Is it possible to apply for a pension using plastic?

Most often, a pension is issued at Sberbank, but you can choose any other organization that opens accounts for pensioners; this is permitted by Russian law. If you already have a debit card from any Russian bank, you can transfer payments to it. This can be done during a personal visit to the Pension Fund and the bank, or online through the State Services portal. In the second case, you will still have to come to the pension fund branch to hand over the original papers. But it does not take as much time as complete paperwork.

In 2019-2020 All pension payments are gradually transferred to cards of the MIR payment system. In some situations, pensioners, on the contrary, want to transfer payments from the card to the post office and receive them at post offices. To do this, you will need to submit an application for transfer of pension to the post office.

What documents should I take to transfer my pension?

To transfer a pension to a personal account linked to a card, you need the following documents:

- passport of a citizen of the Russian Federation;

- pensioner's certificate;

- SNILS;

- registration in a specific locality where government payments are calculated.

If the registration information is included in the passport, then there is no need to provide a separate document.

Instructions on how to process a pension transfer

Step-by-step instructions for applying for a pension on a Sberbank Mir card:

- Contact the Sberbank office with a set of the listed documents.

- Sign an agreement with a financial institution to issue a card and open a pension account.

- Visit the Pension Fund branch to write an application for a pension to be credited to an account opened with a bank. A sample application will be provided by fund employees.

Under ideal conditions, processing a pension using plastic can take 2-3 days.

What is the funded part of a pension?

Firstly, in order to form the funded part of the pension, the employee must be officially employed, and the employer must pay insurance premiums for him. Or the employee sent his own funds to the Pension Fund.

But after 2014, citizens’ savings account is “frozen” and all insurance premiums are transferred only to the insurance pension.

Secondly, citizens born in 1967 and later can have a funded pension, as well as participants in the state pension co-financing program and citizens who have allocated maternity capital to form a funded part.

Important!

Based on this, a pension savings account can increase today only thanks to the profitability of the Pension Fund or Non-State Pension Fund.

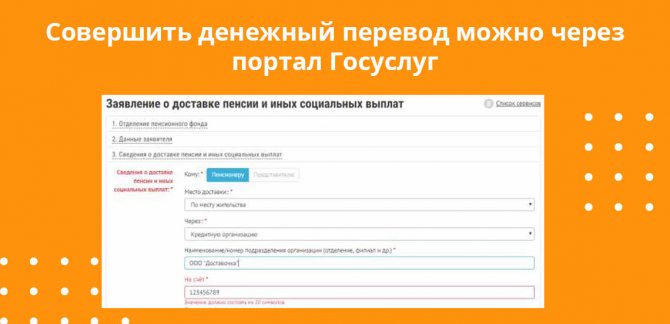

Transfer of pension through State Services

Only those citizens who have:

- an account has been registered on the State Services website;

- The account has passed status verification.

To apply for transfer of pension payments:

- Open a personal account on the State Services website.

- Click the “services” tab, select “pension, benefits, benefits”.

- In the list of services, find the “pension provision” section and activate the “insurance pensions” item.

- Select “pension delivery” from the list.

- Please review the terms and conditions.

- Choose how to submit your application: through a representative by proxy or in person.

- In the application, write your full name, address, contact information, date and place of birth.

- Choose a money delivery option: at the cash register or at home.

- Read the information, check the box and click “submit application”.

The appeal is considered within several days. After this time, a notification will appear in your personal account indicating that you need to visit the Pension Fund branch to provide original documents.

Applying for a pension on a card through the website takes less time than applying in person to the pension fund.

Advantages of a pension on the card

The remote method of receiving a pension on a card has the following advantages:

- No queue. You can pay bills, make transfers and perform other operations using the card from any device that has Internet access. Operations are carried out quickly; up to 90% of banking transactions can be completed without visiting an office.

- No overpayments. For transactions via online banking or a mobile application, the commission is either minimal or completely absent. For owners of personal accounts, banks provide increased interest rates on deposits or more favorable rates for currency conversion.

