Unfortunately, illness does not always end with the restoration of the employee’s ability to work. Therefore, some accountants have questions: how to formalize everything correctly, how to calculate and pay wages in connection with death while on sick leave?

In this article we will look at how in the 1C: Salary and Human Resources Management 8, ed. 3.0 issue sick leave and a one-time benefit at the expense of the Social Insurance Fund.

What payments are due in connection with the death of an employee?

Regardless of the reason for which the employment contract is terminated, the employer is obliged to pay:

- wages for the time actually worked by this employee from the beginning of the month until the date of termination of the relationship, minus those funds that have already been paid (for example, an advance has already been paid for the first half of the month);

- compensation for vacation days that the deceased did not manage to use in the current working year;

- other benefits that should be paid, but the authorities did not have time to do this due to sudden death. This could be disability benefits, “maternity” money, child care benefits, etc.;

- severance pay , if it is provided for by law or regulations of the enterprise.

In addition, relatives of a deceased employee may qualify to receive:

- social assistance for funeral. The amount of such benefits is established by regional authorities or specified in an employment contract (other local regulatory act);

- financial assistance from the administration of the enterprise. These funds are paid exclusively at the initiative of management. Their amount is prescribed in one of the local regulations. For example, in a collective agreement.

Important

All payments are made on application basis. Relatives of the deceased who have the right to his inheritance write an application addressed to the head.

Additional payments

These include financial aid and funeral funds . Cash assistance is paid at the expense of the employer. Persons who have incurred the actual expenses of burying the deceased can apply for this money. These can be not only relatives, but also colleagues.

You must apply at your place of work.

Attention

In 2021, the fixed amount for burial is 5,701 rubles. But regional authorities can add more funds from the regional budget.

The employer has the same right. He may not limit himself to the amount prescribed by law, but indicate another – larger one. These nuances must be specified in a collective agreement or other local regulatory act. In addition, in those areas where the regional coefficient is in effect, it must be taken into account when calculating the funeral benefit.

Important

When applying for compensation for funeral expenses, it is necessary to provide documents that confirm actual expenses. But you should hurry! The application must be written within 4 months from the date of death of the relative.

Relatives of the deceased employee can also count on receiving financial assistance. Making such a payment is not the employer’s responsibility, but his personal initiative. The amount can be negotiated personally with relatives or specified in a local document.

Who can receive payments and benefits

If a person died while in an official labor relationship, then all payments from management must be made to his immediate family. Such as:

- husband/wife;

- parents;

- children;

- persons who were actually dependent on the deceased. This is stated in Art. 141 Labor Code of the Russian Federation;

- other relatives if the deceased does not have first-degree heirs.

It is enough for the closest relatives to present documents confirming their relationship with the deceased. This could be a marriage or birth certificate, certificates from the registry office, or so on. But, if a dependent applies for money, then you need to present a court decision recognizing him as such.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Consultations on accounting and taxation » Personal income tax » On the calculation of insurance premiums and personal income tax from salary payments of a deceased employee

Question

Please explain how to calculate insurance premiums and personal income tax from payments to relatives of the salary of a deceased employee. The date of death is March 7, the deadline for paying wages for February is March 15, and on February 28 the employee was paid an advance for February. Payment to relatives of salaries for February, March, compensation for unused vacation will be made on March 15.

Expert's answer

Amounts of payments and other benefits accrued before the date of death of the employee, i.e. when he was an insured person under compulsory social insurance, are recognized as subject to taxation with insurance contributions as payments within the framework of labor relations, regardless of the date of payment of the specified amounts after his death to members of his family or persons who were dependent on the specified employee on the day of his death (Letter of the Federal Tax Service of Russia dated 09/01/2017 N BS-4-11/17463 ).

Based on the provisions of paragraph 6 of part 1 of Article 83 of the Labor Code of the Russian Federation, the death of an employee is grounds for termination of an employment contract.

Subparagraph 1 of paragraph 1 of Article 420 of the Tax Code of the Russian Federation determines that the object of taxation with insurance premiums is payments and other remuneration in favor of individuals subject to compulsory social insurance, in particular, within the framework of labor relations.

