Who does the reconciliation

Reconciliations are regulated by section 3 of the Order of the Federal Tax Service of the Russian Federation dated 09.09.2005 No. SAE-3-01/444. The reconciliation can be started by the tax office or the payer. Usually reconciliation is done voluntarily, but there are situations when it is mandatory:

- reconciliation is carried out quarterly with the largest taxpayers; for this purpose, a special reconciliation schedule is drawn up;

- reconciliation is needed when deregistering a company with the Federal Tax Service, when the company transfers to another inspectorate;

- upon liquidation of an enterprise.

The tax office can independently request a reconciliation if the payer has overpaid taxes and contributions.

When organizing a reconciliation, the Federal Tax Service sends taxpayers a notification about the date of the audit. If a company representative does not appear at the tax office for reconciliation, the Federal Tax Service will send two copies of the report by mail. They must be signed and one copy sent by mail.

The payer can request a reconciliation at any time. Usually the accounting department does this before closing a period or when applying for a loan, since banks often request a certificate of the status of settlements with the budget.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

How to write an application to the tax office

Submitting an application to your tax office must be carried out on a special form that will correspond to the issue being resolved.

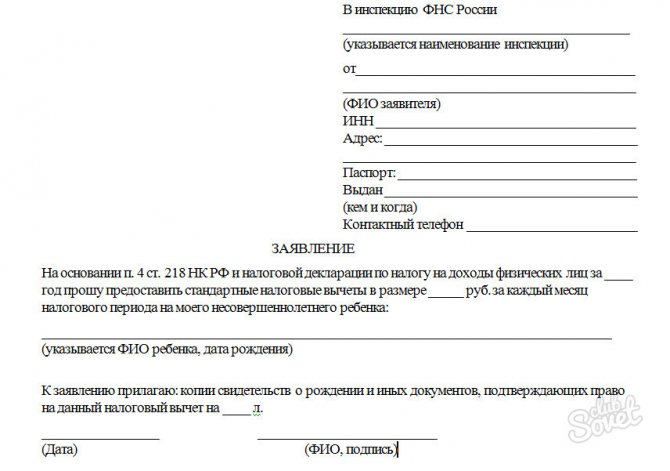

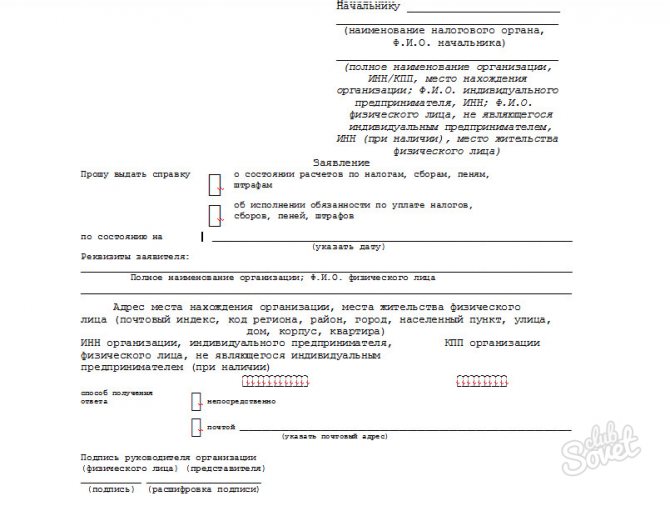

1

When filling out the application, please provide all information correctly and accurately. In the upper right corner, enter the required information about your tax authority and yourself. After the title of the document, state your request based on the articles of the tax code. Next, indicate the list of attached documents (if any). You can include the desired method of receiving the requested documents. Put the date of compilation and signature.

