Worked without registration: features and consequences

Not all workers agree with the opinion that working without an employment contract is bad.

We can say that in this way the employee saves his money without paying taxes, contributions to pension and medical funds. But you shouldn’t delude yourself with just such advantages: there are also very significant disadvantages in working without registration. What are the consequences for an employee who was employed without a contract and receives a salary “in an envelope”:

- Lack of security for the future: the employee does not have official work experience, savings for a future pension, or health insurance;

- Financial insecurity: the employer may leave an unregistered employee without leave and the payments due to him, deprive him of bonuses or not pay wages at all;

- Job instability: An unemployed person can easily be fired, furloughed, or forced to work overtime.

The disadvantages described are the most common ones during employment without official registration. We can say that an employee who does not have an employment contract is practically defenseless before the employer.

The employer will not bear any responsibility for an employee who was employed unofficially. Were you injured at work? Most likely, the employee will simply be left without compensation, and the head of the enterprise will not suffer any punishment.

One of the common causes of conflicts between employees and employers is salary, or more precisely, the procedure for its calculation and payment. Is it possible to punish the manager and oblige him to repay the wages owed if you worked without an employment contract?

Is it possible not to pay a salary to the founding director?

The issue is quite confusing; the legislation does not define the exact status of the director-owner as a subject of labor law. Everything is clear with the hired director; he is a worker like everyone else.

Positions regarding the obligation to pay salaries to the owner-director or founder have changed repeatedly.

At this stage, explanations from official bodies suggest that there is no such obligation; on the other hand, the courts make decisions, considering it mandatory to draw up an agreement and pay a salary to the founding director, from which taxes and contributions are deducted.

During the inspection, an employee of a pension fund or social insurance fund will be able to send materials to the court, and the company will receive a fine and the obligation to pay the amount of previously unpaid contributions.

It’s better to play it safe and sign an agreement with the founding director and pay a salary. Part-time employment and other ways to save on salary are allowed. Such a scheme serves as protection in the future.

How to get paid if the company is bankrupt

It must be borne in mind that the legal regulation regarding wages is strictly established. Thus, according to the articles of the Criminal Code of the Russian Federation, all work must be paid, otherwise the employer’s actions can be reclassified as a criminal offense - coercion to free labor. According to Art. 145.1 of the Criminal Code of the Russian Federation, partial or complete non-payment of wages is prohibited. This predetermines the fact: there are legal ways to solve this problem.

Workers demand payments

In case of non-payment of debt to several employees of the enterprise, a class action lawsuit is drawn up or an appeal to the prosecutor's office. Of course, this does not exclude each individual employee from filing applications.

Mass absenteeism from work is also practiced, with prior notification of the employer by each person who stops going to work. Collective statements usually help speed up the verification process.

Where to turn if wages are not paid on time? The labor inspectorate and the prosecutor's office are contacted at a personal appointment and by submitting an application. To be considered in court, you must draw up and submit a claim, attaching the necessary documents.

Before filing a claim for unpaid wages, it may be advisable to make a telephone call to the labor inspectorate or prosecutor's office. According to the Federal Law “On the procedure for considering appeals from citizens of the Russian Federation,” the form of appeal can be any. The authority will have to give an answer.

By making a phone call, you can arrange a personal meeting and receive some guidance on further actions. Representatives of government bodies take measures to resolve the situation only if they receive written requests.

Depending on the circumstances under which employees’ wages are not paid, the situation of an intentional refusal to issue money or an unintentional one varies. When counting the delay period, one should be guided by Article 136 of the Labor Code of the Russian Federation, according to which wages are paid regularly, twice a month.

The employer organization sets specific dates for payment. It is possible to hold employers accountable even if there is a delay of a day, since missing a deadline is unacceptable and gives grounds for taking action.

On the other hand, a significant delay is usually claimed, and one or two days is considered an insignificant violation of rights that is not worth wasting time on. If the delay is more than two months, criminal liability arises.

Where to go if you don't get paid after you've been fired? How to collect unpaid funds? You should use the same (above) methods of contacting the indicated authorities.

But if the employment relationship is terminated, it is impossible to use the method of influencing the employer - absenteeism. All that remains is the labor inspectorate, the prosecutor's office or the court.

