What is needed for collection

As a general rule, to recover legal costs from the defendant it is necessary:

- submit a corresponding demand to the court. This can be done both during the consideration of the case and after its completion;

- submit to the court documents confirming the incurrence of expenses;

- provide documents and explanations from which it follows that the expenses were incurred specifically in connection with the court case.

However, the amount of the state duty is paid before going to court and proof of payment is attached to the statement of claim. Therefore, in order to recover from the defendant the costs of paying the state duty, there is no need to provide any additional evidence. It is enough just to indicate the demand for reimbursement of state duty by the defendant in the statement of claim.

Expert opinion

Lawyer Alexander Vasiliev comments

If the consideration of the case has already been completed without an indication of the reimbursement of the state duty by the defendant, you can apply to the court with a separate application for the recovery of the costs of the state duty and other legal costs. The court will consider such an application in a separate court hearing and make a ruling on reimbursement of costs or refusal to do so. The same application must also include the costs incurred in connection with its consideration. It is prohibited to submit another application subsequently, so that the collection of costs does not turn into a permanent income for an unscrupulous party.

This restriction does not apply to cases when we are talking about newly paid state fees in connection with an appeal, cassation or supervisory appeal, review of the case due to newly discovered circumstances, as well as expenses during the execution of a court decision. The party appealing the decision of the court of first instance has the right to reimburse the state fee and other expenses incurred in connection with the appeal if the decision is made in its favor.

Legal costs are usually reimbursed by transferring funds. At the same time, the court may set off payments collected in favor of each of the parties at their request.

Reducing the amount of recovered costs

The judicial institution does not have the authority to independently reduce the amount of claims stated in the claim. However, in practice the courts do things differently. They make a reference to the law, judicial practice and write the following phrase: “taking into account the overall costs and nuances of a particular case, the court considers the amount reasonable...”.

Sometimes courts independently reduce the amount, even if the defendant does not present evidence of inflated prices.

It is worth noting that collecting a large amount of office expenses is a complex undertaking, especially when each judicial authority has its own opinion on this matter. Here there are also divergent opinions about whether the size of a lawyer’s remuneration can be influenced by his popularity and the place he occupies in the rankings of law firms. And also, is it possible to compensate as part of the costs of office work the fee paid to the lawyer with whose help the case was won?

When state fees and court costs are not reimbursed

Reimbursement of expenses can be made for all material disputes, the subject of which is money or property. However, there are also court cases that involve:

- establishing facts of legal significance;

- determining the status of persons;

- determination of the legal regime of property.

In such cases there may not be a defendant. The only person interested in the outcome of the case will be the applicant who applied to the court. Therefore, the costs of such cases (including state duty) are paid by such person independently and will not subsequently be reimbursed.

State fees and other costs are not subject to reimbursement in cases where there is no dispute between the parties, but they are forced to go to court - for example, in cases of divorce on the basis of clause 1 of Art. 23 of the Family Code of the Russian Federation by consent of spouses who have common children.

In some cases, when claims are partially satisfied, it is impossible to proportionally distribute the legal costs of the parties, because:

- the claim is of a non-property nature (for example, for compensation for moral damage) or is property, but not subject to assessment;

- on the collection of a penalty if it was reduced by the court due to disproportionality;

- according to the requirements subject to consideration in the manner prescribed by the CAS of the Russian Federation. Moreover, in cases of collection of mandatory payments and sanctions, where the final amount of awarded claims can be changed by the court, costs can be distributed in proportion to the amount awarded.

In these cases, it is impossible to establish the required proportion, so expenses are reimbursed according to the general rule without proportional distribution.

Legal costs are recovered from the plaintiff in cases where:

- the application was left without consideration, except in cases of filing by an incapacitated party or a second failure of the parties to appear at the court hearing. Since the plaintiff is not at fault in these cases, all parties remain at their own costs;

- the proceedings on the case are terminated, except for cases where termination occurs for objective reasons (death of a citizen, liquidation of a legal entity).

