Conscript service in the armed forces is gradually being replaced by contract service. A professional army means much more to the defense of the country than conscript soldiers. But military service is always associated with risks to life and health and leads to professional deformation of the individual. In this text, we will understand what kind of pension provision is guaranteed for contract soldiers and the assistance of a lawyer in Moscow in resolving pension issues for military personnel.

- Basic Concepts

- When can a contractor retire?

- Features of calculating pensions for contract workers

- Supplements to military pension

- Right to a second pension

Length of service

The procedure for retiring military personnel is determined by length of service: at least two dozen full calendar years, 25 years of total (military and civilian) service, of which at least half is service in the ranks of the Armed Forces (Armed Forces).

When continuing to work after retirement from the Ministry of Defense (Ministry of Defense), military payments are maintained on an equal basis with wages.

Periods of service included in the concept of length of service:

- actual fixed-term and contract service in the RF Armed Forces;

- in the Ministry of Internal Affairs (National Guard), criminal correctional institutions, Ministry of Emergency Situations, Federal Drug Control Service (drug control);

- obtaining education in military educational institutions and civilian universities;

- participation in military (combat) actions.

If a serviceman was arrested and deprived of his status, if his innocence is proven, the period of stay in custody will be counted towards his retirement experience.

Preferential length of service

Preferential length of service is time of service in conditions of increased complexity. To take it into account, a certain coefficient has been established. The use of indexation gives the right to early retirement and an increase in the amount of monthly payments. Veterans of the Patriotic War (1941–1945) who fought in penal companies (battalions) have the highest coefficient (in six years).

The following are:

- WWII veterans, internationalist warriors, liquidators of the 1986 accident at the Chernobyl nuclear power plant - within three years;

- participants of the Second World War who did not fight in the active army, partisans and other military units, military specialists, prisoners of concentration camps - a year or two;

- military personnel who served in border troops, territorially remote garrisons, some categories of military personnel of the Navy (Navy Fleet) and Aerospace Forces (Military Space Forces) - a year and a half.

When calculating preferential length of service, only the exact duration of stay in the listed conditions is taken into account. In case of dismissal from the military ranks before reaching 20 calendar years of service (“calendars”), military pension provision is not provided

Payment of pensions to military pensioners

Citizens who are assigned pension payments through the Ministry of Defense of the Russian Federation, the Ministry of Internal Affairs and other structures receive them in the following ways:

- through Russian Post - either at the post office itself, or to your home (depending on the choice of the pensioner). It is worth considering here that the delivery period via mail and the date of accrual of payments by the pension authority may differ from each other, and in order to avoid unpleasant situations and misunderstandings, the citizen must take this difference into account in advance;

- by transferring to an account in Sberbank of Russia - the most common method in our time: most often, a bank card is immediately attached to the account, and SMS notifications about changes in its balance are connected to it, so that when a pensioner receives a short message from the bank, he will immediately understand that he has arrived he received his pension.

The legislation provides for the possibility of a third party receiving a pension if a corresponding power of attorney is issued in his name from the citizen receiving the payment.

Period of payment of pensions to military personnel and members of their families

There are differences in the periods in which a military pension will be paid, depending on the type of payment:

- for a long-service pension - indefinitely (payments cease only in the event of death);

- in case of receiving a disability pension - for the period of validity of the ITU certificate (in other words, as long as the disability is established);

- in the event of the loss of a breadwinner - as long as a family member is considered disabled (up to 23 years of age for the children of the deceased if they are studying at a university on a full-time basis, or up to 18 years of age if they go to work or go to part-time study, or do not study at all). For citizens who have reached 60 and 55 years of age (for men and women, respectively) - for an indefinite period.

No additional income, including income from business activities, deprives the right to receive a pension, with the exception of bonuses provided for non-working pensioners.

