According to the procedure for conducting cash transactions (Instruction of the Bank of Russia dated March 11, 2014 No. 3210-U), deposited amounts do not have to be deposited with the bank, however, undeposited amounts will be taken into account in the cash limit, unlike wages.

You cannot store an unlimited amount of money in the cash register - the cash must be transferred to the bank. There is a concept of a cash limit - this is a certain amount of cash above which you cannot keep cash in the cash register.

The only exceptions are small businesses, which may not set the specified limit (clause 2 of Directive No. 3210-U, clause 1, 4 of the Federal Tax Service letter dated 07/09/2014 No. ED-4-2/13338). If a small business organization has not set a cash balance limit, then it can store any amount of cash it has in the cash register without depositing it with the bank.

The limit on the cash balance at the cash desk of an organization that receives cash proceeds is calculated according to the formula specified in clause 1 of the Appendix to Bank of Russia Directive No. 3210-U.

In this article we will look at the algorithm of actions for depositing wages with the subsequent delivery of deposited amounts to the bank.

We check receipts for receiving money in the payroll

It is necessary to check the receipts for receipt of money line by line in the payroll statement.

Opposite the names of those who did not receive wages, in the columns “Received money” (when issuing money in form No. T-49) or “Signature in receipt of money” (when issuing money in form No. T-53), you need to put a stamp, or make the inscription “deposited”.

note

Tax agents are required to transfer the amounts of calculated and withheld personal income tax no later than the day following the day of payment of income to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation). The deposited salary is considered issued, therefore personal income tax is paid in accordance with the generally established procedure.

How are personal income tax deductions made?

Payment of personal income tax is made in accordance with the type of amount issued. If we are talking about payroll, then deductions intended for personal income tax are taken on the day the salary is provided , that is, not on the day it is actually received by the employee of the organization.

This rule is enshrined in paragraph 1 of Article 6. 226 Tax Code of the Russian Federation .

This means that the period for transferring personal income tax increases until the employee receives his salary from the cash register.

If the company issues wages that have been deposited from cash from the proceeds, then personal income tax is withheld when the employee actually receives the money. The tax must be transferred the next day after payment.

Payment of insurance premiums by the employer is carried out even if the financial resources due to the employee have been deposited. The Tax Code stipulates that payments must be made no later than the fifteenth day of the month following the reporting month.

We compile a register of deposited amounts

From June 1, 2014, it is not necessary to maintain a register of deposited amounts, since there is no such requirement in the procedure for conducting cash transactions dated March 11, 2014 No. 3210-U.

However, this document is convenient for tracking debts to employees, so it is not worth abandoning it at all.

The register of deposited amounts is filled out in any form. As a rule, it includes the following details:

- name (company name) of the organization;

- date of registration of the register of deposited amounts;

- period of occurrence of the deposited amounts of cash;

- payroll or payroll number;

- last name, first name, patronymic (if any) of the employee who did not receive cash;

- employee personnel number (if available);

- amount of outstanding cash;

- the total amount according to the register of deposited amounts;

- cashier's signature;

- deciphering the cashier's signature.

The register of deposited amounts may contain additional details, for example, about the payment of deposited amounts.

The numbering of registers of deposited amounts is carried out in chronological order from the beginning of the calendar year.

Carrying out accounting of the deposited amount

Wages are included in the total cost of ordinary activities, regardless of the time of their payment. It is taken into account in the debit of accounts in cost accounting in the established correspondence with the credit of account 70. The amount subjected to deposit is taken into account in the subaccount “Calculations for deposited amounts” of account 76 (D70 K76-4) .

In the next reporting period, after the expiration date of the deposited amount, this is recognized as other income of the organization.

There is no statutory limitation period for claims for payment of deposited amounts. If there is no demand for wages, then there is no labor dispute.

We enter the deposited amounts into the accounting book

The obligation to maintain a book of accounting for deposited amounts is also not specified in the procedure for conducting cash transactions dated March 11, 2014 No. 3210-U. That is, it is not mandatory.

