General rules

The key responsibility of all policyholders is the timely accrual and payment of insurance coverage in favor of working citizens. VNiM contributions generate funds from the Social Insurance Fund, which pays for sick leave, maternity leave and other categories of social benefits.

The first three days of sick leave are paid by the employer, the rest is paid by the extra-budgetary fund. This rule applies only if the employee himself is ill. For example, when calculating maternity leave or monthly child care benefits, the payment amounts are fully compensated by Social Insurance.

If the organization is a participant in the Social Insurance pilot project, then sick leave and benefits are paid directly from the Fund. But those companies that do not participate in the pilot project must reimburse the costs themselves.

Reimbursement of expenses to the Social Insurance Fund - registration rules and list of documents

If your expenses for paying benefits exceed your monthly contributions, then it’s time to apply for reimbursement of expenses from the Social Insurance Fund.

To reimburse benefits for temporary disability, pregnancy and childbirth, that is, those requiring the calculation of sick leave, you need to register on the FSS portal (fz122.fss.ru). In general, I recommend doing this anyway. It is very convenient, in particular, to check calculations with the Social Insurance Fund, not to mention other advantages.

After registering on the monitoring system website, print out the application and submit it to your FSS branch.

Having received a password and extended rights, log in to the system and calculate certificates of incapacity for work. Now the FSS requires registration of all sick leave certificates on the portal.

After making the calculation, attach the original certificate of incapacity for work to the calculation. Don't forget to fill out the back of the sick leave form if you haven't done so before.

List of documents for reimbursement of FSS expenses

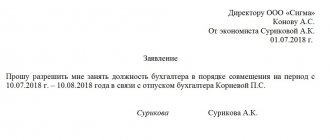

- Application for reimbursement of expenses.

- Interim payslip as of the date of submission of documents (F-4 FSS RF).

- Payment order for payment of the corresponding type of tax (for special regimes of UTII, simplified tax system).

- Temporary disability benefit

- original sick leave certificates with calculation of average wages.

- One-time benefit for women registered with medical institutions. institution in early pregnancy

- original certificate.

- One-time benefit for the birth of a child

- parent's statement

- original certificate No. 24

- a certificate from the other parent’s work stating that the benefit was not assigned or paid (if the parent does not work: a copy of the work record book, a certificate from the social security authorities at the place of residence)

- copy of the child's birth certificate

- Monthly child care allowance until the child reaches the age of one and a half years

- application from a parent for benefits

- a copy of the birth (adoption) certificate of the child being cared for

- certificate (copy) of birth (adoption, death) of the previous child

- extract from the decision to establish child custody

- order from the organization to provide parental leave

- calculation of average earnings

- certificate from the other parent about non-use of leave for up to 1.5 years

- Funeral benefit

- employee's application for benefits

- death certificate from the registry office

- Payment for additional days off to care for a disabled child

- certificate of disability

- parent's application for additional days off

- order to provide an employee with additional days off (copy)

- certificate of unused additional days off by the other parent

- average salary calculation

When an organization has the right to reimburse money from the Social Insurance Fund

It is not always necessary to apply for restoration of expenses through an extra-budgetary fund. To determine the amount to be reimbursed, an organization needs to compare two indicators:

- the amount of accrued insurance premiums for VNIM;

- the amount of expenses incurred to pay for sick leave, benefits and maternity leave at the expense of Social Insurance.

If the costs of paying social benefits exceed the accrual of contributions for VNIM, then reimburse the difference to the Social Insurance Fund. If there is no excess, the employer has the right to reduce the next VNIM payment by the amount of sick leave.

IMPORTANT!

When calculating the amount to be reimbursed, do not take into account the amount of benefits that the employer pays at his own expense (for the first three days of the employee’s illness).

Limits

The amount of reimbursement for labor protection costs is limited. Usually this is no more than 20% of the amounts of insurance premiums accrued for the previous calendar year, reduced by the amount of expenses incurred for:

- payment of temporary disability benefits due to industrial accidents or occupational diseases;

- payment for the insured person's vacation for the purpose of treatment, including travel to the destination and back.