If an employee has already been fired, but is collecting arrears of wages through the court, one must keep in mind the concept of limitation of actions. For this reason, you should not delay filing a lawsuit. Article 392 of the Labor Code of the Russian Federation states that the statute of limitations is only three months and is calculated from the moment of dismissal.

On the day of dismissal, the company had to pay the employee in full. The statute of limitations can be restored if there are good reasons by filing an application containing a request to restore the lost period.

So you should not expect payments from your former employer after dismissal. You need to hurry up and go to court if there are no good reasons for delay.

If citizens come to work from abroad, they must be properly employed. An employment contract is drawn up in the same way as for Russian citizens. It must specify the terms within which salaries are paid.

In this case, the foreign worker has the same right as everyone else to contact the labor inspectorate. If there is no contract, the employee is illegal and the application to the inspectorate will not yield results.

https://www.youtube.com/watch?v=UI-NaP4MneQ

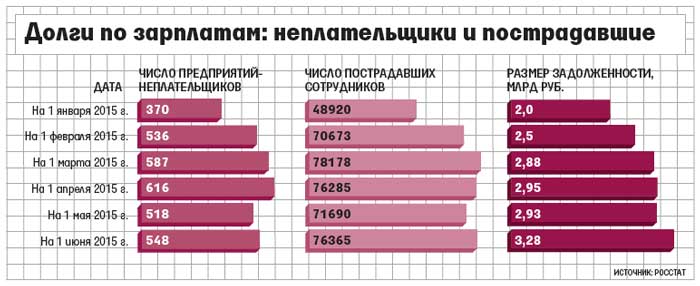

So, if a situation arises when the management of the enterprise refuses to pay an employee’s salary, one of the above methods should be used. Statistical data indicate an increase in the total number of wage arrears in the country.

Therefore, an employee needs to learn to defend his right to payment in such situations. If the employer cannot or refuses to pay wages, he is held liable.

At the same time, the employee protects his rights by appealing to one or more specified authorities. The labor inspectorate is usually a sufficient authority for the return of funds. But if payment still does not happen, the court will provide a guarantee.

Enterprises and companies may go bankrupt, but in this case the law protects the rights of workers and employees. After the initiation of the procedure, the management of the enterprise changes, which is now carried out by the bankruptcy trustee. His task is to evaluate assets and the possibility of financial recovery and distribute accumulated debts.

According to Article 134 of the Law “On Insolvency (Bankruptcy)”, employees of an enterprise are second-priority creditors. Before them, funds are transferred only for the organization of the bankruptcy procedure itself. Therefore, employees have every chance of getting paid, but only the bankruptcy trustee can provide information about when this will happen.

Our assistance to employees

Trdat Group lawyers are ready to help employees receive delayed wages in various situations. For this we:

- We’ll tell you where to go if you don’t get paid, specifically in the case of our client;

- We will find a legal solution in a situation where the employer does not pay black wages;

- We will help you collect evidence;

- We will calculate the debt ourselves, write a statement of claim and submit it to the court;

- We will attend all court hearings for you;

- If necessary, we will appeal the court decision;

- We will accompany the actual collection of the awarded money from the employer’s account;

- If there is no informal employment (without a contract), we will additionally demand through the court to recognize the relationship as an employment relationship and oblige the employer to formalize it;

- At the client’s request, we will negotiate with the employer, write a complaint to him, and help with complaints to the inspectorate and the prosecutor’s office.

The cost of services depends on the complexity of the case and is discussed during a personal consultation.

No documents: what to do if they don’t give you an estimate?

An employee who is not paid a salary without an employment contract has a legal opportunity to protect his interests and receive due payment for his work. For this purpose, there are several state regulatory bodies that carry out supervision in the field of labor activity.

But before you contact, for example, the labor inspectorate or the court, it is worth talking with the employer himself, who is not paying wages. As a rule, ordinary communication about the conflict and threats to file a claim with supervisory authorities are very effective.

