Average salary in Russia in 2021 for calculating alimony

Or parents can reach a voluntary agreement regarding the financial support of the child.

Such a document is signed in a notary’s office, and the party receiving payments (spouse) must independently control their receipt. For example, if the payer changes his place of work, the interested party himself presents the agreement, certified by a notary, at the new workplace. In particular, the parent is responsible for paying money to the children or spouse. Such funds are called alimony, and the procedure for calculating and deducting them is carried out in accordance with the Family Code and federal legislation.

1. Collection of alimony for the past period on the basis of an agreement on the payment of alimony or on the basis of a writ of execution is carried out within the three-year period preceding the presentation of the writ of execution or a notarized agreement on the payment of alimony for collection.

2. In cases where the withholding of alimony on the basis of a writ of execution or on the basis of a notarized agreement on the payment of alimony was not made through the fault of the person obliged to pay alimony, the collection of alimony is carried out for the entire period, regardless of the three-year period established by paragraph 2 of “Article 107” of this Code term.

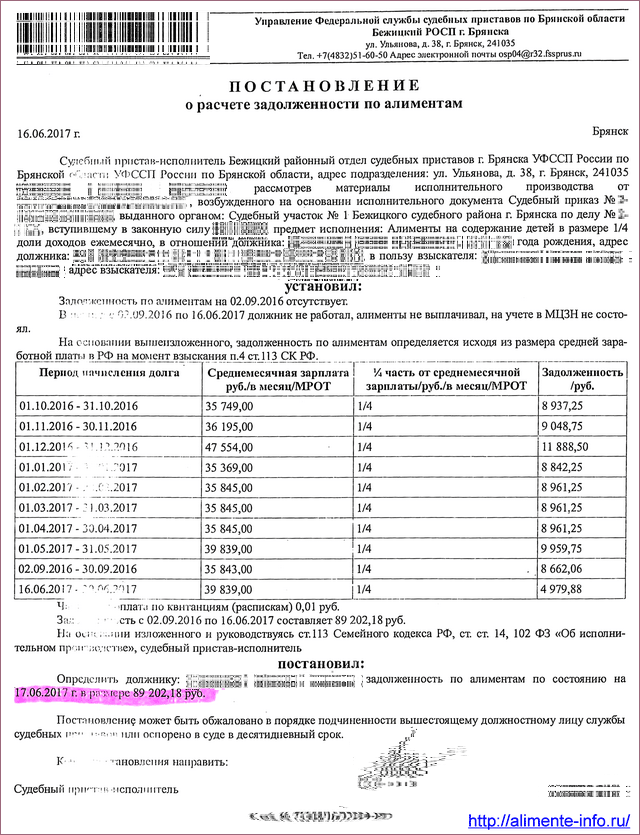

The absence of a permanent job for a person who has an obligation to pay alimony, or his unwillingness to provide information about income, does not mean that he can refuse to make the established payments for child support. In such a situation, the bailiff has no difficulty in calculating the debt.

The Family Code provided for such a development of events, and contains a rule (clause 4 of Article 113) that if the person charged with the obligation to pay alimony did not work during the specified period or did not provide data on the income received, the debt is withheld from him taking into account the average salary. This is what the bailiff is guided by when fulfilling his duties in relation to faulty debtors.

- The income of the obligated person is constant and the salary is paid to him in an “envelope”.

- The debtor has the status of a private entrepreneur, and he deliberately does not submit a report on his income to the court.

- The procedure for such calculation is contained in the agreement between the spouses.

- For various reasons, the parent did not pay amounts for child support, for example, he did not find work for a long time. In this case, the alimony debt should be calculated.

The numerical value of the average salary in the Russian Federation is used to determine the amount of alimony. This is due to the fact that the salary unit calculated in this way determines the average level of wages for a certain group of the average population. Accordingly, the resulting numerical value can be used to calculate the average amount of alimony payments, the final amount of which must partially or fully satisfy the financial needs of the recipient of the amounts.

As a rule, the arithmetic significance of the average salary is most often used when it is necessary to determine the amount of alimony debt for the past period. This option is optimal due to the fact that the final amount of debt is determined based on the annual average salary during the period when no payments were made.

The basis for accounting for average wages to determine arrears of alimony payments are the following regulations:

- Family Code of the Russian Federation (abbreviated as RF IC) dated December 29, 1995 – Law No. 223-FZ. This is the main law in the Russian Federation that regulates relations regarding alimony payments. This is discussed in detail in Art. 113 (on determining alimony debt).

