Sometimes company personnel have to work beyond the established working hours. And we are not talking about a banal delay at work. Overtime refers to work outside the established working hours, when the initiative comes from the employer . If an employee is late or goes out to work on weekends on his own initiative, this is not considered overtime work and is not paid.

The rules for overtime work are stated in Article 99 of the Labor Code. The maximum processing time is 4 hours over two consecutive days and 120 hours per year.

Next, we’ll look at how to process processing.

Written agreement

The main thing that needs to be done when registering overtime work is to obtain written consent . There are only a few cases when it is permissible to involve an employee in work beyond the time limit without his consent :

- To prevent a catastrophe or industrial accident or to eliminate the consequences of an event.

- To eliminate circumstances that disrupt the normal operation of the organization’s communications - water, electricity, gas supply, transport and communications systems.

- If a state of emergency or martial law has been introduced, and the employee must perform the work required by this.

Disabled people and women who have children under 3 years of age can be involved in overtime work only with written consent and in the absence of health restrictions. They must be informed of the right to refuse processing upon signature. There are also categories of workers who are completely prohibited from being involved in work beyond the norm . These are pregnant women, minor employees and some others.

Overtime compensation

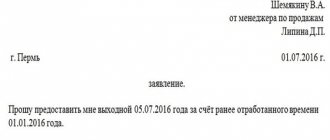

The provisions of Article 97 of the Labor Code of the Russian Federation provide for the right of the employer or his representatives (company management) to involve hired employees in work beyond the established norm, including at night, but only in those cases that are regulated by the current legal framework. In addition, the employee, by writing a corresponding application, can himself agree to such work.

Performing these duties leads to increased energy consumption and a decrease in the time and quality of rest. That is why the law determines that for the performance of duties of an irregular nature, the employer is obliged to provide the employee with fair and adequate compensation. However, not all employees can be called for such work. The law prohibits the application of overtime labor standards to the following categories of citizens:

- employees who have not reached full age;

- pregnant women;

- employees who have disabled family members or who provide care for the sick;

- citizens who are guardians of minor children (if there is no application with consent to such work).

The law guarantees that if a worker is involved in extra-standard work at night, the employer will be obliged to provide him with compensation in the form of increased piecework wages and sign the appropriate orders. Also, as compensation, separate weekends or holidays may be allocated, or the duration of vacation may be increased.

However, it is worth noting that such measures are determined based on the established rules of the company, and in the event that such possibilities are included in the text of the employment agreement with the employee. Often, the agreement states that employees cannot be called to work on holidays and weekends (with the exception of continuous production processes and tasks of a particularly important nature).

Author of the article

Order

The law does not directly indicate that the employer is obliged to document processing with any specific document. In other words, there is no obligation to issue an order or order to engage in overtime work. However, in any case, the manager needs to bring information about processing to the attention of employees . Therefore, in practice, such an order is issued quite often. It specifies which employees and at what time need to be involved in overtime work, and also instructs the accounting department to pay for overtime.

Instead of an order, you can issue, for example, a notice of involvement in overtime work or an overtime log. The last option is suitable for organizations where recycling is a private practice.

Calculation of additional payments for time-based wages

With time-based wages, employees' wages can be calculated based on:

- from the hourly rate;

- from the daily rate;

- from the monthly salary.

If an employee of your organization has an hourly rate, the amount of additional payment is calculated as follows:

Additional payment amount

= Number of hours worked overtime X Employee’s hourly rate X Additional payment coefficient

The surcharge coefficient for the first two hours of overtime work must be no less than 1.5, and for subsequent hours – no less than 2.0.

Your organization may set higher copayment rates. The specific sizes of the coefficients are determined in the collective or labor agreement.

Example. How to calculate overtime pay based on hourly rate

On January 22, 2021, turner of Aktiv JSC A. N. Somov, by order of his manager, worked four hours overtime. The hourly wage rate for a turner at JSC Aktiv is 120 rubles/hour. In January of the reporting year there were 128 working hours. By order of the head of Aktiv JSC, the coefficient of additional payments for the first two hours of overtime work is 1.5, and for subsequent hours - 2.0. Somov’s basic salary for January of the reporting year: 128 hours × 120 rubles/hour = 15,360 rubles. Additional payment for the first two hours of overtime work: 2 hours × 120 rubles/hour × 1.5 = 360 rubles. Additional payment for subsequent hours of overtime work: 2 hours × 120 rubles/hour × 2.0 = 480 rubles. The total amount of wages and additional payments for overtime work for Somov in January of the reporting year will be: 15,360 rubles. + 360 rub. + 480 rub. = 16,200 rub. When calculating personal income tax, Somov’s salary is not reduced by standard tax deductions. The organization pays contributions for insurance against industrial accidents and occupational diseases at a rate of 0.2%, and contributions for compulsory health insurance, compulsory health insurance, compulsory medical insurance - at a rate of 30%. The Aktiva accountant must make the following entries: DEBIT 20 CREDIT 70

- 16,200 rubles.