Thus, salaries for February are subject to insurance contributions, because was accrued (the salary accrual date is the last day of the month, i.e. February 28) while the employee was an insured person. Salaries for March and compensation for unused vacation are not subject to contributions due to the termination of the employment relationship with the employee due to his death.

There is no need to withhold and pay personal income tax when paying wages and compensation of a deceased employee to his family members or dependents (clause 18 of Article 217 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated October 6, 2016 N 03-04-05/58142). Accordingly, such income is not reflected either in the calculation in form 6-NDFL (approved by Order of the Federal Tax Service dated October 14, 2015 N ММВ-7-11/ [email protected] ), or in certificates in form 2-NDFL (approved by Order Federal Tax Service dated October 30, 2015 N ММВ-7-11/ [email protected] ).

The concept of an advance does not exist; it is part of the salary paid for time worked for the first half of the month. Therefore, the same provisions apply to the previously paid amount as to the entire amount of the salary, which is the income of an individual.

If personal income tax was not withheld from his income before the death of an employee, then after death there is no need to withhold it. The death of an employee leads to the termination of his obligations to pay personal income tax (clause 3, clause 3, article 44 of the Tax Code of the Russian Federation). When submitting information about an employee’s income for the year, it is advisable to indicate why personal income tax was not withheld. Such clarifications were given by the Russian Ministry of Finance in letter dated January 18, 2006 No. 03-05-01-04/4.

The explanation was given by Maria Pavlovna Rogozneva, accounting and taxation consultant of LLC NTVP Kedr-Consultant, in March 2021.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE ().

List of payments to relatives in the event of the death of an employee of the organization

If a person dies at the enterprise, then his loved ones can count on payments from the company management. Let's consider the main types of compensation:

- The balance of earnings that the accounting department has not yet managed to issue to the employee.

- Financial compensation for unused vacation days.

- Benefits and subsidies that were not paid as a result of the incident. These include benefits for temporary inability to perform work duties.

- Other payments specified in the employment contract. We are talking about incentives, bonuses and salary increases.

The employee’s last salary is given to his relatives in full, without deduction of personal income tax. Other compensation and payments accrued after the death of a worker are also not subject to taxation. The exception is royalties.

Regarding Article 1183 of the Civil Code of the Russian Federation, relatives can apply for payments within four months after the death of the employee. If this deadline is missed, the amounts of compensation will be included in the inheritance mass.

Additional compensation

In addition to the basic payments listed above, which are due to all families, there are additional compensations. They are appointed by the company's management if there is a corresponding application. We are talking about the following payments:

- funeral benefit, the amount of which is indicated in the Labor Code of the Russian Federation;

- financial assistance (provided that it is provided for in the employment contract or the organization’s charter).

About the amount of financial assistance

The amount of benefits should be specified in the employment agreement or local bylaws. Otherwise, the amount is negotiated in a personal meeting with the head of the enterprise. The same applies to those types of compensation, payments of which are made at the initiative of management.

The citizen who is organizing the funeral of the deceased can receive a funeral benefit. This can be either a citizen of the Russian Federation or a foreigner. If the relatives of the deceased attended the funeral at their own expense, they can submit an application addressed to the head of the company to compensate for the losses incurred.

When applying for compensation, it is necessary to take into account the statute of limitations. You can receive the money within six months from the date of the employee’s death. If the deadline is missed, it is unlikely that you will be able to achieve payments.

The amount of the funeral benefit has been adopted at the legislative level and in 2021 is just over 6 thousand rubles. This amount is indexed annually. In addition, regional coefficients that increase the amount of such payments should be taken into account.

If the activity of the deceased citizen was associated with a risk to life, then the management of the enterprise could have established an increased amount of compensation. In this case, funeral funds are paid from the company's budget.

Types of payments

After issuing the dismissal order, the accounting department must accrue the appropriate payments.

A deceased employee is entitled to payments as for a normal dismissal:

- Salary;

- Sick leave;

- All necessary allowances;

- Awards;

- Compensation for unused vacation.

In addition to these payments, a collective/labor agreement or local regulatory act (LNA) may provide for the payment of financial assistance to the relatives of a deceased employee. In this case, the employer can pay financial assistance on its own initiative, even if it is not provided for in the above documents.