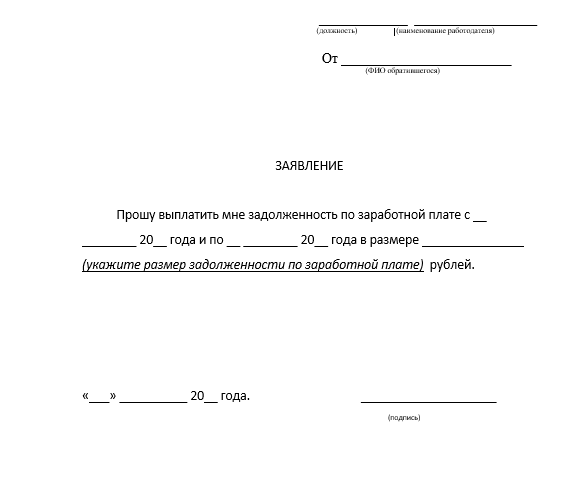

Instead of a regular conversation, an employee can submit a formal written complaint to his employer, which will demonstrate the fact that an attempt has been made to resolve the issue of non-payment of wages amicably. How to make such an appeal?

In resolving any issue, the first step of the parties must necessarily be an attempt to peacefully resolve the conflict. It can be expressed in a pre-trial or claim letter. Such an appeal is made to the enterprise by a person who is not being paid a salary without an employment contract.

A complaint to an employer is a statement that has three parts: a header, a title and a claim. The applicant can hand over the complaint personally to his boss or send a letter by mail if the manager refuses to certify the complaint.

What should be included in the text of the claim? Please include the following information in your application:

- Place of work, date of employment and position.

- The amount of unpaid wages owed, as well as the period of delay.

- Demands for repayment of wage debts.

- Further actions of the applicant if the claim remains unanswered.

We suggest you read: Complaint to the Central Bank against an insurance company

You need to write an appeal to the head of the enterprise in two copies: one will be given to the employer, and the second will remain in the hands of the applicant. Remember that you must respond to a complaint from an employee regarding delay or non-payment of wages within 10 business days from the date of receipt of the complaint. When sending an application by mail, the response period will begin to count from the date of receipt of the letter.

In your complaint to the employer, be sure to indicate the legal norms of the Labor Code of the Russian Federation that were violated by him. For example, according to Article 22 of the Labor Code of the Russian Federation, an enterprise is obliged to pay wages on time and in full.

The employer does not pay wages

There are several authorities to which you can contact regarding the fact that the manager did not pay upon dismissal:

- The Labor Inspectorate works to enforce labor laws. All you have to do is write a complaint against the company. An inspection will be ordered; if the enterprise is a violator, penalties will be applied to it.

- The Prosecutor's Office is a supervisory body that conducts inspections based on received complaints from citizens of any direction. The prosecutor has the authority to inspect the enterprise and impose sanctions on employers. You don’t have to waste your time on a personal visit to the prosecutor’s office, but write a statement and send it to this authority by mail.

- The court will help you get your honestly earned money back.

How to get paid if the company is bankrupt

Situations can be the most unpredictable. Usually, when an employee gets a job at an enterprise, he does not expect that payment of wages will be delayed. It is necessary to distinguish between circumstances when the employer turned out to be a malicious fraudster, extremely unscrupulous, from those cases when the reasons for non-payment did not depend on him.

In the first case, the actions of an attacker or an unscrupulous employer fall under the articles of the criminal code. In the second case, measures and sanctions are applied to him to repay the debt and compensate for damage.

You can take action to repay your debt in the following ways.

Firstly, it is necessary to contact directly the management of the enterprise for which the citizen was employed. Article 142 of the Labor Code of the Russian Federation (Labor Code) provides for the responsibility of the employer in case of delay in payment of wages to employees.

This is material compensation (under Article 236 of the Labor Code of the Russian Federation) and self-defense of the employee in the form of suspension of duties until payment is promised. You are allowed not to go to work if your salary is delayed for more than 15 days.

A written notification to the management of the enterprise or the employer is required. Absenteeism from work is prohibited for civil servants, military personnel and some other categories of workers, for example, those providing life support, as well as during emergency situations.

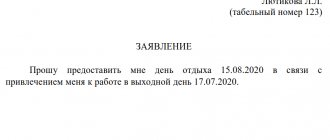

When submitting an application for absence from work due to unpaid work, you need to prepare two copies of the document. An acceptance stamp affixed to one of them will indicate that the notification has been submitted.

