Grounds for debt collection based on a notary’s writ of execution

Notarial activities in Russia are regulated by the “Fundamentals of the legislation of the Russian Federation on notaries”.

- Chapter XVI defines the procedure for collection through a notary;

- No. 360-FZ is called the law on the writ of execution, because it contains amendments to the “Fundamentals”, introducing the possibility of a simplified procedure for collecting debts without a court decision.

For bailiffs, the basis is Art. 12 Federal Law No. 229.

Detailed explanations about the practice of this method of debt collection are given in a joint letter from two departments - the FSSP and the FNP (the second abbreviation stands for the Federal Notary Chamber).

The use of a writ of execution within the framework of enforcement proceedings initiated by bailiffs requires strict compliance with the rules and regulations. We will tell you how, in practice, banks and individuals collect debts in this way.

Legal regulation

This method of debt collection received proper legal support and improvement thanks to the publication of Decree of the President of the Republic of Belarus dated August 11, 2011 No. 366 “On some issues of notarial activity” (hereinafter referred to as the Decree). The specified regulatory legal act contains a closed list of requirements, the collection of which is carried out using a writ of execution. In addition, the text of the Decree contains mandatory conditions for performing this notarial act.

An important feature of debt collection through a writ of execution is that a notarial act can be performed only if all the information and documents necessary to carry out such an act are available, including documents confirming the payment of the notarial fee. Otherwise, you will have to go to court to collect the debt through writ or lawsuit proceedings. The lists of documents required by a notary for each type of claim are established by Resolution of the Council of Ministers dated December 28, 2006 No. 1737 “On approval of the list of documents for which collection is carried out in an indisputable manner on the basis of writs of execution” (hereinafter referred to as the Resolution). In the most general form, we can say that all documents submitted to the notary for the execution of a writ of execution must confirm the indisputability of the claim.

Who has the right to apply for a writ of execution?

The initiator of debt collection under a simplified procedure without recourse to judicial authorities - using a writ of execution made by a notary - is:

- Individuals, individual entrepreneurs and organizations with a notarized loan agreement. This method of completing a transaction is used if we are talking about a large amount.

- Banks and other financial organizations - subject to the possibility in the text of the agreement to collect the debt without trial.

Microfinance organizations do not have the right to use a writ of execution for the purpose of collecting debt from borrowers.

Form and content of the complaint

The rules for drawing up procedural documents are determined by the norms of the Code of Civil Procedure of the Russian Federation. An application for cancellation of notary writs of execution includes:

| Document Section | Description | Note |

| Requisites | The application indicates the name of the district court, details of the debtor, notary, claimant, and the amount of the state fee. The signature of the applicant and the list of attachments are also considered mandatory details. The fee for filing applications in a special manner is 300 rubles (Article 333.19 of the Tax Code of the Russian Federation). If the case is being considered as part of a lawsuit, the payment is calculated taking into account the loan agreement and the repayment schedule. | Article 35 of the Code of Civil Procedure of the Russian Federation allows claims and complaints to be filed electronically. To do this, you will need to fill out a form on the court’s website, and also use a digital signature (Resolution of the Supreme Court of the Russian Federation No. 57 of December 26, 2017). The attached documents are sent in the form of electronic images. The defendant's contact information can be taken from the notice. In addition, notaries publish information on websites. |

| Descriptive part | The details of the loan agreement or other document on the basis of which the obligations arose are subject to reflection. The date of the notary’s writ of execution and the day of notification of it are also indicated here. If there is a dispute about the amount of debt, you will need to provide your calculation. | Events must be presented in chronological order, avoiding redundant descriptions and personal assessments. |

| Motivational part | The debtor lists the violations committed by the claimant or the notary. You can indicate the missed deadline for applying for a writ of execution and other important points. | The court's attention is focused on the contradiction of the notary's actions to the law, the terms of the loan or other agreement. References to regulations and judicial practice become a mandatory component of the motivational part. |

| Requirements | The applicant asks to cancel the notary's inscription and terminate enforcement proceedings. If we are talking about a claim, at the same time demands are made to change the amount of debt. | The wording must be extremely precise and unambiguous. When making demands, it is important to identify the notary’s writ of execution, indicate its registration number and date. |

When drawing up an appeal, you must adhere to standard office procedures. Documents are prepared on A4 sheets in a printed manner, observing standard spacing and maintaining margins. The law does not establish a direct ban on handwritten versions. However, this format is considered obsolete.

