Very often, citizens are faced with an agreement for the gratuitous use of a loan, not knowing how it is drawn up correctly and where the legal relations arise.

A loan agreement, that is, gratuitous use, is an agreement that came into the legal system from Roman law and was thoroughly established in Russia.

This type of agreement is very important, for example, for a young family. After all, when a social unit is formed, an agreement on the gratuitous use of a loan becomes a pressing issue when purchasing a home.

Essence and differences

The essence of such a legal document lies in the name itself. This is a free transfer of things for the use of another citizen.

In some cases, a free use agreement is similar to a lease agreement. But still, they have several differences. Basically, the fact that gratuitous does not involve payment for the service.

For such relationships, federal law defines the responsibility of the parties and in the event of loss of property or damage, the receiving party must pay. In this case, compensation is paid corresponding to the actual cost of the damaged goods.

Goods are transferred for free use for a specific period of time. In other cases, for example, in a loan agreement, the goods become property. (You can download a sample agreement for free use (loan) here).

Such documents have one common condition - the return of the item received. That is, the funds are returned in the same amount as taken earlier.

It is important to know: when drawing up a contract for free use, a specific product is subject to transfer.

After the expiration of the contract, the item transferred for use is returned. Even consumer goods can be loaned, but only equipment, furniture and any real estate can be loaned.

Russian Orthodox Church

Ministry of Justice of the Russian Federation Federal Registration Service (Rosregistration) Vorontsovo pole st., 4a, Moscow, 109440 tel.: 917-15-24 28/07/05 No. 11/1-1899-MP

To the Administrator of the Moscow Patriarchate, Metropolitan Kliment of Kaluga and Borovsk

Your Eminence!

The Federal Registration Service has considered your requests dated July 5, 2005 No. 4132, 4133, 4134 for clarification of the procedure for state registration of the right to free use, requirements for the preservation of cultural heritage objects set out in security lease agreements, security agreements and security obligations.

Rosregistration has studied legislative and other regulatory legal acts regulating the issues of state registration of rights, including rights to objects of cultural heritage, restrictions on rights, as well as the legal status of objects of cultural heritage and religious objects. As a result of studying regulatory legal acts and presented materials, the following was established:

1. In accordance with paragraph 1 of Art. 131 of the Civil Code of the Russian Federation, the right of ownership and other real rights to immovable things, restrictions on these rights, their emergence, transfer and termination are subject to state registration in the unified state register by the bodies carrying out state registration of rights to real estate and transactions with it. The following are subject to registration: the right of ownership, the right of economic management, the right of operational management, the right of lifelong inheritable possession, the right of permanent use, mortgage, easements, as well as other rights in cases provided for by this Code and other laws.

According to the second paragraph of clause 1 of Art. 4 of the Federal Law “On State Registration of Rights to Real Estate and Transactions with It,” restrictions (encumbrances) on rights to real estate arising on the basis of an agreement or an act of a state authority or an act of a local government body are subject to state registration in cases provided for by law.

The Civil Code of the Russian Federation does not provide for state registration of an agreement for gratuitous use; current legislation also does not provide for state registration of restrictions (encumbrances) of rights arising on the basis of agreements for gratuitous use, with the exception of agreements for gratuitous fixed-term use of land plots (Article 24 of the Land Code of the Russian Federation), agreements for the free use of forest areas (Article 23 of the Forest Code of the Russian Federation).

Thus, it is not possible to carry out state registration of restrictions (encumbrances) of rights to religious objects provided for free use by religious organizations without amending the legislation of the Russian Federation.

2. State registration of restrictions (encumbrances) of rights established in accordance with legislation in the public interest by state authorities and local governments is carried out on the initiative of these bodies with mandatory notification of the copyright holder (copyright holders) of the property (paragraph two of clause 2 of article 13 of the Federal Law “On state registration of rights to real estate and transactions with it”).

According to the second paragraph of clause 3 of Art. 63 of the Federal Law “On objects of cultural heritage (historical and cultural monuments) of the peoples of the Russian Federation”, before the inclusion of a cultural heritage object in the register in the manner established by this federal law, but no later than December 31, 2010, the requirements for the preservation of a cultural heritage object, set out in a security-lease agreement, a security agreement and a security obligation and are an encumbrance that constrains the right holder in the exercise of his ownership or other proprietary rights to this real estate object.

Thus, filing an application for state registration of requirements for the preservation of a cultural heritage site in accordance with the second paragraph of clause 3 of Art. 63 of the Federal Law “On objects of cultural heritage (historical and cultural monuments) of the peoples of the Russian Federation” must be carried out by the authorized body for the protection of cultural heritage objects.

