Time payment

In this circumstance, the employee’s income is directly determined by the time he worked; the unit for measuring the month can be set to either the day or the month. An approach can also be chosen when the unit of time is a work shift, in which case a tariff scale .

Salaries are calculated as follows: the salary per unit of time is divided by the actual time worked. At the same time, there is a characteristic property, for example, the salary per unit of time is a constant, but the amount of time worked may vary according to the production calendar.

Example:

In February, according to the working calendar, the number of working days is 17, therefore, with a salary of 16,000 rubles, the cost of a day worked is 941 rubles. But in April, with a working interval of 22 days, the cost will be 727 rubles. Therefore, it is more practical to take time off or vacation at your own expense in January.

Tariff rate. It is advisable to establish this type of remuneration for employees working on a mixed or shift schedule. In this case, payment is made for the number of “sleds”.

Example:

There is a store whose opening hours are from 8 am to 11 pm; sellers change every 10 days. In this case, payment is established according to the tariff rate, for example, the payment for a shift is 1200 rubles. In our store, in one month, one seller worked 16 teams and earned 19,200 rubles, the second 17 shifts and, accordingly, earned 1,200 rubles. * 17 = 20,400 rub. salaries.

Practice shows that if employees work on a mixed schedule, then hourly or shift pay is most appropriate to use.

Salary calculation example

In order to consolidate existing knowledge, several examples will be considered below:

- Georgy works as a packer. The total duration of his working day (shift) is twelve hours. The tariff rate per hour is 190 rubles. In May of this year, Georgy worked a total of 110 hours. In order to find out the salary of this employee, you will need to multiply the tariff rate by the number of hours worked (190 * 110 = 20,900 rubles);

- Let's say Georgy's colleague took a vacation, and therefore he was offered to work overtime. This type of employment is paid at a special rate - the first two hours at one and a half times the rate, and all subsequent hours at double the rate (compared to the daily rate). In April, Georgy worked five days overtime for three hours. In order to calculate the bonus, you will need to multiply the salary by overtime hours and by the increased rate: (190*1.5*2) + (190*2*1) = 570 + 380 = 950 rubles. Then multiply the resulting amount by the number of days when Georgy worked overtime: 950*5 = 4,750 rubles.

So, a shift work schedule can take various forms and include activity at any time of the day. Night hours, unlike daytime hours, are paid at the highest rate and are more profitable. When determining wages, accountants rely on the accounting period, which allows them to calculate the final amount of money intended for each employee.

Piece wages

Such remuneration is quite common; an employee’s earnings are determined not by the time worked, but by certain indicators. Such indicators include the number of parts produced per shift, articles written, etc. Such remuneration is applicable both to large industrial enterprises and to employees working from home.

With such remuneration of labor, a working time schedule must be maintained; the employee’s working time under such a system should not exceed forty hours per week. In the case where the employer is not able to control the work process (employees working from home), the director of the enterprise or other responsible person must issue an order that the employee has the right to independently draw up the schedule and duration of the working day, but the working week should not exceed forty hours per week.

Time tracking

In Part 4 of Art. 91 of the Labor Code of the Russian Federation establishes that the employer must keep track of the time actually worked by each employee.

Moreover, this requirement applies to all employers without exception, regardless of whether they are a legal entity or an individual. The form of ownership also does not play any role.

Record keeping is carried out according to general rules using a working time sheet of the established form, in which data on all hours worked by the employee is entered. In modern conditions, there are three types of such accounting.

Daily

Can only be used if:

- the working week consists of 5 or 6 days;

- The daily duration of the work shift is the same.

For calculations under the daily schedule, each day worked by the employee for the entire working period is taken into account.

What work schedule is convenient for you?

Five days A day in three Two days in two Sliding schedule Free schedule Shifts I’ll write my version in the comments

Monday

When using this type of accounting, the length of the working day should be the same every week. The duration of an employee’s shift or daily work is regulated by the schedule.

Summarized

It is used in cases where the enterprise or organization cannot implement the daily shift duration established for specific categories of employees.

For example, such a situation may arise if an employee is unable to work less than the required 8 or 40 hours per day or week, respectively. In this case, the maximum permissible number of hours for the entire year is calculated, and the shift schedule is drawn up in accordance with the result obtained. As a result, it may turn out that an employee works 50 hours one week, 30 hours another, and at the end of the year the established norm is met.

It is the latter accounting method that is most common in practice for employees who work on a shift schedule.

When conducting it, the employer is obliged to set the following parameters:

Length of the accounting period. It can be a month, a quarter, or a year. At the same time, for workers with normal working conditions it cannot exceed a year, for those who work in harmful and dangerous conditions - three months.

Standard working hours for various categories of citizens. It can be determined using the production calendar , which is approved annually.

Schedule. This document must also be developed and put into effect by order of the head of the enterprise. A schedule is drawn up taking into account the established norm of working hours.

The procedure for determining wages. In this case, a salary or an hourly rate can be selected.

