost the writ of execution, how to restore it?

In the activities of the FSSP on alimony, losses of enforcement documents may occur; this can happen accidentally or intentionally. If the bailiff managed to lose the sheet, then the alimony recipient can restore the court decision. The duplicate will have equal legal force to the lost document.

How to obtain a duplicate writ of execution for alimony? It is enough to contact the court where this document was originally issued and draw up a corresponding application. To issue a duplicate, you will have to pay a fee; its amount must be found out directly in court; it may vary depending on the region. A sample application is provided below.

Consequently, the work of bailiffs on alimony should be entirely aimed at protecting the legitimate interests of the minor. If the alimony recipient has doubts about this, it is better to first try to resolve everything through negotiations and contact the department management.

View more:

Materials Postings by Arrival MAIN PAGE TAX NEWS ACCOUNTING NEWS ACCOUNTING ANNUAL REPORT AND…

Is it often punished under paragraph 1 of Art. 126 Tax Code of the Russian Federation?P. 1 tbsp. 126 Tax Code of the Russian Federation...

Transactions with real estate for a fee or on a contract basis. Subclass 68.3 contains two groups of codes: ...

Double TaxationDouble taxation is the simultaneous imposition of the same taxes on income in different countries. Double taxation is caused by...

Department of Rosprirodnadzor for the Crimean Federal District, Kerch Selection of a territorial bodyCentral apparatus of Rosprirodnadzor02 Department of Rosprirodnadzor for…

Commentary on Methodological recommendations for calculating alimony debts and checking employers

The Bailiff Service has approved new Methodological Recommendations regarding the collection of alimony under writs of execution. They have finally replaced the Temporary Instruction, which has not been in effect since

The new manual is aimed primarily at bailiffs. However, it will also be useful for the debtors themselves; in particular, it has a separate section devoted to the calculation of alimony from entrepreneurs. Organizations that withhold child support from employees should also familiarize themselves with these recommendations. If only for the reason that they contain rules for checks by bailiffs of debtors' employers. Now we will go through the most important points for accountants.

What is a writ of execution

Deductions under writs of execution from wages are:

- On child support for minors

- Child support for elderly relatives

- For compensation for harm to physical or moral health

- For reimbursement of loans, loans and interest on them

- For compensation of damage caused to organizations

According to the law, as soon as a company receives a writ of execution for its employee, it is obliged to withhold from him a certain amount of wages or a fixed amount.

This obligation covers all employee income, except those that fall under the regulations of Art. 101 of Law 212-FZ.. In addition, the amounts that the organization pays as a commission for making transfers are withheld from him.

You can deduct a certain percentage of all accruals from your salary - up to 20% and up to 50% (in some cases). The exception is payments under writs of execution:

- In the form of child support

- For compensation for damage to health

- For compensation of funds to persons who have lost their breadwinner

- For payments to compensate for damage caused during a crime

These transfers are not subject to these restrictions. Obligations under the documents must be repaid in full (except for alimony for minors - limited to 70% of total earnings), despite the amount of the employee’s income.

The organization is obliged to transfer the amounts of deductions within three days after the payment of the employee’s salary.

Deductions under executive documents are made after taxation of the employee’s income, that is, minus personal income tax. When employees receive deductions that completely remove income tax, withholding is made from the entire amount.

When withholding on several writs of execution, it is necessary to adhere to the order established by Law 229-FZ of 02.10.07. If it is not possible to pay off obligations under all executive documents, it is necessary to distribute contributions proportionally among everyone.

Bailiff checks

A bailiff can come to the debtor's employer with an inspection. Such inspections are carried out, as a rule, either at the request of the recipient of alimony, or in the event of a violation by the accounting department of its duties. For example, if the bailiff does not receive the necessary information from the organization on time.

Thus, having received the order of the bailiff and a copy of the writ of execution, the accountant on the same day must send the bailiff a return notification of receipt of documents with the seal of the organization and his signature. The form for this notification is usually attached to the documents received from the bailiff. If the bailiff does not receive such notice within a reasonable time, this may be a reason for an inspection.

The bailiff cannot check everything he wants, but only what is related to the withholding of alimony. And we remind you that they are held on the basis of:

- writs of execution;

- court orders;

- notarized agreements on the payment of alimony.