The employee keeps this copy as proof that the application was correctly registered. A copy of the application with an admission stamp should be removed from the wording: “absenteeism” and “dismissal for absenteeism.” You can, however, send a registered letter with notification. Then you will have to wait until the employer gets acquainted with the application and only then stop your work.

As soon as the employer notifies the employee of his readiness to pay wages, he is obliged to report to work no later than the next day.

Submitting an application to the Labor Inspectorate is the most appropriate way, since this body was created to resolve issues related to labor legislation and is designed to monitor strict compliance with the laws. This institution is endowed with influence and has the means to influence those responsible for delays in wages, who may be fined and deprived of further opportunities to work in positions.

The inspection staff will also provide assistance in going to court, helping to draw up an application and attach documents to it. It is best to make an application to the inspection in two copies, keeping a copy of the text with an acceptance stamp.

The Constitution of the Russian Federation states: the prosecutor's office is a supervisory body that has the authority to conduct inspections on appeals. Depending on the circumstances, types of liability are applied to the culprit for non-payment of wages.

Unscrupulous members of the employer will be subject to sanctions. Therefore, the real opportunity to return funds and punish the culprits is by contacting the prosecutor’s office. Although such an authority is only a means for a future return of money.

To contact the prosecutor's office, you need to appear at this authority, find out the name and office number of the prosecutor on duty. Then come to this employee for an appointment and tell him about the delay in wages that has occurred, and state the essence of the matter.

Then a statement is written - an appeal to the prosecutor's office, the form of which will be indicated by the prosecutor's office employee. If you don’t have time to visit the prosecutor’s office in person, you can write a statement yourself and send it by mail.

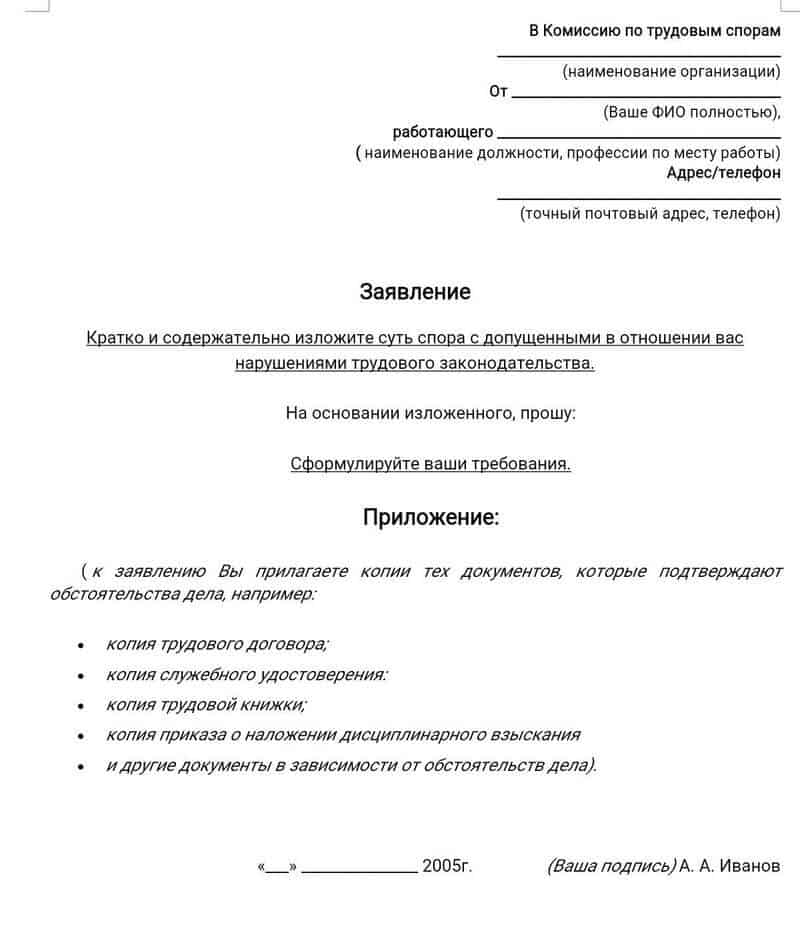

Application to the court for non-payment of wages

The application is drawn up in any form.

