Wage indexation is the responsibility of all employers, which in practice many private employers ignore. There are several reasons for this ignorance:

- because everyone does it;

- because we never carry out indexing and we have never received anything for this;

- because the Labor Code does not clearly define the indexing mechanism;

- because the company does not have LNA on this matter, and there is no court;

- because there will be no scheduled inspection anyway;

- etc.

Nevertheless, Rostrud claims that indexation is mandatory, and its absence is a violation of labor law.

We studied the explanations of Rostrud on the topic of wage indexation on the Onlineinspektsiya.rf portal and made a selection.

Let us recall that, according to Article 130 of the Labor Code of the Russian Federation, the system of basic state guarantees for the remuneration of workers includes, among other things, measures that ensure an increase in the level of real wages.

Article 134 of the Labor Code of the Russian Federation states that ensuring an increase in the level of real wages includes indexation of wages in connection with rising consumer prices for goods and services.

Commercial firms, individual entrepreneurs and other non-budgetary employers index salaries in the manner established by the collective agreement, agreements, and local regulations (LNA).

That is, the company must have a regulatory act, which, among other things, regulates the procedure for increasing salaries. It is there that all the nuances of indexing should be spelled out.

How to index?

Methods of indexation for employers-commercial organizations are not established by labor legislation, and therefore it is allowed both a direct increase in salaries and tariff rates by the indexation coefficient by concluding additional agreements to employment contracts, and the actual payment of wages taking into account the increasing coefficient without making changes to labor contracts. contracts.

In addition, the Ministry of Labor in letter No. 14-1/ОOG-10305 dated December 24, 2018 reports that salary increases can be carried out by increasing individual payments included in the salary, for example, increasing the salary (the share of the tariff in the salary structure).

Wage indexation: right or obligation of the employer?

Employers often confuse two concepts: salary indexation and salary increases. In contrast to the salary increase, which the employer carries out according to his decision and if there are financial opportunities, indexation is a guarantee of wages and must be made to all employees working under an employment contract (Definition of the Constitutional Court of the Russian Federation No. 913-O-O).

Art. 130 of the Labor Code of the Russian Federation states that measures that ensure an increase in the level of real wages are included in the system of basic state guarantees for the remuneration of workers. These measures, according to Art. 134 of the Labor Code of the Russian Federation, consist of indexing wages taking into account the increase in consumer prices for goods and services. The amount of wage indexation may correspond to the consumer price index for goods and services officially established at the end of a certain period (for the country as a whole or in a particular region). The consumer price index for goods and services can be found on the official website of Rosstat. It may also correspond to the amount of inflation, which is enshrined in the federal law on the federal budget. In addition, the amount of wage indexation may correspond to the increase in the cost of living of the working population.

It is important to take into account that government agencies and municipal institutions index wages in the order that comes down from above through regulatory documents. Other employers are required to prescribe the indexation procedure in local regulations. Letter of Rostrud dated 04/19/2010 No. 1073-6-1 states that “if the organization’s local regulations do not provide for such a procedure, then, given that wage indexation is the responsibility of the employer, we believe it is necessary to make appropriate changes (additions) to local regulations in force in the organization.” That is, Rostrud directly says that the employer is obliged to prescribe the procedure for wage indexation.

Frequency and procedure for salary indexation

If an inspector from the state labor inspectorate during an inspection reveals that none of the company’s local regulations stipulate the conditions and procedure for wage indexation, this will be the basis for bringing the employer to administrative liability under Part 1 of Art. 5.27 Code of Administrative Offences. Violation entails a warning or the imposition of an administrative fine on officials in the amount of 1,000 to 5,000 rubles; for persons carrying out entrepreneurial activities without forming a legal entity - from 1,000 to 5,000 rubles; for legal entities - from 30,000 to 50,000 rubles.

What needs to be specified in local regulations:

- frequency of salary indexation;

- the amount of salary indexation (the company can focus on the consumer price index for goods and services published on the Rosstat website, or on the inflation rate published in the federal law on the budget of the Russian Federation);

- part of the salary that will be indexed.

The frequency largely depends on both the integrity of the employer and his financial capabilities. Depending on which increase factor the employer chooses, indexation can be carried out once a month, once a quarter or once a year. At the same time, for quarterly indexation it is better to choose the cost of living indicator, and for annual indexation - the inflation indicator.

The procedure for indexing wages chosen by the employer is enshrined in a collective agreement or local regulation.