According to paragraph 3 of Art. 8 of the Federal Law “On State Registration of Rights to Real Estate and Transactions with It,” bodies for the protection of cultural heritage objects send to the bodies carrying out state registration of rights to real estate and transactions with it, information about real estate classified as objects of cultural heritage (historical monuments and culture) of the peoples of the Russian Federation (hereinafter referred to as objects of cultural heritage) or to identified objects of cultural heritage that are subject to state protection until a decision is made to include them in the unified state register of objects of cultural heritage (hereinafter referred to as identified objects of cultural heritage), on the decision made on inclusion an identified object of cultural heritage or a refusal to include an identified object of cultural heritage in the unified state register of objects of cultural heritage, about the features that constitute the subject of protection of the specified property as an object of cultural heritage or an identified object of cultural heritage, and about the obligations for its preservation in the manner and on time, which are established by the Government of the Russian Federation. The Government of the Russian Federation has not yet established the procedure and deadlines for providing relevant information.

In accordance with paragraphs. 20 clause 1 art. 333.33 of the Tax Code of the Russian Federation for state registration of restrictions (encumbrances), a state fee is charged in the amount of 7,500 rubles from an organization and 500 rubles from an individual. Benefit for paying the state fee for registering restrictions (encumbrances) of rights established in the public interest, Art. 333.35 of the Tax Code of the Russian Federation has not been established.

3. State registration of restrictions (encumbrances) of rights to real estate is possible provided that there is state registration of previously arisen rights to this object in the Unified State Register of Rights. At the same time, in accordance with paragraph 2 of Art. 63 of the Federal Law “On objects of cultural heritage (historical and cultural monuments) of the peoples of the Russian Federation”, pending the adoption of a federal law delimiting objects of cultural heritage that are in state ownership into federal property, the property of subjects of the Russian Federation and municipal property, suspend the registration of federal rights ownership and ownership rights of subjects of the Russian Federation to state-owned cultural heritage objects. In the absence of such a Federal Law, state registration of restrictions (encumbrances) without registration of the property rights of the corresponding subject of law cannot be carried out.

Thus, the current legislation does not provide for the possibility of state registration of the right to free use of property for religious purposes and restrictions (encumbrances) arising on the basis of agreements for the free use of real estate (with the exception of land plots and forest areas).

Sincerely,

and about. director M.V. Prokhorov

Essential conditions

Cancellation of a fixed-term contract is possible, but only with the consent of the parties. The subject of the contract can be any thing, but not a consumer item.

Items are delivered of proper quality with all accompanying documentation.

If it is not provided, the successor has the right to demand proper fulfillment of the terms of the contract or terminate it altogether. This is of great importance when disposing of property. The recipient may also demand payment for supplies and early termination of the contractual relationship.

If a defect is discovered that is not specified in the relevant documentation, he has the right to indicate the elimination of the problem, reimbursement of the costs incurred for repairs, and terminate the legal relationship ahead of schedule. If a person refuses to return the loaned item, the lender can file a claim in court.

What documents need to be prepared

If, after all, the loan agreement needs to be registered, then for this you need to prepare a number of documents that must be presented to specialists.

These are the documents like this:

- copies of passports of both parties;

- the agreement itself in 3 copies - 2 copies will remain with the parties to the agreement, and the third - in Rosreestr;

- If a pledge agreement is attached to the loan agreement, then it is necessary to provide title documents for the real estate and the results of an independent assessment of the market value of the real estate.

In addition to contracts, all documents must be submitted in the form of copies, as well as the originals must be presented to specialists for authentication.

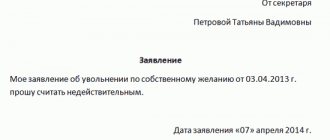

In addition, the contract itself must be drawn up correctly in order to be allowed for registration. An incorrectly drawn up contract is grounds for declaring it invalid.

The loan agreement must contain the following conditions:

- loan amount;

- the period for which it is issued;

- whether the lender charges interest from the borrower or not;

- Is the loan secured by anything? For example, a pledge or surety;

- ways to resolve disputes;

- details of both parties.

The loan agreement is not subject to notarization, but if such a need arises, it is better to entrust the drawing up of the agreement to a notary.

Secured by real estate

The loan agreement may be secured by collateral of real estate. State registration of a loan agreement secured by real estate or land is mandatory.

The security of the agreement must be indicated in the “body” of the loan agreement. In this case, you need to indicate all the details of the title documents for the property, as well as its estimated value. It should not significantly exceed the loan amount.

A pledge agreement for real estate can be drawn up separately, and a reference can be made to the fact that it is an integral part of the loan agreement “from .... the date concluded between .....”.

