In the Soviet Union there were no pension points or insurance coverage. However, many Russians who have been pensioners for a long time, or who are only now retiring, worked in various industries during the Soviet era. And their so-called Soviet experience often amounts to decades. How to convert Soviet experience into pension points, what their value is, and how that long period of working activity is reflected in the amount of the pension is not always clear. These issues are discussed in our article.

Pension points for Soviet experience: algorithm for calculating the amount of pension with an example

Let's start from the end. We talk about the new pension system, effective from 2020, in another article about pension points. The employer's insurance contributions to the Pension Fund for 2002-2014 and stored in the insurance account will be converted into points and will be taken into account in the final calculation of the pension. Pension capital accumulated in 1991-2001 will be re-counted in the form of a point coefficient.

Maria retired in 2021 with 35 years of experience. This means that during the Soviet period she worked for 10 years, and another 10 years until 2002. First, we calculate the ratio of her average monthly earnings and the average salary in the country. If it exceeds 1.2, then we only take into account the maximum threshold - 1.2.

Details

In Soviet times, information was documented

and it was necessary to submit a list of documents to confirm work and social experience (regarding service in the troops of the Ministry of Defense and other bodies equivalent to them, provision of leave to care for a child, for a disabled person, for a second child, etc.).

In accordance with the law, if you have documented work experience, 1% of the pension is accrued for years of work. For example, if a person had 4 years of work experience before 1991, then he is entitled to a pension supplement of 4%. If the working period is 15 years, he receives a 15% bonus, etc.

The Decree of the President of the Russian Federation stipulates that, no matter whether there are supporting documents or not, for the period from 1991 to 2001, all citizens who have reached retirement age will receive additional pension increases in the amount of 10%. The introduction of this allowance is characterized by difficulties associated with employment during the years of the collapse of the USSR and the beginning of the development of Russia.

The concept of “Soviet experience” includes all work experience up to 2001, without dividing it into the Soviet or post-Soviet period. Let’s assume that a pensioner’s work experience is 30 years, with 15 years in the Soviet-post-Soviet period. It is necessary to subtract the coefficient of the average salary both for a specific employee and for the country as a whole. Regardless of the results of the calculations, if the coefficient size exceeds 1.2, then this value is taken as the basis, in other cases in accordance with the calculation.

Pension points for the Soviet era are calculated in accordance with the formula

It includes the sum of work experience and salary for the last 5 years of work. The result obtained must be multiplied by 10%. Moreover, those who worked during the Soviet period will receive an additional 1% annually.

For the period from 2002 to 2021, we add up the cash contributions, and multiply the total by the indexation coefficient. The result obtained should be divided by 228 and the value of the point.

Each person can calculate their pension independently using the formula P=SKxZR/ZPxSZP, where:

— SC is a coefficient whose maximum value is 0.75,

— ZR — average monthly salary for 5 working years,

— ZP is the average monthly salary in the country.

Pension points for length of service accumulated during the Soviet era were introduced in 2010 and consist of:

— 10% of work experience obtained before 2002,

- 1% - for each year of employment starting from 1991.

In accordance with the law, pensions are divided into several types:

— for insurance (for citizens with the lowest work experience and, in addition, an individual coefficient),

— state support (civil servants, combatants, military personnel, etc. are entitled to it),

- non-state support.

In order to process financial payments

you need to take a specific period of time - this will take time, therefore, you should start processing in advance, you may need information for confirmation. For example, certificates from archival organizations, certificates received from the place of work, even union cards confirming membership can be used as evidence.

In accordance with the law, registration must begin one month before retirement age. You can do this yourself, or by issuing a notarized power of attorney for someone close to you.

To apply to the Pension Fund, you must have the following documents:

- application from a citizen who has reached retirement age,

- passport,

- employment history,

- insurance policy,

- for men - military ID,

— an extract for a certain period, if it is not recorded in the work book.

However, in individual cases additional data may be needed.

If all documents are submitted on time

then it will take no more than 10 days to consider the application. If any information is missing, the citizen must provide it within three months. However, pension payments are accrued from the moment you apply to the Pension Fund.

In order to have a complete understanding of which periods in Soviet times were taken into account when calculating the amount of pension payments, you should contact the Pension Fund, where they will give you full information about the name of the period and its duration.