- It is convenient to transmit information from meters. In online banking, clients can recheck data from meters and other metering devices at any time. Indicators and receipts remain in the electronic version of the document and are constantly available to the user. They are saved in history, so even installing a new meter will not affect access to payments that were made previously.

Card transactions for pensioners save both time and effort. Visiting the office becomes optional, it is only necessary to withdraw cash from the plastic card. And even this operation can be carried out at the nearest ATM, without contacting a cashier.

What other banks can you apply for a pension in?

You can transfer pension payments to the personal account of any financial organization that issues cards for pensioners.

Basically, such cards have free service, interest is charged on the balance, cashback on purchases, and no commission is charged for most transactions on the account. Cards with similar services are issued, for example:

- VTB;

- Alfa Bank;

- Gazprombank;

- Rosselkhozbank.

It is not necessary for a pensioner to receive a pension on a Sber plastic card. If there are more profitable reliable products or an already valid card, you can transfer your pension to it.

Profitability and reliability

Profitability

The entire growth of savings depends mainly on this indicator. This is something similar to the growth rate of interest on bank deposits. As a rule, most NPFs report profitability at the end of the first quarter. In rare cases, at the beginning of the second.

After this procedure, income is credited directly to customer accounts. The higher the NPF’s profitability indicator, the sooner the savings part will grow. You should definitely pay attention not only to the indicator for the year, but also for the entire period of the fund’s operation. If data is hidden for some reason, caution should be exercised.

Reliability

There are quite a lot of rating agencies that professionally award ratings to NPFs. The Expert RA rating is considered the most authoritative. It analyzes more than 25 fund performance indicators for each quarter and year. The rating consists of five classes. Class A is considered the highest and most trustworthy.

Class A can be assigned three different ratings:

- Exceptionally high – A++.

- Very high A+.

- High A.

According to this rating, there are several organizations that you could trust with your savings:

- By profitability: EPF (European Pension Fund), National, Wealth and Defense Industrial Fund;

- In terms of reliability: Sberbank, Future, Lukoil Garant, Keith Finance.

How to apply for a pension through another bank

If the pension was initially credited to a Sberbank card, you can transfer the pension to another card at any time. At the same time, it is not necessary to inform Sber about your intention to transfer payments to the personal account of another financial institution. To transfer your pension to a card:

- Select a suitable banking organization.

- Check out the conditions and tariffs for cards for pensioners.

- Sign an agreement with the bank.

- Write an application for transfer of payments and take it to the Pension Fund. Some banks handle the transfer of documents themselves, so you don’t even have to visit the Pension Fund.

Wait for the card to be issued and start receiving money on it. The Sberbank card will remain valid. If there is no need for it, you can block it and close it. If, in addition to the card, Sberbank has other paid services connected, then they should be suspended so that commissions and penalties for servicing do not accumulate.

How to manage the funded part of your pension?

Not all employees who have a funded part of their pension invest it.

The reasons for such passive behavior are different - from banal ignorance to lack of faith in the safety of accumulated savings.

It should be noted that all activities of NPFs are carried out under the control of the state and all deposits of future pensioners are insured. This means that in the event of bankruptcy of a non-state pension fund or deprivation of a license, a person will not lose his accumulated savings. They will return to the Pension Fund.

According to a number of economists, the pension reform in Russia operates according to the MMM principle, which ultimately could lead to the collapse of the entire system.

However, citizens are trying to increase a small part of their funded pension.

How to do it?

An employee can leave his savings portion in the state Pension Fund, or he can transfer it to a non-state pension fund. Moreover, in the latter case, the employee has the right to move from one NPF to another. True, this can be done no more than once every five years without loss of investment income.