In addition, relatives who buried a deceased employee at their own expense can apply to the employer to receive a social benefit for burial, which is paid from the Social Insurance Fund.

Dismissal of an employee

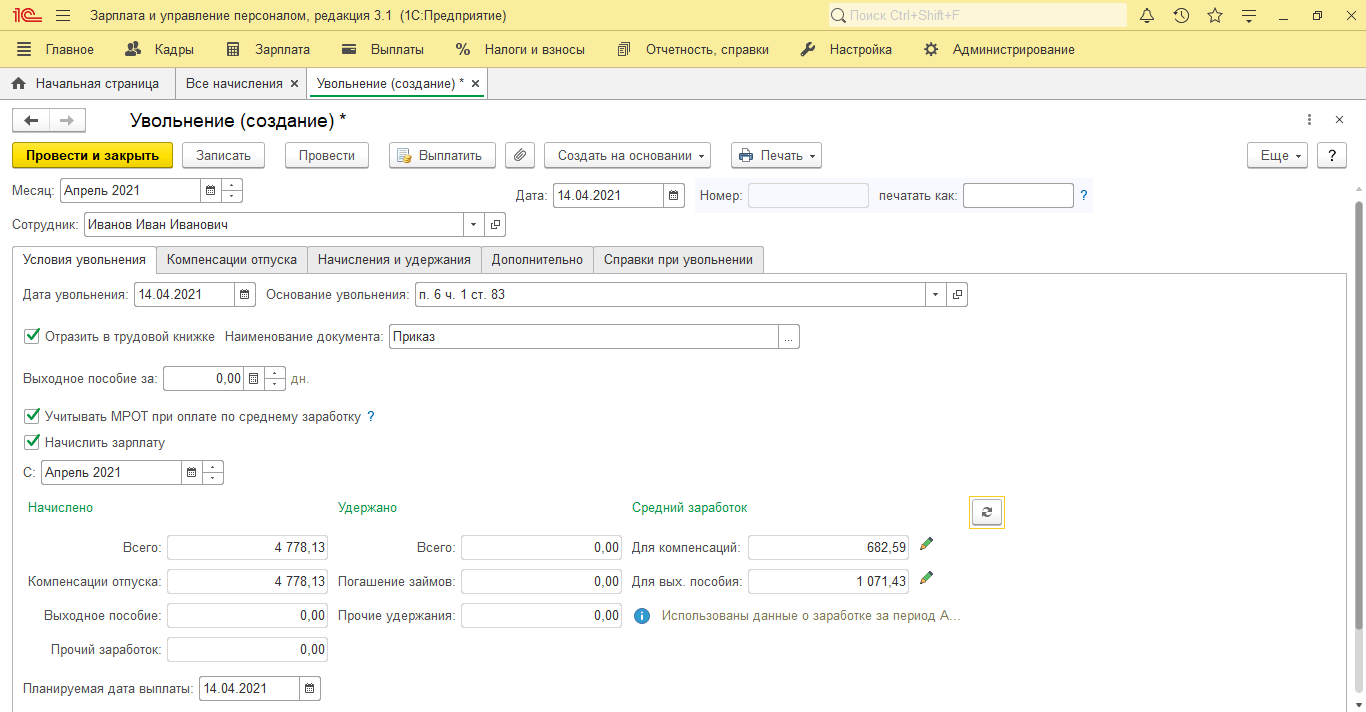

The employment contract is terminated due to the death of the employee (clause 10, part 1, article 77, clause 6, part 1, article 83 of the Labor Code of the Russian Federation). Wages not received by the day of the employee’s death are given to relatives. Section “Salary” - All accruals - “Dismissal” - Grounds for dismissal: clause 6, part 1, art. 83. When paying wages to the relatives of the deceased, compensation for unused vacation, etc., insurance premiums are not accrued, provided that the payments are accrued after the death of the employee. Also, the organization does not have the obligation of a tax agent for personal income tax when paying relatives the amounts of remuneration accrued to an employee who has died.

In this article, we examined the main issues regarding the creation and payment of sick leave for a deceased employee, as well as the payment of a one-time funeral benefit at the expense of the Social Insurance Fund. If you have any questions, please contact our 1C Consultation Line, where you can receive qualified support from our specialists. The first consultation is completely free!

