Who is entitled to a preferential pension?

The right to such a pension is granted on the basis of the following conditions:

- Work involving heavy physical activity.

- Working under adverse conditions.

- Labor activity in the Far North.

- Activity in conditions equivalent to the Far North.

- A position involving work for a limited period followed by retirement.

The right to medicinal product is not canceled if the person continues to work. A person has the right to receive both a pension and a salary at the same time.

Who is entitled to an early old age insurance pension ?

Calculation of preferential pension

There is no fixed amount of pension payments for beneficiaries. Their size is determined by the general indicators of the insurance period, the amount of insurance premiums and accumulated insurance points.

You can calculate your pension using the following formula:

SP=IPK*SPB+FV, where:

SP – the amount of the insurance pension.

IPC – number of pension points.

SPB – the cost of one pension point.

FV – fixed payment. The cost of pension points and the size of the fixed payment is indexed every year. In 2021, one point costs 87 rubles 24 kopecks, the payment amount is 5334.19 rubles, and for some preferential categories it is even higher.

Assignment of a pension due to special conditions

When working in some industries, people suffer harm to their health. This may be due to a harmful microclimate and heavy physical labor. The need to assign a preferential pension is associated with the prevention of significant harm to human health. There are a number of categories of harmfulness. This is the so-called list No. 1 and list No. 2. They were approved by Resolution of the Council of Ministers dated October 2, 1991 No. 517.

Is the period of training included in the special work experience that gives the right to an early pension?

List No. 1

This list includes work in the following conditions:

- Hot metallurgical and mechanical engineering workshops.

- Chemical production.

- Mining industry (underground work).

- Working with a melting furnace.

- Rescue services.

Employees such as geologists and timber harvesters are entitled to LP.

How to apply for an early old-age insurance pension ?

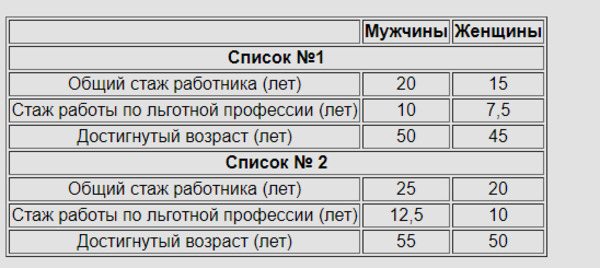

For early retirement, the total length of service must be 20 years for men and 15 for women. Specifically, in the specified production conditions, men must work for 10 years, and women - 7 years and 6 months. If a person has worked in several positions related to hazardous conditions, both jobs are combined into a total length of service. For example, a woman worked in a hot metallurgical shop for 4 years and worked in the mining industry for 4 years. “Special” experience will be 8 years. That is, the woman receives the right to a preferential pension.

IMPORTANT! If the “special” experience required for the appointment of a drug is incomplete, it can be supplemented by experience in the work included in list No. 2.

ATTENTION! The experience in hazardous work may be incomplete. However, if a person has worked more than half of this length of service, one year is deducted from the retirement age for each year of employment. For example, the retirement age for men is 60 years. He worked in hazardous work for 6 years, that is, more than half of his required length of service. Therefore, the retirement age will be 54 years.

List No. 2

Works from list No. 2 are less harmful than list No. 1. This includes:

- Employees of maritime and urban transport.

- Aviation workers.

- Employees of the food and light industry.

- People employed in pharmaceutical production.

- Mineral miners, if the work is not done underground.

- Medical workers.

- Parachutists.

- Theater workers.

- Ballet and circus performers.

The right to a medicinal product is granted with a total length of service of 25 years (for men), 20 years (for women). Employment in positions on list No. 2 should be 15 years (for men), 10 years (for women).

IMPORTANT! If the length of employment in positions on list No. 2 is incomplete, but exceeds half, for every 2 years of work a year is subtracted from the retirement age.

Who is entitled to

Employees working in unfavorable conditions can take advantage of the opportunity to receive an early pension. The list of professions and specialties involving increased complexity was determined back in Soviet times, when two categories (lists) of the most dangerous activities were identified. The legislative act regulating this issue, adopted by the Supreme Soviet of the USSR, is still in force today.

List No. 1

List No. 1 contains a list of types of professional activities that are the most dangerous and undermine health due to extremely unfavorable working conditions. Here we assume specialists working in mining industries, foundries, involved in working with toxic chemicals and explosives.

The right to a preferential pension for male workers in this group arises after 10 years of work in hazardous conditions, which is guaranteed by law. At the same time, the age for retirement is reduced by the same period. In total, you need to work for two decades.

