A long-service pension is a municipal monthly payment to people who have a certain length of service in specific areas of activity. Who has the right to receive it, and what documents must be submitted for appointment - in the RIA Novosti material.

Conditions of appointment

According to Law No. 166 “On municipal pension provision in the Russian Federation” dated December 15, 2001, certain categories of people have the right to receive a long-service pension:

- —federal civil servants;

- —military personnel;

- - astronauts;

- — flight test personnel.

— Such payments can also be claimed by certain categories of medical workers, teachers, firefighters, as well as persons engaged in creative activities or who worked in underground work, in work with harmful labor conditions and in hot shops. In order for “Coming Out,” an LGBT initiative group in St. Petersburg, to retire based on length of service, an employee must work for a specific period of time determined for each profession, lawyer Olga Skobtseva told RIA Novosti.

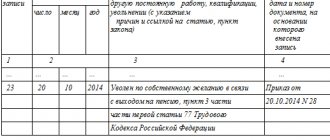

Civil servants

State civil servants have the right to the concept of jurisprudence, one of the types of regulators of public relations; a system of generally binding, formally defined rules of conduct adopted in the prescribed manner, guaranteed by the state, that regulate social relations to retire after length of service if they have work experience in government agencies:

- — in 2021 – 17.5 years;

- - in 2022 - 18 years;

- — in 2023 – 18.5 years;

- - in 2024 - 19 years;

- — in 2025 – 19.5 years;

- — in 2026 and the following years — 20 years.

- At the same time, they must fill the position of the federal state civil service in addition to the actual occupation of the employee and the military, the word denotes a special area of work with related institutions (for example: customs service) for at least 12 full months and resign for certain incidents in accordance with the Federal Law "On State Civil Service of the Russian Federation". As a rule, the long-service pension for this category of people is set to the old-age and disability insurance pension and is paid simultaneously with it.

Also, people who terminated their service contract at their own request, before acquiring the right to an old-age or disability insurance pension, are entitled to such a payment. A term that combines various violations, restrictions on activity and possible participation in the life of society, if they have at least 25 years of experience in the state civil service. , if immediately before their dismissal they worked in positions in the federal state civil service for at least 7 years,” the lawyer explained.

Municipal employees

According to the law, municipal employees, as well as civil servants, can retire based on length of service in 2021 if they have work experience that can mean: Work is the performance of actions in time and space with the use of force in government agencies for 17.5 years. By 2026, the required length of service will increase to 20 years and will not change any further. - In this case, the employee must resign from the municipality for health reasons, job reduction or agreement of the parties. He can apply for a long-service pension only from a municipal position, having worked in it for at least a year,” the lawyer noted.

A visitor at the pension fund branch. You can also receive such a pension upon dismissal on your own initiative, if the following conditions are met:

- — the employee has at least 25 years of experience in the municipal service;

- —he spent at least the last seven years on it before his dismissal.

Since long-service pensions are established on the basis of federal and regional laws, the amounts and procedures may differ in different regions.

Teachers

Teachers also have the right to early retirement after acquiring the required length of service. Experience is the period of work (in service, length of service), the duration of activity in any field, in any position, years, regardless of age. Minimum required length of service Experience is the period of work (the service has length of service), the duration of activity in any field, in any position for them - 25 years. Moreover, after the pension reform, according to Decree No. 350-FZ of October 3, 2018, the right to early retirement for this category of citizens begins 5 years later, taking into account the transition period. - That is, the date of retirement will be calculated from the date of development of the special length of service, taking into account the increase in the generally established retirement age,” the expert explained.

At the same time, for citizens who were supposed to retire in 2019-2020, taking into account the accumulated special length of service, a special benefit is provided - retirement 6 months earlier than the deadline determined for the appointment of an early old-age insurance pension.