The employer can establish summarized accounting both in relation to all employees of the enterprise, and only for certain of them. In this case, the employee must be familiar with this information by including it in the employment contract or by studying the relevant local regulatory act against signature.

Salary payment rules

When paying wages, you should be guided by certain standards adopted by law. Payment periods, so wages must be paid once every half month, and it does not matter whether this place of work is the main one or whether he works part-time. This requirement is interpreted by legislators as reducing the time interval between labor indicators received by the employer and payment for them.

According to legal norms, the timing of salary payments is established in accordance with internal labor regulations or can be regulated by contracts and collective agreements. If the payday falls on a weekend or holiday, the salary must be paid the day before. When paying vacation pay, the payment date must be at least three days before the vacation.

The best sites for finding part-time work online – 9 popular resources

Remember how we used to look for work when there was no Internet? Newspapers with advertisements, recommendations from friends, and everyone’s favorite “word of mouth” came to the rescue.

Now, in the age of total and global informatization, dozens of domestic and foreign Internet resources , where you can find a job to your liking. Evening part-time work in Moscow , remote work or even one-time work - they will always be found “online”.

From personal experience: Finding a job using Internet sites is much easier and simpler! In addition, you can quickly sort through a large number of employer offers and choose the most suitable one!

But there are also pitfalls here, because scammers are found everywhere.

How to protect yourself from them? Having found a resource, the customer of services or the employer should search for information on the Internet; perhaps the unscrupulous employer has already appeared on the black list at www.antijob.net .

Take the time to talk to the employer, “test” him psychologically, find out about guarantees of employment and payment, try to look for those who have already worked and can give you useful and practical advice.

In addition, never agree to prepayment !

In general, part-time work is divided into two main types: non-remote and remote. Whether you work from home or directly on the employer’s premises is, of course, up to you.

Website No. 1: Helper (www.helper.ru)

Part-time jobs in Moscow for women and men on the Helper are available, as they say, “in a wide range.”

Performers on the resource are called assistants or “helpers”. Customers mark out various orders, and you choose the offer you like best and offer your services. On this site you can find part-time jobs for women and men, real work, and the opportunity to work remotely.

Part-time work on Helper.ru

The range of tasks is large. This includes posting advertisements, creating texts, minor repairs, delivery of goods and products, transportation and transportation services.

Website No. 2: Porucheno (www.porucheno.ru)

Do you need a part-time job as a courier in Moscow or want to get a job as a salesperson on the night shift? There are no problems when the right resource for finding employers is chosen.

The Porucheno website invites applicants to try to become agents who, after the application is approved by the customer, can carry out one or another assignment. As a rule, this is the transportation of documents, courier services, and delivery.

If the customer has no complaints against the agent, then he can always count on paying a good fee. Agents also have a rating system. The more orders you complete, the higher your rating, and, accordingly, the more customers.

Site No. 3: YouDo (www.youdo.com)

The YouDo website is famous for the fact that on it a job seeker can find a huge variety of options for part-time work.

You have access to courier services (walking courier, delivery by car), household repairs, cleaning, computer assistance, writing articles, creating websites, logos, computer assistance, promoter work, photo and video services, web development, tutoring, repairs auto, legal assistance, part-time work for students in Moscow.

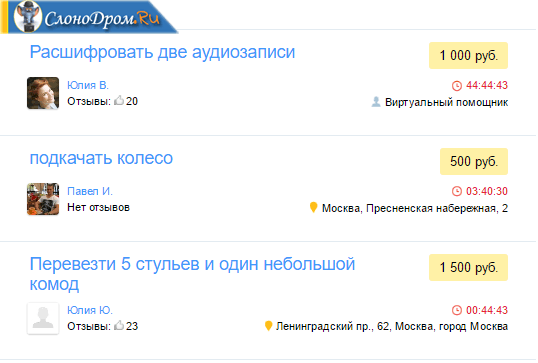

Here is an example of several part-time jobs and payment for them:

Yudu service - part-time work in Moscow: examples of vacancies and pay rates

If you need a part-time job for a man in Moscow , then the YouDo website has something to offer you. The resource has a convenient interface, tasks are replenished daily and, with due diligence, you will definitely not be left without your daily bread.

About making money! up to 60 thousand rubles per month without interruption from their main activity .

To become an employee of the site, you need to send your application to the address: [email protected] , indicating your details and city of residence.

You will have to wait, as verification on the website is required and you will have to undergo an interview at the company’s Moscow office. After three working days, you will receive an email notification that the verification has been completed, and you can begin searching for assignments.

Now the team of performers numbers more than two thousand people. But don’t worry, there’s definitely enough work there for everyone.

Site No. 4: Throw the Kabanchik (www.kabanchik.ru)

Despite its funny name, the site “Throw the Boar” is quite a useful resource. Part-time work for men in Moscow , part-time or full-time work for students - these are the main activities of the site.

The Ukrainian portal has gained great popularity in Russia and has been operating since 2012.