Payment of pension in case of death of a pensioner

If the pensioner dies, the amount of the lost pension will be paid to his family members. However, there are two options defined by the Law of the Russian Federation of February 12, 1993 N 4468-1 and indicating exactly how this will happen:

- if family members take part in organizing the funeral, the unpaid pension amounts will be paid without including them in the inheritance. Most often, to confirm the fact of organizing a funeral, pension departments require documents from funeral services

(checks, receipts, contracts, etc.) - in other cases, payments are made to the heirs on a general basis. In this case, persons wishing to enter into an inheritance will need to contact a notary, provide all the necessary documents grounds for entering into an inheritance and start an inheritance case.

Consequences of the abolition of pensions for military personnel

Speaking about whether benefits for security forces will be abolished from 2021, it is important to note that expert opinions on this issue are divided. Many supported the idea of depriving military personnel of pension benefits

Proponents of abolition point out that upon retirement, a significant amount is paid to the military. They propose to develop a law according to which a military personnel discharged from the reserve will be able to receive an education and work in a civilian profession, if there is such a need.

Whether military personnel will be deprived of pension benefits depends on how long the instability in the economic situation continues. If such a period drags on, politicians can put into effect all the laws that are currently being discussed.

Speaking from the point of view of financial security, one-time payments cannot be compared with monthly security.

Soon after deprivation of military benefits, the following consequences will appear:

- a one-time payment will not provide a decent standard of living for a citizen over a long period of time;

- the absence of social adaptation programs will affect the fact that former military personnel will be left without means of subsistence;

- there will be a decline in the authority of military service.

The calculation of benefits for military personnel is based on the magnitude of reduction factors. The use of this concept is associated with 2012. Since that time, the indicator has been 54%. This means that the pension cannot be more than 54% of the salary received by the military.

It is planned to increase this indicator in October 2020. Due to the changes, the coefficient will be 73.68%.

Speaking about the year in which the funded part of the pension was abolished, it is important to take into account that changes in this direction affected not only those who are serving in military service. Savings have been suspended since 2015

At present, it is difficult to talk about the scale that the military pension reform will bring, since it is impossible to predict the reaction of citizens. All that can be said is that the adoption of such a law will reduce the authority of military service.

Thus, the abolition of military pensions will have a beneficial effect on the country's budget. Moreover, the result of these innovations will not only be positive. A negative point will be a decrease in the authority of authorities.

Pension provision for military pensioners is regulated by a number of laws, the main one of which is the Law of the Russian Federation of February 12, 1993 N 4468-1 (the latest changes made to it date back to December 20, 2021).

Thus, pension provision for military personnel and members of their families involves the payment of a pension, the amount of which depends on a number of factors. These include such as the cause of loss of ability to work (this can be either the presence of sufficient length of service, military or mixed, or disability caused by various circumstances).

The pension reform, which has been carried out in the country since 2014, also affected them. However, the changes made can be assessed as rather positive. Among them are:

- a new calculation formula, which involves the introduction of double pension standards and calculation of length of service;

- increasing bonuses for certain categories of employees who showed activity and initiative in their work;

- raising the retirement age ceiling;

- the right to receive an increased pension if you retire later than the established period.

At the same time, all the benefits that military pensioners are entitled to are preserved.

Of particular relevance is the issue of indexing military pensions. The program adopted several years ago by the government establishes that pensions must be recalculated annually to cover inflationary processes. However, the current difficult economic situation in the country causes certain difficulties in implementing such a measure.

Given that expectations of receiving a higher pension last year were not met, all attention is now focused on 2020: at the beginning of 2021 it became known that from October 1, 2021, military pensions will be increased by 6.3%

Specifics of pension calculation

Since 1993, the timing of military retirement is calculated according to the law “On pension provision for persons who served in military service and service in internal affairs bodies.”

