Rights of the owner of a share in real estate

According to the Civil Code, a gift transaction is recognized as gratuitous (Article 572, paragraph 1), i.e. under it, some property or part of it is transferred as a gift from a citizen to another person on the terms of gratuitous alienation. In other words, the owner transfers the rights to the property to the donee without receiving anything in return. This is the main difference between gift and sale agreements.

The Civil Code reflects the right of the owner of a share in housing to dispose of it at his own will (Article 246, paragraph 2), if the rights of the remaining co-owners are not affected. The latter refers to the legal right of shared owners of real estate to priority purchase of the share of one of the co-shareholders before its free sale or exchange (Article 250 of the Civil Code).

However, the gift transaction is not compensated, which is why it does not fall under the requirements of the law regarding the priority of shared co-owners of common real estate when alienating a share under a gift by any one owner (Article 246, paragraph 2 of the Civil Code). Those. the full owner of a share is not obliged to notify or seek consent from co-shareholders if he intends to donate his share in the apartment to another citizen.

Let us note that when carrying out a compensated transaction under the guise of donating a share, the judicial authorities will apply articles of the Civil Code on the invalidity of a transaction violating the law (Article 168, in accordance with the terms of Article 250) and on the invalidity of a sham transaction (Article 170, paragraph 2, in accordance with the terms of Art. .572 clause 1) with the recognition of the donation as void.

Legal nuances of donation transactions

According to the legislation of the Russian Federation, a promise to donate specific property by its owner to another person in some future, if such is formalized in accordance with the Civil Code of the Russian Federation (Article 574 clause 2), is recognized as a gift agreement (Article 572 clause 2 of the Civil Code). Moreover, according to the terms of the second paragraph 572 of Article of the Civil Code of the Russian Federation, it is mandatory to indicate in the contract a specific description of the subject (object) of the donation.

The property promised by the gift agreement does not pass to the heirs of the donee, just as the obligation to donate does not pass to the heirs of the donor (Article 581 of the Civil Code). Although these obligations may be provided for legal successors by the content of the gift agreement.

The donation of a share in an apartment by guardians (parents, adoptive parents, relatives, representatives of social services) on behalf of wards (under 14 years of age or recognized as incompetent) is completely prohibited (Article 575 clause 1 clause 1 of the Civil Code).

The concept and aspects of donation

The main provisions relating to the gift transaction are provided for in Chapter 32 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation). The essence of the gift agreement is that one party (that is, the donor) transfers or undertakes to give to the opposite party (that is, the donee) a specific thing, and this transfer is carried out absolutely free of charge . In addition, the design of such a transaction may include:

- transfer of property rights of claim;

- release of the donee from a certain property obligation.

Remember: when giving an item as a gift, the recipient’s consent to accept the gift is required. The donee also has the right to refuse the gift at any time (orally - before the conclusion of the contract, in writing - after its conclusion in writing).

Composition of the gift agreement

In the textual content of the agreement for the donation of a share of housing to a spouse or relative, it is necessary to indicate all the essential conditions: about the subject of the agreement; noted in legal acts as necessary for such agreements; requiring an agreement between the parties (Article 432, paragraph 1, paragraph 2 of the Civil Code).

Since the subject of the agreement to donate a share in an apartment is its part, you should indicate the address and housing number, its floor and area (general and residential), the number and area of rooms, cadastre numbers and entries in the Unified State Register. The share of the apartment donated by the owner is indicated along with the general characteristics of the housing in the format of an arithmetic fraction - for example, 1/2 or 1/4.

Owning only a share of an apartment, you can not indicate your intention to give a relative a room, which is occupied by the owner of the share by agreement with all co-owners or, in other words, according to the established procedure for using this housing. However, indicating the part of the residential premises that the donor uses on account of his share will reduce the risk of disputes between the donee and the rest of the shareholders.

But if the room used by the donor is disproportionately larger than his share in the housing, then one of the co-owners of the apartment often refuses to recognize the right of residence of the donee relative in the room of the previous owner (donor), especially if the donee has not previously lived in this living space. An opposing sharecropper often demands the transfer for use of a room commensurate with his share. And if the design features of the housing do not contribute to the allocation of adequate living space, the dissatisfied co-owner has the right to demand monetary compensation for the use by the second co-owner (donee) of a larger living space than is required under his share (Article 247, paragraph 2 of the Civil Code).