– Somov’s salary and additional payment for overtime work were accrued; DEBIT 70 CREDIT 68 SUBACCOUNT “CALCULATIONS FOR INDIVIDUALS INCOME TAX

” – 2106 rub.

(RUB 16,200 × 13%) – personal income tax withheld; DEBIT 20 CREDIT 69–1–2

– 32.4 rub.

(RUB 16,200 × 0.2%) – premiums have been charged for insurance against industrial accidents and occupational diseases; DEBIT 20 CREDIT 69–1–1

– 470 rub.

(RUB 16,200 × 2.9%) – compulsory social insurance contributions have been accrued; DEBIT 20 CREDIT 69–2

– 3564 rub.

(RUB 16,200 × 22%) – contributions for compulsory pension insurance have been accrued; DEBIT 20 CREDIT 69–3

– 826 rub.

(RUB 16,200 × 5.1%) – contributions for compulsory health insurance have been accrued; DEBIT 70 CREDIT 50–1

– 14,094 rub. (16 200 – 2106) – Somov’s wages and additional payment for overtime work were issued from the cash register.

If an employee of your organization has a daily rate, then the hourly rate required to determine the amount of additional payment is calculated as follows:

Hourly rate

= Daily rate / Number of working hours per day

Example. How to calculate overtime pay based on daily rate

On April 24, 2021, milling operator of Aktiv JSC A. N. Ivanov, by order of his manager, worked three hours overtime. JSC Aktiv has an eight-hour working day (five-day working week). In April, according to the five-day working week calendar, there are 22 working days. The daily wage rate for a milling operator at JSC Aktiv is 550 rubles/day. By order of the head of Aktiv JSC, the coefficient of additional payments for the first two hours of overtime work is 1.5, and for subsequent hours - 2.0. Ivanov’s basic salary for April will be: 550 rubles/day. × 22 workers days = 12,100 rub. Ivanov’s hourly wage rate will be: 550 rubles/day. : 8 hours = 68.75 rub./hour. Additional payment for the first 2 hours of overtime work: 2 hours × 68.75 rubles/hour × 1.5 = 206.25 rubles. Additional payment for subsequent hours of overtime work: 1 hour × 68.75 rubles/hour × 2.0 = 137.50 rubles. The total amount of wages and additional payments for overtime work for Ivanov in April will be: 12,100 rubles. + 206.25 rub. + 137.50 rub. = 12,443.73 rub. When calculating the surcharge, the Asset accountant must make the same entries as in the previous example. If an employee of your organization has a monthly salary, then the hourly rate required to determine the amount of additional payment is calculated as follows: Hourly rate = Monthly salary / Number of working hours in a month Example. How to calculate additional payment for overtime based on the monthly salary for the main production worker of Aktiv JSC S.S. Petrov’s salary was set at 14,300 rubles. per month. On January 22, 2021, by order of the manager, Petrov worked four hours overtime. In January there are 120 working hours. By order of the head of Aktiv JSC, the coefficient of additional payments for the first two hours of overtime work is 1.5, and for subsequent hours - 2.0. Petrov’s hourly wage rate will be: 14,300 rubles: 120 hours = 119.17 rubles/hour. Additional payment for the first two hours of overtime work: 2 hours × 119.17 rubles/hour × 1.5 = 357.51 rubles. Additional payment for subsequent hours of overtime work: 2 hours × 119.17 rubles/hour × 2.0 = 476.68 rubles. The total amount of wages and additional payments for overtime work for Petrov for January will be: 14,300 rubles. + 357.51 rub. + 476.68 rub. = 15,134.19 rub. When calculating personal income tax, Petrov’s salary is not reduced by standard tax deductions. The organization pays contributions for insurance against industrial accidents and occupational diseases at a rate of 0.2%, and contributions for compulsory health insurance, compulsory health insurance, compulsory medical insurance - at a rate of 30%. The Aktiva accountant will make the following entries in the accounting records: DEBIT 20 CREDIT 70

- 15,134.19 rubles.

– Petrov’s salary and additional payment for overtime work were accrued; DEBIT 70 CREDIT 68 SUBACCOUNT “CALCULATIONS FOR INDIVIDUALS INCOME TAX”

– 1967 rub.

(15,134.19 × 13%) – personal income tax withheld; DEBIT 20 CREDIT 69–1–2

– 30.26 rub.