You can carry out small and large orders for delivery, clinical services, tutoring, pick up children from kindergarten, walk dogs, bring groceries to a client and receive a real monetary reward for this.

The site has its own TOP of customers and performers, a large catalog of services, and a special application form.

There you will need to obtain the status of a verified performer. But it doesn’t take much time, just confirm your passport using Skype and verify your mobile number.

The only downside is that you will have to pay a commission (albeit a small one) for completed tasks, since this burden falls on the shoulders of the performer.

Site No. 5: Base of hacks (www.ionyk.ru)

“Hackwork Base” is another specialized Moscow site that publishes fresh advertisements for part-time jobs.

This is an excellent resource that will allow you to find additional part-time work to your main job.

For example, here you can find the following vacancies: text reprint operator , call center operator at home , walking courier , courier-recorder , online consultant , assemblers , order pickers ...

We also offer one-time work - filling out paid surveys with payment of up to 1000-1500 rubles for one survey lasting several hours.

You can also find work on a shift schedule, hourly pay, part-time and part-time work with a flexible schedule.

Site No. 6: Avito (www.avito.ru)

Avito is one of the largest online resources on the Internet in terms of the number of advertisements in the “Job” category. It is enough to enter the word “part-time job” or “part-time job with daily payment” in a search on Avito and you will see a huge list of a wide variety of opportunities for part-time work in Moscow in your free time.

I will list just some of the part-time job vacancies that can be found here: drivers, housekeepers, welders, programmers, recruiters, laborers, cashiers, packers, cleaners and many other vacancies.

For example, if you want to work part-time on the night shift, then perhaps a simple job of counting goods with daily payment is suitable for you. In one shift you can earn approximately 1,300 rubles from such work.

How to contact an employer on Avito? You can contact the employer and discuss all the details of the part-time job by phone number and by clicking the “Respond” . The phone number and the “Respond” button will be located to the right of the ad.

Site No. 7: HeadHunter (hh.ru)

Do you need part-time work on weekends in Moscow? The HeadHunter website will allow you to easily find a money-making activity to your liking.

Direct employers post a huge number of vacancies on this resource every day. You can even register on HeadHunter through social networks.

How to find a part-time job on HeadHunter? You compose a complete resume, which, after being checked by a moderator, is published on the site, and set up search filters, choosing options for part-time work.

Did you catch your eye? Simply leave a response to the employer, accompanying it with a letter if necessary, and wait for an invitation to an interview.

Site No. 8: Kwork (www.kworks.ru)

The Kwork site is a relatively young, but at the same time very successful site. There you can always find a daily part-time job with payment in your free time. Many people confuse the Quwork website with freelance exchanges, but this resource has a slightly different character.

Its peculiarity is the fixed price for all services offered, which is equal to five hundred rubles. You can offer your customers your services in text translation, marketing and advertising, design, and web programming.

All you need to do is register and completely fill out your profile with your personal information. But remember that you will not receive 500 rubles for the service; the service will have to pay a twenty percent commission, so be prepared for additional expenses.

Site No. 9: ETXT Copywriting Exchange (etxt.ru)

You can also earn extra money on weekends in Moscow by writing articles. Naturally, you must have a certain literary talent and a desire to earn money. I would like to highlight the ETXT exchange based on personal experience, since over time the resource can replace your real work.

In general, there are a large number of exchanges where you can look for customers or offer articles for sale, but many have a complex rating system, you need to undergo additional testing, and authors often cannot get past the entry level.

The essence of part-time work on the ETXT exchange! On this site everything is a little simpler. You register as a performer and fill out a profile, then take a simple test of your knowledge of the Russian language.

You can take on expensive orders if you have qualified stars, but if you are confident in yourself, then you can always write to the customer yourself and offer your service.

At first, the prices for the author do not seem attractive, but after a short time you will notice how orders will be more expensive and your earnings will increase.

You can earn on the ETXT exchange from 3-5 thousand rubles and up to 80-100 thousand rubles per month . You can earn even more from a part-time job writing texts than from a full-time job.

Prepaid expense

In real labor law, such a concept does not exist; this word is a relic of labor relations from the times of the USSR. The fact is that current legislation stipulates that salaries must be paid every half month, while the legal concept of an advance is that the employee must receive an advance salary for the time not yet worked for the enterprise.

This situation is characterized by experts as not complying with the law. The “advance” part of the salary should not be less than the employee’s earnings for one working day, however, the Ministry of Labor stipulates that the paid parts of the salary must be proportional to the time worked, according to the remuneration system established at the enterprise.

Salary. Difference between salary and salary

It is very common that employment contracts and orders of an enterprise indicate the official salary of an employee, but he receives a slightly different amount of money. Therefore, the issue of salary calculation is a logical question. However, quite a few people know that salary is the amount from which absolutely all taxes are deducted, and salary refers to the amount of money that an employee receives in hand. In addition, the employer pays all taxes from his own funds, and the employee only pays income tax.