Where to send

A complaint to the tax office is drawn up in any form, but must comply with certain standards.

The document is written addressed to the immediate head of the service. Regardless of the content, the document must be reviewed. A complaint to the tax inspectorate, samples of which can be found in Federal Law No. 59-FZ of May 2, 2006 “On the procedure for considering appeals from citizens of the Russian Federation,” is sent as follows:

- take it personally: the letter is drawn up in two copies, one of which is given to the tax authority, the second with a note of acceptance and date remains with the applicant;

- send by mail with acknowledgment of receipt;

- fill out the application form on the Federal Tax Service website.

Among the violations of the tax authority, due to which such documents are drawn up, the most common are the following:

- improper assessment of taxes;

- delay in the return of erroneously calculated tax or a tax deduction provided;

- illegal fine.

Method 1. Online letter through State Services

The first way to help send a letter is online through the State Services website. To do this, follow the following step-by-step instructions:

- Log in to the single portal.

- Open the service you subscribed to earlier. For example, let’s take the “Taxes and Finance” section and the “Tax debt” option.

- Scroll to the bottom of the web page.

- Click “Submit a complaint.”

- Fill out the request.

- Confirm and wait for a response.

It is also worth noting that you must indicate in the letter:

- the service followed by the request;

- date of registration of the service;

- branch of the Federal Tax Service against which the complaint is being made (optional);

- Full name of the inspector who provided the service;

- the reason for filing the complaint;

- additional information to the information presented above (in free form);

- requirements to correct the situation;

- your personal data;

- way to get an answer.

Important. After two weeks, you will receive a response in the method of your choice: by mail or email.

Writing Instructions

In order for an appeal to be considered, you need to know how to correctly. Despite the fact that the complaint is written by a person in any form, it must contain certain mandatory information. Each institution should have an example of a sample according to which any citizen can draw up his letter of complaint.

The letter form must indicate the addressee - the body to which the application will be sent, as well as information about the applicant himself:

- surname, first name, patronymic;

- registration address.

If the applicant is a legal entity, then additionally indicate the following data:

- legal address;

- OGRN;

- position of the person sending the application.

If the registration address does not coincide with the place of actual residence, then write in the letter where to send the response after consideration. The title of the appeal indicates the company or a specific official whose actions are subject to review. If such data is unknown, then this fact must also be reflected.

This part indicates the circumstances that made it possible to determine the fact of the violation. If desired, you should specify which provisions of the law in force on the territory of Russia they contradict. Since not every person can be fluent in modern legislation, it is not necessary to provide links to articles. The text contains specific information on the case. More facts about the incident. There can be no emotions, insults or threats there. A document written in this manner will not be considered.

After presenting all the circumstances of the case, a request follows, i.e. what measures, in the opinion of the applicant, the tax authority should take to understand this problem: conduct an audit and take appropriate measures. The text can additionally indicate a request that the recipient be informed about the results of the internal investigation. You should also include a telephone number for contact.

Copies of documents that clearly confirm the stated facts can be attached to the text of the letter. They should be listed at the end of the appeal.

At the end of the document, the date of preparation and the signature of the applicant are indicated.

Important nuances of online application to the tax office

An important nuance that should be taken into account when submitting an application through a single portal is the presence of a standard account level. If you are a new user, you will find the algorithm of actions on how to create such an account below.

For a simplified level:

- Go to the official website of State Services.

- Click the “Personal Account” button and select “Registration”.

- Enter your first and last name, as well as your mobile phone number and email.

- Create and write a password.

- Activate your profile by clicking on the link in the letter sent to the specified email address.

For standard level:

- Open your profile page.

- Click "Edit".

- Indicate gender, date and place of birth, permanent registration address.

- Add information about your passport and SNILS card.

Good to know. To apply for most services, you will need a verified account level. To obtain it, you can use online banking, digital signature, or visit an accredited customer service center (MFC, Pension Fund, Social Insurance Fund).