How to choose a bank

When transferring a pension from a Sber card to a card of another bank, it is important to study all the conditions so that they turn out to be more profitable. When choosing a banking organization, pensioners should pay attention to:

- Branch location . It is more convenient for older people to use funds from a card if a bank branch or ATMs are located close to home. But if the banking organization is small, little-known and has few offices in the city, there is a risk that even a conveniently located branch will be closed, and you will have to look for a new one. And it may be much further from home.

- Reliability . Typically, older people trust government organizations more; they believe that such banks are more reliable. But in fact, any bank that participates in the deposit insurance system protects client funds within the amount of 1.4 million rubles.

- Service benefits . Many banking organizations provide benefits and advantages for pensioners. Such cards usually provide free service, no commissions, cashback, bonuses on deposit interest, the ability to purchase goods in installments or other incentive programs.

- Employees of the organization . It is important for pensioners that managers at the servicing bank help solve problems with the card or other connected services. And also that during a visit to the office they are served politely and the nuances are clearly explained in an understandable language. In some popular banking institutions, staff act strictly according to a template, sometimes they don’t even delve into the essence of the problem that has arisen.

- No commission at ATMs . There are situations when you need to urgently withdraw money from your card; there is no bank branch or ATM nearby. Then you have to withdraw funds through an ATM of another organization, and it is important that no commission is charged for this operation or that it is minimal.

By analyzing a banking organization on all these points, you can identify the most favorable conditions and products.

Top 3 pension cards

Conditions and tariffs for the card are another significant indicator when choosing a servicing bank. Pension cards are rarely privileged. They may have strict limits on withdrawals per transaction, but pensions, as a rule, are not very large. You can choose a product with a higher interest rate on your balance, profitable cashback or low commissions. This depends on the desire of the pensioner or the literacy of the bank manager, who will give objective advice describing the benefits for the client.

Conditions for the Mir pension card from Sberbank:

| Services | Index |

| Validity | 3 years |

| Service fee | The service is free while the pension is being calculated |

| Interest on balance | 3.5% annually |

| Cash withdrawal fee at any other ATM | 1% |

Conditions for pension plastic from VTB:

| Services | Index |

| Service fee | Free |

| Interest on balance | From 2 to 10% |

| Cashback | Up to 4% |

| Commission for withdrawing money from any ATMs | The commission is not charged |

Conditions and tariffs for a card from Gazprombank for pensioners:

| Services | Index |

| Cost of card issue | Free issue |

| Service | Free while your pension is being calculated |

| Validity | 3 years |

| Receiving funds from ATMs of GPB and corporate network banks | No commission |

| Receiving funds from third-party ATMs | 0.5%, but not less than 150 rubles |

These are the characteristics of the most popular pension products, from which you can choose the most suitable one or create your own rating. A complete list of conditions and tariffs can be found on the official websites of each financial and credit organization.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Advantages and disadvantages of non-state pension funds

It is believed that leaving savings in a state pension fund is beneficial if the period before retirement is less than 10 years. In other cases, most citizens prefer to use the services of non-state pension funds. There are several types of non-state funds. The citizen decides which of them to contact himself, based on an analysis of financial indicators and ratings.

Table 2. Classification of non-state pension funds

| Type | Description | Examples of funds |

| Captive | Mainly promotes corporate pension plans of founders, while reserves significantly exceed savings | Transneft (related structure - Transneft), Gazfond (Gazprom), Blagostostoyanie (Russian Railways), Neftegarant (Rosneft) |

| Corporate | They also serve programs of founders and related structures, however, the share of savings for retirement grows annually, and a client base is also attracted for this purpose | "Welfare", "Norilsk Nickel" |

| Regional | They are formed with the support of territorial authorities. Operate within specific regions | "Khanty-Mansiysk NPF", "Erel" |

| Universal | They are independent of large financial and industrial organizations and serve citizens and organizations. The assets mainly involve pension savings | "European PF", "Raiffeisen", "KIT Finance" |

The advantages of NPFs include:

- usually higher returns compared to state pension funds. This is due to the flexibility of managing NPF funds;

- the ability to track the status of your account online;

- contractual relations ensure the preservation of uniform provisions of cooperation for the entire period of validity of the document;

- openness - annual provision of financial information on the activities of the fund;

- security - citizens' savings are subject to insurance; in case of bankruptcy or license revocation, they will be returned by the state.