Since the current legislation does not establish a specific procedure for indexing wages, the employer making it for the first time must include a provision on the employer’s obligation to periodically increase wages in a local regulation or collective agreement. For this purpose, you can provide a separate chapter in one of these documents or adopt a new local regulation. After this, all employees must familiarize themselves with the rules of indexation against signature.

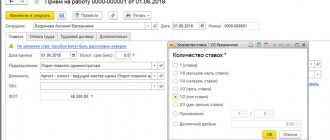

Indexation of the patch is carried out by order of the manager. The order is the basis on which changes are made to the staffing table and additional agreements are concluded to employment contracts on salary indexation. It is registered in the journal for registering orders or instructions.

Next, you need to familiarize employees with the order on salary indexation. Employment contracts indicate non-indexed salaries and allowances, therefore additional agreements must be concluded with employees to change the terms of employment contracts and indicate new indexed allowances and salaries.

Indexation applies to all employees of the organization, therefore, when calculating average earnings when calculating vacation pay, this increase must also be taken into account. In this case, there are two options for calculating the increasing coefficient:

- If only salaries are indexed, then the formula is used: New salary / salary before increase

- If indexation affects the entire wage system, then the formula is used: New salary + new monthly payments / salary before increase + previous monthly payments

Requirements for salary indexation in 2021: comments from the Ministry of Labor

In the Letter of the Ministry of Labor dated December 24, 2018 No. 14-1/OOG-10305, the department once again recalled the contents of Art. 134 of the Labor Code of the Russian Federation and that ensuring an increase in the level of real wages includes indexation of wages in connection with the increase in consumer prices for goods and services. Ordinary employers, unlike government agencies, local governments, state and municipal institutions, index salaries in the manner established by the collective agreement, agreements, and local regulations. Government agencies and municipal institutions do this in the manner established by labor legislation and other regulatory legal acts containing labor law norms.

Since labor legislation does not provide for a uniform method of wage indexation for all employees, the rules are determined based on certain factors:

- depending on the source of financing of organizations;

- laws and by-laws - for government agencies;

- collective agreement, agreement, local regulations - for other organizations.

Indexation is an increase in workers’ wages at the rate of inflation, while the employer has the right to further increase wages for certain categories of workers, as specified in the Letter of the Ministry of Labor.

Experts note that salary increases can be achieved in different ways:

- by proportionally increasing all payments provided for by the organization’s remuneration system and, accordingly, the employees’ employment contract;

- by increasing individual payments included in the salary (for example, increasing the salary (the share of the tariff in the salary structure)).

The employer chooses the most appropriate method, taking into account the opinion of the representative body of employees. But the most important thing that the Ministry of Labor draws attention to is that ensuring an increase in real wages is the responsibility of the employer.

Is it possible not to index the salaries of women on maternity leave, since they don’t work anyway?

A woman contacted Rostrud who was planning to go back to work after maternity leave. During the 3 years that she stayed at home, all employees' salaries were indexed, but her salary remained unchanged. As a result, she will receive less than her colleagues.

Rostrud explained that this should not happen, since discrimination in establishing and changing wage conditions is prohibited by law.

Changes in the wages of women on maternity leave must be carried out simultaneously with other employees, that is, during the period of the specified leave.

If the employer does not have the opportunity to conclude an additional agreement to the employment contract while the employee is on maternity leave, this does not cancel his obligation to index her salary. The employer has the right to conclude an additional agreement to the employment contract after the employee returns from this leave.

The amount of the increase in wages for women on maternity leave should be determined according to the same rules as for other employees, i.e. based on general rules.

The impact of increasing the minimum wage on workers' wages

The minimum wage is established by law. Based on Federal Law No. 421 dated December 28, 2017, the average minimum wage for 2021 in the Russian Federation is 12,792 rubles. Compared to 2021, the minimum wage increased by 21.7%.

In accordance with Art. 133 of the Labor Code of the Russian Federation, each region of the Russian Federation sets its own minimum wage.

Based on Art. 133 of the Labor Code of the Russian Federation, the monthly income of an employed subject who has completed the work required of him during the reporting period should not be lower than the minimum wage. However, if a company is not subject to a regional minimum wage agreement, changes in the regional minimum wage do not affect the compensation of employees of a particular company.

What if the salary was less than the minimum wage before indexation and after indexation still remained below the minimum wage?