The heading indicates the authority for the appeal (the district prosecutor's office of a particular city), the surname, first name, patronymic of the applicant and his address.

At the end, having stated the essence of the issue, you need to put the date of application and signature.

This or that answer given by the prosecutor’s office after the inspection may be the basis for filing a lawsuit with further proceedings.

It is quite possible to file a lawsuit for delay in payment of earned money simultaneously with an application to the prosecutor's office.

Filing an application to the court is a common step when returning money earned but not paid. Punishment of the perpetrators should be carried out by the prosecutor's office, which will consider the elements of a crime under the Criminal Code of the Russian Federation or a violation of the Code of Administrative Offenses, and will assess what is happening.

And the usual compensation for lost income and moral damage must be carried out by a judicial authority. To begin the process, you need to draw up a statement of claim demanding the repayment of the debt and the accrual of penalties for the use of the employee’s funds during the period of delay.

The amount of the penalty corresponds to the refinancing rate of the Central Bank of the Russian Federation, a variable value, which is currently equal to 11% of annual income. This amount is calculated from the next day after the official date on which the salary was required to be paid.

The following can also be recovered in court:

- bonus, if it is obligatory at this enterprise

- compensation for unused vacation

- amount for compensation for moral damage

- costs of seeking legal advice and other legal costs

- lost income if the issuance of a work book is delayed

- compensation for damages for illegal dismissal

- if incorrect entries are made in the work book

It must be said that the state fee for filing applications to the court on the topic of labor disputes is not charged to employees. If payment of funds for the debt was made at the time the case was accepted for judicial proceedings, the claim can be abandoned.

Geographically, the judicial body should be selected according to the location of the enterprise - the employer. At the court premises there are samples for filling out applications and a list of attached documents. Usually this:

- certificate of the amount of debt provided by the accounting department

- employment document, copy

- a copy of the last work record entry

- recent settlement documents

- a copy of the complaint to the labor inspectorate, if available

After receiving a court decision in his favor, the employee contacts the bailiff service (to quickly resolve the issue, in person). Having written an application to the service, you need to wait for the notification, and then for the amount of debt to be transferred to your account.

Worker's rights when wages are delayed

How many days can wages be delayed? Based on Article 142 of the Labor Code of the Russian Federation, the employer is allowed to delay the payment of wages for fifteen days , but no more.

If this period has passed, then the worker can freely defend his rights. He may, for example, not go to work until he receives his earned money. But for this it is necessary to notify the employer in writing.

a demand for payment of arrears of wages and send it to the manager.

It is necessary to fill out the application in two versions: one is sent to the manager, and on the second, let him put his signature and this copy remains with the employee as proof that the employer was aware. If the manager does not want to accept the application or sign, then the employee must send the document by registered mail with notification , as well as a list of the attachments.

At the time of suspension of the performance of his official duties, the worker may be absent from work.

At the same time, the employee’s salary remains at the average size.

If the employee was not at work during this period, then he will have to resume his work activity when the next day comes after receiving a message from the manager about the transfer of the delayed funds on the day the worker returns to work.

Where can I go?

After receiving a claim about unpaid wages from an employee, the employer is obliged to respond to it and take action to resolve the conflict situation. However, not all managers respond to employee complaints, much less fulfill their demands. If a response has not been received or the applicant is not satisfied with it, the applicant should send a letter to the regulatory authorities.

The first authority that can help if wages are not paid without an employment contract is the labor inspectorate. There are branches in every city: you can contact a department employee directly or write an electronic complaint on the inspection website. But what if you don’t have an employment contract?

According to Article 61 of the Labor Code of the Russian Federation, the presence of an employment contract is not required when applying to the court or other supervisory agencies, since the labor agreement begins to be valid from the moment the employee immediately begins working at the enterprise.

This means that even an unofficial employee has the opportunity to file a complaint about unpaid wages, providing government agencies with evidence of the actual performance of their duties. For example, the fact of employment can be proven by:

- Pay slips, accounting extracts, letters from the company to the employee.

- Working documents containing the employee’s details (invoices, invoices, statements).

- Response to a previously filed claim for unpaid wages.