Conditions for making a writ of execution

There are two conditions for using a writ of execution in practice:

- Notarization of the transaction of registration of collateral or issuance of a loan/credit.

- The text of the agreement contains a clause allowing for the possibility of resolving a disputed situation with a debt out of court.

What documents are allowed to put a writ of execution on?

- lending or loan agreements previously certified by a notary;

- pledge agreements that are executed through DOM.RF (aka AHML) are one of the most common situations of mortgage foreclosure through a notarial writ of execution in practice;

- agreements on joint responsibility of the guarantor and the borrower, certified by a notary;

- lending agreements with the bank, if the text directly states the bank’s right to collect in the manner in question;

- contracts for the provision of various services - mobile communications, temporary storage of assets or their rental.

The last item on the list includes the frequently used direction of forced collection of rental debt using a writ of execution executed by a notary. This option of action is being used more and more often by creditors; in 2021 they are trying to provide for such an opportunity in the lease agreement with individual entrepreneurs and legal entities (for non-residential premises).

Mortgage foreclosure

When the bank takes the mortgage without trial

If there is a significant delay on the mortgage, it is quite possible to foreclose on the mortgaged apartment. For a writ of execution to be valid on a pledge agreement, there are a number of conditions.

- The amount of debt must be 5% higher than the value of the collateral - the apartment.

- The delay must be significant, that is, more than 3 months, or payments must be overdue more than three times during the year.

- Or there are gross violations - for example, you do not care about the safety of the collateral.

The mortgage is not subject to the law that it is impossible to foreclose on the only apartment suitable for the debtor to live in. This requirement of the Code of Civil Procedure and the Civil Code of the Russian Federation cannot be fulfilled here. So having children, disabled relatives or a difficult financial situation will not save you from eviction if you bought your only apartment with bank money.

The procedure for collecting a mortgage

If you are in significant arrears on a loan secured by collateral, and the agreement provides for an out-of-court procedure for settling the debt, then the bank notifies you of its intention to use a notary’s writ of execution 14 days before contacting the notary. The same as under other contracts.

The notary notifies within 3 days after the inscription is made and offers to voluntarily fulfill the obligation. Once you receive the letter from the notary, you have seven days to pay and avoid foreclosure.

Bankruptcy of individuals with a mortgage: how to save an apartment? Related article

By law, such a period must be contained in the offer that the notary sends you. The period begins to count from the moment you receive the notice. As a general rule, the sale of collateral should be carried out no earlier than 10 days from the date the debtor receives the notification.

According to the law, the mortgaged apartment is sold at open auction, of which the defaulter must be notified. If the property sold is insufficient, the lender can collect funds from the borrower from other assets.

If there is a co-borrower or guarantor under the agreement, then they can take the apartment only after involving all interested parties.

It is impossible to foreclose on an apartment with a mortgage under a writ of execution if there is no provision in the original agreement that the collateral can be seized out of court.

How to collect a debt through a notary's writ of execution?

The advantage of the procedure is the opportunity to collect not only the principal debt, but also the interest accrued under the terms of the loan agreement. To do this, it is necessary to strictly adhere to the sequence of activities established by law.

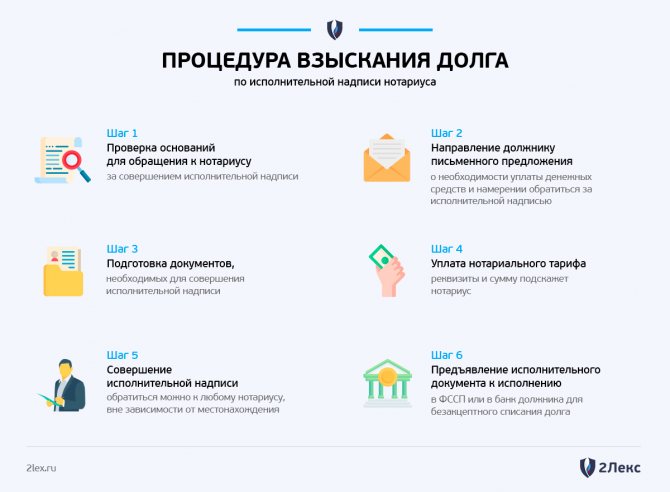

Sequencing

The first step is to contact the debtor with notification of the existence and need to repay the debt. This must be done no later than 2 weeks before the visit to the notary.

