There are several remuneration systems. One of them is the indirect piecework form.

This form refers to the piecework form and is used in calculating wages for auxiliary workers serving individual areas of production and on whom the work process to some extent depends.

How is salary calculated for this form of payment?

Types of piecework wages

Piece wages are a form of remuneration that is introduced with the aim of stimulating workers to produce a larger volume of production in the allotted time. In this case, the main indicator for calculating an employee’s income is the quantity of products produced (services provided, work performed).

We do not recommend establishing piecework payment in industries that require increased concentration of attention from the employee, since the pursuit of increasing the number of products produced can lead to a large number of defects.

The following types of piecework wages are distinguished:

The employer has the right to approve several remuneration systems at one enterprise for each position, department, etc. For example, for the administration - time-based, for the sales department - commission, for the production department - piece-rate bonus. See also “Time-based wage system is.”

Direct piecework wage system

It is approved, as a rule, by production employees, for whom work standards can be set. For example, time or production standards.

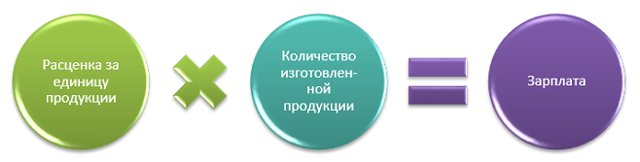

In this case, earnings are calculated based on the number of products manufactured and the prices set by the employer.

The formula for calculating income is as follows:

The piece rate per unit of production can be determined in several ways, for example:

- multiplying the hourly (daily) tariff rate by the hourly (daily) time standard;

- dividing the hourly (daily) tariff rate by the hourly (daily) time standard.

Example 1

Masterok LLC has established a piecework wage system for workshop employees. For the production of one part, a rate of 1,000 rubles is provided. An employee produced 44 parts in September 2021. His earnings amounted to 44,000 rubles. (44 units × 1,000 rub.)

Such a system encourages the employee to increase the volume of output, but he is not interested in the quality of the parts produced. To motivate employees to produce products without defects, employers are introducing piecework-bonus wages.

Piece-bonus wage system

In this case, in addition to income calculated using direct piece rates, the employer pays a bonus, for example, for reducing defects, exceeding standards, and rational use of raw materials.

State employees will have their salaries increased from October 1, 2021

The formula for calculation is as follows:

Example 2

Let's continue with the following example, provided that Masterok LLC has set a bonus of 10% of the amount of income for the absence of defects in products. No defects were found in the employee's details. Therefore, he is entitled to a bonus of 4,400 rubles. (44,000 × 10%). And his monthly earnings will be 48,400 rubles. (44,000 + 4,000).

Piece-progressive wage system

It is used to encourage employees to produce as many products as possible in excess of production standards. Products manufactured by an employee in excess of production standards are paid at increased piece rates.

It is advisable to use this system when you need to quickly increase production volumes. Therefore, it is used quite rarely and for a short time (usually no more than 6 months).

With such a remuneration system, additional bonuses may be provided.

Salary under the piecework-progressive system is calculated according to the formula:

Earnings for products produced within the norm are calculated by multiplying the piece rate within the norm by the number of products manufactured within the norm. And the salary for products in excess of the norm is by multiplying the increased price by the number of products produced in excess of the norm.

Example 3

Let's change the conditions of example 1 and assume that Masterok LLC has installed a piece-rate progressive wage system. The norm is 35 parts per month. The price for each part is RUB 1,000. For exceeding the norm - 1,300 rubles. The accountant calculated the employee’s earnings in several steps:

- income within normal limits - 35,000 rubles. (35 units × 1,000 rub.);

- salary above the norm - 11,700 rubles. ((44 units - 35 units) × 1,300 rub.);

- Semenov’s total income for September is 46,700 rubles. (35,000 + 11,700).

Indirect piecework wage system

This system is used to pay support staff, for example, workers who set up equipment. Their income depends on the output of key workers. This system is used to encourage support staff to provide better services to key workers.

The law does not provide for a single formula for calculating wages under an indirect piecework wage system. The employer can develop and approve its own options.

We'll look at a few possible examples.

At indirect piece rates

The formula for calculation will be as follows:

Example 4

A. M. Grigoriev works at Masterok LLC, who prepares blanks for A. Yu. Semenov for processing manufactured parts. Grigoriev’s daily rate is 1,400 rubles. Semenov’s monthly production rate is 35 parts, but in fact Semenov produced 44 parts.