We invite you to read: Is it possible to repay a microloan with maternity capital?

If none of the specified papers is available, then witnesses can prove the fact of work activity: the employee can attract two people who can confirm that the employee was indeed unofficially employed.

The complaint to the labor inspectorate should also include a calculation of wages and arrears, information about all payments and the procedure for their calculation. The processing time for the application is 30 working days.

In the same way, you can contact the prosecutor’s office if the labor inspectorate could not find violations on the part of the employer. By the way, this government agency is more effective, since law enforcement agencies have more powers. The application to the prosecutor's office is also submitted along with documents proving the fact of employment.

What to do

Nowadays, the payment of “black” wages is considered very common. The employer does this to save on tax payments. And for employees, this method of remuneration is very risky. After all, if he is fired, he may not be paid the amounts required by law. It is possible to return black wages, but it will be extremely difficult to do so. An employee who was not paid such a salary will need to collect a lot of evidence confirming that his real income is significantly higher.

The employee should try to resolve the issue peacefully. To do this, you need to go to an appointment with the director and explain that if the funds are not paid in full, he will write a complaint to the relevant authorities to protect his rights. They will write an application to the tax office, which has the authority to hold the organization accountable for failure to pay taxes in full. As a rule, after such a conversation, the manager offers to solve the problem peacefully. In any case, it will be more profitable for him to pay the missing amounts and pay fines.

If the manager still does not want to pay the debt, he will most likely have to go to court. It is important to know that all legal costs, including attorney fees, are first paid by the person filing the claim. After the court is forced to pay the debt, the employer must pay all costs to the employee. Therefore, it is better to contact a legally competent specialist, he will help you draw up a statement of claim and tell you what to do. The employee has the right to demand payment of a penalty for unpaid amounts. It is 1/300 of the Russian refinancing rate of the total debt daily.

To confirm that the employee worked at the enterprise and received payment for the work done in an envelope, he will need to provide proof of this fact in court. The following can be used as evidence:

- Testimony of witnesses - these may be other employees.

- Photos or video material.

- Payroll statements showing full amounts.

- Envelopes that were handed out, with marks.

- Advertisements in the newspaper about vacancies indicating the salary.

- Income statistics in the city for such specialties.

If the court decides that the materials provided are sufficient to support the plaintiff's claim, then it will rule in his favor. Force the company to pay all legal costs, including the presence of a lawyer in court, to the employee who filed the claim.

What to do if nothing helps?

Supervisory agencies are required to act on a complaint received from an employee within one month. As a rule, an audit will be carried out at a company that does not pay wages. After this, the employer will receive an order to eliminate violations, as well as a fine.

But a complaint to the labor inspectorate or prosecutor’s office does not always bring the expected result: the employer may simply not comply with the order or declare that the employee who filed the complaint has never worked for him. What to do in this case?

Both the employee himself and the regulatory authorities can initiate an appeal to the court if their actions were ignored by the employer. The statement of claim is filed at the place of registration of the applicant or at the location of the employer.

It is necessary to collect evidence that they do not pay wages without an employment contract: about actual employment, about the payment procedure and the amount of debt.

You can prove unofficial employment in court in the same way as when contacting the prosecutor's office or the labor inspectorate. All documents must be certified and attached to the statement of claim. How to go to court:

- We draw up a claim in which you need to indicate in detail the place and date of start of work, position, salary amount and the amount of debt for unpaid wages.

- We prepare an evidence base about employment and the procedure for paying wages. The claim must also provide an example of calculations and the amount of debt.

- Then the claim and all documents must be submitted to the court: personally to a government agency employee, by mail, or through an official representative.

The described actions are an approximate plan of exactly how to file a lawsuit against an employer who does not pay wages to an employee who does not have an employment contract. You can also invite two witnesses to the consideration of the case, who will confirm that the applicant was indeed employed.

The claim is filed in court within two months from the date of non-payment of wages or within one month from the date of dismissal.

Such cases are considered in court within several months. As a rule, the decision will be in favor of the plaintiff: the employer will be obliged to repay the debt for unpaid wages, as well as a fine.

How to recover wages through court?