Expert opinion

Lawyer Alexander Vasiliev comments

The plaintiff is exempt from court costs if the claim is abandoned and the proceedings are terminated after the defendant voluntarily satisfies the stated demands. At the same time, if the plaintiff behaves in bad faith, legal costs may be imposed on him. For example, a clearly inflated amount of claims may be considered unfair actions.

State duty in arbitration. How and how much

The article is devoted to answers to the most frequently asked questions regarding the payment of state fees when applying to an arbitration court.

The state duty can be paid through a representative

On the one hand, the Tax Code of the Russian Federation establishes that the payer of the state duty is obliged to independently, that is, on his own behalf, pay it to the budget. Payment of the state duty by another person for the plaintiff (applicant) is not provided for by law (clauses 1, 3 and 8 of Article 45, Article 333.17 of the Tax Code of the Russian Federation).

At the same time, both citizens and organizations have the right to conduct their affairs in the arbitration court through representatives (Article 59 of the Arbitration Procedure Code of the Russian Federation). And the Tax Code of the Russian Federation allows for the conduct of business through representatives (Clause 1, Article 26 of the Tax Code of the Russian Federation).

Thus, the state duty can be paid by a representative on behalf of the represented person if the payment document for the transfer of the amount of state duty to the budget from the representative’s bank account indicates that the payer is acting on behalf of the represented person.

The state duty has been paid. You have three years

An application (complaint) can be submitted to the arbitration court within three years from the date of payment of the state fee for its filing (subclause 2, clause 1, clause 3, 6 of Article 333.40 of the Tax Code of the Russian Federation).

If, upon returning the application (complaint), the state duty was not returned to the payer, then the amount of the state duty may be counted against the payment of the state duty in connection with the repeated presentation of a similar or other appeal to the arbitration court under the conditions that:

- three years have not elapsed from the date of the relevant court decision on the return of state duty from the budget or from the date of payment of this amount to the budget;

- The repeated application is accompanied by an original document on payment of the state duty if there are grounds for its return from the budget in full, or a copy of the document on payment of the state duty, certified by the judge, if there are grounds for its partial return from the budget, a copy of the judicial act on the return of the state duty, certified by the judge and containing the official seal of the arbitration court.

It is possible to offset the overpaid state duty in connection with the consideration of the case in any of the arbitration courts of the Russian Federation.

If rates have changed

When applying to court, the state duty is paid in the amount established at the time of applying to the arbitration court (based on clause 2 of Article 5 of the Tax Code of the Russian Federation). This rule also applies when applications are left without progress or when they are granted a deferment or installment payment of the state duty.

If already in the process the plaintiff increased the claims and after going to court the state duty rates established by the legislation on taxes and fees changed, then the state duty in connection with the plaintiff’s increase in the amount of the claims after going to court is calculated at the rates in effect on the day of filing the petition for an increase the size of the claims.

Postponement or installment plan

A deferment or installment plan for payment of the state duty can be granted at the request of an interested person for a period until the end of the consideration of the case, but not more than for one year (clause 1 of Article 333.41 of the Tax Code of the Russian Federation).

After granting a deferment in the payment of the state duty, the arbitration court has the right to re-grant such a deferment, but the total period for granting deferments should not exceed one year (clause 1 of Article 64, clause 1 of Article 333.41 of the Tax Code of the Russian Federation).

Suspension of the proceedings is not a basis for suspending the period for which the deferment of payment of the state duty was granted.

If there are several plaintiffs

If there is one claim, and there are several plaintiffs, then the state duty is paid in equal shares in the amount established by the Tax Code of the Russian Federation for the specified claim (clause 2 of Article 333.18 of the Tax Code of the Russian Federation).