Besides this, there are a few more nuances:

- a Federal Tax Service employee will call you for an appointment no earlier than in 14 days;

- the appeal must contain only reliable information;

- Your appointment may be canceled if you are late.

Sending a complaint via the Federal Tax Service website

To submit a complaint, you can use the website of the Federal Tax Inspectorate. To do this, you do not need to have any special skills; just go to the website and find a special form in which the required fields are marked with an asterisk. The only condition for users is registration on the Federal Tax Service website. Entering data will not be difficult. The text of the complaint is allotted 4 thousand characters, which is quite enough to present the information. The documents attached to the letter are scanned and uploaded as separate files. Notification of sending an electronic document will be sent by email.

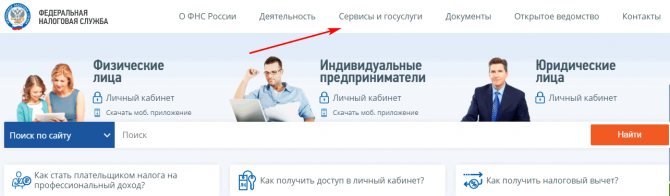

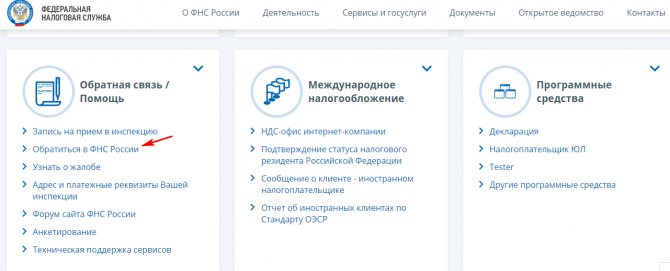

Method 2. Online complaint about the actual service

The second way to contact the tax office is through the Federal Tax Service service. Here proceed as follows:

- Go to the Federal Tax Service website.

- Click on the “Services” section.

- Find the Feedback/Help category.

- Select the option “Contact the Federal Tax Service of Russia”.

- If you want to write a complaint about popular life situations, click “Create a complaint.” If otherwise - “Different treatment.”

- Decide who you are: “IP, individual” or “legal entity”.

- Fill out the request.

- Attach documents.

- Wait for a response.

The letter must indicate:

- branch where the complaint is sent;

- last name, first name and patronymic of the applicant;

- TIN;

- contacts for communication;

- essence of the problem (in free form);

- format of attached scans;

- applicant's address.

Good to know. The complaint will be considered by the Federal Tax Service within one month.

So, it’s worth drawing a conclusion. If the Federal Tax Service: delays in providing the service; issues an unlawful refusal of a service; requires additional unforeseen fees; requires additional documentation; refuses to accept the application; then you have the right to write a complaint online to resolve the problems that have arisen. To do this, use the instructions in our article.

Deadlines for consideration

According to Art. 8 of the Law of the Russian Federation, a complaint sent to the tax office must be registered within 3 days. From the date of registration, the countdown of the period begins, which is 30 days (Article 12). Thus, the total period is 33 days.

There are cases when, by order of the head of the tax and duties inspection or his deputy, the period for reviewing the letter is increased. The new period cannot exceed 30 days. Tax officials must notify the citizen who contacts them about this decision.

Formation of an online complaint

To create an electronic document with which you can appeal the actions or non-regulatory acts of tax authorities, you need to select the item in the “Feedback” section of your personal account in the direction of the corresponding complaint, after which a page will open in the browser on which you need to fill out all the required information, including :

- the name of the tax authority that is competent to consider this or that complaint (based on paragraph 1 of Article 139 of the Tax Code, this is the higher one, that is, as a rule, the regional department of the Federal Tax Service);

- information about the applicant (they are indicated automatically based on the data that was specified by the taxpayer when registering in his personal account);

- choice of method for obtaining the result of consideration of the complaint (reasoned decision);

- an indication of the type of tax act (or an indication of the actions) that is being disputed regarding its legality;

- details of the decision or other act of the tax inspectorate that violates the legal rights of the person sending the complaint;

- the essence of the appeal (divided into 2 parts, the first of which indicates the circumstances of the case and the applicant’s arguments, and the other - the specific request of the person, be it the cancellation of the decision or the recognition of actions as illegal).