How to collect a debt through a notary

After the specified period, the creditor draws up an application for debt collection. The document is issued in paper or electronic form. In the second case, it is submitted on the portal of the Federal Notary Chamber using the applicant’s personal account. After this, the appeal is entered into the federal database.

From a legal point of view, both options are completely equivalent. A set of documents must be attached to the application to confirm the validity of your claims.

Required documents

Regardless of the chosen submission method, the following documentation is attached to the application addressed to the notary:

- calculation of the amount of debt signed by the creditor;

- a document confirming the fact of notifying the debtor of the need to repay the debt (must be sent no later than two weeks before applying for an endorsement);

- bank details to which you want to transfer funds;

- the original of the loan agreement or other document allowing for indisputable debt collection;

- documentary evidence of the transfer of property from the debtor or money from the creditor to the debtor - a receipt, a bank account statement;

- other documents confirming the existence of a debt or collateral and the legitimacy of the creditor’s claims.

Duration of the procedure

The procedure for executing a writ of execution provides clear requirements for the forced collection of debt. These include:

- The period for contacting a notary specialist is 2 years. It is counted from the day following the date when the debt had to be repaid under the agreement;

- the basis for making a writ of execution is the indisputable nature of the debtor’s obligations, which must be documented;

- before executing the writ of execution, the notary informs the debtor about the situation - three working days are allotted for this;

- The notary calculates the amount of debt based on the documents provided. It may not match the lender's calculations.

Price for receiving the inscription

The tariff for the implementation of the inscription is determined in clause 12.10 of Article 22.1 “Fundamentals...”.

Minimum - 300 rubles for debt up to 3000 rubles. Maximum - 0.5% of the amount of debt. To collect a deposit, the maximum collection amount is 300 thousand rubles.

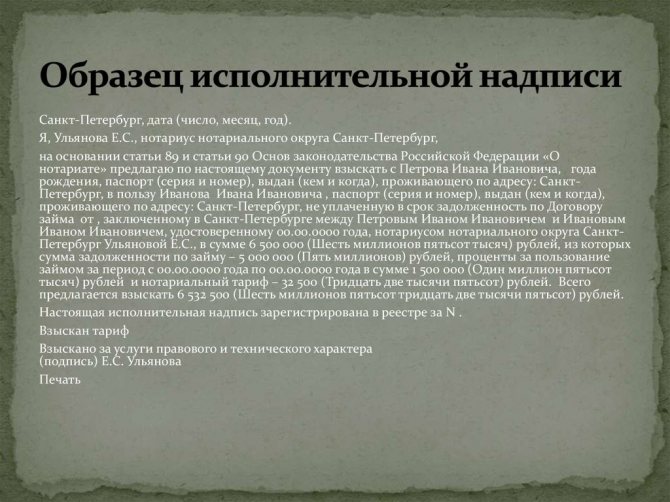

Contents of the inscription

What does the executive inscription look like?

The law strictly regulates the content of the executive inscription. The first and most important requirement is that it is applied to a copy of the loan agreement or an equivalent document.

The original must be marked with a note indicating the action performed by the notary.

The inscription made by a specialist must contain the following information and details:

- the location of the action and the exact date of affixing the inscription indicating the day, month and year;

- information about the creditor, including: full name and registration address for an individual or TIN and OGRN for a legal entity;

- a comprehensive set of data about the debtor. For citizens, full name, registration address, passport details, and place of work are indicated. For companies - name and other registration information;

- list and characteristics of things that need to be transferred to the creditor, their initial cost;

- the amount that is subject to collection in an indisputable manner, with the allocation of a tariff for the implementation of notarial actions;

- the period included in the calculation of the amount of debt;

- notary information;

- details of the entry in the federal register.

Procedure for applying to the FSSP

The executive inscription makes it possible to directly contact the FSSP. To do this, individuals are given three years. For organizations, the specified period of time is noticeably shorter - only 1 year.

To initiate enforcement proceedings, you must fill out an application on a form.

Application to the bailiff to initiate enforcement proceedings (22.0 KB)

The bailiffs send the request to the notary, which takes no more than 3 days. Receiving a response takes another 3 days, and the entire procedure for launching enforcement proceedings lasts no longer than a week. The beginning of forced debt collection is reflected on the official website of the FSSP.

The essence and purpose of the executive inscription

The notary does not have the authority to consider disputes or collect overdue payments. But through this specialist you can certify documents, safely transfer money, apply for registration of transactions, and also receive a number of other services.

The notary is also given the authority to issue an executive inscription. According to it, the creditor can collect the debt without going to court.