Grigoriev’s indirect piece rate per shift: 1,400 rubles. / 35 children = 40 rub.

Since Semenov exceeded the plan, Grigoriev’s daily earnings increased:

40 × 44 children. = 1,760 rub.

Grigoriev worked 22 shifts in September. His income was 38,720 rubles. (22 × 1,760 rub.)

Using the average compliance rate

The formula in this case:

Deputy director: additional payment for performing duties

Example 5

Yu. G. Strelnikov works at Company + LLC, who prepares blanks for manufactured parts for D. N. Migachev. Strelnikov’s monthly salary is 35,000 rubles. The production plan for parts for Migachev is 30 pcs. per month. Migachev produced 28 pieces. The average compliance rate is 0.93 (28/30).

Therefore, Strelnikov’s salary will be: 32,550 rubles. (35,000 * 0.93).

As a percentage of the earnings of employees of the main production

Formula for calculation:

Chord system of remuneration

As a rule, it is installed for individual teams if it is necessary to reduce the time required to complete the work. Employees are paid for performing a certain set (volume) of work according to a unit assignment, and not individual operations or types of work.

The entire list of works included in the chord task, their volume, time standards (production), prices, total cost and deadline for completing all work are established in advance. Payment is distributed among employees, for example, as follows: based on the time worked by each of them, in accordance with the labor participation rate.

The lump sum wage system can be used for construction work, emergency response, and repair of machinery and equipment.

Example 6

The team consists of 5 people. A contract assignment for the construction of utility premises for Sfera LLC was received in the amount of RUB 250,000. The brigade completed the task in a month. The amount of earnings was distributed in proportion to the time worked:

| Workers | Time worked | Amount to be received (RUB) | Calculation |

| 1 employee | 23 days | 59 895,83 | 250 000 / 96 × 23 |

| 2 employee | 20 days | 52 083,33 | 250 000 / 96 × 20 |

| 3 employee | 25 days | 65 104,17 | 250 000 / 96 × 25 |

| 4 employee | 18 days | 46 875,00 | 250 000 / 96 × 18 |

| 5 employee | 10 days | 26 041,67 | 250 000 / 96 × 10 |

| Total | 96 days | 250 000 |

Employees need to be paid wages at least every half month (Article 136 of the Labor Code of the Russian Federation). It is prohibited to pay the entire salary amount in one lump sum after completing the work.

With such a system, additional bonuses may be provided. The bonus is paid in accordance with the employer's bonus system (for example, for reducing the deadline for completing a task, subject to high-quality work).

Comparison of taxes in Russia and the USA

Commission pay

Such a remuneration system is usually used in relation to workers involved in the sale of goods and services: sales managers, store clerks, advertising and marketing specialists, in order to encourage them to increase sales volume, sell products (work, services) to the maximum volumes.

Advantages and disadvantages

It is impossible to say which forms of salary calculation are more beneficial for the employer and which for the employee, everything is individual. But in the sum of factors, piecework wages allow both parties to find compromises.

Disadvantages for the employer

The biggest advantage is the possibility of incentives for quality work, which increases productivity. There are certain disadvantages:

complexity of administration. It is necessary to have a staff of controllers and accountants who monitor production;

possible reduction in product quality. In pursuit of quantity, workers pay little attention to how suitable the product is for further use. We have to install inspectors and develop a system of punishments for marriage;

Increased injury rate. The employee is interested in doing as much as possible, at the expense of his own capabilities.

As a result, concentration and attention decrease, which leads to accidents;

difficulty with labor regulation. Although there are interregional rules, they cannot be extended to an individual company

For example, piecework wages are quite common in trade. But it has little effect on sales volume, since it depends on the day of the week, the assortment presented, payment periods at nearby enterprises;

In addition, each plant uses machines of different capacities. This same problem of rationing represents the main problem for workers.

Disadvantages for employees

There is a principle in economics called the “ratchet effect.” Its essence lies in the paradox of increasing prices.

By applying additional efforts, the workers cope with this task, after which the administration raises the standard again. At a certain stage, it exceeds the capabilities of the performers, and they lose interest in the work.

The ratchet effect is that over a long period of time, the more effort applied, the less is paid per unit of output.