- Federal Law “On Enforcement Proceedings” dated October 2, 2007 – Law No. 229-FZ. In this law, namely in Art. 102, the procedure for claiming alimony debt is specified.

The average salary in the regions of the Russian Federation is 36,746 rubles. Let's consider each region of the Russian Federation separately.

| № | Region | Average monthly salary, rub. |

| Average for the Russian Federation (used to calculate alimony in all regions of the country) | 36746 | |

| 1 | Chukotka Autonomous Okrug | 85678 |

| 2 | Yamalo-Nenets Autonomous Okrug (Yamalo-Nenets Autonomous Okrug) | 83832 |

| 3 | Nenets Autonomous Okrug (NAO) | 71908 |

| 4 | Moscow | 71220 |

| 5 | Magadan Region | 68584 |

| 6 | Sakhalin region | 66239 |

| 7 | Khanty-Mansiysk Autonomous Okrug - Yugra (KhMAO) | 63622 |

| 8 | Kamchatka Krai | 59923 |

| 9 | The Republic of Sakha (Yakutia) | 58504 |

| 10 | Murmansk region | 48715 |

| 11 | Saint Petersburg | 48684 |

| 12 | Moscow region | 43467 |

| 13 | Komi Republic | 43427 |

| 14 | Khabarovsk region | 41401 |

| 15 | Tyumen region | 38370 |

| 16 | Krasnoyarsk region | 38361 |

| 17 | Arhangelsk region | 38351 |

| 18 | Primorsky Krai | 36106 |

| 19 | Leningrad region | 35816 |

| 20 | Tomsk region | 35459 |

| 21 | Irkutsk region | 34907 |

| 22 | Amur region | 33131 |

| 23 | Transbaikal region | 32785 |

| 24 | Sverdlovsk region | 32759 |

| 25 | Republic of Karelia | 32591 |

| 26 | The Republic of Khakassia | 32310 |

| 27 | Jewish Autonomous Region | 31963 |

| 28 | Kaluga region | 31504 |

| 29 | Chelyabinsk region | 31005 |

| 30 | Perm region | 30713 |

| 31 | Republic of Tatarstan | 30410 |

| 32 | The Republic of Buryatia | 30221 |

| 33 | Novosibirsk region | 29868 |

| 34 | Kaliningrad region | 29832 |

| 35 | Kemerovo region | 29828 |

| 36 | Tyva Republic | 29716 |

| 37 | Vologda Region | 29324 |

| 38 | Tula region | 29080 |

| 39 | Krasnodar region | 28586 |

| 40 | Yaroslavl region | 28515 |

| 41 | Samara Region | 28504 |

| 42 | Omsk region | 28465 |

| 43 | Nizhny Novgorod Region | 28172 |

| 44 | Novgorod region | 27901 |

| 45 | Republic of Bashkortostan | 27820 |

| 46 | Ryazan Oblast | 27495 |

| 47 | Astrakhan region | 27423 |

| 48 | Sevastopol | 26895 |

| 49 | Belgorod region | 26873 |

| 50 | Voronezh region | 26758 |

| 51 | Rostov region | 26661 |

| 52 | Udmurt republic | 26544 |

| 53 | Orenburg region | 26109 |

| 54 | Tver region | 26087 |

| 55 | Lipetsk region | 26075 |

| 56 | Vladimir region | 25780 |

| 57 | Volgograd region | 25739 |

| 58 | Stavropol region | 25387 |

| 59 | Kursk region | 25334 |

| 60 | Penza region | 25334 |

| 61 | Republic of Crimea | 25245 |

| 62 | Smolensk region | 25091 |

| 63 | Ulyanovsk region | 24369 |

| 64 | Altai Republic | 23976 |

| 65 | Kirov region | 23625 |

| 66 | Saratov region | 23492 |

| 67 | Kurgan region | 23381 |

| 68 | The Republic of Mordovia | 23379 |

| 69 | Mari El Republic | 23232 |

| 70 | Kostroma region | 22996 |

| 71 | Republic of Adygea | 22982 |

| 72 | Oryol Region | 22890 |

| 73 | Bryansk region | 22819 |

| 74 | Tambov Region | 22762 |

| 75 | Chuvash Republic | 22736 |

| 76 | Chechen Republic | 22520 |

| 77 | Pskov region | 22264 |

| 78 | Ivanovo region | 22067 |

| 79 | Republic of North Ossetia-Alania | 22063 |

| 80 | The Republic of Ingushetia | 21569 |

| 81 | Kabardino-Balkarian Republic | 21489 |

| 82 | Karachay-Cherkess Republic | 21465 |

| 83 | Altai region | 21185 |

| 84 | Republic of Kalmykia | 21133 |

| 85 | The Republic of Dagestan | 19953 |

The application of the average salary in the Russian Federation to alimony is regulated by the following legal norms:

- Art. 102 of Federal Law No. 229-FZ of October 2, 2007 “On Enforcement Proceedings”;

- Art. 113 RF IC;

- Methodological recommendations on the procedure for fulfilling the requirements of executive documents on the collection of alimony dated June 19, 2012 No. 01-16 (in particular, Article 5.1). Bailiffs are recommended to request monthly up-to-date information about the average salary of Russians from Rosstat.

According to disappointing statistics, every third alimony collector in the Russian Federation is faced with the problem of alimony debt. This happens most often due to the deliberate actions of the defaulter:

- dismissal from the official workplace;

- unofficial employment and receiving “gray” wages;

- did not register as an unemployed person with the Employment Center at his place of residence to look for a job.

We suggest you read: How to choose a bandage for pregnant women

Regulatory acts when taking into account the average salary indicator

The basis for accounting for average wages to determine arrears of alimony payments are the following regulations:

- Family Code of the Russian Federation (abbreviated as RF IC) dated December 29, 1995 – Law No. 223-FZ. This is the main law in the Russian Federation that regulates relations regarding alimony payments. This is discussed in detail in Art. 113 (on determining alimony debt).

- Federal Law “On Enforcement Proceedings” dated October 2, 2007 – Law No. 229-FZ. In this law, namely in Art. 102, the procedure for claiming alimony debt is specified.

Calculation of alimony arrears from the average monthly salary in the Russian Federation

The basis for taking into account the average salary when determining the amount of alimony debt is the following regulations:

- Federal Law “On Enforcement Proceedings” No. 229-FZ dated October 2, 2007. The law, in particular, in Article 102, establishes the procedure for collecting alimony debt by executive bodies.

- Family Code of the Russian Federation No. 223-FZ of December 29, 1995: the basic law in Russia regulating family relations regarding the payment of alimony. Thus, Article 113 of the Family Code details the procedure for determining alimony debt.

- in the event of subsequent employment of the debtor or identification of his other income, collect the accumulated debt in favor of the recipient of alimony;

- on the basis of the resolution on debt settlement, apply measures to the debtor to bring him to various types of liability (administrative, civil, criminal).

The main value used by the bailiff when calculating debt. is the average monthly salary in the Russian Federation. The use of this particular indicator for the Federal Bailiff Service (FSSP) is regulated by three regulations:

- clause 4 art. 113 of the Family Code of the Russian Federation;

- clause 3 art. 102 of Law No. 229-FZ “On Enforcement Proceedings”;

- “Methodological recommendations on the procedure for fulfilling the requirements of executive documents on the collection of alimony” (approved by the FSSP of Russia 06.2012 No. 01-16).

Art. 5.1 of the “Methodological Recommendations...” defines the main points for calculating debt from the average monthly salary for FSSP employees:

- Information on the current average salary in the Russian Federation must be requested monthly from Rosstat or confirmed on its official website.

- Personal income tax (NDFL), equal to 13%, is not withheld when calculating debt.

- The moment of debt collection is the date of actual repayment of the debt.

- The calculation of alimony arrears must be carried out by a FSSP employee quarterly.

The debtor should remember that alimony arrears will be calculated not according to the region of residence of the payer or the claimant, but according to the indicator of the Russian Federation in order to protect the rights and legitimate interests of minors in whose favor alimony payments are accrued.

Since the “statistical” average monthly salary in the country as a whole is often much higher than the real income of a working citizen in most regions of the federation, becoming an alimony debtor in this case is extremely unprofitable, primarily for the payer himself (and vice versa - it is often more profitable for the recipient of alimony).

Payer Petrenko N.N. received a monthly salary at the enterprise in the amount of 20,000 rubles. his child support obligations for 1 child according to the court order amounted to 1/4 of all types of income. Since Petrenko N.E. has no other income. did not have, the monthly payment for child support was 5,000 rubles.

