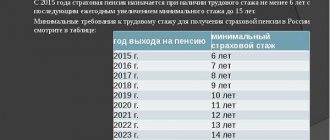

At the beginning of 2015, the provisions of the pension reform came into force. From this moment on, the calculation of the pension is influenced by the length of the insurance period and the number of “pension points” accumulated during the period of working activity, the number of which is proportional to pension insurance contributions from the employee’s income. The law still allows an employee to retire due to old age earlier than upon reaching retirement age - for this it is necessary to have a special insurance period. Let's find out how the special insurance period is calculated.

What is special insurance experience?

Special insurance experience - the total duration of all periods of performance of official duties in hazardous production conditions (unfavorable, difficult), in harsh climatic zones, in areas with a special status.

In other words, we can say that special insurance experience is the time that a worker gave during his life, carrying out activities that are of particular importance for the country or associated with the negative impact on the body, health and life of the employee of psychological or physical stress, harmful production conditions , various dangerous factors.

We can talk about taking into account special insurance experience when the chosen type of activity meets special conditions, including:

- civil service under contract;

- specificity of certain types of work;

- special conditions for carrying out labor duties;

- carrying out work in the Far North or equivalent areas.

If an employee has special insurance experience, this fact gives him certain guarantees, namely:

- the right to receive an old-age pension before retirement age;

- the possibility of receiving payments for length of service (applies to military personnel and civilians equivalent to them).

Insurance experience and its legal significance

The right to many types of social security directly depends on a citizen’s participation in labor activity and payment of unified social tax and insurance contributions, i.e.

from insurance experience. The definition of insurance experience is contained in several federal laws. Thus, Article 3 of the Federal Law of July 16, 1999 “On the Basics of Compulsory Social Insurance” states that the insurance period is the total length of time for paying insurance contributions and (or) taxes. And Article 2 of the Federal Law of December 17, 2001 “On Labor Pensions in the Russian Federation” states that the insurance period is the total duration of periods of work and (or) other activities during which insurance premiums were paid, taken into account when determining the right to a labor pension in the Pension Fund, as well as other periods.

The second formulation is more precise, but it does not exclude the possibility, as an exception to the general rule, of counting into the length of service periods during which work was not carried out and contributions were not paid. In addition, Federal Law No. 167-FZ of December 15, 2001 “On Compulsory Pension Insurance in the Russian Federation” allows for the payment of contributions without engaging in any work activity (Article 29).

The insurance period has the following characteristics:

quantitative (duration in years);

qualitative (expressed in the characteristics of production conditions - harmful, difficult, etc.; climatic zones and territories in which labor activity was carried out - regions of the Far North and areas equivalent to them).

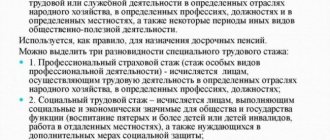

Taking into account these characteristics, the special (professional) insurance experience, which is part of the general insurance experience, also differs.

The total insurance period is the total total duration of labor and other activities during which insurance premiums or unified social tax were paid, as well as other periods specified in the law. This type of length of service has legal significance in determining the right to a labor pension and in calculating the amount of benefits for temporary disability, pregnancy and childbirth.

In addition to periods of working activity, the general insurance period for acquiring the right to a labor pension also includes periods when a citizen did not work for objective reasons recognized by the state as valid (for example, in connection with military conscription, unemployment, etc.). They are counted towards the insurance if they were preceded or followed by periods of working activity.

Special (professional) insurance experience is the total duration of periods of labor activity in workplaces with difficult or harmful working conditions, in special climatic conditions or territories with a special status with the payment of insurance premiums.

Calculation of special insurance experience: how it is determined

When calculating the duration of the special insurance period, the following periods of labor activity will be taken into account:

- creative work carried out in the state. institutions;

- work in state or municipal medical centers;

- teaching activities on children's profiles in municipal and state institutions;

- work as a geologist, topographer, etc. as part of various expeditions during research;

- work as a truck driver during mining (in quarries, open-pit mines, mines, mines, etc.);

- carrying out work in the subway or on railway tracks;

- in difficult conditions under the influence of certain factors (high temperatures, pressure, radiation, loud sound, vibration, etc.).

What categories of employees are paid?