If the amount of the claim consists of the independent claims of each of the plaintiffs (for example, a claim for compensation for damage caused by a source of increased danger to the property of several persons), then the state duty is paid by each of the plaintiffs based on the size of the claim they make.

The payment of the state duty in the case may be entrusted by the co-plaintiffs to one or more of them (Part 3 of Article 46 of the Arbitration Procedure Code of the Russian Federation).

Refund of state duty

The amount of overpaid state duty is returned if the plaintiff reduces the size of the claim (subclause 3, clause 1, Article 333.22 of the Tax Code of the Russian Federation), but only when the reduction in the size of the claim is accepted by the arbitration court (Part 1, 5 of Article 49 of the Arbitration Procedure Code of the Russian Federation).

If the proceedings are terminated due to the plaintiff's (applicant's) refusal of the claim (application), the state duty is not returned if it is established that the refusal is associated with the voluntary satisfaction by the defendant (interested person) of the stated requirements after filing the statement of claim (application) with the arbitration court (para. 3 subparagraph 3 paragraph 1 article 333.40 of the Tax Code of the Russian Federation). In such circumstances, the court must consider the issue of assigning the costs of paying the state duty to the defendant (interested person), based on the provisions of Article 110 of the Arbitration Procedure Code of the Russian Federation, taking into account the fact that the claims submitted to the court have actually been satisfied.

If one of the parties is exempt from paying state duty

If the court decision is made in favor of the plaintiff and he is exempt from paying the state duty, then the defendants pay it (subclause 2, clause 2, article 333.17 of the Tax Code of the Russian Federation).

If the plaintiff, exempt from paying the state duty, refuses the claim in connection with the voluntary satisfaction of his demands after applying to the arbitration court, the proceedings on the case are terminated and a decision not in favor of the defendant is not made, due to which in this case the state duty to the budget is not recovered from the defendant.

There are no grounds for collecting state duty in a case in which a court decision was made to refuse to satisfy the claims of the plaintiff, who was exempt from paying state duty (Article 333.37 of the Tax Code of the Russian Federation).

Requirements for a writ of execution

Writs of execution for the collection of state duties are issued ten days after the judicial act on the collection of state duties comes into force and in the absence of information in the case that the state duty was paid voluntarily (subclause 2, clause 1, article 333.18 of the Tax Code of the Russian Federation), and are sent by the arbitration court to the tax authority at the location of the debtor (Part 3 of Article 319 of the Arbitration Procedure Code of the Russian Federation).

It must contain an indication of the collection of state duties for the federal budget.

Arbitration courts do not calculate and withhold interest and penalties when issuing writs of execution for the collection of state duties.

How are legal costs distributed?

The court decides the issue of legal costs regardless of whether such a petition was filed (Article 110 of the Arbitration Procedure Code of the Russian Federation).

If the decision is made against several defendants, then the court costs incurred by the plaintiff to pay the state duty are recovered by the court from these defendants as co-debtors in a shared obligation, even if the plaintiff demands to recover such expenses from only one or several of them.

If legal costs for payment of state fees are incurred:

- third parties who do not make independent claims regarding the subject of the dispute;

- persons who did not participate in the case, on whose rights and obligations the arbitration court adopted a judicial act, in connection with their filing of an appeal or cassation complaint -

then they can also be reimbursed to these persons (Chapter 9 of the Arbitration Procedure Code of the Russian Federation).

The law does not provide for the possibility of returning the paid state duty from the budget to the applicant if a judicial act is adopted in his favor.

Also, the law does not exempt state bodies and local governments from reimbursement of legal costs.

Therefore, if a judicial act is not adopted in favor of a state body (local government body), an official of such a body (with the exception of the prosecutor and the ombudsman for human rights), then the applicant’s expenses for paying the state fee are subject to reimbursement by the relevant body as part of court costs (Part 1 of Art. 110 Arbitration Procedure Code of the Russian Federation).