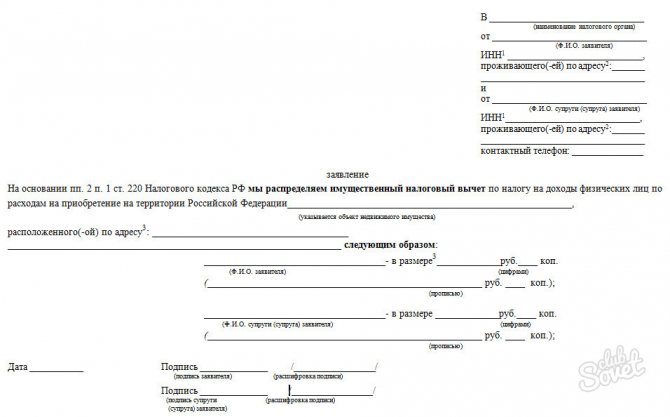

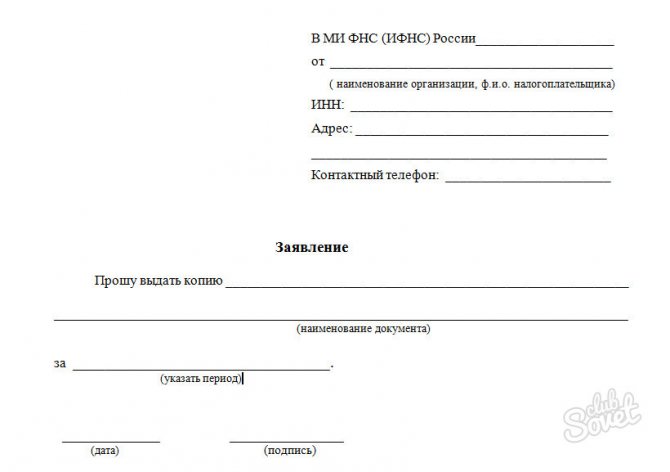

2

Tax legislation specifies categories of citizens who have the right to claim a tax deduction. There are standard (Article 218 of the Tax Code of the Russian Federation), social (Article 219 of the Tax Code of the Russian Federation), property (Article 220 of the Tax Code of the Russian Federation), professional (Article 221 of the Tax Code of the Russian Federation) tax deductions. Although the regulations stipulate that such an application can be completed by the applicant in any form, it is better to contact your tax service for the form. This will allow you to comply with a number of formal requirements and reduce the time it takes to review your documents.

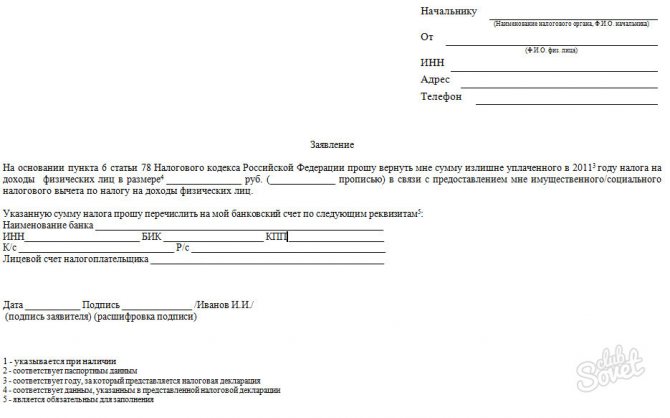

3

When a husband and wife purchase an apartment without allocating shares (into common joint property), the spouses have the right to distribute the property tax deduction among themselves in any respect. For example, you decide to distribute the deduction in a ratio of 100:0. The recipient of the deduction due must submit an application with information about the decision made. At the same time, your other half will not lose the right to receive a deduction in the future.

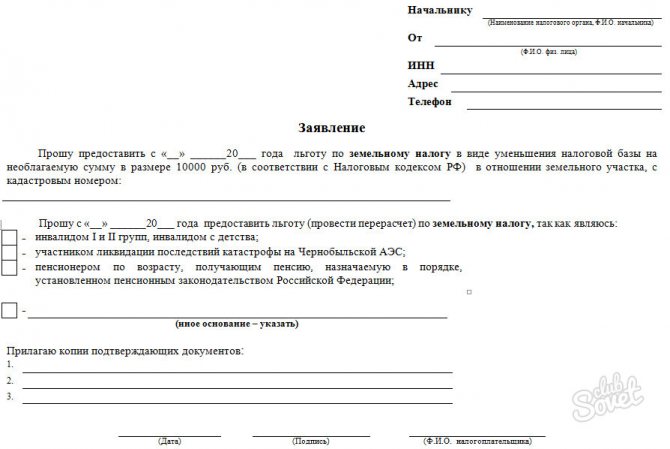

4

If you decide to receive a property deduction for personal income tax through a tax agent (employer), you will have to contact the inspectorate with a request to confirm your right to a property deduction.

