What is an executive document?

Debt under ID stands for debt under an executive document.

A writ of execution is an official requirement under which debt can be collected in favor of a legal entity or individual. Issued only by a judge and must contain his signature and the seal of the judicial authority.

Based on the document, enforcement proceedings are opened, the result of which is the restoration of the rights of the claimant and the recovery of debt amounts in his favor. The document by which this process takes place is the writ of execution. According to it, the plaintiff can request repayment of the debt independently or through the bailiff service.

We list the details that are required to be included in the writ of execution:

- the essence of the decision of the judicial authority;

- number of the case for which enforcement proceedings will be initiated;

- information about the claimant, acting as the plaintiff, and the debtor, the defendant in the case;

- information about the judicial authority that made the decision on recovery under the writ of execution;

- date of issue and ID number.

Exceptional cases

229 Federal Law Art. 111 part 3 states that if there is not enough money to pay all claimants in full, then the claims will be satisfied in the shares due to each plaintiff according to the writ of execution.

That is, if there is not enough finance to pay debts to all applicants within one queue, then the fund will be distributed in equal proportions, calculated on the basis of the amounts described in the executive document.

This you need to know: Maximum percentage of deductions for writs of execution

How to get an ID?

According to the norms of the Civil Procedure Code of the Russian Federation (Article 428), a writ of execution is issued to the claimant after the court decision comes into force. The exception is an order for immediate execution. Then it will be issued immediately after the decision on collection is made in the courtroom.

A writ of execution is issued to the plaintiff, in whose favor the amount of debt will be collected, or is sent for execution by the court after the expiration of the period given for the opportunity to appeal the decision (most often given 1 month).

There are three ways to obtain a writ of execution:

- The claimant personally or his representative by proxy;

- By mail, indicating the exact address in the application;

- Sent directly to the FSSP for execution.

In the event that there are several interested parties as plaintiffs, the writ of execution can be drawn up in the required quantity. In this case, such a request must be reflected in the application.

The application for receipt of a document does not have a strictly established form. The applicant can submit it in free form to the judicial authority, indicating his details and requesting a writ of execution for a specific case. You must sign and date it.

The procedure for repaying debt under a writ of execution

There are two ways to pay off your debt:

1. Voluntarily.

If the debtor is ready to repay the debt, then he will be exempt from paying the enforcement fee, and will also avoid all the prohibitions and restrictions that threaten forced collection. A period of up to five days is allotted for voluntary repayment .

In the event that the amount of debt is large enough and the debtor cannot pay it off all at once, he has the right to apply to the court to delay or spread out the execution of the requirements under the writ of execution. By writing a statement addressed to the bailiff, he, in turn, can apply for a deferment to the judicial authority at the place of enforcement proceedings.

It should be noted that an installment plan or deferment can only be associated with reasonable arguments by the debtor and evidence that he is not able to pay the entire amount at once. At the same time, the terms within which the obligations under the executive document will be fulfilled in full are specified.

2.Forcibly.

If the period allotted for the voluntary fulfillment of obligations has passed and the debtor has not shown a desire to act, the amount of the debt will be forcibly collected. There are several options for repaying debt, depending on the combination of factors and circumstances of the case:

- debiting funds from the debtor's bank accounts. Upon receipt of the writ of execution, the bank monitors the receipt of funds in the accounts and unconditionally writes them off in favor of the claimant. At the same time, the bank can act not only as a executor, but also as a collector when it demands funds under a writ of execution to repay a loan taken by a citizen and evading the fulfillment of obligations under it;

- sending the ID to the debtor’s place of work or receiving a pension (PFR). In this way, it is possible to collect a debt only in cases of small amounts under a writ of execution (up to 10 thousand rubles), periodic payments (alimony, etc.) and the debtor does not have property;

Deductions under a writ of execution should not exceed half of the salary or pension. An increase to 70% is possible only when collecting alimony or for compensation for damage to health caused to the claimant.

- seizure of property with its subsequent sale at auction, as well as funds. This option occurs when a citizen has a large debt, he has no income and it is impossible to collect the amount in other ways.

Situations often arise when the debtor has neither official income from which foreclosure can be applied, nor property subject to seizure and sale at auction. In this case, bailiffs work to identify other assets and search for sources of income of the debtor for a certain period of time. If the payment deadline expires, but there is no positive result, then a determination is made to terminate the enforcement proceedings with the impossibility of collection. The writ of execution will be returned to the claimant, but he has the right to initiate the procedure again and go to court again.