In addition, the disadvantages for employees are a sharp decrease in income when they go on sick leave or vacation. Although the law provides that sick leave and vacation pay are calculated based on the level of salary for the previous period, the employer prefers to enter into a fixed-term employment contract to perform a certain amount of work.

Pros for an entrepreneur

The popularity that piecework has gained is due to the fact that this is a distribution of the wage fund in which the employee is interested in productivity.

At the same time, hiring personnel who are willing to work on a piece-rate basis indicates their willingness to earn money rather than receive money, although finding such a specialist is somewhat more difficult.

Intensification of production in such conditions will serve to proportionally reduce fixed costs, which has a positive effect on the company’s profitability.

Benefits for employees

There is one plus, but it outweighs everything else - income directly depends on what you can do. Therefore, those who want to earn good money willingly agree to piecework wages.

Since a businessman risks practically nothing when hiring a new specialist, newcomers who have no practical experience are often hired for such work. Working on a piecework basis is a great opportunity to develop professional skills and gain experience.

Piecework wages: types, sample contract and example of calculating charges

Hello! In this article we will talk about piecework wages.

Today you will learn:

- What is piecework wages and where is it applied?

- What types of piecework wages exist;

- What are the prerequisites for transferring to piecework wages;

- Advantages and disadvantages of this type of payment.

One of the most important aspects of organizing work activities in a company is the choice of the form of monetary remuneration for employees. We are most familiar with the time-based form, when salaries are calculated depending on the salary and the number of days worked.

However, such a scheme is not suitable for many types of activities where it is extremely important for the employer to motivate the employee to increase productivity, and also where it is possible to keep quantitative records of the work performed.

Then another common form is used - piecework wages.

What is piecework wages?

Piece wages are a type of monetary remuneration for an employee where his earnings directly depend on the units of production he produces or on the volume of work performed, provided that the result of his work can be calculated and the quality can be tracked.

- piecework wage agreements

For most types of work, only one of two forms of payment is possible. For example, administrators, doctors, accountants, security guards, and teachers are on temporary duty. Piecework wages are typical for such professions as turner, welder, taxi driver, copywriter, and member of a repair team.

However, there are often cases when, to further motivate an employee, an employer uses a calculation procedure that is characteristic of both forms.

The employee is paid a monthly fixed salary, most often small but guaranteed, so that the employee has something to live on in case of the “off season”.

In addition, the employee receives payment per unit produced or a percentage of sales.

Example.

In many clothing or electronics stores, where sales volumes largely depend on the active work of the sales assistant, the company, in addition to the salary, may pay him a certain percentage of the cost of the goods sold. Owners have long come to the conclusion that using the carrot of a monetary reward is much more effective than threatening them with the stick of dismissal for being idle on the sales floor.

Concepts inextricably linked with the word “piecework”

Production rate is the number of units of product established by the company that must be produced within a certain period of time. Usually they talk about hourly, daily and monthly norms.

Tariff rate (salary) is the minimum guaranteed monthly wage for a given level of qualification. Specified in the employment contract. The salary is only part of the salary, which, in addition to the salary, may include all kinds of bonuses and social benefits.

The price is the amount of earnings for one unit of work performed or products produced. It is calculated through the ratio of the tariff rate to the production rate.

Tariff schedule - tariffication of wages based on the complexity of the work and the qualifications of the employee. There are ranks or categories (for example, engineer of the first category or piece worker of the 5th category).

Calculation of piecework wages

Let us give two examples of such calculations.

Example 1. The daily rate of processing parts on a milling machine for a milling machine operator is 120 pieces. The daily rate for the tariff is 1200 rubles. In one month, the employee processed 2,400 parts.

The piece rate is calculated by dividing the daily tariff rate by the daily rate for parts:

R = 1200/120 = 10 rubles/pcs.

In this case, the monthly salary of the master will be:

Z = 10*2400 = 24000 rub.

Example 2. The calculation looks somewhat different when the standard determines not the number of products, but the time period.

The time limit for using the machine is set at 30 minutes per operation. The hourly tariff rate is 150 rubles. During the month, the employee performed 600 operations.

- We calculate the piece rate:

- R = 150*30/60 = 75 rubles/operation

- Monthly earnings will be:

- Z = 75*600=45000 rub.