5

Sometimes there are situations when the payer overpays the accrued amount of tax to the budget. Then the legislation makes it possible to exercise the right to offset or return the remaining funds. To do this, you need to send an application for a refund (credit) of overpaid funds.

6

Federal legislation partially exempts a certain category of citizens from paying the full tax fee. Having received a notification letter about the need to pay a certain amount without taking into account the benefits due to you, submit a corresponding application to the inspectorate with documents that will confirm the availability of benefits.

7

If you decide to find out about the presence of arrears to the budget, you will need to fill out an application for tax arrears. In response to an application requesting a certificate on the status of settlements for taxes, fees, penalties and fines, the inspectorate will send data with a list of specific figures. When applying for a certificate of fulfillment of the obligation to pay taxes, fees, etc., a text stating the fact of the absence or presence of debt. Don't forget to indicate the period for which you would like to receive information. There is no set form for the document. However, by filling out a ready-made form, you will increase the speed of application processing and receive the necessary information on time.

8

If you have lost part or all of your tax documents, contact the tax service with a request to restore them.

On our website you can find samples of completed tax applications:

- Application form to the tax office;

- Application form for a tax deduction;

- Sample application for a tax deduction;

- Application form for distribution of property tax deduction between spouses;

- Sample application for distribution of shares in common joint property;

- Application form for issuing a notice of confirmation of taxpayer rights;

- Sample application for issuing a notice of confirmation of taxpayer rights;

- Application form for tax refund (credit);

- Sample application for tax refund;

- Application form for property tax relief;

- Sample application for property tax benefits;

- Application form for issuing a certificate of taxes and fees;

- Sample application for issuing a certificate of taxes and fees;

- Application form for issuing a copy of a tax document.

Each tax office has stands with sample documents. The tax inspector will help you choose the correct application form.

How to request a tax reconciliation

The taxpayer has several options for requesting a reconciliation report with the Federal Tax Service.

Personal appeal

To do this, you need to prepare an application for a reconciliation report with the tax office. Write it in free form on the organization’s letterhead, be sure to indicate:

- name of the company or full name of the entrepreneur;

- TIN, KPP, OGRN;

- contact numbers and e-mail;

- a list of taxes and fees for which you require reconciliation;

- the period for which reconciliation is required;

- method of receiving the reconciliation document: in person or by mail;

- Full name and position of the employee who submitted the application, usually the chief accountant or general director.

An application can be submitted by an employee of an individual entrepreneur or LLC if a power of attorney has been issued to him.

The period for producing a paper act is 5 working days. You can pick up the certificate in person within 3 business days, otherwise it will be sent by mail.

Electronic request through the taxpayer’s personal account

You can receive a reconciliation through the Personal Account of a taxpayer - a legal entity. Just fill in all the required fields.

The period for drawing up a reconciliation report is 5 working days. Then, within 3 days, the inspectorate will send the acts to the taxpayer by mail to the address specified in the application. If you did not specify an address for correspondence, then wait for the document at the legal address.

Electronic request through the reporting system

You can generate, sign and send an application to the inspectorate through a reporting service, for example, Kontur.Accounting. A couple of clicks and the tax office will receive your request. Typically, services check the application so that you do not miss anything.