The company develops the form of this book independently. The book opens for a year. In it, each depositor is given a separate line, which indicates his personnel number, last name, first name and patronymic, and the deposited amount.

In the group of columns “Attributed to the account of depositors” the month and year in which the deposit debt was formed, the numbers of payment (settlement and payment) statements and the amount of deposited payments must be indicated, and in the group of columns “Paid” the number of the cash receipt order is recorded against the name of the depositor and the amount paid for the corresponding month.

Procedure for depositing

The deposit process is carried out in several successive stages:

- After the expiration of the period when employees took the money they earned, the cashier checks the statement intended to report on the amount issued.

- Next, the cash desk employee calculates the amounts issued and calculates the balance in the cash register.

- In the statement, he finds the names of employees who did not come for the required amount and did not sign, writes “deposited” and puts the corresponding stamp.

- Employees who fall under deposit are registered in a special register for deposited amounts.

Such a register includes details :

- the date on which the register was compiled;

- general period for depositing salaries;

- date and number of the payroll from which data on the lack of payment of wages is taken;

- the initials of the employee who did not receive the funds and his individual personnel number;

- the total amount for which the deposit was made;

- the amount of the general register;

- the initials of the cashier who prepared the statement and his signature.

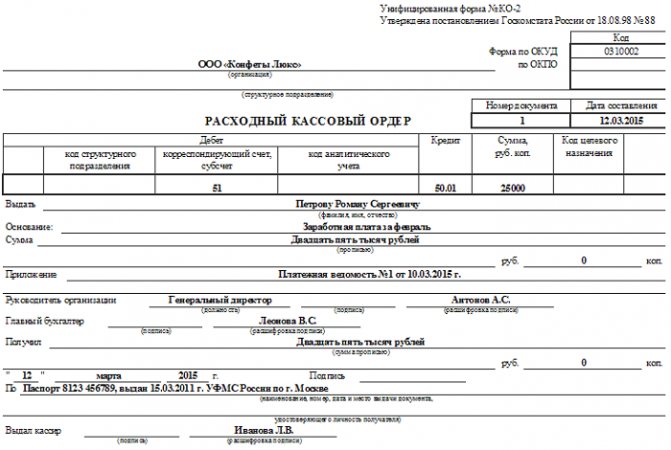

After the register is fully compiled, it is certified by the chief accountant. The amount for which the deposit was made is handed over to the bank and a cash receipt order is created for it.

All data on deposited amounts is entered into the book of depositors, where they reflect the latest transactions carried out during the year.

We certify with a signature

After this, the cashier signs the pay slips, register and ledger of deposited amounts (if any) and submits them to the accountant for signature.

note

The legislation does not provide for a shift in the deadlines for payment of insurance premiums in the case of salary deposition.

Payments in favor of employees under employment contracts are subject to insurance contributions to extra-budgetary funds (Clause 1, Article 7 of Federal Law No. 212-FZ of July 24, 2009). In this case, contributions must be calculated on the date of accrual of these payments (Article 11 of Law No. 212-FZ).

Consequently, the employer charges insurance premiums regardless of whether the employee actually received the salary or the organization transferred it to the depositor (Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ).

Statute of limitations

Salary escrow makes the organization where the employee works a creditor to the employee. If the employee does not request the money he earned, then the debt to the employee will be written off. This is due to the expiration of the statute of limitations.

in the general income of the enterprise in the amount that is reflected in the accounting register.

The statute of limitations is calculated based on the lapse of three years in accordance with Art. 196 of the Civil Code of the Russian Federation. When this period comes to an end, the amount is taken into account as non-operating income, which is enshrined in Article 250 of the Tax Code of the Russian Federation .

How to make a salary deposit in 1C - watch the video:

If the salary is not claimed within three years

If an employee has not applied for wages within three years, then the accountant includes it as part of other income in accounting, and in tax accounting – as part of non-operating income. To do this, you need to take an inventory of payments to employees for wages, prepare an inventory report, draw up an accounting certificate and issue an order from the head of the organization. The corresponding income must be recognized on the last day of the reporting period itself in which the statute of limitations expires.

