What kind of salary is there and when is it supposed to be paid?

An employee's salary is calculated using a time sheet.

When calculating salaries, the accountant is guided by the basic documents and regulations of the organization. The list is as follows:

- internal labor regulations,

- collective agreement,

- provisions on material incentives and remuneration,

- staffing table,

- clauses of the employment agreement,

- local regulations.

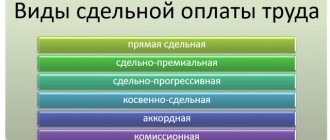

Remuneration for labor can be piecework or time-based. With a piece-rate system, earnings directly depend on output: the volume of products produced, the number of services provided. In case of time-based earnings, the employee receives a salary corresponding to his position. The salary for each position is established by the staffing table.

The procedure for calculating salaries may provide for bonuses and additional allowances. For example, for length of service, high results of work or its intensity.

Important!

Wages must be paid to the employee at least twice a month. This employer’s obligation is enshrined in Article 136 of the Labor Code of the Russian Federation. Violation of the article entails administrative liability.

There are two established methods of paying salaries 2 times a month:

- Advance and payment at the end of the month. In the first half of the month, an advance is issued - part of the official salary. This part is fixed in the monthly tariff schedule. To receive an advance, you need to work for at least two weeks. At the end of the month, the employee receives the remainder. It can be fixed or depend on the hours worked or the amount of work done.

- Payment for the 1st and 2nd half of the month. Salaries are calculated twice a month - in the 1st and 2nd halves of the month. The calculation is made based on the actual time worked or the amount of work, in two-week increments. An employee works for two weeks and receives payment the next day of the week. Typically, this payment procedure is established in a collective or employment agreement.

A simple piecework wage system

With a simple piece-rate wage system, wages are calculated based on the piece rates established in the organization and the quantity of products (work, services) produced by the employee.

Salary can be calculated as follows:

Wage

= Piece price per unit of finished product x Quantity of manufactured products

The piece rate is determined by the formula:

Hourly (daily) rate / Hourly (daily) production rate = Piece rate

The production rate is the amount of products, work, and services that each worker must produce per unit of working time.

Production standards are determined by the management of the organization. The size of the hourly (daily) rate must be established in the Regulations on remuneration and staffing of the organization.

Example. Simple piecework wages

The hourly rate of A.N. Ivanov, an employee of Passiv LLC, is 200 rubles/hour. The production rate is two parts per hour. During April of the reporting year, Ivanov produced 95 parts. The piece price for one product is: 200 rubles.

: 2 pcs. = 100 rub./pcs. Ivanov’s salary for April of the reporting year will be:

100 rubles. × 95 pcs. = 9500 rub.

Calculation of wages based on salary

Time-based or time-bonus calculation systems can be based on the tariff rate or monthly salary. The tariff rate can be daily or hourly.

There is also an option when the salary corresponds to the number of working hours in a month. If an employee works only part of the time, he receives a salary in proportion to the share of days worked.

Formula for calculating wages at a fixed daily tariff rate:

Salary = Days × Rate

- Salary - the amount of wages accrued for the month.

- Days - the number of days actually worked according to the timesheet.

- Rate — daily tariff rate.

At the hourly rate, its value is multiplied by the monthly amount of time worked in hours.

Salaried employees (engineers, technicians, department heads) receive a fixed rate per month worked. If they work part of the month, the salary is calculated based on the number of days worked:

Salary = Salary / Norm × Actual

- The norm is the number of days in the past month according to the production calendar, and

- Fact - days actually worked.

The above formulas calculate wages without allowances and bonuses. 13% of personal income tax is withheld from the amount received, after which it is transferred to the employee’s bank card or issued at the cash desk.

Piece-bonus wage system

With a piece-rate-bonus system of remuneration, the employee is awarded bonuses in addition to wages.

Bonuses can be set either in fixed amounts or as a percentage of wages at piece rates.

Wages under the piecework-bonus wage system are calculated in the same way as under a simple piecework wage system. The bonus amount is added to the employee's salary and paid along with the salary.