Women are entitled to benefits only if they have completed 7.5 years of “harmful” work experience; the age is reduced by 10 years. Total experience of 15 years.

List No. 2

List No. 2 contains a list of types of professional activities that involve difficult working conditions, the nature of which leads to early loss of ability to work.

These, among other things, should include specialists working in the railways, construction industry, communications, etc.

The age for workers in these groups is reduced by 5 years. Moreover, the conditions under which they have the right to count on benefits are much more complex. In other words, you need to have more work experience both in general and in hazardous production in particular.

For employees whose professional activities involve harmful and difficult working conditions, additional insurance premiums must be paid:

- from the first list – 9%;

- from the second list – 6%.

Important! If the organization has carried out special events related to the certification of workplaces, then based on the results of a special assessment of working conditions, a differentiated approach can be applied to calculate the amounts of additional insurance contributions.

Doctors

The work of doctors is also associated with working conditions that pose a certain risk and tension, therefore, a preferential retirement procedure has been developed and applied for them, but subject to a number of conditions, including those related to the place of work and position held. Thus, the right to a benefit is given by working in the following healthcare institutions:

- hospitals;

- clinics;

- dispensaries;

- antenatal clinics;

- maternity hospital;

- MSCh;

- FAPs;

- SMP;

- blood transfusion stations;

- military hospitals and infirmaries.

Employees of the above-mentioned institutions must work in positions included in one of the following groups:

- doctors;

- nursing staff (nurses, midwives, paramedics, laboratory assistants, etc.).

Specialist doctors who hold administrative positions and do not actually carry out medical activities also have the right to count on benefits.

To have a legal right and be able to receive a pension, they must have at least thirty years of experience in medicine if they are in the city, and at least 25 years if working in the countryside.

Teachers

Pedagogical activity involves increased psycho-emotional stress, which also leads to early loss of ability to work. In this regard, the law provides for early retirement for this category of workers. Like doctors, this opportunity depends on length of service, which is at least 25 years of work in the following institutions:

- schools (general education, correctional, gymnasiums, lyceums);

- institutions of further education;

- orphanages;

- Secondary educational institutions and vocational schools;

- kindergartens and nurseries.

Teacher positions that give the right to early retirement are strictly defined by law. Among them, the following should be highlighted:

- teachers (including primary school);

- directors, head teachers;

- educators;

- speech therapists.

Working in the north

Labor activities carried out in difficult and sometimes extreme conditions of the Far North also involve the accrual of an early pension.

The requirements for “northerners” are such that they must have 15 years of work experience in the Arctic and tundra zones (Far North), and 20 years in areas with similar conditions. At the same time, we should not forget about the mandatory minimum work experience in general.

Attention! Localities equated to the regions of the Far North, according to geographical principles, are not part of the Arctic and tundra belts, however, the unfavorable natural conditions characteristic of them require additional benefits for people working there.

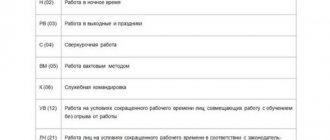

Features of calculating work experience

To determine length of service, one work record book is not enough. A document confirming full-time employment in hazardous production will also be required. The length of service does not include the following periods:

- Administrative leave.

- Holiday according to BiR.

- Holiday to care for the child.

- Business trip if it lasts for a long time.

- Execution of government duties.

- Leave due to study.

The period of sick leave is included in the length of service.

ATTENTION! If an employee is injured at work, which leads to disability, he does not lose the right to a preferential pension.

Important nuances

Some professions require a special procedure for calculating length of service. For example, the list does not include such a specialty as a diver. However, it is clear that full-time work is not relevant for this profession. It is impossible to dive under water for 8 hours in a row. In this case, a full load is considered to be 25 hours of diving per week, 275 hours per year, 2760 hours per 10 years. If there are not enough diving hours, the work experience will be incomplete.

Under certain conditions, the following coefficients are used when calculating length of service:

- Service in leper colonies and anti-plague institutions - length of service is multiplied by 2.

- In the Far North or in conditions equivalent to it, the length of service is multiplied by 1.5.

There is a special procedure for calculating length of service when working in the Far North. To receive a preferential pension, a man in this case must work for 15 years, and a woman – 10 years. In conditions equivalent to the Far North, the duration of work for men should be 20 years, for women - 15 years.

IMPORTANT! A preferential pension is a right, not an obligation. An employer cannot force an employee to leave work before reaching general retirement age.