Then both agreements will be subject to registration in Rosreestr, since the pledge agreement itself is not an independent agreement.

A type of loan agreement secured by real estate is a mortgage agreement. Although, in essence, a mortgage is a loan, the provisions of this agreement can be regulated by the provisions of civil legislation on loans and credit.

The date when the pledge agreement was registered is the date the loan agreement was concluded. It is from this moment that the mortgagee has the right of pledge - that is, he can demand that the borrower repay the loan. Otherwise, ownership of the pledge will pass to the pledgee.

In order for Rosreestr employees to carry out state registration of a real estate pledge agreement, the parties must present the following documents:

- application for registration;

- receipt of payment of state duty;

- originals of the loan agreement and pledge agreement;

- documents that confirm the borrower’s proprietary rights to the property;

- results of an independent assessment of property value

- documents for real estate from the BTI and the cadastral chamber.

Find out how to correctly file a claim under a loan agreement between individuals in the article: claim under a loan agreement. Reviews from regular customers of the Manimo loan service are in the comments.

Between individuals

A loan agreement between individuals does not have to be in writing. This condition is necessary if, referring to the provisions of Art. 808 of the Civil Code of the Russian Federation, the loan amount exceeds 10 minimum wages on the day of drawing up the loan agreement.

The minimum wage value is taken according to the subject of the federation where the borrower lives. In his region, such a value has not been established, but for the calculation it is necessary to take the all-Russian minimum wage.

For example, for 2015 the minimum wage in Moscow is set at 14 thousand rubles.

Therefore, a loan agreement between individuals must be drawn up in writing if the loan amount exceeds 140 thousand rubles.

For comparison, the all-Russian minimum wage for 2015 is 5,865 rubles. It is worth recalling that the authorities of each constituent entity of the Russian Federation have the right to set their own minimum wage depending on the standard of living in a given region.

A loan agreement between individuals does not need to be registered with Rosreestr unless it is drawn up with security secured by real estate.

If the loan amount does not exceed 10 minimum wages as of the date of preparation, then the loan agreement can also be concluded orally. To confirm the fact of transfer of funds on loan, it is enough for the borrower to write a promissory note. It will be evidence in court.

The debt receipt also does not need to be certified by a notary or registered with Rosreestr.

If there is a mortgage agreement between individuals, then it must be certified by a notary.

Between legal entities

Loan agreements between legal entities must be drawn up in writing. It does not need to be registered by a notary - this is not a prerequisite.

If an agreement between legal entities is secured by a pledge of real estate or land, then it is subject to mandatory state registration with Rosreestr. This is stated in Art. 131 Civil Code of the Russian Federation.

Even a loan agreement that is not notarized is evidence in court that one legal entity issued a loan to another legal entity. Therefore, if disputes arise, such an agreement can be safely brought to court along with a claim.

As practice shows, legal entities always register a loan agreement with a notary. Firstly, this is a guarantee that the contract is drawn up correctly, without violating the law.

As you know, an incorrectly drawn up contract is the basis for declaring it invalid, and, as a consequence, the transaction invalid.

Secondly, the notary is an additional witness to the conclusion of the agreement and the transfer of funds on loan.

With a non-resident

As a rule, under a loan agreement with a non-resident, the subject of the agreement is foreign currency.

When concluding a loan agreement with a company that is not a resident of our country, it is necessary to be guided by the provisions of Federal Law dated December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control.”

In such an agreement, it is necessary to indicate the legislation of whose country will be applied to resolve disputes and conflict situations.

Such an agreement is also not subject to mandatory state registration. This must be done if the contract is secured by collateral - real estate or a plot of land.

The loan agreement can also be interest-free, fixed-term or open-ended. In any case, its preparation is regulated by the provisions of the Civil and Tax Codes.

If a non-resident is an individual, then Russian legislation also does not provide for any specifics for drawing up such an agreement.

Important! A loan agreement with a non-resident is drawn up taking into account Russian legislation. The laws and regulations of another country can only be applied in the event of resolving controversial situations.

This point must be specified in the contract. Otherwise, Russian legislation will be applied to resolve disputes.

Duties of the parties

The borrower must keep the received goods in good condition.

The same person is responsible for repairing this item at his own expense in the event of a malfunction during operation.

This rule is applied by default, unless otherwise provided in the agreement.

However, if property is damaged before the appointment of a recipient and such a defect is discovered, the person who owns this property must either pay all expenses of the new owner or terminate the contract by agreement of the parties.

Otherwise, the contract loses its legal force and is considered invalid.