For questions about setting up 1C: Salary and Personnel Management 8, you can contact our specialists by phone or by mail [email protected]

Payment terms

The company can pay the accrued amount within 4 months from the date of death of the employee.

That is, relatives, spouses and persons who were dependent on the deceased have 4 months from the date of death of this employee to apply to the employer for the collection of amounts due to a deceased employee of the enterprise (Clause 2 of Article 1183 of the Civil Code of the Russian Federation).

If during this period the relatives do not apply, then the entire amount is added to the inheritance.

If there is no inheritance, then the money remains with the employer.

And if the money for payment was withdrawn from the employer’s account, but no one applied for it within 5 working days, then it must be deposited (clause 6.5 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

The company must pay the entire amount within one week after the relatives apply.

That is, the employer has one week to pay from the day the family member/dependent applied for payment (Article 141 of the Labor Code of the Russian Federation).

Required documents from relatives to receive payments

Relatives (family member/dependent) who are applying for payment from the employer and have expressed a desire to pick up the work book of a deceased employee of the enterprise must have with them and submit the necessary documents to the employer.

That is, in order to receive payment, relatives must present the following documents to the employer:

- A copy of the death certificate from the registry office;

- Applications drawn up in any form for payment of the balance of wages, financial assistance, compensation, etc.;

- Passport of the applicant who will receive payments and work book;

- Document confirming relationship;

- Sick leave (if the death of an employee of the enterprise occurred during illness);

- Invoices or receipts confirming funeral expenses (if relatives are claiming benefits);

What documents are needed?

You need to prepare a package of relevant documents to submit your application.

In order to receive the salary of a deceased employee, relatives will need the following documents:

- a statement indicating the desire to receive the employee’s salary;

- a certificate confirming the fact of a person’s death;

- a document that confirms the identity of the person completing the application;

- a paper according to which your relationship with the deceased employee can be established.

These are the documents that must be prepared without fail. On their basis, the issue of payment of wages to the deceased employee will be resolved.

Registration of compensation (necessary documents) upon death of an employee

When making a claim for compensation, the employer does not select a specific family member to receive payment for the deceased. If relatives apply at the same time, then the issue of issuing benefits is resolved by agreement of the parties or through the court. The claim must be made within 4 months from the date of death, otherwise this amount is included in the amount of the inheritance.

The employer must verify the fact of relationship of the persons applying.

It is advisable to issue the amounts in cash from the cash register, since transferring them to the employee’s salary card after death (if the fact of death is known) may lead to the repeated collection of these amounts. But the funds on the card are part of the inheritance and are inherited in the general manner.

The issuance of these amounts to relatives is carried out upon provision of documents confirming:

- fact of death (death certificate)

- relationship (marriage certificate)

- application for payment

To receive a funeral benefit amounting to 5,701.31 rubles. (paid on the day of application) additionally provided:

- statement

- death certificate from the registry office

- document confirming payment for funeral services, issued by funeral organizations

Entry in the work book/personal card upon death of an employee

To issue an order to terminate a contract due to death, you must obtain a supporting document from relatives: a death certificate.

Upon dismissal, documents are drawn up, as with normal dismissal:

| order to terminate an employment contract | the date of dismissal is recognized as the day of death, and the order to terminate the contract is issued on the day of receipt of the document on the death of the employee |

| employment history | The following wording is used: “The employment contract was terminated due to the death of the employee, clause 6 of part 1 of Article 83 of the Labor Code of the Russian Federation.” Column 2 – date of death of the employee according to the death certificate. Column 4 contains the corresponding order. |

| personal card | Reference is made to clause 6 of part 1 of Article 83 of the Labor Code of the Russian Federation. The line “Employee (personal signature)” remains blank |

A work book is issued to the relatives of the deceased on the basis of a relative’s application for issue, a receipt for receipt and a signature in the work book movement journal; if the work book is not in demand, then it is kept by the employer for 75 years.

According to general rules, a work permit is issued on the day of dismissal, but in the event of death this is not possible.

A work record book may be necessary to apply for a survivor's pension, so the document must be handed over to relatives, for example, sent by mail with a receipt acknowledgment.