(RUB 15,134.19 × 0.2%) – premiums are charged for insurance against industrial accidents and occupational diseases; DEBIT 20 CREDIT 69–1–1

– 439 rub.

(RUB 15,134.19 × 2.9%) – compulsory social insurance contributions have been accrued; DEBIT 20 CREDIT 69–2

– 3329.52 rub.

(RUB 15,134.19 × 22%) – contributions for compulsory pension insurance have been accrued; DEBIT 20 CREDIT 69–3

– 771.84 rub.

(RUB 15,134.19 × 5.1%) – contributions for compulsory health insurance have been accrued; DEBIT 70 CREDIT 50–1

– RUB 13,167.19. (15,134.19 – 1967) – Petrov was given wages and extra pay for overtime work from the cash register.

Obviously, with this calculation option, when setting the tariff rate for a month, the hourly rate and surcharge for overtime work in one month may turn out to be more or less than the hourly rate and surcharge in another month. Therefore, officials of the Russian Ministry of Health issued letter No. 16–4/2059436 dated July 2, 2014, which can be used by organizations in other industries, since Article 152 of the Labor Code does not establish a procedure for determining the minimum one and a half and double amount of overtime pay.

Officials advise calculating the hourly tariff rate by dividing the employee's salary by the average monthly number of working hours, depending on the established length of the working week in hours.

In this case, the average monthly number of working hours is calculated by dividing the annual norm of working time in hours by 12.

This procedure for calculating part of the salary per hour of work to pay for overtime work (as well as at night or on non-working holidays) allows you to receive the same payment for an equal number of hours worked in different months.

The procedure for calculating the hourly tariff rate from the established monthly one must be fixed in a collective agreement, agreement or local regulation.

How are overtime hours paid?

Payment for hours worked in excess of the norm occurs in accordance with the rules of Article 152 of the Labor Code of the Russian Federation . The odds are:

- the first 2 hours of overtime are paid at least one and a half times the rate ;

- the next hours - no less than double the amount .

Internal documents or an employment contract may stipulate a special procedure for paying overtime hours - in a larger amount than established in the Code. In addition, an employee may, if he wishes, receive an additional day off instead of payment.

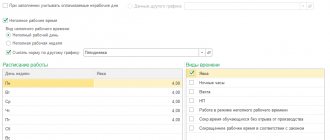

The Labor Code obliges the employer to keep records of overtime hours worked. In the timesheet, such hours are indicated by the code “C” or “04” . Processing time is calculated based on the timesheet.

If working time is not taken into account daily , then overtime is also calculated for each day. This is how overtime hours are calculated for employees who work a standard 5 days a week for 8 hours .

Example. The specialist worked overtime for 2 days during the month: on February 5 the overtime was 3 hours, and on February 12 - 3 hours. According to accounting data, this specialist earns 150 rubles per hour. You need to calculate how much you need to pay him for processing.

On the first day of overtime (February 5), overtime payment is made based on one and a half rates, since the employee worked 2 extra hours: 150 * 1.5 * 2 = 600 rubles.

On February 12, the overtime was 3 hours. The first two of them will be paid using a coefficient of 1.5, and the third hour will be paid at a double rate: 150 * 1.5 * 2 + 150 * 2 = 900 rubles.

These calculations are correct for daily working hours . If summarized records are kept for a period (month, quarter) , a different approach is applied. In this case, in accordance with the production calendar, the normal working hours and processing time for the month, quarter, and year are calculated. A little further we will show with examples how to make such calculations.

Standard calculation method

In accordance with Art. 152 of the Labor Code of the Russian Federation, overtime hours worked are paid according to the scheme outlined below:

- the first two hours of overtime work - at a coefficient of not less than 1.5;

- third and further hours of overtime work - at a factor of 2 or more.

The procedure for calculating payment is established at the local level through a collective agreement, individual employment contracts and relevant orders of the head of the enterprise or organization. At the same time, the procedure established at the local level should not worsen the employee’s position in comparison with the amount of payment established by the Labor Code of the Russian Federation.

The formula for calculating overtime hours is not regulated; however, Letter No. 16-4/2059436 of the Ministry of Health of the Russian Federation contains a completely workable calculation formula.

So, in accordance with the Letter of the Ministry of Health, overtime can be calculated by performing the arithmetic operation O / (GN / 12) = PO, where:

- O is the salary size;

- GN – annual norm according to the production calendar;

- 12 – months of the calendar year;

- PO – hourly salary.

For example, take the following hypothetical conditions.