Wanting to avoid payment obligations and hide his income, on July 1, 2016, Petrenko quit his job and got an unofficial job at a private company (without an employment contract). In October 2016, he received a decree from the bailiff to calculate alimony debt for 4 months from the average monthly wage (AMS) in Russia in the amount of 35,843 rubles. for September 2016:

- July 2021 - RUB 8,960.75 (1/4 of the SWP);

- August 2021 - RUB 8,960.75 (1/4 of the SWP);

- September 2021 — RUB 8,960.75 (1/4 of the SWP).

Total debt gr. Petrenko N.N. from 07/01/2016 to 10/01/2017 amounted to 26,882.25 rubles. It turns out that if this citizen continued to officially work at this or another enterprise and paid alimony in good faith, the amount of alimony payments for the same period would be only 15,000 rubles. - which is almost 2 times lower.

Thus, according to official data from Rosstat:

- The average salary in Russia in 2021 was 36,746 rubles. ;

- the maximum average monthly salary was registered in the Chukotka Autonomous Okrug - 85,678 rubles. ;

- the minimum salary was paid in the Republic of Dagestan - 19,953 rubles. average for 2021.

Thus, the difference in income levels between residents of regions with the highest and lowest average monthly wages according to data for the past 2021 amounted to 85,678 – 19,953 = 65,725 rubles.

At the same time, out of 85 constituent entities of the Russian Federation:

- only 17 regions have salaries above the national average (in these regions, calculating alimony debt from the average Russian salary of 36,746 rubles may be more profitable for payers and unprofitable for recipients of alimony payments);

- in the remaining 68 regions, the salary level is lower than the Russian average (here, using the average salary to calculate alimony is more beneficial for the recipient and unprofitable for the majority of payers).

Full data on the average salary in Russia in 2021 according to Rosstat are given in the table below.

Name of the federal subject

In the first quarter of 2021, the average earnings in the Russian Federation amounted to 36,600 rubles. – this is statistical data. In each region, this indicator does not correspond to the Russian average; in some areas it is much lower, and in others it is several times higher. Calculation of alimony based on average earnings in Russia is necessary for arrears in child support payments.

The need to calculate alimony based on the average salary in the Russian Federation is due to the fact that often potential payers do not have a regular income, receive wages in envelopes, are not officially employed, and have the status of entrepreneurs. For these reasons, it is not possible to indicate in the court decision a specific amount of deduction of funds.

If the alimony holder does not intentionally provide or is unable to present to the court a certificate of the amount of his actual salary, then the court has the right to calculate alimony based on legislative norms - the amount of average earnings.

It is not a fact that this figure will be less than what is required by law. This depends on the regional indicator. Based on this, the court will assign the appropriate deduction percentage depending on the number of children in the family: for 1 child - 25%, for 2 children - 33%, 50% - for three or more.

When debt arises, the size of your average earnings affects the amount of debt. The debt will be collected in court regardless of whether the alimony provider provides proof of income or not. The required percentage of payments must be subtracted from the average earnings in the country and multiplied by the number of months of delay.

The bailiff, based on the claimant’s report of non-receipt of alimony, will be obliged to calculate the debt of the defaulter, recording this in a special document - a resolution on the calculation of the debt, and take the entire range of administrative and executive measures against the debtor to repay the debt.

If during the period of non-payment of alimony the debtor was unemployed or officially unemployed and had no other income, the calculation of the debt in the share established by the court is made from the average monthly salary in the Russian Federation as a whole (Article 113 of the RF IC).

“Dodgers” from alimony payments should remember that changing jobs to an unofficial one in this situation is extremely unprofitable, since, as a rule, the average monthly wage in the Russian Federation significantly exceeds the real income of the debtor in “gray” employment, therefore, the amount of debt will be inflated .

Vitaly M. was charged with alimony in favor of two children in the amount of 1/3 of the salary. Being an officially employed person with an earnings of 26,000 rubles. Vitaly paid monthly child support in the amount of 8,666 rubles. After some time, Vitaly quit his job, re-employed unofficially (without concluding an employment contract) and stopped paying money.

| Month | Average monthly salary in rubles. in the Russian Federation | Part of the deduction from the average monthly salary | Debt in rub. |

| January | 39 017 | 1/3 | 13 005,66 |

| February | 40 443 | 1/3 | 13 481 |

| March | 42 364 | 1/3 | 14 121,33 |

We invite you to familiarize yourself with: Sample application to reduce the amount of the penalty under a loan agreement in court

In total, the total amount of debt for 3 months of delay from Vitaly M. amounted to 13,005.66 13,481 14,121.33 = 40,607.99 rubles.