The list of professions to which special insurance experience applies is approved at the government level. This procedure concerns both the list of categories of workers who are entitled to early retirement due to old age, and those who may qualify for payment in accordance with their length of service.

Categories of citizens who are accrued special insurance experience, which ensures the right to receive an old-age pension early:

- people working in difficult working conditions (underground, in hot shops, etc.);

- drivers of heavy vehicles in mining areas (mines, quarries, mines);

- subway and railway workers, public transport drivers;

- participants of survey expeditions;

- teachers in municipal and state educational institutions with a children's profile;

- people of creative professions who carry out their activities in state entertainment structures (theater, cinema, etc.);

- employees of municipal and state medical institutions;

- timber harvesters;

- port employees who are involved in loading and unloading operations;

- firefighters, rescuers;

- citizens who have experience working in areas with high background radiation.

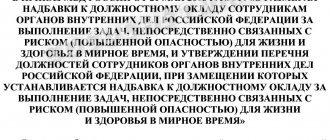

Categories of citizens who are accrued special insurance length of service, ensuring the right to a pension in accordance with length of service:

- civil servants;

- military contractors;

- people working in prisons;

- test pilots, etc.

The procedure for calculating pension payments for representatives of each of the listed professions is strictly regulated by the law discussed above. Articles 13 and 14 of the same regulatory legal act also regulate the procedure for calculating the duration of the length of service itself.

Calculation of special insurance experience: special positions and professions

There are no clear criteria by which one can say with certainty that a profession or position is “harmful”. However, the law prescribes focusing on the following indicators:

- the nature of the work performed;

- production conditions associated with exposure to harmful and life-threatening factors;

- service in the fire department;

- service in the penitentiary system;

- pedagogical activity;

- work in treatment institutions;

- performing work at an enterprise located in the Far North or similar areas.

Calculation of special insurance experience: special working conditions

Non-standard conditions for carrying out activities are considered:

- underground works;

- difficult and dangerous work;

- work in the field of mining production;

- work of high severity and intensity.

Back in 1991, the Government established a list of special working conditions, under which in some cases the retirement age is reduced by 5 years, in others by 10 years. The lists are still taken into account to this day.

How to calculate special insurance experience

Calculation of special insurance experience is carried out on a calendar basis. That is, 30 days of work under special conditions will be counted as a special month. length of service Months will then be converted to years. However, it should be remembered that there are conditions that must be met in order to qualify for special insurance coverage:

- income from activities must be paid to the Pension Fund;

- the work must be carried out during a full working day (if an employee works part-time, the duration of the shift is important, and for a full work shift, the actual time worked is taken into account);

- work that gives the right to special insurance coverage must be the main type of activity.

In addition to the time actually spent at the workplace, special experience includes:

- periods of temporary disability;

- basic annual leave with pay;

- additional rest time provided to employees working under special conditions.

What is included in the insurance period?

During the life of any person, various life situations may arise, the solution of which obliges him to suspend his work activity for some time. The insurance period consists of two types of periods: insurance (payment of insurance contributions to the Pension Fund occurs) and non-insurance (no payments are made). In order for non-insurance periods to be included in the length of service, a certain requirement must be met: they must be preceded and followed without any long breaks by insurance periods.

Non-insurable periods of time include the following circumstances:

- Completion of military service upon conscription;

- Periods of temporary disability of a citizen due to the occurrence of certain health problems, during which the corresponding benefit is paid;

- The periods of time during which one of the parents cared for the infant until the age of one and a half years;

- Periods of time during which the employee cared for a child with a disability/an adult citizen - a disabled person of the first group/a person over 80 years of age in need of constant care;

- The period of time during which a citizen was imprisoned for unjustified reasons, and then was released, subject to the removal of all charges against him;

- The length of time a person is registered with the Employment Center, periods of participation in community service;

- Time spent performing duties in law enforcement agencies based on signing a contract.

In order to have a longer period of special insurance experience necessary to receive an early pension, care should be taken to ensure that non-insurance time periods are included in it, because the size of future pension accruals directly depends on this.