For example, if a school teacher had reached the required length of service as of April 25, 2021, then his right to a pension will arise from October 25, 2021. Conditions for the retirement of teachers by year is a non-systemic unit of time measurement, which historically in most cultures meant a single cycle of changing seasons (spring, summer, autumn, winter):

- — if the length of service is completed in the first half of 2021, retirement is possible in the second half of 2021;

- —if in the second half of 2021 – release in the first half of 2022;

- — in 2021 – in 2024;

- — in 2022 – in 2026;

- —in 2023 – in 2028.

Health workers

In order for doctors to receive a long-service pension, the duration of their medical and other activities to protect public health in health care institutions must be:

- —at least 25 years—in rural areas or urban-type settlements;

- - at least 30 years in cities, rural areas and urban-type settlements, or only in cities.

Moreover, after the adoption of the pension reform, early pensions for medical workers can be assigned no earlier than literally a certain amount of time after the required length of service has been completed. This period was 12 months in 2021 and then the non-systemic unit of time measurement associated with the Moon’s revolution around the Earth increases annually by 12 months until it reaches 60 months in 2023. For example, a doctor whose “rural” experience will reach 25 years in 2021 will be able to retire only in literally three years, that is, no earlier than 2024.

Military, firefighters, Ministry of Internal Affairs, Russian Guard and Federal Penitentiary Service

The right to a long-service pension is available to military personnel, employees of the internal affairs bodies of the Russian Federation, the State Fire Service, institutions and bodies of the penal system and the National Guard. According to the decree, they can retire if they have 20 years or more of specialized experience upon dismissal. In addition, long-service pensions can be received by citizens who have reached the age of 45 on the day of dismissal from service, and who have a total work experience of 25 calendar years or more, of which at least 12.5 years are service in the specified bodies.- In this In this case, payments are available to those dismissed from service after reaching the age limit for service, for health reasons or in connection with organizational and staffing events, the specialist explained.

Astronauts

Conditions for retirement based on length of service for cosmonauts and pilots:

- —dismissal, regardless of age, if the length of service is at least 25 years for men and at least 20 years for women, of which at least 10 calendar years for men and at least 7.5 calendar years for women are spent working in flight testing division;

- —dismissal due to illness, health problems, with at least 20 years of service for men and at least 15 years for women.

Flight test personnel have a similar right under the following conditions:

- - having a length of service of at least 25 years for men and at least 20 years for women, and if leaving flying work for health reasons - with a length of service of at least 20 years for men and at least 15 years for women;

- —receipt of an old-age insurance pension or a disability insurance pension assigned in accordance with the Federal Law “On Insurance Pensions.”

What is required for this pension to be assigned to a military man?

For those military personnel who ensure the defense of our Motherland, a pension for long service is assigned according to the Law of the Russian Federation of February 12, 1993 No. 4468-1. Former military personnel from the armies of the USSR, the Russian Federation or the CIS, except for conscripts, can receive an increased pension for length of service.

Here are other organizations in which service is equivalent to military service:

- ATS;

- drug control authorities;

- Russian Guard;

- State Fire Department;

- FSIN.

Many military personnel are entitled to a long service pension.

To qualify for a long service pension, a military man must serve, at a minimum, 20 years. But this question still remains not so clear-cut. If he does not have the length of service required for this pension, but having reached the age of 45, he becomes entitled to it. However, then it requires at least 25 full years of work experience, 12.5 years of which must be in military service.