The essential conditions included in the agreement for the donation of a share in an apartment by the parties may include the right of residence of the donor or any other persons on the corresponding share of the living space for a specified period, or indefinitely. For example, the donor may enter into the contract document the condition of lifelong residence in the shared living space donated to the relative.

Rules for preparing a deed of gift for a share of an apartment

Under the terms of the law No. 122-FZ (Article 24, paragraph 1), transactions for the alienation of shares in the right of common ownership of real estate are subject to certification by a notary (a similar requirement is approved by the law No. 218-FZ, Article 42, paragraph 1). Also, transactions for the alienation of shares in housing owned by minors or citizens of limited legal capacity require notarization (Article 54, paragraph 2 of Law No. 218-FZ).

In the context of these norms, minors are young citizens aged 14-18 years. A donation transaction on behalf of a minor of this age range is permissible subject to the written approval of the young person’s legal representatives, as well as with the prior consent of the guardianship authorities (Article 60, paragraph 3, Family Code; Article 37 and Article 26, paragraph 1, Civil Code).

Let us emphasize once again that gift transactions on behalf of children under 14 years of age are completely impossible (Article 575 clause 1 clause 1 of the Civil Code). However, donating a share in an apartment in favor of younger children (under 14 years old) and older children (14-18 years old) is not limited by law, since their property only increases as a result of these transactions.

A deed of gift for a share of housing in favor of a minor is drawn up by the donor, who is a shared owner of the apartment along with the other co-shareholders, by a notary. Note that in case of full ownership of an apartment by a donor who wishes, for example, to give shares in it to two minors (for example, grandchildren), notarization of the donation transaction is not required (Article 160 and Article 161 of the Civil Code).

The share in housing given to minors is accepted by their legal representatives (parents, trustees, guardians or adoptive parents). But the subsequent disposal and use of the donated property of minors by their guardians is allowed under the conditions of compliance with the norms established by law (Article 17-23 of Law No. 48-FZ; Article 60, paragraph 3 of the Family Code; Article 26, Article 28, Article 37 and Article 292, paragraph 4 of the Civil Code), which, as a rule, require the mandatory consent of state guardianship authorities.

To donate a share in an apartment by one spouse (wife, husband), prior approval by the other spouse may be required. In particular, when purchasing real estate or a share in it by a donor who was married at the time of purchase of housing without registering another (different from Article 34 of the Family Code) regime of property relations through a marriage contract (i.e. unequal marital shares in property when it is divided ) the consent of the husband/wife will be required for the transaction of donating this share (Article 35, paragraph 3 of the Family Code).

In this case, written or oral consent is not required from the husband/wife of the donee, because the transaction is gratuitous and the donated property becomes the exclusive property of the donee, not being jointly acquired property (Article 34, Article 36, paragraph 1 of the Family Code).

Features of donating a share of a room

In the Russian Federation, many are accustomed to living in very cramped living conditions, in particular, in communal apartments owned simultaneously by several owners. As a rule, there are as many owners of an apartment as there are rooms in it, but in some cases it becomes necessary for even one room to have several shared owners at once. This may be due to the need to allocate a share in the right to real estate to a minor, for example.

A room share gift agreement implies that one person transfers or promises to transfer in the future to another person a share in the ownership of the room belonging to him, and such transfer is carried out free of charge. In cases where the transaction consists only of a promise to give part of the room as a gift in the future, it is necessary that the promise be expressed in writing (as required by the norm of paragraph 2 of Article 574 of the Civil Code of the Russian Federation) and express a clear intention to donate strictly defined property . When transferring a share of any real estate as a gift, the consent of the recipient of the gift to accept it is required.

The donor of a room share may, without notifying the other owners, donate his share . The preemption rule does not apply in this case. If the spouses’ real estate is transferred as a gift, which is joint, but not shared (if the shares of each spouse in the right of ownership are not determined) property, then it is not possible to transfer one’s part of the room as a gift without the consent of the other spouse .

Attention

If among the co-owners of the room there are minors (children under 14 years old), as well as citizens recognized as incompetent, then donation on behalf of such persons by their legal representatives is prohibited.