To accurately calculate your insurance period, use the online calculator

Legislative acts on the topic

| Federal Law of December 28, 2013 No. 400-FZ | About insurance pensions |

| Federal Law of December 15, 2001 No. 166-FZ | On state pension provision, on the importance of length of service when assigning pension benefits |

| Resolution of the USSR Cabinet of Ministers of January 26, 1991 No. 10 | On approval of lists of production work, professions, positions and indicators giving the right to preferential pension provision |

Answers to common questions about calculating special insurance experience

Question No. 1: How to prove the presence of special experience if there are no entries in the work book?

Answer: Confirmation of the right to record special insurance experience, in addition to the work book, are employment agreements, extracts from places of work, certificates, and salary accounts.

Question No. 2: I was engaged in entrepreneurial activity, without having a certificate of registration as an individual entrepreneur. I worked under difficult conditions, which could have given me the right to take into account special insurance experience. How can I prove that I have the right to accrue special payments? length of service?

Answer: You will need to present a document confirming the transfer of insurance payments to the Social Insurance Fund employee.

New rules for calculating and confirming insurance experience

(Resolution of the Government of the Russian Federation dated October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming insurance experience for establishing insurance pensions”)

From January 1, 2015

Rules for calculating and confirming the insurance period for establishing insurance pensions

come into force .

At the same time, Decree of the Government of the Russian Federation dated July 24, 2002 No. 555 “On approval of the Rules for calculating and confirming the insurance period for establishing labor pensions” loses force.

There are no too big differences between the documents

.

Let's consider the new provisions

.

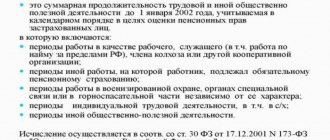

Periods counted in the insurance period

Currently, the insurance period includes

(counts)

the period of care of one of the parents for each child

until he reaches the age of one and a half years, but

not more than four and a half years in total

.

From January 1, 2015

The period of care

of one of the parents for each child until he reaches the age of one and a half years

will be counted (included) in the insurance period not more than 6 years in total

.

The periods of work on the territory of the Russian Federation continue until a citizen is registered as an insured person

can be established on the basis

of witness testimony

.

From January 1, 2015

it is established that

the nature of the work is not confirmed by testimony

.

From January 1, 2015

periods of work and (or) other activities that took place before the date of entry into force of the Federal Law “On Insurance Pensions”

can be confirmed

in the manner established by the relevant regulatory legal acts that were in force during the period of performance of work and (or) other activities.

Periods of work and (or) other activities and other periods are confirmed by documents drawn up on paper or in the form of an electronic document

.

Documents confirming periods of work before registration of a citizen as an insured person, included in the insurance period

From January 1, 2015

periods of work are confirmed

on the basis of individual

(

personalized

)

accounting

.

If the individual (personalized) accounting information contains incomplete information

about periods of work

or there is no information

about individual periods of work, periods of work

are confirmed by documents

specified in the Rules.

That is, a work book, etc.

Documents confirming periods of other activities before registration of a citizen as an insured person, included in the insurance period

From January 1, 2015

periods

of other activities

are confirmed

on the basis of individual

(

personalized

)

accounting

.

If the individual (personalized) accounting information contains incomplete information

about periods of other activities or

there is no information

about individual periods of other activities, periods of other activities are confirmed by the documents specified in the Rules.

The composition of such documents is similar to that given in Resolution No. 555.

Documents confirming other periods before registration of a citizen as an insured person, counted towards the insurance period

From January 1, 2015

other periods are confirmed on the basis of individual (personalized) accounting information.

If the individual (personalized) accounting information contains incomplete information

about other periods

or there is no information

about certain other periods, other periods are confirmed by the documents specified in the Rules.

The period of care of one parent for each child

until

he reaches the age of one and a half years

, for example,

is confirmed by documents certifying the birth of the child

and his achievement of the age of one and a half years (birth certificate, passport, marriage certificate, death certificate, certificates from housing authorities about cohabitation until the child reaches the age of one and a half years.

From January 1, 2015

The employer's documents on the provision of parental leave

until the child reaches the age of one and a half years considered as supporting documents

The period of care provided by an able-bodied person for a group I disabled person, a disabled child under the age of 18, or for a person who has reached the age of 80

, is established by a decision of the body providing pension provision at the place of residence of the person being cared for, adopted on the basis of an application from an able-bodied person caring for him and documents certifying the fact and duration of being on disability (for disabled people of group I and disabled children), and also the age (for the elderly and disabled children) of the person being cared for.