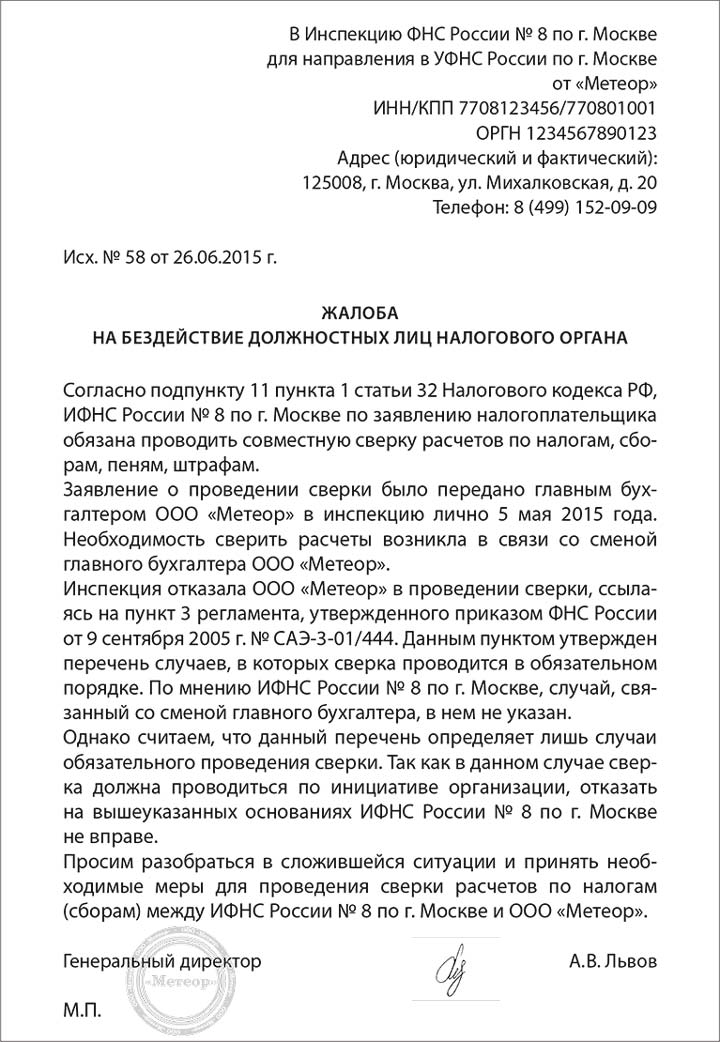

Complaint to the tax service

If the rights of a taxpayer have been violated, he can write a complaint against the tax service or against individual employees; this is provided for in Article 139 of the Tax Code of Russia.

A complaint can be filed with a higher tax authority, the same tax office that you are complaining about. You can file a complaint within a year from the date a person receives information about a violation of their rights. The citizen himself or his representative can file a complaint.

It can be sent by mail, taken personally to the office, while you keep a second copy with a mark of acceptance, date, signature of the employee who accepted it and a seal. The complaint is sent by registered mail. Now the most popular and convenient way to send a complaint is by email or filing a complaint on the website.

There are situations when the tax service delays payment of tax deductions. The timing of payment of deductions is stipulated in the Tax Code of Russia. Some tax authorities transfer money even faster than the deadline of four months. When they delay implementation, explaining this by workload, then the need arises to push the process.

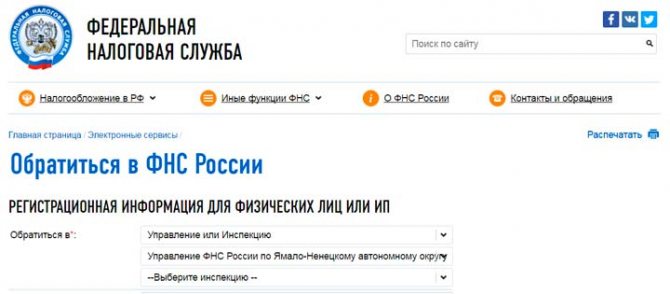

How to file a complaint

On the website of the tax inspectorate there is a section “contact the Federal Tax Service”, and you do not need to go and stand in line and wait. Your application will be reviewed and the protracted process will be expedited; from the moment you apply, you will receive the money no later than two weeks later.