It is also not permissible to carry out such a transaction in relation to:

- state and municipal employees (if this is related to the official position or official duties of such persons);

- employees of social, medical or educational organizations , persons located in such institutions, as well as their spouses or relatives.

Registration of a deed of gift for a share in housing

Since the donation of a share in an apartment owned by several co-owners implies a transfer of ownership, the gift transaction requires state registration (Article 131, Article 574, paragraph 3 of the Civil Code).

Thus, the recipient’s ownership of the donated share of housing, along with a gift agreement of any form of transaction (notarial or simple), is subject to unconditional registration in the Unified State Register of Real Estate in accordance with Law No. 218-FZ (Article 42, paragraph 2).

Activities for state registration of rights to real estate based on transactions of owners are carried out by the authorized agency - Rosreestr, including its regional divisions. The donee has the right to apply for the service of state registration of a gift for a share of an apartment and the right of ownership to it through the MFC.

The amount of the state duty charged for carrying out actions for state registration of rights and real estate transactions - when contacting the Rosreestr Office or the MFC, the donee should provide documented fact of payment of the state duty - is determined by the Tax Code (Article 333.33, paragraph 1, paragraph 22).

Regardless of the form of the gift agreement (notarized or simple), the Rosreestr service carries out a legal examination of the transaction and establishes its legality. The period for registration actions when applying to branches of Rosreestr takes a maximum of seven working days, when applying for state registration at the MFC - nine working days (Article 16, paragraph 1, paragraphs 1 and 2 of the law No. 218-FZ).

Upon completion of the registration procedures, the parties to the share donation transaction receive copies of the agreement with a state registration mark (Article 28, paragraph 2 of the law No. 218-FZ). The recipient is also provided with an extract from the Unified State Register of Real Estate, which serves as evidence of the fact of state registration of rights (Article 28, Clause 1 of Law No. 218-FZ).

The concept of shared ownership

Shared ownership is closely related to the concept of common ownership. Common ownership arises in relation to an indivisible thing, which is the property of several persons at the same time, or in relation to a divisible thing, if common ownership of it is established by law or by agreement of the parties. Common joint property (by default, which occurs, in particular, between married persons) differs from shared property, which implies the ownership of a thing by several persons at the same time and a strict definition of the shares in the right of each such person .

When establishing shared ownership, each of the co-owners is assigned a strictly expressed share in the right in relation to the common property. The size of each share can be established either on the basis of regulations or on the basis of an agreement between the owners. If such a size is not established, it is recognized as equal (according to paragraph 1 of Article 245 of the Civil Code of the Russian Federation).

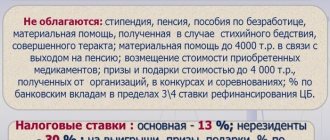

Taxes when donating a share in residential real estate

According to the current tax legislation, the receipt by an individual of real estate as a gift, including a share in an apartment, is recognized as taxable income (Chapter 23 of the Tax Code).

But also income received as a result of a gift transaction that occurred between members of the same family and/or their close relatives (Article 14 of the Family Code) is recognized as not subject to taxation (Article 217, paragraph 18.1 of the Tax Code). Therefore, for the case considered in this article - donation of a shared part of an apartment to a relative - there is no need for the recipient to pay tax.

Refusal to accept a gift

Before actually taking possession of the donated share of housing, the donee has the full opportunity to refuse the proposed gift (Article 573 of the Civil Code), which will mean termination of the donation agreement. Since this transaction is formalized in writing, the refusal of the gift must also be in writing. If, under the gift agreement, state registration took place in accordance with the Civil Code (Article 574, paragraph 3), then the refusal (written) to accept a share in the apartment as a gift must also undergo state registration.

Refusal to accept a share in an apartment as a gift

What we usually call a share is a share in the ownership of an apartment.

A share in the right is not part of an apartment, not a separate room or two. A share in the right means that you own the entire apartment, but only within the size of the share. In practice, this is not very convenient, especially if the owners are strangers to each other. Therefore, such share owners often agree on who will live in which room and which part of the apartment will use. In particularly difficult cases, co-owners can allocate their share in kind - divide the apartment through the court.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

The share must be allocated and registered, that is, registered in the unified state real estate register - EGRN. For example, one of the spouses decided to donate his share in the right to an apartment. If the shares were not allocated before, the division will exist only in words. To donate or sell such a share, you need to agree on the division of rights to the apartment in writing and register the shares with Rosreestr.