Buy a book

Salary 2021 with a detailed description of all remuneration systems, rules for calculating and paying taxes in 2021

Example. Salary calculation for piecework-bonus payment system

Turner 3rd category S.S. Petrov has a piecework wage system. The piece rate for a 3rd category turner is 80 rubles. for one finished product. According to the Regulations on bonuses, if there is no defect, employees of the main production are paid a monthly bonus of 3,000 rubles. In April, Petrov produced 100 products. Petrov’s basic salary for April of the reporting year will be: 80 rubles/piece.

× 100 pcs. = 8000 rub. The total amount of Petrov’s accrued wages for April of the reporting year will be:

8,000 rubles. + 3000 rub. = 11,000 rub.

Calculation of average monthly salary

The amount of an employee’s average monthly salary is needed for basic payroll operations:

- vacation pay and compensation for unused vacation if an employee resigns;

- payments, while maintaining the average monthly salary at the main place of work;

- remuneration during downtime due to the fault of the employer or due to natural disasters and other force majeure;

- severance and other benefits, termination of an employment contract, staff reduction;

- disability benefits;

- payment for working hours on business trips.

The average monthly salary is calculated if the employee requests income certificates and other data.

The list does not include some types of social benefits and compensation:

- one-time financial assistance (for vacation, for treatment);

- compensation for travel, housing and communal services, food;

- benefits for temporary disability and maternity;

- monthly benefits for caring for a child under 1.5 or 3 years old;

- funeral allowance and some others.

The last 3 types of payments are made from the Social Insurance Fund. To compensate them, the employer submits special petitions.

When calculating average monthly earnings for the past year, the above social payments and compensations are subtracted from the amount of accruals. The resulting amount is divided by the number of calendar months worked. A calendar month is understood as a fully worked period from the 1st to the 30th (31st), and in February - to the 28th (29th).

Important!

Salary calculation is regulated by Article 139 of the Labor Code and the Regulations of the Government of the Russian Federation of 2007 (as amended from time to time).

Indirect piecework wage system

The indirect piecework wage system is used, as a rule, to pay workers in service and auxiliary industries. Under such a system, the wages of workers in service industries depend on the earnings of workers in main production, who receive wages on a piece-rate basis.

With an indirect piecework wage system, the wages of workers in service industries are set as a percentage of the total earnings of workers in the production they serve.

Example. Application of indirect piecework form of remuneration

To the employee of auxiliary production of Aktiv LLC S.S. Petrov established an indirect piecework wage system. Petrov receives 3% of the earnings of primary production workers. In November of the reporting year, the earnings of primary production workers amounted to 560,000 rubles. Petrov’s salary for November will be: 560,000 rubles.

× 3% = 16,800 rub. Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

Average salary calculation

To calculate the average salary, you need:

- The amount of wages accrued for 12 months. If the employee worked less, all days worked are taken into account;

- Working hours according to the calendar. To calculate it, add up all calendar days in a year and divide by 12. The result is the average number of days in a month.

Formula for calculating average salary:

Average salary = Payments for the period / Time worked

Formula for calculating average monthly salary:

Salary = Salary per year / Days on average

- Days on average - averaging the number of days in a month.

Formula for calculating average daily wage:

Average daily salary = (Basic salary + Additional) / (12 × 29,3)

- Basic salary - the amount of basic salary for 12 months. Includes payment based on official salary, tariff or piecework.

- 29.3 is the average number of days in a month established by law.

- Additionally - additional payments for 12 months. The additional salary fund includes additional payments, allowances, bonuses, remunerations, coefficients, night and overtime.

When an employee resigns, compensation for unused vacation is added to the salary. In this case, the average monthly salary is adjusted to the actual time worked and earnings per day are calculated. The number of days of remaining vacation is multiplied by the average daily wage.

Interest on the balance on the Current Account

All offers from domestic banks share common rules for calculating interest on an account. In most cases, they are calculated monthly or quarterly, using a fixed annual rate. Interest is accrued on the real balance on the current account at the end of the month, which is recorded using special software. To do this, the program automatically takes into account the balance at the end of each day of the month. Then the data is summed up and divided by the number of calendar days. The resulting average amount is the final amount to be calculated.

