What is the tariff system of remuneration. Differences from the tariff-free system

The tariff system includes a number of provisions, norms, rules and regulations that make up a unified method of calculation, as well as the calculation of employee wages. The form of remuneration under consideration differs significantly from the non-tariff form.

The tariff system takes into account the complexity of the work, its intensity, working conditions, qualifications of certain categories of personnel; only if the specified components are available and analyzed, the employee will be paid a salary.

The non-tariff system has fundamental differences: the wages of all employees of the enterprise depend on the results of the work of the entire enterprise and on the amount of money allocated by the employer to pay for the labor process.

A fundamentally important element of the non-tariff system is the coefficient that takes into account the individual contribution of each employee to the overall final result. The tariff-free system is distinguished by the fact that the salary of each member of the work team is part of the general wage fund.

The tariff system of remuneration includes the main elements:

- tariff schedules;

- tariff directories;

- tariff rates.

Do you need help from a labor lawyer?

We will analyze your prospects for free!

+7

Pros and cons of BSOT

The tariff-free system can be viewed as an attempt to overcome the obvious shortcomings of its tariff prototype. Thus, when establishing a tariff category, achievement of levels is often biased, for example, “for length of service.” In addition, often in the same qualification category there are workers with different levels of efficiency and other important work qualities. This leveling often demotivates employees.

Positive qualities of BSOT, in contrast to the tariff model:

- the ability to take maximum account of the employee’s individual contribution to overall labor efficiency;

- the greater the initiative of employees, the higher the salary can be - hence the increase in motivation;

- more opportunities to objectively track the growth of employee qualifications;

- BSOT helps to bring real and nominal wages closer together, since inflation is compensated by productivity growth, and therefore by the growth of the wage fund, which is distributed proportionally rather than fixedly.

What disadvantages of BSOT will you have to put up with:

- the system for assigning coefficients is complicated compared to the tariff model, where this process is unified;

- the process of setting the coefficient is largely subjective;

- the basic indicators on the basis of which the calculation is made still largely “equalize” employees;

- A complete assessment of the qualification level of the team is impossible, since the tariff-free system is not applied to the entire enterprise (usually no more than 10% of the salary fund is distributed this way).

Unified tariff and qualification reference books

These reference books are necessary to regulate the work of representatives of the main working professions, management positions, employees and specialists within the enterprise. Using the provisions of a single directory, you can determine the suitability of an employee for the position held.

The document contains requirements for personnel categories, descriptions for each type of activity, a listing of the employee’s skills and knowledge, and a list of professions related to each type of work.

The unified directory of positions for managers, employees, and specialists contains requirements for the qualifications, knowledge and education of these categories of workers and explains their main job responsibilities.

Using the provisions of the directory, various types of professional activities are compared according to the complexity of their components. In addition, categories and qualifications are determined. This process is generalized into the concept of “tariffication”.

Moscow State University of Printing Arts

14.

Chapter 14. Tariff-free wage system

The non-tariff wage system is based on establishing the level of wages depending on the qualification level and business qualities of the employee, the complexity of the work and the functions he performs, and the assessment of his labor contribution to the overall results of the team. It is characterized by the following features:

- • close dependence of the level of employee remuneration on the results of the work of the primary team or the enterprise as a whole;

• assigning to each employee relatively constant coefficients that comprehensively characterize his qualification level and determine his labor contribution to the overall results of the team’s work;

• establishing for each employee labor participation coefficients in current work results, complementing the assessment of his qualification level.

Since non-tariff remuneration systems make employee earnings completely dependent on the final results of the work collective, their use is advisable primarily where the labor collective bears joint responsibility for the results of work. An analysis of the practice of using such remuneration systems shows that they are most effective in relatively small teams with a stable composition of workers. The most common non-tariff (systems) of remuneration at enterprises are: the option of remuneration according to labor rating, the “fork” option, the collective system of remuneration.