An attachment (attachment) of the complaint in the form of an independent document is not required and is not provided. Based on Art. 137 of the Tax Code, any person whose rights have been violated and who is registered on the tax service website can file a complaint online with the tax office.

In what cases does the state inspectorate refuse to consider

There are a number of cases when the Federal Tax Service may give a negative decision in considering citizens’ appeals, including:

- lack of details;

- the text contains offensive words or contains obscene expressions or various types of threats to an official;

- the text is impossible to read;

- drafting a response without disseminating state secrets is impossible.

In case of refusal to consider the complaint, a person has the right to file a complaint with the tax inspectorate. You can send your completed appeal to the following government agencies:

- higher tax authority;

- the prosecutor's office;

As a rule, litigation is the most effective, but it also has its drawback - a long review period.

An excellent option would be to appeal the tax authorities’ decision to all authorities at once. In this case, it is better to use the qualified assistance of lawyers to draw up the document.

Violations, whatever they may be, must be identified and eradicated so that similar cases do not occur in the future. For this purpose, a specific document is drawn up - a complaint. A sample complaint to the tax office can be found on the Internet or you can contact the appropriate authorities for help.

Instructions

Decide on the form of delivery of the letter, since its design will depend on this. If the question you are interested in can be easily resolved by a response from the tax service, then select the electronic form of the letter. To fill it out, follow one of the links indicated at the end of the article, depending on whose interests you are protecting. That is, whether you are a taxpayer as an individual or a representative of an organization, individual entrepreneur (legal entity). To resolve serious issues that involve possible recourse for further proceedings (to higher authorities or courts), when you need to keep a copy of the letter and a document confirming its sending, you will need to send the letter using the postal service with acknowledgment of receipt.

Now compose the text of the appeal. Such a letter should be written in a business style, excluding emotional displays regarding an issue that is important to you. For the email option, start by contacting the head of your Federal Tax Service

the word "Dear". His name and patronymic can be found out as well as the address of the inspection by using the search on the website of the Federal Tax Service of the Russian Federation. Describe the essence of the problem and the circumstances surrounding its occurrence. After that, list your requirements, but in a respectful manner, starting this part of the letter with the word “Please.” Sign the letter and date it. For a written request by mail, begin the letter by indicating the initial details of the addressee and sender (with the obligatory message of the taxpayer’s home address, full name and contact telephone number). Place them in the upper right corner of the sheet according to the rules of document flow. Further, the content of the letter will not differ from the version for electronic sending, but here do not forget to put the personal signature of the sender and a transcript in brackets (full name).

For individuals, contact the Federal Tax Service

at your place of residence is extremely simplified, thanks to the new service offered by the tax service.

This is the “Taxpayer’s Personal Account”, located at https://service.nalog.ru/debt/

. Here you can contact the tax office for taxes by simply filling out an email form, which will be automatically forwarded to the desired office.

The Federal Law “On the Procedure for Considering Appeals from Citizens of the Russian Federation” gives Russians the right to send letters to any government agencies whose competence includes issues of interest to them. Tax authorities are no exception. The taxpayer has the right to apply to the inspectorate

at the place of registration or legal address, and to the regional department or directly to the Federal Tax Service.

You will need

- - paper;

- - Printer;

- - fountain pen;

- - computer;

- - Internet access.

Instructions

the letter personally

to

the inspection

or send it by mail, indicate in the first line its name, or abbreviated as: IFTS, its number after the hyphen and the city or district where the inspection is located.