This service is provided for any account – ruble or foreign currency.

However, to receive interest, a separate agreement or an additional agreement to the existing cash settlement agreement is always signed.

The document specifies all the rules and features of the accrual of funds, their payment and withdrawal.

These funds are of particular importance for large enterprises, which often accumulate large sums in their current accounts at the end of the working day. However, this service can also be used by entrepreneurs who do not carry out large non-cash transactions. Indeed, for individual entrepreneurs, even a small amount received by them will be a very significant increase in operating funds.

Settlements with company personnel for wages

Accounting for settlements with employees for wages constitutes a significant and integral part of the work of the accounting department of any enterprise. This group of calculations involves making salary accruals and deductions from them, making social payments, accruing tax payments and payments to extra-budgetary funds. The bulk of the calculations here are made up of payroll. The most common wage systems are time-based and piece-rate. The specific type of payment is established in the collective labor agreement, or in the local regulatory act of the enterprise.

Pay systems

With a time-based wage system, the amount of wages depends on the amount of time actually spent at the workplace, taking into account the employee’s qualifications and working conditions. The time-based form of wages can be simple time-based and time-based bonuses. A simple form establishes the dependence of the amount of wages solely on the amount of time worked, regardless of the quantity and quality of products produced by the employee. The time-based bonus form of wages provides not only for payment for the time spent by the employee, but also for the payment of bonuses for the quantity and quality of work done.

The salary amount, calculated in accordance with the established salary (simple form), is found as the ratio of the product of the employee’s salary and the amount of time worked according to the schedule to the monthly working time fund. The salary amount, taking into account pre-established indicators of the quality of work performed (bonus form), is calculated by adding the actual time-based earnings and the amount of the accrued bonus. In turn, the size of the bonus is found through the product of time-based earnings and the bonus indicator. The amount of the bonus is reflected in the bonus regulations adopted by the enterprise in the form of a certain percentage of the established salaries.

Example

Let’s say an employee’s salary is 20 thousand rubles. In accordance with the bonus regulations, the employee’s bonus is equal to 30 percent of the established salary, and out of 20 allotted days, the employee worked only 19. The amount of the accrued salary will be equal to:

20,000 x 19 / 20 = 19,000 (simple form)

19,000 x 30 / 100 = 5,700 (premium)

19,000 + 5,700 = 24,700 (premium form)

One of the subtypes of time-based wages is the form in which wages are calculated based on the established category and the corresponding tariff. The salary here is calculated according to the product of the tariff of a certain category and the time worked by the employee. The categories and corresponding tariff rates are determined by the level of qualifications of workers. The tariff rate of the first category is remuneration for simple labor performed per unit of time, but not less than the minimum wage established by law. Tariff rates of all other categories are determined by the product of the tariff rate of the first category by the tariff coefficients of the corresponding categories.

With piecework wages, wages are calculated based on the piecework rates established by the employer for the production of a unit of product and the quantity of products produced by the employee. Piecework wages can be direct and progressive. With direct piecework payment, earnings are easily determined by multiplying the prices established at the enterprise and the quantity of products produced by the employee. With the piece-rate progressive form of remuneration, earnings are formed from payments for the production of the initial base and payments in excess of the established production standards, which are made at increased prices.

Example

The price per unit of production is 17 rubles, the employee, in accordance with the production document, produced 700 products per month, and the production rate is 500 products. The employee fulfilled the general norm by 140 percent. In this case, payment for products produced in excess of the production norm is carried out at double the rate (maximum possible) of piece rates. The amount of accrued salary will be equal to:

700 x 17 = 11,900 (direct piecework)

(500 x 17) + (200 x 34) = 15,300 (piece-progressive form)

The employer is obliged to keep records of working hours actually worked by each employee, and settlements with employees for payment for work performed. Accounting for the time and wages of employees on a time-based wage system is carried out in a timesheet for recording the use of working time and calculating wages, which reflects information about working and non-working time, vacations, business trips and sick leave.