As part of the case, we undertake the following responsibilities:

- filing an application to initiate enforcement proceedings;

- participation in the procedure for exclusion from the inventory of property on the side of the claimant or debtor as part of enforcement proceedings;

- filing petitions for additional actions such as: seizure of property, prohibition of registration actions in the MREO traffic police, bodies carrying out registration of real estate;

- procedure for banning travel outside the Russian Federation;

- petitions to request information about the availability of property from the debtor to the tax authorities (transfers of wages, whether the debtor is registered as an individual entrepreneur, participation in business activities as a manager or founder of a legal entity), to the employment service, to regional banks regarding the availability of accounts and funds on them, to the registration authorities and the BTI on the issue of real estate registered in the name of the debtor,

- requesting the debtor’s credit history to enable the seizure of a bank account;

- participation of a lawyer in litigation on issues of deferment and installment execution of a court decision, both on the part of the initiator of the application and on the part of the interested party;

- travel together with the bailiff to the debtor for the purpose of searching for property;

- drawing up applications to initiate a case and representing interests within the framework of an audit, according to the elements of the crime provided for in Art. 157 of the Criminal Code of the Russian Federation (on the fact of malicious evasion of payment of funds for child support), Art. 177 of the Criminal Code of the Russian Federation (on the fact of malicious evasion of debt repayment), Art. 312 of the Criminal Code of the Russian Federation (on the fact of illegal actions in relation to property described or seized or subject to confiscation), Art. 315 of the Criminal Code of the Russian Federation (on the fact of malicious evasion from execution of a judicial act);

- procedure for prohibiting the debtor from driving a vehicle;

- mediation procedure with the debtor (offering options for mutually beneficial resolution of the conflict, concluding a settlement agreement);

- work regarding the allocation of the debtor spouse’s share in jointly acquired property;

- resolving the issue of additional measures of influence on the debtor (in case of evasion of payment of alimony, a process can be initiated to deprive parental rights, etc.);

- analysis for re-request of previously received information due to the passage of time;

- increasing the debtor's debt by filing applications to the court to index the court decision, collecting additional damages (penalties), including the possibility of using the method of bringing the debtor to criminal liability;

- posting information about the debtor in the media and the Internet (posts on a social network, creating groups or a full-fledged website), which interferes with the debtor in his business activities or in promoting his own brand;

- appealing the actions of the bailiff in case of his illegal action (inaction) to a higher authority or to the court.

Video with tips on protecting the rights of the claimant, the possibilities of filing a complaint against the bailiff, actions aimed at speedy execution of the court decision by the bailiff:

Individual actions or a combination of all actions aimed at speedy execution of a court decision can give a positive result. Conversely, without proper control and intervention of lawyers in the enforcement process, rarely does anyone achieve full execution of a court decision. To get started on the path to executing the decision, just call us - we will do the rest for you.

ID validity period and other nuances

The deadlines for the presentation of writs of execution are established by law and are reflected in Article 21 of the Law “On Enforcement Proceedings” No. 229-FZ.

After the ID comes into force, the claimant has three years to submit claims under this document. As a rule, they turn to bailiffs for collection and, as practice shows, debt repayment can take years. During this period, proceedings can be completed and resumed as long as the claimant has a firm intention to receive the entire amount of the debt or until the entire amount is repaid.

The reasons why debt cannot be acquired immediately can be different, for example, lack of property, work, or being on parental leave. Then the bailiffs decide that it is not possible to collect the debt from the debtor. The writ of execution with the corresponding resolution is returned to the plaintiff.

Nuance ! The claimant can resume the process within three years until the statute of limitations has expired. Repeated application during this period may change the situation and there will be a chance to return the funds.

Example of withholding amounts

The writ of execution is received by the organization that issues wages to the debtor, from the claimant or from the bailiff. According to Article 99 of Federal Law No. 229, the employer does not have the right to withdraw from the employee’s income an amount greater than 50% of the monthly salary. If we are talking about payments for children under 18 years of age, then the threshold rises to 70% of income.

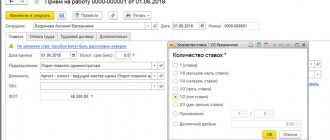

An example of collection of debts of different priority

A writ of execution was received in the name of the employee Andreev I.G. Based on the sheet, the employer is obliged to collect 33% from the employee’s salary to pay child support for two children.

A month later, the company received a second document - about the withholding of personal income tax that was underpaid during the sale of real estate. Collection of funds must be made monthly from 07/01/2020 to 10/30/2020 in the amount of 3,820 rubles. (total RUR 11,460).

Andreev’s monthly earnings are 18,580 rubles. According to the law, it is allowed to withhold no more than 9,290 rubles. (18,580*50%).

Amounts for payment of alimony - 6,131.40 rubles. (18,580 * 33%). Deductions for children are of the first priority, so the company does not have the right to withdraw more than 3,158.60 rubles from Andreev’s salary. (9,290 – 6,131.40). Thus, the retention occurs in the order:

- July: alimony - 6,131.40, personal income tax - 3,158.60 (r.);

- August: alimony - 6,131.40, personal income tax - 3,158.60 (r.);

- September: alimony - 6,131.40, personal income tax - 3,158.60 (r.);

- October: alimony - 6,131.40, personal income tax - 1,984.20 (r.).

Hotline for citizen consultations: 8-804-333-70-30

It will not be possible to satisfy the requirements of the second writ of execution within the requested 3 months. According to the priority, funds will be collected in the fastest possible way.

An example of collection of debts of one priority

Rechy A.I.’s salary is 19,510 rubles.

In July 2021, a writ of execution was received against the employee, according to which in the period from 01.07 to 30.11 it is required to withhold 10,150 rubles. The funds will go to:

- for compensation for material damage equal to 7,575 rubles. (total RUB 30,300);

- for compensation for moral damage - 2,575 rubles. monthly (total 10,300 rubles).