The essence and purpose of the executive inscription are described in the law on notaries.

The most important points of using the executive inscription:

- the inscription can be made by any notary working in Russia;

- collection through a notary is allowed only for indisputable claims and obligations, the list of which is specified in the law;

- the order of the notary is obliged to be carried out by the bailiffs, since a copy of the agreement with a notary mark is equated to executive documents;

- information about the notarial action will be entered into the federal register, which guarantees the legality of the collection.

The creditor himself chooses the methods of debt collection. But this option can be used as a writ of execution when this possibility is specified in the main agreement. The exception is obligations under notarized transactions.

Before putting a mark on a copy of the agreement, the notary is obliged to check the indisputability of the debt and the grounds for its occurrence, as well as the calculation of the delay. The notary will also check the procedure for notifying the debtor, since this is the responsibility of the creditor.

When contacting a notary, it is initially assumed that there is no dispute between the parties. Therefore, the debtor is not called to the notary’s office. However, if a dispute does arise, the defaulter has the right to challenge and cancel the notarial order through the court.

What debts can and cannot be collected through a notary?

Collection based on a notary's writ of execution is not allowed for all types of debts.

The list of indisputable requirements that one has the right to certify through notary offices includes:

- transactions previously certified by a notary, if they arose monetary or property obligations (agreement, receipt, lease documents);

- loan agreements, if the money was issued by the bank (the law prohibits microfinance organizations from collecting debts through a notary);

- loan agreements, if the creditor is JSC DOM.RF (this is a structure with state participation through which you can get a mortgage);

- surety agreements, if it contains a clause on joint and several liability (if the guarantor bears subsidiary liability, you cannot contact a notary);

- contracts for communication services (if they specify a payment period).

If the transaction was previously certified by a notary, then the documents on it do not necessarily include a clause on the possibility of collection through a notary. In other situations, the contract must include such a clause, otherwise the claimant will be refused to review the documents.

A notary's writ of execution regarding the collection of rent is allowed if this transaction has been notarized. Lease parties rarely practice this option of concluding a contract, as it entails unnecessary costs.

Resolution No. 543 specifies a special list of documents on which the inscription can be affixed:

- loan agreement;

- documents on storage transactions (receipt, agreement);

- documents related to the rental transaction (agreement or other document confirming the rental of property, debt settlement).

An executive inscription is a simplified procedure for collecting a debt through a notary.

A bank can receive an inscription under a loan agreement, or a creditor under a notarized transaction. The period of delay for making an inscription cannot exceed 2 years.

The law on the notary's writ of execution does not contain a list of obligations that cannot be collected in this way. By exclusion, the list of prohibitions includes loan agreements with microfinance organizations and simple written receipts without notarization.

The notary's office will not accept documents for the collection of fines or compensation for harm to the health and life of citizens. You cannot obtain a notarized order for alimony arrears or for utilities.

Executive inscription of a notary on a loan agreement

For loans, debt collection is allowed based on a notary’s writ of execution. The agreement must contain a clause giving the bank the right to collect through a notary. You can check your contract yourself to see if this clause is present. If the content of the document does not contain permission for notarial collection, the bank will not be able to exercise this right.

Only undisputed debts are collected through a notary. This means that the bank does not have the right to include in the calculation commissions and fines that are not confirmed by the original agreement. But the notary will certify the requirement to receive from the borrower the body of the loan and the interest on it with his signature.

On the loan agreement

Loan debt can also be collected through a notary. List of such situations:

- if the transaction was certified through a notary;

- if the claimant is JSC DOM.RF;

- if the creditor has a loan agreement or a pledge ticket.

A simple written receipt for a loan is not included in this list. It can only be used to collect debt in court.

On the pledge agreement

The collateral secures the main obligation. For example, when foreclosure on a mortgage, the lender (mortgagee) will be able to return the money through the sale of the mortgaged property.

To make a notarial inscription on pledge agreements, you need to take into account the special provisions of Article 348 of the Civil Code of the Russian Federation and Law No. 102-FZ:

- foreclosure on the pledged property is possible if the amount of the debt exceeds 5% of the value of the pledged property;

- the period of delay must exceed 3 months;

- since the loan provides for the return of money in periodic payments, the creditor must confirm the delay in payments at least 3 times within 12 calendar months.

If the listed conditions are not confirmed, then the violation of obligations is considered insignificant. In this situation, the claimant will be denied the inscription.