Sometimes the limit is allowed to increase to 30% of the annual amount of insurance premiums minus related expenses. Employees of the Social Insurance Fund receive all this data from Form 4-FSS for the previous year. In the absence of compensation within two years, for organizations with up to 100 employees, it is allowed to use data for the three previous years to calculate the limit.

What documents to submit for reimbursement

To restore funds through the Social Insurance Fund, you will have to prepare a special package of documents. Fill out the following papers:

- The policyholder's application for compensation in 2021 of the established form.

- Certificate of calculation recommended by the letter of the Federal Social Insurance Fund of the Russian Federation dated December 7, 2016 No. 02-09-11/04-03-27029.

- Explanation of expenses or calculation according to Form 4-FSS.

- Copies of supporting documents. These are copies of certificates of incapacity for work, birth certificates of children, death certificates, certificates of registration in the early stages of pregnancy, and so on. That is, those documents on the basis of which social benefits were paid.

IMPORTANT!

Submit a certificate of calculation and breakdown of expenses, in accordance with letter No. 02-09-11/04-03-27029 of the Federal Social Insurance Fund of the Russian Federation dated December 7, 2016, to Social Insurance if you are applying for reimbursement of funds for periods occurring after January 1, 2017. Calculation 4-FSS is submitted to reimburse costs incurred in periods before 01/01/2017.

Copies of supporting documentation must be provided to only two categories of policyholders. These are for those who apply the 0% tariff from 01/01/2017 according to Art. 427 Tax Code of the Russian Federation. And for those who, before December 31, 2016, applied a reduced tariff under clauses 8-10 of Part 1 of Art. 58 of Law No. 212-FZ. Other employers create copies at will.

We recommend providing copies of documents to the Foundation. This will significantly speed up the consideration of the application and increase the chances of a positive decision by inspectors from the extra-budgetary fund.

Attachments to the application

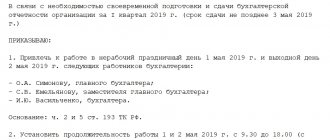

Since since January 1, 2017, reporting on contributions in connection with disability and maternity has been accepted by the Federal Tax Service, the Federal Tax Service does not have the necessary data to verify the accuracy of the information received from the policyholder. Therefore, to confirm expenses incurred after the specified date, you additionally need to fill out and submit to the Fund:

• certificate-calculation;

• breakdown of expenses.

The forms of these documents are given in the appendices to letter No. 02-09-11/04-03-27029.

If expenses were incurred no later than December 31, 2016, an application is submitted in Form 23-FSS.

The certificate indicates the accrual and payment of contributions for the reporting period (on an accrual basis), and displays the amount of debt. In the transcript, the data is duplicated from Appendix 3 to Section 1 “Calculations for Insurance Premiums”: the form contains detailed information about the benefits paid - the number of cases, the number of paid days and the accrued amount of expenses.

In addition, other documents confirming payments must be attached to the application - for example, copies of sick leave, certificates from other employers, etc. It is better to check the exact list with your FSS branch.

