Financial assistance for vacation

Local regulations of the employer or the company’s collective agreement establish the possibility of providing financial assistance - a one-time payment towards the employee’s annual paid leave. To obtain it, as a rule, simultaneous compliance with a number of conditions and requirements is required.

The law does not directly mention financial assistance for vacation, but Article No. 144 of the Labor Code of the Russian Federation allows a budgetary organization to introduce additional salary supplements, and this should be established by collective agreements, agreements and other internal documents.

The conditions for providing a lump sum payment differ significantly from employer to employer, but there are general principles:

- the employee does not have a disciplinary sanction for the current year of work;

- provided once a year and no earlier than 12 (24) months from the date of hiring the employee;

- vacation corresponds to the approved schedule and is at least 14 calendar days.

Financial assistance is also provided in other cases. Often it is paid in the absence of any supporting documents; its amount is determined individually, at the discretion of the manager. The bonus regulations (or other local regulations) establish the maximum amount of such additional payment and other conditions for its provision. Draws up an order and is paid to the employee in difficult life situations.

Decor

In a commercial organization

If we are talking about an incentive payment, then no application is required. However, this rule applies only if the employee goes on a scheduled vacation . In this situation, an order to go on vacation is issued, which includes a clause on the payment of incentive financial assistance.

The payment amount must be specified in the collective agreement . Often the employer pays 1 salary, but there may be payments in the amount of half the salary or even 2 salaries.

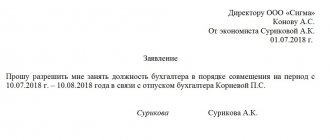

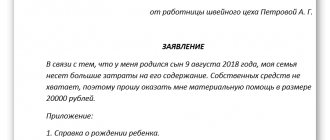

If an employee goes on vacation unscheduled or the matter concerns social assistance, then the employee must write a statement . It displays the following information:

- In the upper right corner it is indicated to whom and from whom the appeal is coming. The position and full name are indicated. manager, as well as position and full name. applicant.

- The name of the appeal is written in the middle of the new line . All letters must be capitalized (ex. STATEMENT).

- Text part. If we are talking about vacation , then the duration of the vacation and the amount of payment are indicated. (ex. “I ask you to apply for another paid leave with a lump sum payment in the amount of 1 salary for 2021 from 01/08/18 to 02/08/18”). The salary amount should be agreed upon with management in advance. If we are talking about social assistance , then the reason for the application should be explained in the text part and supporting documents should be attached. (ex. “I ask you to provide me with financial assistance in connection with the birth of a child. Birth certificate AA No. ... is attached.). Based on this application, the management of the enterprise itself will determine the amount of assistance provided.

- After the text part there is a date, signature, transcript of the signature .

Sample application for financial assistance for vacation:

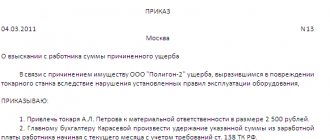

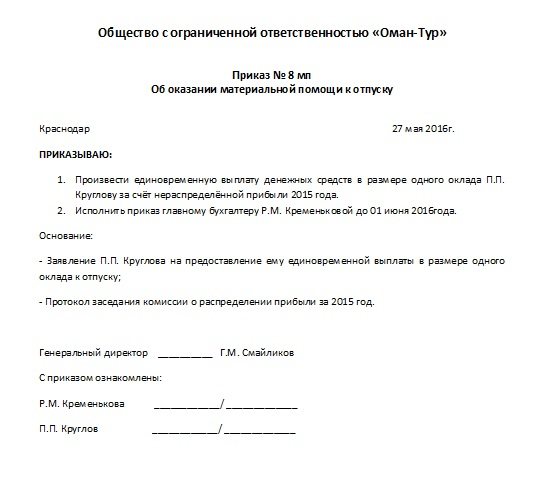

Based on the application, an order for a lump sum payment is issued . The order is issued on an official form and contains the following basic data:

- specific payment amount;

- FULL NAME. recipient of assistance (employee);

- reasons for payment indicating the document details (usually this is an employee’s statement);

- funds from which the payment is made (trade union dues, organization budget, profit, payroll, etc.);

- date of;

- signature of the general director/head of the organization.

Sample order:

In a government institution

To receive payment from a budgetary institution, an employee must attach an application for assistance . The application should indicate the article of law according to which the applicant is entitled to receive financial assistance.

The amount of payment to government employees is specified in clause 14 of Order of the Ministry of Labor No. 163n and is 2 salaries.

Is financial assistance taken into account when calculating vacation pay?

To calculate vacation pay, you need to calculate your average earnings. All types of payments provided for by the remuneration system and applied by the relevant employer are taken into account, regardless of the sources of these payments (Part 2 of Article 139 of the Labor Code of the Russian Federation). Clause 3 of the regulation on the specifics of the procedure for calculating average wages, approved by Government Decree No. 922 of December 24, 2007, stipulates that the calculation does not take into account social payments and other payments not related to wages (material assistance, payment for food, travel, training , utilities, recreation and others). To take financial aid into account when calculating vacation pay, you need to find out whether it relates to the remuneration system of a particular employer, and in what capacity it is applied.