The need to calculate the amount of debt is related to:

- in case of official employment of a person, funds will be withdrawn from his salary until the debt is fully repaid;

- After a large debt has arisen, measures for compulsory collection of funds may be applied.

According to the provisions of the laws, FSSP employees must be guided by the average salary in Russia to calculate alimony. In doing so, the following principles must be taken into account:

- such data is subject to monthly updating (therefore, the amount of deductions may be different for each month);

- the amount is calculated excluding income tax of 13%;

- the debt will be formed until it is fully repaid (even if the alimony obligee makes regular contributions to the debt, the amount will grow, since regular payments for the current period are not received).

Calculations are made based on the following directions:

- healthcare (up to 29,000 rubles);

- trade (29 thousand);

- construction (30,000);

- education (28 thousand rubles);

- agriculture (21,000);

- finance (74,000);

- transport (40 thousand);

- real estate (43,000).

Average earnings in Russia 2021 for calculating alimony

Firstly, in order to avoid the appearance of debt as such, it is necessary to pay alimony on time in the amount (share, percentage) in which it is established by the executive document (agreement, court order, writ of execution).

Secondly, if the debt arose in the absence of the fault of the person obligated for alimony (serious illness, force majeure circumstances, serious difficult life situations), the person can reduce the amount of the debt or be completely freed from paying it by filing a claim of this nature in the magistrate’s court in accordance with the procedure .2 tbsp. 114 RF IC.

Thirdly, if the payer is fired/resigned from his official place of work or decides to find employment unofficially, it is best for him to register with the Employment Center as an unemployed person looking for a job - in this case, the debt will be accrued from the monthly unemployment benefit, and not from the average salary in the country, which is several times lower.

However, the debtor will not be able to enjoy such a “benefit” for a long time - if there is no desire to get a job on the offered positions within a year, the person is deregistered at the labor exchange, or remains registered, but without paying benefits.

45, question 1331340 1 answer. Published: Bulletin of the Federal Bailiff Service, N 4, 2021. If the debtor did not work or did not provide documents confirming his earnings and (or) other income, then the debt is determined based on the average salary in Russia. The average salary indicator is used to calculate alimony, or more precisely, to calculate alimony debt.

the amount of earnings of the alimony payer for the entire period of debt formation - if the place of work and the average salary by region of Russia are known. In relation to the average salary in Russia, it is not taken into account in all cases of calculating alimony debt, however, according to statistics, therefore, to calculate alimony from the amount of earnings and or other income of the employee.2019-10-20.

What is the average salary for calculating alimony in Russia in 2021? Answer. Calculation of alimony: average salary in Russia in 2021. Taking into account the average salary when calculating alimony. Both its exact monetary value and the calculation method are missing. The average salary in Russia is used to calculate alimony.

The average salary is also used when establishing the amount of alimony as a share of earnings: for the entire period during which no alimony payments were made, the average salary in Russia is calculated for calculating alimony in 2021. Average earnings by regions of Russia. The size of the average salary is one of the macroeconomic indicators. When is the average salary taken into account for calculating alimony.

Average salary in Russia (updated)

Hello! I would like to clarify this question: if the father does not pay child support, has no official income or property, and is hiding in another city, then how will the debt be calculated and collected? Judging by the article, based on the average salary in the city. But if he is officially unemployed and does not have any valuable property, then how can he pay off the debt?

The average salary is not high. Did you happen to fall on your head from the stove? Oh yes, you don’t have stoves, you have a comfortable existence in a beautiful city with all the amenities. And now an example: Altai Territory, where the average salary is officially 24 thousand rubles (this is mainly the capital Barnaul). The average in Russia is 43 thousand rubles. We live in a village where the salary is 12 thousand, real money if you have it (but check out these villages and find a job). And now we are losing our jobs (there simply aren’t any.) and living on our own farm, if that can be called life. Now, according to the law, an offended (abandoned, alone, etc.) woman with a child demands alimony. According to the law, we consider 25% of the average salary in Russia, that is, 43 thousand = 10.5 thousand. This is fine. Oh, yes, we are lazy and that’s why we live here, but we could go to a non-rubber village and earn normal money. Thank you all! For your brains, for your laws. For your averages.