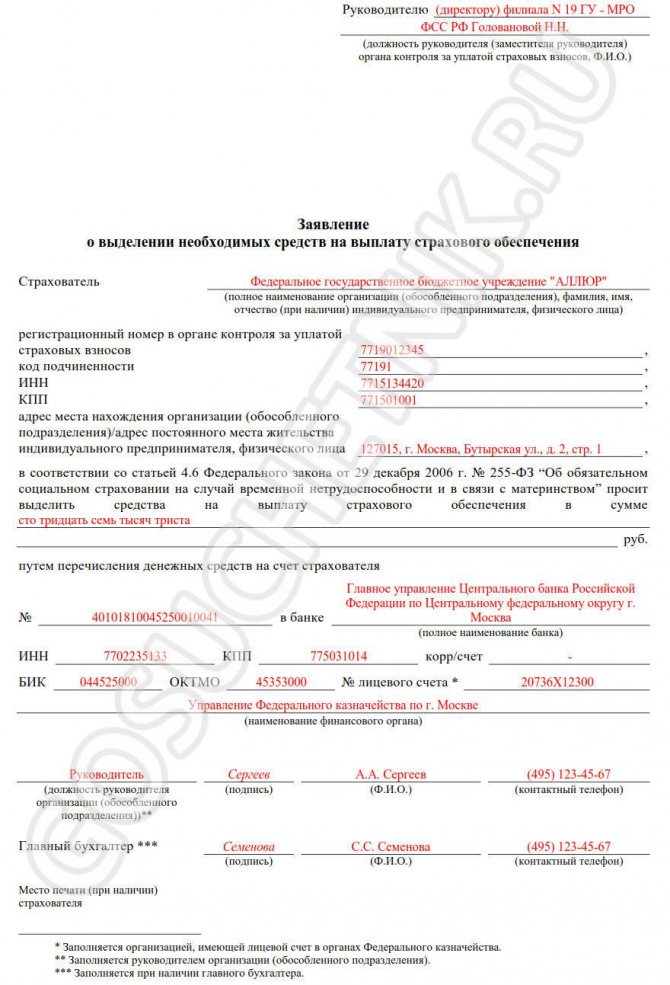

An example of filling out a certificate of calculation and decoding

Regionstroyproekt LLC in the 1st quarter of 2021 accrued contributions to the Social Insurance Fund in case of disability and maternity - 21,000 rubles, of which 14,000 rubles. were transferred in February-March 2021, and the remaining 7,000 rubles. – in April 2021

In the 2nd quarter of 2021, the company was exempt from paying insurance premiums, as it belonged to industries affected by the coronavirus pandemic. However, during this period the company incurred expenses:

• in March 2021, sick leave was paid to 2 employees (for a total of 21 days of illness) in the amount of RUB 15,000;

• in June, a benefit for the birth of a child was assigned and issued in the amount of 18,004.12 rubles.

In order to reimburse social insurance expenses for the 2nd quarter of 2021, Regionstroyproekt LLC sends an application to the Social Insurance Fund, indicating the amount to be reimbursed: 33,004.12 rubles. (15,000 + 18,004.12). The calculation certificate reflects accruals for 6 months of 2020, and the breakdown shows benefits paid.

The document was signed by the director of the company A.N. Demidov. and chief accountant – Antonova M.A.

The Fund has 10 days to make a decision on the application. The review period may increase if an on-site or desk audit is scheduled, but not more than 3 months. The FSS must notify the FSS of any refusal of compensation within 3 days. If the decision is positive, the funds will be transferred to the account specified in the application.

Important information about deadlines

There is no deadline for filing a refund claim. The policyholder has the right to apply for any reporting period if there are documented grounds. There are no restrictions on the number of applications for FSS reimbursement for two years or more. The policyholder is not limited in terms of terms.

The fund will consider the appeal within 10 calendar days and refund the funds. But only on condition that the policyholder has provided the entire package of necessary documents.

IMPORTANT!

The review period will be extended if Foundation controllers request additional information. Or, upon request, a desk or field inspection will be scheduled. The money will be refunded only after the inspections are completed.

How can an employee fill out and submit a form for payment to the Social Insurance Fund?

The application for direct payment to the Social Insurance Fund is filled out by the employee independently and submitted along with the sick leave to the employer. The employer is obliged to submit it to the Social Insurance Fund authorities within five days of receiving such a form.

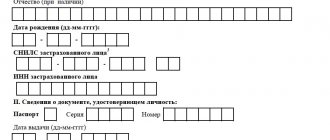

There are certain rules for filling out an application for sick leave payment through the Social Insurance Fund:

- All entries must be black and written using a gel or capillary pen, or typewritten.

- Blots, corrections, crossing out, covering up, etching are not allowed.

- Only those sections for which the applicant has information should be completed.