For example, IFTS-16 for Moscow. You can also address the letter

to the head of the inspectorate or a specific employee.

To do this, indicate his position, surname and initials. However, all this does not guarantee that your letter

will be handed over for execution to the person to whom you are addressing it. When submitting an online application form on the website of the Federal Tax Service of Russia or a regional office, you can select the body to which you are applying from the drop-down list.

letter depending on the content

: a complaint about unlawful actions, an information request, a proposal, or simply an appeal. In the line below, indicate the subject of the letter: who you are complaining about, indicating at least the official’s place of work, even better - the position and surname and initials, what you want to know about (for example, about the features of applying the simplified taxation system), what you propose.

Next, briefly outline the essence of your appeal: describe the incident that became the reason for your appeal, ask, in accordance with the Federal Law “On the procedure for considering appeals from citizens of the Russian Federation,” to give you clarification on issues of interest and provide a list of them, or to consider your proposal. If you are responding to a written request from the inspection, begin the text with the phrase “In response to your request No.... dated... I report the following...”. The query output is taken from this document. Next, state your answers to the questions asked by the tax inspector.

Print the letter

. Don't forget to date it and sign it. If you are writing on behalf of an organization, print the text on its letterhead and seal it.

When sending a letter through the site, you only need to click the appropriate button and enter the verification code. You can also send a letter

by mail (reliably with a receipt) or personally take it to the

inspectorate

. In the second case, make a copy of it and ask the inspector who will accept your appeal to make the appropriate mark on it.

Video on the topic

If an enterprise shows a loss in its tax return over several reporting periods, the tax office may require substantiation of the loss reporting. In this case, it is necessary to carefully consider the information provided and take some measures to solve the problem.

Instructions

Study the tax legislation, which provides for various measures for unprofitable enterprises. Thus, paragraph 3 of Article 88 of the Tax Code of the Russian Federation states that the explanation

must be written in case of an error in the tax return, provision of conflicting documents or inconsistency in the information provided by the taxpayer.

The laws do not say anything about unprofitable reporting, so inspectors refer to the last paragraph of the law and demand that an explanation

, citing an incorrect calculation of income and expenses.

Sample letter of request

A letter of request is written to obtain any official information or documents. A very similar topic is the request letter. So check out this article with sample request letters. There may also be some useful examples for you. Well, of course, you will find a sample request letter in this article.

Like any business letter, the request is drawn up on official letterhead. To write a letter of request correctly, you must also know the basic rules for formatting document details (such as addressee, signature, title to the text, etc.). A letter of request must be sent a letter of response.

Typically, the text of a request letter begins with an explanation of the reasons and motives for your application. Examples - “In accordance with the concluded agreement...”, “In order to implement previously reached agreements...”, “Based on a telephone conversation...”, “To resolve controversial issues...”, etc.

You can also refer to the necessary legislative and other regulations. Then the link should be formatted like this:

“In accordance with paragraph X of Art. XX Federal Law dated 00.00.2012 No. 208-FZ “... full title of the document.”

You can skip an indication of a specific point or article, but then the sequence is always followed - the type of document (resolution, order, etc.) + the author of this document + date + its number + its title.

However, if the reason for the request is obvious, then it is permissible to immediately proceed to presenting the essence of the request without any explanation. And vice versa, if there is a need, you can describe the situation in detail without limiting yourself to one phrase.

The request itself formulates specific questions of concern to the author of the letter - “Please inform us about...”, “Please send...”, “We will be grateful if...”, etc. It is permissible to tactfully indicate the desired time frame for receiving the requested information.

Letter of request – sample format in doc format.

Another example of a request letter

We ask you to inform us about the possibility of supplying combined racks (catalog code SKP-325-0942) in the amount of 50 pieces by November 10, 2014, and also inform us about the terms of payment and delivery.

How to write a letter to the tax office?