One of the most common non-tariff models of remuneration is payment based on labor rating. The labor rating of each employee is determined as the product of several coefficients, for example the following: - a coefficient characterizing the educational level; — coefficient characterizing work experience; — significance coefficient characterizing the employee’s ability to implement his knowledge and experience.

The price of the rating is determined by dividing the wage fund (WF) by the sum of the ratings of all employees:

The salary of each employee is determined by multiplying the price of the rating by his personal rating, i.e. according to the formula

.

Within the department (for work teams), it is advisable to use the option of point-based non-tariff remuneration, taking into account points for hours worked (BOV), for labor participation (LTU) and for qualification level ().

A worker's wages are determined by the formula

where is the sum of the products of points scored by all workers of the brigade for all indicators; p — brigade size; - the product of points scored by workers according to established indicators:

Remuneration based on wage ratios of different quality is a “fork” option. This system is based on the ratios in remuneration for labor of different quality (depending on the qualification groups of workers, the skill of workers, professions, positions, etc.), taking into account these ratios, and funds intended for remuneration are distributed among employees. The salary of a specific employee is determined by the formula:

where is the salary of the i-th employee;

where is a coefficient showing how many times the salary of the i-th employee is higher than the minimum for the previous period (); Payroll - wage fund intended for distribution; n is the total number of employees of the enterprise (shop, division).

The given formula calculates the share of the total wage fund that each employee should receive according to his qualification level and quality of work. At the same time, the ratios in wages of various categories should not be spotty. They should be installed in the form of “forks” with a fairly wide range, which makes it possible to more actively stimulate creative, effective work, and a responsible attitude of workers to their responsibilities in the enterprise.

This method of calculating wages makes it possible to establish the dependence of its size not only on the degree of realization of the potential abilities and labor contribution of each individual employee, but also on the results of the work of the team in which he works. This ensures a combination of the interests of the enterprise and the individual employee.

The use of this remuneration model makes it possible to significantly reduce the scale and range of application of various types of bonuses, additional payments and allowances or to abandon them completely. This is due to the fact that, firstly, indicators that are stimulated by bonuses, additional payments and allowances can be stimulated by the use of “forks” of ratios in wages of different quality. Secondly, in this model of organizing wages, the wage fund is distributed among workers without a remainder, so there is no constant source of payment of bonuses, additional payments and allowances. This model contains several elements:

- • the number of qualification groups that unite workers of various categories (workers, employees, specialists, managers of various levels). In the practice of enterprises using such a system, the number of qualification groups ranges from 8 to 15;

• the value of pay increase coefficients from one qualification group to another, reflecting the ratio of wages between groups. In this case, the coefficients can increase: uniform, progressive, regressive mixed;

• ranges of coefficient values, pay ratios, reflecting possible individual differences in the employee’s labor contribution within a particular qualification group.

Table 14.1

Example of parameters of a “fork” model of a remuneration system

| Qualification Groups | “Forks” of ratios in wages for workers of various qualification groups | ||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Workers | 0,6-1,4 1-2,0 1,4-2,4 1,9-3,1 | ||||||||

| Employees | 1-2,1 1,5-2,5 | ||||||||

| Specialists | 1,6-2,6 2,0-3,2 2,5-3,9 | ||||||||

| Heads and deputies of all divisions (departments) | 2,1-3,3 2,6-4,1 3,2-4,8 | ||||||||

| Director of the enterprise, chief engineer, deputy directors | 4,5-5,5 4,8-5,8 5,0-6,0 | ||||||||

In the example given, nine qualification groups are identified. The initial group included workers of the lowest qualifications, performing simple, unattractive work, workers of 1-3 categories. The second group includes drivers, technicians without categories, technicians of the 2nd category, workers of the 4th category, etc. The third group included workers of the 5th category, technicians of the 1st category, heads of some support services, etc. The last three Qualification groups include enterprise managers.

When defining intervals by skill group, it should be kept in mind that the values of the intervals must overlap each other in such a way that the average value of the interval of the previous group acts as a lower value for the next one. This allows the administration to reduce the coefficient for certain shortcomings in work, setting the employee’s payment within a lower qualification level.