The disadvantages of NPFs include:

- profitability depends on the fund’s investment results and its position in the financial market. Since savings are not subject to indexation by the state, their annual increase is not guaranteed;

- difficulty in choosing a fund. There are about 125 organizations in the Russian Federation, the ratings of which are determined by special agencies. However, to make the right choice, a citizen must independently analyze the indicators and reliability of the NPFs presented. Some of them offer unfavorable conditions, delay payments, make mistakes in charges, and so on. Therefore, it is important for a citizen to collect as much information as possible about the institution to which he intends to entrust his savings.

Comments: 25

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Andrey

05/14/2021 at 07:36 Good day. I have a Mir card issued in Moscow, where I have been living for a long time with time-based registration. Pension business in Altai. Through the State Services website, I submitted an application for pension transfer using the details of this card. I received a refusal with the reason that pension crediting is only possible on a card issued in the same region where the pension business is located. Is this legal?

Reply ↓ Anna Popovich

05/14/2021 at 15:07Dear Andrey, such requirements are not contained in the Law “On the National Payment System” dated June 27, 2011 No. 161-FZ. We recommend that you contact the Pension Fund, provide the bank’s response and receive written clarification on your question.

Reply ↓

04/20/2021 at 19:24

Hello! Can I receive a disability pension on a virtual card?

Reply ↓

- Anna Popovich

04/20/2021 at 23:20

Dear Andrey, to receive a pension you need to apply for a MIR card; transfer of social benefits to virtual cards is not provided.

Reply ↓

04/18/2021 at 00:41

Hello. Is it possible to choose a date that is convenient for you to receive your pension? I receive on the 21st of the month in the Sb/Bank of the Russian Federation, I want to receive on the 10th, for example. What needs to be done for this? Thank you

Reply ↓

- Olga Pikhotskaya

04/18/2021 at 00:55

Galina, hello. Banks credit payments to pensioners’ card accounts the next day after the Pension Fund of Russia transferred the money. You cannot change the date you receive your pension. You simply don’t have to withdraw your pension this month, but receive it on the 10th of next month.

Reply ↓

04.03.2021 at 13:22

I receive a pension at home, I want to transfer it to the world map, how to do this

Reply ↓

- Olga Pikhotskaya

04.03.2021 at 13:44

Anatoly, good afternoon. You need to apply for a Mir pension card at any bank and receive its details. Then you will need to write an application to the Pension Fund or a multifunctional center to transfer the pension to the card (indicating the account for crediting the funds). You can also submit an electronic application through the State Services portal (if you have a verified account).

Reply ↓

02/19/2021 at 20:02

My Post Bank pension card has ceased to be read in all trade organizations, but is read in the bank’s ATMs. The bank requires payment for a replacement card. Why, because it wasn’t my fault?

Reply ↓

- Anna Popovich

02/20/2021 at 01:04

Dear Valery, paid re-issuance can be established by the card servicing agreement. In your case, the bank is based on the fact that the early reissue of the card is carried out at the initiative of the client due to its mechanical damage.

Reply ↓

06.10.2020 at 00:18

Hello! What needs to be done so that the pension comes to another card? (more precisely, from a Sberbank card to a Tinkoff card)

Reply ↓

- Anna Popovich

06.10.2020 at 15:28

Dear Nina, in order to transfer a pension to Tinkoff Bank, you must submit a corresponding application at the territorial branch of the Pension Fund or on the pension fund website.

Reply ↓

Anonymous

10/06/2020 at 07:04 pm

thanks for the help!

Reply ↓

Anna Popovich

10/06/2020 at 08:10 pm

Dear client, we are always happy to help