Withholding of alimony

Legal relations related to the maintenance of minors can be settled voluntarily on the basis of an agreement establishing the procedure and terms of such payments.

In essence, an agreement is a special type of contract concluded between a person entitled to receive payments and one who is obliged to make them. The incapacity of one of the parties is the reason for concluding an agreement with the participation of a legal representative.

The agreement is drawn up in writing, and the document receives legal force from the moment it is notarized. The value of a certified agreement is equal to the value of a writ of execution, which gives the parties the right to present it for actual execution to the FSSP authorities or at the payer’s place of employment.

What to do if this happens?

If an organization does not pay alimony, first of all, you need to find out the reason. It may happen that the employee (debtor) is no longer an employee of this company, accordingly, the obligation to pay benefits from the company is automatically removed. There may be other reasons for delay or non-payment of alimony, in any case, the algorithm of actions in this situation will be as follows :

- First, you need to send a request to the organization about the reasons for the delay in transfers (written in the form of an official appeal addressed to the manager, drawn up in 2 copies).

- Next you should wait for a response.

- If this does not follow, you need to file a claim or contact other authorities to resolve the issue.

You may find the following information interesting: alimony penalties.

Letter of claim to an enterprise

The complaint to the organization is written in free form. It must contain the following information :

- Organization details.

- Manager details.

- Full name and details of the applicant.

- Defaulter's details: full name, position.

- Circumstances of the case: number of the writ of execution, period of delay in payments, amount of debt.

- Demand: resume the transfer of alimony, pay off the debt.

- Signature and date.

The claim can be submitted in person (in 2 copies, one of which remains with the claimant with a signature confirming acceptance). If the debtor's place of work is far away, the document can be sent by registered mail with notification. Copies of postage receipts should be retained in case of litigation.

A complaint is an official document, and it must be drawn up in accordance with all the rules of business correspondence (exclude obscene language, present all information concisely and to the point).

The generally accepted period for reviewing claims is 10 days. If during this time no response has been received, alimony payments have not been received, you need to contact other authorities.

What amount of alimony can be determined by agreement?

The fact that the agreement is a form of contract gives the parties the right to freedom to determine its essence. Its main provisions are designed to determine the amount of payments, their timing and method. As in other agreements, liability for actual failure to fulfill obligations, the procedure for making changes and other provisions may be provided here. The amount of payment is determined by the parties by agreement. In order to avoid abuse of the right to establish any amount of alimony payments, the legislator limited the lower limit by prohibiting the withholding of alimony from wages in agreements below the amount that is provided for by law and could be established on its basis.

Thus, deduction of alimony from wages for maintenance:

- one child cannot be assigned less than a quarter of the salary;

- two – below 33% of income;

- three or more - less than half of earnings.

The parties may agree that the deduction of alimony from wages will be in a fixed amount.

Child support debt: how much of your salary can be withheld by law?

Is it legal to withhold such amounts from the income of a negligent payer? Absolutely legal. Most often, a child support deduction of 70 percent is assigned if the father has accumulated many years of debt. Or if he needs to support children together with his ex-wife (or several), despite the fact that the woman is on maternity leave for up to 3 years.

Most often, living on 30% of income is difficult, so alimony payers try to find errors in the calculations. Or convict your ex-wife, employer or bailiffs of abuse of power. Sometimes there are actually errors in deductions that affect, for example, the amount of alimony debt.

In any case, the payer can:

- Study the materials of enforcement proceedings (decree on debt calculation, writ of execution). This is stated in Article 50 of Law No. 229-FZ of October 2, 2007.

- Familiarize yourself with the accounting calculations on the basis of which alimony payments were made.

the person who made it will have to reimburse the funds . This could be a bailiff, an ex-wife, or an accounting department at work. But even if the calculations are correct and the accrual of 70% is correct, the payer can still go to the magistrate’s court and ask to reduce the amount of alimony or partially write off the resulting debt.

Changing the terms of the agreement to withhold alimony

The agreement can be amended or terminated by the parties at any time, requiring only mutual consent. The procedure for making changes does not differ from the procedure for concluding an agreement, which indicates the need for notarization of an agreement set out in writing.

The law does not allow unilateral changes or refusal to fulfill agreements of one of the parties without the consent of the other.

The party whose financial situation or family status has changed, even in the absence of the consent of the second party to the agreement, has the right to apply to the court to request a change or termination of the agreement. As a rule, such grounds give the alimony payer the right to pay alimony in a smaller amount, and the recipient to demand an increase in this amount.

A claim brought within the framework of such legal relations is considered in accordance with the general procedure.

Procedure for withholding alimony

What is the procedure for withholding alimony?

Forced withholding of alimony is the most common type of financial support for a child.

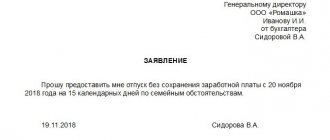

Withholding of alimony based on agreement

The existence of agreements between the parents, set out in the agreement on deduction of alimony from wages, establishes the amount of alimony and the procedure for collecting it. The parties can establish a rule for transferring funds from wages, both as a percentage and as a fixed value. The main thing is that this amount should not be lower than what could be established by the court on the basis of the law.

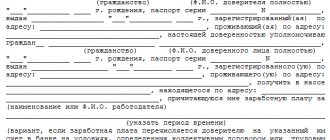

Withholding of alimony from wages is carried out based on the application of the employee himself. Such an application for deduction of alimony from wages must be made in simple written form. It must indicate:

- Full name of the recipient and his passport details;

- details of the child, including his age;

- establish the nature and amount of deductions;

- retention frequency (once or twice a month);

- transfer deadline; recipient details;

- the date from which transfers must be made.

