Salary

Remuneration is a financial system that regulates monetary relations between employer and employee. According to established legislation, payments must be made on time and in the prescribed amount.

Article 129 of the Labor Code of the Russian Federation contains basic information about the rules for making payments. Tariffs and wages are regulated by various legal acts and agreements. In controversial situations, federal legislation is recognized as dominant and decisions are made in accordance with it. For example, instructions for calculating the tariff rate are contained in Art. 143 Labor Code of the Russian Federation.

What formula is used for the calculation?

When using this system, a certain standard is established in advance. Upon completion, the employee can receive the previously agreed amount. If he has the strength and ability to exceed this norm, then remuneration is carried out at increased rates.

A simple formula is used for calculation:

The salary amount = the norm for the quantity of products produced * the rate within the norm + the volume of products produced after the plan is fulfilled * the rate above the norm.

Piece wages

Piecework remuneration is one of the types of wages, which involves the dependence of the amount of money on the quantity or volume of work delivered.

The volume of work delivered may be calculated in terms of the number of units produced, the number of tasks completed, or some other measurement. This takes into account the quality of work, the complexity of the task, working conditions and the required level of qualifications.

Advantages of piecework payment

From the employer's side:

- The employee's interest in performing the maximum amount of work.

- The employee is also responsible for fluctuations in output.

- There is no need to control the work process, since payment is made after the fact and before that it is possible to assess the volume of work and its quality.

- It is believed that if an employee is ready for piecework payment, he knows how to work productively.

From the employee's side:

- Has the opportunity to independently control your earnings and increase it by increasing the volume of work.

- Work on a piecework basis is available even to novice specialists and workers without a reputation.

Disadvantages of piecework wages

From the employer's side:

- Possible reduction in product quality to increase production volumes.

- Often the costs of product quality control are equal to the total costs of control in other production areas.

- Often, workers are in a hurry and violate safety regulations or rules for handling equipment, which leads to injuries and breakdowns.

- Workers don't care much about production costs.

- Psychological factor - the employee does not feel like he belongs to the company’s team and does not work for a common result, but only for his own enrichment.

- Some types of work are quite difficult to measure in all respects; accordingly, difficulties arise in determining the volume of work performed.

- High staff turnover, which stems from a psychological factor, rarely employees are focused on the prospect of long-term cooperation.

- The need to introduce any compensating payments to smooth out possible fluctuations in earnings.

From the employee's side:

- Earnings are unstable, this fact frightens many workers who do not like risks.

- The employer is not always able to take into account all the factors that influence the result, but often do not depend on the employee.

- The rate of wages may be lowered as output increases, so that the amount of work is not directly proportional to the amount of earnings.

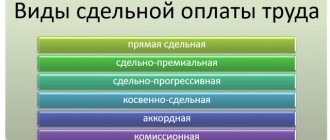

Types of piecework payment

Payment at piece rates is divided into:

- Direct piecework. It provides a direct relationship between the volumes completed and the amount of earnings.

The prices (rate) are fixed, depending mostly on the specifics of the work, its conditions and the qualifications of the employee. It is worth noting that when using this type of payment, the employee is least interested in the company’s production growth and improving overall performance indicators. So this type of payment is more suitable for hiring temporary workers. - Piece-bonus . In essence, this is the same as direct piece payment, however, it implies the presence of incentive payments for work above the plan or for the high quality of the product produced.

- Indirect piecework. It helps calculate wages for maintenance personnel involved in maintaining equipment or working places. It is quite difficult to determine the volume and quality of work performed. To calculate wages, you need to divide the rate by the production rate of workers using the equipment being serviced. Bonuses under such a system are usually awarded for trouble-free operation of equipment.

- Chord . Such a system is designed to complete work with a limited time frame. Then the worker knows the price for the entire volume and knows in what period of time he needs to complete the work. If the task takes a long time to complete, an advance is paid. It is a common practice to pay bonuses for completing work ahead of schedule. It is used mainly in those areas where it is difficult to standardize labor in any other way: during repairs, construction.

- Piece-progressive . Such a system involves paying for production norms at standard prices, and after exceeding the plan, prices increase. Typically, increased prices do not exceed standard prices by more than 100%. Typically, a progressive piece-rate system is introduced for a certain period of time in those areas of production where maximum performance is required. This payment method is quite expensive for the employer.

What wages can be under a piece-rate progressive system: examples

Norms for the volume of work (output), deadlines, prices for norms and above norms - all this is prescribed in the local document of the organization and the contract concluded with the employee.