Procedure for registration and application

Payment of financial assistance for vacation, provided for in the internal documentation of the institution, must occur on the basis of a written application from the employee. It is the preparation of this document that is the first stage of processing the payment.

The legislation does not provide for an established form of application for payment of financial assistance, therefore in most cases it is drawn up arbitrarily or according to a sample provided by the manager. The specificity of financial assistance for leave is that the employee has the right not to write a separate application at all - the request for its payment can be indicated in the application for leave.

How to make an application?

For example, the main text of the document may be as follows: “I ask you to provide me with annual paid leave from June 20, 2016 for 28 calendar days and financial assistance in the amount of two salaries, provided for by the collective agreement.” However, it is better to check with the employer for more detailed wording.

In addition, the optional nature of writing an application is evidenced by the fact that the payment of financial assistance is provided for by local acts of the institution.

Therefore, the transfer of this amount to the employee along with vacation pay must occur without fail, regardless of whether he asked for it in writing or not.

Basic rules for drawing up an application:

- the applicant must indicate not only his first and last name, but also his position and place of work (for example, a specific structural unit);

- the document is drawn up in the name of the head of the institution, the chief accountant or the chairman of the trade union (this is determined by the internal documents of the organization);

- After the main text, the date of preparation of the document and the signature of the employee are indicated.

Afterwards, the application is considered by the responsible person, who makes a decision on payment of assistance or refusal of it. If, as a result of the review, a positive decision was made, then the payment order is then transferred to the accounting department. After the calculations have been made, assistance is paid in the manner prescribed for vacation pay, that is, at least three days before the start of the vacation.

The amount of unemployment benefits depends on the average salary from your previous job. Read about the benefits for retirees living in Moscow and the region here. Do you think you deserve a better salary? Then it's time to write a memo about a salary increase. You will find a sample in this article.

When financial assistance is not taken into account in expenses

As a general rule, material assistance does not reduce income tax, since it is not included in expenses. This is directly stated in paragraph 23 of Art. 270 Tax Code of the Russian Federation.

Financial assistance is of a social nature, given to employees for personal needs, and therefore is not related to remuneration and the employee’s performance of his or her job function.

For example, the organization provided assistance to its employees affected by the flood, including donating basic necessities to them. On the one hand, the employer is interested in the normal physical and moral condition of his employees in order to properly perform their labor functions. However, the Ministry of Finance in its letter dated August 24, 2012 N 03-03-06/4/87 concluded that such payments of financial assistance are not taken into account for tax purposes. In addition, the regulatory authority noted that, according to paragraph 16 of Art. 270 of the Tax Code of the Russian Federation, when determining the tax base, expenses in the form of the value of property transferred free of charge are not taken into account.

Also, the judges of the Supreme Arbitration Court of the Russian Federation, in the Resolution of the Presidium of November 30, 2010 N 4350/10, indicated that financial assistance that is not related to the employee’s performance of a labor function cannot be taken into account in expenses. For example, these are payments to meet the social needs of workers in connection with natural disasters, the death of family members, the birth of children, etc. That is, just those payments that are clearly social and not production oriented. We will consider in more detail below what types of assistance are exempt from taxation.

If the employee decides to return the material assistance received, then these amounts are not included in income tax income (letter of the Ministry of Finance of Russia dated May 30, 2013 N 03-03-06/1/19741).

Legislative regulation

Registration and accrual of money in the form of financial assistance is regulated and regulated by the following legislative documents:

- articles of the Labor Code;

- regulations in force within the enterprise;

- collective agreements between the organization and staff (if any).

The procedure may be regulated by a separate act regulating payments as financial support.

Subscription to our publications

Subscription by mail

You can subscribe at any post office using one of the subscription catalogs. Subscription indexes for our publications can be found on the website: https://bino.ru/subscription/standart

Subscription to the Publishing House

A convenient and fast way to subscribe is in the subscription department of our Publishing House. By subscribing in any month for the current year, you will receive all issues starting from the 1st. Prices for our publications can be found on the website: https://bino.ru/subscription/redaction

Alternative subscription

You can subscribe in the regions from our representatives. Here, just like in the Publishing House, by subscribing in any month for the current year, you will receive all issues starting from the 1st. See the catalog of our regional representatives and their coordinates on the website: https://bino.ru/subscription/alter

Our email newsletters:

New in legislation for budgetary institutions

Address:

New in legislation for non-profit organizationsAddress: | New legislation for law enforcement agenciesAddress: | |

Budget institutions: financial and economic activitiesAddress: | Non-profit organizations: financial and economic activitiesAddress: | Law enforcement agencies: financial and economic activitiesAddress: |