The length of service of military personnel applying for a long service pension starts at 20 years. In the case of a mixed type of activity, half of the duration of work must relate to the time of military service. When calculating the latter, preferential coefficients are taken into account, for example, pensions for participants in clashes in hot spots and Chernobyl victims. In 2014, amendments were adopted to Art. 49, 53 Federal Law “On Military Duty and Military Service”, from now on the retirement age limit for men increased by 5 years and amounted to 50 years for ordinary personnel (soldiers, contract sergeants), colonels and captains must serve up to 55 years, The average general corps retires at 60 years of age, and the senior command staff at 65 years of age. This measure did not affect women who wear shoulder straps under 45 years of age.

To calculate pensions for retirees, the norms of federal laws No. 173 Federal Law “On Labor Pensions in the Russian Federation”, 4468-1 Federal Law “On pension provision for persons who served in military service” are applied. The percentage coefficients of material support are determined by the reason for entering a well-deserved retirement.

http:

The long-service military pension is equal to half the average amount of salary. An increase of 3% is assigned for each year of service beyond the established standard of service; in general, the amount of the increase is allowed up to 85% of a certain salary. When taken into account in the total length of civil and military service, the value of the military pension for length of service is equal to half of earnings with an additional payment of 1% for the number of overtime years.

Assignment of pensions to military pensioners

Current legislation actually separates two categories of citizens who served (or are serving) in the Armed Forces and are entitled to receive a pension. These categories are described in the Law of the Russian Federation of February 12, 1993 N 4468-1, as well as in Article 4 of the Federal Law of December 15, 2001 N 166-FZ:

- military personnel under contract in the Russian Federation, in the CIS countries or other countries as officers, midshipmen, soldiers, sailors, etc. (if there are/absence of relevant agreements with these countries);

- persons who served in the army on conscription and who were diagnosed with a disability due to a military injury or illness not related to the direct performance of official duty (but acquired during service or within three months after dismissal).

Depending on their membership in one category or another, citizens will receive either a military pension (in the first case) or a state pension (in the second).

As mentioned above, the appointment of this type of payment for citizens serving under a contract is carried out by the Ministry of Defense, the Ministry of Internal Affairs of the Federal Penitentiary Service or the FSB in accordance with the current legislation applied to social protection authorities. Pension provision for conscripts who have become disabled is provided by the Pension Fund of the Russian Federation.

When to apply for a pension?

As in all other options, in the case of military pensions, applying for appointment to the pension authorities upon acquisition of rights to it. The right may be length of service (a sufficient number of years in service in the Armed Forces), the establishment of disability (due to a military injury or due to an illness acquired during service) or the loss of a breadwinner who was a serviceman.

Based on the articles, and the Law of the Russian Federation of February 12, 1993 N 4468-1, it is possible to draw up a table with the conditions for applying for payments.

| Type of pension | When to Apply for an Appointment |

| For length of service | More than 20 years of service, or more than 25 years of total work experience, including 12.5 years of service in the Armed Forces |

| By disability | Determination of group I, II or III disability by medical and social examination bodies |

| On the occasion of the loss of a breadwinner | Upon the death of a serviceman with disabled dependents |

How to apply for a military pension?

To apply for a pension, citizens undergoing military service must contact the pension authorities of the Ministries or Federal Services where the citizen served, or the territorial body of the Russian Pension Fund at the place of residence - depending on the circumstances giving the right to this payment.

If you receive a military pension (not for conscripts who have become disabled), it is important to register with the military registration and enlistment office at your place of residence, providing the appropriate documents. The main option is described here; the package of documents may vary depending on the circumstances:

The main option is described here, the package of documents may change

depending on the circumstances:

- a passport with registration at the place of residence controlled by this military registration and enlistment office (for example, if a citizen is registered (or temporarily resides) in the Yasenevo district of Moscow, he must apply to the Cheryomushkinsky military registration and enlistment office);

- military ID with marks and corresponding seals;

- private bussiness.

After a citizen has registered with the military commissariat, he can submit documents for a pension to the pension department of this institution.