From January 1, 2015,

on the basis of

a citizen’s

, the period of his care

for a group I disabled person, a disabled child under the age of 18, or a person who has reached the age of 80,

can be established even before the conditions that give the right to an insurance pension occur

.

Currently, the period of residence of military spouses

, undergoing military service under a contract (active (long-term) military service), together with their spouses in areas where they could not work due to lack of employment opportunities, which occurred before January 1, 2009, is confirmed by certificates from military units ( institutions, enterprises and other organizations), military commissariats in the form in accordance with Appendix 4 to Order No. 555.

The specified period, which took place starting from January 1, 2009, is confirmed

certificates from military units (institutions, enterprises and other organizations), military commissariats in the form provided for in Appendix No. 4, and a certificate from a state institution of the employment service.

Grounds for issuing the certificate

in the form provided for in Appendix No. 4, are information from the military personnel’s personal file or a document confirming registration at the place of residence or place of stay, as well as work books of spouses of military personnel.

From January 1, 2015, information from the military personnel’s personal file is also used as a basis.

, and a document confirming

registration at the place of residence

or place of stay,

and not either one or the other document

.

Also, from January 1, 2015,

the periods of residence

indicated in such a certificate,

which coincide with the periods of work

contained in the work book,

are not taken into account

by the body providing pensions

when calculating the insurance period

.

Features of confirming the insurance experience of certain categories of insured persons

From January 1, 2015

if

the insured person is a recipient of a pension in accordance with the legislation of a foreign state, information about the periods

taken into account when establishing such a pension

is confirmed by a document

issued by the body providing pensions in that state or by another organization whose powers include issuing such documents.

If, in order to calculate the insurance period required to acquire the right to an insurance pension,

for old age,

information is required about receiving a long service pension or a disability pension

in accordance with the Law of the Russian Federation “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances , institutions and bodies of the penal system, and their families" and on periods of service preceding the assignment of a disability pension, periods of service, work and (or) other activities taken into account when determining the amount of a long service pension in accordance with this Law,

such the information is confirmed by a certificate from the body

providing pensions in accordance with this Law.

The procedure for calculating insurance experience

Let us recall that calculating the duration of work periods

, including on the basis of witness testimony, and (or) other activities and other periods,

is carried out on a calendar basis based on a full year

(

12 months

).

Moreover, every 30 days

periods of work and (or) other activities and other periods

are converted into months

, and every 12 months of these periods are converted into full years.

From January 1, 2015, calculating the duration of each period

included (counted) in the insurance period

is made by subtracting

the start date of this period from the end date of the corresponding period

and adding one day

.

Periods of work and (or) other activities and other periods are included

(

counted

)

in the insurance period on the day preceding the day of application

for the establishment of an insurance pension, and in cases provided for in Parts 5 and 6 of Art. 22 of the Federal Law “On Insurance Pensions” - until the day preceding the day of assignment of the insurance pension.

It has been established that the insurance period does not include periods

taken into account when establishing a pension in accordance with the legislation

of a foreign state

.

From January 1, 2015

when calculating the insurance period, periods of activity

of persons who independently provide themselves with work

, heads and members of peasant (farm) households, members of family (tribal) communities of indigenous peoples of the North, Siberia and the Far East of the Russian Federation, engaged in traditional economic sectors,

periods of work for individuals

( groups of individuals)

under contracts are included in the insurance period subject to payment of insurance premiums

.

When caring for children by both parents

No more than 6 years of care

are counted in the insurance period

of each parent , if they do not coincide in time or care is provided for different children.

When calculating the insurance period in order to determine the right to an insurance pension, periods of work and

(

or

)

other activities that took place before the Federal Law “On Insurance Pensions” came into force and were included in the length of service

when assigning a pension in accordance

with the legislation in force during the period of performance of work

(activity),

may be included in the specified length of service

using rules for calculating the relevant length of service provided for by the specified legislation (including taking into account the preferential procedure for calculating length of service), at the choice of the insured person.

In the absence of the will of the insured person

the body providing pensions applies the specified rules for calculating length of service if, without their application, the right to an insurance pension does not arise.

Also established are the features of confirming and calculating the insurance period when performing works of an author's order, as well as for the authors of works

.