It took the bailiffs 12 years to adopt new recommendations for the collection of alimony. But they do not resolve absolutely all issues.

Please note that voluntary statements by employees regarding the transfer of alimony do not apply to enforcement documents. Therefore, the bailiff should not check the correctness of the calculation and transfer of such amounts.

If the bailiff discovers that the organization is violating labor tax laws, then he must report this to Rostrud and/or the tax service. It is interesting that, as an example of a tax violation, the manual provides payment to the debtor of a salary in an amount below the industry average.

Based on the results of the inspection, the bailiff will draw up If it turns out that the organization calculated alimony incorrectly, the errors will need to be corrected.

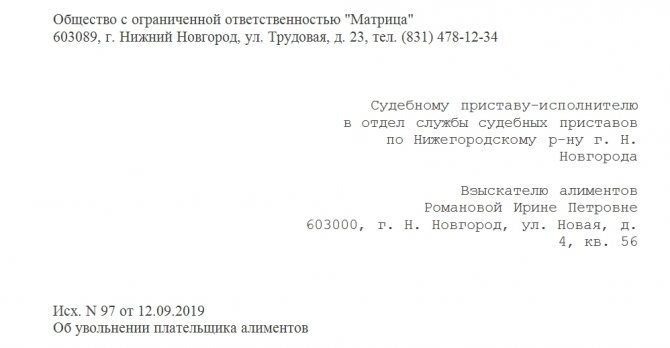

Components of a letter

The document must contain an introductory, main and final part. The introduction must contain the following information:

- Details of the organization from whose staff the alimony payer was excluded: address, telephone numbers, zip code, etc.

- Direct indication (appeal) to a specific department of bailiffs. It is not necessary to indicate the name of a specific bailiff (it is usually unknown). There is enough separation here, indicating the place of attachment. This will be enough to correctly compose the letter to the bailiffs.

- Appeal to the alimony collector. You should send a letter not only to the bailiffs, but also to the specific recipient of alimony. And in this case, the data of the full name, surname, patronymic, as well as the address with an index must be provided. Without indicating the recipient of alimony, the letter completely loses its meaning and legal force.

- Date the document was signed.

- His number. It is he who is indicated in the registration documentation. In turn, these records will serve as evidence that the correspondence was sent.

- Name of paper.

The main part, as is customary in business correspondence, should be specific, complete and reasoned. The introduction of the main body of the letter should contain the following information:

- For what reason is the letter being sent? Everything is clear here - dismissal.

- A link to a document obliging the employee to pay alimony. In the given sample letter to the bailiffs when dismissing an alimony worker, this basis is paragraph 1 of Article 111 of the RF IC. It is this that is referred to in the vast majority of cases in letters of alimony payment.

- Link to outgoing letter from bailiffs. She will explain the essence of the issue, the reason that prompted the organization to begin writing this letter. Dismissal is also a reason in itself. But if a request was sent from the bailiff service, then you need to refer to it, indicating the date and number of the corresponding letter.

After the preamble (immediately after the phrase “we inform the following”), there is the text of the message itself, including:

- Full name of the dismissed employee.

- The position, specialty for which he was previously hired.

- On the basis of which the employee pays alimony. The number and date of the writ of execution on the basis of which he is obliged to do this are indicated.

- Which judicial district issued the writ of execution (it would be logical if the letter was sent exactly to the district in which the paper on the collection of alimony was issued).

- When the dismissal occurred (date).

- For what reason did the employee quit? If this is a voluntary dismissal, then there must be a reference to clause 3, clause 1, part 77 of article 77 of the Labor Code. If for other reasons, then the references to legislation will be different, but their presence is highly encouraged by regulatory authorities when conducting inspections. This makes the process more convenient.

- Has the final payment been made? If not made and there are debts, then be sure to indicate the reason for their occurrence.

- Final settlement date (if any).

- The name of the address of the former employee's new place of work. Even if before his dismissal he did not inform where he was transferring or not transferring. In any case, the phrase about the place of work must be present, recording the good faith of the employer, his willingness to provide any assistance to the bailiff service and other authorities involved in the collection of alimony.

- Place of residence of the alimony provider, which was recorded in the organization’s papers. It is indicated as the last place of residence.

- Information that the writ of execution is sent to the bailiff for further collection of alimony.