If errors were made in the documents confirming work experience (for example, work books), as a result of which the Pension Fund of Russia refused to take into account work experience, this fact may be disputed in court. The pension assigned for work in Soviet times is worth taking full responsibility for its registration.

How to calculate pension points for Soviet service

In accordance with Federal Law No. 400, the calculation of insurance benefits is based on the duration of work of citizens, the number of individual coefficients earned, as well as the price of one individual industrial complex at the time of pension assignment. But what to do if the future pensioner worked in the USSR for half of his life? How are pension points calculated for service during the Soviet period? This issue is regulated by Federal Law 173-FZ (provisions that do not contradict the current legislation of the country).

A is the average earnings coefficient; B is the amount of remuneration received by the citizen for work; C is the level of average monthly salary in Russia for a certain period of time.

How the calculation is done: step-by-step instructions

To convert work experience during the Soviet period into an individual pension coefficient, the following indicators are taken into account:

- duration of work in the period up to 2002,

- Duration of work until 1991:

- the average monthly salary for a certain period of time before 2002.

Taking into account the specified data, the calculation of the IPC for the Soviet period is carried out as follows.

Step 1. The number of IPCs is calculated taking into account the following data:

- as for women, if the duration of work is less than 20 years, a coefficient of 0.55 is applied, if the work experience is more than 20 years, then the coefficient of 0.55 is multiplied by 0.1 (for each additional year of work above the norm provided by law),

- As for men, if the duration of work is less than 25 years, the same coefficient is applied - 0.55; if the work experience is more than 25 years, then 0.55 is multiplied by 0.1 for each additional year of work above the norm provided by law.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

However, ultimately the coefficient may not exceed 0.75. If it is higher, then 0.75 is taken as the basis.

Step 2. The ratio of the average monthly salary of a pensioner for a certain period of Soviet times and the level of average monthly salary for the same period in the Russian Federation is calculated.

The calculation is carried out according to the formula:

A=B/C, where:

- A is the coefficient of average monthly earnings, B is the amount of remuneration received by a citizen for work, C is an indicator of the average monthly salary in the Russian Federation for a certain time period.

In this case, the maximum value of this ratio should not exceed 1.2. This requirement does not apply to residents living in the Far North and equivalent areas.

Latest edition of the law on insurance pensions.

Step 3. The estimated benefit amount is determined by applying the following algorithm: A (for 2002) = B * C * 1671 450, where:

- A – the estimated amount of the pension payment,

- B – length of service coefficient,

- C – the ratio of average monthly earnings,

- the numerical value 1671 indicates the average monthly salary in the Russian Federation from 07/01/01 to 09/30/01,

- the numerical value 450 represents the basic amount of labor benefit established for 2002.

Step 4. Taking into account the fact that the minimum calculated pension is set at 660 rubles, further calculations will be as follows.

Please note! The amount of valorization is calculated. To do this, take the length of work experience up to 1991, a one-time increase in pension payments for 2002 at the rate of 10% of the amount that was obtained as a result of the calculation. Then, for each year of work experience during the Soviet period, an additional 1% is accrued.

The final valorization indicator will look like this:

A=B (for 2002) * (0.1+0.01 * duration of work until 1991), where:

- A – one-time increase indicator,

- B – estimated pension amount.

Step 5. The benefit amount is calculated as of 2015, since pension payments were increased in the period from 2002 to 2015.

The following formula is used for the calculation: A = (B for 2001 + C) * 5.6148 rubles, where:

- A – the amount of accruals made,

- B is the calculated pension indicator,

- C – valorization indicator,

- the numerical indicator 5.6148 represents the amount of indexation of the total amount of insurance premiums.

Step 6. The IPC for the Soviet period is calculated using the formula A = B / 64.1, where:

- A – number of individual coefficients,

- B – the amount of part of the insurance payments until 2002,

- the numerical value 64.1 represents the value of one coefficient for 2015.

Watch the video. Experience and pension points:

Pension points for Soviet experience

If, when assigning pension payments, a pensioner finds out that Soviet-era work experience was not taken into account, he has the right to submit a corresponding application to the territorial division of the Pension Fund for recalculation of the pension.

The biggest difficulty in calculating a pension is confirming work experience during the Soviet period. In those days, there was no automated accounting system, and all data must be documented. If for some reason the documents have not been preserved, then it will be quite difficult to prove work experience during the Soviet period.