We recommend reading: If I flooded my neighbors, what should I do?

When is alimony calculated from the average salary in Russia?

As you know, there are many more alimony debtors than bona fide payers, and the reasons for alimony debt can also be very different: from the real lack of a job to the concealment of income by the debtor. However, such factors do not relieve the “evaders” from the assigned obligation and do not bring any particular difficulty to the bailiff: alimony arrears arise in relation to the debtor and grow monthly.

In this case, the amount of debt by the bailiff is determined from:

- method of withholding payments. specified in the writ of execution or agreement;

- income from work or other income from which funds may be withheld.

The alimony debt is determined by an authorized official of the FSSP based on the average salary in the Russian Federation, if during the period of formation of the debt the payer:

- was unemployed;

- did not provide documents confirming earnings or other income;

- was not registered with the employment center.

As you know, there are many more alimony debtors than bona fide payers, and the reasons for alimony debt can also be very different: from the real lack of a job to the concealment of income by the debtor. However, such factors do not relieve the “evaders” from the assigned obligation and do not bring any particular difficulty to the bailiff: alimony arrears arise in relation to the debtor and grow monthly.

- alimony voluntary notarial agreement between the payer and the recipient;

- the court's decision;

- court order.

- the method of withholding payments specified in the writ of execution or agreement;

- income from work or other income from which funds may be withheld.

- was unemployed;

- did not provide documents confirming earnings or other income;

- was not registered with the employment center.

After the grounds for making regular financial contributions for children arise, the alimony payer must constantly make such financial transfers. If a debt arises or late payments occur, the child’s legal representative has the right to file a complaint with the bailiff service.

FSSP employees are beginning to take enforcement measures to collect funds. And if the defaulter has not independently applied to the FSSP with a request to suspend contributions until he finds a permanent job, then the debt will be calculated based on local indicators of average income in a particular region.

In order for the average salary in the Russian Federation to be taken into account for calculating alimony, the following circumstances must be proven:

- the child’s parent is not officially employed;

- refusal to present official salary statements (for employment abroad);

- the debtor is not registered with the employment service.

In this case, there is reason to believe that the citizen has unofficial income from which financial contributions to children can be paid.

How is child support withheld from wages?

First, the woman must apply to the magistrate’s court for a decision, on the basis of which the collection will be carried out. The claim is sent to the authority at the place of residence of the plaintiff. This matter is not complicated; accepting such appeals and making decisions on alimony is standard practice. The court determines the percentage of alimony from the salary according to the number of children.

Having received a court decision, a woman can go to the debtor’s place of work, transfer the decision there and write a corresponding statement, attaching the details of her current account where the funds will be transferred.

If the debtor’s place of work is unknown or it is simply inconvenient to visit it, then you can immediately go to the bailiffs with the court decision. The case will be handled by the bailiff at the debtor’s place of residence. If the name of the employer is unknown, the bailiff submits a request to the Federal Tax Service and quickly receives the necessary information.

Next, a resolution is sent to the legal address of the employer of the alimony payer, according to which the deduction will be carried out. What percentage of the salary is child support - this must be indicated in the resolution. When the payer receives his next salary, it will be given to him minus alimony.

If the debtor officially receives 12,000, but in fact 30,000, the withholding will be carried out only from 12,000, that is, for one child the woman will receive 3,000 rubles.

Average earnings in Russia 2021 for calculating alimony

As noted above, the calculation of alimony based on average earnings in Russia is carried out by bailiffs in the absence of information about the official income of the alimony holder. And the work of the FSSP begins only after the legal representative of the child files a complaint about the lack of payments from the second parent.

When further calculating the amount of debt, the following indicators are taken into account:

- the number of children for whom deductions are made (this is necessary to establish percentages for deductions, that is, 25 for one child, 33 for two, 50 for three or more children);

- average monthly salary for calculating alimony (current indicators throughout the Russian Federation);

- the period of time during which the debt was formed.

Parents who conscientiously fulfill the obligation to pay child support and have no debts will not have problems in the future with forced collection of the debt. Some non-working payers transfer funds to the collector and keep receipts to confirm the fact of payment or take receipts from the collector.