Features of determining length of service for seasonal work

There is a special list of seasonal work for which an employee is entitled to receive a preferential pension. The list includes peat mining and field surveys by geologists. Seasonal work, if indicated in the lists, is counted for the year. For example, an employee works only in the summer. In this case, a year will be counted towards the length of service. This calculation method is relevant if the employee worked the entire season or completed work early due to injury.

Long service pension

A long-service pension involves the assignment of payments after a certain length of service has been completed. It is assigned to employees of the Ministry of Internal Affairs. Employees become eligible for a pension after 20 years of service. For 20 years of service, 50% of the pension is accrued, for each subsequent year - 3%.

The following specialists also receive the right to a long-service pension:

- Employees involved in mining.

- Mine rescuers.

- Teachers.

- Doctors.

- Fire service employees.

- Military.

In most cases, the length of service required to receive a long service pension is 25 years for men and 20 years for women.

List of professions giving the right to early retirement

In December 1991, a list of professions for early retirement was determined. Based on the intensity of the impact of harmful factors on the human body, it was divided into two lists. The first included particularly dangerous conditions, the second - harmful. The benefits provided for each list also differ.

The general list includes:

- mining operations related to the extraction of minerals;

- metallurgy: steelmaking, rolled metal, production of pipes and hardware (cookers, gas workers, roasters);

- chemical production of ammonia, urea, mercury, synthetic rubbers and plasticizers;

- production of explosives used in industry and for the needs of the Armed Forces;

- organization and provision of transportation by rail: drivers, inspectors and attendants;

- production of medical products;

- typists of specialized agricultural transport;

- doctors and teachers, as well as trainers and instructors performing duties in accordance with their position;

- drivers of regular buses or trams;

- dispatchers and flight directors of civil aviation;

- FSIN employees, rescuers and firefighters;

- circus and theater artists, ballet dancers;

- workers with radiation and other specialists in accordance with government decree No. 10 of January 26, 1991.

Men with a profession from the first list, in order to receive the benefit, are required to work in the relevant position for at least 10 years and have 20 years of total experience. When both conditions are met, the retirement age is reduced to 50 years. For women, 7 years of preferential experience and 15 years of general experience are enough. They will be able to retire at 45 years old.

Preferential pension provision for the second list of professions is assigned if a man has accumulated 12.5 years of work in hazardous production and earned 25 years of insurance experience. For women the indicator is 10 and 20 years, respectively. A man retires at 55, a woman at 50.

How and for whom preferential conditions have changed in connection with the reform

The pension reform, which began in 2021, has affected a large number of Russian citizens. Some of the negative consequences of the current reform of the pension system were also felt by employees planning to receive preferential payments.

Thus, the increase in retirement affected, first of all, “northerners” . Now people who worked in the difficult climatic conditions of the Arctic and tundra, as well as areas similar to the Far North, will retire 1 year later every year, until in 2024 the retirement age figures for them stop at around 55 years and 60 years depending on gender.

For doctors and teachers, much will remain the same. Thus, there are no plans to increase the length of service; it will be 25 years for teachers, and 25 years and 30 years for doctors, depending on the area of work. However, there will be a gradual postponement of the exercise of the right to receive payments, that is, they will continue to be accrued, but not paid immediately. Thus, employees who applied for a pension this year will begin to receive payments only next year. The maximum deferment period will be 5 years by 2024.

Reference! The only category of beneficiaries who were not affected by the pension reform at all were workers in hazardous industries. For them, the rules and conditions for receiving benefits remained the same as before.

Persons working in specific conditions deserve additional incentives. It is provided by the state not only in the form of various material bonuses and coefficients to wages and pensions, but also by a preferential procedure for retirement. Even under the conditions of reforms, these categories of workers, for the most part, retain their benefits.

Workers from lists No. 1 and No. 2 and insurance premiums

The organization is located at OSN, the type of activity is electrical installation work. There are preferential professions of foreman and foreman, who are entitled to early retirement. We did not formalize them, we want to formalize them and submit them retroactively for all the years of the organization’s existence.

Please explain step by step what documents are required? What additional tariffs apply and from what period?

According to Art. 27 of the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation”,

an old-age labor pension

is assigned before reaching the generally established age, in particular:

– for men over 50 years of age

and women upon reaching the age of 45 years, if they have worked, respectively, for at least 10 years and 7 years 6 months in underground work, in work

with hazardous working conditions

and in hot shops and have an insurance period of at least 20 and 15 years, respectively;

– for men upon reaching the age of 55 years

and women upon reaching the age of 50, if they have worked in jobs

with difficult working conditions

for at least 12 years, 6 months and 10 years, respectively, and have an insurance record of at least 25 and 20 years, respectively.