How to challenge or cancel a writ of execution made by a notary?

The number of situations where a bank collects funds from a problem borrower through a notary’s writ of execution is constantly growing. But this state of affairs does not always suit the debtor. As a result, the question of whether it is possible to challenge an executive inscription, and if so, how to do it, becomes particularly relevant.

There are several grounds for canceling the writ of execution:

- Absence of a clause in the agreement with the creditor regarding collection without trial.

- The creditor is the MFO, not the bank.

- The creditor did not notify the debtor two weeks before contacting the notary.

- The notary did not notify the debtor within three days after the inscription was completed.

To challenge the inscription, as well as for a court order, 10 days are allotted. If it was not possible to meet the deadline, it is possible to file a petition with the court for its restoration.

(12.4 KB)

An application to challenge the writ of execution is sent to the court. Practice shows that judges have a favorable attitude towards such claims, especially if they have real grounds in the form of violations of the procedure committed by the creditor or notary specialist. If there were no such violations, it is problematic to count on the cancellation of the writ of execution.

If the debtor learns about the collection of the debt using a notarial signature from the bailiffs, he receives the right to send an application to the FSSP to postpone the commenced enforcement actions. This is enough for the bailiffs not to bother the borrower for 10 days, which will give time to go to court.

Legislative framework and judicial practice

The legal basis for the cancellation of a notary’s writ of execution becomes Articles 89 – 94.4 of the Fundamentals No. 4462-1. In order to ensure uniform practice, the Federal Tax Service of the Russian Federation also issued information letter No. 4135/03-16-3. The document explains procedural aspects.

To challenge a notary's writ of execution in court, debtors will have to study the Code of Civil Procedure of the Russian Federation, Law No. 229-FZ of October 2, 2007. Depending on the basis of the debt, it will be necessary to analyze regulations on credit relations, consumer loans, microfinance activities, mortgages and other regulations. Judicial practice will help substantiate the position. For example, the definition of the Constitutional Court of the Russian Federation No. 1590-O dated July 6, 2001 has legal significance.

Free legal reference books will help you draw up an application to cancel a notary’s writ of execution. Samples of procedural documents are also published on the websites of district courts.

Advantages of debt collection through writ of execution

The procedure for forced debt collection through the court takes at least 3-4 months. Competent lawyers on the debtor's side can prolong the consideration of the case, and as a result, collecting the debt becomes not only time-consuming, but also expensive - you will have to pay for the services of lawyers, examinations and assessments.

Debt collection based on a notary's writ of execution is faster and cheaper. Its duration is no longer than three weeks: two are necessary to notify the debtor in advance, another one is necessary to begin enforcement proceedings.

The amount of expenses is also at an acceptable level - only 0.5% of the debt amount. Therefore, it is not surprising that this method of forced debt collection is in increasing demand.

Grounds for cancellation

The legislator did not approve a single list of reasons. The statement may refer to the following violations:

- Formal. The notary is obliged to indicate the place, date of commission, his data, name of the office, district, information about the creditor and payer, and the period of debt formation. The writ of execution includes information about the property being claimed, the tariff collected, and the registration number. The signature and seal of a notary are also considered mandatory (Article 92 of the Fundamentals No. 4462-1). The absence of at least one requisite becomes grounds for cancellation.

- Procedural. The reason for the challenge may be procedural errors. Thus, the application should refer to the application of unauthorized persons for a writ of execution, violation by the creditor of the deadlines and rules for the transition to forced collection.

- Essential. Withholding of funds under a notary's writ of execution is permitted subject to basic conditions being met. The requirement must be undeniable. The instrument is applied if no more than 2 years have elapsed from the date of the first delay, and the agreement contains a special clause. An application for cancellation is submitted if these principles are violated.

But it will not be possible to challenge the notary’s inscription due to the lack of notification. The violation is not considered serious.

Recommendations for effective use of the procedure

To use the obvious advantages of the considered method of collecting debt, use simple recommendations.

- Involve lawyers in completing a transaction to issue a loan or register a pledge. This will ensure the accuracy of the documents, but also simplify the debt collection procedure.

- Mandatory consultation with a competent lawyer before starting the collection procedure, even if he did not participate in the preparation and execution of the transaction. Seeking help from a notary results in the need to pay for the services of an expensive specialist in excess of the established tariffs.

Our lawyers provide free consultations - we will help you collect the debt, challenge the notary’s inscription, or write off credits and loans through personal bankruptcy.