To begin with, we note that the statute of limitations for going to court is one year from the date on which the money must be paid. There is a nuance here that is beneficial for the employee. If, despite non-payment of wages, he continues to work, the violation is recognized as continuing and the statute of limitations does not begin to run (Regulation of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2).

The condensed algorithm of actions is as follows.

- The employee writes a statement of claim to the court with a description (yes, yes, brief and informative) of the situation with a request to the court to recover from the employer the back wages in the exact amount, as well as interest and moral damages. It is more convenient to make the calculation of debt and compensation as a separate appendix to the document.

- The application must be accompanied by copies of the employment contract and any other evidence of non-payment of wages: claims, notices, etc.

- The entire package of documents is submitted to the district court at the place of your choice: your residence or employer registration.

- In a couple of weeks, a hearing will be scheduled, which the employee needs to attend, or, even more reliably, send a competent lawyer in his place. By the way, the costs of a lawyer will be recovered from the employer.

- The basis for collecting money will be a court decision.

What liability is exposed to the employer who caused the delay?

In the absence of corpus delicti under the Criminal Code of the Russian Federation, delayed wages are subject to liability in accordance with the Code of Administrative Offenses (Code of Administrative Offences), Article 5.27. A fine of up to 5,000 rubles is imposed on an official or entrepreneur, and up to 50,000 on a legal entity. If the violation is repeated, the culprit is subject to disqualification for up to three years.

If there is a two-month delay in the payment of earned money, the Criminal Code of the Russian Federation, Article 145.1, is applied, according to which the fine increases to an amount from 100 to 500 thousand rubles. Or, income in the amount of salary for 3 years is collected. A term of imprisonment of up to 3 years is also imposed.

The reasons for non-payment of wages may be valid. This may be a coincidence of circumstances beyond the control of the employer. Then, if there is a delay, he is obliged to pay penalties (compensation) at the refinancing rate.

But even in this case he faces administrative liability. In particular, payment of compensation is mandatory and cannot be avoided. With debt repayment and compensation, all types of liability can be removed from the culprit.

Responsibility of the director if he pays what is due

The law provides for fines for wages not paid on time:

- Officials and entrepreneurs will pay from 1000 to 5000 rubles.

- Organizations such as legal entities will give from 30,000 to 50,000 rubles.

- If the law is repeatedly violated, the official is disqualified for three years.

In case of non-payment of wages in full for more than two months, the legislation provides for the following penalties:

- Fine from 100,000 to 150,000 rubles.

- Criminal liability for up to 3 years and deprivation of the guilty person the right to work or the opportunity to work in certain positions for three years.

Even if there is a delay in paying income to employees through no fault of the enterprise, the employer must pay compensation to the employees. He too may be held accountable.

In what situations is a delay in payment of earnings recognized?

The rules for interaction between a hired worker and an employer are discussed in detail in a separate law - the Labor Code (LC) of the Russian Federation. In the situation of dealing with a non-payer of wages, the following paragraphs are relevant:

- 67th standardizes the procedure for formalizing labor relations. The contract must be formal, printed and signed by both parties.

- 136th regulates the procedure for paying out earned funds. It sets out the following strict standards:

- earnings are calculated and given to the worker in two parts;

- the first must be available to the employee on the day specified in the contract in the period from the 15th to the 31st (30th or 28th);

- second: from the 1st to the 15th of the next month.

From the above provisions of the legislation, mandatory for employers of all forms of ownership, the following fundamental conclusions follow:

- Only officially employed persons can demand payment.

- The delay is counted from the dates specified in the contract.

Law No. 272-FZ dated July 3, 2016 introduced changes to regulations. They touched upon the tightening of responsibility for delays in funding earnings. Persons registered as individual entrepreneurs may be subject to a fine in the amount of:

- from one to five thousand rubles for the first violation;

- for a repeat: from 10 to 30 thousand rubles.

Employee rights

In accordance with labor legislation, an employee has the right to suspend his work activity from the 16th day of salary delay by notifying the employer in writing. During the suspension of work, the employee retains his salary until the employer sends written notice of his intention to repay the resulting debt, after which the employee will be required to return to his duties.

The problem can be resolved in several ways, through various authorized bodies. But the main thing is to act as quickly as possible - there is a risk of missing the deadline, after which it will be difficult to receive your salary.