Documents for registration

In order to receive a military pension, a serviceman (or members of his family) must provide the following documents to the pension department in 2019:

- passport;

- military ID or other document confirming military registration;

- photo 3x4;

- a certificate from the territorial body of the Pension Fund stating that the serviceman does not receive other types of pension;

- work book or other documents confirming the length of service (if the payment will be made based on the total length of service);

- a certificate of disability (issued by the federal medical and social examination bodies), as well as the conclusion of the military medical commission - if the pension is issued on the basis of disability;

- death certificate of a serviceman, as well as a certificate of family composition, certificates from places of study and other documents - when applying for a military pension in the event of the loss of a breadwinner.

Features of calculating pensions for contract workers

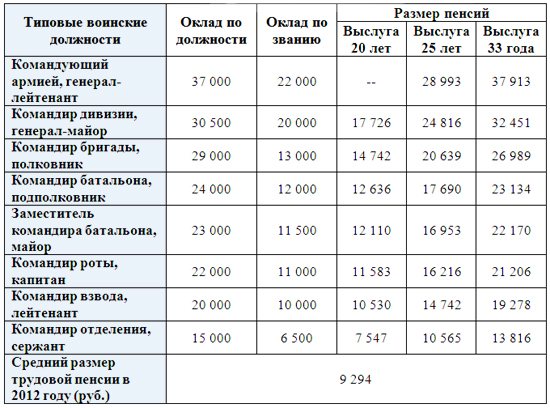

The pension of contract workers depends entirely on the amount of monthly allowance they receive. Consequently, it is possible to quite roughly calculate what kind of pension benefits a serviceman who has served under contract can claim.

- By length of service with special experience of more than 20 years - 50% of the DD. For each year above the minimum length of service, 3% is added.

- According to length of service with special experience of 12.5-20 years - 50% of DD. For each year above the minimum length of service, 1% is added.

- For disability, when assigning groups I and II due to military trauma - 85% DD.

- For disability, when assigning group III due to military trauma - 50% of the disability.

- For disability, when assigning groups I and II due to illness - 75% DD.

- For disability, when assigning group III due to illness - 40% DD.

Survivor pensions depend on the circumstances under which the breadwinner died. If death occurs while on duty, disabled recipients are paid 50% of the DD amount. If a serviceman dies while not on duty and his death is in no way related to service, the dependent is entitled to no more than 40% of the DD.

Types of state support for former military personnel and their families

Retirees and their relatives are provided with financial support depending on the reason for leaving service. Namely:

- by length of service;

- due to disability;

- for the loss of a breadwinner to family members.

Each of the above types of payments to retirees and their relatives has its own nuances. The methodology for assigning software is contained in Law No. 4468-1. However, there are general subtleties that are taken into account in any case:

- A serviceman is free to return to service if his health allows. In such a situation, pension provision stops. It will be resumed only after the next resignation.

- A retiree who receives financial support from the state budget has the right to find a job:

- under a rental agreement;

- Start your own bissnes.

The fact of participation in labor activities will not affect accruals. The exception is the allowances established for non-working pensioners.

Pension accruals based on length of service

This type of software is assigned to defenders of the Motherland subject to the following conditions:

- transfers to the reserve;

- having at least 20 years of military experience (called length of service).

Attention: if the officer returned to service, then the reassignment of software is made taking into account additional length of service. In other situations, other criteria for receiving government support apply.

These include leaving service:

In other situations, other criteria for receiving government support apply. These include leaving service:

- due to reaching the age limit;

- due to disability;

- due to reduction.

The criteria for granting a pension in the above situations are:

- 45 years of age at the time of dismissal;

- having a total work experience of at least 25 years, of which:

Important: employees of the police, prosecutor’s office, Ministry of Emergency Situations and others established by the relevant legislative acts are treated as military personnel.

When is state support for disability assigned?

Defenders of the Motherland and law and order are provided with financial support from the state budget in the event of a disability that prevents further service. The criteria for receiving this type of income are:

- disability must occur during service or within 3 months after leaving it;

- later registration of disability is associated with a disease that arose during military service.