Possible difficulties

The biggest difficulty in calculating a pension is confirming work experience during the Soviet period. In those days, there was no automated accounting system, and all data must be documented. If for some reason the documents have not been preserved, then it will be quite difficult to prove work experience during the Soviet period.

For example, women who did housework and raised children on their own must provide relevant evidence. Men who served in the military at that time must also provide written evidence.

If the length of service cannot be confirmed, then upon reaching retirement age a social benefit will be assigned, which will be paid by the state.

Is a pension paid if a person has not worked all his life?

How to calculate pension points for Soviet service

Pension points (individual pension coefficient) are the units with which the Pension Fund determines the availability of the right to an old-age pension and its size. The more points, the greater the amount a person will receive. Such a system was introduced recently, and many worked in the Soviet and post-Soviet periods, when there were no points. Will this time be counted towards them when calculating their pension, and how much will they receive?

For work in 1991-2001. 10% is added to the pension. Before 1991, pension points, more precisely, an increase for existing length of service, are awarded automatically, even if the person actually worked less: the Pension Fund does not check this information.

Step-by-step algorithm for calculating the pension supplement

The step-by-step algorithm for calculating the pension bonus for work in Soviet times is extremely simple. To convert Soviet work experience into points, you need to take into account:

- duration of labor until 1991;

- duration of work from 1991 to 2002;

- the average monthly salary until 2002.

If you know the above factors, then using a calculator you can easily find out how many points you will be given based on a special formula. So, the calculation is done like this:

- Determine your ratio. For women who worked in the USSR for less than 20 years, and men who worked for less than 25 years, the coefficient is 0.55, if more than 20 years for women and 25 years for the stronger half of humanity - 0.55 times 0.1 (in other words , additional points are given for each year worked above the established norm). The final coefficient cannot be more than 0.75. If during the calculation there is a larger value, then 0.75 will still be taken as the basis.

- Calculation of the average monthly salary for the period of work in Soviet times and its conversion to the average monthly salary for the same period in the Russian Federation. The formula is simple: A (average monthly earnings coefficient) = B (salary for work in the USSR) / C (average monthly salary in the Russian Federation for the same period). The resulting value should not be higher than 1.2. An exception is made only for residents of the Far North and areas that are equivalent to it. In all other cases, the maximum coefficient is 1.2, even if according to calculations it is higher.

- The benefit amount is calculated using the formula: A (amount of pension payment for 2002) = B (work experience coefficient) * C (ratio of average monthly salary) * 1671 (this is the size of the average monthly salary in the Russian Federation in the period from July 1, 2001 to September 30, 2001) – 450 (this is the basic cost of labor benefits since 2002).

- Calculation of the valorization indicator. It is calculated taking into account the fact that the minimum pension is 660 rubles. The calculation formula is as follows: A (one-time increase rate) = B (calculated pension amount for 2002) * (0.1 + 0.01 * period of work until 1991).

- Calculation of benefits for 2015. You must be guided by the following formula: A (amount of pension accruals) = (B (calculated pension indicator for 2001) + C (valorization indicator)) * 5.6148 (indexation amount of the total amount of insurance contributions.

- Calculation of the IPC for the period of work in the USSR. Follow the formula: A (number of personal coefficients) = B (size of part of insurance payments until 2002) / 64.1 (size of one coefficient for 2015).

Remember! The entire algorithm is subject to calculation in stages. The result will be a calculation of the IPC for Soviet times.

How to correctly calculate pension points for Soviet service? Formulas and examples

Hello! The procedure for assigning an increase to a fixed amount is regulated by Federal Law No. 400, dated 2013. This law contains information regarding social benefits and government increases. If a citizen of the Russian Federation has worked for more than 30 years, then he has the right to receive 1 coefficient towards his pension. More information here: https://posobie.guru/pensii/vidy-pensii/strahovaya/stazh/st-30-let.html

This is interesting: Payment for 2 children 100,000 what kind of payments are due

Hello! If a person worked back in Soviet times, then these years are taken into account when calculating a pension. The types of labor activity that determine length of service are discussed in paragraph 3 of Article 30 of Law No. 173-F3 “On Labor Pensions in the Russian Federation”. The same article contains a formula according to which length of service is determined. When calculating pensions for citizens working before 2002, length of service is calculated taking into account the Pension Fund of the Russian Federation. During this time, it includes the main periods of labor activity for which cash contributions to the Pension Fund were made. All information is here: https://posobie.guru/pensii/vidy-pensii/strahovaya/stazh/soveskij.html

Accrual of pension points

The work experience acquired during this time is necessarily included in the calculation of the pension.