Option 1

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The enterprise sets standards for the volume of work per month (see Table 1).

Table 1. Production standards

| Products | Manufacturing standard, pcs. | Deadline |

| Table | 40 | 1 month |

| Chair | 70 | 1 month |

| Stool | 90 | 1 month |

The scale of additional payments can be stepped, see an example in Table 2.

Table 2. Prices for meeting the norm and above the norm for furniture production

| Products | Payment for fulfilling the norm, rub. per piece | Payment for the next 20 units above the norm, rub. per piece | Payment for production above the norm + 20 units, rub. per piece |

| Table | 500 | 1000 | 1500 |

| Chair | 300 | 600 | 1000 |

| Stool | 100 | 300 | 500 |

Thus, if an employee fulfills the quota in a month and produces 40 tables, then he will receive a salary of 20,000 rubles. If he makes 50 tables, then by 20,000 rubles. another 10,000 will be added, and the total will be 30,000 rubles.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Option 2

The enterprise sets production standards on a daily basis (see Table 3).

Table 3. Production standards

| Products | Manufacturing standard, pcs. | Completion time, days |

| Table | 3 | 1 |

| Chair | 5 | 1 |

| Stool | 7 | 1 |

They also set prices for fulfilling and exceeding the norm (see Table 4).

Table 4. Prices for meeting the norm and above the norm for furniture production

| Products | Payment for fulfilling the norm, rub. per piece | Payment for the next 20 units above the norm, rub. per piece | Payment for production above the norm + 20 units, rub. per piece |

| Table | 500 | 1000 | 1500 |

| Chair | 300 | 600 | 1000 |

| Stool | 100 | 300 | 500 |

Let's say there were 17 working days in January. Then for this month the employee had to produce 17 × 3 = 51 tables, for which he would receive 51 × 500 = 25,500 rubles.

If an employee produced 60 tables, then his salary will be 25,500 + 9 × 1000 = 34,500 rubles.

How is piecework wages calculated?

When making calculations, a system of fixed prices per unit of production or fulfillment of an agreed volume is usually used. This approach allows you to take into account the maximum number of factors and set a stable price for labor.

Prices directly depend on temporary production standards, tariffs and type of work. To calculate the final price, divide the hourly rate (or daily or standardized) by the production rate for the same period of time. Payments can occur either individually or to a group of workers.

With a direct piece-rate wage system, calculate wages using the formula: Wages = Piece rate per unit of product (type of work) x Number of manufactured products (work performed)

System concept

Progressive remuneration is a special wage calculation scheme in which, until the established norm is met, the work of employees is assessed at direct piece rates, and if the standards are exceeded, then increased tariffs are applied.

Typically, at enterprises, standards are set within the limits of actual values determined over three months of the company’s operation. The main goal of such a system is to increase labor productivity. Each employee realizes that the more work tasks he completes, the higher his salary will be.

Piece-progressive wages assume that the same part made by an employee can be paid differently. Such actions motivate employees to work at a significant level of output.

Piece work and time work: what is the difference?

In fact, piecework and time-based payment are polar approaches to remuneration and, accordingly, to its evaluation. Time-based pay assumes that the employee spends his time in the most efficient way. The employer hopes that the result of the employee’s work will be more valuable than the time purchased.

When using piecework payment, time spent is not recorded. Often, the employer does not know how many hours it took to produce the product and has difficulty determining its cost. The employee bears all responsibility for the effective use of time, and bears the costs associated with irrational time management. Often, workers themselves set piece rates for their work.

Advantages and disadvantages

There are pros and cons to progressive pay, so you should consider both the positives and the negatives before implementing one.

| Advantages | Flaws |

| Remuneration is closely related directly to the number of products created by one employee | Workers will try to produce goods as quickly as possible, which may negatively affect their quality |

| The ability to significantly motivate employees, which directly affects the increase in labor productivity, which is a significant indicator in any enterprise | The rhythm of the production process, established before the introduction of progressive wages at the enterprise, is artificially disrupted |

| The turnover of working capital accelerates and the quantity of products sold increases, which leads to higher net profit | The amount of funds paid to employees increases, so there is an overspending of the wage fund |

| You can quickly remove bottlenecks in the enterprise | Often, the introduction of such a system even leads to a violation of discipline and a deterioration in relationships between employees |

Thus, the use of this payment method can result in both positive and negative consequences, so it is important to rationally evaluate the result. It is advisable to make a special forecast in advance by specialists.