Tariffing procedure

Tariffication occurs by comparing the work performed at the enterprise with the list and examples of work contained in a single directory. For pricing purposes, an enterprise can develop and introduce internal lists of work, and use them along with the main ones.

Depending on the rank, the salary of an employee of an enterprise varies. To transfer an employee from rank to rank, in accordance with the internal regulations of the organization, a qualification commission is formed and convened, and its chairman is elected.

The employee, in the presence of members of the commission, passes a qualification exam, which includes testing theoretical knowledge and, in some cases, practical skills. If the exam is passed successfully, the employee receives a certain rank or moves from one to another, which is recorded in his work book. To rate the salaries of managers, as well as employees and specialists, a single directory of the specified positions is used.

Salary calculation rules

In a collective tariff-free system, the salary of each employee is calculated according to the formula:

C = F * KKU * KTU * T / (OKKU * OKTU * OT) , where:

F - the size of the wage fund in a given month (or other billing period), KKU - the personal coefficient of the employee’s qualification level, KTU - the coefficient of labor participation, T - the number of hours worked by the employee, OT - the total number of hours worked by the entire team, OKKU - the sum of qualifications coefficients of all team members, and OKTU is the sum of labor participation coefficients of all team members.

The labor participation rate is determined by personal output in each specific month , and the number of hours worked may not be taken into account. For example, the KTU of each employee can be proportional to the number of products he produces.

The qualification level (QL) is a more constant value and changes every few months depending on the level of professional skill of the employee.

There are different ways to change the level of CSC, for example, as the ratio of an employee’s salary in the current month and the minimum salary in the team (S/Smin).

To increase the CFC, an employee must first increase his salary through more intensive work or more hours worked, after which the constant CFC indicator will increase. This approach encourages workers to constantly increase their productivity.

Sometimes, for simplification, a general coefficient of labor contribution is used, calculated as the sum of KTU + KKU.

Commission system

Salary calculation under the commission system is carried out according to the formula:

C = B * K , where B is the amount of revenue, K is the employee’s commission.

For example, a seller of insurance policies is assigned a commission of 20% of revenue. During the month, the employee sold policies for 100,000 rubles, his salary was 100,000 * 20% = 20,000 rubles.

The commission may be indicated not as a percentage, but as a fixed amount . For example, a designer receives 1000 rubles for each logo, created 20 logos in a month, his salary is 20 * 1000 = 20,000 rubles.

Floating odds system

The formula for calculating wages is C = F * KTU / OKTU, where F is the wage fund, KTU is the employee’s labor participation coefficient, OKTU is the sum of the coefficients of all employees.

Example . The coefficients of advertising agency employees are distributed as follows:

- director – 2,0;

- marketer – 1,6;

- designer – 1,2;

- printer – 1,1;

- courier – 0,9.

The amount of the salary fund was 100,000 rubles. The designer's salary is:

100000 * 1.2 / (2.0 + 1.6 + 1.2 + 1.1 + 0.9) = 100000 * 1.2 / 6.8 = 17647 rubles.

The coefficients under this system are distributed by the company’s management based on the assessment of personal contribution to profit generation and skill level.

Tariff rates

The tariff rate is understood as a payment to an employee measured in monetary terms, taking into account his qualifications, nature and standards of work performed. Calculation of tariffs occurs both for time-based and piecework wages.

The tariff rate is a guarantee that the employee will receive money for work, provided that it is performed in good faith. Additional payments, bonuses, compensations are not included in the concept of “tariff rate”. Consequently, the tariff rate is the minimum wage for an employee, to which, in the process of wage formation and calculations, other components of wages are added.

Forms

There are several options for a non-tariff wage system:

- The remuneration of an employee in a collective form depends on how the entire enterprise performed over a certain period. In this case, the labor success of a particular person is not taken into account. All participants in the system, depending on the coefficients, receive salaries from the general fund.