The procedure for filling out the form to receive direct payment of sick leave benefits for temporary disability:

Articles on the topic (click to view)

- Criminal Lawyer

- How to pay your internet or TTK TV bill without commission?

- Conditions for bankruptcy of individuals

- Article 1484. Civil Code of the Russian Federation. Exclusive right to a trademark

- Sale of apartments at bankruptcy auctions in St. Petersburg

- Trademark cost calculator How much does it cost to register a trademark:

- Who can begin bankruptcy proceedings for a legal entity, what stages does bankruptcy include, and how long do such stages last?

- In the header, in the appropriate columns, the full name of the territorial body of the Social Insurance Fund is written.

- The header indicates who the application is coming from.

- After the words “In connection with the occurrence of an insured event, I request you to assign and pay (pay)” the type of insured event is indicated with a tick. If the applicant is in doubt as to what type of insured event he is in, this can be clarified on the certificate of temporary incapacity for work.

- In the “payment method” column, put a tick next to either “by postal transfer” or “by transfer to a credit institution.

- If the method of receiving the amount of sick leave benefits “through a credit institution” is selected, then the bank details and passport details field is filled in.

- If the applicant wishes to receive disability benefits by postal order, only personal information and address should be filled out in the application. The transfer will be sent to the post office to which this address belongs. You will need to appear in person to receive the transfer after receiving the relevant notice.

After the form is filled out, it must be taken to the employer along with the original temporary disability certificate.

How to make an application

According to the recommendations of representatives of Social Insurance, an application to the Social Insurance Fund contains the required details:

- name and address of the location of the policyholder;

- policyholder registration number;

- the amount of funds claimed for reimbursement.

The procedure for completing the form is fixed in letter No. 02-09-11/04-03-27029 of the Federal Social Insurance Fund of the Russian Federation dated December 7, 2016.

How to submit an application for reimbursement of expenses for the Social Insurance Fund in 2020

There are no particular difficulties in filling out the form. In the header of the application, the company indicates the name of the department of the Social Insurance Fund and the name of the head of the department. In the main text you must put:

- registration number of the organization or individual entrepreneur;

- subordination code;

- INN and checkpoint of the company.

Next, enter the amount that the policyholder wants to return - that is, the difference that arose due to the excess of expenses over accruals. Below are the bank account details to which the Fund will transfer funds if the decision is positive.

The application is signed by the head and chief accountant of the company. The contact telephone numbers of officials and the date of completion are indicated. If there is a seal, the application is certified by its imprint.

The representative of the policyholder, in addition to the signature and transcript of the surname, enters in specially designated lines the details of documents confirming identity (for example, passports) and powers (usually a power of attorney).

If the policyholder decides to apply for compensation, reimbursement of expenses to the Social Insurance Fund can be found at the end of this article.

When does the return take place?

- in the quarter when benefits were transferred;

- per year of granting;

- in other periods.

After submitting the documents, the Social Insurance Fund is obliged to transfer the money to the company’s account within 10 days. If an audit has been initiated against the employer, the time for transferring money is postponed to a later period.

The employer has the right to monitor the status of the register sent to the Social Insurance Fund for reimbursement of expenses. This can be done on the official website of the FSS in the electronic account. This opportunity is available to employers from pilot regions of the new project, where direct payments have been introduced.

- ready for loading – papers are waiting to be loaded into the software module for assigning transfers;

- double – the application is in progress and is being re-uploaded;

- a notice has been generated - clarifications and revisions are required;

- sent for payment – compensation is calculated;

- verified – compensation is generated;

- payment execution – money is transferred to the recipient.

Compensation from the Social Insurance Fund is compensation to the employer for social benefits paid. To receive reimbursement of expenses, you must promptly submit the appropriate package of documents to the Social Insurance Fund.

Every employee working under the terms of an employment contract has the right to receive benefits for temporary disability. If the employer is unable to pay the costs, then the employee has every right to draw up an application sent directly to the Social Insurance Fund.