Example No. 1

Citizen V. works in an LLC. According to the provisions of the executive document, he must pay alimony for the maintenance of his minor children A. and B. in the amount of 1/3 of all types of income. The accounting department of the LLC received a resolution to withhold child support from V.’s wages.

We suggest you read: How to collect alimony from a convicted person, who pays if the husband is in prison

The calculation will be carried out according to the specified formula only if the payer has no debt. If there is a debt for alimony payments, up to 70% of the debtor’s earnings will be withheld, since he will have to fulfill current obligations and pay off the debt.

Example No. 2

Let's consider a situation where a citizen evades paying alimony, either does not work, or works unofficially (that is, without concluding an employment contract). Then the calculation of alimony debt must be carried out using the average Russian salary. Let's take the average salary in the country at the end of December 2021. Its size was 35,900 rubles.

We calculate using the formula: 35,900*1/3=11,966.66. This means that for December 2021 the payment amount will be 11,966.66 rubles. Please note that the indicated amount may change monthly; the calculation must be updated regularly. A willful defaulter risks accumulating a debt on which penalties will be charged.

Amount of child support for 3 children

If we talk about percentage deductions, then the amount of alimony for 3 children is half the income of the alimony payer. And although we are discussing the amount of child support for three children, it should be borne in mind that it will be exactly the same for four, five, six, and so on. This, of course, is unfair.

However, the law is powerless here. More than half of the earnings are deducted only in exceptional cases - if, in addition to the children, their disabled mother also receives alimony. Then deductions can reach up to 70%. However, each such case requires individual consideration.

The courts are in a difficult position. On the one hand, they guard the interests of minors, that is, they are obliged to collect the full amount of alimony for 3 children and a mother who is unable to work.

But, on the other hand, if the alimony payer has children in a new family, and the salary is small, the remaining 30% simply will not cover the needs of the other minor dependents of the alimony payer. Consequently, the rights of minors will still be violated. Therefore, each case with an increase in the percentage deduction is carefully considered.

Amount of child support for 3 children from a working person

In the case of stable employment and a “decent” salary of the father, the amount of alimony for the maintenance of 3 children is determined as 50% of income. When assigning a fixed payment subject to indexation, a value that is as close as possible to this indicator is also selected. We are talking about cases where the father’s income is seasonal or irregular, or he receives income in the currency of another state.

In this case, based on 2NDFL certificates, his income for the previous year is determined, divided by 12 months, then 50% is calculated. This will be the monthly amount of child support for three children. If the income is too high, the percentage may be less. The fixed amount assigned by the court rarely exceeds one regional subsistence level for each child, even with a high income of the payer.

If the official income is low, the percentage amount must also be observed. However, with a low income, even half the minimum wage for three children is very little. 6065 rubles in alimony from the minimum wage, this is significantly less than 1 “children’s” monthly allowance for each child.

And at the same time, three children, or even more, will have to be fed. But it's still better than nothing.

Amount of child support for 3 children from a non-working person

The amount of alimony for 3 children of an unemployed father will be equal to half of his unemployment benefit, for a pensioner - half of the pension, for a student - half of the scholarship.

Citizens who have no earnings and are not registered with the Central Employment Service will be “calculated” according to the average salary in the country. Which will be about 15 thousand rubles for three children. In numbers, this is the most profitable option, but can a person without income pay for it?

Mothers of many children receiving alimony can only hope that the expected changes in alimony legislation this year will take place. And the state guarantees an amount of alimony that provides at least the basic needs of the child. Just as this is already happening with pensioners who receive a social supplement if their pension “does not reach” the subsistence level.

If you have any questions, please contact family lawyers at prav.io for legal advice. Experienced online family lawyers will provide you with up-to-date legal information and help you with the preparation of documents for the court.

Alimony from a non-working person in 2021: amount and how to calculate

If the alimony provider, who is in arrears in paying alimony for the maintenance of his own children, does not provide the court with documents indicating real income, one should not forget that sooner or later the plaintiff will file an application with the court demanding payment of the accumulated debt.

Based on statistical data, this figure for the country is usually higher than in the region of residence, and much more than the actual income of a working citizen in most regions of the Russian Federation. This fact is extremely disadvantageous for the payer who does not want to support his own children, but the amount of alimony will suit the recipient.