Lists of relevant works, industries, professions, positions, specialties and institutions

(

organizations

), taking into account which

an old-age labor pension is assigned early

Decree of the Government of the Russian Federation dated July 18, 2002 No. 537 established that with the early assignment of an old-age labor pension in accordance with Art. 27 of the Federal Law “On Labor Pensions in the Russian Federation” lists of production, work, professions and positions apply

(with additions and amendments to them), approved by the Cabinet of Ministers of the USSR, the Council of Ministers of the RSFSR and the Government of the Russian Federation,

in the following order

:

– in case of early assignment of old-age labor pension to workers engaged in underground work, in work with hazardous working conditions

and in hot shops, -

List No. 1

of production, work, professions, positions and indicators in underground work, in work with particularly harmful and especially difficult working conditions, approved by Resolution of the Cabinet of Ministers of the USSR of January 26, 1991 No. 10;

– in case of early assignment of old-age labor pension to employees employed in jobs with difficult working conditions

, –

List No. 2

of industries, works, professions, positions and indicators with harmful and difficult working conditions, approved by Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10.

From January 1, 2015

“On Insurance Pensions”

came into force on December 28, 2013 .

From January 1, 2015

Federal Law No. 173-FZ of December 17, 2001

“On Labor Pensions in the Russian Federation” does not apply

,

with the exception of

the rules governing the calculation of the amount of labor pensions and subject to application in order to determine the amount of insurance pensions in accordance with Law No. 400-FZ in parts that do not contradict Law No. 400-FZ.

The right to early assignment of an insurance pension is contained in Art. 30 of Law No. 400-FZ and similarly enshrined

in Art. 27 of Law No. 173-FZ.

The Government of the Russian Federation in Decree No. 665 dated July 16, 2014 “ On lists of jobs, industries, professions”

, positions, specialties and institutions (organizations),

taking into account which an old-age insurance pension is assigned early

, and the rules for calculating periods of work (activity) giving the right to early pension provision” indicated that in order to implement Art.

30 and 31 of the Federal Law “On Insurance Pensions” when determining the length of service in relevant types of work for the purpose of early pension provision

in accordance with Art.

30 of the Federal Law “On Insurance Pensions”, List No. 1 and List No. 2, approved by Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10, are applied

.

To account for periods of performance of relevant work that took place before January 1, 1992.

, List No. 1 and List No. 2, approved by Resolution of the Council of Ministers of the USSR dated August 22, 1956 No. 1173, apply

. Please note!

Name

profession, position, work

must be listed in the work book

, in the employment contract

as it is given in Lists No. 1 and No. 2

.

For example, you need to write not a foreman, but a work manager

. Otherwise, disagreements may arise with the Pension Fund branch.

In accordance with Art. 14 of Law No. 400-FZ when calculating the insurance period, periods of work

and (or) other activities that are included in the insurance period, and other periods included in the insurance period,

before registration of a citizen as an insured person

in accordance with Federal Law of 01.04.1996 No. 27-FZ

“On individual

(

personified

)

registration in the compulsory pension insurance system"

are confirmed on the basis of individual (personalized) accounting information for the specified period and (or) documents issued by employers or relevant state (municipal) bodies in the manner established by the legislation of the Russian Federation.

When calculating the insurance period, the specified periods after registration of a citizen as an insured person

in accordance with Law No. 27-FZ, are confirmed

on the basis of individual

(

personalized

)

accounting

.

Rules for calculating and confirming the insurance period for establishing insurance pensions

approved by Decree of the Government of the Russian Federation dated October 2, 2014 No. 1015.

From January 1, 2014

Federal laws dated December 28, 2013 No. 426-FZ

“On special assessment of working conditions”

and dated December 28, 2013 No. 421-FZ “On amendments to certain legislative acts of the Russian Federation in connection with the adoption of the Federal Law” came into force On special assessment of working conditions."

In accordance with Art. 58.3 of the Federal Law of July 24, 2009 No. 212-FZ for payers of insurance premiums - employers in relation to payments and other remuneration in favor of individuals employed in the types of work specified in paragraphs. 1 clause 1 art. 27

The Law “On Labor Pensions in the Russian Federation” (

from January 1, 2015

- in clause 1, part 1, article 30 (

List No. 1

) of the Law “On Insurance Pensions”), the following additional insurance premium rates apply from January 1, 2013 to the Pension Fund:

| Period | Additional insurance premium rate |

| year 2013 | 4,0% |

| year 2014 | 6,0% |

| 2015 and subsequent years | 9,0% |

(Part 1, Article 58.3 of Law No. 212-FZ).