The text of the main part ends with this phrase. The conclusion is quite succinct. If a former employer wants to formalize a letter to the bailiffs in a legally competent manner, then it will be enough to sign the accountant and manager and the seal of the organization at the end, as well as provide links to the attached documents. The latter are a writ of execution and a copy of the order to dismiss the employee (this is the minimum set of attached papers).

Alimony - only from real income, and not from all

Some accountants incorrectly calculate alimony in a situation where the employee has had absenteeism. Referring to the norms of the old Temporary Instructions, they play it safe and take a full month’s salary to calculate alimony (that is, an amount greater than what the employee received

However, this approach is incorrect, and it is not surprising that the new manual no longer contains such provisions. So the employer must withhold alimony only from the amounts of income actually accrued to the employee. Of course, alimony is calculated from the amount remaining after personal income tax withholding.

At the same time, there is no need to calculate alimony from the employee’s “unearned” income. For example, from payments to an employee related to the purchase of his property, be it a computer or an apartment

How to calculate alimony if there are a lot of debts

It happens that one employee receives several enforcement documents. In this case, the accountant must determine the sequence in which to repay the employee’s debts. First, you need to withhold amounts to pay off first-priority debts. This also includes alimony. But, besides them, the requirements of the first priority include the requirements

- for compensation for harm caused to health;

- for compensation for damage in connection with the death of the breadwinner;

- for compensation for damage caused by a crime;

- on compensation for moral damage.

Let us remind you that when collecting alimony for minor children and other first-priority claims, the total amount of withholding cannot exceed 70% of the salary and other income of the debtor. In other cases, you can keep no more

And if the total amount that can be withheld from the employee’s salary is not enough to pay off all first-priority debts, the accountant must himself distribute the amount withheld from the employee’s income among all of his first-priority debts (in proportion to the amounts of debts

For example, an accountant has two writs of execution for employee Petrov. One must send 15,000 rubles to citizen A. (the mother of his first child), and 30,000 rubles to citizen V. (the mother of his other two children) according to the other. Only 20,000 rubles can be withheld from employee Petrov’s salary for August 2012. In this situation, citizen A. needs to send 6666.67 rubles. (15,000 rubles x 20,000 rubles / (15,000 rubles + 30,000 rubles)), and for citizen V. - 13,333.33 rubles.

The procedure for registering deductions under a writ of execution

The presence of a writ of execution is sufficient grounds for withholding money from wages. The employee’s written consent is not required, nor is an organization order. The presence of the following documents also presupposes unquestioning fulfillment of the requirements specified in them:

- court order;

- resolution of the executive authority regarding an administrative offense;

- a completed act upon completion of the work of the labor dispute commission;

- employee agreement for voluntary transfer of alimony payments (certified by a notary);

- an application written by an employee for payment of alimony for children under 18 years of age and other deductions on a voluntary basis.

The amounts specified in the writ of execution are subject to withholding every month exactly on the date of accrual of the employee’s salary.

The following may also be deducted from an employee's income:

- bank commission for money transfer to third parties;

- amounts paid for postal services if, for example, alimony was sent by postal order.

These deductions are made specifically from the employee’s salary, not from the amount of deductions themselves.

Procedure for an accounting employee:

- The amount is calculated for each type of earnings and additional payments, not counting funds from which deduction cannot be made according to the writ of execution;

- Personal income tax is withheld;

- The amounts of payments to third parties are calculated and transferred to their account within 3 days after the payment of the employee’s salary;

- Data on deductions is entered into account 76 for separate subaccounts.

Indexation of alimony established as a percentage of the subsistence minimum

It happens that alimony is established not as a percentage of the employee’s income, but as a fixed amount of money. And in this case, the accountant in the writ of execution may see not a specific amount, but a formula into which the current value of the subsistence level established by the subject of the Russian Federation must be substituted. Moreover, this minimum must be taken at the place of residence of the person receiving alimony (and not at the subject where the employee himself lives or the organization is located

You can follow the Russian cost of living: official website of Rosstat → Population → Standard of living → Living wage

The size of the subsistence minimum should be determined in the subject quarterly. Moreover, it is also necessary to take into account the socio-demographic group to which the alimony recipient belongs. If in the subject of the Russian Federation where the alimony recipient lives, the cost of living has not been established for his socio-demographic group, then you need to focus on the subsistence minimum for this group, established in general by Russia.