Types of remuneration

At the moment, the legislation provides for several types of remuneration:

- Main. It consists of:

- payment for a specified period of time, payment for a specified amount of labor, subject to the calculation of payments according to the piecework system, as well as time-based or progressive payment;

- overtime payments for work longer than the established period, for night work, for any work performed in excess of the norm specified in the contract;

- payments for production downtime that occurred due to reasons beyond the employee’s control;

- bonus payments, as well as incentives and incentives.

- Additional. It consists of :

- payment for time not worked for reasons beyond the employee’s control in cases where such a possibility is provided for in the contract and legislation;

- vacation deductions;

- payments to employees on maternity leave and nursing mothers;

- teen benefits;

- severance pay.

In addition to species, classification by form is also used. These include:

Time-based payment is based on the amount of time the employee spent at work. Usually the contract specifies the number of working hours.

Time payment may include:

- hourly pay;

- tariffs (daily or hourly);

- a certain norm established by agreement and helping to make a different measurement of time worked.

Time payment consists of:

- simple - assumes that the employee is paid for a certain amount of time that he spent on the work process, regardless of how many and what kind of labor products were produced;

- bonus – assumes that in addition to payments based on time worked, bonuses are provided for high quality work.

Piecework payment is divided into several subtypes. Read more about each type of payment below.

When is it appropriate to use it?

Progressive remuneration is a rather specific salary calculation scheme, so it is not used very often. It is most effective for enterprises that specialize in mass production of a large number of different goods, parts or other small items. They should be easily identifiable using a standard description. They must have certain distinctive features so that they cannot be confused with other products.

It is most optimal to use this system under the following conditions:

- it is possible at the enterprise to accurately determine all the qualitative criteria for the result of the work of each specialist, and it is also possible to calculate without difficulty how many products were made by him over a certain period of time;

- the company has an urgent need to increase production volume, and at the same time it is impossible to attract new workers, for example, one large order has been received from the state or a large commercial organization;

- The company creates special accounting for the release of goods, which allows you to control the quality and quantity of products produced;

- on the part of the management team, a decision is made on strict control over labor intensity, the cost of manufactured elements, the profitability of the enterprise and other performance indicators.

It is to increase motivation that progressive remuneration is used. Its areas of application are numerous, so it can be used in different enterprises. Due to the fact that each employee will strive to ensure that his labor productivity grows, which will lead to an increase in his salary, it will not be difficult to increase almost all the economic indicators of the company.

Legal norms

Guarantees for timely and complete transfer of payments are established by Article 130 of the Labor Code of the Russian Federation.

According to the law, the state provides guarantees for:

- minimum wage level;

- control of the level of salaries of employees of budgetary institutions;

- regulation of the amount of tax deductions for wages;

- introducing restrictions on wages in kind;

- regulation of federal legislation in accordance with the interests of workers;

- exercising state control over the fulfillment of labor remuneration obligations;

- holding unscrupulous employers accountable;

- establishing rules regarding the timing and order of payments;

- control over the implementation of legislation.

Calculation example

Every entrepreneur planning to use this system in his company must understand how progressive wages are calculated. An example of this process is considered quite simple.

For example, the company uses a piece-rate and progressive wage scheme. For one unit of output, the employee is paid 250 rubles. The norm per day is 4 units. If the plan is exceeded, then 300 rubles are paid for each additional unit. A worker can expect a different salary depending on monthly output:

- in March (21 working days) 89 units of products are produced, so the salary at a rate of 84 units will be equal to: 250*84+300*5=21000+1500=22500 rubles;

- in April, 80 units of products are produced in 22 working days, therefore, with a norm of 88 units, the employee receives a standard salary: 80 * 250 = 20 thousand rubles;

- in May, 108 units are produced in 21 working days, so the salary at a rate of 84 units is equal to: 250*84+300*24=21000+7200=28200 rubles.

Thus, the calculation will indeed be simple if it is possible to accurately determine how many units of product are produced by a particular employee per month or other amount of time.

If the products are found to be defective

Another interesting question is how the salary is calculated if you have fulfilled the plan, but some of the products turned out to be defective. For example, Nikolai made 100 parts, as planned according to the plan. But 15 of them were defective. One part costs 10 rubles.

Calculation:

(100 – 15) x 10 = 850 rubles

And if you exceed the plan and find a defect, the calculation will be performed as indicated in the following example. Evgeny made 130 parts when the norm was 100. One part costs 10 rubles, the additional payment for exceeding the plan is 1000 rubles. Out of 130 parts, 2 were defective.

(130 – 2) x 10 = 1280 rubles.

1280 + 1000 = 2280 rubles.