According to the current legislation, the state of disability is recorded by medical and social examination bodies (MSE). In particular, specialists identify the cause of the patient’s condition. And the category of a military pensioner depends on it. They are divided into persons who have received disabilities:

- due to injury;

- due to a disease that arose during military service.

Important: financial support for this category of citizens is assigned for the period of disability determination (until the next re-examination). An indefinite pension is paid to persons who have reached the maximum age for employment:

An indefinite pension is paid to persons who have reached the maximum age for employment:

- 60th anniversary of women;

- 65th anniversary for men.

State support for military family members

Relatives of soldiers and officers who are dependents are also entitled to financial support from the state budget. It is installed in the following situations:

- death of a serviceman while on duty or within a three-month period after discharge from service-related injuries and illnesses;

- death while receiving a military pension;

- death within a period of up to five years after the termination of maintenance payments;

- death in captivity (in the absence of evidence of a criminal act against the Motherland);

- missing.

Important: financial support is provided to every disabled dependent of the Defender of the Fatherland. The following have the right to apply for payments from the federal budget:

The following have the right to apply for payments from the federal budget:

- Military children:

- minors;

- at the age of 18 to 23 years, subject to full-time education;

- Spouses or parents:

- recognized as incapable of work for any reason:

- having no other income;

- A relative caring for the young children (until their 14th birthday) of the deceased breadwinner;

- Grandparents of the deceased in the absence of another supporter.

Attention: a preferential procedure for providing a survivor's pension has been established for spouses and parents of deceased defenders of the Fatherland

Right to a second pension

Former military personnel can be re-employed in a civilian occupation. At the same time, the transfer of contributions to the Pension Fund by the employer entitles workers to receive pension benefits if:

- Reaching the age limit for compulsory employment:

- 65th birthday for men;

- 60th birthday for women;

- Compliance with the following conditions in 2021:

- having 11 years of insurance experience (10 years in 2021);

- accrual of 18.6 pension points (16.2 points in 2021).

Important: the requirements are increasing every year, in accordance with the new “civil” pension legislation. By 2024 it will be necessary to have 15 years of experience and 30 points by 2025.

Features of assigning military pensions

Retired officers and soldiers receive benefits established by other legislation. Namely:

- the assignment of accruals is regulated by Law No. 4468-1, approved on February 12, 1993;

- all payments are made from the federal budget;

- funds for the state maintenance of this category of citizens are transferred not through the Pension Fund of Russia (PFR), but through the relevant ministries.

Important: military personnel who served as conscripts as soldiers, sailors, sergeants and foremen, who became disabled as a result of military injury or illness during military service, will receive payment based on Law No. 166-FZ of December 15, 2001. Members of military families are also provided for by the state in the event of the loss of a breadwinner for any reason:

Members of military families are also provided for by the state in the event of the loss of a breadwinner for any reason:

- death during the performance of duty;

- death from old age or disease.

Military pensions in 2021 were indexed, like those of all other citizens. Previously, they, like everyone else, were paid five thousand in compensation. The financial support of retirees is calculated on the basis of a military personnel allowance (MSS). In some situations, the amount of allowance increases. Due to the fact that military personnel go on vacation early, they are allowed to continue working in civilian life. For this, the former military may be assigned a second pension, without stopping the payment of the previous one (that is, they will receive two at once).

Attention! In 2012, May presidential decrees instructed officials to increase military pensions each year by 2 percent above projected inflation. In particular, by increasing the reduction factor applied to military pensions

However, this has not yet been accomplished. And in 2021, the increase in the coefficient was completely suspended.

As a result, starting from 2013, military and departmental pensioners do not receive the indexation due to them. In 2019-2021 the promised increased indexation will also not happen. This is already reflected in the federal budget for the corresponding period. Indexation instead of the due amount - 5.4% will be at the level of 4.3%. At the same time, the planned inflation will be 3.4%. and the reduction factor will remain unchanged - 72.23%.