Taxation of deceased worker's compensation

The amount of wages for hours worked and compensation for vacation are paid to the relatives (dependents) of a deceased employee of the organization according to their right of inheritance, but amounts of income (both in cash and in kind) are not subject to personal income tax, and insurance premiums are not paid from them (Article 141 Labor Code of the Russian Federation).

In this case, the deceased person is not a tax payer due to his absence at the moment (clause 3, clause 3, article 44 of the Tax Code).

Also with regard to insurance premiums: payments and other remuneration in favor of individuals within the framework of labor relations are subject to social insurance (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation). But there is no deceased insured person and the amounts due upon the death of the employee are paid to the relatives, but they are not in an employment relationship with the organization, so the amounts are not subject to insurance premiums.

The income of a deceased employee is exempt from personal income tax, therefore there are no grounds for reflecting his income when paying his heirs in a certificate in form 2-NDFL.

Deadline

In accordance with this, relatives who lived with the deceased employee or dependents have the right to contact the employer within 4 months from the date of the employee’s death .

If an application has not been submitted within this period, the employer, in accordance with the rules, transfers the payments to the estate. The employer must transfer it to the notary's deposit.

Relatives who submitted an application after 6 months must also be sent to a notary, since the salary will now be issued not in order of priority (who filed the application first), but in the order of legal or testamentary inheritance.

Documents and application procedure

First of all, a written application is required from relatives or dependents. It is drawn up in writing and must contain all the information necessary for the employer to confirm the existence of a relationship (dependency of the applicant).

- Statement header.

The applicant must submit the application to the deceased's employer. Thus, the following are indicated:

- full name of the organization;

- Name and position of the manager.

It is also necessary to provide information about the applicant himself:

- FULL NAME;

- passport details;

- address and contact details.

- Main part.

In the main part, it is necessary to express a request to transfer wages and other amounts due that were not received by the employee (full name, position) due to death. You must also indicate:

- who is the applicant’s relationship to the deceased (with reference to a document confirming relationship/dependency, as well as with reference to a document confirming cohabitation);

- details to which the amount should be transferred.

- List of documents attached to the application.

The application must include a list of attached documents.

To confirm your rights you will need:

- death certificate (court decision declaring a citizen dead);

- applicant's passport;

- a document confirming the relationship (birth certificate, marriage certificate, etc.);

- a document confirming that relatives live together (extract from the house register or a single housing document).

If, in addition to wages, the applicant requires a funeral benefit, the following must be attached to the documents:

- death certificate (not certificate) in form 33, issued by the registry office;

- a check or other document confirming payment for funeral services.

The application must contain the date of its submission and the signature of the applicant with a transcript.

Salary of a deceased employee in reporting

Question:

An employee of the organization died in April. In the 1st quarter, reports were submitted, his salary was included in all reports. For April, this employee was accrued 15,000 rubles, the amount was not taxed. Salaries for April were given to relatives. I am interested in reports 6NDFL, FSS and DAM (checking control ratios), in which reports the amount of 15,000 rubles. will it hit, and which ones won’t?

Questions are answered by specialists from Intercom-Audit Ekaterinburg LLC

Answer:

Based on the provisions of clause 6, part 1, art. 83 of the Labor Code of the Russian Federation, the death of an employee is grounds for termination of an employment contract.

Moreover, in accordance with the provisions of Art. 141 of the Labor Code of the Russian Federation, wages, as well as other payments not received by the day of the employee’s death, are issued to members of his family or to a person who was dependent on the deceased on the day of his death.

This provision corresponds with Art. 1183 of the Civil Code of the Russian Federation on the inheritance of unpaid amounts provided to a citizen as a means of subsistence, according to clause 1 of which the right to receive wages, equivalent payments and other monetary amounts that were payable to the testator, but were not received by him during his lifetime for any reason amounts provided to a citizen as a means of subsistence belong to the members of his family who lived together with the deceased, as well as his disabled dependents, regardless of whether they lived together with the deceased or did not live.

By virtue of paragraphs. 3 p. 3 art. 44 of the Tax Code of the Russian Federation, the obligation to pay taxes and (or) fees terminates with the death of an individual - the taxpayer or with his declaration as deceased in the manner established by the civil procedural legislation of the Russian Federation.