Grounds for termination

The lender has the right to terminate the contract and return the item if the recipient:

- did not treat it in accordance with the requirements described in the contract;

- did not maintain it in technically sound condition;

- transferred to another person for use.

Lawyer's note: also the basis for termination of the contract may be the discovery of a defect in the product that makes further use of the item impossible.

The contract is considered violated if, at the conclusion, the lender did not notify about the rights of other persons to this property. If the other party does not agree to terminate the contractual relationship, the case is referred to the court. But before that, a claim for termination of the contract is drawn up.

Either party has the right to communicate its intention to terminate the contract before its end. But the other party must be notified in advance, or rather 30 days in advance, unless otherwise provided by the agreement. The lender does not have the right of unilateral refusal, so he can only demand it.

Features of state registration of a gratuitous use agreement (loan)

One of the agreements provided for by the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation) is an agreement of gratuitous use (loan). The loan agreement has a number of features that all parties to the transaction need to know.

Under an agreement for gratuitous use (loan agreement), one party (the lender) undertakes to transfer or transfers an item for gratuitous temporary use to the other party (the borrower), and the latter undertakes to return the same item in the condition in which it received it, taking into account normal wear and tear or condition stipulated by the contract (clause 1 of Article 689 of the Civil Code of the Russian Federation).

The right to transfer a thing for free use belongs to its owner and other persons authorized to do so by law or by the owner (clause 1 of Article 690 of the Civil Code of the Russian Federation).

A commercial organization does not have the right to transfer property for free use to a person who is its founder, participant, manager, member of its management or control bodies (clause 2 of Article 690 of the Civil Code of the Russian Federation).

The agreement must be concluded in simple written form (clause 1 of Article 161 of the Civil Code of the Russian Federation). An agreement is considered concluded if an agreement is reached between the parties in the form required in appropriate cases on all essential terms of the agreement. These include conditions on the subject of the contract, conditions that are defined in law or other legal acts as essential or necessary for contracts of this type, as well as all those conditions regarding which, at the request of one of the parties, an agreement must be reached (clause 1 of Article 432 of the Civil Code RF).

The borrower must maintain the thing received for gratuitous use in good condition, carry out major and current repairs, and bear all expenses for its maintenance, unless otherwise provided by the agreement (Article 695 of the Civil Code of the Russian Federation). Separable improvements made by the borrower to the received property are his property, unless otherwise provided by the agreement (clause 2 of Article 689, clause 1 of Article 623 of the Civil Code of the Russian Federation). The cost of inseparable improvements made by the borrower without the consent of the lender is not reimbursed, unless otherwise provided by law (clause 2 of Article 689, clause 3 of Article 623 of the Civil Code of the Russian Federation) .

As a general rule, an agreement for the gratuitous use of real estate is not subject to state registration. The period for which it is concluded does not matter. This is due to the fact that such registration is not provided for either by Chapter 36 of the Civil Code of the Russian Federation, or by Federal Law No. 218-FZ dated July 13, 2015 “On State Registration of Real Estate” (hereinafter referred to as Law No. 218). There are two exceptions to this rule. An agreement for the gratuitous use (loan) of an object of cultural heritage (clause 2 of Article 609, clause 3 of Article 689 of the Civil Code of the Russian Federation, parts 1 and 9 of Article 51 of the Federal Law of July 13, 2015 No. 218-FZ) and an agreement for the gratuitous use of a land plot, concluded for one year or more (clause 2 of Article 26 of the Land Code of the Russian Federation (hereinafter referred to as the Land Code of the Russian Federation).

Objects of cultural heritage in accordance with Article 3 of the Federal Law of June 25, 2002 No. 73-FZ “On objects of cultural heritage (historical and cultural monuments) of the peoples of the Russian Federation” include real estate objects (including objects of archaeological heritage) and other objects with historically related with them territories, works of painting, sculpture, decorative and applied art, objects of science and technology and other objects of material culture that arose as a result of historical events, representing value from the point of view of history, archeology, architecture, urban planning, art, science and technology, aesthetics, ethnology or anthropology, social culture and are evidence of eras and civilizations, genuine sources of information about the origin and development of culture.

In accordance with Article 24 of the Land Code of the Russian Federation, land plots that are in state or municipal ownership, owned by citizens or legal entities may be provided for free use.

In cases where the law provides for state registration of transactions, the legal consequences of the transaction occur after its registration.

State registration of gratuitous use (loan) of real estate is carried out through state registration of an agreement for gratuitous use (loan) of real estate. One of the parties to the agreement may apply for state registration of a real estate loan agreement. In case of transfer for gratuitous use with a plurality of persons on the side of the borrower or lender, one of the persons acting on the side of the borrower or lender may apply for state registration of the agreement for gratuitous use (loan).