In the next 2 years, pension payments will be indexed in 2021 - by 3.8% and in 2021 - by 4%.

Download for viewing and printing:

Benefits and privileges for veterans

Veterans of this category include participants in armed conflicts, service personnel of a military unit, drivers and freight forwarders, pilots who penetrated enemy territory, miners and performers of military missions. To receive benefits and additional payments to a military pension, combat veterans must provide a certificate of the established form, issued at the place of residence.

Let's look at a number of significant pension benefits for combat veterans.

- Tax relief. Participants in military clashes do not pay property taxes and state duties in various budgetary institutions, and have benefits on land and transport taxes. The monthly tax deduction varies from 500 to 3000 rubles. The minimum tax deduction amount is 500 rubles.

- Pension benefits. Military pensions for combatants are significantly higher than the average civilian pension. An additional payment is made every month: in 2016 it was set at 2,500 rubles.

- Solving the housing problem. Veterans of military operations who registered with the state before 2005 have the right to expect to receive housing or a plot of land for building a house, and receive discounts when paying for housing and communal services.

- Free medical care, benefits for treatment in medical institutions, sanatoriums, and the purchase of medicines.

- Priority when installing a telephone in an apartment, purchasing transport tickets, and providing medical care.

- Working veterans receive annual paid leave upon request and, in addition, extraordinary rest without pay. Military personnel who served in a combat zone for 3-6 months are entitled to 20 days of paid rehabilitation leave.

- Funeral services. The state reimburses the family's burial expenses.

Benefits for dead or deceased combat veterans apply to family members who have lost their breadwinner. Close relatives reserve the right to housing and other social guarantees. For minor orphans of veterans, a five percent discount is provided when obtaining vouchers to health camps. If a widow enters into a marriage, the benefits are canceled.

Assignment and payment of pensions to military personnel

An application for pension support must be sent to the body where the defender of the Motherland and law and order served. The Pension Fund assigns financial support to conscripts, just like civilians. They should contact their local office.

In order to receive maintenance, retirees must provide the following to the relevant ministry or department:

- application;

- documents proving the right to receive payments from the federal budget (for example, an ITU certificate).

A package of documents can be provided:

- in person or through a representative to see a specialist;

- by post.

The application is usually processed within ten working days. This period is counted from the moment:

- filing an application;

- providing the last missing paper.

If a positive decision is made, transfers begin on the first day of the month the right to them becomes available. In this case, you can receive state support:

- through a branch of the Russian Post;

- to a bank card (account).

Important: it is necessary to promptly inform the government agency making the transfers about the death of the recipient. Overpaid funds are recovered from fraudsters in court

Arbitrage practice

It is obvious that the trends discussed above towards an actual reduction in material support for military pensioners could not but become a cause of discontent among citizens belonging to this category. Thus, in 2015, a public organization of pensioners from the Moscow region filed a complaint with the Constitutional Court of Russia, according to which the reduction coefficient was declared contrary to the Constitution of the Russian Federation as it worsened the financial situation of military pensioners.

Reducing material support for military pensioners

In addition, the initiative group in its complaint drew special attention to the existing exceptions to the procedure for calculating the amount of pension provision - in particular, the mentioned coefficient is not used to determine the amount of pensions for employees of the military prosecutor's office, military bodies of the Investigative Committee of the Russian Federation, as well as judges of the Military Collegium of the Supreme Court of the Russian Federation and military courts. The reaction of the highest authority was to refuse to recognize the provisions outlined in the complaint as contrary to the Constitution

He was motivated by the fact that the current legislation does not contain clauses that in one way or another determine the reduction of pension support for military pensioners, and the exclusion from the general principle of certain categories of employees of military institutions is associated with the peculiarities of their activities and the specifics of their legal status. What exactly this specificity is was not explained in the answer.