Regional values of the cost of living must be monitored according to the laws of the constituent entities. For example, for this you can use the database

Please note that according to the Family Code, indexation of alimony is provided only in proportion to the increase in the cost of living

From this formulation, the bailiff service concluded that if the cost of living has decreased, then alimony must be withheld in the amount in which it was withheld in the previous quarter.

The cost of living rarely, but does, decline in some regions. Therefore, the accountant needs to be careful and not trust the program to calculate alimony or incorporate a complex algorithm into it that takes into account this feature.

It happens that in the writ of execution the amount of alimony is tied to the minimum wage. To calculate such alimony, the manual prescribes the use of the federal minimum wage, and not the regional one. Let us remind you that from 06/01/2011 it is

By the way, accountants may have other difficulties when calculating alimony tied to the subsistence level. After all, as a rule, the value of such a minimum becomes known not in the first month of the quarter, or even in the last, but later. And how much later depends solely on the speed of its approval by a specific subject of the Russian Federation. The Methodological Recommendations say nothing about how to withhold alimony in such cases. And when calculating alimony, the accountant has no choice but to calculate alimony using the amount of the last subsistence level (of course, if it did not decrease compared to the previous quarter).

When establishing alimony in a fixed amount, it will have to be recalculated depending on the increase in the cost of living

For example, at the beginning of September 2012, in many regions the cost of living had not yet been approved even for the second quarter - there is only data on its size for the first quarter. And then, when calculating alimony for September, you will have to focus on the cost of living for the first quarter.

Then, if regional authorities approve an increased cost of living for the second quarter, the safest way is to recalculate alimony payments for April - June and withhold them. And when data appears that the cost of living has been set at an increased rate in the third quarter, the accountant will need to recalculate alimony for July - September. But if the cost of living decreases or remains the same, recalculations will not be required. But in general, you can sympathize with the accountant: he probably has enough work even without these recalculations.

If you do not recalculate the alimony withheld based on the latest data on the cost of living, the bailiff may consider such non-recalculation a mistake.

If an employee quits and then becomes aware of an increase in the cost of living, recalculation of alimony will be the responsibility of the bailiff.

Accounting for withheld alimony and reporting on it

When dismissing a debtor-employee, you must immediately inform the bailiff about this and return him the writ of execution with a note of all amounts withheld from the debtor during his work in your organization. Indicate:

- amount of deductions;

- each amount withheld, the number of each payment (receipt) with the date of transfer;

- balance of debt.

This record must be certified with the seal of the organization and the signature of the official.

ADVICE

So that at the time of dismissal of an employee-debtor you do not have to bring up primary documents for several years, it is better to keep a separate register for each such debtor to record the withheld and transferred amounts of alimony.

When to confirm a hold

In some cases, a citizen is required to officially confirm the fact that funds have been withheld from him under a writ of execution. Most often, such confirmation from the place of work is required:

- for trial;

- to the tax authorities;

- to a bailiff carrying out other enforcement proceedings;

- to social protection authorities to receive subsidies and other social support measures.

There may be other life situations when this document is required and the law provides for the possibility of obtaining it because the debtor has the right to prove his good faith when repaying the debt.

Do I need to report to the bailiffs about the payment of alimony?

The Law on Enforcement Proceedings dated October 2, 2007 No. 229-FZ does not contain provisions on the debtor’s obligation to promptly report to the bailiff service. However, if the payer does not inform the bailiff about the payments, he is authorized to seize the debtor’s accounts and property and force a write-off.

Let's consider two situations when you need to report to the bailiff.

Alimony is paid by the employer

A common situation is when a writ of execution is transferred to the employer. The organization's accounting department independently calculates and withholds alimony from the payer's salary.

The bailiff is guided by Methodological Recommendations No. 01-16, approved by the FSSP on June 19, 2012. Section 7 of the document provides the procedure for auditing the accounting departments of organizations. They are carried out at the initiative of the service or on the basis of an application from the claimant.

At the request of the SSP, the accounting department provides a report on alimony. The specialist checks the following points:

- are writs of execution recorded in a special journal;

- are the executive documents stored correctly?

- whether alimony is calculated correctly;

- whether the deadlines for withholding alimony payments from the payer’s wages are observed;

- Are postal orders, receipts, and payment orders filled out correctly?