Before taking into account the average salary indicators, FSSP employees conduct a check to establish the amount of an official citizen. To achieve this, cooperation is carried out with the following bodies and departments:

- tax service (the Federal Tax Service contains information about all taxes paid that are associated with the receipt of various types of income, including periodic ones);

- Pension Fund (from all official income contributions are made to the pension fund, so this is how you can clarify where a citizen works);

- employment Service;

- financial institutions (the bank has information about the regular income and transfers of the alimony worker).

The second way to obtain information about profits is to voluntarily submit such documents to the FSSP. If the bailiff was unable to independently determine the amount of official profit, then the amount of debt begins to be counted based on the average wages in the country. As a rule, income in the field in which the alimony payer worked is taken into account.

In practice, debtors often subsequently go to court in an attempt to reduce the amount of debt, citing the fact that the person’s potential income is significantly lower than the stated figures. But since the court takes the children’s side in such disputes, the amount of debt cannot be reduced.

Thus, it is much more profitable for a negligent parent to make regular deductions on their own. The only option to suspend the accrual of debt is to submit a corresponding application to the FSSP, which will indicate that the alimony payer is looking for a job and, after employment, undertakes to begin repaying the debt. A reduction in the amount of payments is possible only if the parent has another baby who needs to be supported financially.

Irresponsible parents naively, and often criminally, believe that being unemployed, it is impossible to collect child support from them due to the lack of official income. Legislation, while standing up for the protection of the child, does not relieve them of responsibility, having created a number of enforcement instruments.

If an agreement is concluded between the parents on the payment of alimony as a percentage of earnings, then for periods in which the payer has no official income, the average salary in Russia is taken. Receiving unemployment benefits is considered earnings, and if the payer is on the labor exchange, then a percentage of this benefit is withheld from him.

Average Russian salary for calculating alimony 2021

According to Article 113 of the RF IC, a parent can collect alimony for the past period - for the last 3 years before the date of filing a claim with the court or the bailiff service with a writ of execution. You can collect alimony debt at any time, the entire amount of the debt, for the entire period - of course, if the alimony obligations arose on the basis of an agreement or a court decision.

Most people have a rough idea of the average salary. What is this value? This is the arithmetic average of the salaries of workers in a specific field in a specific region of the state or throughout the country. When determining the average salary, absolutely all salaries are taken into account - both the lowest and the highest.

- Related Posts

- Agency commission when selling an apartment

- Governor's 100 thousand for 2 children in the Moscow region

- Children's card preschool

- Find out the queue number for kindergarten by last name

Where to find data on average wages in the country

Based on the Federal Law “On Enforcement Proceedings,” legislators have developed methodological recommendations that set out the procedure for fulfilling the court’s requirements for a writ of execution. The document is intended for employees of the bailiff service and explains in detail the concepts of enforcement proceedings for debt collection, prescribes the step-by-step actions of bailiffs in the procedure for debt settlement, and explains the features of the procedure:

- The 13% income tax is not charged on the calculated amount, since the calculation was not made from the actual income of the alimony recipient.

- The calculation is made at least once a quarter. The bailiff draws up an official resolution on the settlements made, indicating the total amount to be paid.

- If any of the parties does not agree with the assessment, it has the right to appeal the decision in court.

- The bailiff must explain to the parties the procedure for settlements and appeals.

- The total amount of alimony calculated by the bailiffs is subject to regular indexation, which is carried out in proportion to the increase in the cost of living in the region.

A separate point in the recommendations is a description of the calculation of alimony debt for individual entrepreneurs who use different taxation systems in their activities.

Information on the average monthly salary of working citizens in general for Russian enterprises can be found on the Rosstat website.

Quarterly, information from the regions on the actual amount of average earnings is posted on the portal.

Currently, the average salary for calculating alimony in the country is about 27,500 rubles. However, these indicators are quite conditional. Each region of the Russian Federation has its own average indicators, which may differ significantly from those indicated above.

Average Russian salary for alimony in 2021

The calculation will be carried out according to the specified formula only if the payer has no debt. If there is a debt for alimony payments, up to 70% of the debtor’s earnings will be withheld, since he will have to fulfill current obligations and pay off the debt.

- When determining the amount of debt, personal income tax in the amount of 13% is not withheld from average earnings.

- The debt is collected on the day it is fully repaid by the payer.

- Debt calculation using average salary indicators is carried out every quarter by a bailiff.