In accordance with paragraph 18 of Art. 217 of the Tax Code of the Russian Federation, income in cash and in kind received from individuals by inheritance is not subject to taxation on personal income, with the exception of remuneration paid to the heirs (legal successors) of the authors of works of science, literature, art, as well as remuneration paid to the heirs of patent holders inventions, utility models, industrial designs.

According to paragraph 1 of Art. 20.1 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases”, the object of taxation with insurance premiums for injuries are payments and other remunerations paid by insurers in favor of the insured within the framework of labor relations and civil law contracts. Amounts not subject to insurance premiums are specified in Art. 20.2 of Law No. 125-FZ.

Thus, the amounts of wages accrued for time worked and compensation for unused vacation paid to family members of a deceased employee of the organization in connection with the inheritance of these amounts are not subject to personal income tax and insurance contributions; accordingly, these amounts are not reflected in form 6-NDFL, as well as in calculations according to form 4-FSS (letter from the Federal Tax Service dated 08/01/2016 N BS-4-11/ [email protected] , dated 03/23/2016 N BS-4-11/4901).

Amounts payable to the relatives of a deceased employee in accordance with Art. 141 of the Labor Code of the Russian Federation, are not subject to inclusion in the base for calculating insurance contributions for compulsory social insurance. A similar position was expressed in Letters of the Ministry of Labor of Russia dated February 20, 2013 N 17-3/292 and the Ministry of Finance of Russia dated November 16, 2016 N 03-04-12/67082, letter of the FSS of Russia dated April 14, 2015 No. 020911/065250.

However, they are subject to reflection in the corresponding lines for calculating insurance premiums as amounts not subject to insurance premiums in accordance with Art. 422 Tax Code of the Russian Federation

From all of the above, it follows that unpaid wages and compensation for unused vacation days of a deceased employee are not reflected in the 6NDFL and 4-FSS reports, but are reflected in the calculation of insurance premiums.

When checking the control ratios according to the 6NDFL and DAM reports, the Federal Tax Service Inspectorate will, upon request, need to provide explanations about the relevant discrepancies.

30.07.2020

How to calculate salary not received by the date of death?

Let's consider the main payments that a relative of a deceased employee will receive.

- Salary balances.

Calculated using the formula:

Balances = (Salary + bonuses + other allowances) x (Number of days worked until death / Number of days in a month).

Supplements and additional payments for special working conditions (work at night or on weekends, northern coefficient, etc.) are also added to the salary.

- Compensation for unused vacation.

For each month worked, the employee is accrued 2.33 days of paid leave. If he did not have time to use them before his death, this compensation will be added to his salary. A total of 28 vacation days accrue over 12 months.

First of all, it is necessary to calculate how many vacation days the employee has accumulated:

Unused vacation = Number of years worked x 28 + 28 / 12 x Number of months worked in total - The total number of vacation days that the employee spent during the entire period of work.

If an employee has worked for more than half a month, it is counted as a whole period and is included in the accounting. The resulting number is also rounded to the nearest whole in favor of the employee, regardless of the arithmetic rules.

If the employee has worked for less than 1 year, the following formula is used:

28 / 12 x Number of months worked – Number of vacation days used.

The amount of compensation is calculated taking into account the established days:

Compensation = Unused vacation days x Average daily salary.

In turn, the average daily earnings are calculated:

ZPsr. = Salary amount for 12 months / 12 / 29.3.

Let's look at the calculation of the full payment using an example.

Berezkina I.M. submitted an application to the organization where her husband worked until his death for payment of his wages and funeral benefits, attaching all the necessary documents to the application.

Berezkin K.N. did not go to work on the day of his death, April 28, 2019. His salary was 34,561 rubles per month, the average daily salary was 1,179 rubles 55 kopecks. He has accumulated 28 days of vacation (since the last time he took a vacation was in April 2021).

The application was submitted in May 2021. At that time, the funeral benefit was 5,701 rubles 31 kopecks. In addition, the organization’s collective agreement established financial assistance to the families of deceased employees in the amount of 4,000 rubles.