Based on the results of the inspection, a report is drawn up. Reporting documentation is attached to it. If violations are identified in the actions of accounting employees, the issue of holding them accountable is decided.

Bailiffs are empowered to report to the territorial bodies of Rostrud and the Federal Tax Service about violations of labor and tax legislation identified during the inspection. For example, based on facts of payment to the debtor of wages below the minimum wage.

The payer independently lists the contents

Many alimony payers agree to comply with the court decision voluntarily. Therefore, having received a resolution to initiate enforcement proceedings, at a personal meeting with the bailiff they agree on the procedure for informing the SSP about the fulfillment of their obligations.

In practice, maintenance is voluntarily paid to the claimant in the following ways:

- By transferring cash into the hands of the alimony recipient, a receipt is issued indicating the purpose of the payment, the specific amount, and the details of the writ of execution.

- By postal transfer – a receipt is issued by the post office.

- By bank transfer – when transferring funds through a bank branch or online banking, the purpose of the payment is indicated.

In all cases, the payer must collect receipts, checks and receipts to attach to the alimony payment report.

Certificate for bailiffs from the place of work - sample

Good afternoon Complain to the Central Bank of the Russian Federation https://www.cbr.ru Internet reception https://fssprus.ru Can bailiffs seize a card Can bailiffs seize a credit account Which accounts can’t be seized by bailiffs Transfer property to relatives. You must show documents confirming ownership of the property (checks, receipts). Show documents proving ownership by another person: sales receipts, contracts, deeds of gift, electronic receipts, bank statements, deeds of inheritance, draw up a simple purchase and sale agreement, etc.; in the absence of any documents, it is necessary to ask employees to send requests to organizations where they can confirm the ownership of a particular item. This procedure may take a long time, during which time the property will be seized; when it is impossible to determine ownership, there is a right to demand the exclusion of property, exemption from seizure and protection from sale. To do this, you need to send an application of the established form and wait for the start of the case in court. It is important to note that the person sending such a letter can be not only the owner of the thing, but also its pledgee or another person interested in it. The list of what will remain in the possession and use of the debtor in any case is approved by Federal Law No. 229 of 02/01/2008. The list is as follows: an apartment, house or other residential premises, which is considered the only place of residence (if it is not the subject of collateral); personal items for everyday use in the everyday sense; personal medals, orders and other awards; a means of transportation used to earn income or work; materials for heating and cooking; finances equal to the cost of living established in the region. Any unlawful step by a representative of the FSSP can be appealed within 10 days by the party against whom enforcement proceedings have been opened or by another person whose rights have been violated. The claim is written to the head of the service or directly in the form of a lawsuit in court. Each case is considered separately, and if abuse of authority is proven, the items will be returned to the applicant. According to the Labor Code of the Russian Federation, the amount of salary withheld on account of the debt is calculated in the following proportions: according to the law - 20% of the salary; according to federal law or court decision - 50% of salary; exceptions to the rules (for example, alimony) – 70%. The most common rate is 50% withholding from wages towards credit debt. If the borrower has children, then the amount of withholding is reduced: The presence of 1-2 children - bailiffs do not have the right to withhold more than 30%; The presence of a child studying at a university not on a budgetary basis - 30%. Death of a spouse and presence of minor children – 25%. Death of a spouse and absence of minor children – 50%. According to the law, the court cannot withhold from the following types of profit: 1. Maternity capital and other payments for child support; 2. Compensation for work in hazardous industries or in difficult climatic conditions; 3. Compensation for damage to health received in connection with the work activity of the debtor (paid by insurance companies or employers); 4. Cash payments to the family of those killed at work; 5. Payments to a citizen caring for a group I disabled person; 6.Accruals during the period of dismissal of an employee. In accordance with the norms of clause 12, part 1, art. 101 of the Federal Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ for benefits to citizens with children, accrued from the federal or regional budget (including extra-budgetary state funds - FSS, Pension Fund and Compulsory Medical Insurance Fund) cannot to be levied under enforcement documents. Article 446 of the Civil Procedure Code of the Russian Federation and Article 101 of the Law on Enforcement Proceedings contain information about what property is not subject to seizure: the only housing, if it is not purchased on credit and is not mortgaged (when it comes to a private house, then the land on which it it’s worth it, they also can’t arrest); basic necessities, personal belongings, household appliances as part of ensuring normal living conditions; things for performing professional duties, the cost of which does not exceed 100 times the minimum wage; domestic animals and poultry kept not for profit, as well as pastures, feed and buildings necessary for them; seed fund for future plantings; firewood, coal and other substances necessary for heating premises for one season; transport belonging to a disabled person and necessary for him to move; honorary badges, medals, orders, etc. belonging to the debtor. Knowing what property cannot be seized, it is worth remembering that there is a fairly extensive list of benefits, additional payments, payments protected from collection, including: compensation for health damage;