It is unlikely that the average reporter can boast of knowing all the intricacies of working with the tax inspectorate. If for a long time you need to know how to write a letter to the tax service, do it correctly and legally, then you will definitely need special knowledge in this matter, and even better, sample letters.

Basic Rules

If you plan to take the letter to the tax office yourself or send it using postal services, then you should indicate the name of the inspectorate in the first line of the letter. There is no need to describe it in full, you can abbreviate it: IFTS. Then its number is indicated, separated by a hyphen, and the city or region to which the service is assigned is called. For example: Federal Tax Service Inspectorate - 27 in Sverdlovsk.

The letter can also be addressed to both the head of the inspectorate and a specific employee of this tax service. To do this, you must indicate his position and last name with initials. However, all this does not guarantee that your letter will be transferred to a specific addressee for execution. An online form on the website of the Russian Federal Tax Service or a regional administration also helps you understand how to correctly compose a letter to the tax office, where you can independently select the body (from the drop-down list) to which the application will be made.

Depending on the essence of the letter, title it. Perhaps this will be a complaint about unlawful actions, or simply an appeal, information request or proposal. On the next (bottom line) you need to indicate the subject of the letter. If this is a complaint, then it is indicated to whom exactly and, at a minimum, the official’s workplace. The best option would be to write down your position and surname with initials, and indicate what exactly you are offering or want to know (for example, an explanation of the application of the simplified taxation system).

Then the essence of the appeal itself is described. Here you should outline the event that served as the reason for the written appeal, and also ask, guided by the Federal Law “On the procedure for considering appeals from citizens of the Russian Federation,” to provide you with an explanation regarding these issues (provide a list of them), or, if this is a proposal, then consider it. In situations where you need to respond to a written request from the inspection, the text should begin with the phrase “In response to your request no. from. I report the following. ". And then provide answers to the questions posed by the tax officer.

When the letter is completed, it should be printed and signed and dated. If the letter is written on behalf of an organization, then the text must be printed on its letterhead and sealed. Sending a letter through the site will require you to click the appropriate buttons and enter a verification code. If the letter is sent using the services of a post office, then, for greater reliability, it is better to indicate that the letter is delivered with a notification.

If you deliver the letter yourself, then it would be a good idea to make a copy of it and ask the tax inspector (who will receive your sheet) to make the appropriate marks on it.

How to write a letter to the tax office?

The most popular masterpiece of Russian bureaucracy and insanity among taxpayers is the cover letter. How else can you characterize the existence of a document compiled for at least one more document, and which should also be posted (registered) in journals?

Most often, a cover letter to the tax office, a sample of which can be downloaded at https://file-loaads.asia/, by entering the required request in the “find” box and clicking the “download” button, is written in free form according to the principles of a business letter. Sometimes, some inspections themselves provide sample letters for each case and require adherence to specified requirements. If this is also present in the inspectorate to which you are reporting, then you should take samples from the tax office and use them when filing reports.

Covering letter to the tax office

A covering letter to the tax office is an explanatory note to the updated VAT return, as well as other documents sent to the tax office.

How to write a cover letter to the tax office

A covering letter to the tax office is drawn up according to the general structure of a business letter.

The header of the letter indicates the position, Federal Tax Service No., city and full name of the recipient.

This is followed by the date, document number, and letter title.

The address to the recipient is written as needed.

The text of a cover letter to the tax office with a list of documents usually begins with the words:

- We send you...

- We send you&hellip

- We present to you&hellip

This is followed by a list of attached documents indicating their name, number of sheets and copies of each document.

The final part of the cover letter to the tax office contains the position, signature and full name of the sender.

Sample cover letter to the tax office

We prepare a written request to the tax office

Accountants are sometimes faced with a situation where they cannot unambiguously interpret the meaning of a new amendment to the law or explanatory letters from the Ministry of Finance or the Federal Tax Service. They need more information. How to correctly compose a written request to the tax office

Anna Dynkina reports. state tax inspector.