Types of piecework wages for workers

The existence of several types of this payment is explained by the diverse specifics of existing work where piecework payment is used.

Let's look at its main types with examples:

| Piece payment type | Characteristic | Example |

| Direct piecework | Salaries are calculated based on completed volumes using fixed piece rates established in accordance with the employee’s qualifications | The piece rate for a seamstress of the highest category is 50 rubles per shirt. In a month she sewed 600 shirts. Her piecework earnings for the month will be 30,000 rubles |

| Piece-bonus | Provides for the payment of bonuses for exceeding production standards established by the company. Indicators for bonuses can be improved labor productivity, product quality, reduction in the number of defective products, as well as money spent | The monthly production rate for leather shoe upper manufacturers is 100 units. The company purchases leather with a reserve, but at the same time has established a monthly collective bonus in the absence of damaged material |

| Indirect piecework | Used to pay workers who monitor the smooth operation of equipment. Thanks to them, essential workers are not idle due to equipment breakdowns. To calculate earnings, the indirect piece rate is multiplied by the number of units produced by the main workers | A master adjuster serves several workshops. The tariff rate of the master is 15,000 rubles per month. Over the course of a month, the workshop produced 2,000 units of product against a norm of 1,500 units. The indirect price will be the ratio of the foreman’s tariff rate to the workshop rate: 15000/1500=10 rubles/unit. The master’s salary will be: 10*2000=20000 rub. |

| Piece-progressive | A very motivating system, it is used to sharply increase production. Until the production rate is reached, calculations are carried out using fixed piece rates. When production exceeds standards, payment is made at increased prices | A turner turned 300 parts in a month at a rate of 250. According to the piece rate, he receives 80 rubles per part. If the plan is exceeded, each detail is paid in the amount of 100 rubles. The basic salary of a turner: 250 * 80 = 20,000 rubles. Taking into account exceeding the norm: 50*100=5000 rub. Total salary of a turner: 20000+5000=25000 rub. |

| Chord | It is used when payment is made not per unit, but per stage of work or for all work performed. The work order also indicates the start and end dates of the work. Used in construction, agriculture, and transport. Can be either individual or team | An agreement on interior house work is concluded with a team of finishers. All work is divided into stages (carrying out electrical wiring, plastering walls, laying floors, etc.). Each stage of work is accepted by a responsible person, who determines whether the work meets quality standards, after which a settlement is made with the team |

| Mixed | Mixing piecework and time-based wages. It is used when the employer is interested in the constant presence of an employee at the workplace, while his activity largely determines his work efficiency | A nail technician has a fixed salary for being in the salon at certain hours. He will receive this money even if for the whole day, say, due to bad weather, not a single client comes to him. In this case, the master receives a percentage of the amount paid by the client for each work performed. |

The procedure for transferring to piecework wages

An enterprise can switch to piecework wages if the necessary prerequisites are met:

- Well-established accounting of manufactured products or services provided;

- Presence of an uninterrupted supply of materials and everything necessary for work;

- Effective quality tracking;

- Developed logical tariff systems and local standards;

- The ability to take into account quantitative data on the performance of each employee separately;

- The existing need at this level of company development is to increase the level of production (sales) many times over.

Advantages and disadvantages

The main advantage of piecework payment is the employer’s ability to increase labor productivity by introducing incentives for employees (for example, increasing tariffs), and the disadvantage is the possible loss in the quality of products or services due to increased output.

The use of this form of payment is inappropriate if it is impossible to increase the quantitative indicators of production under the conditions of current technological standards or safety requirements.

According to Art. 160 of the Labor Code of the Russian Federation, when introducing a piecework payment system at an enterprise, the employer is obliged to establish a daily or hourly production rate and corresponding payment rates. Part 2 art. 22 of the Labor Code provides for the employer’s obligation to provide employees with a sufficient amount of work as specified in the employment contract. It should also set out the conditions for calculating wages (Article 57 of the Labor Code of the Russian Federation).

The presence of a piece-rate form of payment at an enterprise is fixed by a collective agreement and other regulations corresponding to the legislation.

When performing any operations, the accountant is required to record wage entries in a special journal or enter data into a computer database.

Sick leave for pregnancy and childbirth is paid to workers, students and the unemployed who are registered with the employment center. Read more about calculating sick pay here.

A special form is used to calculate the average salary. You will find a detailed explanation, as well as examples, in the article.