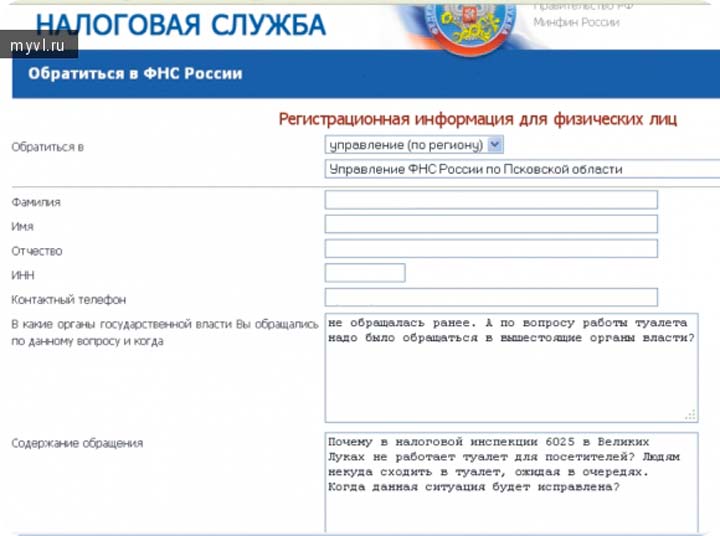

On the website, select the Individuals tab, then click on “Contact the Federal Tax Service of Russia”, at the bottom of the page click “Individual or Individual Entrepreneur”. And the registration form opens.

Here you need to fill in information about the Federal Tax Service of which city and region, your full name, Taxpayer Identification Number, telephone number for contact. The content field should reflect the essence of your complaint. When and to which tax office did you apply, with what question, what statements did you write, in what timeframe was the money supposed to arrive, and that at the time of writing the complaint it had not arrived, and the deadline had already passed. Indicate that you are asking to pay the tax deduction due to you, a penny for missing the deadline.

If there are documents, for example, a declaration signed by the operator, then you can attach them. Choose to have the answer sent to you by mail in paper form, and click the send button.

After this, the tax inspector should contact you.

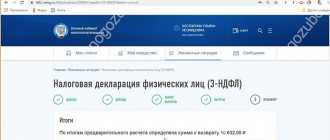

How to sign a tax reconciliation report

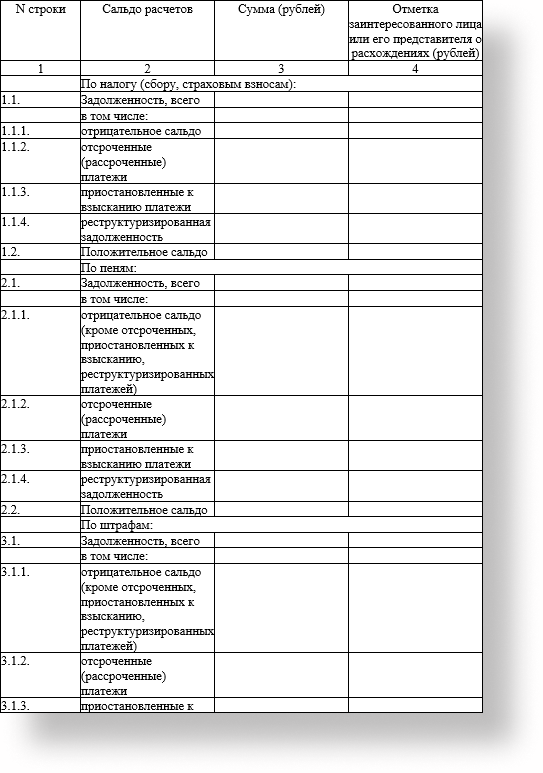

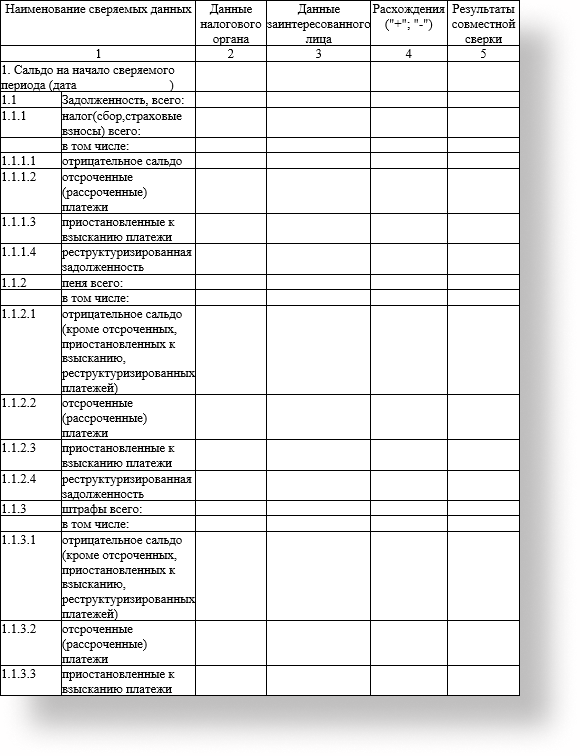

As a result of the request, you will receive a reconciliation report with the tax authorities in the form KND 1160070, which is approved by Order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-17/ [email protected] First of all, we are interested in the tabular part of section 1.