Taxation and insurance premiums

Neither personal income tax nor insurance premiums are deducted from payments received in connection with the death of an employee , which is justified in the following regulations:

- states that the obligation to pay tax and insurance premiums ceases due to the death of the taxpayer;

- prohibits levying tax on funeral benefits, and clause 8 of the same article – on financial assistance paid by the employer of the deceased to his family;

- – amounts received by inheritance are not subject to taxation (if wages and other payments passed into the inheritance estate and were received by relatives through a notary);

- – a ban on collecting contributions from funeral benefits.

Who receives the money of a deceased employee?

Material payments due to the death of an employee at the enterprise are awarded to close relatives of the person, as regulated by labor legislation. Among this list of persons are noted (Article 2 of the Family Code of the Russian Federation):

- Spouse.

- Parents or adoptive parents.

- Natural or adopted children.

Also, funds can be issued to citizens who were dependent on the deceased employee. To confirm this fact, you must obtain a certificate from the judicial authority.

Arranging for funeral compensation

One of the additional compensations that relatives of a deceased person can count on is subsidies for the burial of the deceased. Payments are made from the budget of the organization in which the deceased employee worked. So, in order to receive this compensation, the organization must provide:

- Application in any form.

- Employee's death certificate.

This package of documents remains with management for further confirmation of payments made during the inspection of the Social Insurance Fund.

FAQ

Question No. 1. My brother died, he has no other relatives. Do I have to enter into an inheritance in order to receive my employer’s salary?

No, entering into inheritance is not a prerequisite. To receive payments, it is enough to contact the organization at the last place of employment of the deceased.

Question No. 2. Can I receive funeral benefits from my employer if the deceased quit his job the day before his death?

No, in this case you need to apply for benefits to Social Security, because the employment relationship between the employee and the employer is terminated due to termination of the contract.

Common Mistakes

Mistake #1. The employer paid all funeral expenses, but relatives can still apply for funeral benefits.

No, this is a mistake. This benefit is paid only if relatives have spent their own funds.

Mistake #2. The deceased relative worked unofficially, but relatives can collect wages from his employer.

No, this is a question of the conscience of the former leader. According to the law, there is no labor relationship between them, and in order to receive payments, you will first have to establish the fact of employment, and only after that you can apply for payments.

Death of an employee. Personal income tax contributions

- ...By virtue of subparagraph 3 of paragraph 3 of Article 44 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code), the obligation to pay taxes and (or) fees terminates with the death of an individual taxpayer or with his declaration as deceased in the manner established by the civil procedural legislation of the Russian Federation.

In accordance with paragraph 18 of Article 217 of Chapter 23 “Individual Income Tax” of the Tax Code, income in cash and in kind received from individuals through inheritance is not subject to personal income tax, with the exception of remuneration paid to heirs (successors) authors of works of science, literature, art, as well as remuneration paid to the heirs of patent holders of inventions, utility models, industrial designs.

Thus, the amounts of wages accrued for time worked and compensation for unused vacation paid to family members of a deceased employee of the organization in connection with the inheritance of these amounts are not subject to personal income tax.

- Subparagraph 1 of paragraph 1 of Article 420 of Chapter 34 “Insurance Contributions” of the Tax Code determines that the object of taxation of insurance contributions for organizations is payments and other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance made , in particular within the framework of labor relations.

Considering that there is no insured person under compulsory social insurance and the above-mentioned payments after the death of an employee are made by the organization to a member of his family who is not in an employment relationship with this organization, such payments are not subject to insurance premiums. {Question: About personal income tax and insurance contributions when calculating wages and compensation for unused vacation to a deceased employee and their payment to a member of his family. (Letter of the Ministry of Finance of Russia dated April 24, 2017 N 03-15-06/24374) {ConsultantPlus}}

- The official position of the controllers on this issue is given in Letters of the Ministry of Finance of the Russian Federation dated August 22, 2017 N 03-15-07/53912 (communicated by Letter of the Federal Tax Service of the Russian Federation dated September 1, 2017 N BS-4-11/17463 to lower tax authorities), dated April 24, 2017 N 03-15-06/24374. Similar conclusions were previously made by the Ministry of Labor, which explained the provisions of the Federal Law of July 24, 2009 N 212-FZ “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund,” which became invalid on January 1, 2021 (Letters dated 06/23/2015 N 17-3/В-307, dated 08/27/2014 N 17-3/В-407, dated 02/20/2013 N 17-3/292), as well as the FSS (Letter dated 04/14/2015 N 02-09-11/06-5250).