- The commission form is usually used in small private firms. It involves the payment of wages based on the results of the work done. Its size is determined by the quantity and quality of the work they perform.

- When the system applies so-called “ floating coefficients ”, the main principle of remuneration will be the quality of the work performed by the employee. Most often, such a system is used to remunerate executive employees.

In other countries, for example, in the USA, France, Japan, non-tariff wages have received the widest application. They usually use the following forms of this payment system:

- participation in company profits;

- taking into account the merits of a particular employee when determining wages: motives, aspirations, abilities, goals;

- accounting for the contribution of each employee;

- salary calculation depending on the employee’s performance in the past month.

Tariff schedule and tariff category

The tariff schedule represents the ratio of tariff rates in accordance with the category. Designed in the form of a table for entering data. For different categories of work, tariff scales with different numbers of categories are provided.

Enterprises, as a rule, use a six-digit grid, where the first digit is the lowest and the sixth is the highest.

An enterprise, in accordance with its internal situation, can change the tariff scale towards increasing or decreasing its range. The instrument in question is used not only in relation to blue-collar professions. The tariff schedule is typical for calculating wages of public sector workers.

The tariff category shows the level of qualifications and skills of the employee and characterizes the complexity of the work he performs. The composition and size of an employee’s salary largely depends on the tariff category.

Distinctive features

In practice, the non-tariff wage system is used by both small enterprises with a limited staff of labor and large holdings with branches and representative offices throughout the country. The system allows small businesses to make maximum use of labor resources, increasing the efficiency of each employee at the micro level by focusing on the overall result. In a large business, structural divisions are considered as separate elements.

Comparative characteristics of SOT

The names of the systems eloquently indicate the differences. Tariff and non-tariff remuneration systems differ at the stage of wage formation, calculated on the basis of individual coefficients. The size of the payroll may vary, but the contribution of a particular employee remains the same. Comparative characteristics of key parameters are presented in the table:

| Indicators | Tariff SOT | Tariff-free SOT |

| Size in monetary terms | Constant based on a certain percentage for each unit produced | Variable from the calculation of the individual coefficient applied to the changing payroll |

| Salary calculation procedure | Direct, based on piece rates, tariff rates or established official salaries, adjusted for time worked. | Reverse, based on the formed wage fund, not related to tariffs. In case of a partially worked month, the adjustment is made at the level of decreasing the component of the labor participation coefficient. |

| Percentage based on volume | Stable, for example, 20 kopecks per ruble earned | Floating, since equality is not satisfied due to the preliminary fixation of payroll |

| Formation of payroll | Summing up accrued salaries and obtaining the result - a specific figure for the size of the payroll | Definition based on baseline with further breakdown by employee |

Tariff and non-tariff wage systems in their pure form are practically not used due to the mandatory reconciliation of indicators with the minimum wage. In practice, a mixed system is more often used, taking into account upward adjustments in case of insufficient earnings and a subsequent decrease in the future.

Advantages

The essence of the non-tariff wage system determines the growth in popularity due to a number of advantages:

- The mechanism of formation of payroll. The generated amount of funds to finance wages under a tariff-free wage system is a value obtained based on a percentage of the base indicator: revenue, sales volume, output, etc.

The achieved performance indicator is taken as the foundation, excluding unprofitability, low profitability and the likelihood of debt.

- Level of motivation. The underlying desire to increase wages for a comprehensive result does not require the use of the usual “levers of influence” on employees:

- premium-progressive scale;

- chord method;

- bonus reward.

- Simplicity and transparency. Knowing the established personal coefficient and the share in the total “share”, each employee without special education will be able to calculate the amount of money due. This eliminates misunderstandings in the team and gives everyone the opportunity to increase their efficiency by mastering the formation mechanism.

- Protection against inflation processes. The market for the services provided immediately responds to an increase in consumer prices by increasing the selling price of manufactured products. The form of the non-tariff wage system, which provides for the formation of wages based on the results obtained, automatically takes into account inflation.