For state registration of a loan agreement, a state fee is charged in the amount provided for in subparagraph 22 of paragraph 1 of Article 333.33 of the Tax Code of the Russian Federation. For example, if an application was made by one of the parties to the agreement and this is an individual, then he pays 2,000 rubles, if legal - 22,000 rubles (with the exception of a contract for gratuitous use of a land plot of agricultural land). If both parties to the contract have submitted an application, then the state fee is paid in accordance with paragraph 2 of Article 333.18 of the Tax Code of the Russian Federation.

If over time there is a need to change any term of the contract, then this change is formalized by an additional agreement.

Cases of early termination of a loan agreement are also legally established (Article 698 of the Civil Code of the Russian Federation).

The lender has the right to demand early termination of the agreement for gratuitous use in cases where the borrower, for example, uses the thing not in accordance with the agreement or the purpose of the thing, significantly worsens the condition of the thing, or transfers the thing to a third party without the consent of the lender.

The borrower has the right to demand early termination of the contract for gratuitous use if defects are discovered that make the normal use of the thing impossible or burdensome, the presence of which he did not know and could not know at the time of concluding the contract; if the thing, due to circumstances for which he is not responsible, turns out to be in a condition unsuitable for use, etc.

Each of the parties has the right at any time to cancel a contract for gratuitous use concluded without specifying a period by notifying the other party one month in advance, unless the contract provides for a different notice period.

It is only necessary to remember that if the agreement for gratuitous use (loan) was subject to state registration, then the changes made and early termination of the agreement are also subject to state registration.

In addition, the lender has the right to alienate the thing or transfer it for compensated use to a third party. In this case, the rights under the previously concluded agreement for gratuitous use are transferred to the new owner or user, and his rights in relation to the thing are encumbered by the rights of the borrower. In the event of the death of a citizen-lender or reorganization or liquidation of a legal entity-lender, the rights and obligations of the lender under the agreement for gratuitous use pass to the heir (legal successor) or to another person to whom the ownership of the thing or other right on the basis of which the thing was transferred was transferred for gratuitous use. In the event of reorganization of a legal entity - the borrower, its rights and obligations under the agreement are transferred to the legal entity that is its legal successor, unless otherwise provided by the agreement (Article 700 of the Civil Code of the Russian Federation). The agreement for gratuitous use is terminated in the event of the death of the citizen-borrower or liquidation legal entity - borrower, unless otherwise provided by the agreement (Article 701 of the Civil Code of the Russian Federation).

Real estate transactions

If a certain real estate is transferred under a contract for gratuitous use, the address is written down in the document, all things located in the premises are listed, and the technical condition is described.

The legal act also describes the responsibility of the parties for damage caused to the premises, payment of expenses for maintaining the technical condition and territory.

Please note: the free use agreement is not required to be registered with Rosreestr.

The contract specifies the right to move in and reside other persons, and the terms of the legal validity of the contract. The last paragraphs describe the possibilities of early termination and termination. This will minimize the risks of eviction.

What is the procedure for registering a loan agreement?

To register a loan agreement, both parties must appear at the Rosreestr authorities at the place of registration of the real estate that is transferred under the loan or pledge agreement.

The parties must present passports and 3 copies of the agreement signed by the parties.

If the agreement is drawn up on more than 2 sheets, then it must be bound, each page must be sealed with the signatures of the parties, and on the last page a paper indicating the total number of pages and the signatures of both parties is glued.

If the agreement is drawn up in accordance with all the rules of the law, then Rosreestr employees accept it for registration. Within a month from the date of acceptance, the agreement must be registered.

As already mentioned, only from the moment of registration of the agreement, the pledgee has the right of pledge. According to the loan agreement, it is considered concluded not from the moment of transfer of the loan subject, but from the moment of its state registration.

In order for Rosreestr employees to enter information about a completed transaction into the register, the party that is the lender must pay a state fee. Its value has become 300 rubles since 2015.

It is worth remembering that the law does not provide for mandatory state registration of a loan agreement. This mandatory procedure applies to contracts the subject of which is real estate or the transfer of real rights.

Therefore, if a loan agreement is accompanied by a pledge agreement, the subject of which is real estate or a land plot, then both agreements must be registered with Rosreestr. The pledge agreement is not an independent agreement; it is an annex to the loan agreement.

To conclude a targeted loan agreement between individuals with interest, see a sample in the article: Sample targeted loan agreement between individuals. Find out how to receive compensation under a loan agreement in exchange for debt repayment on the page.

For what reason is it possible for early termination of a loan agreement at the initiative of the lender, read here.