The list of types of activities that determine length of service is specified in Art. 30 clause 3 of Law No. 173 - Federal Law. The same article provides the formula by which the labor period is converted. Work experience includes the following types of activities:

- periods of forced temporary disability;

- time of registration at the labor exchange and receipt of unemployment benefits.

When calculating a pension for citizens working before 1991, its size increases by 1% for each year worked. The period of Soviet service is confirmed by entries in the work book. Or other documents established by government agencies.

For everyone who worked from 1991 to 2001, pension payments are increased by 10%.

The length of service earned after 2002 is calculated on the basis of the citizen’s registration in the Pension Fund of the Russian Federation. During this period, it consists of the main periods of labor or other activity for which payments were made to the Pension Fund.

Based on the Federal Law “On Insurance Pensions,” the amount of payments is now calculated in a new way. It depends entirely on the number of pension points. It is their totality that makes up the IPC, the pension coefficient.

P = F N B*Sb

P - pension payment; F - the amount established by the state, fixed; N - the component accumulative part; B - points accrued; Sb - value of the point value.

Points are awarded for each year worked. Currently the minimum score must be 11.4. By 2025 you will need to score 30 points.

The fixed amount is determined regardless of length of service. It is 4,559 rubles; to calculate it, it is multiplied by the inflation factor equal to 1.04.

For a certain category of citizens, increased rates are applied when calculating payments.

These include:

- elderly people over 80 years old;

- category of disabled people of group 1;

- persons working in the Far North;

- citizens who have a dependent incapacitated family member.

The funded part is formed from deductions. There are two options for pension savings:

- The insurance part is a deduction from salary in the amount of 16%.

- The funded part includes insurance, it is 10% of the salary and the funded part is 6%.

B = (Sv/Sm)* 10

St – insurance premiums that are paid per year. They depend on the level of salary and the chosen type of pension. See - insurance payments that are deducted from salary at a 16% rate.

Pension points for Soviet work experience

- It is forbidden to give a useless answer. The consultation must be complete and reasonable.

- It is prohibited to duplicate/copy answers from other lawyers from different sources.

- Your answer must be original and unique.

- It is prohibited to quote laws excessively without explanation.

- It is prohibited to offer your services bypassing the site (indicate contacts).

- It is prohibited to provide links to third-party sites unless absolutely necessary or without a client’s request.

- It is forbidden to be rude to the client

By consulting clients on Justiva.ru, you accept the rules for the provision of legal services. In case of violation, the administration has the right to delete your answers and limit your account from using certain functionality.

How to Calculate Pension Points for Soviet Experience 61 Years of Birth

- 1.8 points:

- Military service;

- raising a disabled child;

- maternity leave (first child).

- caring for an elderly person (over 80 years old) or a disabled person (group 1).

- 3.6 points - caring for a second baby.

- 5.4 points - caring for a third child.

The period of work carried out during the existence of the USSR and post-Soviet times (1991-2001) is difficult to account for due to the lack of automated systems at that time. All information about a person’s work in Soviet times was recorded in documentary (paper) form:

This is interesting: Indexation of Pensions for Working Pensioners in 2020 Latest News

Features of accrual of main and additional points

Every pensioner needs to know the specifics of accruing basic and additional points. Currently, the size of the insurance pension depends on the following indicators:

- individual, presupposing the presence of work experience, existing points, etc.;

- a fixed payment, the amount of which is determined by law.

There are no difficulties in the calculation, and below we will discuss how to correctly calculate your future pension.

Keep in mind that there is such a thing as additional pension points. They can be provided:

- persons who served in compulsory military service – 1.8 points;

- persons caring for an elderly person (over 80 years old) or a disabled person – 1.8 points;

- for a parent caring for a child under one and a half years old – 1.8 points;

- a parent caring for two children – 3.6 points;

- for a parent caring for three or more children – 5.4 points.

In other words, if you fall into one of the above categories, you may qualify for extra points.

How can you calculate pension points for Soviet service?

Increasing standards and requirements for receiving decent pensions are pushing future retirees to self-education. When retirement age approaches, the desire of a Russian citizen to independently determine the points for calculating subsequent monthly pension assistance becomes understandable.