On non-property claims

If the application indicates several interrelated claims of a non-property nature, then the state duty is paid for each (subclause 1, clause 1, article 333.22 of the Tax Code of the Russian Federation). For example, on a claim for recognition of ownership of three separate real estate properties, the state duty will be 12,000 rubles. (4000 rubles × 3, subparagraph 4, paragraph 1, article 333.21 of the Tax Code of the Russian Federation).

If a claim of a non-property nature, including one with a monetary value, is partially satisfied (for example, a claim for the award of compensation for violation of the right to execute a judicial act within a reasonable time), the cost of paying the state duty in full is recovered from the opposite party in the case.

The amount of the state fee when filing a claim with an arbitration court to declare a transaction invalid and apply the consequences of its invalidity is 4,000 rubles.

When submitting applications of a non-property nature, including applications for recognition of rights, applications for awarding duties in kind, a state fee of 4,000 rubles is paid. (Subclause 4, Clause 1, Article 333.21 of the Tax Code of the Russian Federation).

This applies, for example:

- applications for recognition of the right of ownership, right of use, right of possession, right of disposal;

- applications for exclusion of property from the inventory.

State fees are not paid when filing applications:

- on suspension of execution of a decision of a state body, local government body, other body, official (Part 3 of Article 199 of the Arbitration Procedure Code of the Russian Federation);

- on suspension of execution of the contested decision of an administrative body on bringing to administrative liability (Part 3 of Article 208 of the Arbitration Procedure Code of the Russian Federation);

- on suspension of execution of the appealed judicial act (Articles 265.1, 283, 298 of the Arbitration Procedure Code of the Russian Federation), -

as well as applications for suspension of enforcement proceedings (Article 39 of the Federal Law of 02.10.07 No. 229-FZ “On Enforcement Proceedings”).

State duty for securing a claim

When filing an application to secure a claim, a state fee of 2000 rubles is paid. (Subclause 9, Clause 1, Article 333.21 of the Tax Code of the Russian Federation).

Applications for securing a claim include applications specified in Part 1 of Article 90 of the Arbitration Procedure Code of the Russian Federation and applications aimed at securing property interests.

The state fee is payable for each application for securing a claim, including in bankruptcy cases, regardless of how many measures to secure the claim the applicant indicated in one application.

When filing an appeal or cassation complaint against a ruling to secure a claim or a ruling to refuse to secure a claim, the state duty is not paid (subclause 12, clause 1, Article 333.21 of the Tax Code of the Russian Federation).

The state duty is not paid when filing applications for counter-security and cancellation of security for a claim (Articles 94, 97 of the Arbitration Procedure Code of the Russian Federation), for applications to replace one interim measure with another, for applications to ensure the execution of judicial acts (Articles 95, 100 of the Arbitration Procedure Code of the Russian Federation).

If the application for interim measures was granted, but the decision following the consideration of the dispute on the merits was not made in favor of the plaintiff, the court assigns the costs of the state duty to the plaintiff.

Pay half

Upon submission:

- appeal, cassation complaint;

- applications for review of a judicial act in the order of supervision of decisions and (or) orders of the arbitration court;

- complaints against court rulings to terminate proceedings;

- applications to leave a claim without consideration;

- applications for the issuance of writs of execution for the forced execution of arbitration court decisions;

- applications for refusal to issue writs of execution -

- The state duty is paid in the amount of 50% of the amount of the state duty payable when filing a claim of a non-property nature (subclause 12, clause 1, article 333.21 of the Tax Code of the Russian Federation).

Since in the cases under consideration the state duty is paid for filing a complaint, the amount of the state duty does not depend on how many demands were made by the plaintiff (applicant) at the stage of consideration of the case in the court of first instance and resolved by the court in the framework of this case.