A notarized agreement submitted to the employer’s accounting department is mandatory for making transfers, because its strength is equal to the strength of the executive document.

The lack of desire on the part of the alimony payer to fulfill the agreement voluntarily, including by transferring it to the accounting department at the place of work, is the basis for the alimony recipient to apply to the court in order to obtain a court order.

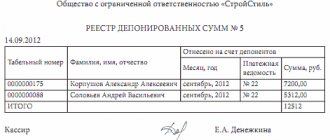

Registration of transfer of alimony through accounting

If the spouses were able to agree with each other on the payment of alimony without bringing the matter to court, then all they have to do is confirm the terms of their agreement with a notary. When peace negotiations do not lead to anything, the potential recipient of child support brings an application to the court. If the defendant agrees to pay alimony under the specified conditions, the court will issue an order. If there are serious disagreements between the former spouses, the single parent will be forced to file a statement of claim in court, after which the verdict will be a writ of execution. In order for an employer to begin transferring alimony, he must provide documents confirming the legal basis for the payments. Such papers include notarized agreements between spouses, court orders and writs of execution.

All these documents must indicate the conditions for the transfer of alimony, as well as the details for their transfer (mailing address of the defendant or bank account). The claimant must himself send the original papers to the organization where the future payer works. If the alimony worker works at several enterprises at once, then it is necessary to deliver documents to each of them. Duplicates, photocopies and scanned electronic versions are not accepted.

Agreements on the payment of alimony, writs of execution and court orders are documents of strict accountability. Therefore, the employer appoints a responsible accounting employee to record, store and process them. These papers are handed over against signature and are stored not in a general pile of documents, but in specially designated places: safes or metal locked cabinets.

If documents on the assignment of alimony are lost, the responsible person may be punished with a fine of up to 2,500 rubles.

The entire procedure for withholding and paying alimony is specified in the Family Code of the Russian Federation. Upon receipt of writs of execution, orders and agreements, the accountant is obliged to record their appearance in the reporting journal. Then the responsible employee determines from what date the funds must be withheld. The date must be indicated on the documents received. Sometimes the papers arrive much later than the start date of collection stated in them. In this case, the accountant is obliged to borrow the debt for the previous days or months from the employee of the enterprise. If all the necessary documents arrive on time, then the accounting department begins to calculate payments for child support from the employee’s next salary according to the specified percentage or a fixed amount after deducting personal income tax. Alimony is not paid in advance, so the recipient can expect it no earlier than the day the former spouse “pays”, but no later than three days after this event.

According to the law, alimony cannot amount to more than 50% of a citizen’s income. If, in addition to the basic monthly contribution, a child support debt is withheld, then the total amount of payments should not exceed 70% of the salary. Before making payments, the accounting department checks whether these conditions are met.

Postings for the transfer of alimony reflect quantitative changes in the payer’s salary and are usually characterized by the debit and credit of the accounting item. So, the debit part will always have account No. 76, and the credit part will depend on the method of paying alimony. That is, account No. 50 is a cash payment, No. 51 is for payment by bank transfer, No. 71 is for a postal transfer. And the posting of alimony through the eyes of an accountant always looks like this: Dt 76 Kt 50 (51, 71).

When transferring alimony, the organization does not undertake additional expenses associated with the delivery of funds to the recipient. That is, the costs for bank commissions and postal transfers are paid by the employee.

Also, payers often have a reasonable question: is it necessary to pay alimony from the refund of tax deductions? For example, if an employee gets sick, studies or buys a home, he can get some of the funds back by filing an application with the tax office. In fact, these payments are not listed in the list of income from which alimony is collected. Therefore, the payer can be calm in the event of receiving a tax refund.

See also:

Registration of a receipt for the collection of alimony

Certificate of withholding of alimony

At the request of the employee, he must be provided with a certificate of withholding of alimony.

Withholding of alimony for individual entrepreneurs working under the simplified tax system is carried out based on the results of the deduction of documented expenses related to business.

Child support is withheld not only from wages; it is also calculated from other types of income, such as:

- monetary support for municipal employees, health workers and teaching staff;

- creative fees;

- allowances and bonuses;

- pensions;

- other compensation payments.

When calculating alimony, amounts of income related to: the provision of payments on the occasion of marriage registration, the birth of a new child, the death of a relative, and compensation payments are not taken into account.

The termination of alimony withholding is associated with the death of the payer or recipient, as well as with the child reaching the age of majority.

How is alimony paid?

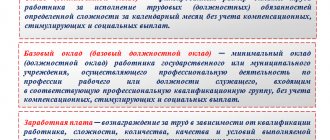

The list of income from which funds are withheld is prescribed in Government Decree No. 841 of July 18, 1996. These include:

- salary, compensation, incentive payments (bonuses, allowances, vacation pay, etc.), average monthly earnings for periods of time specified by law. All other “labor” payments, incl. upon reduction, the salary of certain categories of workers;

- social benefits from the state, such as: pensions (except for survivors’ pensions), unemployment benefits, educational scholarships, disability payments;

- a person’s income from business activities, from the disposal of property (for example, the amount from renting out an apartment under a residential lease agreement; dividends from shares, etc.), from the sale of products of intellectual activity (royalties);

- compensation payments for moral damage caused, as well as amounts of financial assistance in connection with death or for damage to health.

How to calculate the penalty for alimony ?