Home / Complaints, courts, consumer rights

Back

Published: September 22, 2018

Reading time: 8 min

0

845

When wanting to purchase a certain product or service, the buyer often agrees to one of the seller’s conditions: to pay a certain amount, part of its cost or the full cost, called an advance payment (deposit). But often, for a number of reasons, the buyer decides to refuse to purchase a product for which part of the money has already been paid.

- Types of prepayment

- Is it possible to return the prepayment?

- When is it not possible to return the prepayment?

- How to return the prepayment?

- The procedure for filing a claim for a refund of prepayment

In this case, the question arises: is it possible to return the prepayment and how to do this?

Types of prepayment

The terms of the concluded agreement for the provision of services or the purchase and sale of goods determine the types of prepayment, of which there are three:

- execution of an agreement valid for a certain time , during which the amount is paid in installments;

- contribution of a portion of the amount (a certain percentage of the price);

- payment of the full price (in this case, the buyer, due to certain circumstances, can pick up the product or service from the seller after some time).

The buyer should distinguish between the concepts of “advance” and “deposit”. An advance does not require documentation, unlike a deposit, which has legal force, since it is a guarantor of the transaction.

The buyer has the right to demand a refund of the advance payment if he decides to refuse to purchase a product or service. The seller does not have the right to refuse to return the advance payment, but is obliged to do this within the time limits established by the legislation of the Russian Federation.

Compensation in case of non-provision of services

Another type of violation of consumer rights is failure to provide a pre-agreed service.

The market for the services provided is very large, but few people know that any provision of services to an individual is also regulated by the Law “On the Protection of Consumer Rights”. Confirmation of such intentions, in contrast to the purchase of goods, is a written or oral public agreement. Under such an agreement, one party (consumer) undertakes to pay for the service, and the second party (seller) undertakes to perform the specified service. Typically, payment for future services is taken in advance. If the service is not provided, the seller is obliged to refund part of the amount paid.

If an individual or legal entity refuses to fulfill the terms of the service agreement, the following must be done:

– draw up a claim or report that the seller refuses to fulfill the terms of the contract;

– if any actions have been carried out (for example, repairs have been started but not completed, an advance payment has been made), demand that everything be restored to its original condition and return the advance payment.

If the seller refuses to fulfill the consumer’s legal requirement, it is necessary to contact the consumer protection service, and then to the court with a statement of claim.

Refunds for services not provided must occur at the request of the seller or by court decision.

Is it possible to return the prepayment?

At the request of the buyer, the seller is obliged to return the prepayment in full - this is stipulated in the Law on the Protection of Consumer Rights of the Russian Federation. A refund of the money paid is possible if the concluded agreement did not include a condition on non-return of the deposit.

Returns are made in two ways:

- drawing up and submitting an application for return of the deposit (prepayment);

- termination of a concluded sales contract or service contract.

If the seller refuses to return the advance payment, the buyer has the right to file a complaint with the authorized bodies (department for consumer protection, prosecutor's office, etc.).

Most often, the buyer demands a refund of the amount paid in case of obvious violations on the part of the seller, namely:

- failure to comply with the date of provision of goods or services;

- providing the buyer with another product that does not correspond to the one for which the deposit was made;

- The product presented does not match the quality.

As practice shows, the vast majority of sellers satisfy the claims made by buyers, as they value their reputation. Therefore, problems with the return of the prepayment amount usually do not arise.

Prepayment

How to get a?

Firstly, the site and the entire company must give the impression of a reliable partner.

Few people will want to transfer money to an account written on a single page of a simple website with the promise of the cheapest or, conversely, the most exclusive services or goods. Secondly, it is necessary to do everything so that it is convenient and safe for the buyer to pay for the order, and there are no problems with processing orders and withdrawing money from the system. In other words, you need to choose a reliable intermediary - a service for accepting funds.