The reaction of the highest authority was to refuse to recognize the provisions outlined in the complaint as contrary to the Constitution. He was motivated by the fact that the current legislation does not contain clauses that in one way or another determine the reduction of pension support for military pensioners, and the exclusion from the general principle of certain categories of employees of military institutions is associated with the peculiarities of their activities and the specifics of their legal status. What exactly this specificity is was not explained in the answer.

The Russian pension system is full of ambiguities and contradictions. Nevertheless, any citizen of the country who has devoted many years to work for its benefit can apply for well-deserved financial support, and knowledge of the principles and patterns of functioning of this system will help to achieve the cash payments provided for by law as quickly and efficiently as possible.

Video about providing housing for military personnel:

Mar 30, 2018

Supplements to military pension

There are a number of reasons for increasing the pension provision of a contract soldier. Thus, for Heroes of the Russian Federation and the USSR, a 100% increase in the amount paid is provided. Recipients of the Order “For Service to the Motherland” may qualify for a 15% increase in pension pay. Moreover, the increase in content is not made once, but for each award.

An increase in pension benefits is provided in accordance with regional coefficients. A contract worker's pension will increase if he moves to the Far North or to areas that are equivalent to it. Also, the increase in salary will remain when leaving the Far North (regions equivalent to it), if special military experience is acquired in service in these harsh conditions.

Description of Federal Law 4468-1

Military service is one of the most risky, specific jobs that requires responsibility. In addition, security service employees are regularly exposed to danger and stress, which results in deteriorating physical health. For these and other reasons, the working age of military personnel has been reduced to 45 - 55 years, according to the Constitution of the Russian Federation. Upon reaching retirement years, according to the law, military personnel are entitled to payments, benefits and compensation from the state. These provisions are regulated by Federal Law No. 4468-1.

Federal Law on military personnel in the latest edition is here:

According to the Federal Law, in the Russian Federation pension accruals are due to citizens serving in the Ministry of Defense of the Russian Federation, the Ministry of Internal Affairs, the FSB (the law on the FSB is here:), the Ministry of Emergency Situations and other executive authorities where military affairs are provided. The law states: the size of the pension for military personnel and their families is calculated based on the average salary, position and military rank, the interest rate for length of service, as well as payments related to the indexation of cash benefits. Disabled persons injured while performing military service are entitled to additional monetary compensation.

Also read more about Federal Law No. 69 here:

Summary of Federal Law No. 4468-1:

- Ch. No. 1 - describes the types of pension insurance and the procedure for assigning payments;

- Ch. No. 2 - the amount of a fixed military pension and additional compensation for length of service;

- Ch. No. 3 - procedure for assigning a disability pension;

- Ch. No. 4 - conditions for receiving pensions for relatives of deceased military personnel in the event of the loss of a breadwinner;

- Ch. No. 5 - the procedure for calculating military benefits;

- Ch. No. 6 - general procedure for payment of pension insurance.

What types of pensions does the state provide?

When retiring, people have many questions. What types of payments are there, how are they assigned and how are pensions calculated for military pensioners? It is very difficult for people who have connected their lives with serving their homeland. Military personnel are always close to danger; their work is not only a great responsibility and complexity, but also poses risks to life.

What is included in a military pension? Military service takes away sleep, health, and sometimes even life itself. Based on this, government agencies showed concern for the quickest transfer to VP of people whose service is extreme.

Are military retirees entitled to additional payments? Pension provision for military personnel in Russia differs from other payments prescribed by the state. VP can only be awarded to a person who has served in the army. This could be service in the Ministry of Emergency Situations, in the tax structure, in the State Tax Committee, in the Armed Forces of the Russian Federation, in the Federal Penitentiary Service. All people who served in the above departments have the status of military personnel and therefore can receive military service. The state provides the following types of military pension:

- Pension payments based on length of service.

- Disability pension payments.

- Pension payments in connection with the loss of a breadwinner.