While serving in the army, a soldier is given a coefficient of 1.8. In order not to get confused, Russian citizens are encouraged to use a convenient pension calculator posted on the official website of the Pension Fund of Russia https://www.pfrf.ru/eservices/calc/. The calculator is designed taking into account a variety of factors, which is why it is very popular among future retirees.

Rules for accruing pension points for Soviet experience

The length of service is used when calculating pensions for the period before 2002 and is an indicator of the employee’s total length of service. The earnings coefficient is an individual indicator of a citizen, determined for a month out of any 60 consecutive months within 10 years of service.

This is a recalculation of old-age payments for the Soviet period. It affected all senior citizens – those with mixed experience and those who are already pensioners. At the same time, all of them automatically receive an increase of 10%, and for those who have experience before 1991, 1% for each year.

The concept of coefficient based on experience and earnings

Those born before 1966 can only take into account the insurance option when calculating benefits; the younger generation has the right to use savings to increase old-age benefits.

You can find out what insurance experience is and according to what rules it is calculated in the article at the link.

Additional points are used in the following order:

- 1.8 points per year for conscripts and parents on parental leave for up to 1.5 years;

- if there are two one and a half year old children then 3.6 points;

- 3 children or more 5.4 points;

- caring for a disabled person/elderly relative 1.8 points.

The length of service is used when calculating pensions for the period before 2002 and is an indicator of the employee’s total length of service. The earnings coefficient is an individual indicator of a citizen, determined for a month out of any 60 consecutive months within 10 years of service.

In this case, breaks are not taken into account. To do this, it is necessary to divide the salary amount accepted for calculating the pension by the average monthly earnings.

What is the experience coefficient?

Valorization

This is a recalculation of old-age payments for the Soviet period. It affected all senior citizens – those with mixed experience and those who are already pensioners. At the same time, all of them automatically receive an increase of 10%, and for those who have experience before 1991, 1% for each year.

Since 2001, pension payments have increased by 352 rubles and by the beginning of 2002 its average amount was 1,600 rubles.

Calculation of the part of the pension earned before 2002

Attention - if the value of RP = SK x KSZ x 1671 (or RP = 0.55 x KSZ x 1671 in the case of incomplete experience) turns out to be less than 660 rubles, then RP = 660 rubles are used in the calculations.

The law imposes a restriction on the value of the SSC - the coefficient cannot be more than 1.2. An exception to the limitation of the upper limit of the KSZ value of 1.2 was made only for those who worked before 01/01/2002 in the regions of the Far North. For them, depending on the regional coefficient, the bar ranges from 1.4 to 1.9 - see reference materials .

Pension points for Soviet work experience

- It is forbidden to give a useless answer. The consultation must be complete and reasonable.

- It is prohibited to duplicate/copy answers from other lawyers from different sources.

- Your answer must be original and unique.

- It is prohibited to quote laws excessively without explanation.

- It is prohibited to offer your services bypassing the site (indicate contacts).

- It is prohibited to provide links to third-party sites unless absolutely necessary or without a client’s request.

- It is forbidden to be rude to the client

By consulting clients on Justiva.ru, you accept the rules for the provision of legal services. In case of violation, the administration has the right to delete your answers and limit your account from using certain functionality.

Pension calculator

The actual amount of the insurance pension is calculated by the Pension Fund of the Russian Federation when applying for its appointment, taking into account all the generated pension rights and benefits provided for by pension legislation on the date of assignment of the pension. For example, for disabled people of group I, citizens who have reached the age of 80, citizens who worked or lived in the Far North and equivalent areas, citizens who have worked for at least 30 calendar years in agriculture, who do not carry out work and (or) other working activity and living in rural areas, the insurance pension will be assigned in an increased amount due to the increased size of the fixed payment.

This is interesting: For Work in the Chernobyl Zone, Leave to the Ministry of Internal Affairs

These results of calculating the insurance pension are purely conditional and should not be perceived by you as the real amount of your future pension. To make the results easier to understand, all calculations are performed under constant conditions of 2020. For calculation purposes, it is accepted that the entire period of formation of your future pension rights took place in 2021 and you were “assigned” an insurance pension in 2021, taking into account the life plans you personally indicated, and also on the condition that you will “receive” all the years of your working life the salary you specified.

What are pension points, how are they awarded and calculated?