- Selection of frames. Establishing a personal IQ for salary will help the employer get rid of employees who are unwilling to work with a focus on results, without conducting surveys and testing of employees. Individuals who are unable to work in a team are eliminated without any effort on the part of management.

The interest of each employee in the final result, since it is the foundation for calculating wages in a non-tariff wage system, will be reflected in financial performance and improve the microclimate in the team psychologically, turning a randomly selected staff into a cohesive team.

Flaws

In addition to the psychological unpreparedness for working in a team, the disadvantages of the non-tariff wage system at the enterprise include:

- Lack of stability. For example, a production worker cannot calculate the salary of the current month, since it is not related to the process of sales and formation of total income, which reduces motivation and makes it difficult to focus on the result of a specific period.

- Collective responsibility. A guilty employee or department’s personal “contribution” can negate the efforts of the team or department. Thus, a sales manager who has gone on a spree will punish the production department, which successfully completed the task, with a lack of sales volumes and an automatic reduction in the team’s wages if sales are taken as the basis for the calculation.

- Internal competition. Since the amount of remuneration for work depends on individual coefficients and the specific weight of indicators, a number of employees try to demonstrate their own importance by leveling the efforts and indicators of other employees. Teamwork will be lost, and efficiency and focus on the final result will decline.

Labor legislation does not provide for a mechanism for the formation and there is no definition of a non-tariff wage system, which such an enterprise must determine independently, document, without violating labor law norms.

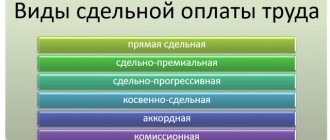

The use of tariff systems for time-based and piecework wages

The main types of payroll calculation include:

- time payment;

- piece-work payment.

When calculating wages, the employer takes into account the following elements:

- grade of work;

- its characteristics;

- the standard time allotted for its implementation;

- tariff rate.

Calculation of piecework payment is made on the basis of the provisions of the unified tariff and qualification reference books. The most important component of work with piecework payment is production. One of the main disadvantages of piecework payment is the high probability that, in an effort to produce more products, the employee will not pay due attention to the quality of the finished product.

When calculating time wages, the amount of money an employee receives monthly depends on his rank. Also, when calculating time-based wages, the amount of time worked plays a significant role, which fundamentally distinguishes this form of payment from piecework.

Time-based payment requires mandatory staff pricing and clear timekeeping of the time spent by the employee on work. Today, most enterprises produce time-based wages, recognizing it as a more convenient type of payment for the parties to labor relations than piecework wages.

Procedure for establishing tariff systems

Russian labor law in its provisions determines the procedure for establishing tariff systems. Regardless of the legal form of the organization and the type of its activity, the tariff payment system is established by local regulations, provisions of collective agreements, and agreements.

Also, when establishing tariff systems, the data of the unified tariff and qualification reference book are fundamentally taken into account, taking into account all the requirements of the labor legislation of the Russian Federation and other regulations mandatory for execution on the territory of the Russian Federation. The employer, when introducing tariff systems to the enterprise, must respect the rights of the employee and create decent working conditions.

Author of the article

Grading

Russian companies currently widely use a foreign analogue of the tariff schedule - grading, developed by Edward Hay in 1943. In accordance with this system, all positions in the company are given points, depending on which the salary of each employee is calculated using score tables. In practice, there are 2 approaches.

- Grading of positions or jobs, when a position is evaluated, regardless of which employee occupies it. The grade depends on the value and importance of this position for the company. This system is used by LUKOIL Overseas Holding Ltd., LLC LUKOIL Perm, OJSC Zarubezhneft, but it can be successfully applied by any medium and large manufacturing and trading companies.

- Grading of employees, when employees are assigned to grades personally, taking into account the value of the work performed and the skill level of the employee himself. Such a system exists in the companies IBS and MTI, but can be implemented in consulting firms and other small organizations where high demands are placed on the level of education and qualifications of employees.