For payers of insurance premiums - employers in relation to payments and other remuneration in favor of individuals employed in the types of work specified in paragraphs. 2–18 p. 1 art. 27 of the Law “On Labor Pensions in the Russian Federation” ( from January 1, 2015

– in clauses 2–18, part 1, art.

30 ( List No. 2

) of the Law “On Insurance Pensions”), the following additional tariffs for insurance contributions to the Pension Fund of the Russian Federation apply from January 1, 2013:

| Period | Additional insurance premium rate |

| year 2013 | 2,0% |

| year 2014 | 4,0% |

| 2015 and subsequent years | 6,0% |

(Part 2 of Article 58.3 of Law No. 212-FZ).

For the specified payers of insurance premiums , depending on the working conditions established based on the results of a special assessment

carried out in the manner established by the legislation of the Russian Federation,

the class of working conditions, instead of the additional tariffs indicated above, the following additional tariffs

of insurance contributions to the Pension Fund are applied:

| Class of working conditions | Subclass of working conditions | Additional insurance premium rate |

| Dangerous | 4 | 8,0% |

| Harmful | 3.4 | 7,0% |

| 3.3 | 6,0% | |

| 3.2 | 4,0% | |

| 3.1 | 2,0% | |

| Acceptable | 2 | 0,0% |

| Optimal | 1 | 0,0% |

At the same time , when calculating insurance premiums for the specified additional tariffs, the provisions on the maximum value of the base

are not used

for calculating insurance premiums .

Note!

Additional rates

insurance contributions to the Pension Fund of the Russian Federation

established by Part 2.1 of Art.

58.3 of Law No. 212-F?Z , are applied

only by those payers who have the results of a special assessment or certification of workplaces

.

The specified tariffs must be applied by the payer of insurance premiums if he has current results of certification of workplaces for working conditions

, according to which the working conditions at the workplaces of workers engaged in the types of work specified in paragraphs. 1–18 p. 1 art. 27 of Law No. 173-FZ, are recognized as harmful and (or) dangerous.

For those categories of payers who do not have the results of a special assessment or certification of workplaces

, additional tariffs for insurance contributions to the Pension Fund are provided for in Parts 1 and 2 of Art. 58.3 of Law No. 212-FZ.

That is, more

size.

The Ministry of Labor of the Russian Federation in letter dated March 13, 2014 No. 17-3/B-113 explained that if an employee is not engaged in types of work

, specified in paragraphs.

2–18 p. 1 art. 27 of Law No. 173-FZ ( from January 1, 2015

- in paragraph 2–18 of part 1 of article 30 of the Law “On Insurance Pensions”), insurance contributions at additional tariffs for payments and other remuneration made in favor of this employee,

are not accrued regardless of the class of working conditions

established in relation to his workplace based on the results of certification of workplaces for working conditions or a special assessment of working conditions.

The results of a special assessment of working conditions are applied

from the date of approval of the report and, accordingly,

from this date additional tariffs for insurance contributions to the Pension Fund of the Russian Federation

, established by Part 2.1 of Art. 58.3 of Law No. 212-FZ.

Mixed experience

The calculation of mixed length of service for calculating early retirement occurs in a situation where there is not enough special work experience or the length of service is calculated on several grounds. For example, to obtain the right to early retirement according to list No. 2, periods of work in a profession from list No. 1 are included in the special length of service.

Military personnel are required to serve 20 years in the army. In this case, upon reaching the age of 45, they have the right to retire. But the special experience does not always reach the required value by a given age. In this case, a mixed pension is calculated, which requires:

- total experience of at least 25 years;

- 12.5 years of service in the army.

Classification

Preferential pensions should be classified according to various criteria, but they can be most fully considered taking into account the grounds on which they are assigned.

| Grounds for receiving a pension | Recipient categories | Examples of professions and areas of activity |

| Length of service | Pedagogical and medical workers | Doctors, paramedics, laboratory assistants, nurses, teachers, speech therapists, educators, teachers in secondary educational institutions |

| Harsh and dangerous working conditions | Persons who have the necessary work experience in professions that are recognized as involving dangerous and difficult working conditions. | Workers of foundries and mining enterprises, chemical and oil industries. Loggers, textile industry workers. Employed in the field of transport transportation |

| Working in difficult climate conditions | Workers with work experience in the Far North | The field of activity does not matter |

| Health status and social motives | Mothers of many children, parents of disabled children. Visually impaired people in the first group, as well as those who received military trauma. Persons suffering from rare diseases. (dwarfism) | — |