Setting the stage

It just so happens that our taxation system is in some places too confusing and incomprehensible. Therefore, officials from various departments tirelessly write amendments to laws and explanatory letters. If you cannot understand the intricacies of the legislative framework on your own, then you need to contact the authors of laws, amendments or letters.

To avoid such an unpleasant situation as a refusal to accept documents from the tax office or, even worse, being accused by them of tax evasion, we advise you to send a written request to the Ministry of Finance or the Federal Tax Service in order to clarify the intricacies of Russian legislation.

However, before sending such a letter, you should prepare:

Study existing information resources, such as the Tax Code and stands located in tax offices, as well as the current Regulations of the Federal Tax Service (hereinafter referred to as the Regulations). There is a high probability that these sources will be enough to answer your question. In addition, regulatory documents contain information about the rights and obligations of each, knowledge of which will allow the payer to smooth out a possible conflict situation and achieve his goal within the framework of existing powers.

Clearly formulate the content of your request, on which the addressee will depend; we remind you that, according to the Regulations, tax authorities have the right only to inform, but if you want to receive clarification, then you need to write a request to the Ministry of Finance

Decide on the form of the request—whether it will be written or oral. If you decide to contact the inspectorate with an oral request, it is recommended to make it brief and to the point, having first written down the essence of the request as a cheat sheet.

Word of mouth

Studying existing information resources, such as the Tax Code, information stands located in tax offices, as well as the current Federal Tax Service Regulations, can provide an answer to the taxpayer’s question.

A taxpayer can receive oral advice from his tax office by contacting them in person or by calling the inspectorate's helpline. We remind you that for representatives of taxpayers it is necessary to have a duly executed power of attorney, and for taxpayers applying in person - an identification document. If the tax inspector does not have grounds for refusal, he must formulate an answer at the time the taxpayer applies. Paragraph 27 of the Regulations defines a time period of 15 minutes (or 30 minutes if preliminary preparation is needed), with the exception of the period five working days before the deadline for submitting tax returns, then the Regulations provide 2 hours for preparing an oral response.

If, in order to respond to an oral appeal on issues arising in a specific situation, it is necessary to provide a regulatory justification, or if the information provided by phone is not enough, the inspector, by virtue of paragraphs 33, 34 of the Regulations, is obliged to invite the taxpayer to send an appeal in writing.

Write letters

Taxpayers can submit a written appeal in person to the office of the tax authority, or send it by mail or electronically (clause 37 of the Regulations). A recommended sample form of a written request is given in Appendix 4 to the Regulations.

In this case, the written request must contain the following mandatory information (clause 40 of the Regulations):

For an individual: last name, first name, patronymic, signature and postal address

For an organization: full name, TIN, postal address, last name, first name, patronymic and signature of the head or authorized representative of the organization who submitted the appeal, an image of the organization’s seal if the appeal is submitted on paper other than company letterhead.

If the written appeal submitted to the inspection by the taxpayer in person is missing at least one of the specified details and if there are grounds on which free information can be refused, in accordance with paragraph 42 of the Regulations, the appeal must be returned to the taxpayer.

Clause 39 of the Regulations allows 30 days from the date of registration of the appeal to prepare a written response.

We recommend that all written requests be submitted in duplicate. If you decide to personally submit an appeal to the inspectorate, then on the second copy the tax authority official must put a mark on acceptance of the appeal and the documents attached to it, indicating his surname, initials and position, as well as the date of its acceptance. Applications sent by mail are recommended to be submitted by registered mail with notification and a description of the attachment. The date of submission of the written request will be considered the day of dispatch. If you send a letter via communication channels, you must receive a message stating that the letter was sent from a specialized operator and confirmation of receipt from the tax authority.