The organization carried out salary indexation, but in the end low-paid employees did not feel it. Before indexation, their salary was less than the minimum wage and every month they received an additional payment up to the minimum wage. After indexation, the salary increased, but it again turned out to be below the minimum wage and they are again paid additionally up to the minimum wage. That is, the increase has formally occurred, but in fact it is not noticeable.

Regarding this situation, Rostrud gave the following explanation: the employer is obliged to increase the level of real wages of all employees without exception.

Unfortunately, Rostrud does not provide clearer recommendations or explanations on this matter.

Meanwhile, it can be assumed that formally, even in this situation, the increase will be ensured at least due to the fact that the minimum wage will be increased from the new year. If indexation occurs not from January 1, but, for example, from April 1, then the situation becomes more complicated - after all, the minimum wage will not change after indexation.

Let us note that this situation is somewhat similar to the indexation of pensions that do not reach the subsistence level. For many years, some pensioners did not feel any increase, since as the pension increased, the social supplement to it decreased and the total amount of payments did not change. Last year, this situation was changed and they began to first make an additional payment, and only then index this total mass.

How to calculate - indexing example

Let's assume that the price inflation index for 2021 based on the 2015 situation was:

February period -103.8%; June period -106.1%; August period -105.9%; November period -104.7%.

If we give an example taking into account the daily rate, then it turns out that taking into account the daily rate of one thousand rubles by the end of December 2015, the rate was recalculated.

Then the result will be like this:

- 1250 daily value in rubles × 103.8% = 1298 rubles;

- 1250 daily value in rubles × 106.1% = 1326 rubles;

- 1250 daily value in rubles × 105.9% = 1324 rubles;

- 1250 daily value in rubles × 104.7% = 1309 rubles.

An example on how to calculate the indexation of wages in the salary part. The salary at the end of December 2015 was 20,000 rubles/month. Svet LLC carried out the indexation procedure, and the rate for each day was recalculated. It turned out like this:

- 18,500 monthly norm in rubles × 103.8% = 19,203 rubles from March 1, 2015;

- 18,500 monthly norm in rubles × 106.1% = 19,629 rubles from July 1, 2015;

- 18,500 monthly norm in rubles × 105.9% = 19,592 rubles from September 1, 2015;

- 18,500 monthly norm in rubles × 104.7% = 19,370 rubles from December 1, 2015.

How to force an employer to index wages?

This question is often asked to Rostrud. The answer is predictable - file a complaint with the state labor inspectorate, as well as with the court.

At the same time, you can contact the State Tax Inspectorate electronically - through the Rostrud service.

By the way, the Federation of Trade Unions insists on establishing in labor legislation and social partnership documents specific terms and amounts for wage indexation , ensuring an increase in the level of real wages.

It is possible that sooner or later amendments will be made to the Labor Code and the indexation process will be spelled out more clearly.

Application procedure in the public sector

The current labor legislation focuses on the indexation process specifically in the public sector, that is, in enterprises and organizations that are financed from the state budget. The signal for its implementation is the corresponding orders of the main executive body of the country, that is, the Government of the Russian Federation.

Most often, salary adjustments are made once a year, at the beginning of a new calendar year . However, this may happen more often or less frequently, since the Labor Code of the Russian Federation does not contain instructions regarding its frequency. Indexation in the budgetary sphere is directly affected by the general level of well-being of the state, because funds are allocated from the budget for this.

To adjust wages, various coefficients can be used, the choice of which determines the indexation procedure.

These could be the following indicators:

- Consumer price index. It is established officially for the country as a whole or for a specific region. The monthly value of this indicator is posted on the official website of Rosstat. The percentage of price growth over a certain period will be the amount by which salaries need to be indexed.

- Inflation index. This indicator is set annually in the federal law on the country's budget for the current year at a certain level (for example, 6 or 8%). In this case, the indexation size should be the same. An alternative option could be the inflation rate for the previous period (year, half year, quarter).

- Percentage of increase in the cost of living. The cost of living is determined by law by the Government of the Russian Federation and is also published on the official website of Rosstat.

After determining the coefficient, it is multiplied either by the total wage fund of employees, or by tariff rates or salaries of specific employees. In the first case, the share of the increase will be the same for everyone, but in the second there may be significant differences. Most often, all these issues are determined in a government resolution, so the heads of budgetary organizations can only comply with the adopted instructions.

Can a pregnant woman be fired during her probationary period? How long do you need to work at work to get maternity leave? Follow the link for all the information you need. How to correctly calculate sick leave, you will read in our material.