Who should I choose? Here are the most famous, proven and reliable:

- "Interkassa";

- PayOnline System;

- Z-Payment;

- Sprypa;

- RBK Money;

- Assist;

- Robokassa;

- Cyber Plat;

- “Unified cash desk W1”;

- "Qiwi wallet"

Almost all of them accept payments through many electronic money systems, terminals and ATMs, but today most people prefer to pay for purchases on the Internet with plastic cards, so you need to choose a service that works with bank cards.

The second selection criterion is the simplicity and convenience of withdrawing money from the system.

Most payment systems can transfer money to other payment systems (Webmoney, Yandex.Money, etc.), but when transferring money multiple times, interest is lost. Although small amounts can be immediately spent on the Internet - to pay for hosting, renew domain registration, advertising, and purchase software licenses. In order to receive money in your hands, you must have a bank account.

There is one more nuance when choosing a service: some of them charge either money for registering in the system or a monthly fee for use. Others charge a percentage for the transfer. You need to choose the most favorable conditions for your business. If sales volumes are large, it may be more profitable to pay monthly, which will be evenly distributed over all orders and amount to tenths of a percent of their value. If the flow of orders is still small, high percentages of the payment amount may be more convenient, which for a month of work will most likely be less than the monthly payment.

Having chosen a system, you need to register in it, add a code or a special module to the site and inform customers about new payment methods. Afterwards, you need to monitor, track how many orders were made with prepayment and what percentage of the money was spent on paying for the service in order to switch to the most profitable payment system in time.

How to return?

When drawing up contracts, it is important not to confuse advance payment and deposit. An advance payment is a partial prepayment, which in case of cancellation of the purchase is always returned to the buyer minus the seller’s costs, if this is specified in the purchase and sale agreement. The deposit has a clear legal definition and plays the role of a guarantor of the transaction (deed of purchase and sale), refusal of which may lead to the loss of the deposit.

Typically, a deposit is used when producing a batch of goods to order, with characteristics that preclude its sale to other buyers. For example, a series of badges and coins for guests for a wedding anniversary. If the buyer refuses, the manufacturing company will suffer losses, but the deposit should compensate for them.

So, the advance and full prepayment must be returned to the buyer upon termination of the purchase and sale agreement. Unless otherwise specified in the contract, the amount is returned in full and all losses for payment for bank services fall on the seller. To minimize costs, money is returned in the same way as it was received, that is, cash - cash, money transfers - money orders.

The receipt and, most importantly, the return of the prepayment must be reflected in the accounting records. First of all, after receiving an advance payment, no later than five calendar days from the date of receipt of funds, you must issue an invoice to the buyer for the amount of the advance payment. On the day of shipment of goods (performance of work, provision of services) for which an advance was received, the organization has the right to deduct VAT accrued earlier from the advance payment.

In the event of a change in the conditions or termination of the purchase and sale agreement and the return of advance payments, you can apply a deduction of tax previously accrued and paid to the budget on the amounts of advance payment for goods, but only after the transactions for changes in connection with the refusal of goods are reflected in the accounting (works, services). The fact of return of advance payments must be reflected in accounting and confirmed by documents, that is, payment orders. The deduction can be used no later than one year from the date of such refusal.

Why is this necessary?

Prepayment has its pros and cons for both sides of the transaction.

Pros and cons for the seller

| + Prepayment guarantees that the buyer is really interested in the purchase and is unlikely to refuse it. + Having received money in advance, you can safely deliver the goods without complicating the logistics by transferring money (especially large amounts) through a courier. + The seller who has received an advance payment can immediately put the money into circulation. | — There are many methods of prepayment, but at first they all seem more complicated than receiving money directly when transferring the goods. — You need to prove your reliability to the buyer, win his trust. — In case of problems with delivery or another situation when it is impossible to deliver the goods, the seller is obliged to return the advance payment, which is associated with some difficulties (labor costs, or rather) and a waste of money on the services of a bank or payment system for the transfer. |

Pros and cons for the buyer

| + By making an advance payment, it is easier to plan your spending over time. + Prepayment always implies a certain amount, while paying for goods by cash on delivery, for example, may include the walking cost of shipping. + Most often, the seller offers the most convenient payment methods - “Yandex.Money”, transfer from a card, etc. | — There is a risk of losing your money if the seller turns out to be unreliable. - Feeling of anxiety when money has been transferred, but the goods have not yet been received. |

When is it not possible to return the prepayment?