When submitting applications of a non-property nature, such as:

- application for recognition of a non-normative legal act as invalid;

- application for recognition of decisions and actions (inaction) of state bodies, local government bodies, other bodies, officials as illegal -

- The state duty is 200 rubles. for individuals and 2000 rub. for legal entities (subclause 3, clause 1, article 333.21 of the Tax Code of the Russian Federation).

When appealing judicial acts in these cases, the state duty is paid in the amount of 50% of the indicated amounts, i.e., 100 rubles. for individuals and 1000 rub. for legal entities.

IMPORTANT:

Let us remind you that the state duty is calculated in full rubles: the amount is less than 50 kopecks. is discarded, and the amount is 50 kopecks. and more is rounded to the full ruble (clause 6 of Article 52 of the Tax Code of the Russian Federation).

If, after the expiration of the period for which a deferment or installment plan for payment of the state duty was granted, the case is not considered, then the court issues a ruling on the recovery from the plaintiff-applicant of the unpaid state duty, subject to immediate execution (Article 187 of the Arbitration Procedure Code of the Russian Federation).

If the defendant is exempt from paying the state duty, and the plaintiff, in whose favor a judicial act was adopted, which ends the consideration of the dispute on the merits, was granted a deferment of its payment and the state duty was not paid by the plaintiff, then the state duty is not collected from the defendant.

Persons filing appeals and cassation complaints against decisions, resolutions and rulings of the court to terminate proceedings in a case, to leave an application without consideration, to issue writs of execution for the forced execution of arbitration court decisions, to refuse to issue writs of execution in other cases (for example, specified in subparagraphs 6, 8, 10, 11 of paragraph 1 of Article 333.21 of the Tax Code of the Russian Federation), pay a state duty in the amount of 50% of the amounts provided for in subparagraph 4 of paragraph 1 of Article 333.21 of the Tax Code of the Russian Federation.

Ekaterina STUDENIKINA, Candidate of Legal Sciences

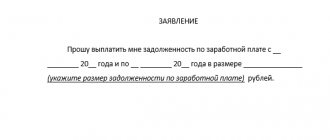

Sample application for reimbursement of state duty

If the court does not reimburse the costs of the state duty in the decision, the plaintiff may file a free-form application. A sample of such a statement is given below.

B (indicate the name of the court)

Case No. (specify case number)

From: (full name), plaintiff in the case

Defendant (indicate full name or name)

Application for recovery of legal costs

The court (indicate the name of the court) is processing case No. (indicate the case number) regarding the claim filed by me. The decision in the case was made (indicate date) in my favor. The decision does not reflect the issue of distribution of legal costs, including the payment of state fees.

In connection with the consideration of this case, I incurred the following expenses: paid a state fee in the amount of (specify the amount) rubles. Proof of payment of the state fee was attached to the statement of claim.

In accordance with Art. 98 Code of Civil Procedure of the Russian Federation,

ASK

To recover from the defendant (full name) the costs of paying the state duty in the amount of (specify the amount) rubles.

Signature, date

Assignment of rights to reimbursement of state fees and court costs

In case of inheritance, reorganization, assignment of rights and other cases of succession of parties to a lawsuit, the right to reimbursement of state fees, compensation for representative services, etc. is also transferred to the new person. This right to reimbursement of expenses is not inextricably linked with the identity of the participant in the process, therefore its alienation does not contradict the law (clause 9 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of January 21, 2021 No. 1 “On some issues of application of the legislation on reimbursement of costs associated with the consideration of the case”) .

It is not necessary that the new person has previously been a participant in the same process. The right to reimbursement of state duty and other expenses can be transferred:

- to any person;

- both during the consideration of the case and after its completion.

From a procedural point of view, the transfer of the right to reimbursement of costs can be formalized by a ruling on the replacement of the relevant party in the case where there is a complete replacement of the party in the process. If a separate agreement on the assignment of the right to receive payments is concluded, then it will not require the party to be replaced by its legal successor. The right to compensation arises only at the time of award of payments, therefore, at the time of assignment, registration of succession is not required.