This rule must also be observed in the case of piecework wages. The employer also maintains a payroll, payslip and personal account. Personnel accounting is mediated by maintaining personal cards of employees, orders for hiring, transfer, and dismissal. To consolidate information about production, enterprises maintain work orders and route sheets. Each employee is assigned a personnel number, which is then registered, as necessary, on all personnel records of the organization.

Salary deductions

The legislation does not limit the list of payments that can be withheld from an employee’s salary. In practice, the most common types of deductions are amounts of personal income tax, alimony under writs of execution, deductions for marriage, intra-organizational fines, deductions for goods purchased on credit, unreturned accountable amounts, advances. The total amount of all deductions for each payment cannot exceed 20 percent, and in cases provided for by law, 50 percent of wages. If deductions are made under several enforcement documents, their total amount should also not exceed 50 percent of wages.

The limit on the amount of deduction from wages and other income of a debtor-citizen established by the law on enforcement proceedings does not apply when collecting alimony for minor children, compensation for harm caused to health, compensation for harm in connection with the death of a breadwinner and compensation for damage caused by a crime. In these cases, the amount of deduction from wages and other income of the debtor-citizen cannot exceed seventy percent.

The main deduction from wages now is personal income tax. The tax base is calculated taking into account all the employee’s income, both in cash and in kind, as well as taking into account all tax benefits due to the employee. Also, other types of deductions can be made from wages, such as deductions by agreement with the employee himself, or by a court decision (alimony payments collected by force). These deductions do not reduce the tax base. Thus, the tax base is defined here as the monetary expression of taxable income, reduced by tax deductions provided for by the rules of the Tax Code of the Russian Federation.

Example

The employee receives a salary of 30 thousand rubles. There are no tax deductions. The employee also receives monthly income from the enterprise in the form of rent for non-residential premises leased to the enterprise. The total rent amount is 37 thousand rubles. The amount of the employee's paid income after tax is:

(30,000 + 37,000) x 13% = 8,710 (personal income tax)

67 000 – 8 710 = 58 290

Also among the main types of deductions are alimony payments. Withholding and payment of alimony is made on the basis of either a notarized agreement on the payment of alimony, or a writ of execution issued by the court. Writs of execution are subject to registration in the book of registration of writs of execution; the form of this book can be developed by the enterprise independently. Alimony is withheld by the enterprise on a monthly basis, transferred to the recipient no later than three days from the date of payment of wages and other income of the payer from which they were withheld, and the postal transfer of alimony is carried out at the expense of the payer himself.

Alimony can be calculated in the amount of a certain share of the alimony payer’s earnings and in a fixed amount. The first option is used when collecting alimony from parents for minor children in court. Alimony here is paid on the basis of: for one child - one quarter of earnings, for two children - one third, for three or more children - half. As for the second option, the amount of alimony determined by the court is subject to mandatory indexation in proportion to the increase in the minimum wage established by law.

In accordance with the law, alimony is collected after deduction from personal income tax. From here, the amount of alimony withheld can be found as the product of the difference between the monthly salary accrued and the amount of personal income tax withheld by the percentage of alimony payments withheld.

Example

Let’s assume that the income of an employee obliged to pay alimony for minor children under two writs of execution according to a court decision is 25 thousand rubles. According to the first writ of execution, the amount of deduction is equal to a quarter of earnings, according to the second - half of earnings. The amount of alimony is:

25,000 x 13% = 3,250 (personal income tax)

25,000 – 3,250 = 21,750 (amount for calculating alimony)

(21,750 x 25%) + (21,750 x 50%) = 5,437.5 + 10,875 = 16,312.5 (total amount of alimony)

21,750 x 70% = 15,225 (total amount of alimony that can be paid, subject to legal restrictions)

21,750 / 16,312.5 x 5,437.5 x 70% = 5,075 (alimony under the first writ of execution)

21,750 / 16,312.5 x 10,875 x 70% = 10,150 (alimony under the second writ of execution)

The withholding of alimony ends upon the employee's dismissal from the enterprise. The administration must inform the bailiff who sent the writ of execution, as well as the recipient of the alimony, within three days about the dismissal of an employee who is obligated to pay alimony based on a court decision or a notarial agreement.