How to receive deposited money?

An employee who is overdue for receiving his salary must contact the cashier or the secretariat (the form of appeal should be written or oral, it is decided by the enterprise). The registered application is transferred to the chief accountant, who will take these funds into account as additional cash receipts.

In what cases will the deposited salary no longer be returned?

If funds not received for any reason are returned to the company’s account, the person who earned them may claim them for a fairly long, but not infinite, period of time.

The funds returned to the bank, which at one time represented wages, will simply turn into the organization’s profit and can no longer be paid at the request of the employee after the expiration of a three-year period (Article 196 of the Civil Code of the Russian Federation).

If this happens, then these funds will be included in the income item, which is how they are taken into account in accounting and taxation.

The accountant is asked to reflect this as follows: debit 76, credit 91-1, subaccount “Calculations for deposited amounts” - “Deposited wages written off upon expiration of the claim period.”

Accounting for deposited wages

Salaries in accounting, regardless of the date of their receipt by the employee, are taken into account in the expenses of the month in which they were accrued (clause 5 of PBU 1/2008).

Payroll in accounting is reflected by the following entries:

DEBIT 20 (23, 25, 26, 29, 44, etc.) CREDIT 70

– wages accrued;

DEBIT 70 CREDIT 68, subaccount “Personal Tax Payments”

– personal income tax is withheld from the amount of wages;

DEBIT 70 CREDIT 50

– wages paid minus personal income tax;

DEBIT 68 subaccount “personal income tax settlements” CREDIT 51

– personal income tax has been paid to the budget.

Salary deposit. To account for deposited amounts, account 76 “Settlements with various debtors and creditors”, subaccount 76-4 “Settlements for deposited amounts” are provided.

The deposit of wages is reflected by the following entries:

DEBIT 70 CREDIT 76, subaccount 76-4 “Settlements on deposited amounts”

– the amount of uncollected wages has been deposited;

DEBIT 51 CREDIT 50

– the amount of the deposited salary is credited to the company’s current account.

The issuance of deposited wages is reflected by the following entries:

DEBIT 50 CREDIT 51

– received money from the bank to pay the deposited salary;

DEBIT 76, subaccount 76-4 “Settlements on deposited amounts” CREDIT 50

– deposited salary was issued.

The write-off of unclaimed wages is reflected by the posting:

DEBIT 76, 76-4 subaccount “Settlements on deposited amounts” CREDIT 91-1

– deposited wages are included in other income after the statute of limitations expires.

Professional press for accountants

For those who cannot deny themselves the pleasure of leafing through the latest magazine and reading well-written articles verified by experts. Select a magazine >>

Accounting entries for deposited salaries

It doesn’t matter when exactly the staff representative should have received it in his hands and did not receive his “hard-earned money”, accounting for the salary should concern the month when it was accrued, as stated in paragraph 5 of PBU 1/2008. Accounting procedures are divided into three parts: accrual, deposit and payment of deposited salary.

Payroll payments:

- debit 20 (23, 25, 26, 29, 44), credit 70 – “Salaries accrued”;

- debit 70, credit 68, subaccount “Calculations for personal income tax” - “Personal income tax is withheld from the amount of wages”;

- debit 70, credit 50 (51) - “Salaries paid minus the amount of personal income tax.”

Deposit of salary amounts is carried out in the subaccount “Settlements on deposited amounts”, which is part of account 76 “Settlements with various debtors and creditors”:

- debit 70, credit 76 – “The amount of uncollected salary has been deposited”;

- debit 51, credit 50 - “The amount of deposited wages has been credited to the organization’s current account.”

Payment of deposited salary funds:

- debit 50, credit 51 – “Money was received from the bank for the issuance of deposited salaries”;

- debit 76, credit 50, subaccount “Calculations for deposited amounts” - “Deposited salary issued to employee.”

Question: What is the period for withholding and paying personal income tax on wages deposited by the employer? View answer