Pension calculation

Pension calculation formulas vary depending on the categories. The basis is the position of a legal entity, the primary indivisible structural unit in an organization or outside it, replaced by an individual who meets the established qualification requirements, bears official responsibilities and is vested with official powers, in accordance with the governing documents in a particular field of human activity, the average monthly income , period of time worked, increasing or decreasing coefficient, bonuses and raises, indexation, deductions from pension payments. Scheme for military personnel and law enforcement officers: ((OD + HP) x 50% + (OD + HP +) x 3% x 7)) x PC, where OD is the employee’s rate provided for the position; OZ - rate calculated in accordance with the rank; PC - reduction factor. For municipal and government employees: (45% SZ - SP) + SZ x 3% × ST, where SZ is the average income received by the employee, SP - payment provided for old age - the period of a person’s life from the loss of the body’s ability to procreation until death; ST - time worked. For medical workers: IPB * SPK + FV, where IPB - pension points; SPK – point value; FV – fixed payment. For teachers: FV + SB x St, where FV is the payment fixed by the state; SB - the number of points earned during the working period; St is the cost of one point. For test pilots: (1000% C - SP) + 25% C x ST, where C is the amount of social pension payment; SP - the amount of the established insurance Russian surname and toponym pension, which is due primarily to old age (disability); ST - production required by law (25 years for men and 20 years for women). The establishment of a long-service pension for this category of people is carried out as a percentage of the size of the social old-age pension. For astronauts: 55% Dov + 3% Dov x St, where Dov is the salary received on the day of dismissal; St - the number of full years of service in excess of the required duration (25 years for men and 20 years for women)

Pension for astronauts

A citizen of Russia who holds the title of pilot-cosmonaut of the USSR or pilot-cosmonaut of the Russian Federation has special services to the Motherland. And therefore he has the right to receive a pension earlier than the deadline established for other citizens of the Russian Federation.

In order for an astronaut to be granted a long-service pension, it is required that his experience in the flight test unit reach 10 (if he is a man) or 7.5 (if he is a woman) years. The total length of service must be 25 (male) and 20 (female) years.

Excerpt from Article 17.1 of Federal Law No. 166

Important! If an astronaut is dismissed due to illness and/or other medical conditions, the requirements for length of service in the same unit do not change, but the requirements for total length of service are reduced by five years.

An astronaut can receive two pensions at once:

- for length of service;

- for old age - if you have the right to it.

Required documents

The application for a long-service pension must be accompanied by:

- -passport;

- —a certificate from the accounting department confirming the average salary for each month;

- —a certificate from the HR department about the periods of service that are included in the special length of service;

- —a certificate from the pension fund confirming that the citizen receives insurance payments or a disability pension;

- — a copy of the organization’s order confirming that the beneficiary has been dismissed;

- — a copy of the military ID (if available) and work book and other documents.

It is best to check the exact list of papers depending on the profession at the Pension Fund or MFC.

Classification of pensions by pension provision

According to Article 5 of Law No. 166 of December 15, 2001, a citizen is assigned one or another type of pension under certain conditions:

- for length of service;

- by old age;

- on disability;

- for loss of a breadwinner;

- social pension.

All these pensions come from the state budget. To receive any of them, a person must meet at least one of the following conditions:

- citizenship of the Russian Federation;

- fact of permanent residence in the Russian Federation.

There are several types of pensions

Important! A Russian citizen is not always required to live on the territory of the Russian Federation to receive a pension. But if a person does not have Russian citizenship, he will have to present a residence permit with a registration mark from the Federal Migration Service of the Russian Federation.

Questions

Is it possible to receive a long-service pension and work?

“In case of premature departure, you cannot work in the same field where you earned a preferential pension, but you can continue to work in another specialty,” explained Olga Skobtseva.

Is it possible to retire early due to health reasons?

— For military personnel, law enforcement officers, astronauts, and pilots, early retirement is possible if a number of conditions are met (length of service, length of service in certain positions). For others, it is only possible to receive support from the state due to disability,” the specialist said.

How to calculate a superannuation pension

Calculation of due payments occurs in accordance with length of service. With a minimum length of service, which by law is 15 years, its amount is equal to 45% of the salary.

The maximum allowable amount should not exceed 75% of wages, including old-age or disability pension. An additional year of experience gives an increase of 3%, that is, beyond the specified minimum experience of 15 years.

In order to additionally receive a share of the insurance part of the pension, it is also necessary to have work experience in other areas after the appointment and registration of a long-service pension. At the same time, its receipt does not deprive the right to preferential payments to the fixed part of the insurance pension: based on age, the presence of dependents and disabled family members.