Summary calculations and analytical accounting

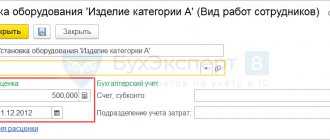

Payroll calculations are made using account 70 “Settlements with personnel for wages” and corresponding accounts. This takes into account amounts for all types of wages, benefits, bonuses and income from the company’s securities. Amounts of wages due to employees can be taken into account on the credit of the account in correspondence with the accounts of production costs, sales expenses, as well as with account 96 “Reserves for future expenses”, in cases where wages are accrued from reserves for payment of remunerations for length of service and vacation pay.

Income accrued to employees from participation in the capital of the enterprise is reflected in correspondence with account 84 “Retained earnings (uncovered loss)”, and accrued social insurance benefits - with account 69 “Calculations for social insurance and security”.

The paid amounts of salaries, bonuses, income from participation in capital, benefits, taxes on personal income are reflected in the debit of account 70 “Settlements with personnel for wages”. In cases where the necessary amounts were accrued by the enterprise, but not paid, they are subject to accounting as the debit of account 70 and the credit of account 76 “settlements with various creditors and debtors” subaccount “Settlements on deposited amounts”.

Deductions from wages are reflected in the debit of account 70 “Settlements with personnel for wages” in correspondence with various accounts, depending on the type of deduction. For example, the amount of material damage caused is taken into account in the credit of account 73 “Settlements with personnel for other operations” subaccount “Settlements for compensation of material damage”, the amount to repay a loan previously issued to an employee is the subaccount “Settlements for loans provided”, and the advance accrued for the first half of the month - on the credit of the “Cash” account. Alimony is accounted for in the debit of the accounts on which the employee’s income is accrued (70, 73, 84), and in the credit of account 76 “Settlements with various debtors and creditors” subaccount “Alimony”.

The deposited wages are subject to transfer to account 76 “Settlements with various debtors and creditors” subaccount “Depositors”. Unpaid money is deposited into the company’s current account at a credit institution and is reflected in the debit of account 51 “Cash accounts” and the credit of account 50 “Cash”. The receipt of deposited amounts of wages from a current account in a credit institution to pay depositors is reflected by a reverse entry, that is, by debit to account 50 and credit to 51.

Deposited wages issued to employees from the enterprise’s cash desk are accounted for in the debit of account 76 “Settlements with various debtors and creditors” subaccount “Settlements on deposited amounts” and in the credit of account 50 “Cash”. At the same time, there are situations when unpaid wages remain unclaimed. In these cases, the enterprise is obliged to store unclaimed deposited wages in its current account for three years and then has the right to attribute these amounts to the financial results of its activities. This is reflected in the debit of account 76 “Settlements with various debtors and creditors” subaccount “Settlements on deposited amounts” and the credit of account 91 “Other income and expenses”.

Analytical accounting for account 70 “Settlements with personnel for wages” is carried out in relation to each employee of the enterprise. For the purpose of analytical accounting, enterprises maintain an employee’s personal account, a tax card for recording income and personal income tax, and payroll statements. Accounting for deposited wages is maintained for each employee in the register of unpaid wages, on deposit cards or the book of unpaid wages.

A personal (personal) account is opened when an employee is hired and is used to monthly reflect information about wages paid to the employee during the calendar year. When an employee is hired, information from the employee’s personal card (Form No. T-2) is transferred to his personal account. Here all accruals and deductions from the employee’s wages are recorded on the basis of primary documents recording production and work performed, time worked and documents for various types of payment.

On January 1 of each year, a new personal account is opened for the employee. The calculation data reflected in the personal accounts of employees is then recorded in the employee’s tax card and in the payroll. The payroll records include the amounts of accrued wages by type, the amount of deductions and directly the amounts to be paid to the employee.