payment for the loss of a breadwinner, for injury or death while performing a professional duty, for victims of disasters; subsidy for caring for a disabled person; federal surcharges for the purchase of medicines, travel expenses, etc.; alimony; travel and depreciation allowances; benefits for birth, death (funeral benefits) or on the occasion of marriage; social insurance payments (exceptions - pensions and sick leave); child benefits and maternity capital; state assistance to victims of a terrorist attack or the death of a close relative; financial assistance provided by philanthropists; compensation for a tourist package. Carefully read the court decision in enforcement proceedings. Take photographs of all documents in production. If you do not agree with the production materials. File a complaint through the office, the chief bailiff of your area against the bailiff who is handling your case. Print on two sheets of paper, one for the institution, the other for you with a mark (date, signature of the person who accepted the application) stamp of acceptance. If you do not receive a response within 10 days, complain to the FSSP Office in your region. If you do not receive a response within 10 days, contact the court at your place of registration with a statement to challenge the actions/inactions of the bailiff. The MIP legal team will draw up all documents, complaints and statements for you using the MIP promotional code 9. Consultations are free. Document preparation services are paid. Representation of interests in court is also paid. For the cost of services, please call +7 (499) 938-82-06 Moscow, Staropimenovsky Lane 18 Attention! Promo code discounts are no longer valid

How to write a report correctly?

The law does not contain mandatory requirements for drawing up a report on alimony, so it can be compiled in any form.

If alimony is withheld by the employer

After receiving the writ of execution, the accounting department of the organization in which the payer works sends a notification to the SSP that the document has been accepted for execution. When a request is received from the service, a report must be prepared.

Each employer has its own documentation practices. Typically, a child support report is prepared in the form of a certificate that contains the following information:

- name of the employing organization;

- information about the payer;

- details of the writ of execution;

- period and total amount of recovery;

- monthly breakdown of the amount;

- information about the recipient of payments;

- data on the presence or absence of debt;

- signatures of the head of the organization and the chief accountant.

If the payer intends to report on the fulfillment of alimony obligations on his own, he has the right to ask the accounting department to issue him a certificate to present at the place of demand.

If the payer independently lists the contents

In the case when the payer transfers alimony on his own, he must inform the bailiff monthly about the transfer of funds in favor of the recipient.

You must write a letter indicating the following information:

- names of the BSC;

- data on enforcement proceedings;

- information about the debtor and recipient;

- information about the purpose of the funds;

- information about the period and amount of payment;

- payment document details.

Payment documents (checks, receipts, bank account statements) are attached to the letter. If the payment was made via Internet banking, you can attach a screenshot of the SMS message. It should be clear from it that the purpose of the payment is the payment of alimony.

Disputes often arise due to the fact that the payment document does not indicate the purpose of the payment . In such a situation, you will have to contact the recipient to confirm that the money was transferred to pay alimony. We recommend that payment documents be drawn up in such a way that they show that the payer has fulfilled alimony obligations for a specific period.

Payment of funds under a writ of execution

If a mother receives financial assistance for her children under a writ of execution, data on the funds paid can be obtained in two ways:

at the spouse’s place of work;- with the help of bailiffs.

What to do if the accounting department refuses to issue the required document, citing confidentiality of information? The request must be made in writing. To ensure that the enterprise does not refuse to accept it, you must send the request by mail, by registered mail with notification.

It is convenient to receive a certificate by mail if the payer works in another city and the second parent does not have the opportunity to go to receive the document in person.

If the company still refuses to provide data on alimony payments, you can turn to bailiffs for help. Judicial authorities have the right to request information on financial assistance to dependents from a company, private enterprise and other companies.