Juggling answers

There are decisions in which the court refused to apply subparagraph 3 of paragraph 1 of Article 111 of the Tax Code of the Russian Federation, indicating that the taxpayer cannot be guided by explanations coming from the tax authorities if they are not related to the procedure for filling out tax reporting.

Often, guided by subparagraph 3 of paragraph 1 of Article 111 of the Tax Code of the Russian Federation, organizations submit requests to the tax authorities, driven by the desire to avoid liability, since one of the circumstances that excludes the taxpayer’s guilt in committing a tax offense is the implementation of written explanations from authorized departments. However, since tax authorities have the right to give explanations only regarding the procedure for filling out declarations, and other services relate to information, the question arises: are explanations of the tax authority that do not relate to the procedure for filling out declarations exempt from liability?

Despite the fact that, according to paragraph 7 of Article 3 of the Tax Code of the Russian Federation, all irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees are interpreted in favor of the taxpayer, in reality it is extremely rare to take advantage of this provision, since letters from any department, including the Ministry of Finance, They are only informational and explanatory in nature and are not regulatory legal acts, that is, these documents are not binding.

There are conflicting opinions on the explanatory work of tax authorities not related to filling out declarations - both among the courts and among officials of the Ministry of Finance.

Some court decisions indicate that the responses of the tax authority to a specific request from the taxpayer, as well as reports from the inspectorate about the need to apply a special tax regime, are clarifications that exclude the taxpayer’s guilt in committing a tax offense (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated March 20, 2008 No. F03-A37 /08-2/685 in case No. A37-1575/2007-15, FAS North Caucasus District dated July 28, 2009 in case No. A53-5840/2008-C5-47).

At the same time, there are decisions in which the court refused to apply subparagraph 3 of paragraph 1 of Article 111 of the Tax Code of the Russian Federation, indicating that the taxpayer cannot be guided by explanations coming from the tax authorities if they are not related to the procedure for filling out tax reporting (see, for example, Resolution of the Federal Antimonopoly Service of the North-Western District dated September 1, 2008 in case No. A44-86/2008).

As for the clarifications of the Ministry of Finance, in accordance with paragraph 8 of Article 75 of the Tax Code, penalties are not charged on the amount of arrears that the taxpayer incurred as a result of his compliance with written clarifications on the procedure for calculating, paying a tax (fee) or on other issues of application of legislation given either to him, or to an indefinite number of persons by a financial, tax or other authorized government body within its competence (these circumstances are established in the presence of a corresponding document of this body, in the meaning and content related to the tax (reporting) periods for which the arrears arose, regardless of the date of publication of such document). However, these provisions do not apply if the written explanations are based on incomplete or incorrect information provided by the taxpayer. In this case, explanations must be given either directly to the taxpayer or to an indefinite number of persons.

From the above it follows that the presence of a written explanation is extremely important and in its meaning it should relate to the period when the arrears arose. If the letter is addressed to a specific organization or entrepreneur, then the specified taxpayer must have the original letter with the originating number and date. If the letter is addressed to an indefinite number of persons, then, according to clarifications of the Ministry of Finance dated August 7, 2007 No. 03-02-07/2-138, it is necessary to have a letter published on the official website of the department or in the media. Explanations from officials not published in the form of a letter, without a date or number (interview, article, commentary, consultation) are not exempt from sanctions.

It is not uncommon for an accountant, when paying a certain amount to an employee, to ask the question: is this payment subject to personal income tax and insurance contributions? Is it taken into account for tax purposes?

Not only legal entities or individual entrepreneurs, but also ordinary citizens can file a complaint with the tax office. Increasingly, on forums, employees are asking questions about how to write a complaint to the tax office against an employer. So for what reason can you complain about your employer to the tax authorities?