{Question: Is it necessary to impose insurance premiums on wages paid to relatives after the death of an employee? (“Payment: accounting and taxation”, 2021, N 10) {ConsultantPlus}}

- As follows from Letter of the Ministry of Labor of Russia dated February 20, 2013 N 17-3/292, if at the time of calculation of wages the employer has information about the death of an employee, then wages and other payments accrued in accordance with the law in his favor are not subject to taxation of insurance premiums.

Article: Personal income tax and insurance premiums upon the death of an employee (Lukasevich M.S., Ryabova N.D.) (“Electronic journal “Financial and Accounting Consultations”, 2014, No. 5) {ConsultantPlus}

- From the explanations contained in Letter No. 17-3/292 of the Ministry of Labor of Russia dated February 20, 2013, it follows that contributions from the last salary of the deceased do not need to be calculated and paid. With the death of an employee, the labor relationship between him and the organization is terminated (clause 6, part 1, article 83 of the Labor Code of the Russian Federation). Therefore, there is no need to charge contributions to compulsory pension (social, medical) insurance in the amount of the salary accrued to the employee for the month in which he died.

Although the explanations given are not a normative legal act, you can refer to them during inspections. Let us note that previously, regulatory authorities often took a different point of view: unlike the personal income tax payer, the payer of social insurance contributions is not the deceased employee, but his employer; accordingly, with the death of the employee, the employer’s obligation to calculate and pay contributions does not disappear. Article: An employee of an organization has died: legal and tax consequences (Fimina N.V.) (“Remuneration: accounting and taxation”, 2015, No. 3) {ConsultantPlus}

- Question: Is it necessary to pay insurance contributions to the Social Insurance Fund on payments accrued in favor of an employee after his death?

Answer: There is no need to transfer insurance contributions to the Social Insurance Fund from payments accrued in favor of an employee after his death... {Question: Is it necessary to pay insurance contributions to the Social Insurance Fund from payments accrued in favor of an employee after his death? (“Remuneration: accounting and taxation”, 2015, N 7) {ConsultantPlus}}

- ... Example 9.4. The local regulatory act of the organization establishes the following days for payment of wages:

25th of the current month - advance payment;

The 10th of the next month is salary.

Option 1. The employee died on January 28.

On January 25, the employee received an advance on wages for January. Since the advance is paid before accrual (before it is reflected in accounting and tax accounting), it is not included in the base for calculating insurance premiums.

The employment contract is terminated due to the death of the employee on January 28 (clause 6, part 1, article 83 of the Labor Code of the Russian Federation). The final calculation includes:

— wages for the period from January 1 to January 28 (the amount “to be paid” is reduced by the amount of the advance);

— compensation for unused vacation.

Since these payments are due to a person who is no longer insured, they are not recognized as subject to insurance premiums and are not included in the calculation.

Option 2. The employee died on February 5.

Wages for January were accrued (reflected in accounting and tax accounting) on January 31 and included in the base for calculating insurance premiums (on January 31 the employee is alive and is an insured person). The calculated amount of contributions must be transferred no later than February 15. The corresponding amounts are reflected in the calculation.

The employment contract is terminated due to the death of the employee on February 5 (clause 6, part 1, article 83 of the Labor Code of the Russian Federation). The final calculation includes:

— wages for the period from February 1 to February 5;

— compensation for unused vacation.

These payments are not considered subject to insurance premiums and are not included in the calculation. “Salaries in 2018” (21st edition, revised and expanded) (E.V. Vorobyova) (“IC Group”, 2018) {ConsultantPlus}

Persons entitled to receive financial assistance upon the death of an employee. Documents for receiving payment

It is desirable that the documents establishing the possibility of receiving payment define the circle of those entitled to do so. For example, these may not be any relatives, but only family members. Family law includes parents, children and spouse. By the way, the imposition of personal income tax and insurance premiums on them depends on who exactly is the recipient of the payments (see below).

If the corresponding obligation of the employer is not established in the documents, then he decides to whom to transfer the money at his own discretion.

To process payments, you will need a written application from the interested person (in free form), as well as a copy of the death certificate. The absence of these documents will certainly interest the tax authorities in the event of an audit.