Loader A. worked 3 hours overtime. The salary of a loader is 15,000 rubles. Taking into account a 40-hour work week, loader A. worked 1970 hours during the billing period. We calculate payment for overtime work:

15,000 / (1970/12) = 91 rubles 40 kopecks cost of one standard hour. Next, we calculate the hours taking into account the coefficient:

- 91.40 × 2 × 1.5 (one and a half coefficient) = 274 rubles 20 kopecks payment for the first two overtime hours;

- 91.40 × 1 × 2 = 182 rubles 80 kopecks for the third overtime hour;

- 272.20 + 182.80 = 455 rubles payable for 3 overtime hours.

Overtime and salary

When calculating the additional payment for overtime above, we also took into account the cost of an hour of work. But how to calculate it? If an employee receives a net salary , then everything is simple: its size is divided by the number of hours in the accounting month according to the production calendar. If working hours are taken into account summed up over a longer period, for example, a quarter, then the average daily earnings are calculated for this period.

But what if bonuses and allowances are added to the salary? Should they be taken into account when calculating average daily earnings? Article 152 of the Labor Code of the Russian Federation does not say this. The procedure for paying overtime based on earnings, taking into account bonuses and other incentive payments, can be prescribed in the employment contract or local regulations. But what if it doesn’t say that there either? Then experts recommend being guided by the decision of the Supreme Court of the Russian Federation of June 21, 2007 No. GKPI07-516. It states that in this case only the “bare” salary is taken into account.

An example of calculating overtime with summarized recording of working hours

To employee Selivanov M.A. The hourly wage is set at 150 rubles per hour, the organization operates a summarized recording of working time, the accounting period is a quarter. The general working hours for this employee are 40 hours per week. Let's calculate overtime for Selivanov M.A for the 2nd quarter of 2021, if he worked 496 hours in this quarter according to the time sheet.

According to the production calendar, the standard working time for a 40-hour week in the 2nd quarter of 2021 is 488 hours.

According to the results of the quarter, Selivanov worked 496 - 488 = 8 hours of overtime. Of this time, 2 hours are paid at one and a half times, and the remaining 6 hours at double:

Payment for overtime work Selivanova M.A. will amount to 2,250 rubles based on the results of the accounting period - 2 quarters of 2021 with summarized accounting of working hours.

Overtime with other payment systems

Shift work

If the time worked by an employee working in shifts is taken into account based on the tariff rate , then the following approach is used to calculate overtime. It is necessary to add up all the hours worked during the period and multiply them by the established rate.

However, with a shift work schedule, the usual payment system in accordance with the salary can be used. In this case, the calculation of overtime payments is made as under the salary system.

Piece-work payment

Payments above the norm for piece-rate employees are calculated in a completely different way. Let's look at the example of a manufacturing enterprise.

The worker receives 500 rubles for each unit of production produced. This payment is valid during normal working hours. If a worker works overtime, he will be paid using the same coefficients (1.5 and 2) depending on the number of parts produced during processing.

Let's say a worker worked 4 hours overtime and produced 1 part in the first 2 hours of processing, and another 1 part in the next 2 hours of processing. The surcharge is calculated as follows: 500 * 1.5 * 1 + 500 * 2 * 1 = 1,750 rubles.

Calculation taking into account shift work schedule

When calculating the amount of payment for overtime hours during a shift work schedule, it is advisable to use the summarized accounting of working hours in the accounting period. The accounting period can be any period of time from one month to one year.

If we return to our example above about loader A. and slightly change the conditions, then the calculation will be made as follows.

With the previous salary of 15,000 rubles, we will take one month as the accounting period, during which the loader worked 176 hours, while the standard hours for the same month are 159.

In total, loader A. worked 17 hours above the norm. We make the calculation:

- we calculate wages for standard hours - 176 × (15000/159) = 16,603.77 for 159 hours;

- We calculate the additional payment for hours worked in excess of 17 hours. We multiply the first two hours by a factor of one and a half, all subsequent hours by a factor of 2. From the example above, we remember that an hour of work for a loader costs 91.40. Thus, 91.40 × 2 × 1.5 = 274.20 rubles. for the first two overtime hours and 91.30 × 15 × 2 = 2848.20 for the remaining overtime hours;

- We calculate the payment for 17 hours worked overtime - 274.20 + 2849.20 equals 3133 rubles payable.

Additional payment to wages for night work

The legislation establishes that work at night should be paid at a higher rate than work during normal hours. The surcharge for night work from 10 pm to 6 am must be at least 20%.

If an employee always works at night, or each shift contains the same number of night hours (for example, a night watchman), then there is no point in calculating additional payment for night hours: it is easier to immediately set the tariff rate for the shift taking into account night work and reflect this in the labor contract. agreement

And if the employee has a shift schedule, and the shifts fall at different times (contain different numbers of night hours), then it is necessary to keep records of night hours and calculate additional payment for them.