It is obvious that the tax authorities are interested in the collection of taxes, and from 2021 also insurance premiums. Accordingly, you can inform them, for example, that your employer pays part of the salary to employees “in an envelope.” This means that no one calculates, withholds or pays personal income tax on this gray salary (clause 1 of Article 226 of the Tax Code of the Russian Federation). And it does not charge contributions from it (clause 1, clause 1, article 419 of the Tax Code of the Russian Federation).

In this case, failure to fulfill the duties of a tax agent is punishable by a fine in the amount of 20% of the unwithheld and/or unpaid amount of tax (Article 123 of the Tax Code of the Russian Federation). And for non-payment of contributions, a fine is provided - 20% of the unpaid amount, or 40% of it if the tax authorities manage to prove the employer’s intent (clause 1.3 of Article 122 of the Tax Code of the Russian Federation).

But there are several “buts” here. After filing a complaint with the tax office against the organization, you and other employees will probably be called to the Federal Tax Service as witnesses. That is, you need to be prepared for this. Then, most likely, the manager will be called to give explanations to the salary commission, but he is unlikely to immediately admit everything.

Of course, testimony alone is not enough to hold an organization accountable for failure to withhold personal income tax and failure to pay insurance premiums. However, there were precedents when, under such circumstances, tax authorities managed to win a case in court and fine the employer (Resolution of the Federal Antimonopoly Service of the Moscow Region dated January 18, 2012 N A40-71623/10-111-46).

In addition, based on a complaint, the company may be included in. In this case, the check will be general and the inspectors will look at documents relating not only to personal income tax, but also to all other taxes. According to statistics, 99% of such checks result in additional charges.

Word of mouth

A taxpayer can receive oral advice from his tax office by contacting them in person or by calling the inspectorate's helpline. We remind you that for representatives of taxpayers it is necessary to have a duly executed power of attorney, and for taxpayers applying in person - an identification document. If the tax inspector does not have grounds for refusal, he must formulate an answer at the time the taxpayer applies. Paragraph 27 of the Regulations defines a time period of 15 minutes (or 30 minutes if preliminary preparation is needed), with the exception of the period five working days before the deadline for submitting tax returns, then the Regulations provide 2 hours for preparing an oral response.

Studying existing information resources, such as the Tax Code, information stands located in tax offices, as well as the current Federal Tax Service Regulations, can provide an answer to the taxpayer’s question.

If, in order to respond to an oral appeal on issues arising in a specific situation, it is necessary to provide a regulatory justification, or if the information provided by phone is not enough, the inspector, by virtue of paragraphs 33, 34 of the Regulations, is obliged to invite the taxpayer to send an appeal in writing.

How can I initiate an unscheduled inspection?

Unscheduled inspections can be initiated by the tax inspectorate itself based on received complaints or statements about possible violations of the law in companies. Can the founder initiate a tax audit? The founders of companies and organizations do not have such a right; if he needs information about the correctness of documentation and payment of taxes, he can hire an independent audit firm and conduct a full audit of the enterprise.

Most often, the initiators are the employees - former or current (more about complaints against the employer at the link), if their labor rights are violated, and a misunderstanding arises with the employer on this basis.

Before you set the tax authorities on an organization, you should understand the following aspects:

- The tax office will not respond to a complaint if it cannot establish the identity of the person who filed it. Those. Anonymity of the complaint is excluded.

- The tax office checks the accounting documents, and then everything can be completed correctly.

What should you do if you do not want the employer to find out that it was you who wrote the application? How to send a tax audit to a company without giving yourself away? As stated above, an anonymous letter to the tax office will not help, but you can write an application to the labor inspectorate. This organization is obliged to respond to anonymous complaints about violations of labor laws at enterprises and most likely, based on the results of the audit, will also involve the tax office.

Before causing problems for a person, i.e. For the employer, think carefully: “Do you really need this?” After all, most often in such cases we are driven by a feeling of revenge and resentment. First, try to talk to him in a good way, and, as a last resort, intimidate the tax or labor inspectorate and most likely he will make concessions and the conflict will be resolved peacefully.