In some cases, it is impossible to return the money paid. These include the following:

- service order . In this case, the prepayment is withheld to cover the company’s costs (payment of employees, purchase of tools and materials, transportation);

- ordering goods with delivery from the store . In this case, an advance payment is also withheld to cover transportation costs, as well as payment for the work of the employees who carried out the transportation. The buyer must be warned about this in advance by the employees of the outlet;

- if there is a non-refundable prepayment clause in the contract . If an agreement is concluded for the provision of services or the purchase and sale of goods, then the agreement may contain a clause under which the paid deposit remains with the seller if the buyer refuses to purchase the product or service.

In all other cases, the buyer has the right to demand the return of his own funds left as an advance to the seller.

How to return the prepayment?

In order to return funds paid as an advance for a product or service, the buyer should follow the following procedure:

- Review the concluded purchase and sale agreement (service agreement). The contract should not contain the clause “Withholding the advance payment in the event of the buyer’s refusal of the product or service.”

- Contact the seller in one of the convenient ways (by phone, via the Internet or in person) and inform him of your refusal. In this case, you must provide a specific reason for the refusal.

- Write an application for a refund , if such a procedure is provided.

- Wait 10 days for the seller to make a decision.

- Receive funds in one of the convenient ways specified in the return application.

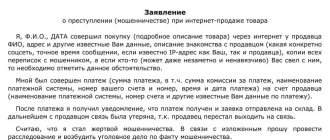

If the seller does not make concessions or simply ignores the request, you should proceed as follows:

- Drawing up a claim (in 2 copies). The document must indicate the fact of contacting the seller with a return request.

- Hand over the claim personally to an employee of the trading company . In this case, the claim must be registered by this employee as an incoming document. The claim can also be sent by registered mail with acknowledgment of receipt.

- Wait within 10 days from the date of registration of the application or its delivery by the postman. After the set time has expired (10 days), if the seller ignores the submitted claim, then there is only one way out - going to court.

If the amount of the claim against the seller is less than 50,000 rubles, then the statement of claim is filed with the World Court at the location of the outlet. Claims with an amount of more than 50,000 rubles are considered by courts of general jurisdiction.

Typically, retail outlets make contact with buyers and return the prepayment, since the courts, as a rule, take the side of the buyers and oblige sellers not only to return the money to the buyer, but also to compensate him for moral damages, as well as the costs of the trial.

The buyer must have a contract for the provision of services or a purchase and sale drawn up and signed by both parties. Such a document is the basis for consideration of the case in court.

In its absence (with a verbal agreement between the seller and the buyer), returning the amount paid will be problematic and, most likely, impossible.

Refund for services: procedure

The first action of a consumer who wants to reimburse expenses for poor-quality, late-delivered or unprovided services is to send a written demand to the counterparty.

A claim for a refund can be made in free form, but must be in a business style and in compliance with a number of rules, including:

- a clear statement of the essence of the problem;

- clear formulation of requirements with references to legislative norms;

- indication of details for the return of funds.

It is recommended that the application be accompanied by documents confirming the facts stated in it. An important point is the procedure for submitting a claim, namely:

- delivery in person with a receipt stamp;

- sending by registered mail (a description of the attachment and notification of receipt are required).

The Contractor is obligated by law to fulfill the requirements presented or refuse in writing within 10 days from the date of receipt. Refusal to satisfy demands or failure to respond within the period established by law becomes grounds for transferring the dispute to court.