If you agree with the tax authorities, you can simply sign the act and indicate “Agreed without disagreement.” Then send one copy of the act to the tax office.

In case of discrepancies, you need to fill out column 4 of section 1 of the act, where you will indicate the data on your tax accounting. Then in section 1 you need to sign and indicate “Agreed with disagreements.” Submit one copy to the Federal Tax Service.

After receiving the act of disagreement, the tax office will begin an audit. You will be asked to provide documents confirming the accuracy of the corrections you made, for example, copies of payment slips.

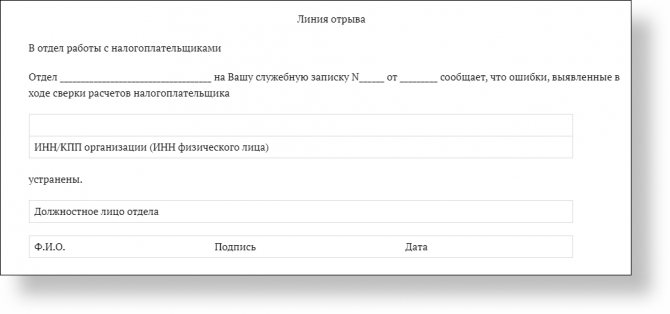

Next, two scenarios are possible. The first is that the tax office made a mistake. If an error is identified, the inspector writes a memo on the same day to the department that made the error. The correction period is 5 working days (clause 3.1.5 of section 3 by Order of the Federal Tax Service of the Russian Federation dated 09.09.2005 No. SAE-3-01/444). After this, the taxpayer will be sent a tear-off portion of the memo.

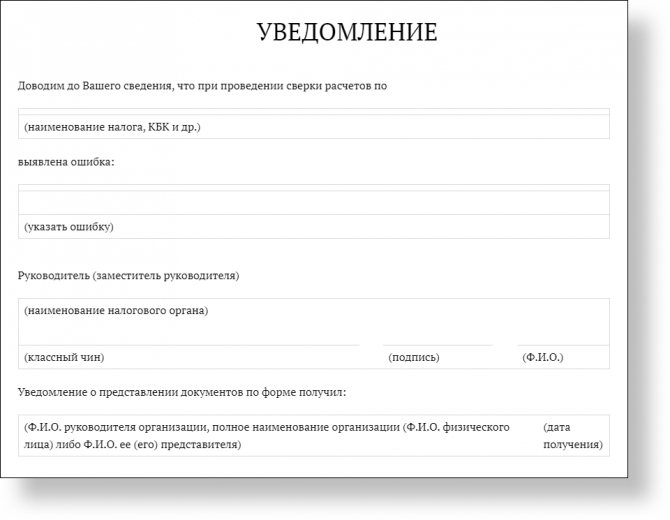

The second option is that the taxpayer made a mistake. In this case, the Federal Tax Service will notify you of the error using a special form (Appendix 2 by Order of the Federal Tax Service of the Russian Federation dated September 9, 2005 No. SAE-3-01/444). If the error was your fault, you need to quickly eliminate it, for example, submit an updated tax return.

After checking and eliminating the violations, the Federal Tax Service will send you a new reconciliation report (clause 3.1.6 and clause 3.1.7 of section 3 by Order of the Federal Tax Service of the Russian Federation dated September 9, 2005 No. SAE-3-01/444). Here again, there can be two scenarios: “Agreed with discrepancies” or “Agreed without discrepancies.” If there are discrepancies, you will need to sign and complete Section 2.

By law, there are 15 days for reconciliation, but if necessary, the period is extended, which most often happens in case of disagreement.

In accordance with the Federal Tax Service Letter No. AB-4-19/ [email protected] , reconciliation is terminated in the following cases:

- the act was signed without disagreement;

- the taxpayer did not return section 1 of the act within 10 working days;

- the taxpayer did not return section 2 of the act within 15 working days.