You can give an apartment or a share in the right to it to almost anyone: a stranger or a family member. But there are still some restrictions. They apply to any expensive gifts, and not just shares in the right to an apartment.

Judging by the nature of the bans, it is clear that they all relate to the fight against corruption.

Consent will only be required from the spouse if the share appeared during marriage and did not come to you as an inheritance or as a gift.

The procedure for giving does not depend on who exactly you decide to give a gift to - the rules are the same for giving to a relative and for giving to a stranger. This will only affect the taxes that the new owner will have to pay. I’ll tell you about this separately.

We know everything about real estate

We analyze complex situations with the purchase and sale of housing, talk about the laws that affect property owners

The donee may refuse the share until he has accepted it under the agreement. But if the agreement has already been submitted for registration, then the refusal of the gift will have to be registered. To do this, you will need to submit an application to Rosreestr.

The donor can also refuse to give a share, but only in special circumstances.

To do this, two conditions must be met:

- The share has not yet been donated, but only promised.

- The donor's situation - financial or family - has changed so much that if he fulfills the promise, it will significantly reduce his standard of living.

Refusal to donate a share

According to the provisions of the Civil Code (Article 577), the donor has the right to refuse to execute the gift agreement if, shortly after the gift agreement, the donor’s family status, or his property status or health status has seriously changed, as a result of which the execution of the gift agreement will cause a significant decrease in his standard of living.

We note the particular relevance of this norm when donating part or the entirety of residential real estate. For example, the donor’s health has deteriorated or his life circumstances have changed dramatically, and he previously donated an apartment to his daughter and intended to move to another region of the country, but is now forced to stay.

The donor has the option of refusing to fulfill the agreement on the grounds reflected in Article 578, paragraph 1 of the Civil Code. According to this norm, the donor can cancel the donation in the event of an attempt on the life of the recipient, his close relatives or family members, as well as in the event of intentional infliction of physical harm on the donor. In the event of the death of the donor due to the intentional misconduct of the donee, the heirs of the donor may exercise the right to judicially demand the cancellation of the gift transaction.

Also, under the terms of Article 578, paragraph 2 of the Civil Code, the donor has the right to demand judicial termination of the gift transaction in the event of a threat of irretrievable loss of the share in the apartment caused by the donee’s request. In principle, the threat of loss of a share of housing (destruction of the premises, irreparable damage, damage in certain places), which is a significant non-property value for the donor (for example, an apartment-museum or having inseparable structural elements of cultural and architectural value), can develop as a result of the recipient’s failure to fulfill rules for the use, maintenance and operation of housing.

It is important to note that the refusal of the donor on the basis of the norms of the Civil Code (Article 577 clause 1 and clause 2) to execute the gift agreement does not create legal conditions for the donee to claim compensation for losses under the canceled gift transaction (Article 577 clause 3 of the Civil Code) .

Where to submit documents?

The donor submits the papers to the territorial Federal Registration Service. Documents can also be submitted through multifunctional centers (MFCs) to provide state and municipal services to the population.

The owner of the property or his representative also applies to the Federal Registration Service with a power of attorney to register ownership rights. Rosreestr must register ownership under the gift agreement no later than one month from the date of receipt of the application. However, constituent entities of the Russian Federation can set their own deadlines. For example, in Samara it is seven working days, in Cheboksary - 15 calendar days, in Moscow - 11 days.

Cancellation of donation of share in housing

According to the norm of the law, the donor is given the right to introduce into the text of the contract an essential condition establishing the cancellation of the donation of a residential share in real estate if the donor survives the donee (Article 578, paragraph 4 of the Civil Code). If the donation is canceled in this case, the donee (his heirs) is obliged to return the donated property if it is retained in kind by the time the contractual reason for canceling the transaction arises (Article 578, paragraph 5 of the Civil Code). Note that we are not talking about the literal safety of the apartment and the share in it, since it practically cannot go to waste - here it is appropriate to talk about constructive changes in housing, its deep reconstruction.