To better understand what pension points are and what the changes associated with recalculation from points mean, it is enough to compare the accruals before and after the change in the conditions for assigning pensions. In the pre-reform period, you only had to have experience and salary. The calculation was made based on the number of insurance contributions paid by employers.

Three years ago, as a result of the fight against gray wages, the requirements became more stringent. The PC was changed to IPC (individual pension coefficient). From 2021, the pension amount is based on a points algorithm. There are conditions for granting a pension:

Methods of obtaining

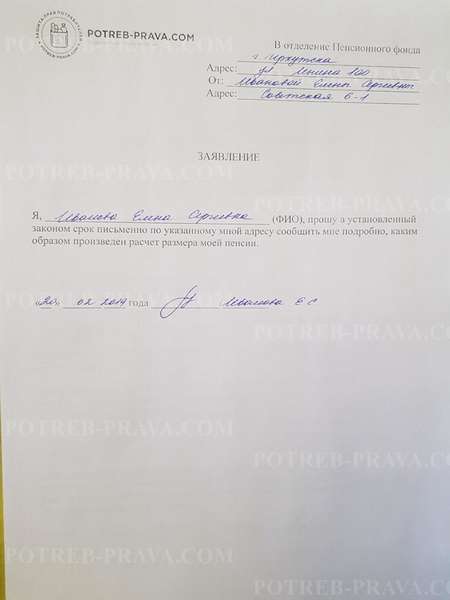

Applications to the pension fund for a full pension calculation free of charge in word format

In order to find out the number of accrued individual pension coefficients, you should:

- make calculations yourself using the information provided above,

- contact your local Pension Fund office for help,

- use a special calculator posted on the Internet.

If, when assigning pension payments, a pensioner finds out that Soviet-era work experience was not taken into account, he has the right to submit a corresponding application to the territorial division of the Pension Fund for recalculation of the pension.

The developed form for such an application can be found on legal websites on the Internet or on the official website of the Pension Fund.

ATTENTION! Look at the completed sample application to the pension fund for a full pension calculation:

Watch the video. How to calculate pension points:

How to calculate pension points for Soviet service with an example of calculation

Please note that under the new rules, retiring later will be beneficial! For each year of later application for a pension, the insurance pension will increase by the corresponding premium coefficients.

But there are limitations. A person can purchase no more than half of the insurance period, which is necessary for calculating a future pension. That is, a maximum of 7.5 years. In this case, the total number of points is not limited. More purchased - more pension assigned.

09 Jun 2021 uristlaw 228

Share this post

- Related Posts

- What is the Hazard Percentage of a Driver-Stoker in the Republic of Kazakhstan?

- Mortgages for Young People Over 35 Years of Age

- Application for Free Meals for Homeschoolers

- Civil Code of the Russian Federation debt collection

General information on Soviet experience

People who are retiring at this particular moment worked during the Soviet Union (before the collapse of the USSR in 1991).

A lot has changed in the period up to now, including when calculating pensions. Periods of labor and social activity for a future pensioner entail the appointment of an increase in pension according to a certain system. An example of calculation is given later in the article. The entire period of work experience is, conditionally, divided into 4 periods:

- until 1991;

- 1991-2001;

- 2002-2014;

- 2015 – present.

All information on the calculation of pensions, including for Soviet service, is presented in exhaustive quantities in Federal Law of Russia No. 173-FZ. It also provides examples of calculations and a formula according to which all calculations should be carried out.

From 2015, pensions will be calculated according to a certain new system with the accrual of special points. And for 2002-2014, the calculation was carried out based on the number of insurance premiums. In this article, we are more interested in Soviet and post-Soviet experience, so we will focus on this information, and its general essence comes down to specific numbers.

During the Soviet Union, all information was documented, therefore, in order to calculate and increase the pension, it is necessary to have such documents, confirming labor and social activities for these periods. This also applies to parental leave, military service, etc.

According to the law, having worked in Soviet times (documented), 1% is added to the pension amount for all years. That is, if a person worked and has a work experience of 4 years during the USSR (before 1991), his pension supplement will be 4%, if he worked for 17 years, then 17%, etc.

Also, by decree of the President of Russia, it was decided and established that, regardless of the provision of documents or the presence of work experience, in principle, for the period from 1991 to 2001, all pensioners will be accrued an additional 10% to their pension.

Soviet work experience is considered to be all work activity up to 2001 inclusive; it falls under the general calculation without division into Soviet and post-Soviet times.