Then the bailiff will be obliged to provide the answer in writing. What to do if the bailiffs are inactive and refuse to contact the organization for documents? The woman, in this case, has the right to write a complaint against them to the senior bailiff. If the situation does not change, you can contact the prosecutor's office.

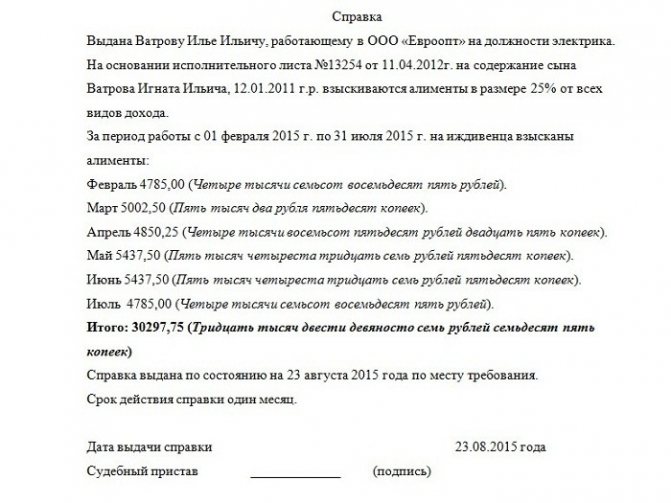

Sample certificate of alimony from place of work

Sample certificate

Sample certificate of alimony from bailiffs

Sample certificate

Voluntary agreement

If the parents have reached an agreement in raising children after a divorce and have entered into an alimony agreement according to all the rules, then this document has the force of a writ of execution. The payer submits the agreement certified by a notary to the accounting department at the place of work to collect funds for child support.

If the alimony provider transferred the money personally, it is necessary to formalize the receipt of funds in writing in order to provide the bailiffs with receipts on the basis of which a certificate of alimony payments is issued.

Validity period of the certificate

It is believed that documents on withholding funds in favor of children do not have an expiration date, because the amount of payments for the same month will not change.

But social protection authorities are interested in receiving reliable and up-to-date information. Therefore, usually the certificate should be taken for the nearest period; usually the amount of funds for the past six months is calculated.

If alimony payments are not made

In the event of debt formation, when the payer evades providing financial assistance to children, the alimony document is replaced by a certificate of non-payment of alimony. This document is issued by bailiffs, who also indicate the period during which there were no deductions in favor of dependents. Moreover, the certificate can only be used for a month.

If a woman has reached an agreement with her ex-husband, he provides the family with financial support, but the agreement has not been certified by a notary? In this case, a certificate of alimony payments will not be issued.

How to submit a report to the SSP?

You can submit the report in person, entrust this issue to a representative, or send it by mail.

Personally

If the payer decides to report to the bailiff in person, he will need to visit the SSP and submit documents to the office. We recommend preparing the report in two copies. One with supporting documents is handed over to the specialist. On the second one, he must put an incoming stamp with the date and signature. In the future, it will serve as evidence that the debtor properly reported to the bailiff.

Through a representative

It is not necessary to visit the SSP in person. The payer has the right to issue a notarized power of attorney for the representative. When handing over documents, the bailiff must give a receipt with the following information:

- date of receiving;

- the official who received the report;

- list of documents received;

- signature of the official.

It is advisable to use the services of a representative in the case when the payer cannot appear at the SSP in person. For example, he is on a business trip, is sick, and cannot leave his workplace. In other cases, you should not spend money on notary services for drawing up a power of attorney and paying remuneration to the authorized person.

By mail

The payer has the right to send a report by mail. It is necessary to issue a postal item with a notification and a list of attachments. Upon receipt of the letter, the SSP specialist will put a date and signature on the back of the notice. This document will be proof that the report was sent to the bailiff.

Let's sum it up

Thus, the legislation does not contain requirements to report to the bailiff about the payment of alimony . At the same time, the payer is interested in ensuring that the bailiff does not have any claims against him regarding the proper fulfillment of obligations. Therefore, it is recommended to agree with the BSC in what form it will report. If alimony is transferred by the employer, the bailiff independently conducts checks. The payer can insure himself and transfer certificates of withholding of alimony received from the employer.

Articles recommended for you:

Sep 10, 2019adminlawsexp

vote

Article rating